There are two competing narratives in markets at the moment.

One narrative is that the global economy is simply normalizing after Covid. As that process continues, inflation will come down, and we will have a soft landing as labor markets, product markets, and supply chains continue to normalize.

The other story is that the Fed is stepping hard on the brakes, and the lagged effects of Fed hikes and rates staying higher for longer will weigh on nonfarm payrolls, capex spending, and consumer spending over the coming 12 to 18 months, which will cause a recession.

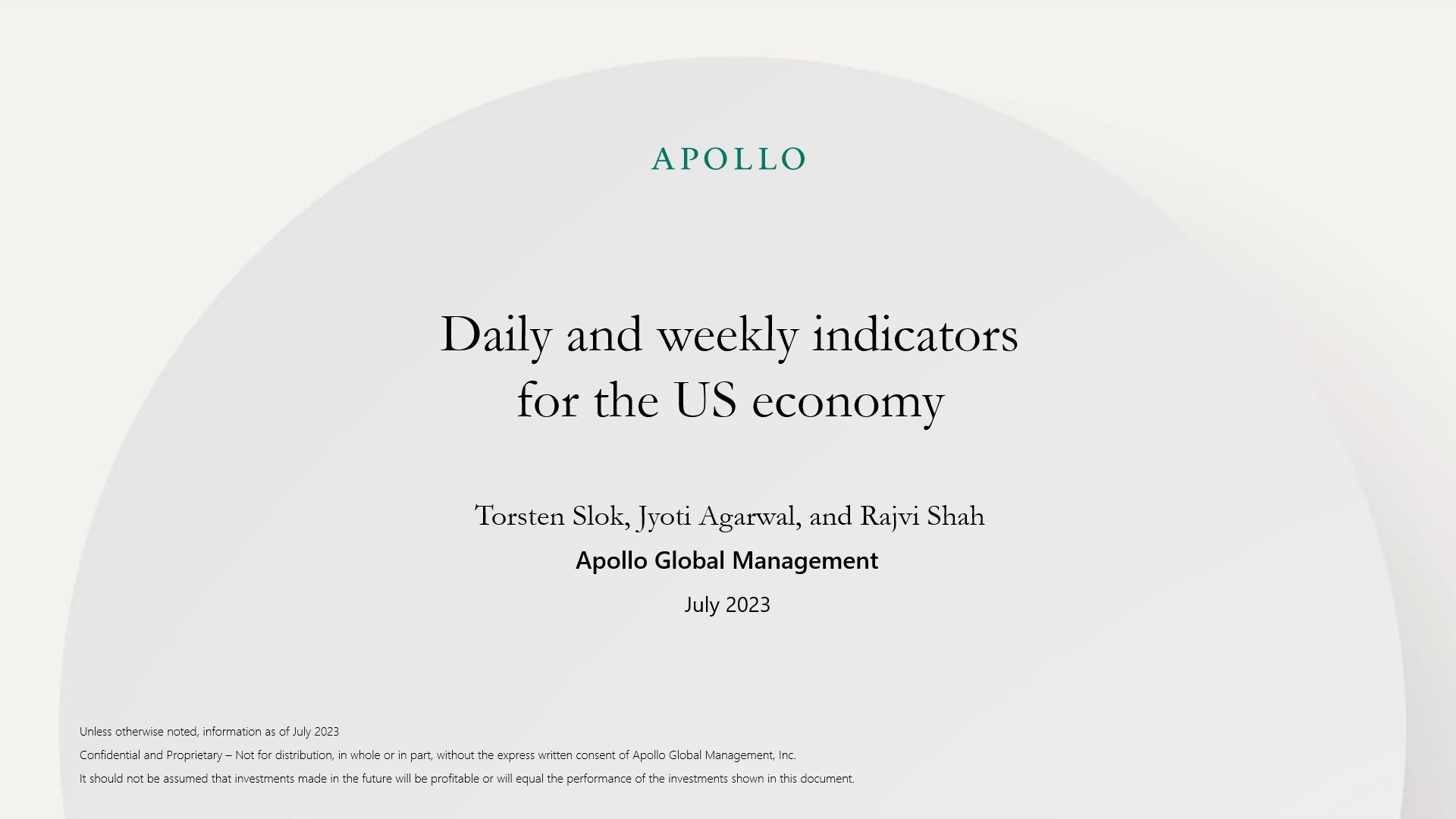

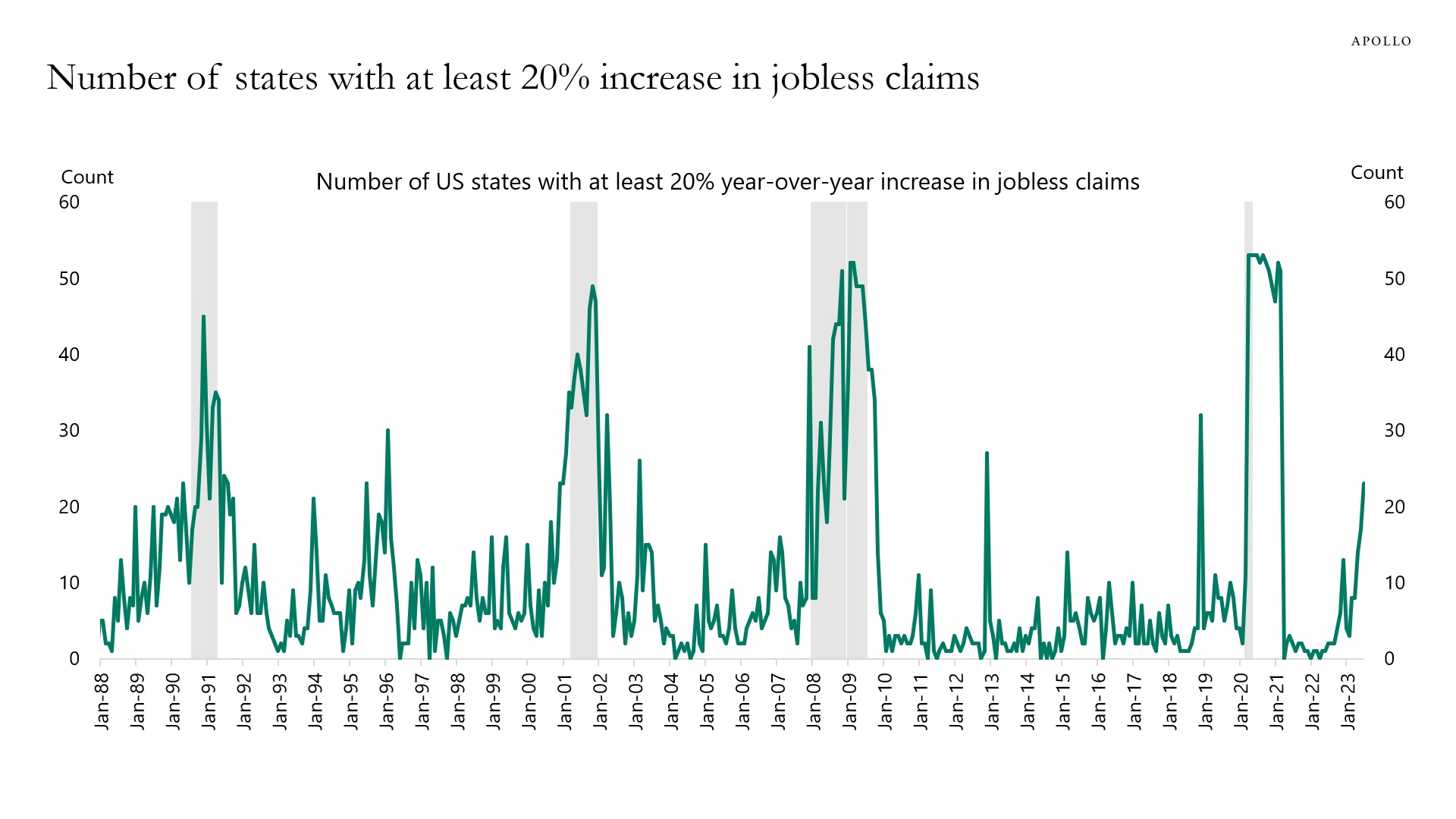

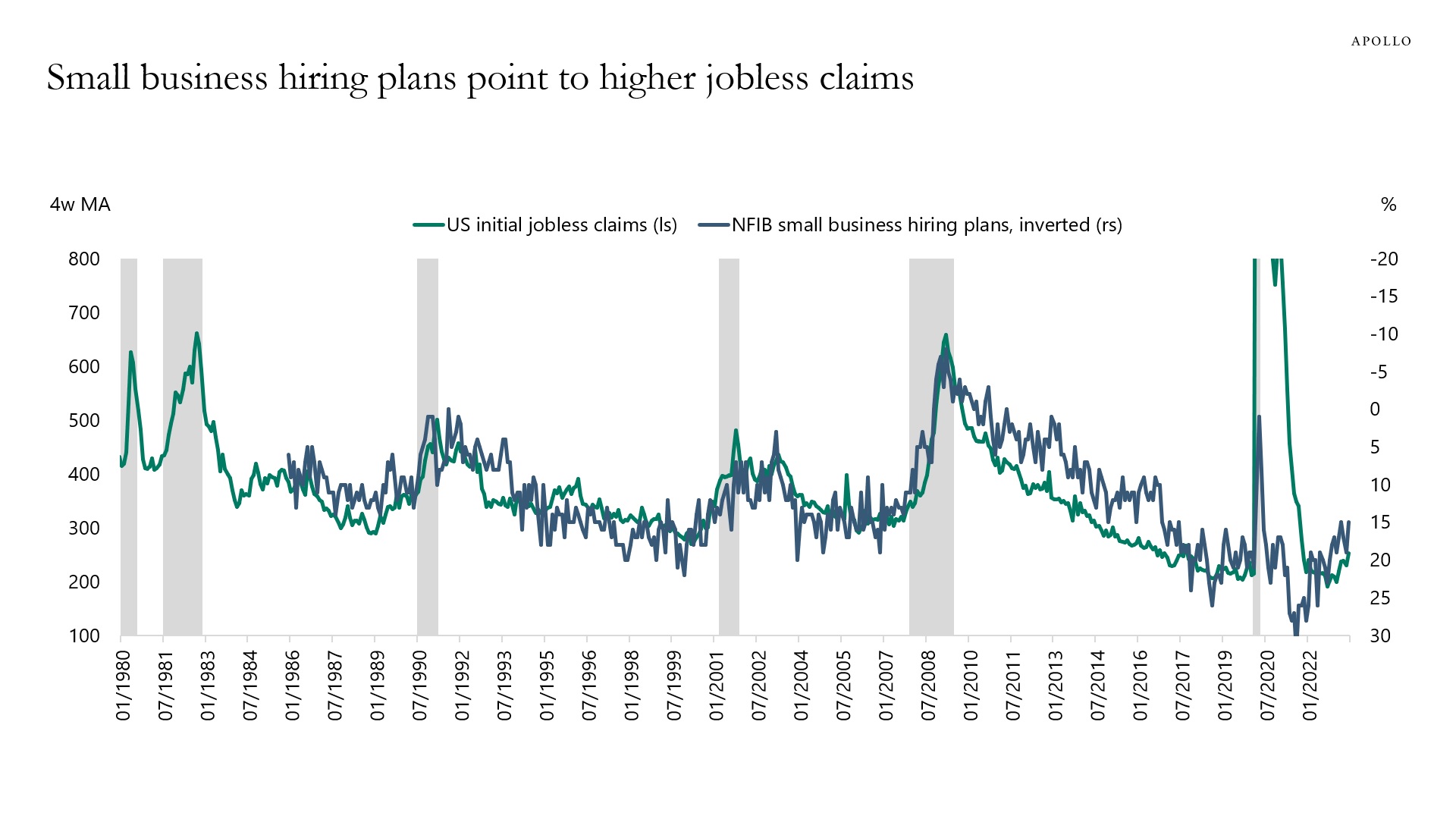

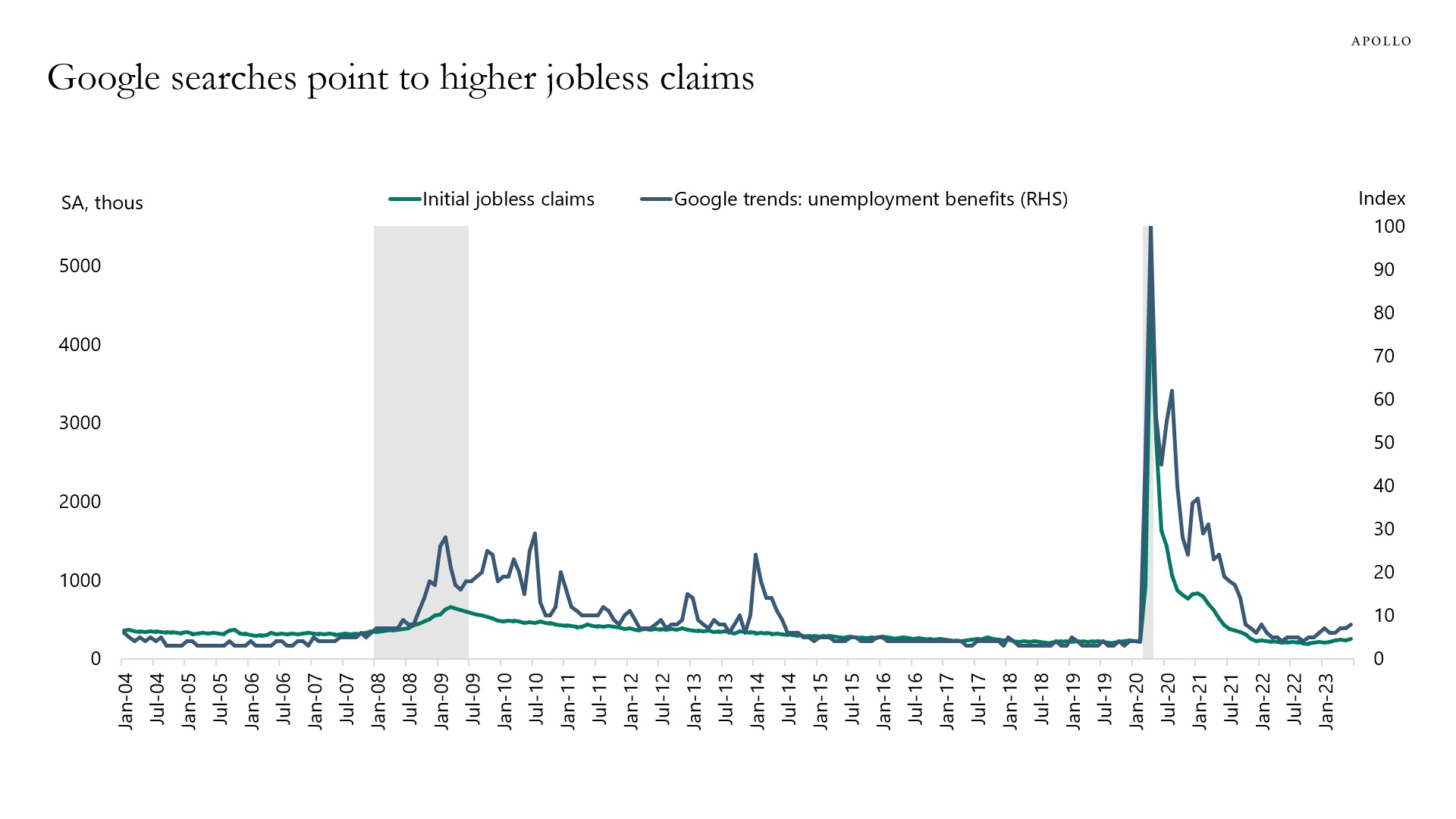

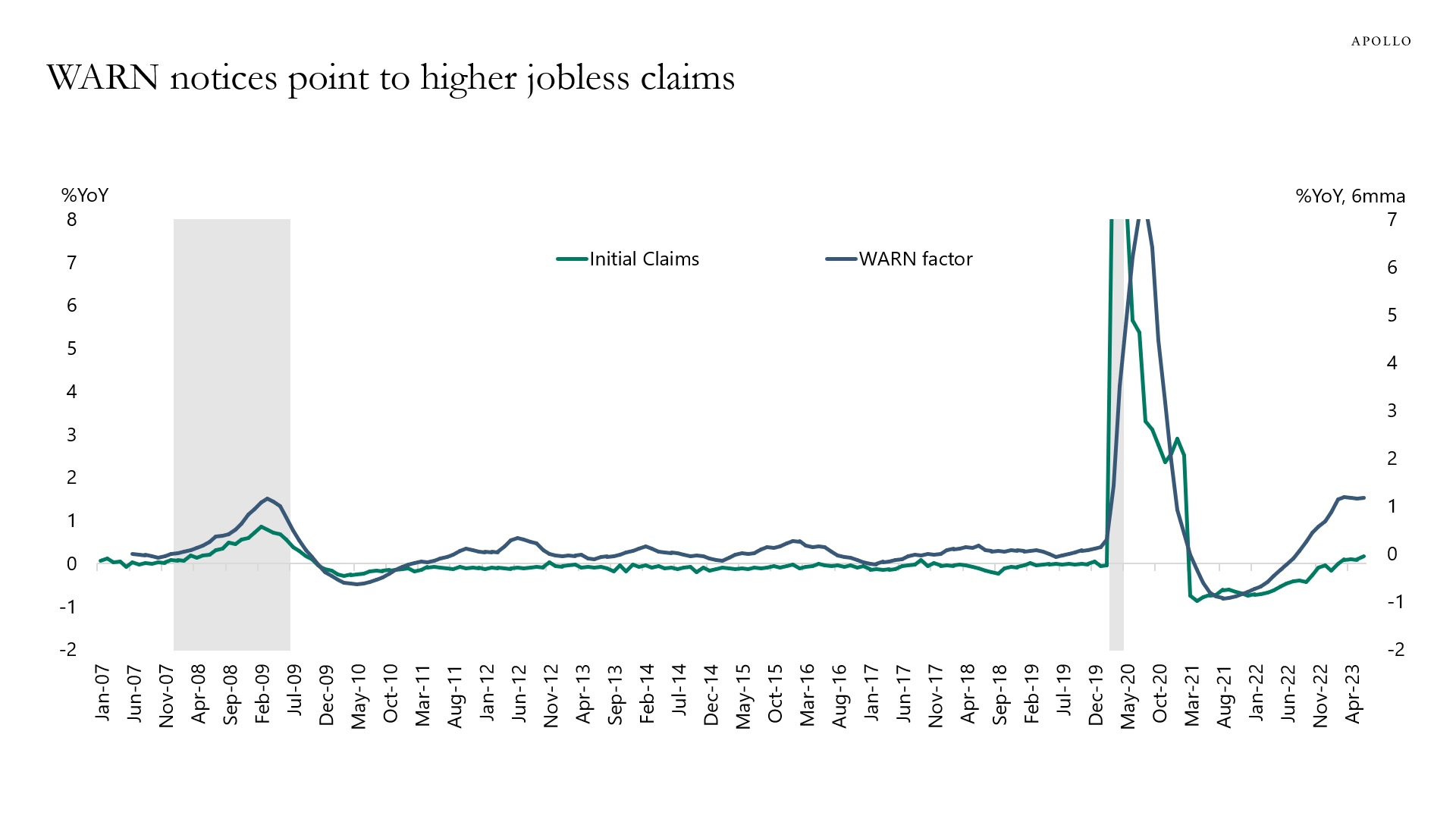

Looking at a broad range of leading indicators, including rising delinquency rates for credit cards and auto loans, rising default rates for HY and loans, rising weekly bankruptcies, slowing weekly loan growth for banks, and leading indicators for jobless claims (see charts below), we continue to see the recession narrative as the most likely outcome.

Rising rates have already had a negative impact on more leveraged consumers, firms, and commercial real estate. And with the Fed on hold for “a couple of years,” the negative effects of higher rates will continue. In that sense, if the economic data soon starts to re-accelerate, then housing inflation will start to move up again, and the Fed will raise rates even more to slow down the economy.

Let’s not forget that a hard landing will always start out by looking like a soft landing.

Our chart book with daily and weekly indicators for the US economy is available here.