Want it delivered daily to your inbox?

-

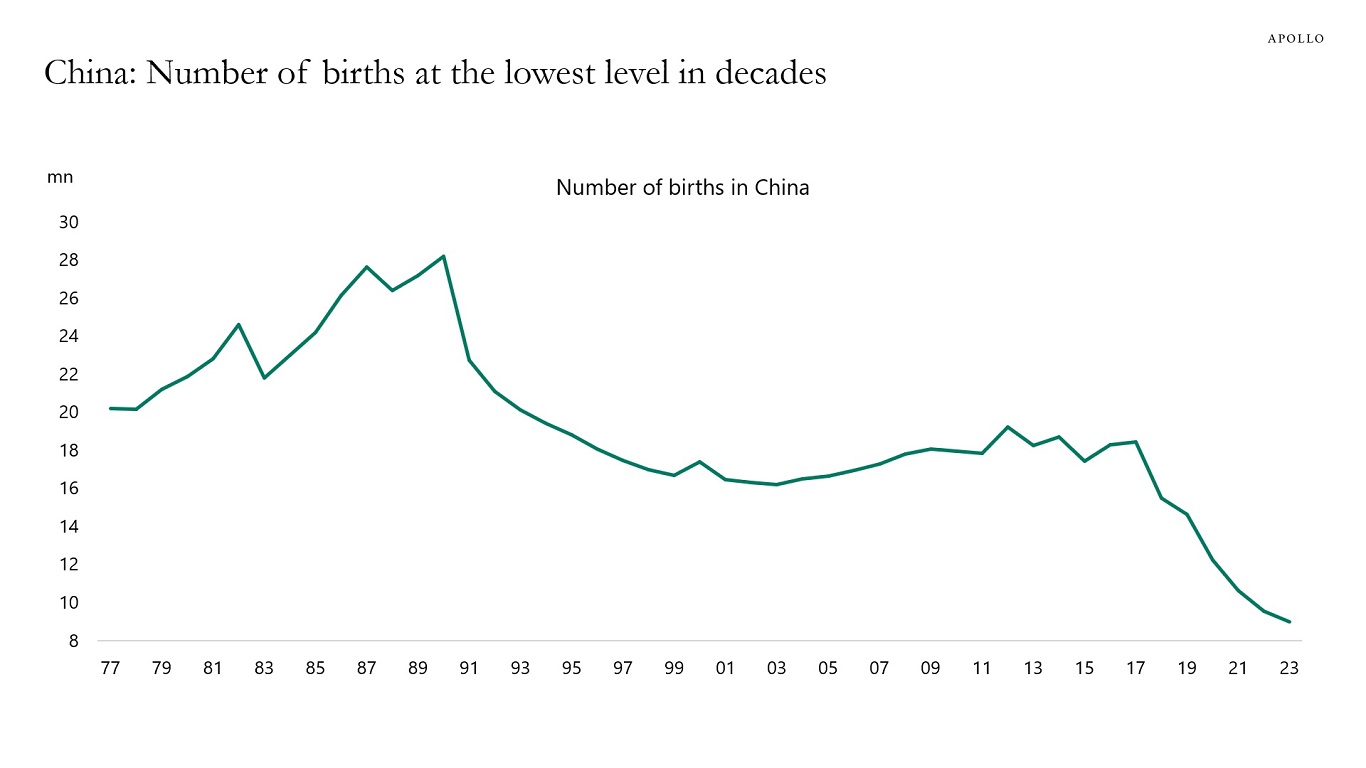

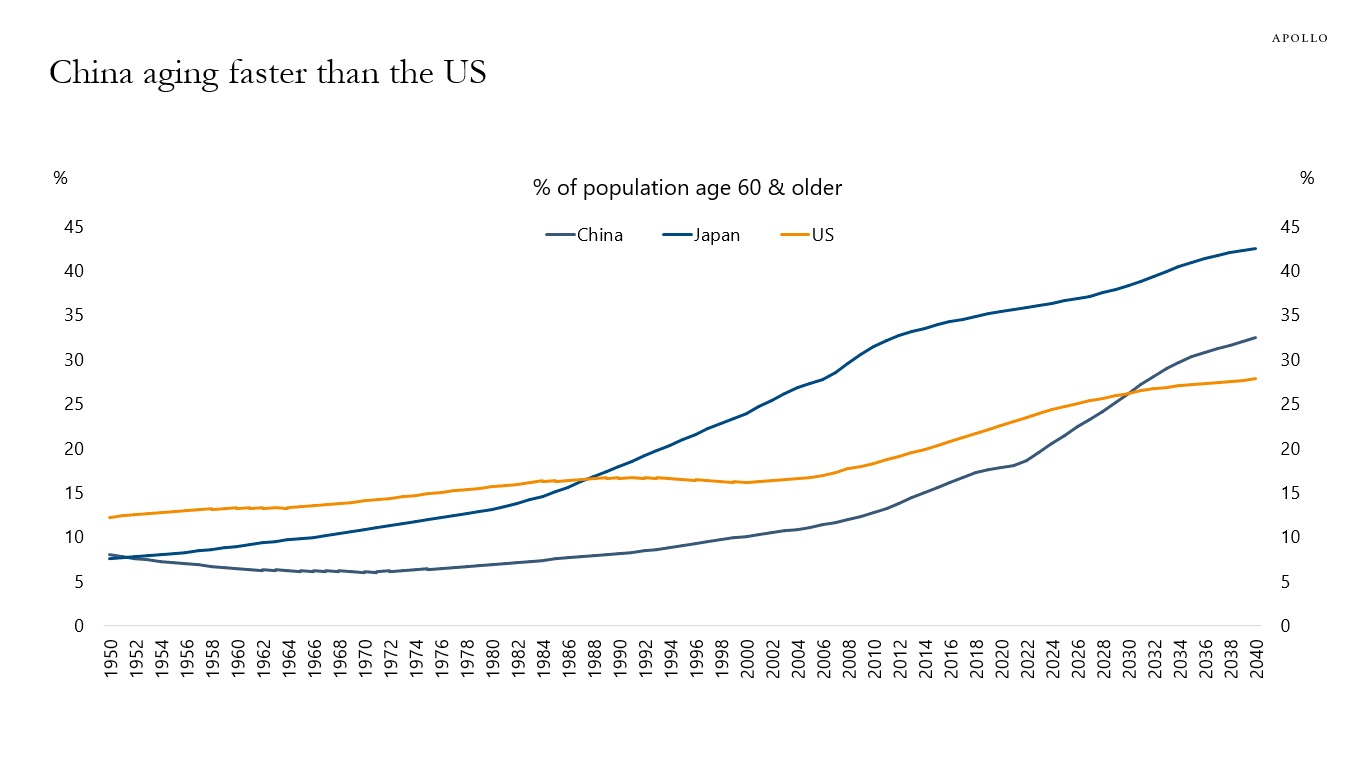

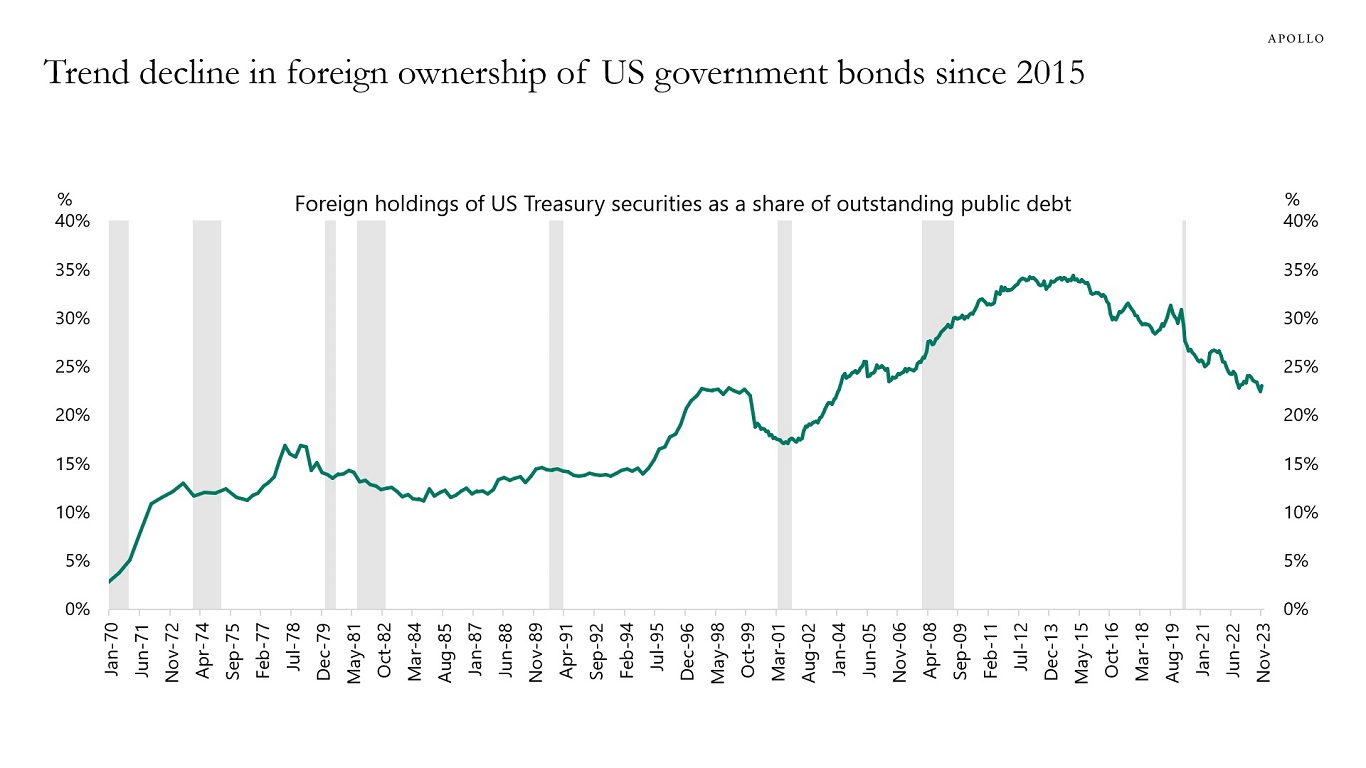

China began its one-child policy in 1980 and ended it in 2016. In 2021, it started its three-child policy, encouraging couples to have three children. The UN projects that China’s population will decline from 1.4 billion today to 800 million by the end of this century. China’s demographic headwinds have significant implications for growth, savings, and FX reserve accumulation and, therefore, Chinese appetite for buying US Treasuries.

Source: UN, National Bureau of Statistics of China, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

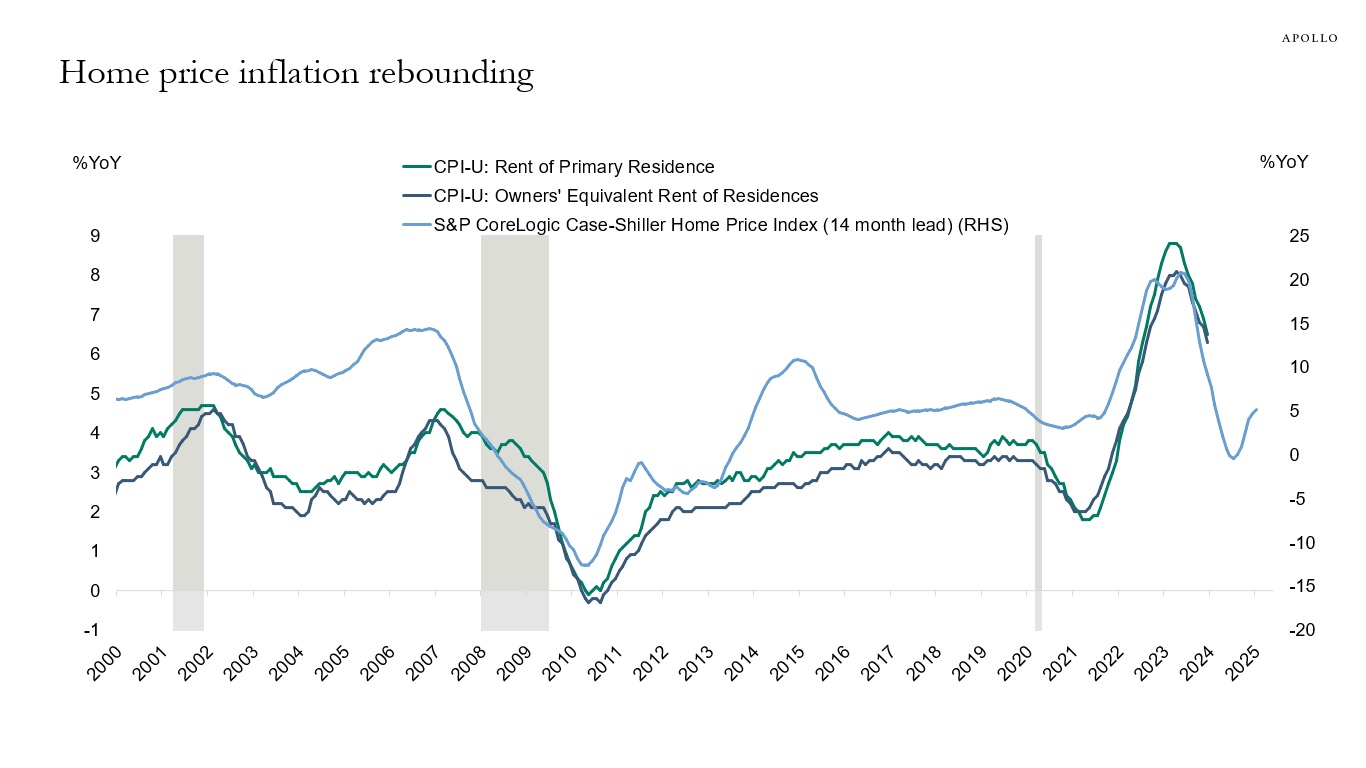

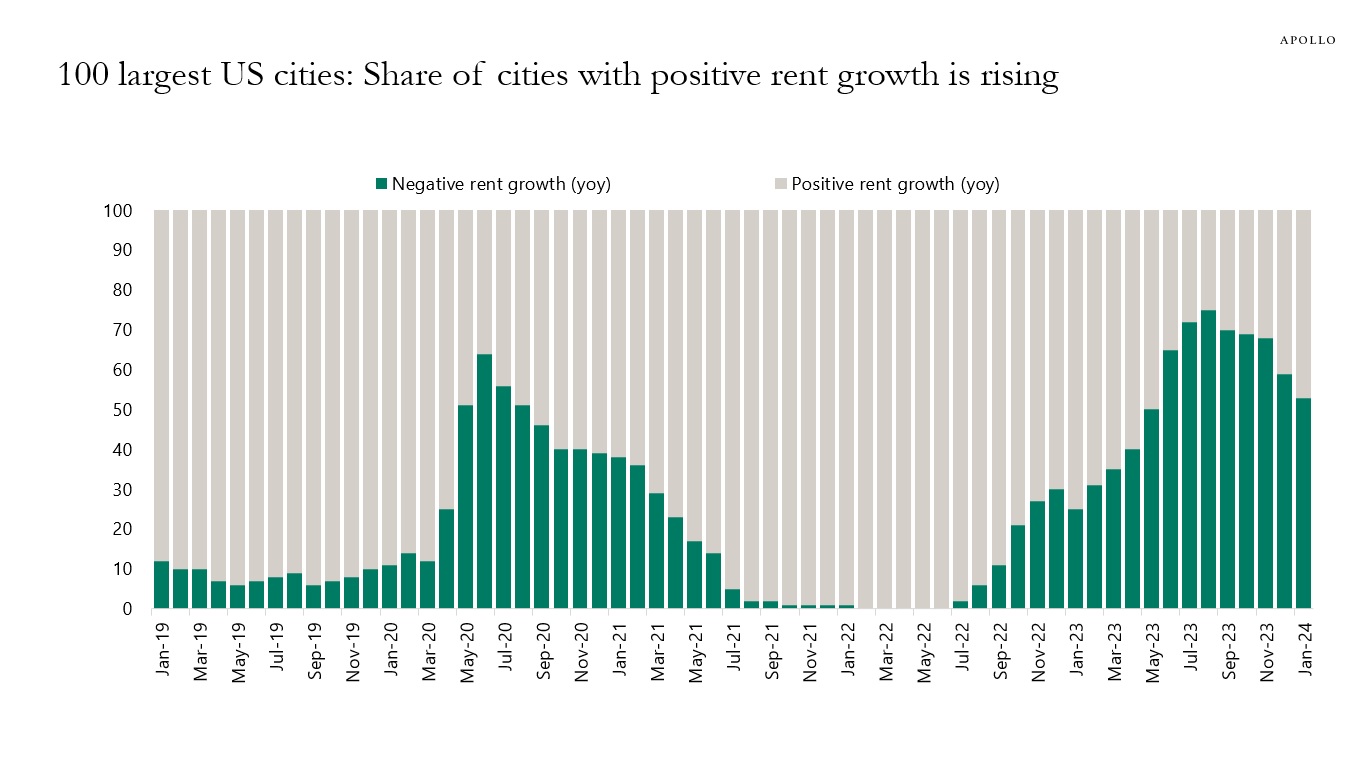

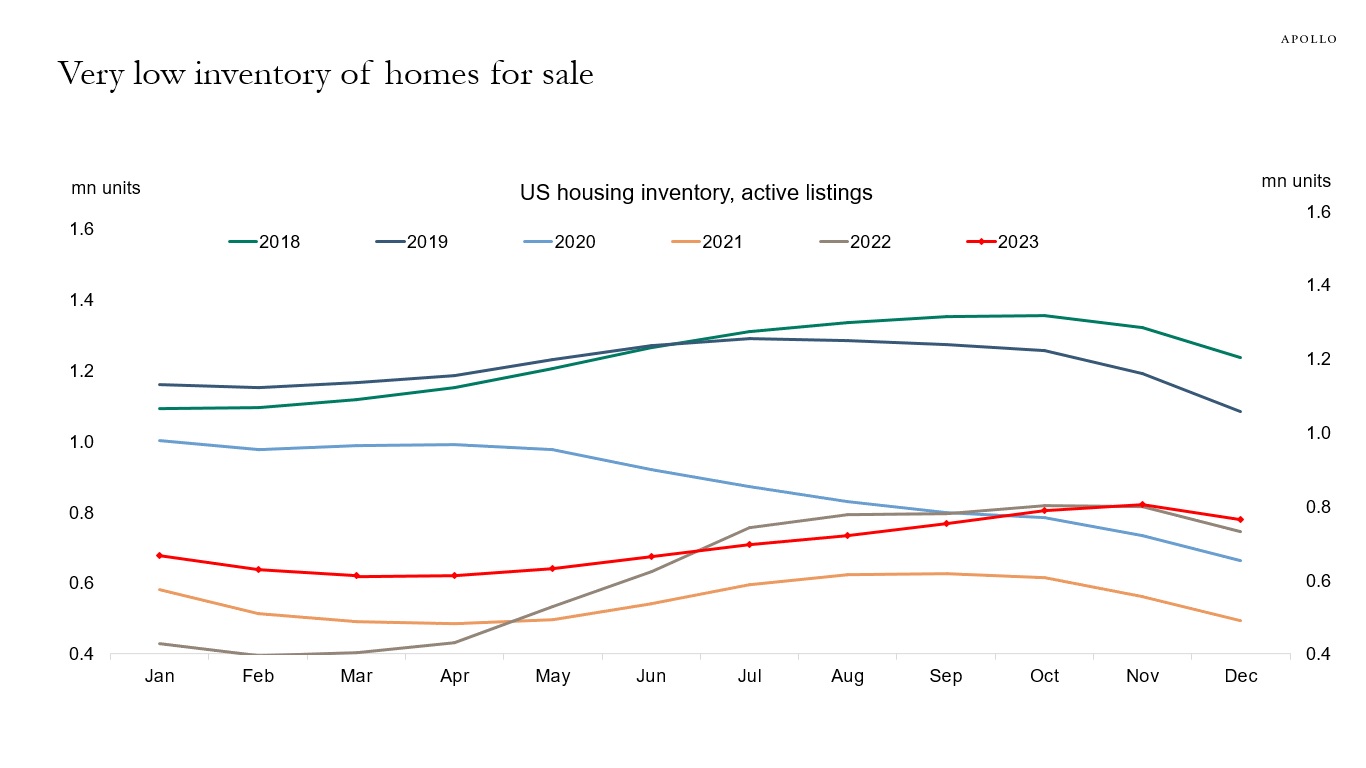

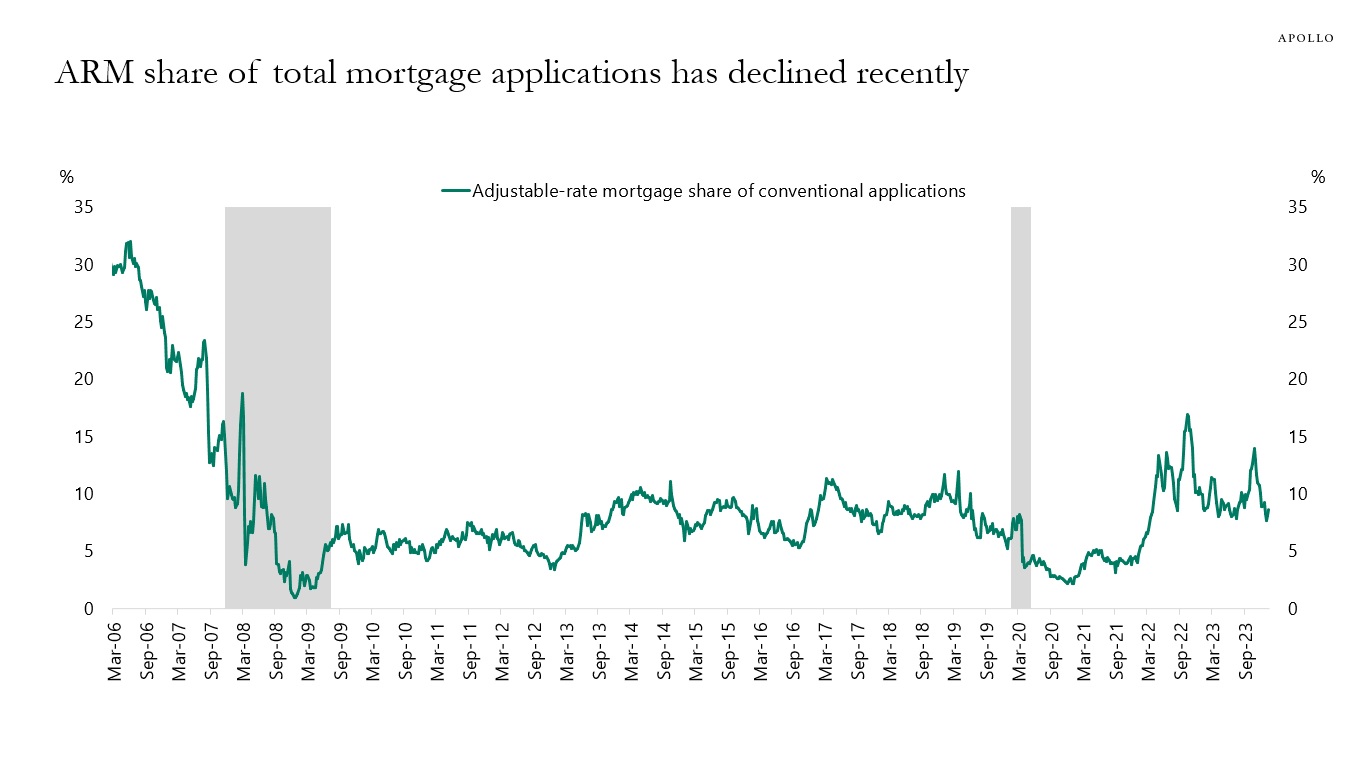

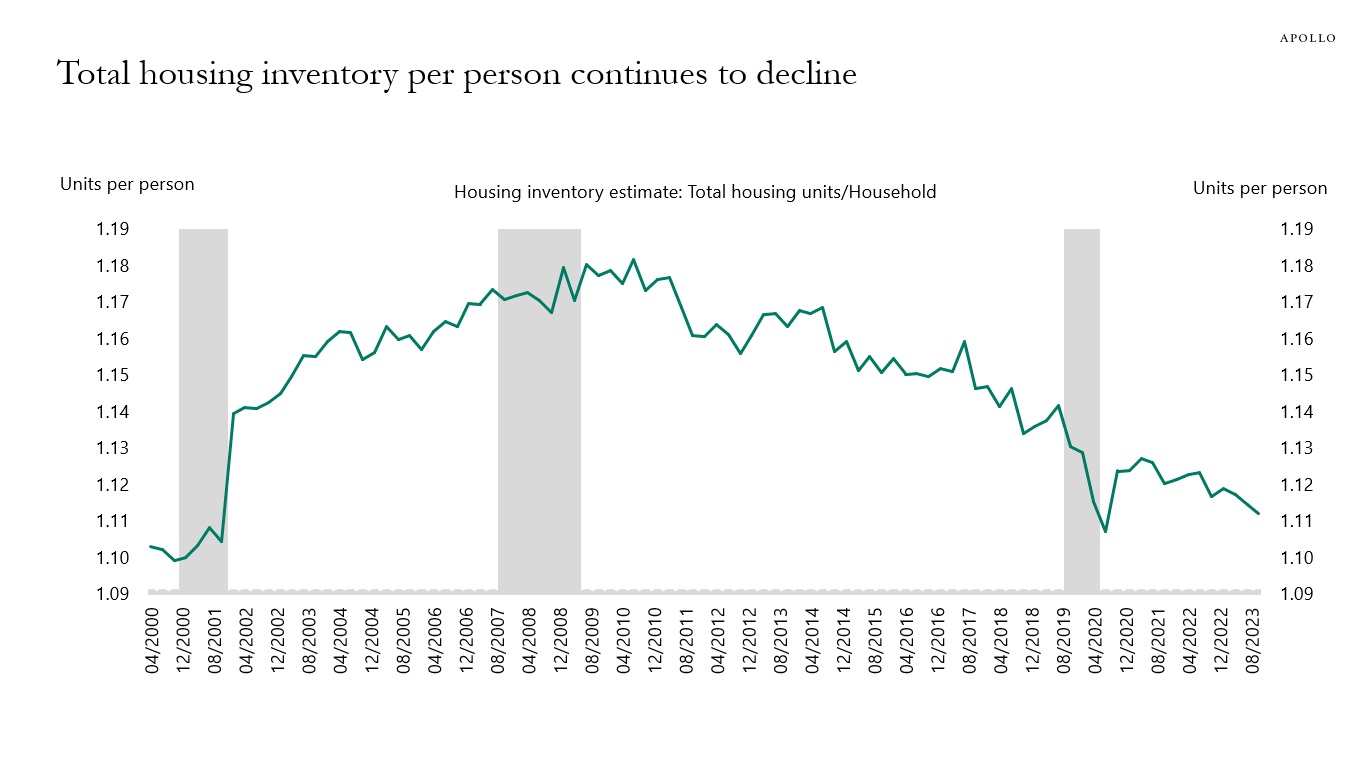

Our latest outlook for the housing market is available here, key charts below.

Source: Apollo Chief Economist

Source: Haver Analytics, BLS, S&P, Apollo Chief Economist

Source: Apartmentlist.com, Apollo Chief Economist

Source: Realtor.com, Apollo Chief Economist

Source: MBA, Bloomberg, Apollo Chief Economist (Note: It is 5-year ARM)

Source: Census Bureau, FRED, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

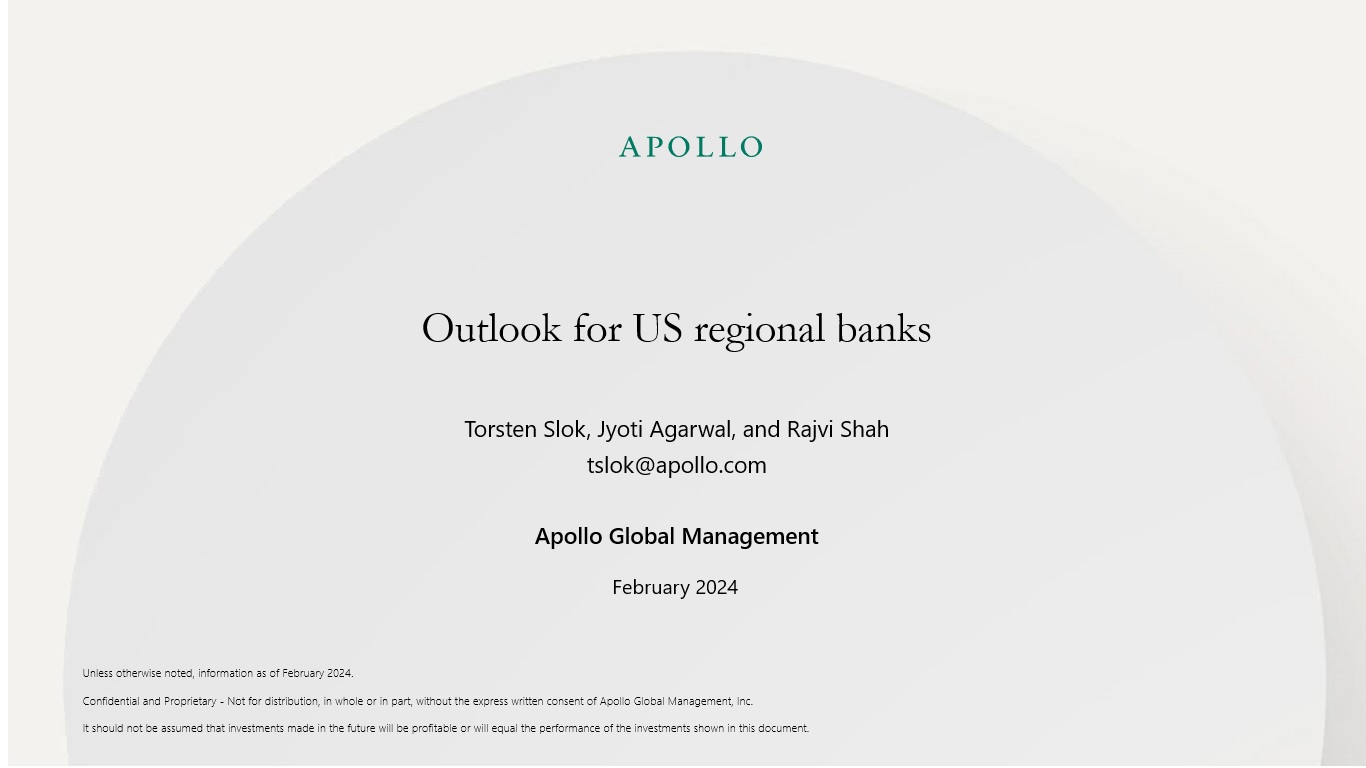

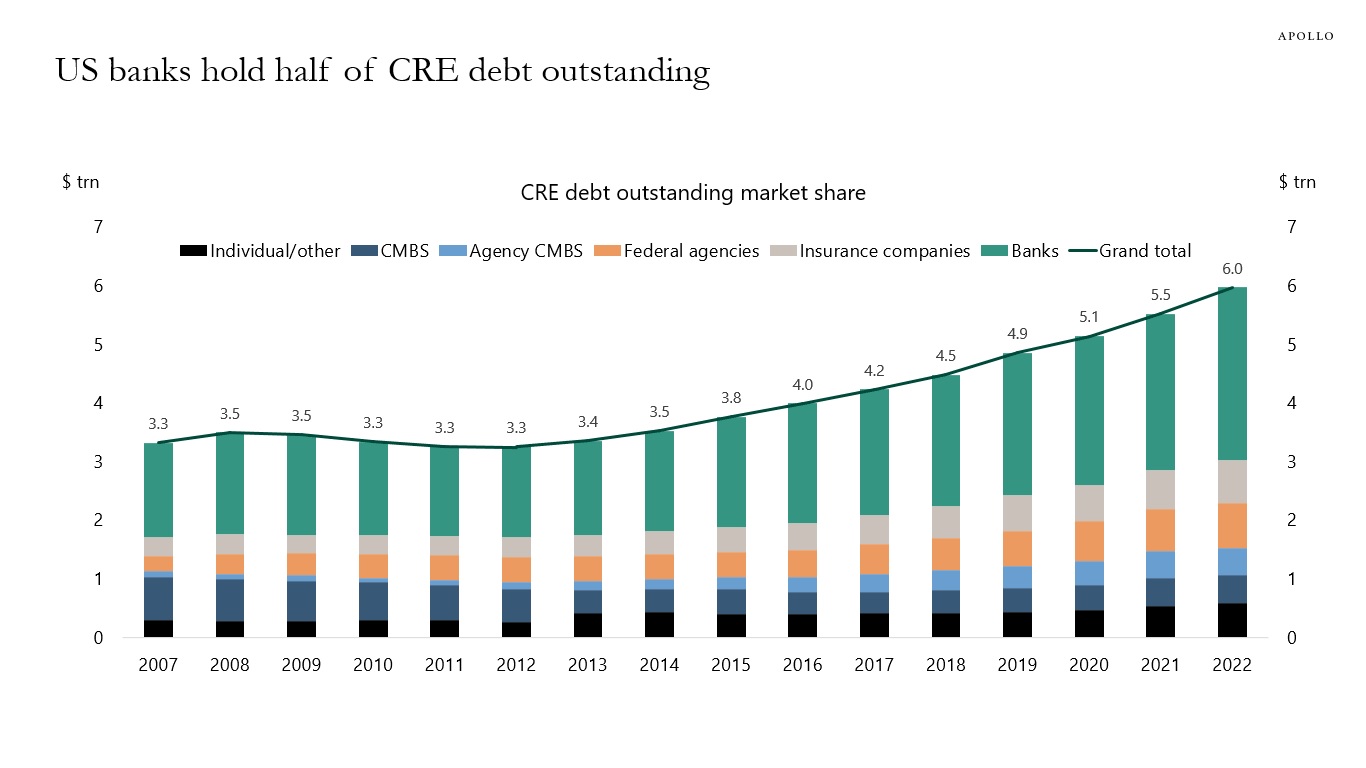

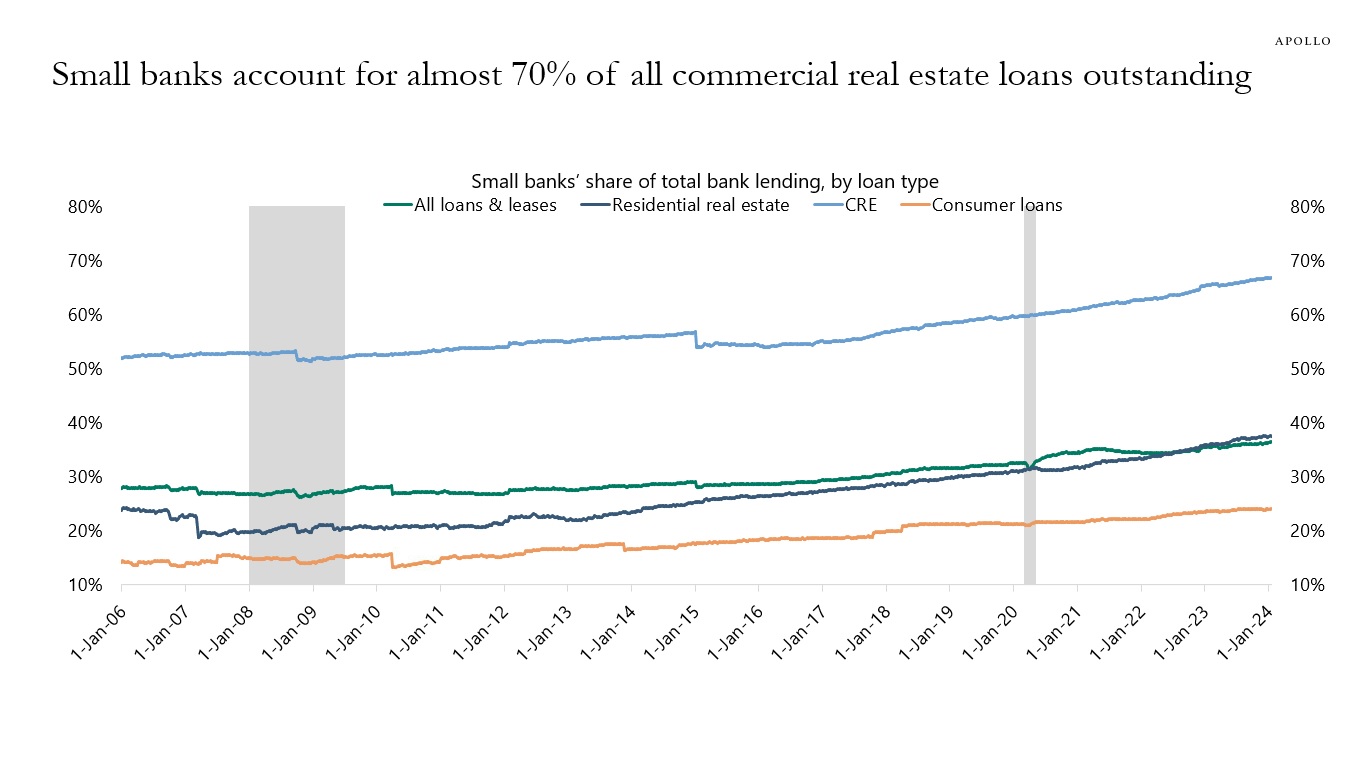

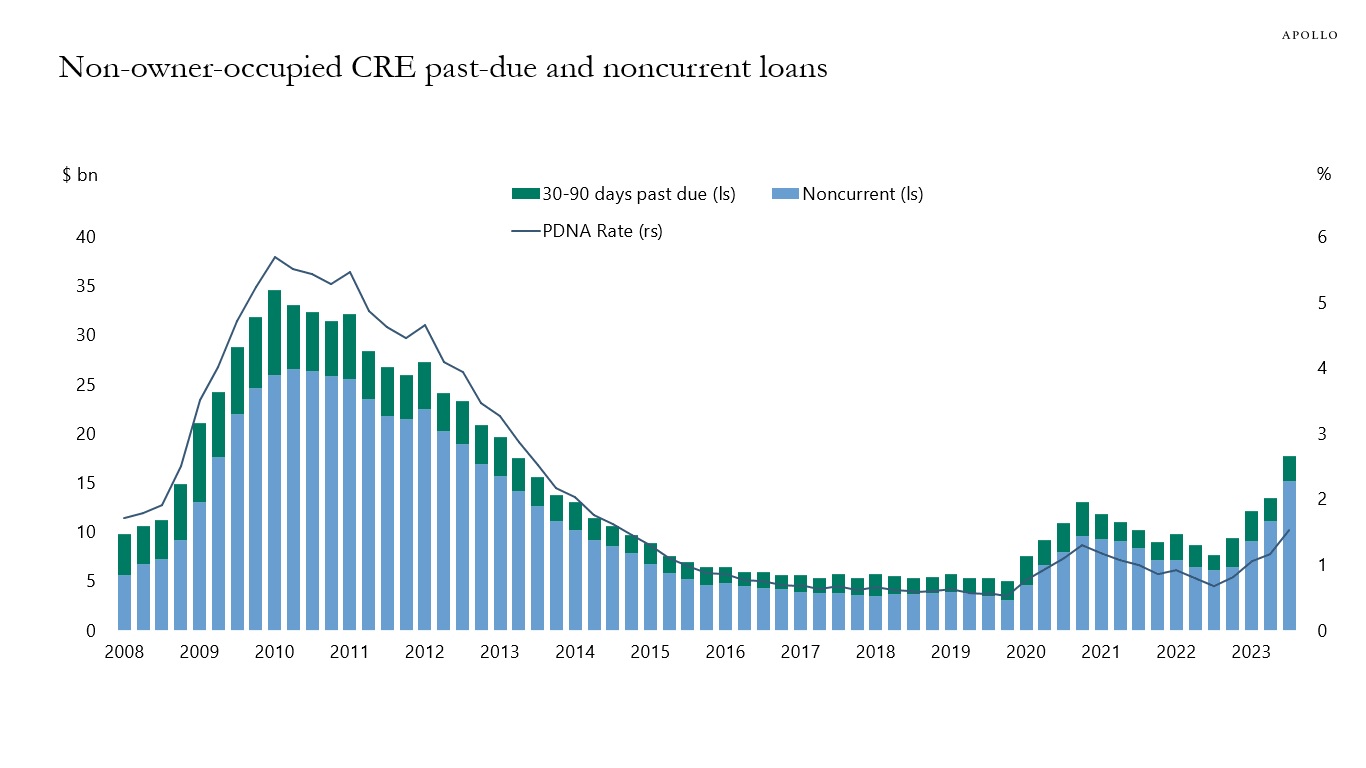

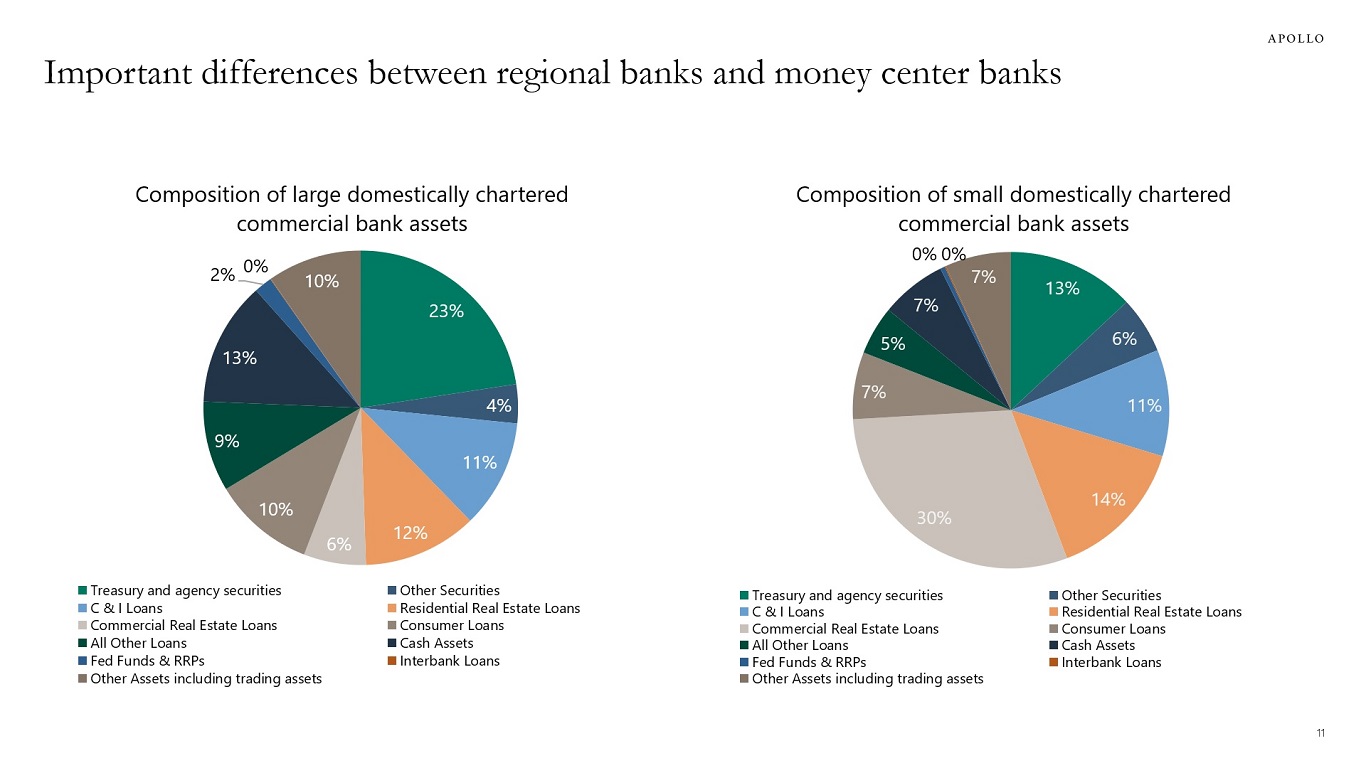

Our updated banking sector chart book is available here, key charts below.

Source: S&P Capital IQ, Apollo Chief Economist

Source: Federal Reserve Board, Haver Analytics, Apollo Chief Economist

Source: FDIC, Apollo Chief Economist

Source: FDIC, Apollo Chief Economist. (PDNA stands for Past Due and Non-Accrual rate defined as loans that are past due and are in non-accrual status.)

Source: FRB, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

About 18% of China’s population is older than 60. Over the coming decades, that share will rise to 32%, higher than in the US, see chart below. Our latest outlook for China is available here.

Source: UN, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

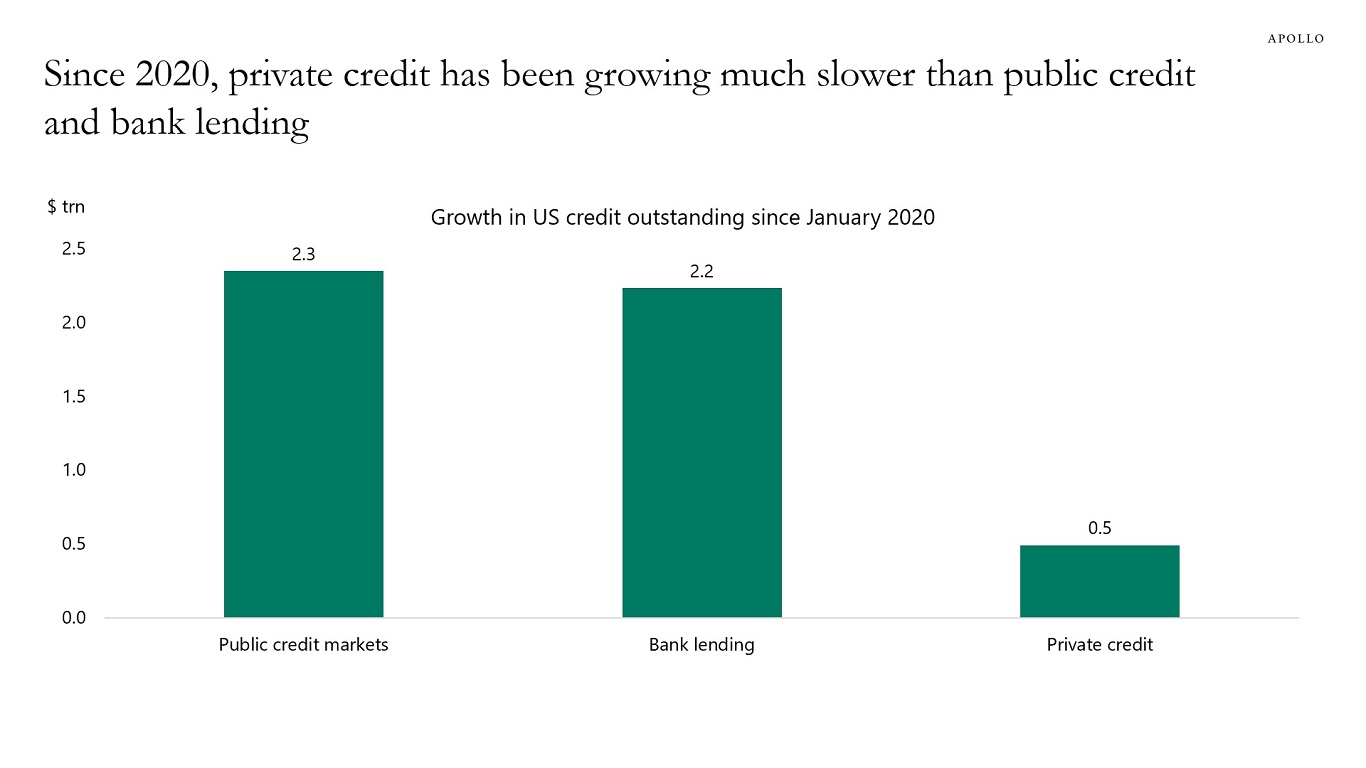

Comparing the growth in private credit with the growth in other sources of financing for corporates shows that private credit has been growing much slower than public credit and credit extended by banks, see chart below.

Source: FRB, ICE BofA, Bloomberg, Preqin, Apollo Chief Economist. (Note: Public credit markets include HY, IG, and leveraged loans. Bank lending includes loans & leases in bank credit. All commercial banks and private credit is dry powder + unrealized value/NAV of all the funds in the private debt space.) See important disclaimers at the bottom of the page.

-

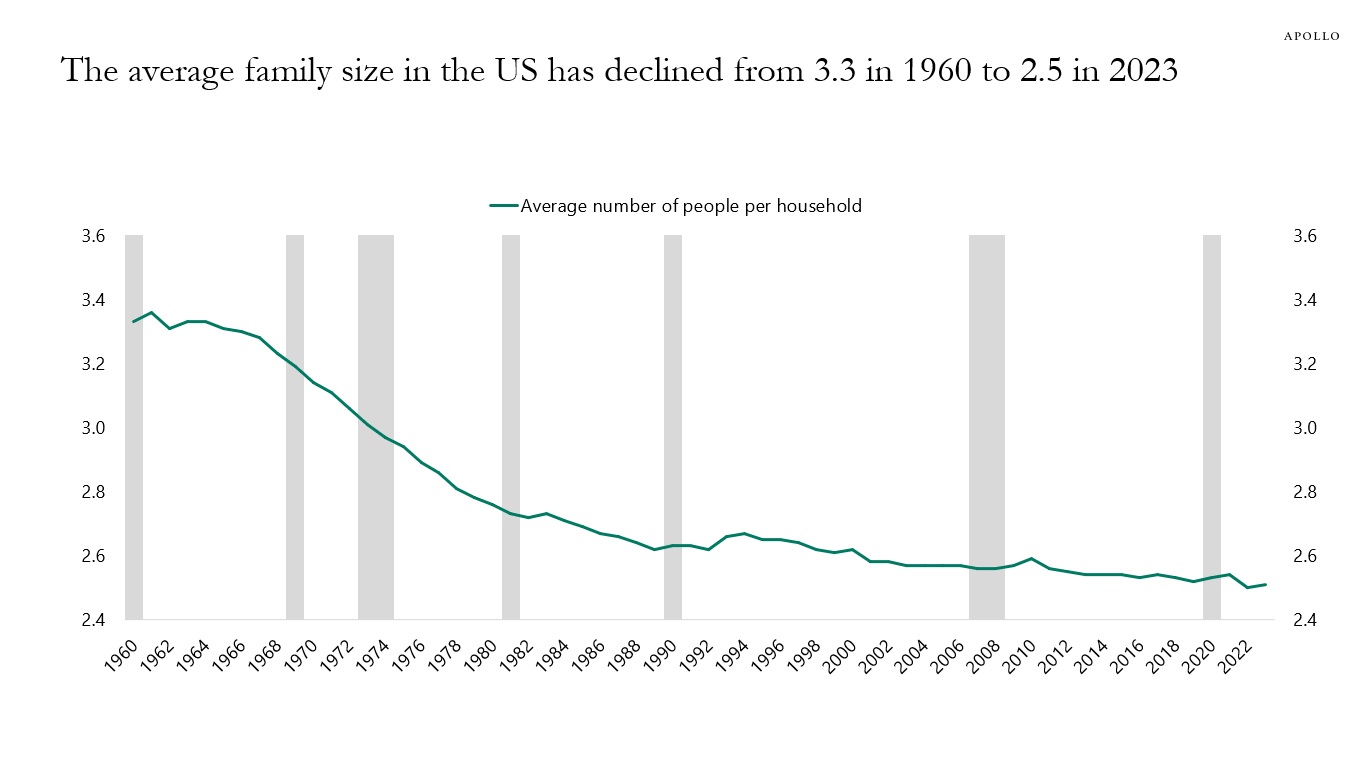

The average number of people per household continues to decline, see chart below.

Source: Census Bureau, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

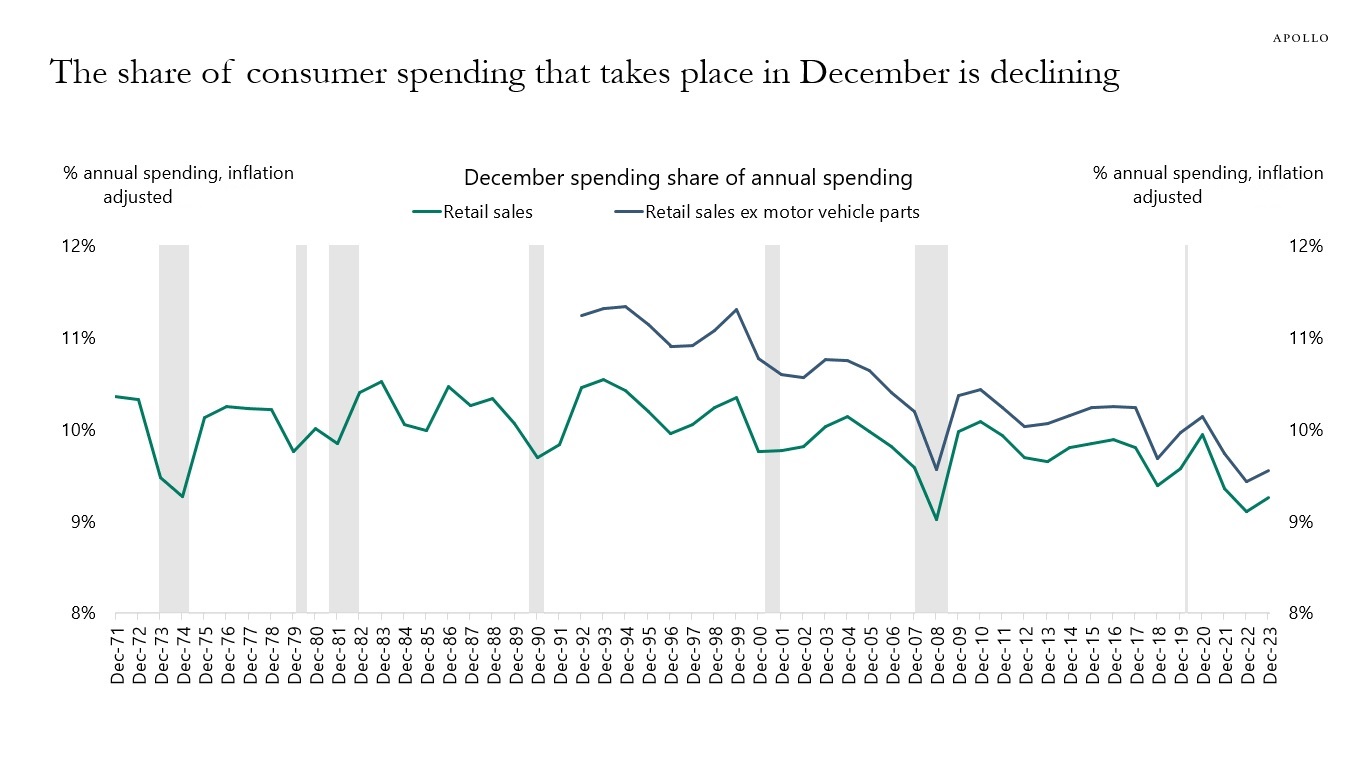

The share of consumer spending that takes place in December has been steadily declining for decades and now makes up less than 10% of total private consumption, see chart below.

The reason is that consumers spend less money on goods and more money on services such as restaurants, hotels, airlines, concerts, and sporting events.

Source: Census Bureau, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

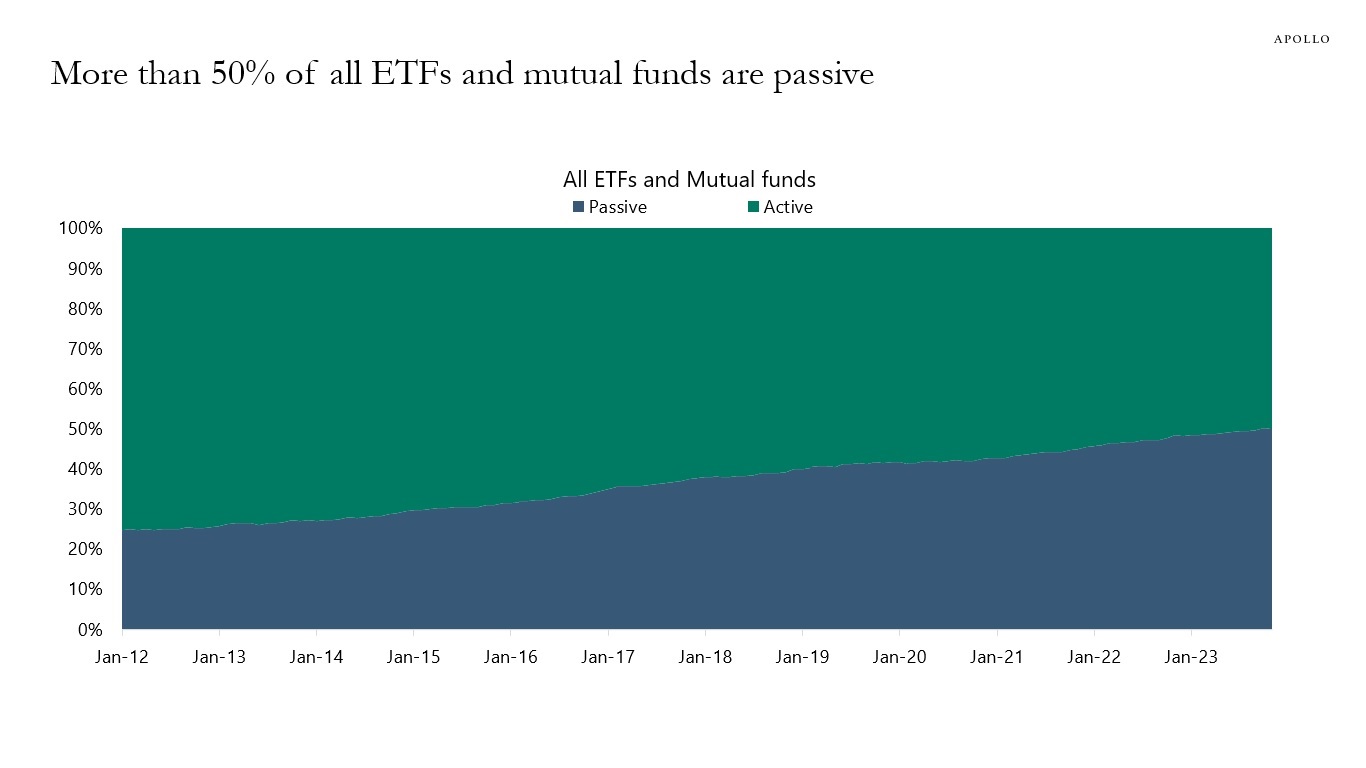

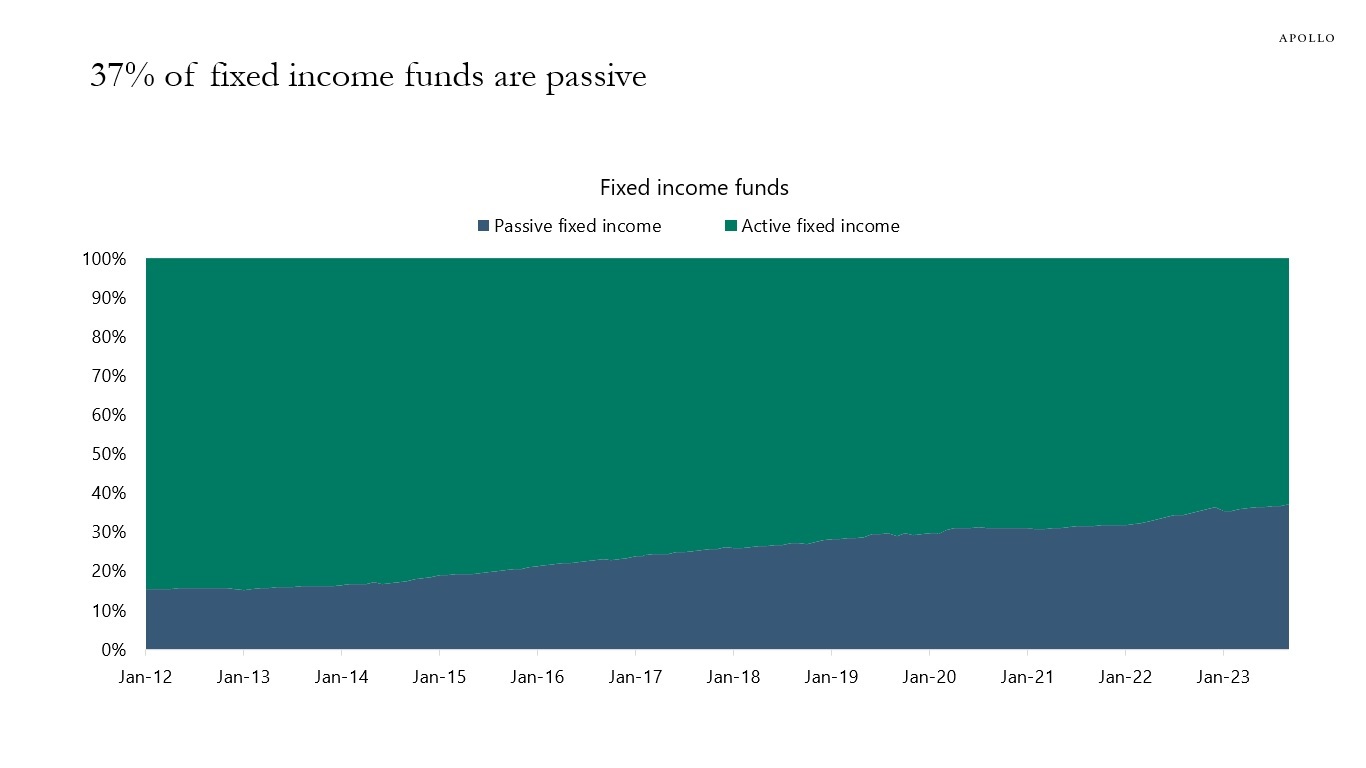

More than 50% of all ETFs and mutual funds are passive, and 37% of fixed income funds are passive, see charts below. Numerous studies show that active mutual fund managers continue to underperform their benchmark, see for example here, here, and here.

Source: Bloomberg, Apollo Chief Economist

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

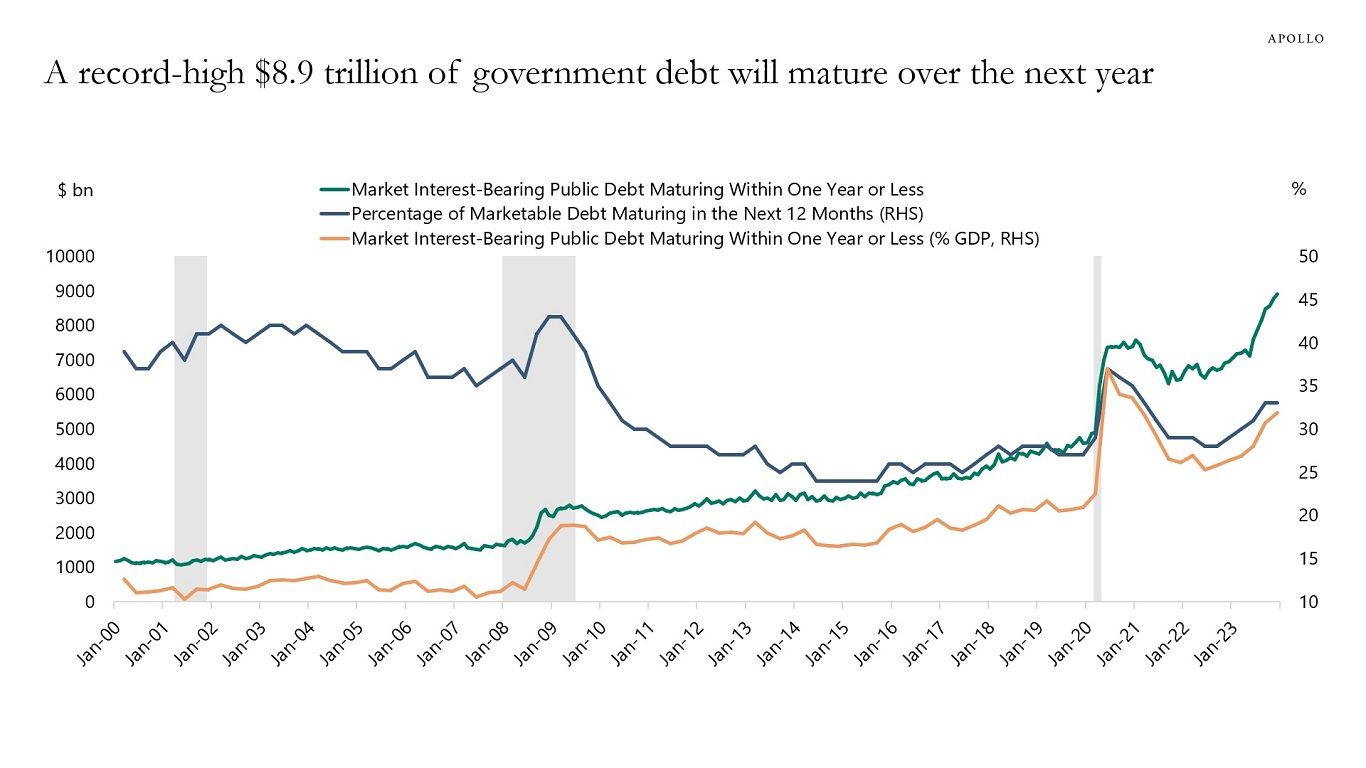

A record $8.9 trillion of government debt will mature over the next year, see the first chart below. The government budget deficit in 2024 will be $1.4 trillion according to the CBO, and the Fed has been running down its balance sheet by $60 billion per month.

The bottom line is that someone will need to buy more than $10 trillion in US government bonds in 2024. That is more than one-third of US government debt outstanding. And more than one-third of US GDP.

This may be a particular challenge when the biggest holders of US Treasuries, namely foreigners, continue to shrink their share, see the second chart.

More fundamentally, interest rate-sensitive balance sheets such as households, pension, and insurance have been the biggest buyers of Treasuries in 2023, and the question is whether they will continue to buy once the Fed starts cutting rates.

Our updated outlook for Treasury demand is available here.

Source: Treasury, BEA, Haver Analytics, Apollo Chief Economist

Source: Treasury, Haver Analytics, Apollo Chief Economist

See important disclaimers at the bottom of the page.

-

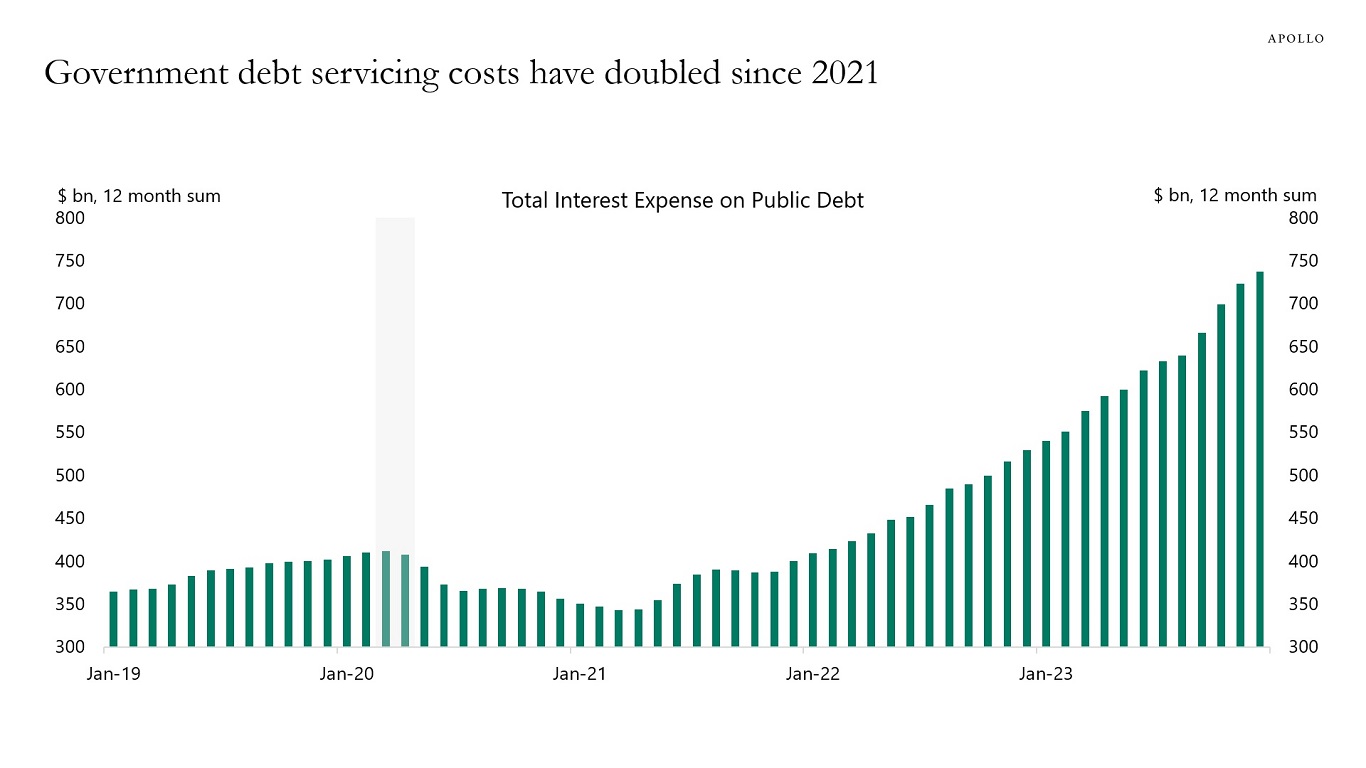

In 2021, US government interest payments were around $350 billion, see chart below.

Because of the increase in interest rates and debt levels, annualized debt servicing costs are now above $700 billion.

Source: US Treasury, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.