This chart book looks at demand and supply in the Treasury market, including recent developments in Treasury auction metrics. There are 10 conclusions:

1. For every $5 the government collects in taxes, a dollar goes to paying interest on debt.

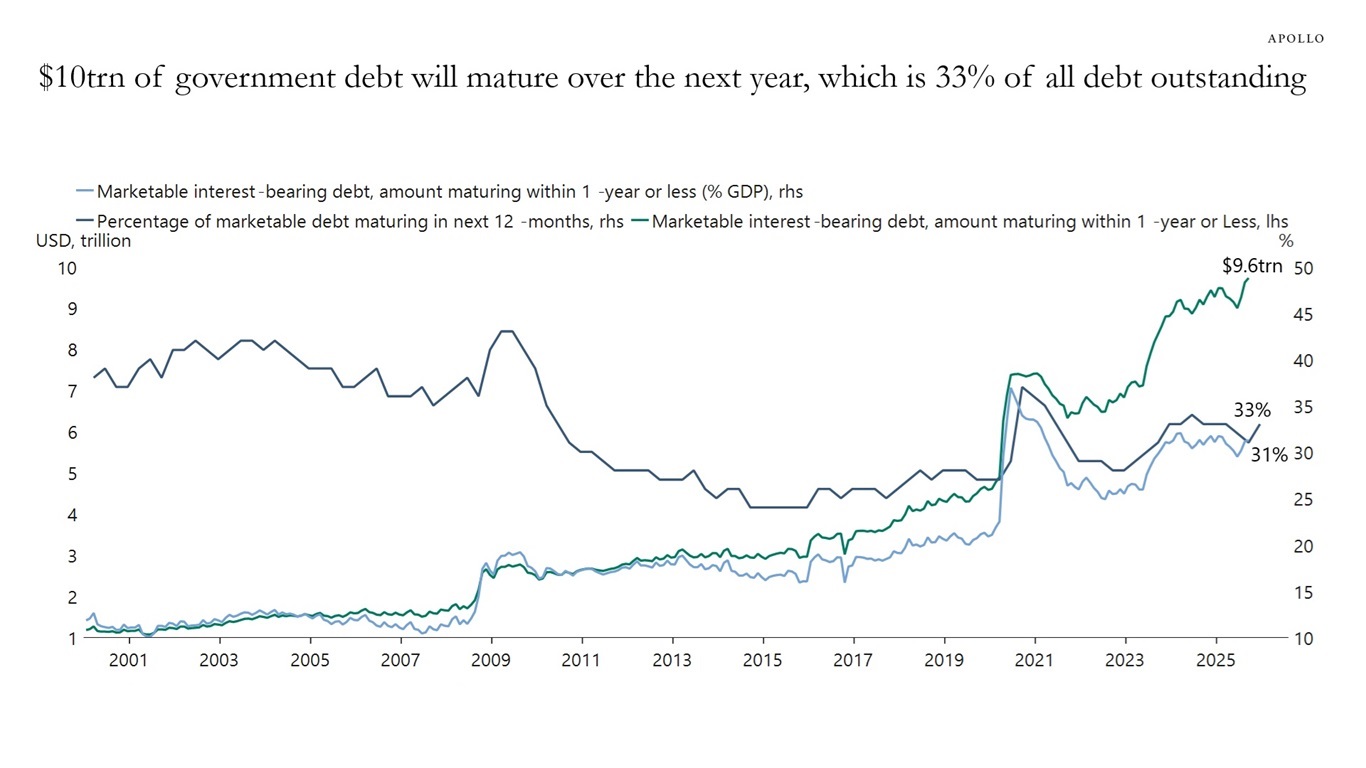

2. $10 trillion of government debt will mature over the next year, which is 33% of all debt outstanding.

3. The share of T-bills outstanding has increased to 22%, and 85% of Treasury gross issuance is T-bills.

4. The average federal net interest expense per day, including weekends, is now $3.5 billion.

5. Foreign ownership of Treasuries has declined to 25% of the total outstanding, down from 33% a decade ago.

6. Japan has been increasing its holdings of Treasuries while China has been lowering its holdings.

7. In Treasury auctions, tails and stop-through have been small and relatively balanced, implying that there is still solid demand across the curve.

8. Treasury auction metrics show that indirect bidding, often a proxy for foreign central bank demand, has been declining over the past year, particularly for notes.

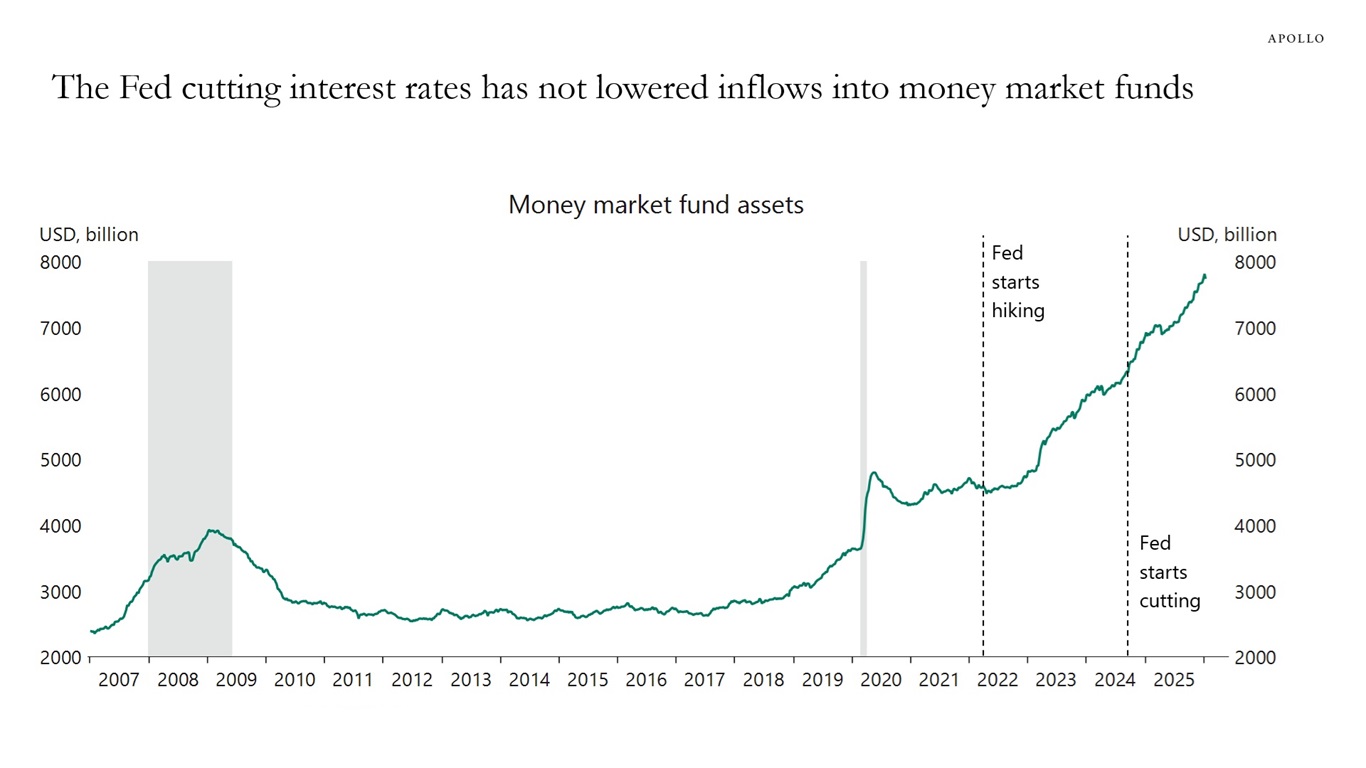

9. The Fed cutting interest rates has not lowered inflows into money market funds, implying that “money on the sidelines” is not as interest rate sensitive as many people think.

10. 89% of US government debt is fixed rate, and 22% of debt outstanding is in bills.