How Back-to-Basics Value Creation Can Drive Alpha in 2026 and Beyond

Introduction: A Turning Point for Private Equity

Equity markets are entering a structurally different era. Public markets sit near record highs, driven by concentration, technical flows and negative equity risk premia — a tough starting point for future appreciation. Private equity, meanwhile, is confronting the end of a decade that ended in 2022 where cheap debt and multiple expansion could substitute for genuine value creation. Returns and realizations have predictably lagged after the interest rate reset in 2022.

In an easy‑money environment, many managers effectively subsisted on a “buy high, sell higher” strategy and generated less value from buying well and operational improvements.

The question for 2026 and beyond is not whether private equity will remain relevant, it is which strategy will excel in an environment that looks different than the recent past. The answer, we believe, lies in a return to the roots of the asset class: disciplined buying, hands-on operational improvement and clear, repeatable pathways to liquidity. These fundamentals were central to PE’s earliest successes but were lost sight of during periods of excess against an ultra-accommodative backdrop. We believe a return to fundamentals will define those strategies best positioned to outperform in a world with normalized rates.

In this article (the first in a series about the new private equity landscape), we explore how the asset class should return to its core principles to help deliver excess returns over public markets. These are the same principles that have historically driven returns in the private equity industry, except for the 2010–2022 period.

The Market Backdrop: Public and Private Equity at a Crossroads

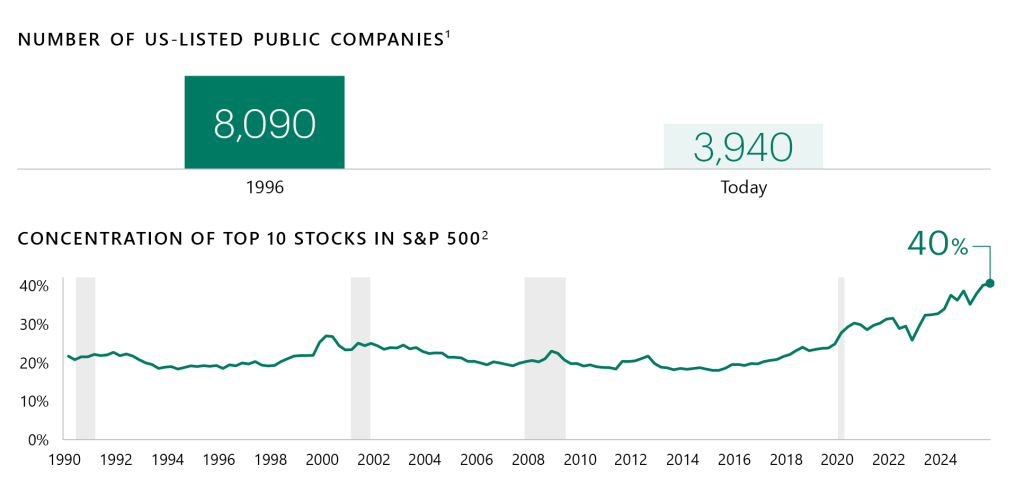

On the surface, public equity markets appear healthy. In reality, these markets are defined by a shrinking opportunity set, narrow leadership and returns driven by the reflexivity of index investing, which pushes up the valuation of the largest companies:

- The number of public companies has been cut in half over two decades, shrinking the investable universe.

- Each year, more companies are removed from the public markets than are added.

- The top 10 stocks in the S&P 500 represent 40% of the benchmark’s market cap, a historic high.

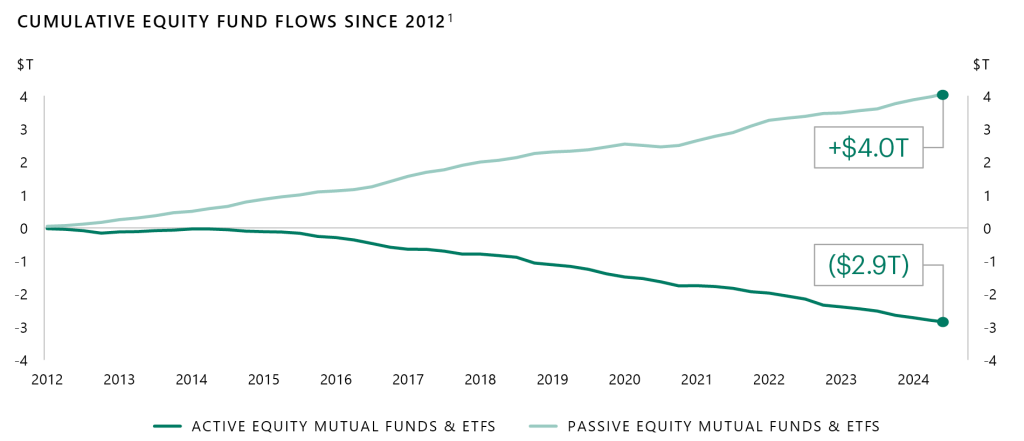

- Passive flows dominate price action, amplifying crowding and reducing the role of fundamentals.

- The vast majority of public equity fund managers have struggled to outperform their benchmarks.

Public Markets Are Facing Structural Challenges

Passive Flows Are Dominating Price Action and Crowding Markets

Sources: Bloomberg, Russell and S&P

These are not cyclical quirks but long‑term secular trends away from active management and towards index investing. While indexation has benefited investors with lower costs, it has also distorted price discovery and fundamental valuation.

Private equity investing has changed just as dramatically. A decade of ultra‑low rates allowed many managers to rely on expanding multiples, cheap leverage and buoyant exit markets. We believe that era has ended. Higher financing costs, slower exits and a recalibration of pricing power have revealed which managers depended on beta versus those whose returns stem from operational value creation, along with shrewd asset sourcing and selection. In that environment, financial engineering often played a larger role in driving returns than hands‑on operational improvement. A carve‑out, a strategy in which an underperforming business is separated from a parent company and repositioned as a standalone enterprise, historically exemplified the asset class’s operational roots. As financing costs have risen, exit markets have slowed and pricing power has recalibrated, the distinction between managers who generate returns through operational value creation and those more reliant on favorable market conditions has become increasingly apparent.

“The next 10 years will look significantly different from the last 15 — an era buttressed by a zero-interest-rate policy and multiple expansion.”

Bain & Company, Global Private Equity Report 2025

Going forward, can private equity get back to the fundamentals that made investing in the space different and value-additive? Traditionally, private equity emphasized long-term value creation and operational efficiency improvements outside the constraints of quarterly public market reporting and short-term performance pressures.

The Myth of the Last Cycle: Why Many Managers Are Struggling

One fact captures today’s challenge: since 2018, capital calls have exceeded distributions by roughly $1.5 trillion.1 The effects are clear: exits are slow, DPI is depressed and fund lives are stretching significantly beyond the expected 10-year terms, dragging down IRRs.

These pressures reveal structural weaknesses in the industry:

- Overreliance on leverage and rising multiples

From 2010–2021, approximately 66% of value creation came from leverage and multiple expansion, factors beyond a manager’s control and thus beta.2 High entry prices and aggressive capital structures worked, until rates normalized. - Constrained exits and misaligned pricing expectations

Buyers can underwrite less leverage; sellers are still anchored to peak-cycle valuations. The bid–ask gap has frozen deal-making and extended hold periods, as managers with unrealistic valuation expectations are forced to hold assets longer to grow into target return multiples. - Lack of true exits

Many firms are leaning into continuation vehicles, secondaries and hybrid structures to engineer liquidity rather than generate it through fundamental value creation.

These challenges are not temporary. They are symptoms of a regime shift, one that exposes managers without a true value creation engine. The dispersion between top and bottom quartile funds now exceeds 25 percentage points — a sign that private equity is no longer a rising-tide-lifts-all-boats industry.3

A Winning Strategy Today Resembles the Past

In our view, the firms that will outperform in 2026 and beyond will do so by reclaiming the practices that defined private equity’s foundational decades: buy well, control the controllable, make fundamental improvements to a business and look to return capital early and often.

A Repeatable Playbook for Value Creation

Buy Intelligently

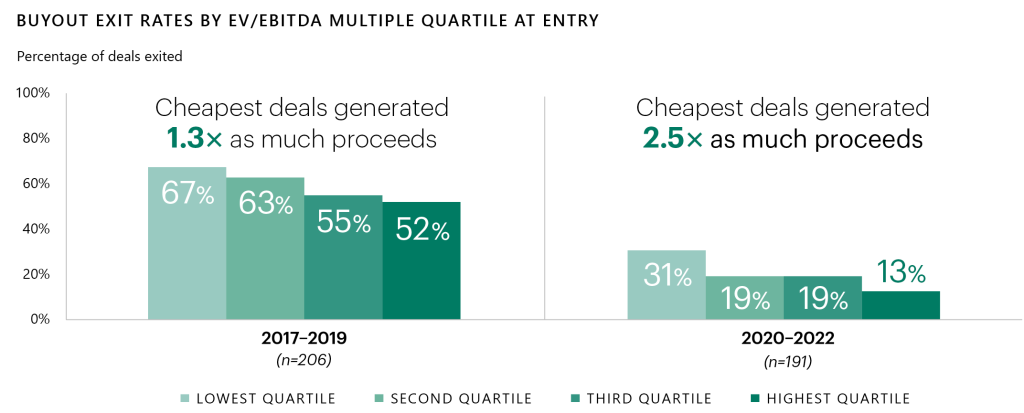

Purchase price is once again the dominant driver of returns. Managers often succeeding today share several traits:

- They source complex, bilateral or off-cycle opportunities where competition is limited.

- They avoid overpaying for assets. Purchase price matters. It has a significant impact on how long it takes to exit an investment, and the value ultimately realized at exit. This

relationship is illustrated in the Daily Spark, “Buy Low, Sell High Is a Superior Strategy,” by Apollo Chief Economist Torsten Slok, and in the chart below. - They use leverage prudently to preserve interest coverage

ratios and enhance free cash flow.

In an environment where valuations remain high and debt is more expensive, disciplined buying is not defensive, it is alpha.

Build Through Operational Value Creation

Cheap leverage can no longer mask a weak value creation capability. Leading managers distinguish themselves by how they operate:

- Develop detailed value creation plans upfront.

- Deploy operating teams focused on speed of execution and purpose-built to deliver on the investment thesis.

- Use M&A selectively to build scale and strengthen competitive positions.

- Actively manage capital structures to support growth, preserve downside protection and return capital early.

Buy Low, Sell High Is an Effective Strategy

Flexibility Is Key to Liquidity

Exit with Flexibility and Focus

While there has been some recovery in private equity exit activity, volumes remain well below five-year averages.4 Even if exit volumes normalize, the backlog of assets needing to be sold is so significant that distribution yields, as a percentage of assets held, are unlikely to normalize as well. In a constrained exit environment, liquidity becomes a strategic capability. Leading firms typically approach exits with discipline and flexibility:

- Underwrite multiple exit paths from day one.

- Pursue early capital return where possible via minority sales, dividends where leverage levels can be maintained and creative opportunities to arbitrage entry multiples (e.g., sale and leasebacks).

- Look to drive returns from fundamentally improving a business rather than counting on high multiples. Lower dependence on multiple expansion provides greater exit optionality.

Firms generating strong DPI today are distinguished not by perfect market timing but by flexible, multi-channel liquidity strategies.

Conclusion: The Future of PE Belongs to Those Who Reclaim Its Past

Private equity stands at an inflection point. We believe the era of easy money has ended, and with it the illusion that overly simple strategies like buying good companies at any price can reliably deliver alpha. Over time, private equity has distinguished itself from public markets through active ownership and long-term value creation, often in environments far less accommodating than the one that just passed. Private equity has a way of reinventing itself and, this time, that reinvention is just a return to fundamentals and the original promise of the asset class: to buy intelligently, improve relentlessly and return capital through disciplined, flexible execution.

The managers we believe will outperform in 2026 and beyond will not be the ones chasing beta or momentum. They will be those returning to the craft: the builders, the operators and the investors for whom value creation is not a buzzword but a repeatable system.

Private equity’s path forward is not new. It is a return to its roots.

1 Source: Morgan Stanley Research. Digging into the DPI Drought. June 2025.

2 Source: McKinsey Global Private Markets Review 2024. Represents total return for buyout deals that were entered in 2010 or later and exited in 2021 or before.

3 Note: Private equity includes buyout, growth/expansion, diversified and turnaround funds across vintage years from 2005-2019. Data (20-year IRRs) as of December 31, 2024. Source: Preqin

4 Source: Bain & Company Global Private Equity Report 2025

The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions and views expressed reflect the current opinions and views of the authors and Apollo Analysts as of the date hereof and are subject to change. Please see the end of this document for important disclosure information.

Important Disclosure Information

This presentation is for educational purposes only and should not be treated as research. This presentation may not be distributed, transmitted or otherwise communicated to others, in whole or in part, without the express written consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

The views and opinions expressed in this presentation are the views and opinions of the author(s) of the White Paper. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Further, Apollo and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this presentation. There can be no assurance that an investment strategy will be successful. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially, and should not be relied upon as such. Target allocations contained herein are subject to change. There is no assurance that the target allocations will be achieved, and actual allocations may be significantly different than that shown here. This presentation does not constitute an offer of any service or product of Apollo. It is not an invitation by or on behalf of Apollo to any person to buy or sell any security or to adopt any investment strategy, and shall not form the basis of, nor may it accompany nor form part of, any right or contract to buy or sell any security or to adopt any investment strategy. Nothing herein should be taken as investment advice or a recommendation to enter into any transaction.

Hyperlinks to third-party websites in this presentation are provided for reader convenience only. There can be no assurance that any trends discussed herein will continue. Unless otherwise noted, information included herein is presented as of the dates indicated. This presentation is not complete and the information contained herein may change at any time without notice. Apollo does not have any responsibility to update the presentation to account for such changes. Apollo has not made any representation or warranty, expressed or implied, with respect to fairness, correctness, accuracy, reasonableness, or completeness of any of the information contained herein, and expressly disclaims any responsibility or liability therefore. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Investors should make an independent investigation of the information contained herein, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

The Standard & Poor’s 500 (“S&P 500”) Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies by market value.

Additional information may be available upon request.