Warehouse lending can offer a rare combination of investment-grade quality, floating-rate exposure, broad credit diversification and higher yields

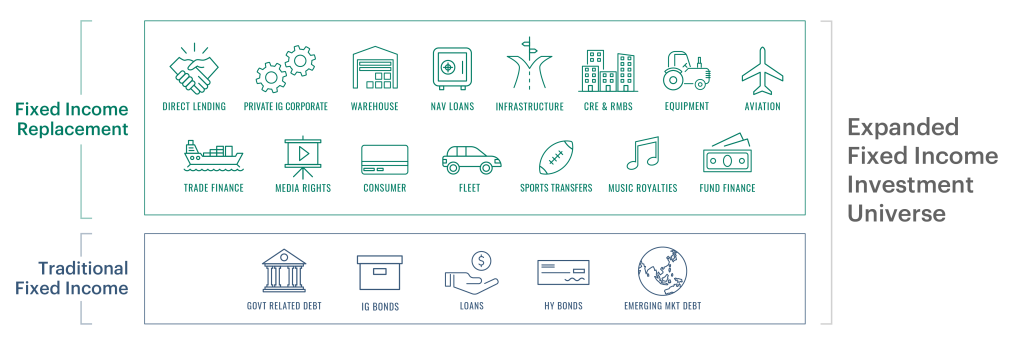

In today’s markets, public bonds capture an increasingly smaller share of the real economy, as more lending and credit creation take place in private markets. Against this backdrop, we believe a fixed income replacement approach can offer investors a modern way to build resilient, income-focused portfolios. This approach seeks to complement or replace parts of traditional fixed income allocations by targeting high-quality, privately originated credit opportunities that can deliver attractive yields and investment-grade risk. By tapping areas of the market shaped by regulatory change and bank retrenchment, this approach aims to unlock sources of income and diversification that are often inaccessible through public bonds.

Warehouse lending is a central example of this philosophy in action. By providing short- to medium-term financing that supports asset originators and specialty lenders, warehouse facilities help power the flow of credit throughout the economy. For investors, warehouse lending can offer the potential for higher yields, robust collateral protection and steady income—benefits that enhance and modernize the traditional fixed income framework.

The Engine of Economic Growth Has Changed. Fixed Income Allocations Need to Adapt:

Overview of Warehouse Lending: A Critical Resource with Limited Supply

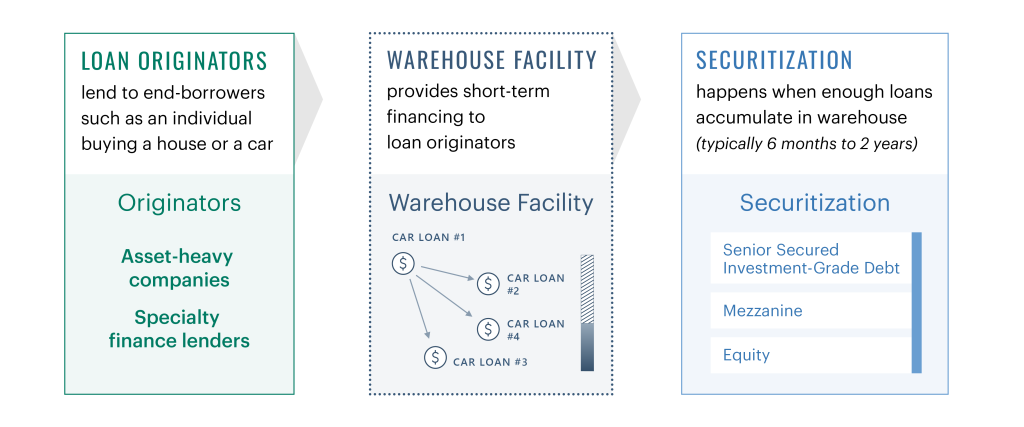

Why do Companies Need Warehouse Loans? Short Answer: The Securitization Process Takes Time.

Asset-heavy companies and specialty finance lenders such as mortgage originators, auto lenders and consumer loan platforms frequently tap the securitization market to enhance their profitability. However, the securitization process takes time because companies must first build a sufficiently large and diversified pool of loans/leases/assets to satisfy the market and investor requirements in the securitization space. Warehouse loans are short- to medium-term loans that provide these companies with the liquidity needed to build portfolios of loans, leases and other assets that could ultimately be sold into rated securitizations, or to insurance companies and other long-term holders of assets. Warehouse loans enable these companies to operate at scale without tying up significant amounts of their own equity as they originate, and potentially wait to tap securitization markets or other long-term financing channels.

While warehouse financing requires companies to contribute some of their own equity, without it they would have to fund this “ramp-up” period entirely with their own capital, making their business models far less efficient and profitable.

Scarcity Premium Drives Attractive Relative Value

Warehouse loans are mission-critical for companies with asset-heavy balance sheets and specialty finance business models. However, the market for these facilities is highly concentrated—the top 20 providers account for approximately 75% of the total market share.1 This scarcity gives lenders negotiating leverage and the ability to structure bespoke agreements with attractive terms and favorable risk/return profiles that often exceed those available in broader securitization and IG equivalent markets.

Warehouses Provide a Bridge to Securitization:

For investors, the dynamics of the warehouse lending space translate into investment-grade risk with the potential for higher returns.

Warehouse facilities can command higher spreads while lending at lower loan-to-value (LTV). This structure also incentivizes borrowers to free up their equity by moving to longer-term securitization financing, aligning their interests with the short-term nature of the warehouse facility.

Warehouse facilities additionally can benefit from better structural protections than their public securitization equivalents, for example:

- Performance triggers for metrics such as cash collection, charge-offs, losses

- Collateral eligibility criteria generally stricter than those of public securitizations

- Concentration limits that cap certain characteristics of the collateral pool

- Covenants ensuring continued sponsor / counterparty performance

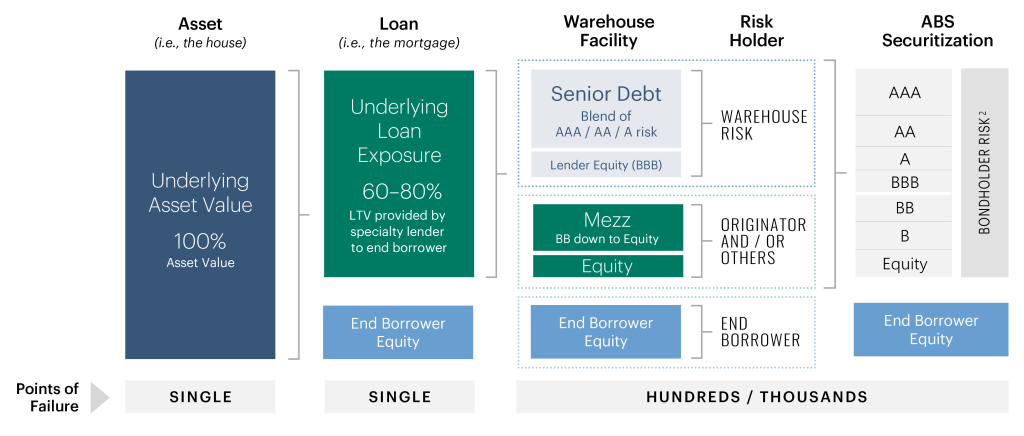

Validating the Investment-Grade Equivalent Risk of Warehouse Loans

While warehouse loans are officially unrated, they are designed to meet the standards required for investment-grade ABS issuance—overcollateralization, reserve accounts, diversification and ongoing surveillance. And as we previously explored, warehouse loans typically have more robust structural protections and lower LTV ratios than the investment-grade tranches of the securitizations they ultimately feed.

In many cases, term takeouts of warehouse facilities get explicitly rated, and when these warehouse-financed assets transition into rated ABS transactions, the investment-grade ratings assigned by agencies have provided tangible confirmation of the facilities’ structural integrity and credit quality.

Example of How Warehouse Loans Can Provide IG Equivalent Risk1

1. Ratings for illustrative purposes only and based on credit equivalents.

2. Illustrative tranching; not all securitizations have AAA – Equity tranches.

The Bottom Line

Private IG can enhance traditional fixed income allocations and provide material risk-adjusted excess spread — warehouse loans are an important part of this equation.

1. Based on latest available data as of October 2025. Sources: Apollo Analysts, Official Thomson Reuters F20a league tables US Securitizations ex CMBS; Agency CMOs; CDOs & Self Funded

The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions and views expressed reflect the current opinions and views of the authors and Apollo Analysts as of the date hereof and are subject to change. Please see the end of this document for important disclosure information.

Important Disclosure Information

This presentation is for educational purposes only and should not be treated as research. This presentation may not be distributed, transmitted or otherwise communicated to others, in whole or in part, without the express written consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

The views and opinions expressed in this presentation are the views and opinions of the author(s) of the White Paper. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Further, Apollo and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this presentation. There can be no assurance that an investment strategy will be successful. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially, and should not be relied upon as such. Target allocations contained herein are subject to change. There is no assurance that the target allocations will be achieved, and actual allocations may be significantly different than that shown here. This presentation does not constitute an offer of any service or product of Apollo. It is not an invitation by or on behalf of Apollo to any person to buy or sell any security or to adopt any investment strategy, and shall not form the basis of, nor may it accompany nor form part of, any right or contract to buy or sell any security or to adopt any investment strategy. Nothing herein should be taken as investment advice or a recommendation to enter into any transaction.

Hyperlinks to third-party websites in this presentation are provided for reader convenience only. There can be no assurance that any trends discussed herein will continue. Unless otherwise noted, information included herein is presented as of the dates indicated. This presentation is not complete and the information contained herein may change at any time without notice. Apollo does not have any responsibility to update the presentation to account for such changes. Apollo has not made any representation or warranty, expressed or implied, with respect to fairness, correctness, accuracy, reasonableness, or completeness of any of the information contained herein, and expressly disclaims any responsibility or liability therefore. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Investors should make an independent investigation of the information contained herein, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

The Standard & Poor’s 500 (“S&P 500”) Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies by market value.

Additional information may be available upon request.