Want it delivered daily to your inbox?

-

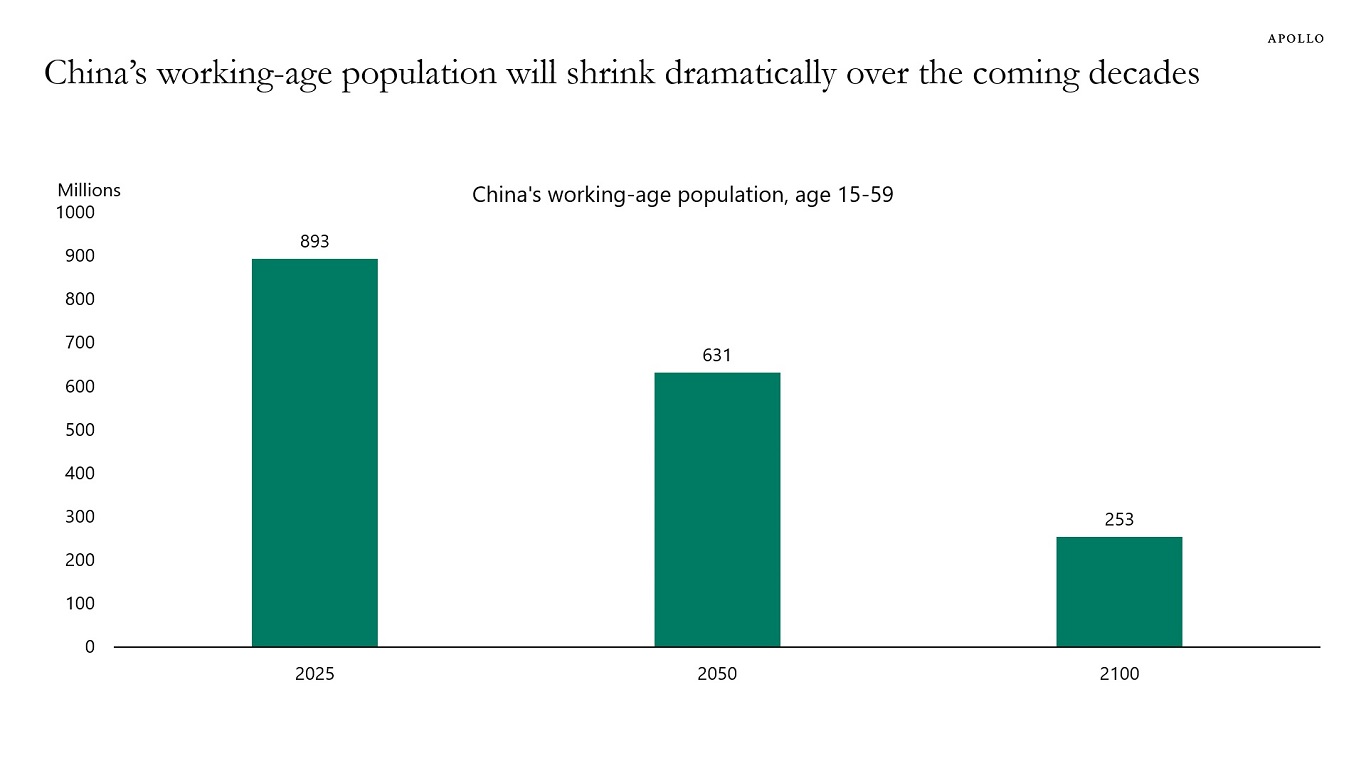

China’s working-age population will shrink dramatically over the coming decades, driven by the lagged effects of the one-child policy, an aging population, and a significant decline in fertility rates—which currently stand at 1.09 births per woman, far below the 2.1 needed to maintain population size.

This decline in the working-age population will have significant implications for economic growth, the fiscal outlook due to an aging population, and investment and productivity growth.

These risks to China’s long-term outlook are, in many ways, similar to those we have seen in Japan in recent decades.

Sources: UN Population Forecasts, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

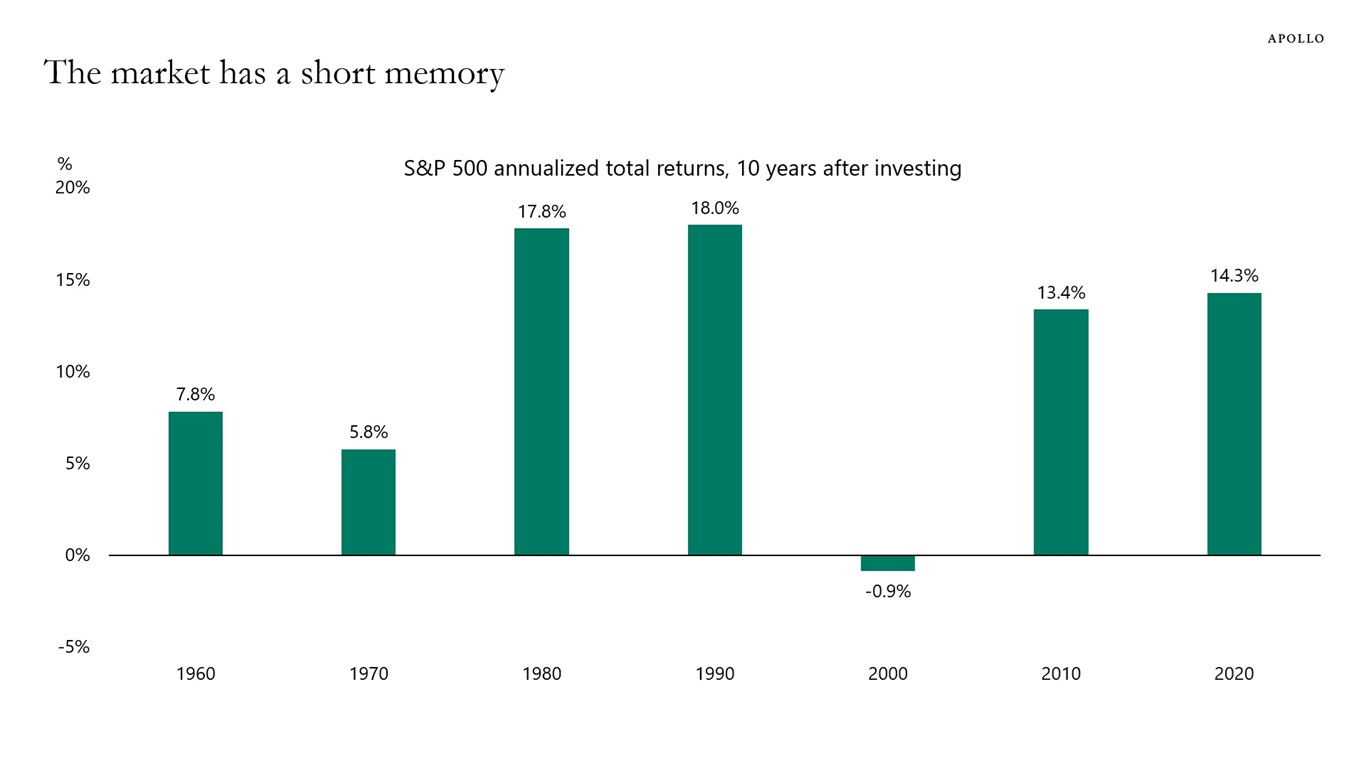

The narrative in bond markets today is that all-in yield levels are high. The narrative in stock markets is that it is a good strategy to buy stocks when the S&P 500 is at all-time highs.

Where are these narratives coming from? They are based on the recent performance of bond markets and stock markets: Yield levels were much lower before 2022, and stock markets continue to go higher and higher no matter what happens.

In other words, the market puts more weight on recent events in investment decisions. In short, the market has a short memory because many traders have never seen anything else.

But what if this way of investing is wrong? What if the stock market is about to enter a high inflation period similar to what we saw in the 1960s and 1970s (as shown in the chart below)? Maybe it was the period from 2009 to 2022 that was unusual in fixed income? If that is the case, then yield levels today are not high. Maybe the market today is putting too little weight on the US fiscal problems?

The bottom line is that markets will continue to hold on to yesterday’s narrative until it becomes completely clear that the narrative has changed.

Note: Returns are calculated in the S&P 500 index for the following 10 years for people investing in 1960, 1970, 1980, 1990, 2000, 2010 and 2020. Annualized returns for 2020 are calculated using data from January 2020 to July 7, 2025. Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

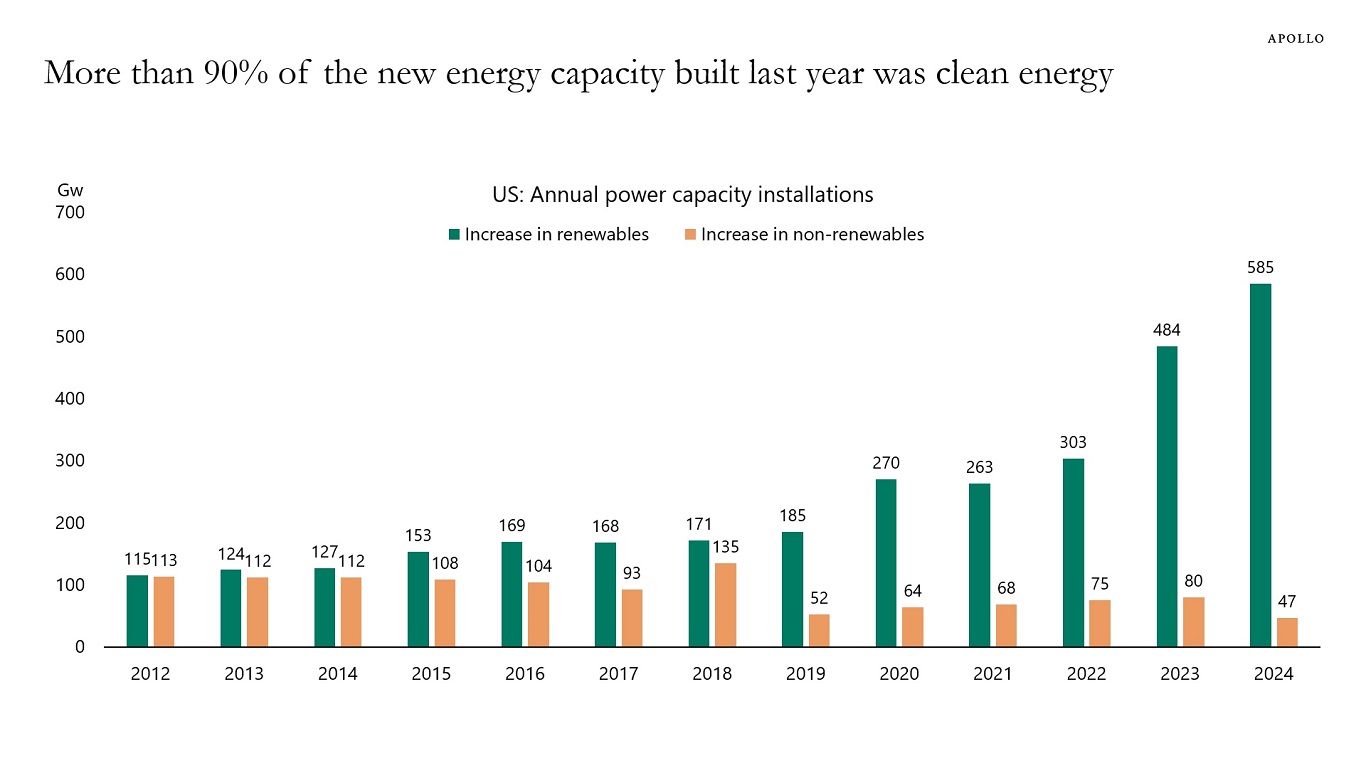

Clean energy is playing a bigger and bigger role in new power installations, see chart below.

Note: GW = Gigawatts. Sources: IRENA, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

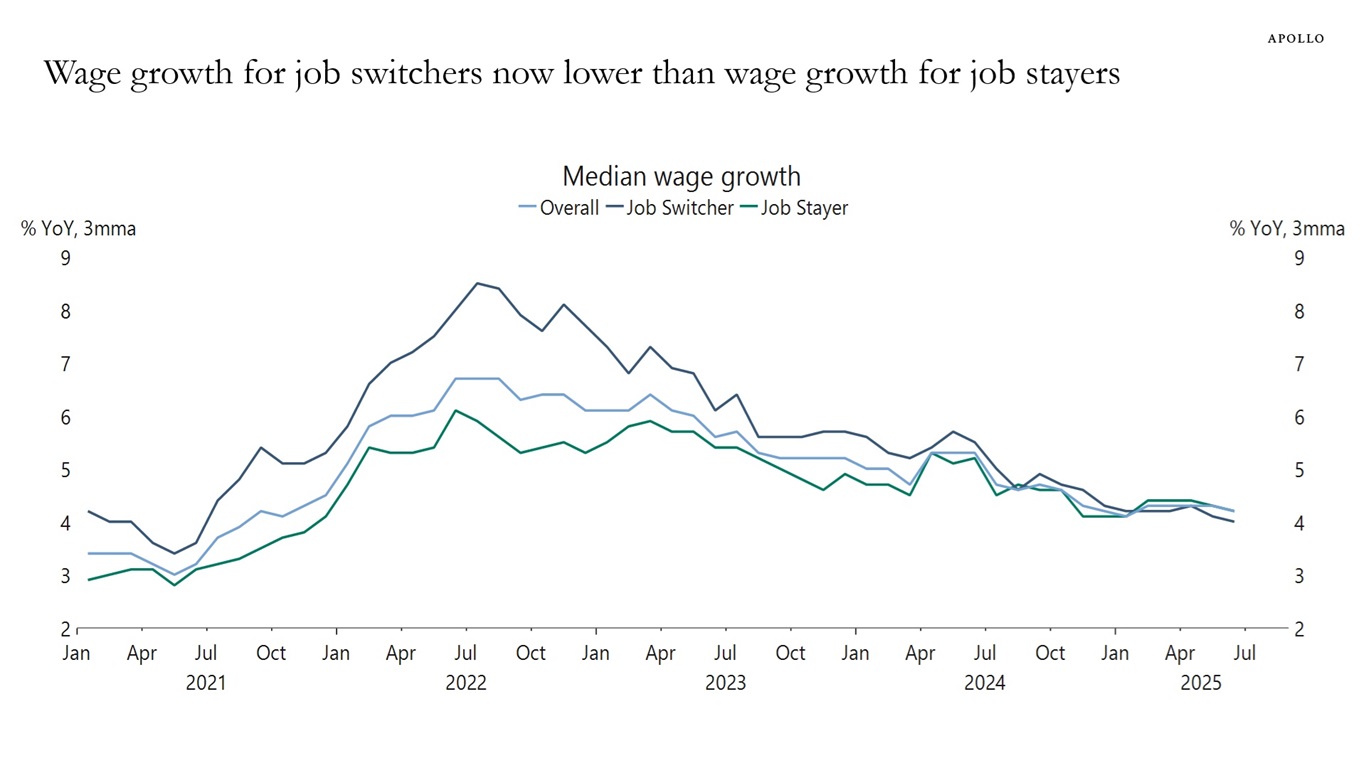

When the labor market is hot, wage growth for job switchers is higher than wage growth for job stayers, see chart below.

Today, wage growth for job switchers is lower than wage growth for job stayers, suggesting that the labor market is cooling down.

Sources: Federal Reserve Bank of Atlanta, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

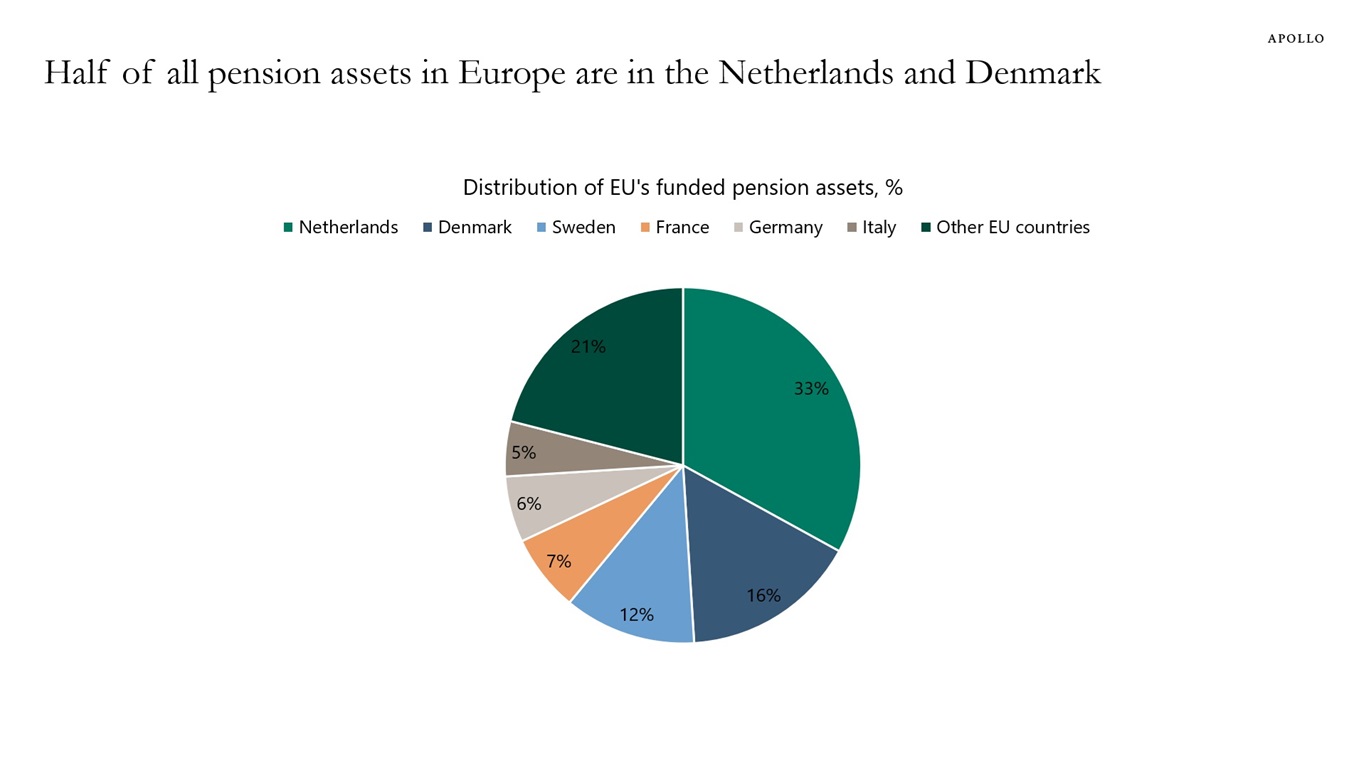

Retirement systems are very different across European countries. The Netherlands and Denmark together account for half of all pension savings in Europe, see chart below.

Note: Data for 2023. Sources: OECD, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

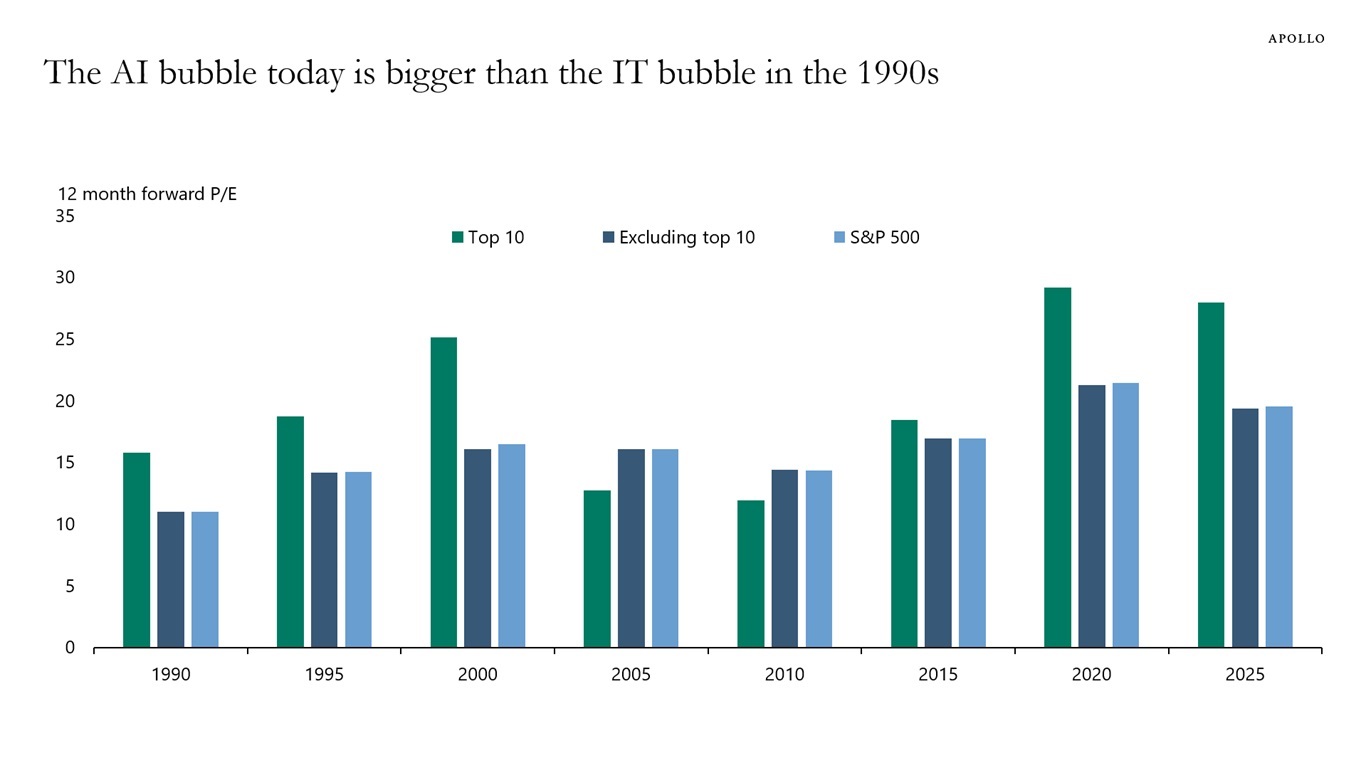

The difference between the IT bubble in the 1990s and the AI bubble today is that the top 10 companies in the S&P 500 today are more overvalued than they were in the 1990s, see chart below.

Note: Data as of July 2025. Top 10 companies are by market cap. Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Only 25% of meals sold by restaurants are consumed on premises. The remaining 75% are delivery orders, see chart below and here.

Sources: National Restaurant Association – From Trend to Transformation: Off-Premises Dining Now Essential for Restaurant Consumers, Operators, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

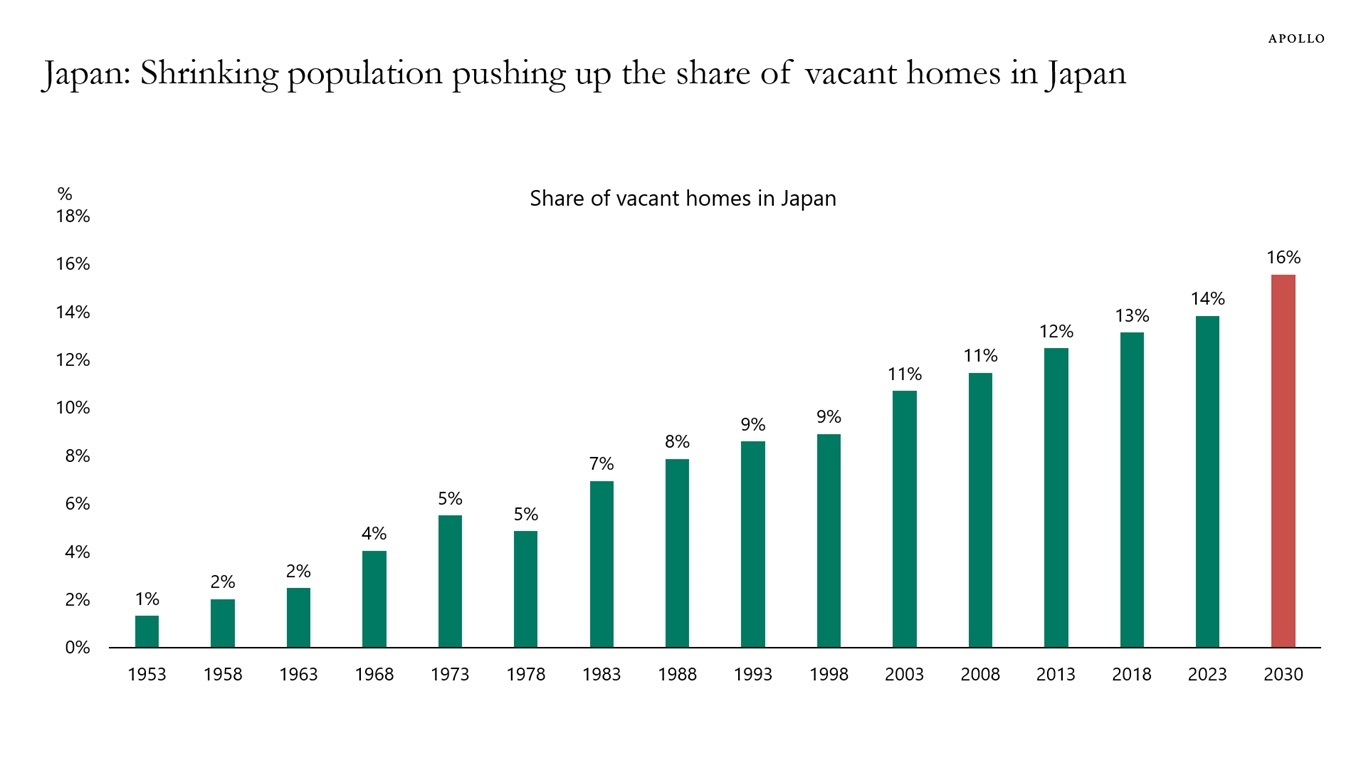

One consequence of a shrinking population in Japan is that there are more and more vacant homes, see chart below.

Note: 2030 forecast based on UN population growth estimates. Sources: Japanese Ministry of Health, Labor & Welfare, United Nations Department of Economic & Social Affairs (UNDESA), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Our chart book, available here, summarizes our current outlook for public and private markets.

See important disclaimers at the bottom of the page.

-

If 3,000 unauthorized immigrants are deported every day, the labor force will decline by roughly 1 million people in 2025.

Lowering the labor force by 1 million will reduce the participation rate by 0.4 percentage points, which will lower the unemployment rate, lower job growth, and increase wage inflation, particularly in the sectors where unauthorized immigrants work—namely construction, agriculture, and leisure & hospitality.

In short, deportations are a stagflationary impulse to the economy, resulting in lower employment growth and higher wage inflation.

For more discussion and quantification, see this new working paper by Edelberg, Veuger, and Watson.

Sources: ICE, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.