Want it delivered daily to your inbox?

-

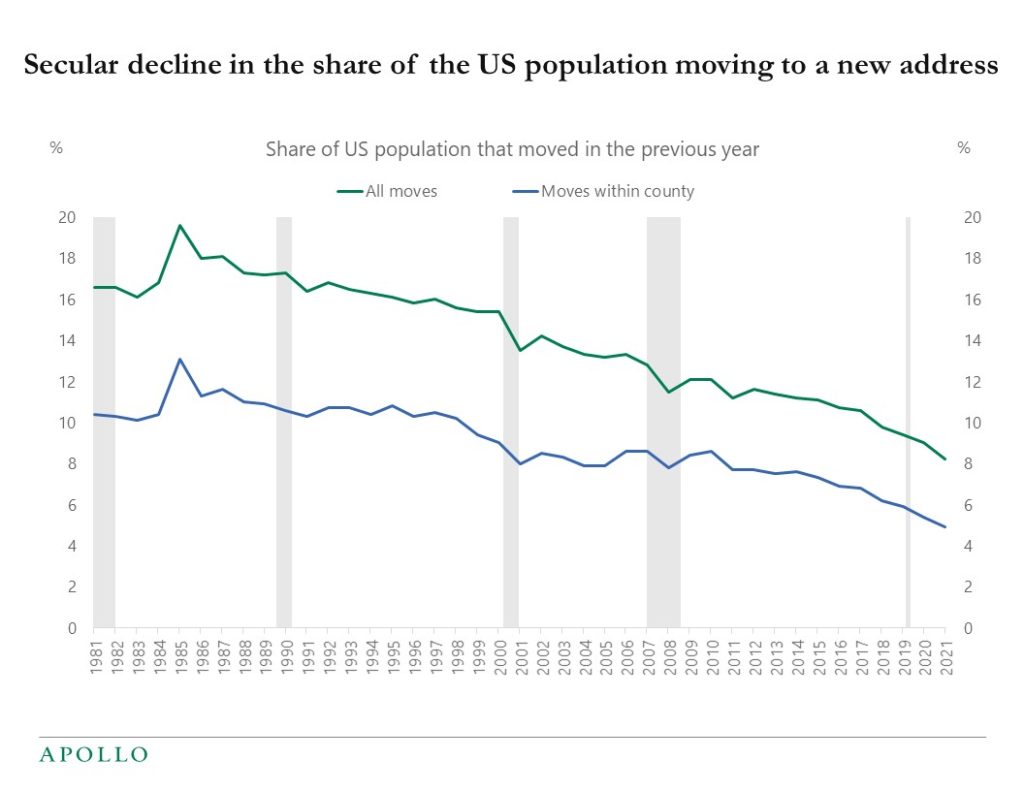

Americans are moving less, see chart below, and the sources of this trend decline are: 1) a rise in the share of dual-income households, 2) affordability (a trend increase in home prices relative to income), and 3) demographics (population getting older and people move less often as they age). These trends, combined with more people working from home post COVID, point to a continued decline in mobility going forward. For more discussion, see also here.

Source: Census CPS, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

We have updated our supply chain chart book, and the conclusion is that things are starting to look better, but we are still far from normal.

See important disclaimers at the bottom of the page.

-

Fed: Flow Dynamics in High Yield Corporate Debt Mutual funds

https://www.federalreserve.gov/econres/notes/feds-notes/interest-rates-expectations-and-flow-dynamics-in-high-yield-corporate-debt-mutual-funds-20220617.htmBIS: Banking in the shadow of Bitcoin? The institutional adoption of cryptocurrencies

https://www.bis.org/publ/work1013.pdfECB: Liquidity coverage ratios and monetary policy credit in the time of Corona

https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2668~3f5a65348b.en.pdfSee important disclaimers at the bottom of the page.

-

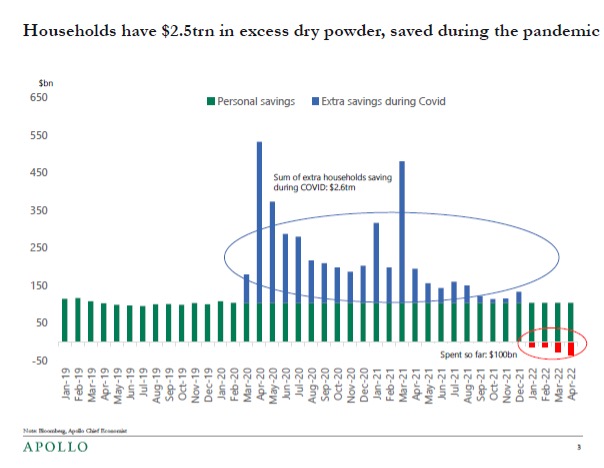

The first chart below shows that households during the pandemic saved an additional $2.6trn, and so far, consumers have only spent $100bn of these savings.

The second and third charts show that the amount of money in checking accounts at commercial banks is about $3trn higher than the pre-pandemic trend.

With US annual consumer spending at around $16trn, these amounts of cash on the sidelines are a significant tailwind for the US economy over the coming quarters. And because these savings are readily available for consumers to spend, increasing the Fed funds rate will have a less negative impact on the economy than normally because consumers don’t need to borrow when they have extra cash in their bank accounts.

Put differently, when there is a lot of cash in the economy, the transmission mechanism of monetary policy is weaker. As a result, the Fed has to increase interest rates even more than during previous hiking cycles.

The bottom line is that interest rates will continue to rise, and it could take several quarters before the US consumer starts slowing down meaningfully.

See important disclaimers at the bottom of the page.

-

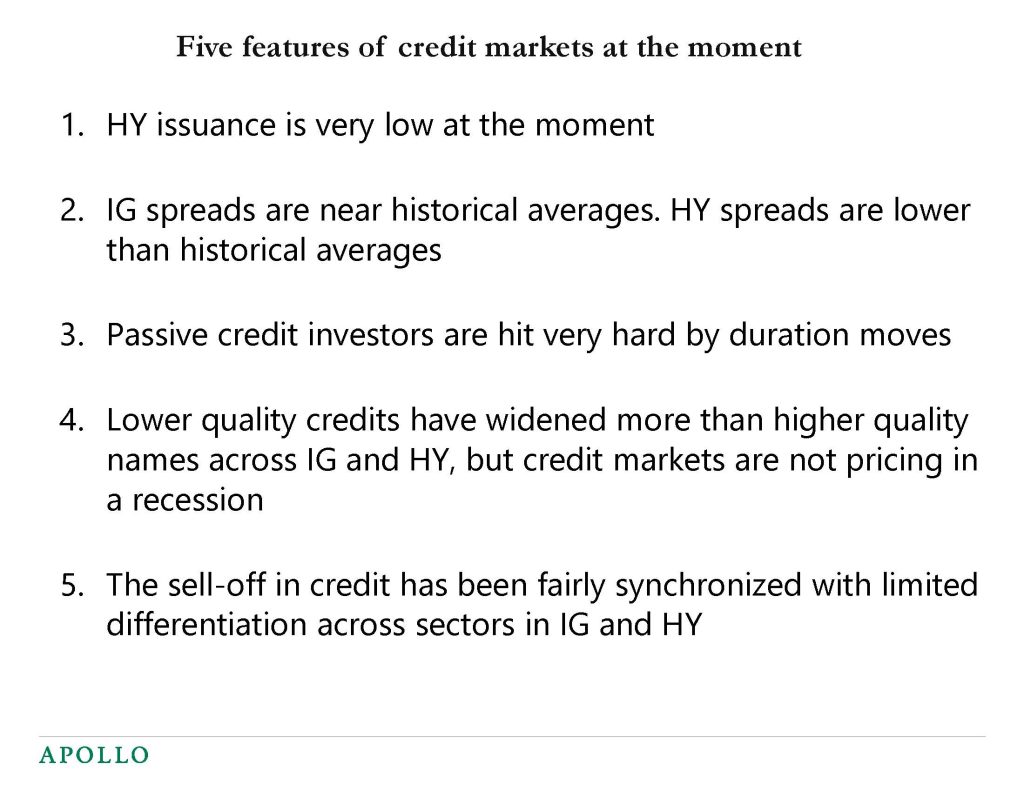

Below are five key features of credit markets at the moment. For more see our attached Trends in credit markets presentation.

Source: Apollo Chief Economist See important disclaimers at the bottom of the page.

-

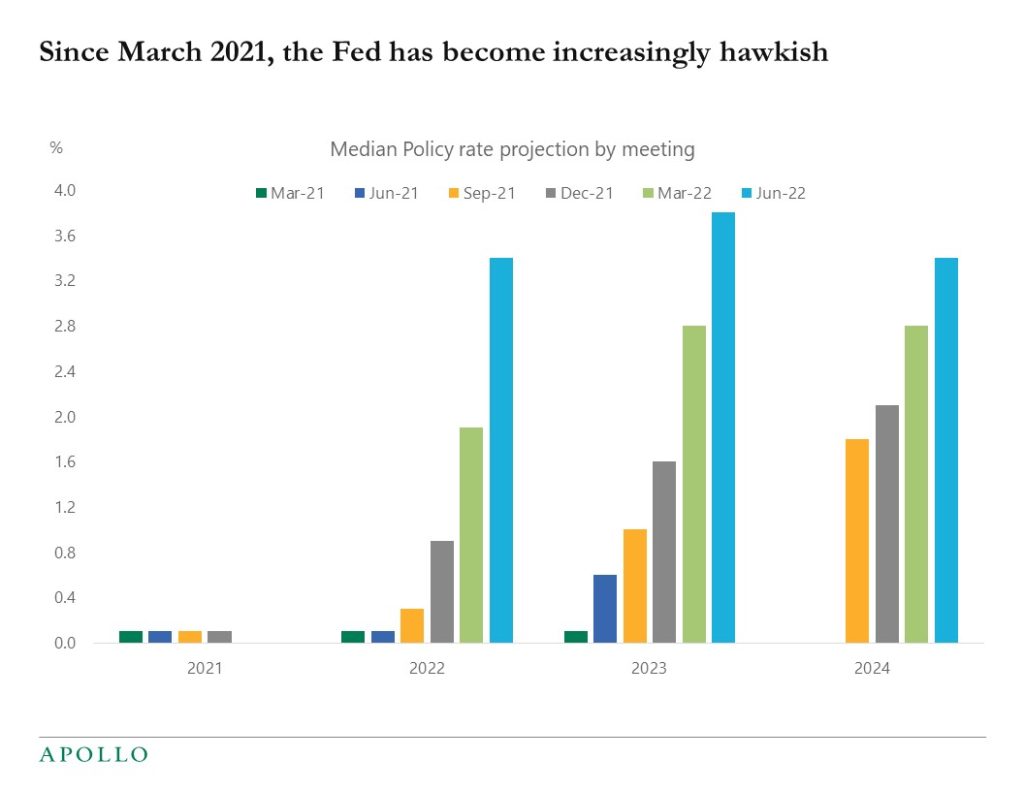

The Fed delivered 75bps and said that we could get another 75bps in July. The speed with which the Fed has changed its view on where short rates will be is unprecedented. In March 2021, the FOMC said the Fed funds rate by the end of 2022 would be 0%. Today they are saying that the Fed funds rate by the end of 2022 will be 3.4%, see chart below.

Source: FOMC Summary of Economic Projections, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

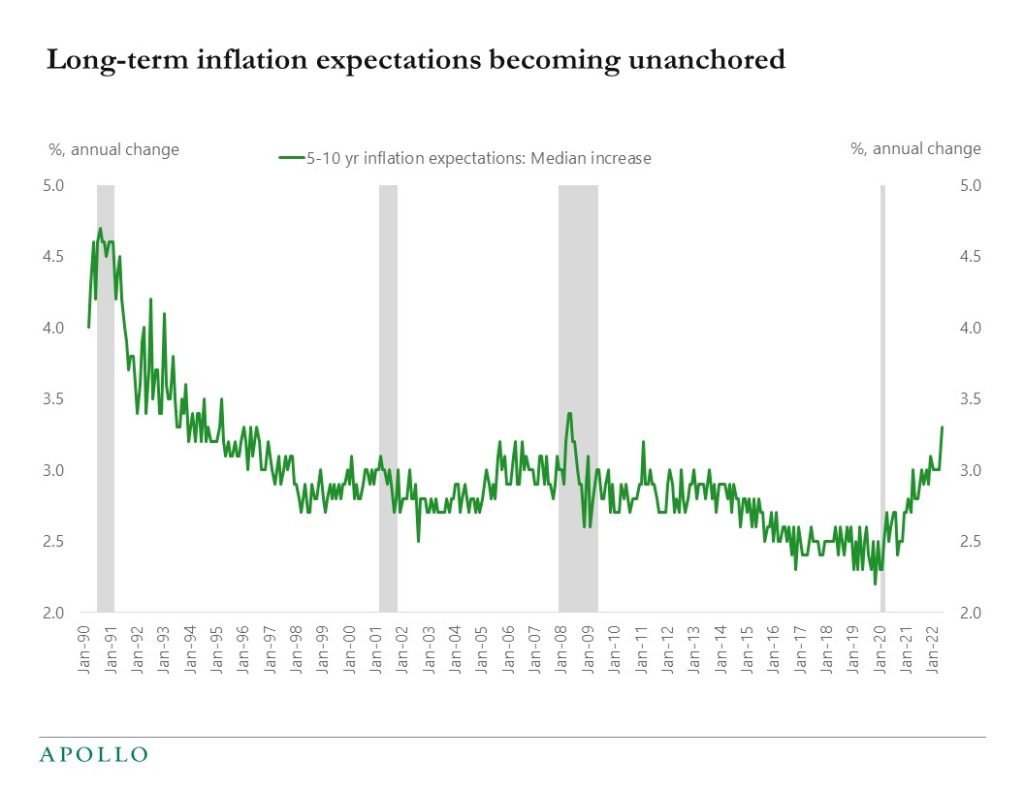

One strong argument for the Fed hiking 75bps today is that the average US household is starting to expect higher inflation to become a permanent feature of the US economy, see chart below. In other words, inflation expectations are becoming entrenched among workers, households, and businesses.

This has significant negative implications for the planning of CapEx spending and consumer spending. As a result, the Fed wants to reduce long-term inflation expectations as quickly as possible. The only way to do that is to show a strong commitment to getting inflation down by tightening financial conditions further through higher short and long rates, wider credit spreads, and lower equities.

From a strategy perspective, if we get 75bps today, it could trigger a rally in credit and equities after the meeting because it would signal that the Fed is committed to getting the inflation problem under control.

Source: U. of Michigan Sentiment, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

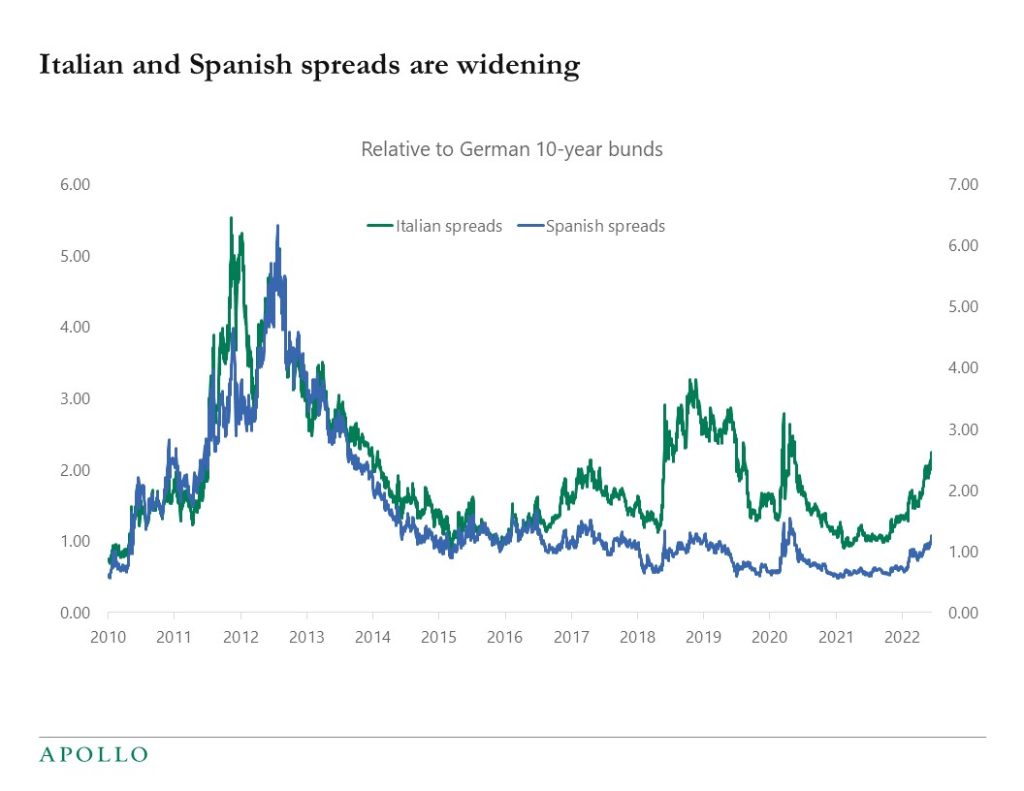

Since the ECB last week announced that from July 1, they will no longer be doing QE, i.e. the ECB will no longer be buying European government bonds, spreads between periphery government bonds and German bunds have widened, see chart below. This is increasing the risk of more distress in European assets.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

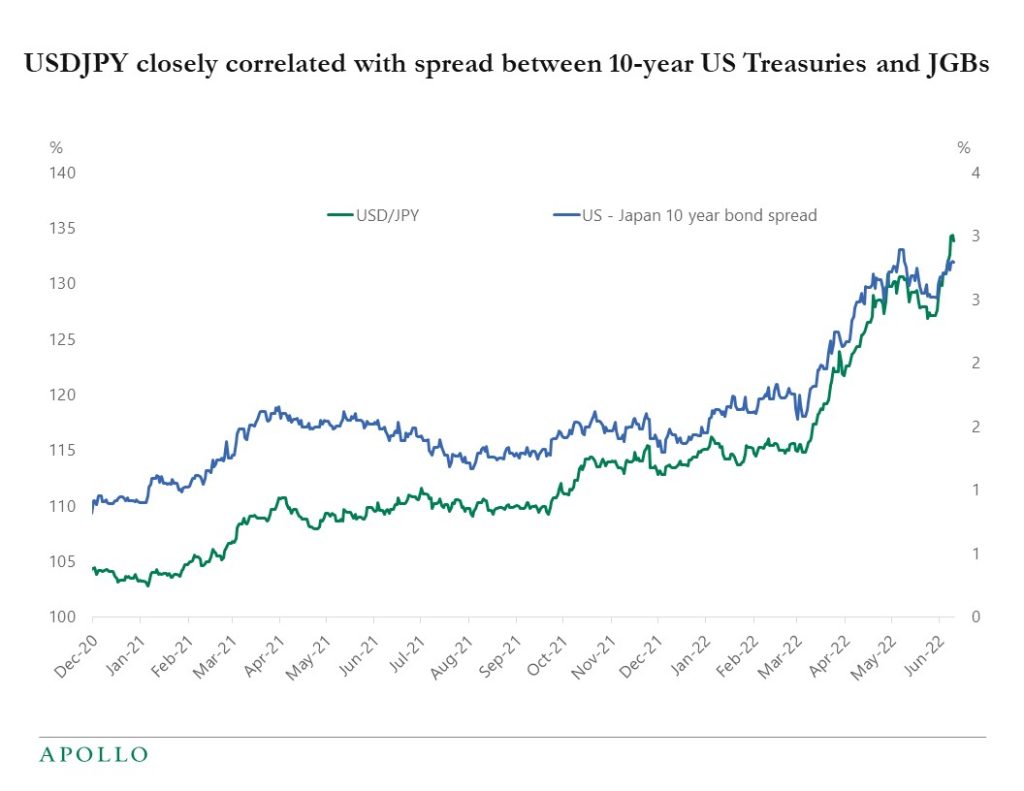

The biggest foreign holder of US Treasuries is Japan, but Japanese investors have in recent months been selling Treasuries. With the Fed raising rates, hedging costs have increased, making US Treasuries less attractive for foreign investors. This is likely to continue as long as the Bank of Japan does yield curve control. The bottom line is that with rising hedging costs, foreign investors have less appetite to buy US Treasuries, which adds to the upward pressure on US rates.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Larry Summers: Comparing Past and Present Inflation

https://www.nber.org/papers/w30116Buy Now, Pay Later (BNPL)…On Your Credit Card

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4001909China’s Economic and Trade Ties with Russia

https://crsreports.congress.gov/product/pdf/IF/IF12120See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.