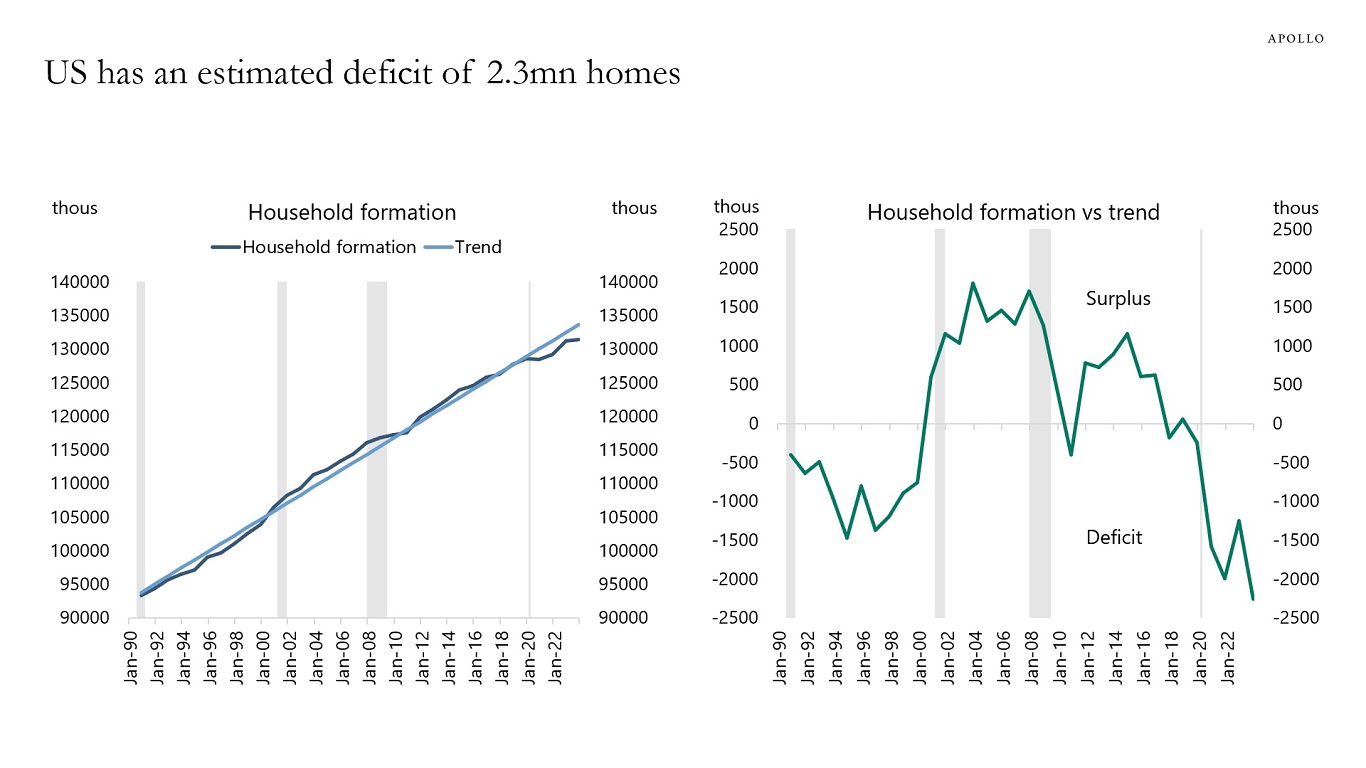

Ten reasons to be bullish on US housing:

1) Household formation is 2.3 million below its long-run trend, i.e., there is pent-up demand for 2.3 million homes in the US, see the first chart.

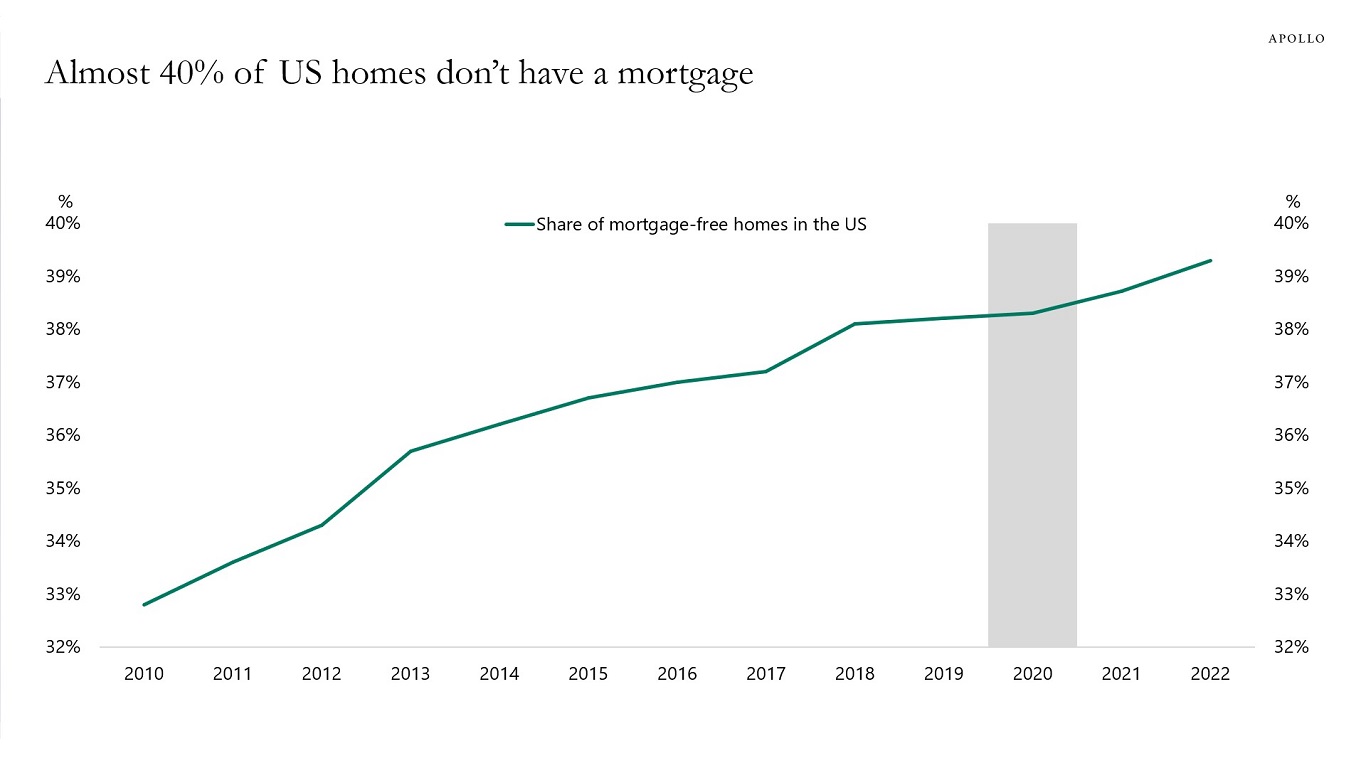

2) The share of homes without a mortgage is rising, and now at about 40%, see the second chart.

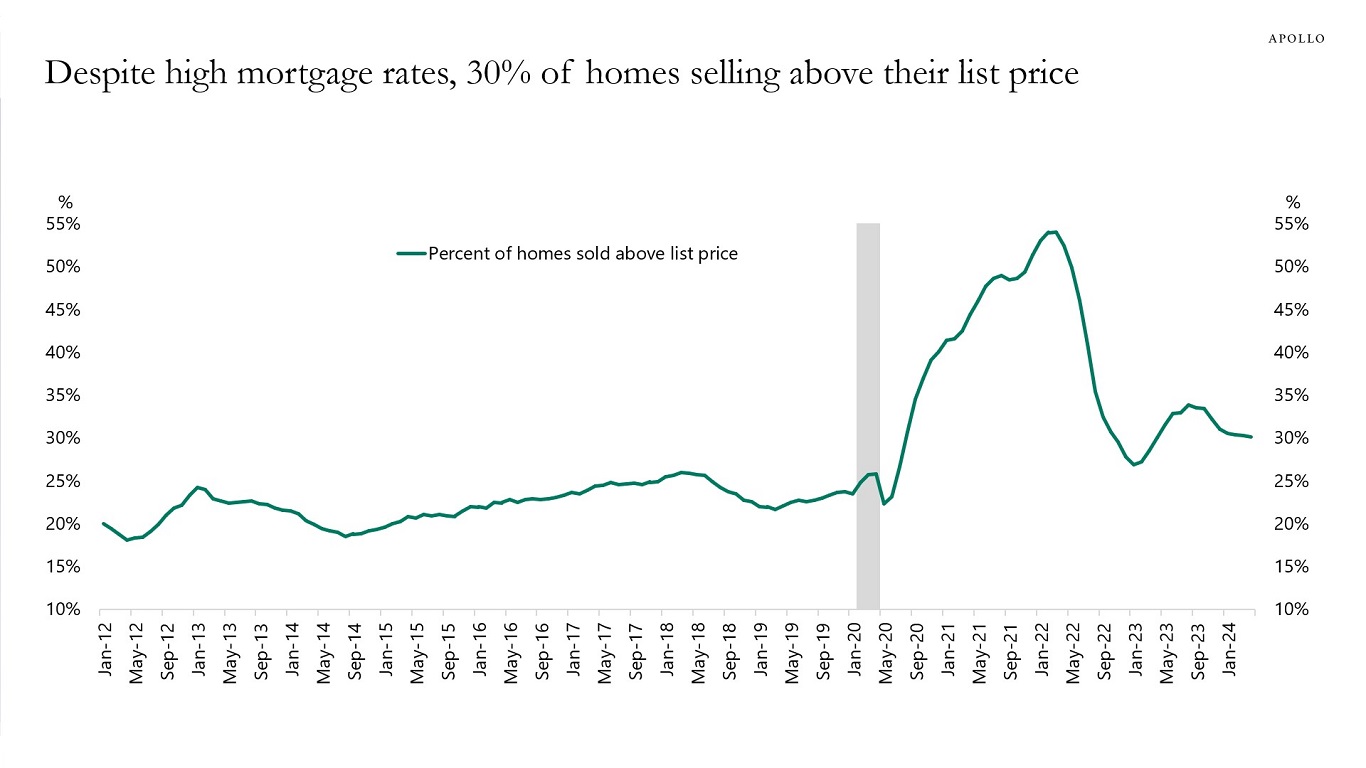

3) 30% of homes are selling above their list price, see the third chart.

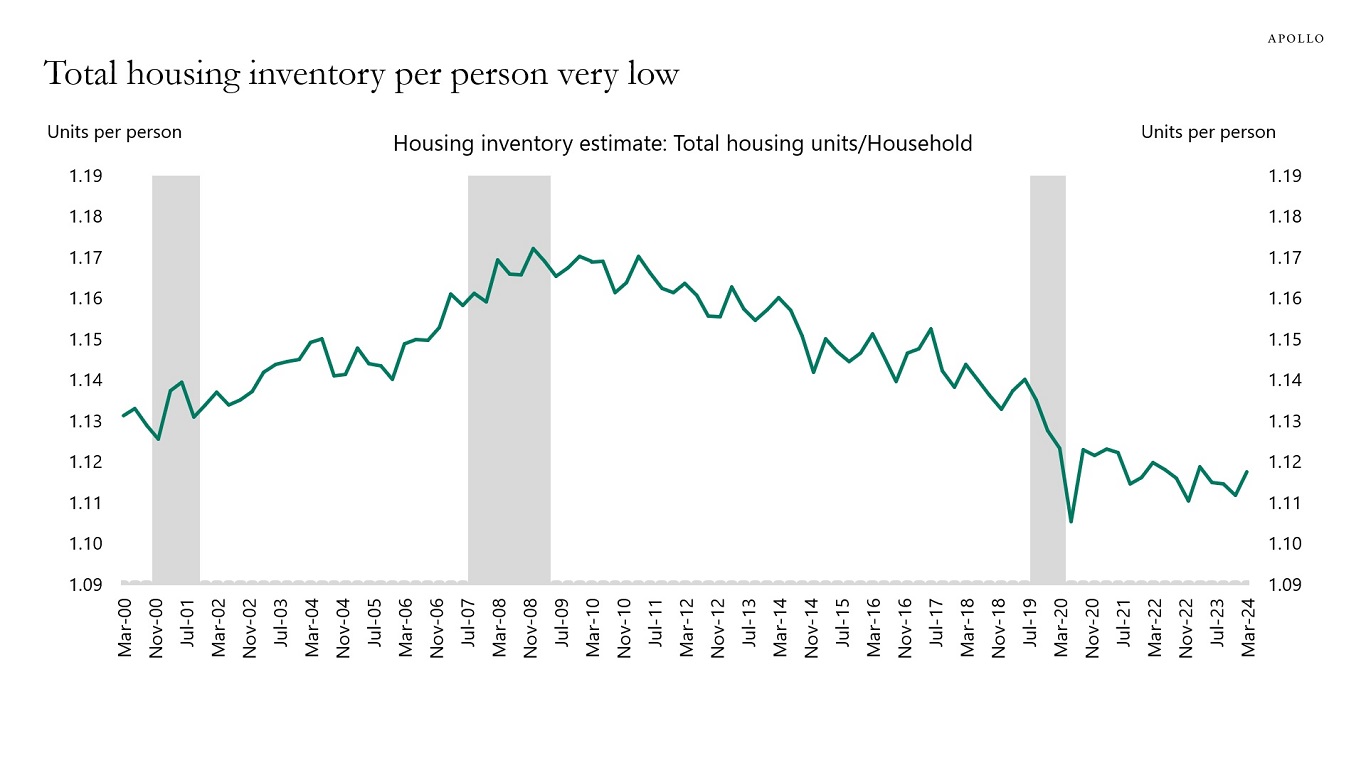

4) The inventory of homes for sale remains very low, see the fourth chart.

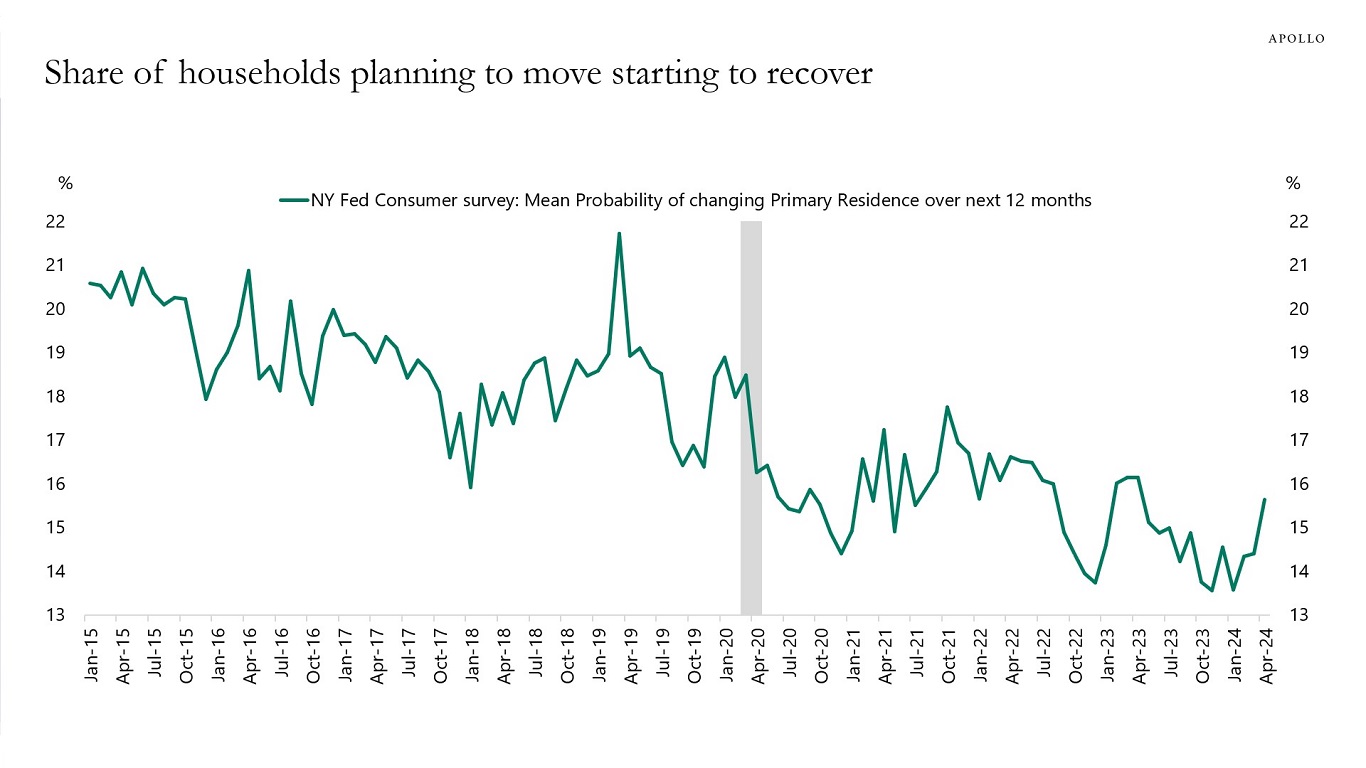

5) The share of people planning to move to a new address has started to increase, see the fifth chart.

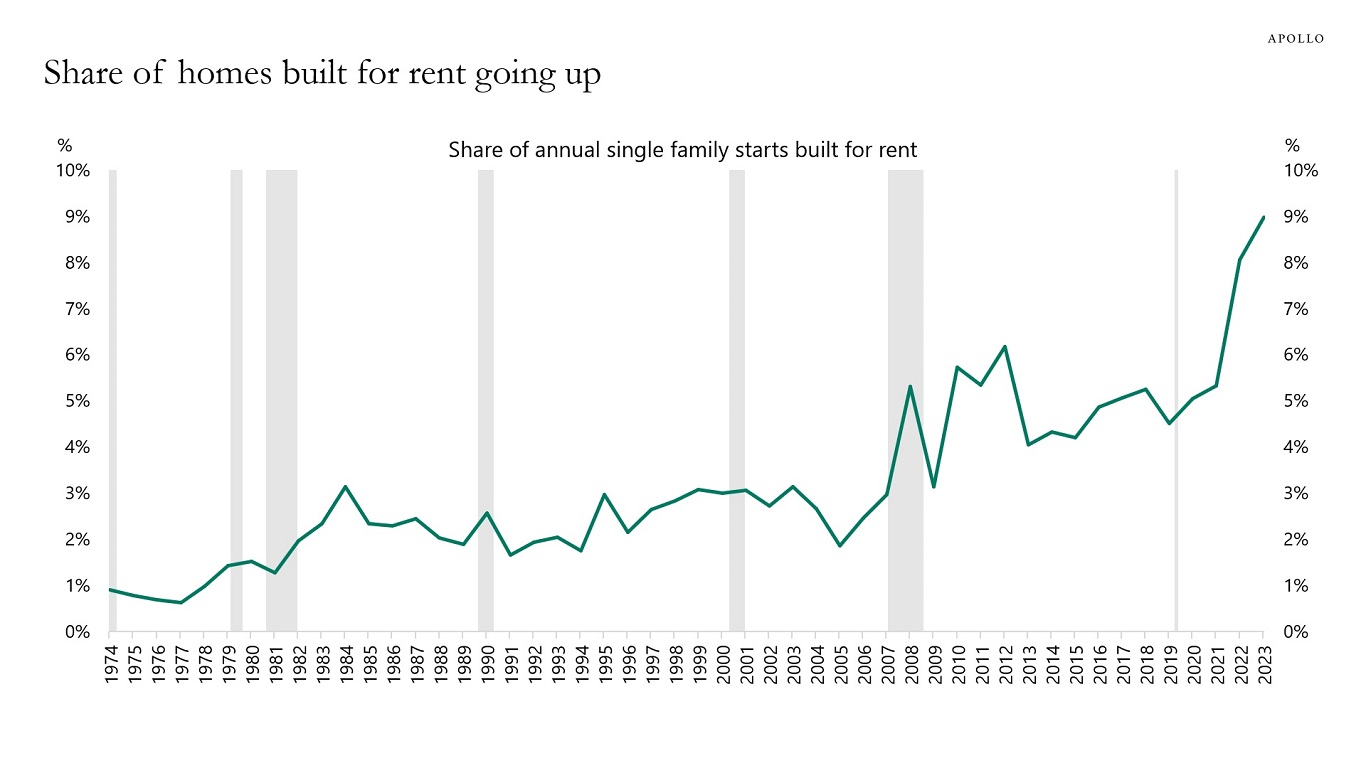

6) The share of homes built for rent is going up, see the sixth chart.

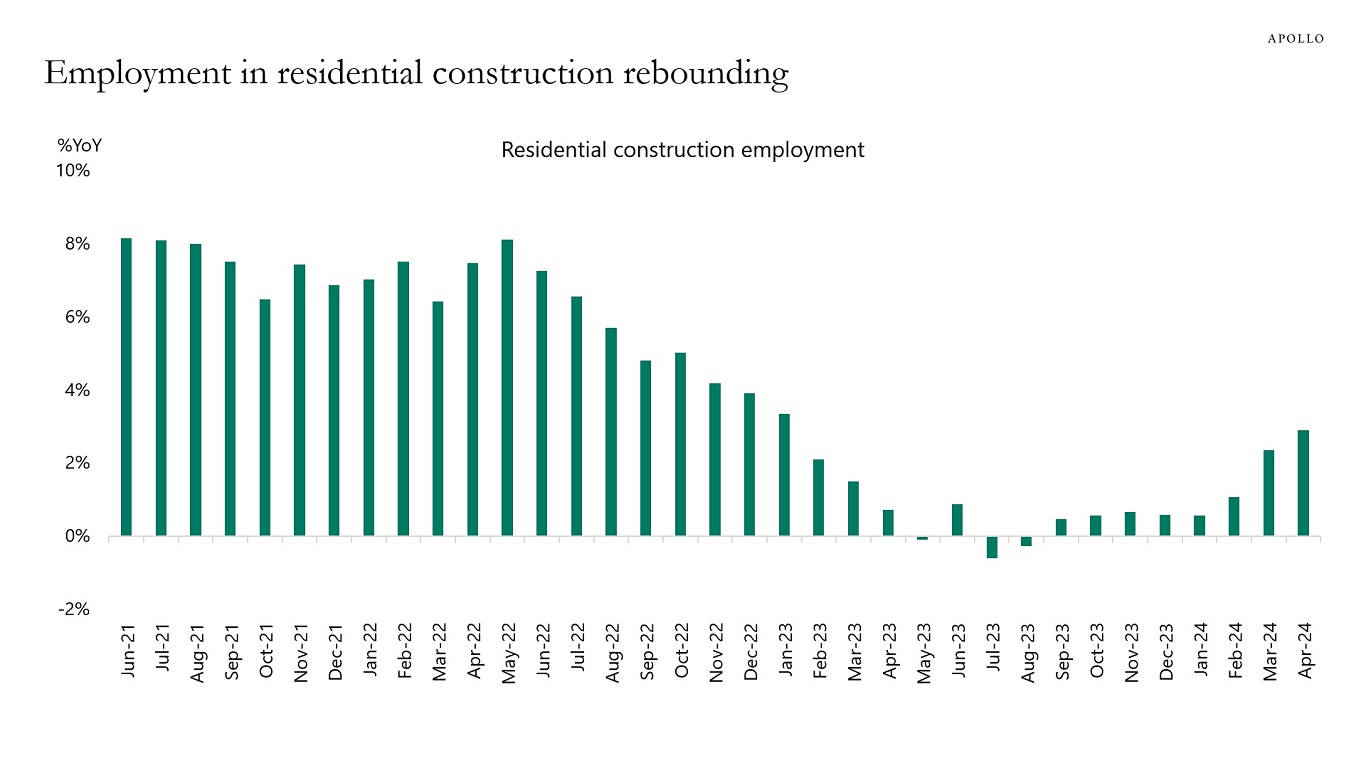

7) Employment in construction is rebounding, see the seventh chart.

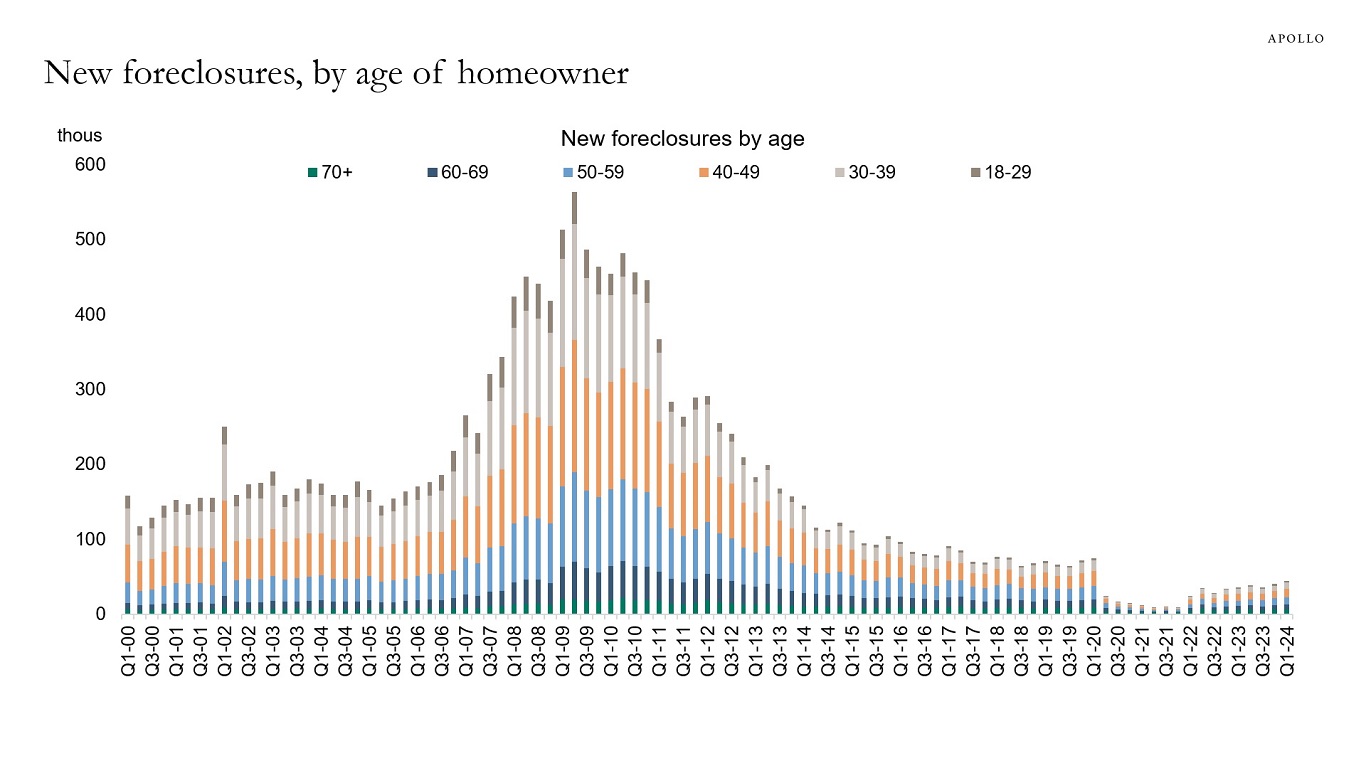

8) The number of new foreclosures remains very low, see the eighth chart.

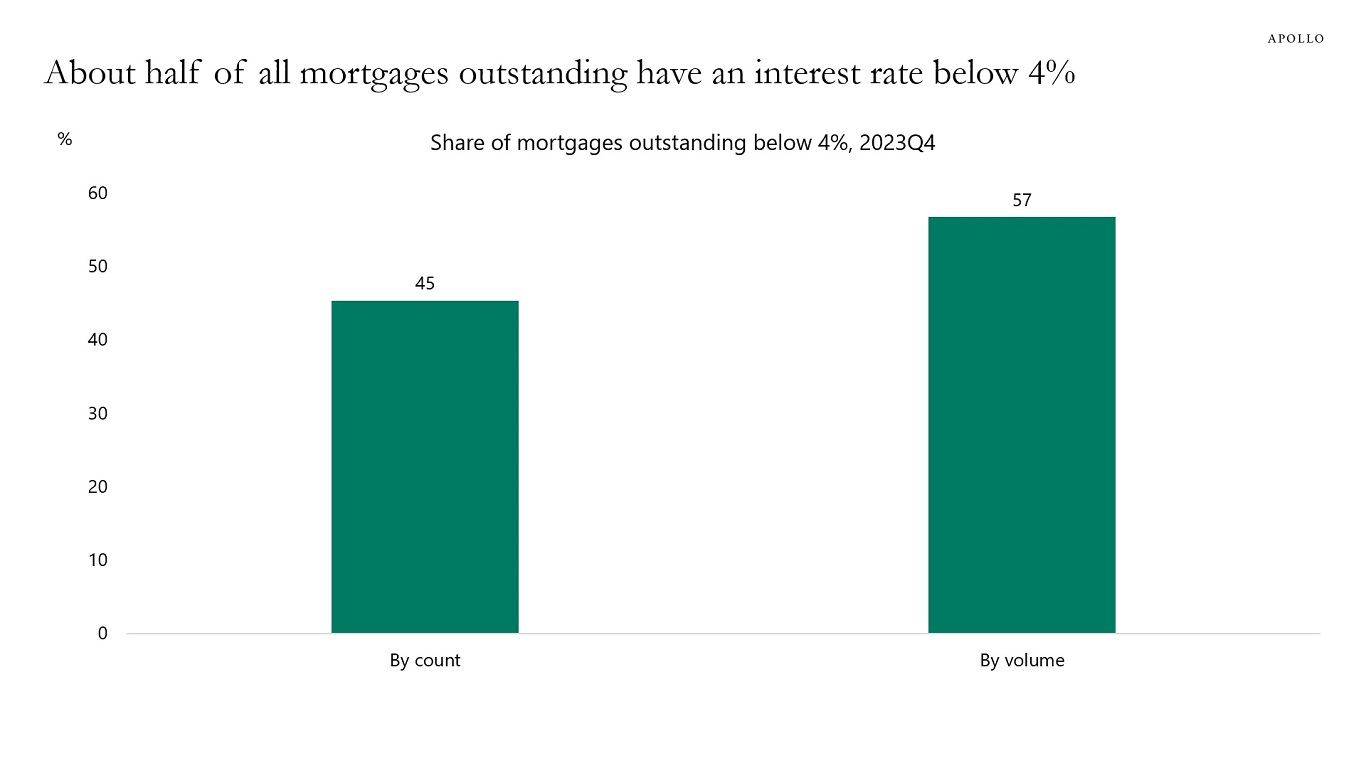

9) About half of mortgages have an interest rate below 4%, see the ninth chart.

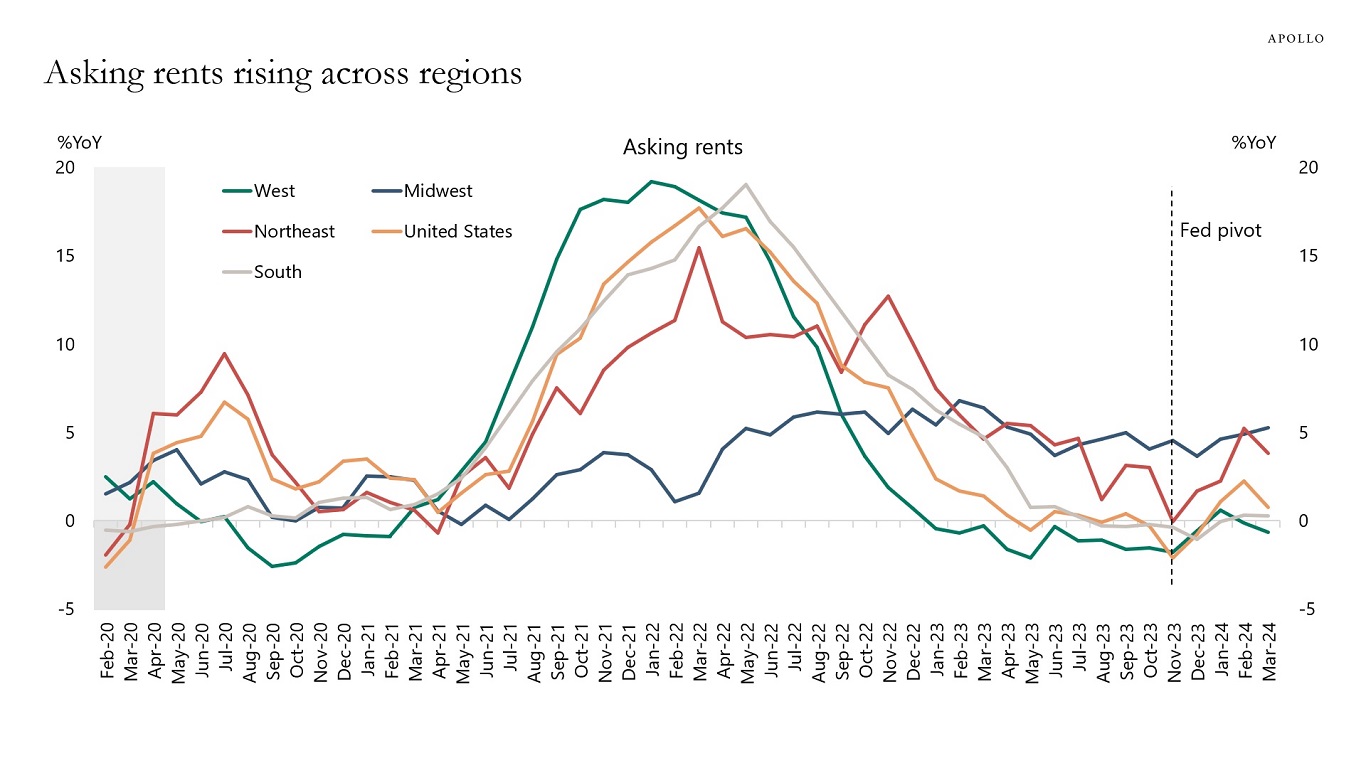

10) After the Fed pivot in November 2023, asking rents have started to increase, see the tenth chart.

Our updated US housing chart book is available here.