The market came into 2023 expecting a recession.

The market went into 2024 expecting six Fed cuts.

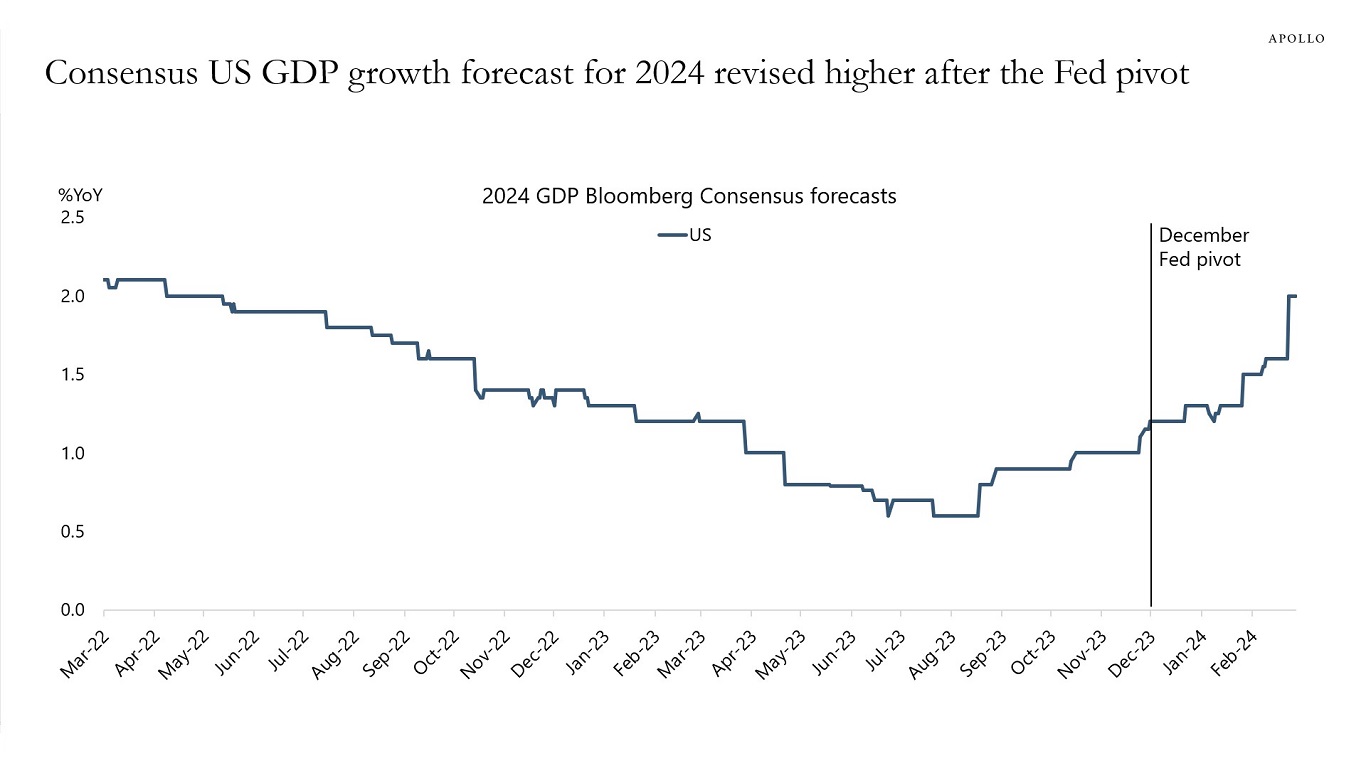

The reality is that the US economy is simply not slowing down, and the Fed pivot has provided a strong tailwind to growth since December.

As a result, the Fed will not cut rates this year, and rates are going to stay higher for longer.

How do we come to this conclusion?

1) The economy is not slowing down, it is reaccelerating. Growth expectations for 2024 saw a big jump following the Fed pivot in December and the associated easing in financial conditions. Growth expectations for the US continue to be revised higher, see the first chart below.

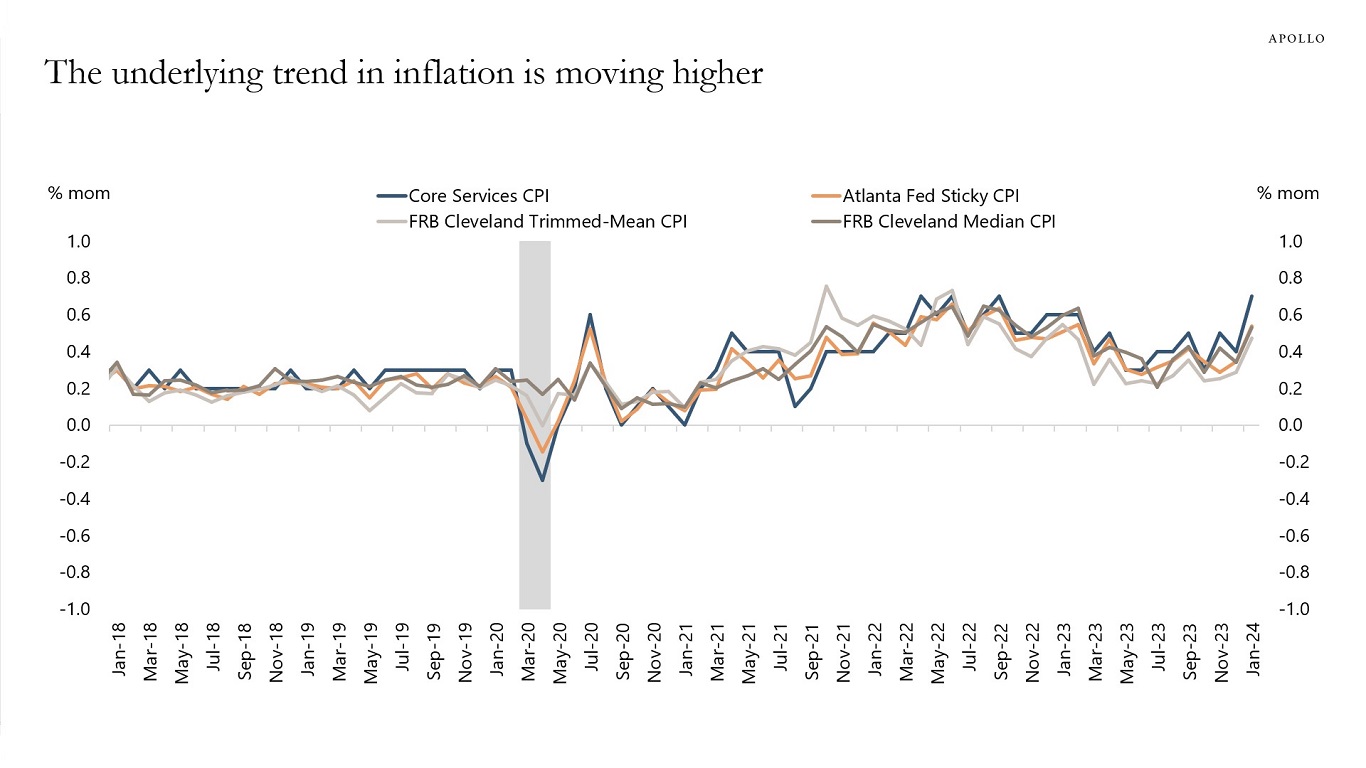

2) Underlying measures of trend inflation are moving higher, see the second chart.

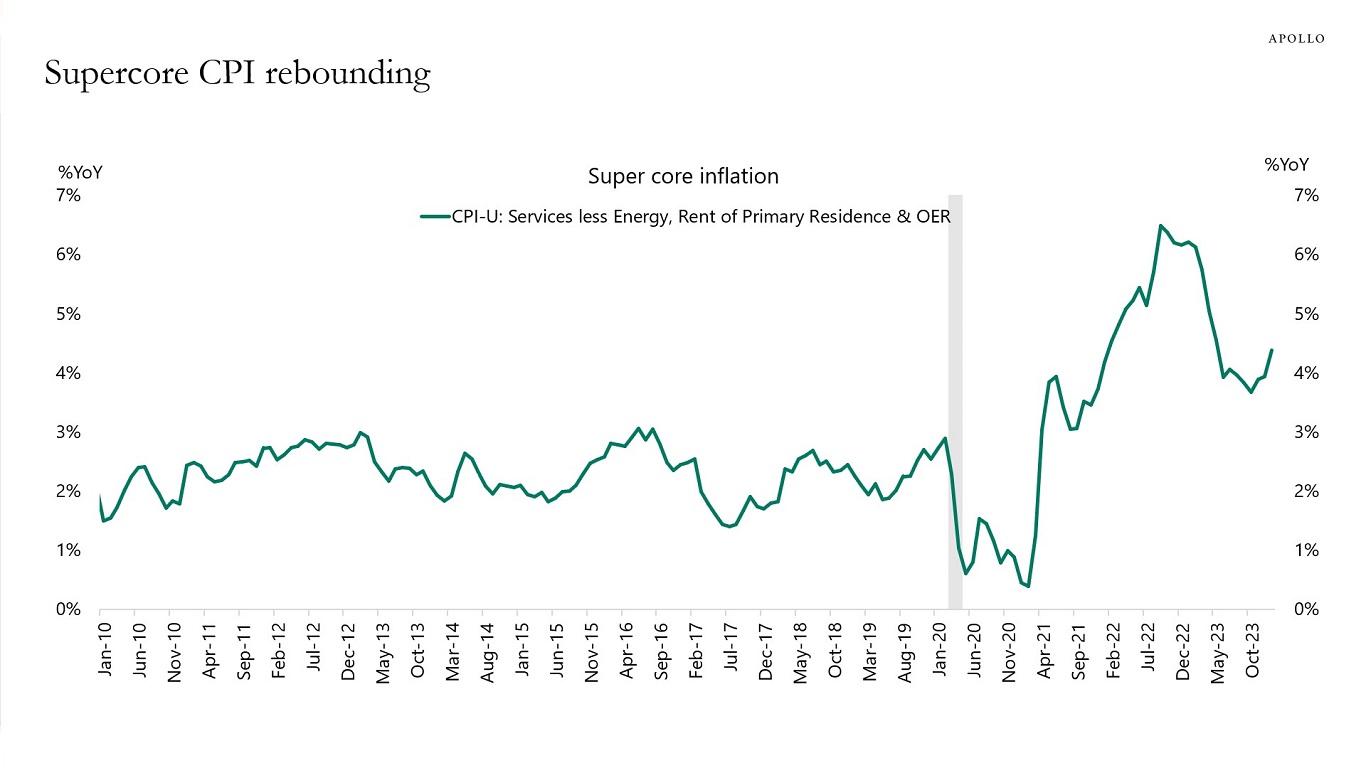

3) Supercore inflation, a measure of inflation preferred by Fed Chair Powell, is trending higher, see the third chart.

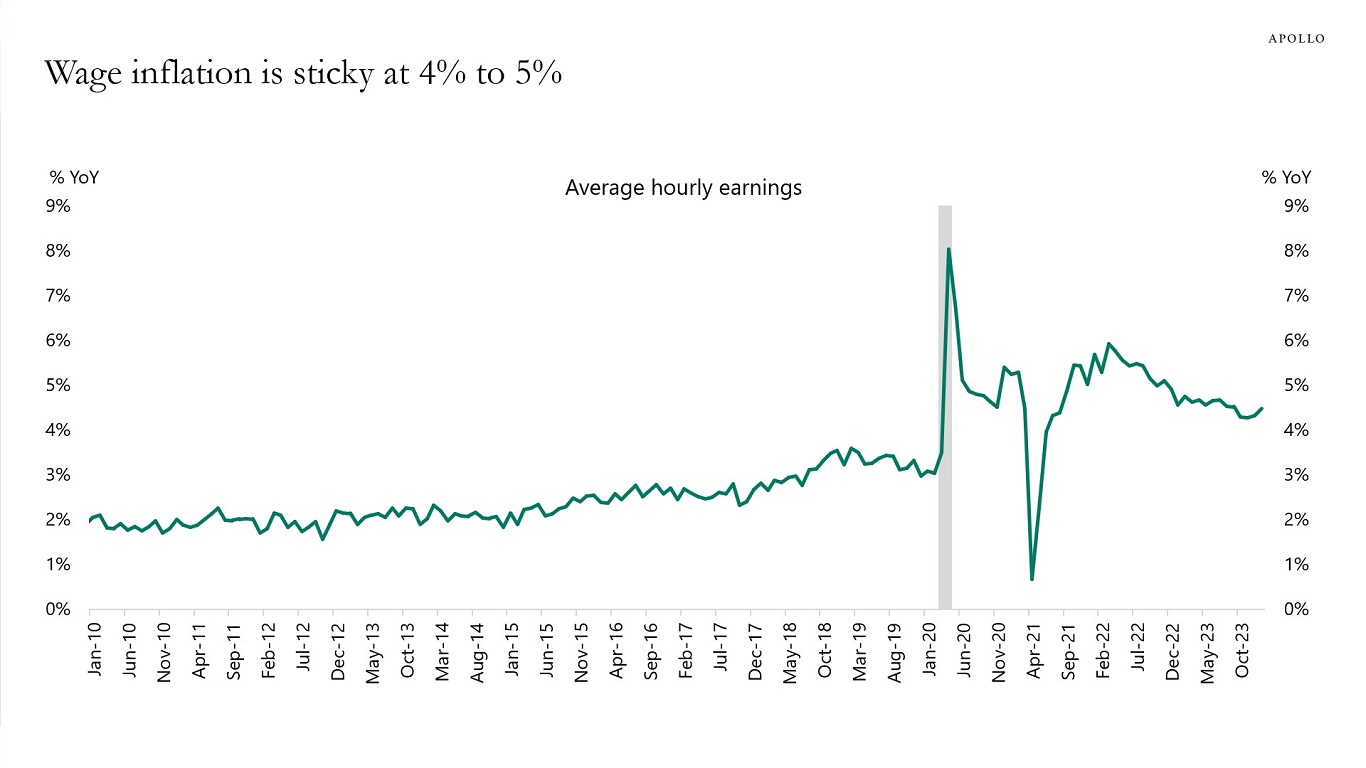

4) Following the Fed pivot in December, the labor market remains tight, jobless claims are very low, and wage inflation is sticky between 4% and 5%, see the fourth chart.

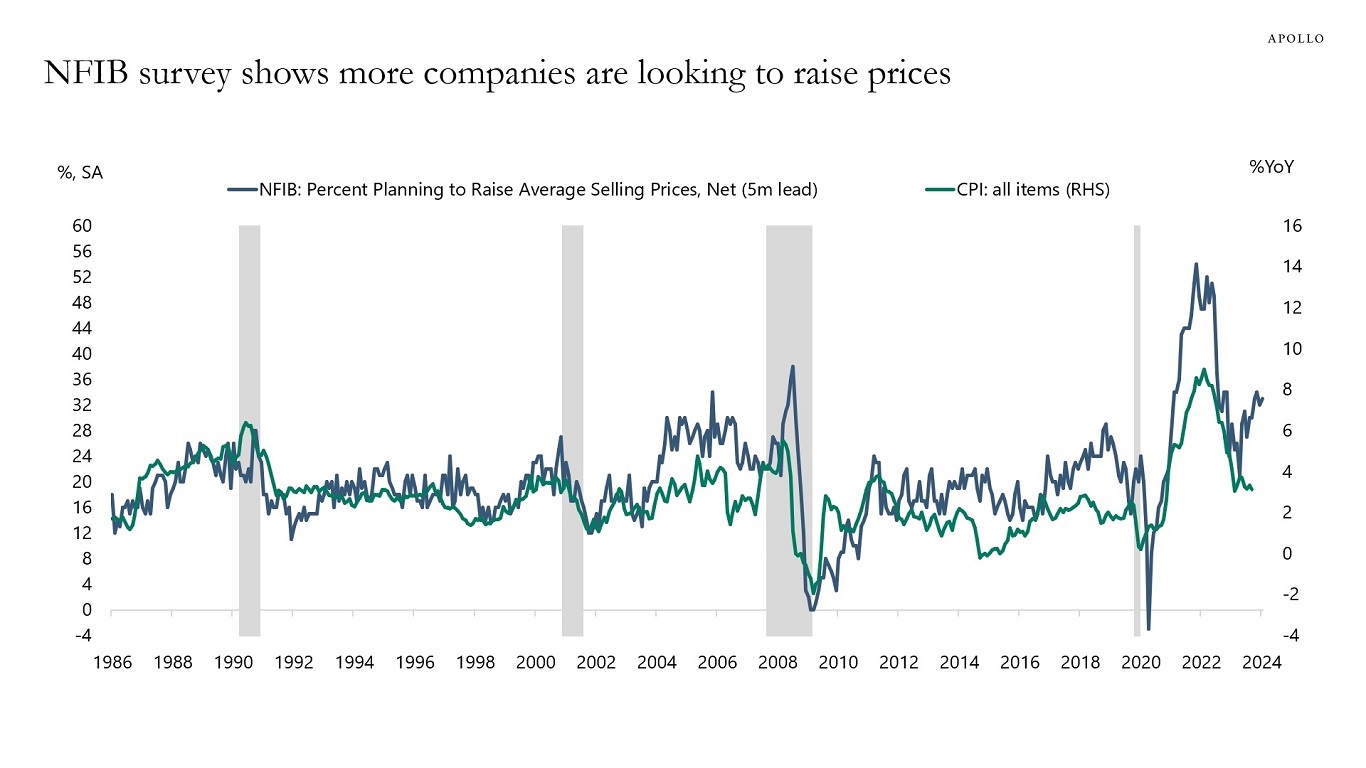

5) Surveys of small businesses show that more small businesses are planning to raise selling prices, see the fifth chart.

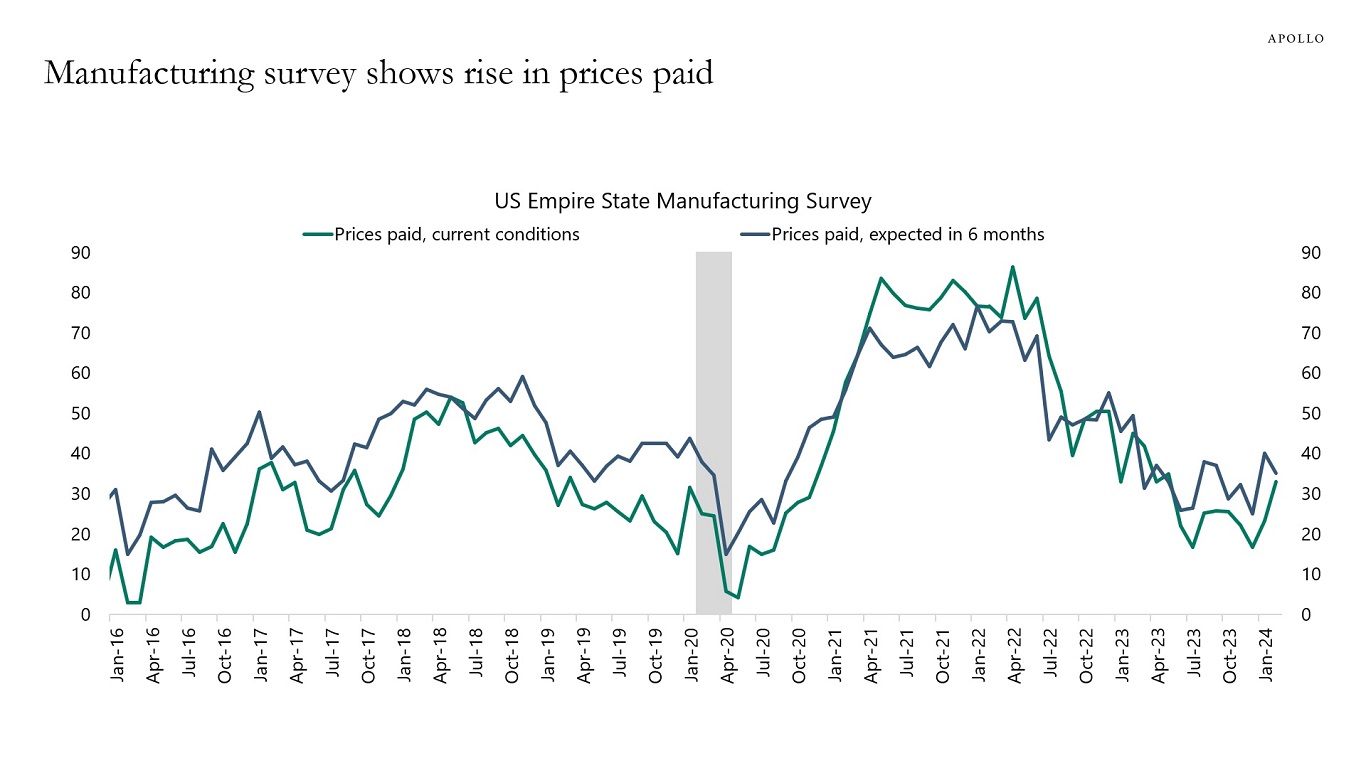

6) Manufacturing surveys show a higher trend in prices paid, another leading indicator of inflation, see the sixth chart.

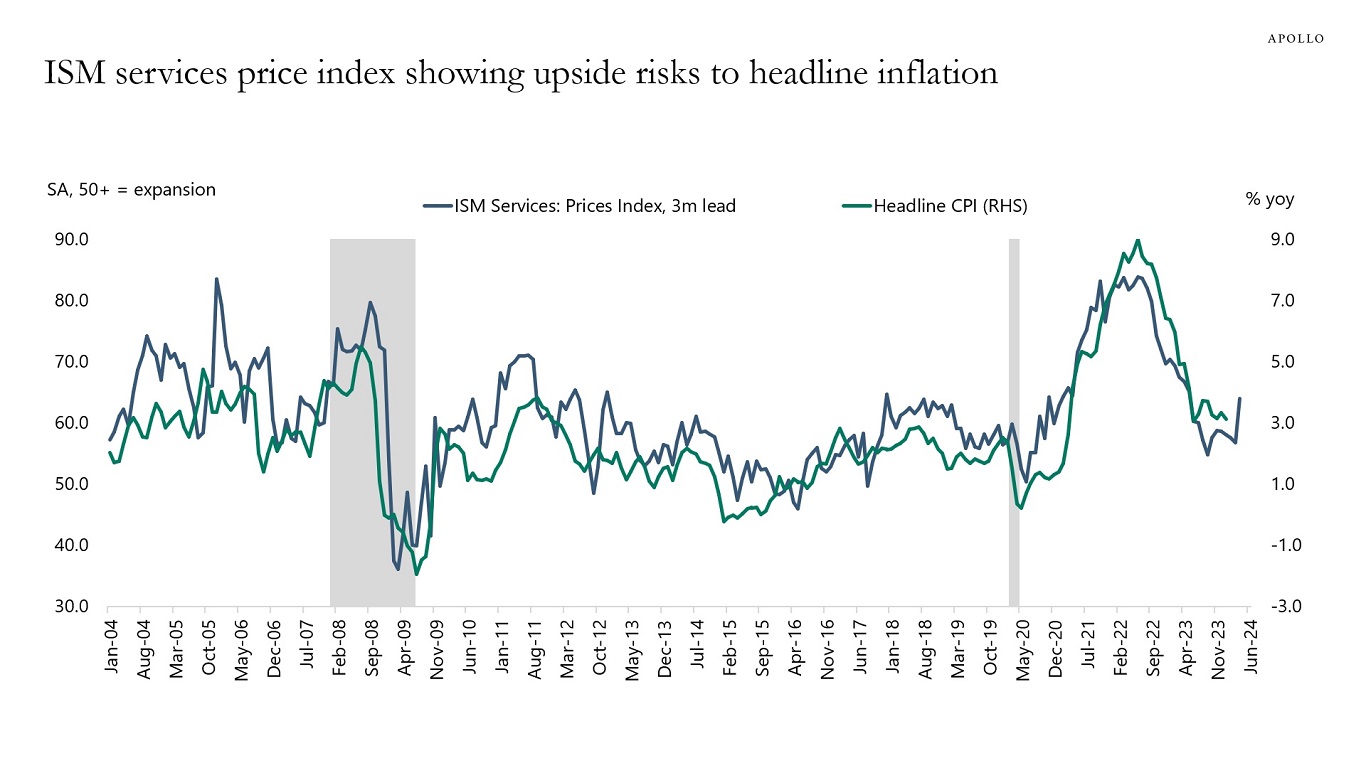

7) ISM services prices paid is also trending higher, see the seventh chart.

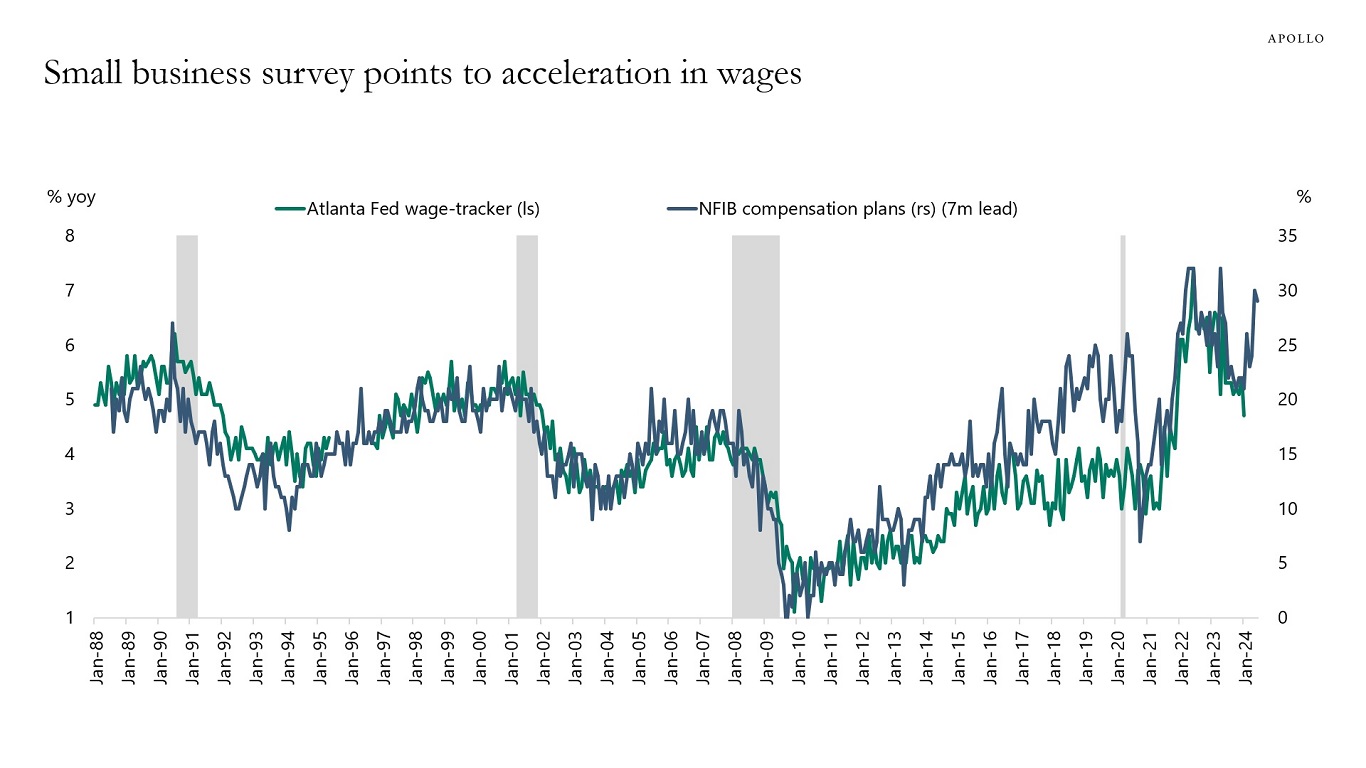

8) Surveys of small businesses show that more small businesses are planning to raise worker compensation, see the eighth chart.

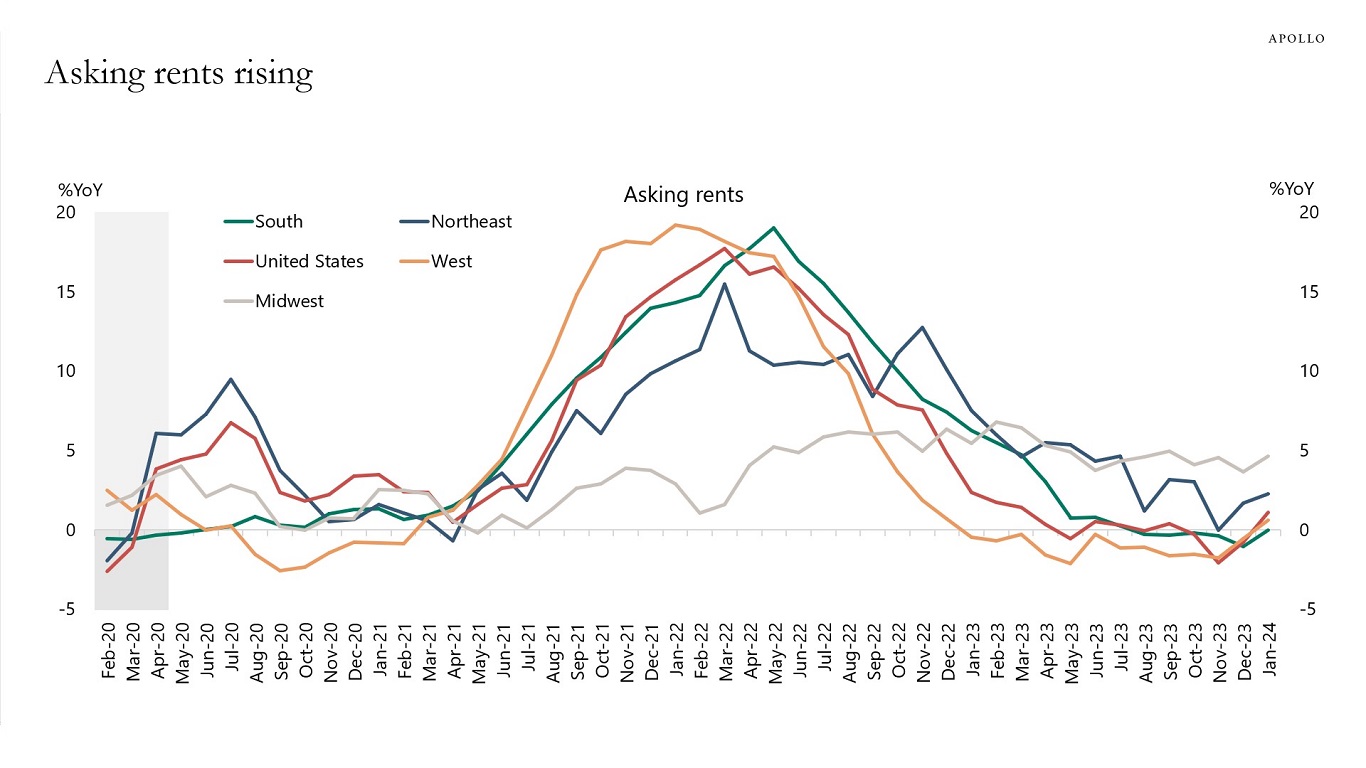

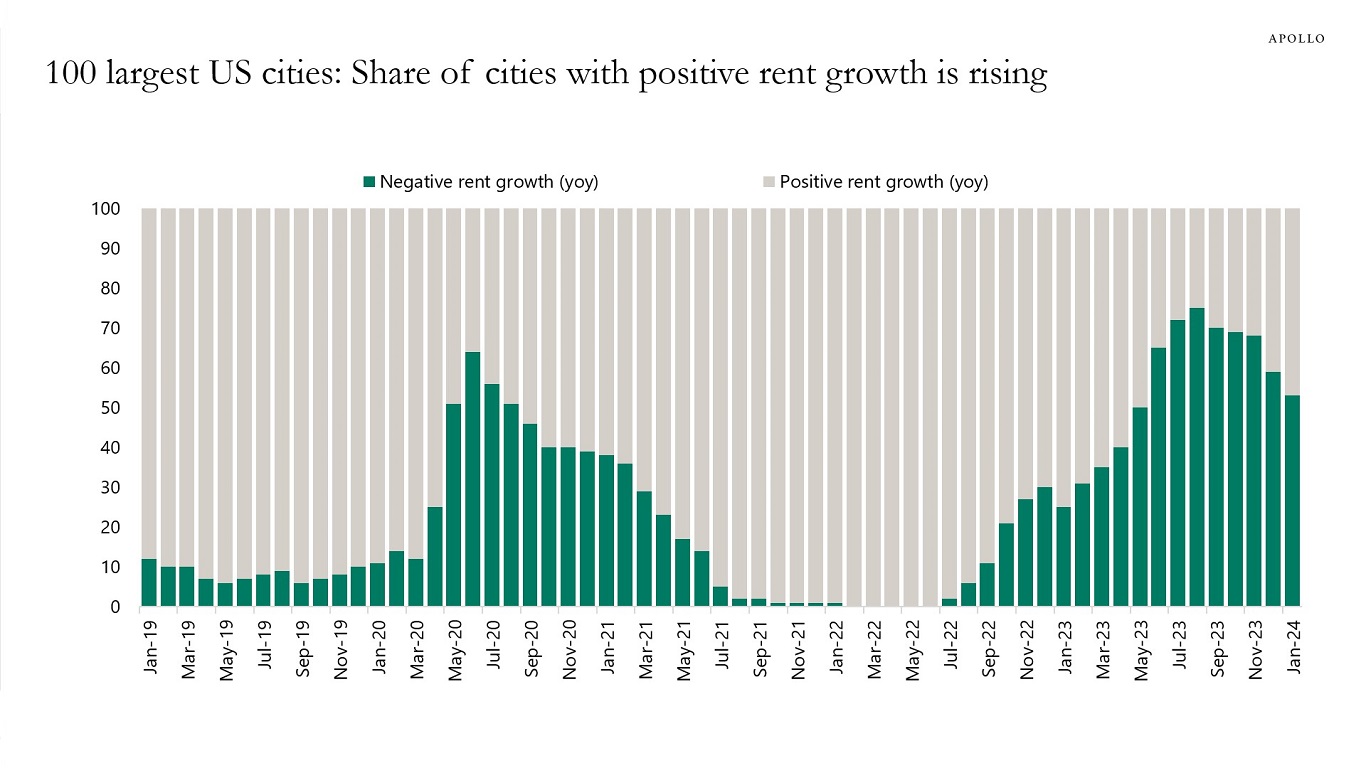

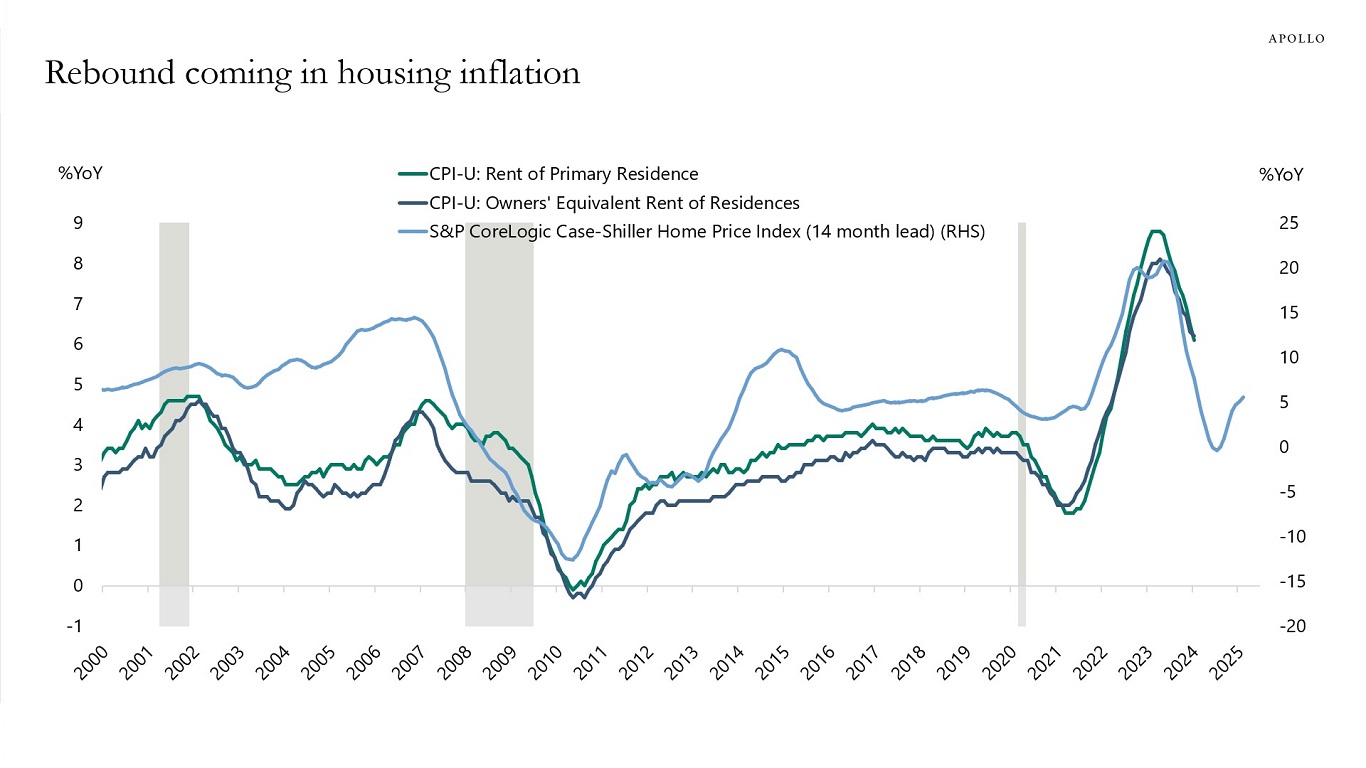

9) Asking rents are rising, and more cities are seeing rising rents, and home prices are rising, see the ninth, tenth, and eleventh charts.

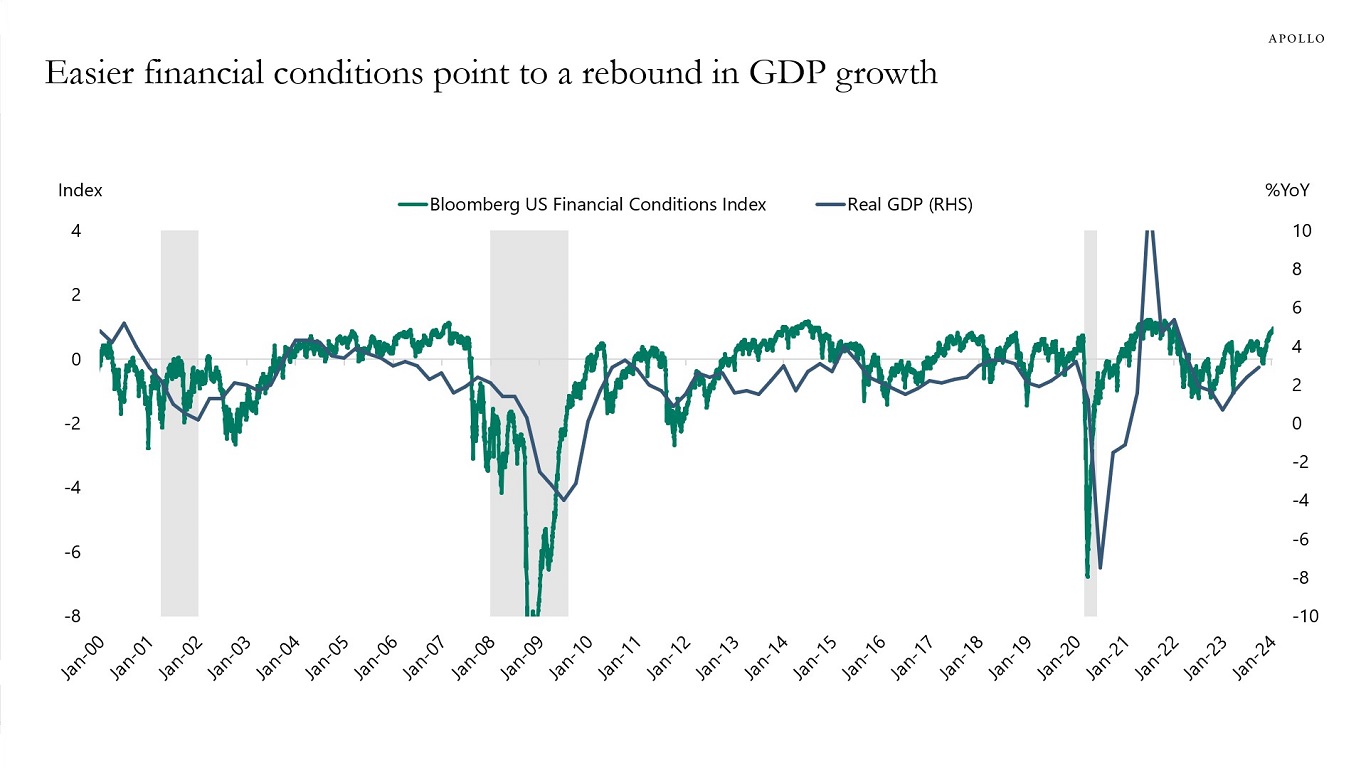

10) Financial conditions continue to ease following the Fed pivot in December with record-high IG issuance, high HY issuance, IPO activity rising, M&A activity rising, and tight credit spreads and the stock market reaching new all-time highs. With financial conditions easing significantly, it is not surprising that we saw strong nonfarm payrolls and inflation in January, and we should expect the strength to continue, see the twelfth chart.

The bottom line is that the Fed will spend most of 2024 fighting inflation. As a result, yield levels in fixed income will stay high.