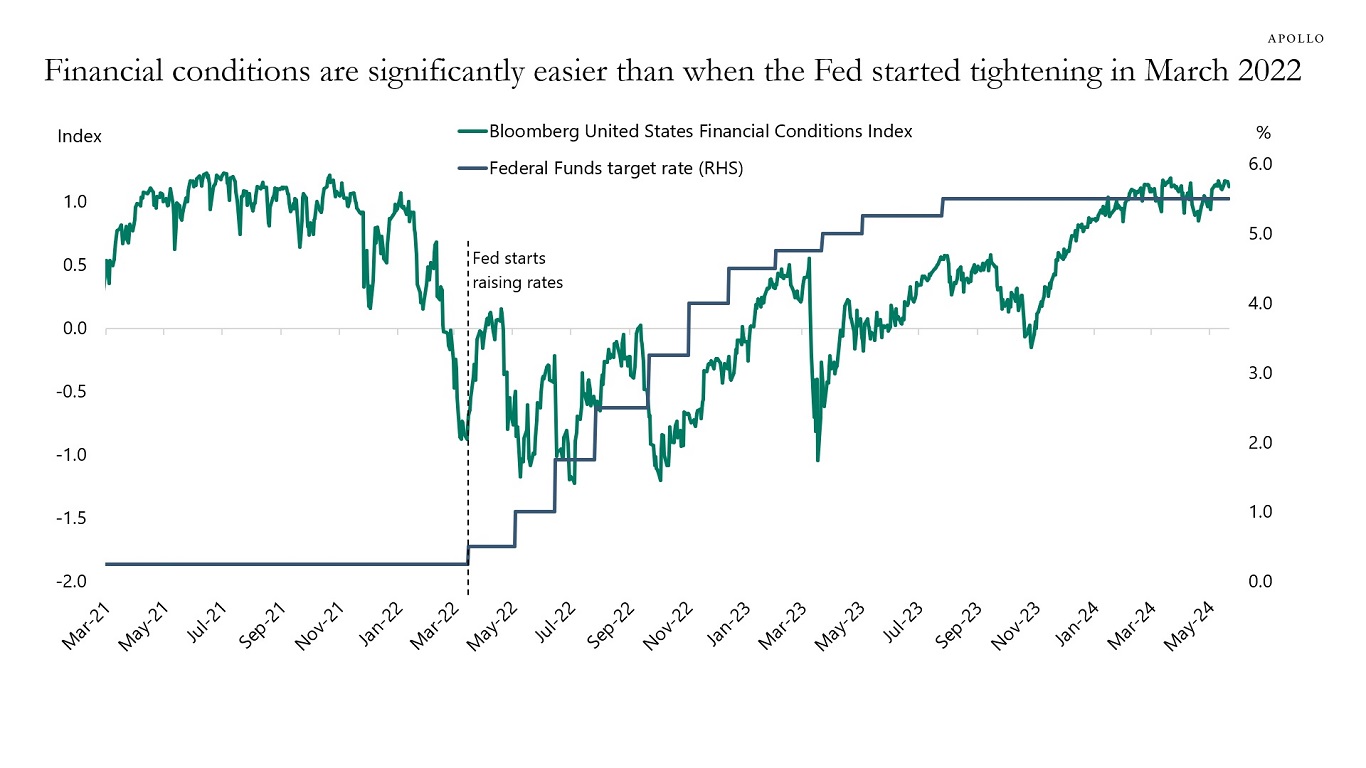

Financial conditions are significantly easier than when the Fed started raising interest rates in March 2022, see chart below.

The strength in the stock market is partly driven by strong earnings, including from NVIDIA. But the stock market is being boosted by more than strong earnings and the prospects of AI lifting future GDP growth.

Since the Fed pivot in November 2023, when the FOMC started talking about cuts instead of hikes, the S&P 500 market cap is up $9 trillion. For comparison, consumer spending in 2023 was $19 trillion. In other words, in a few months, the household sector has experienced a windfall gain corresponding to about 50% of last year’s consumer spending!

Combined with continued easy fiscal policy via the Chips Act, the Inflation Reduction Act, and the Infrastructure Act, it is not surprising that employment growth and inflation have been reaccelerating in 2024.

In short, why is the economy still so strong? Because fiscal policy is still a significant tailwind to the economy, and easy financial conditions have been offsetting Fed hikes.

Looking ahead, with the stock market hitting fresh all-time highs and fiscal policy still supportive, the expectation in markets should be that the economy will continue to accelerate over the coming quarters.

You can call this the Fed Cut Reflexivity Paradox: The more the Fed insists that the next move in interest rates is a cut, the more financial conditions will ease, making it more difficult for the Fed to cut.