Want it delivered daily to your inbox?

-

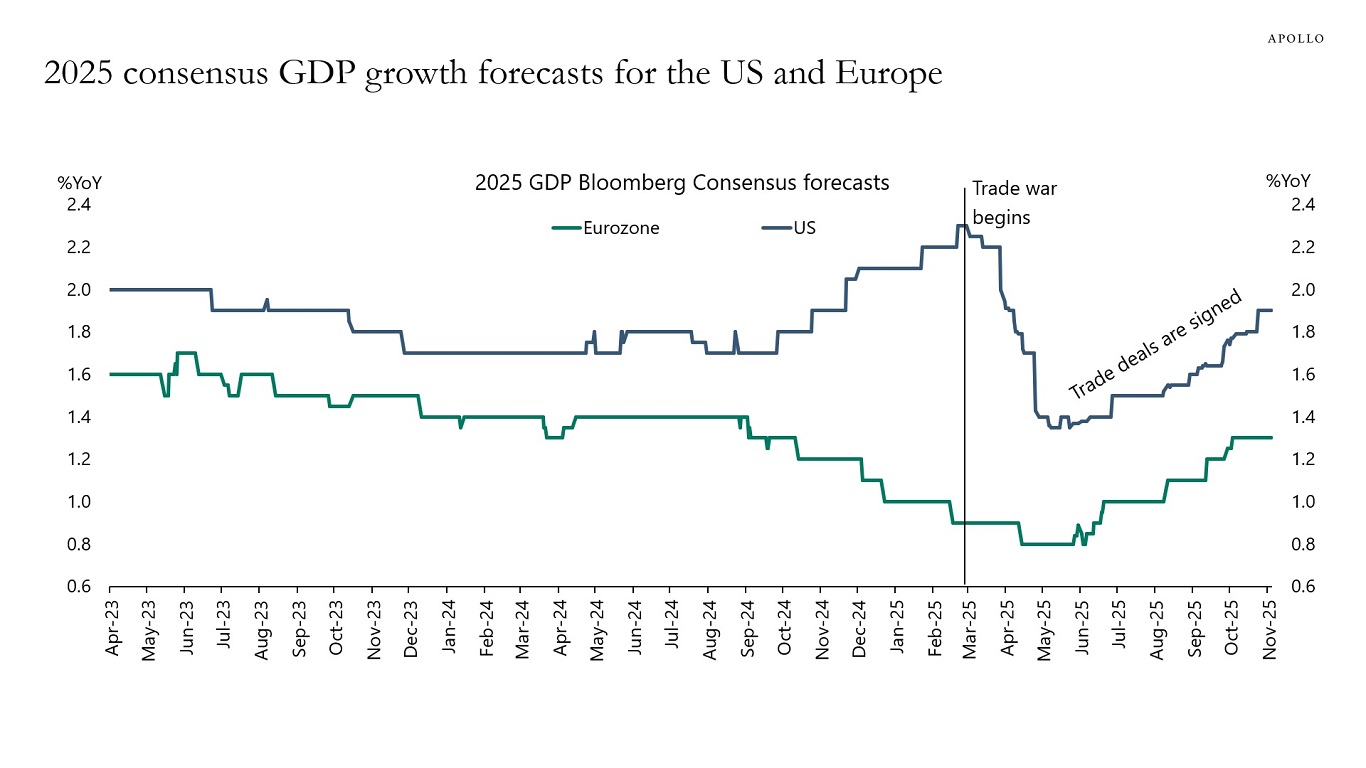

When the trade war started in March, the consensus began to revise down expectations for growth.

But as trade deals were signed with different countries over the summer and into the fall, growth expectations have been revised up, see chart below.

Looking ahead, growth is likely to reaccelerate in 2026, driven by lower trade war uncertainty, a lower dollar, and the positive effects of the One Big Beautiful Bill, which the CBO estimates will boost GDP growth by almost a full percentage point in 2026, mainly because of accelerated depreciation.

Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

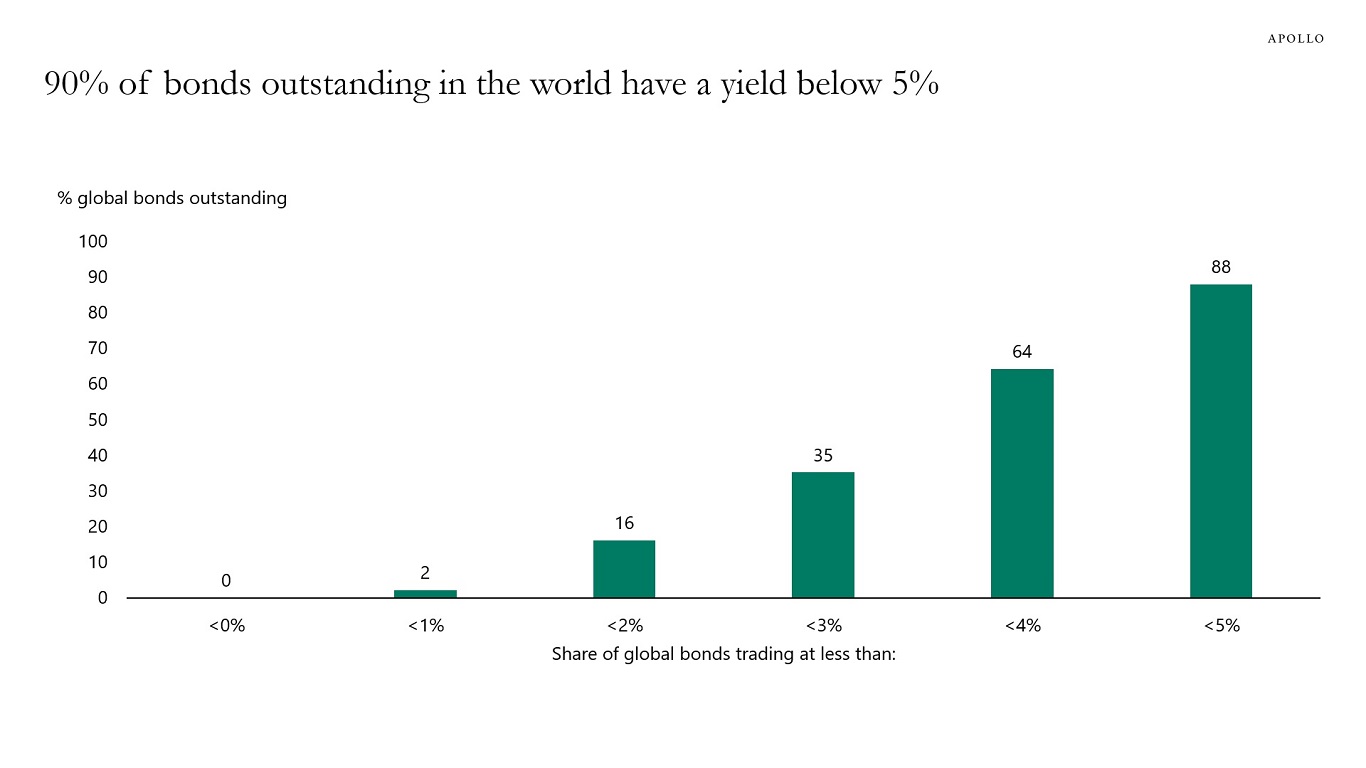

Ninety percent of all public fixed income outstanding in the world trades at a yield below 5%, see chart below.

Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

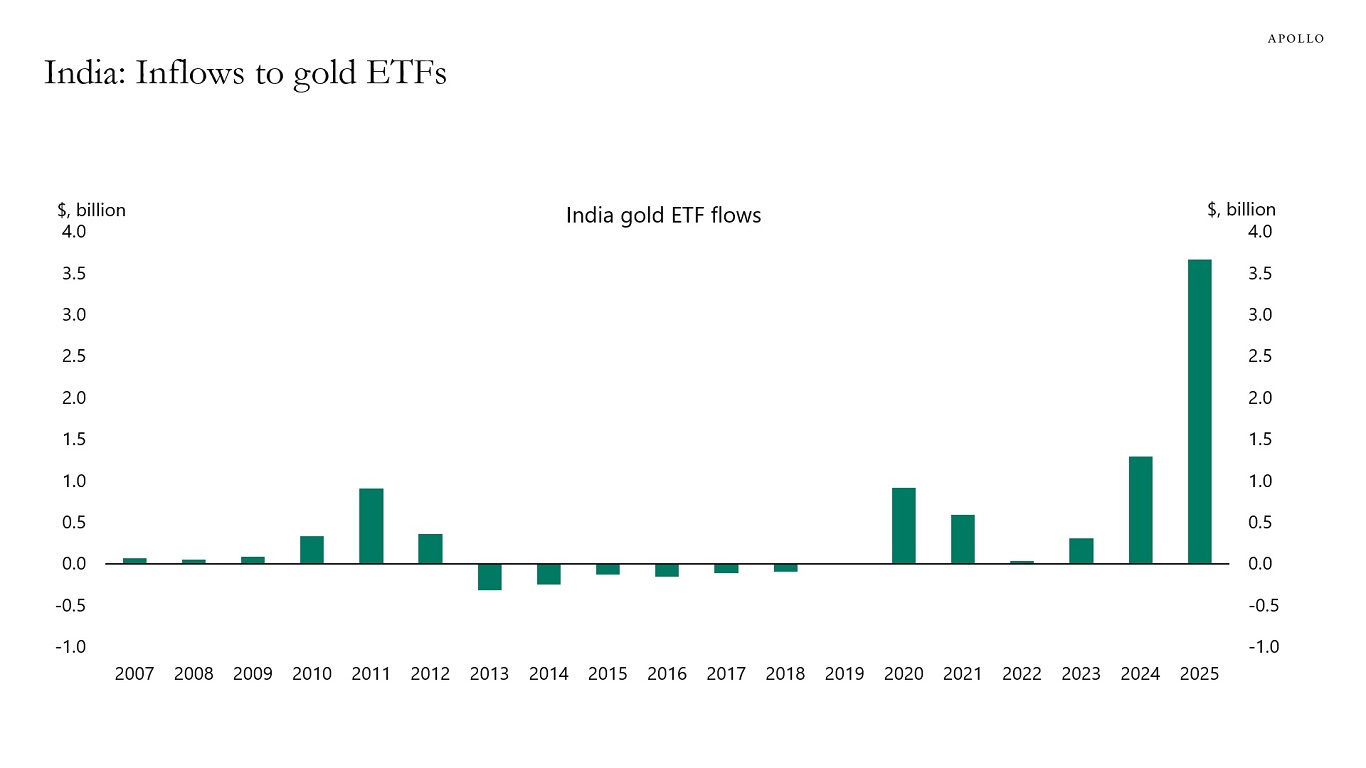

Inflows into gold ETFs in India in 2025 are on track to be triple the inflows seen in 2024, see chart below.

Note: 2025 data is annualized. Sources: World Gold Council, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

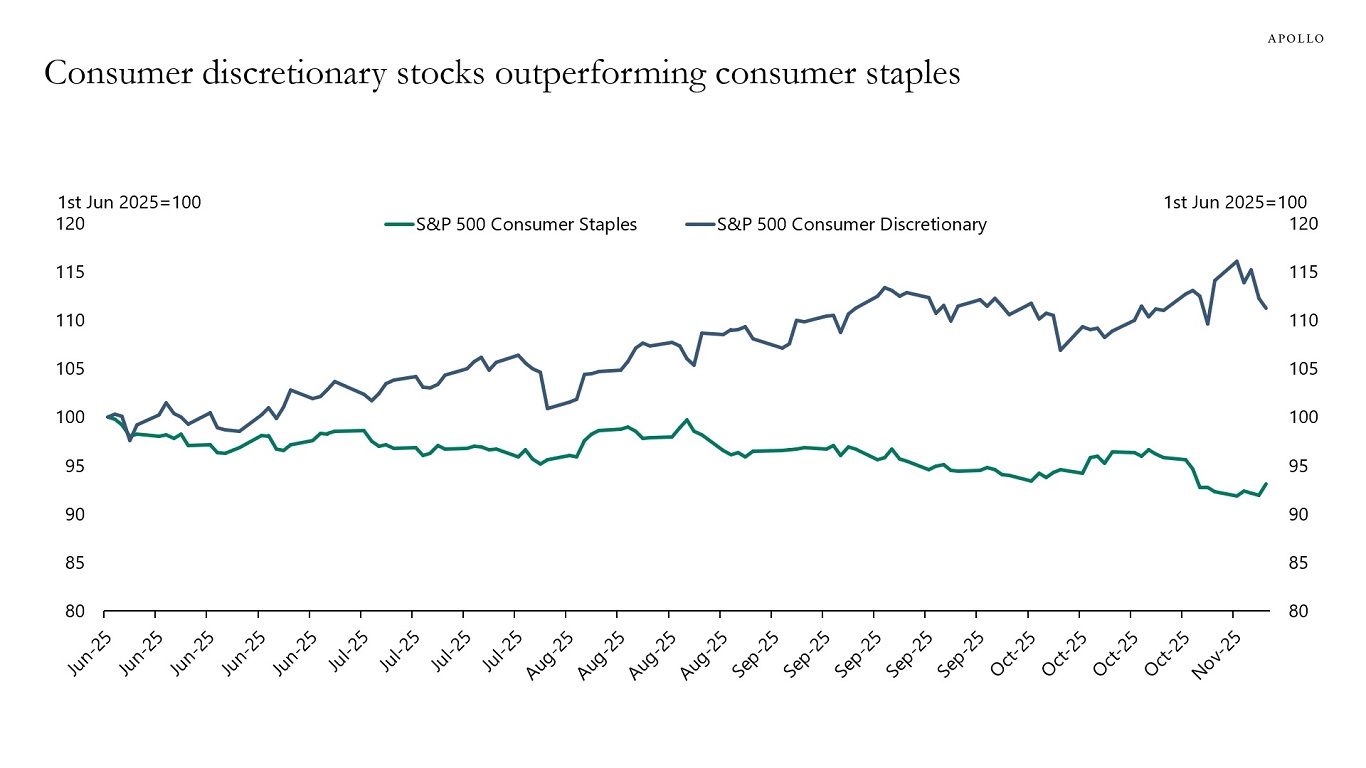

Higher-income households have seen their stock holdings rise and their home prices increase. At the same time, the cash flow received in fixed income, including private credit, is near the highest levels in decades.

This strength of higher-income household balance sheets relative to lower-income balance sheets is the reason why consumer discretionary stocks in recent months have been outperforming consumer staples, see chart below.

Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

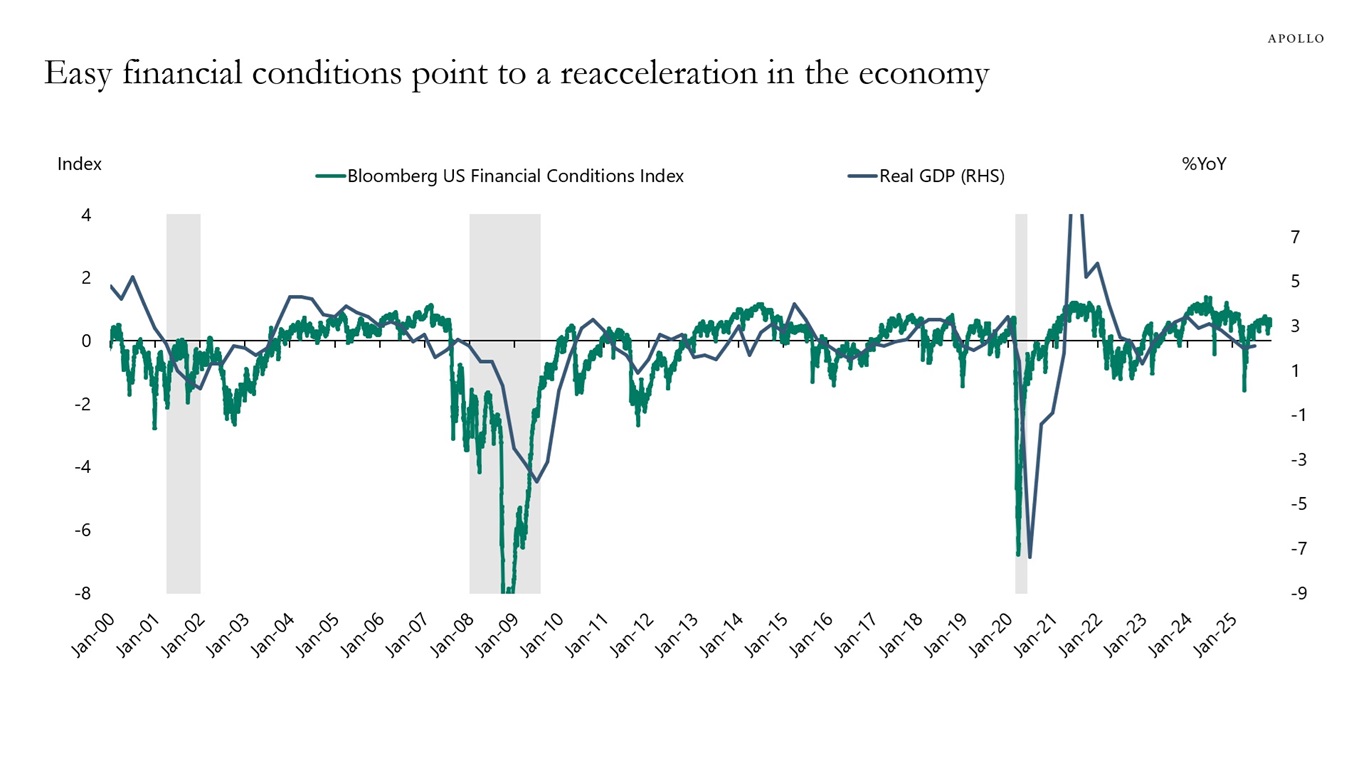

The arguments for a rebound in the economy over the coming quarters are that (1) Liberation Day was almost eight months ago, (2) fiscal and monetary policy are easy, and (3) easy financial conditions point to a reacceleration in the economy, see chart below.

Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

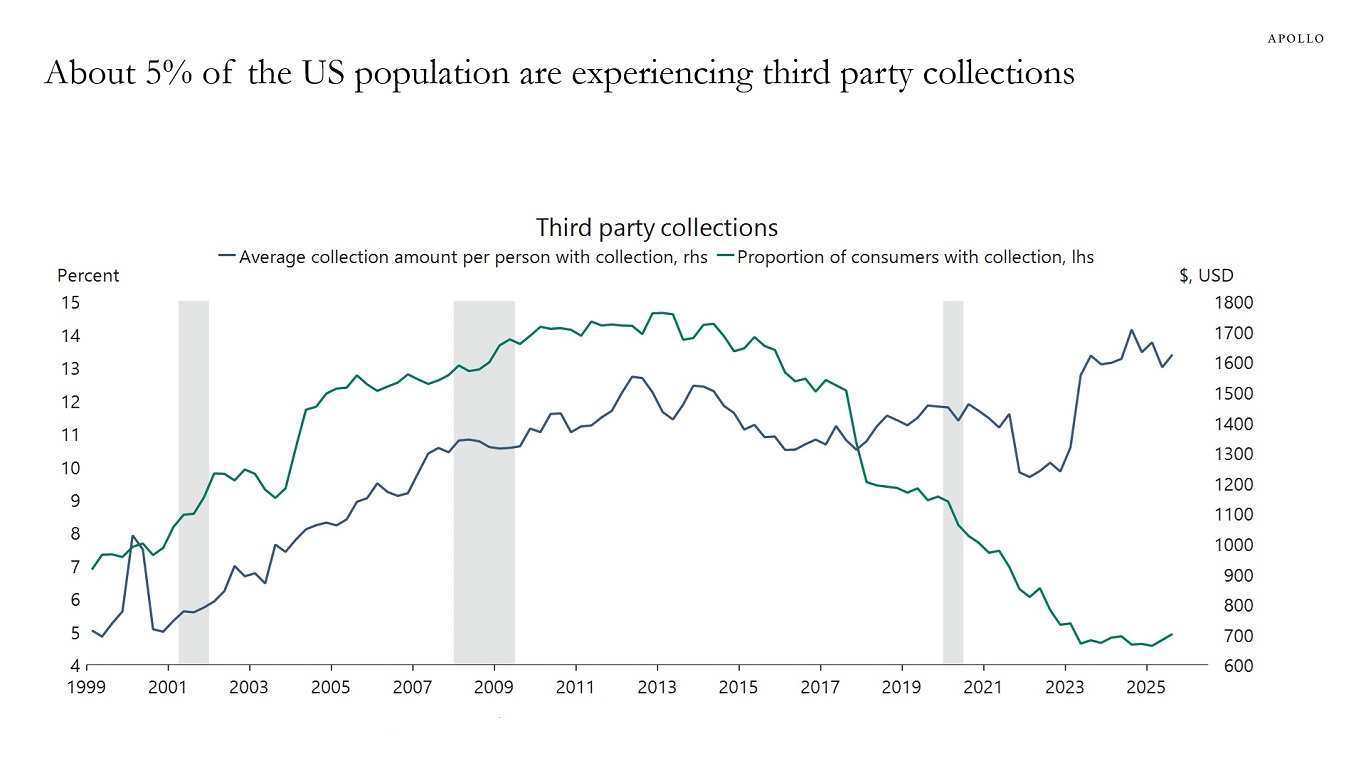

About 5% of the US population is experiencing third-party collections, down from 14% during the GFC, see chart below.

Sources: Federal Reserve Bank of New York, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

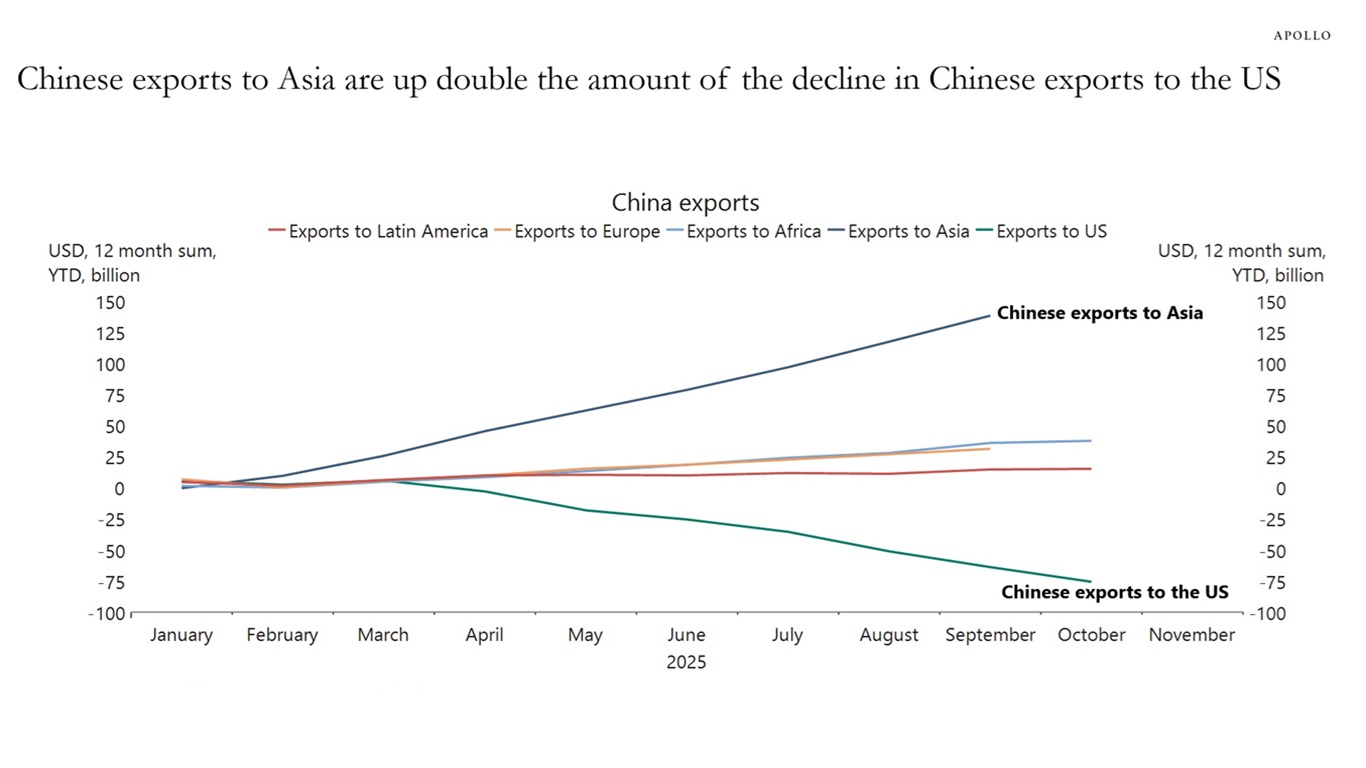

Since the beginning of the year, Chinese exports to the US are down $75 billion and Chinese exports to Asia are up $150 billion. Chinese exports to Europe, Africa and Latin America are basically flat, see chart below.

Sources: China General Administration of Customs (GAC), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

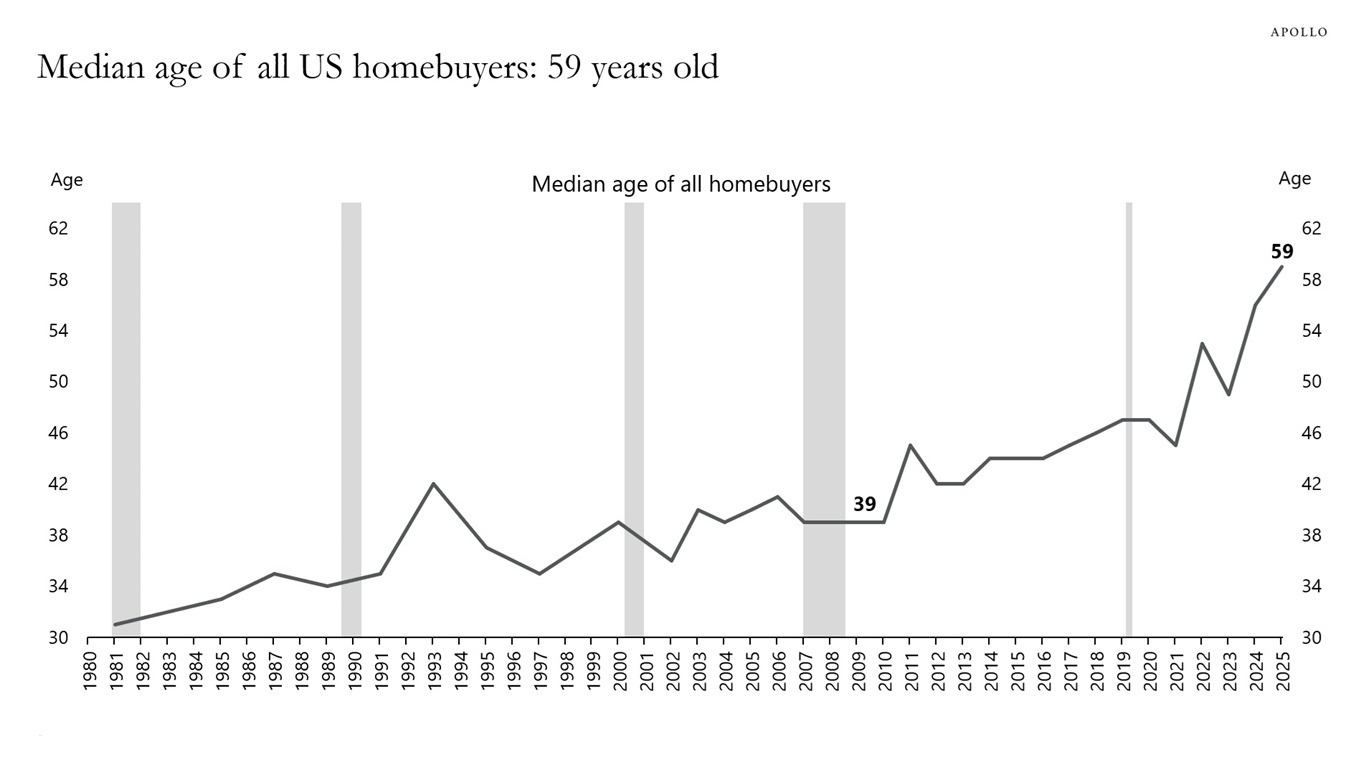

In 2010, the median age of all US homebuyers was 39 years old. Today, it is 59, see chart below.

Sources: National Association of Realtors, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

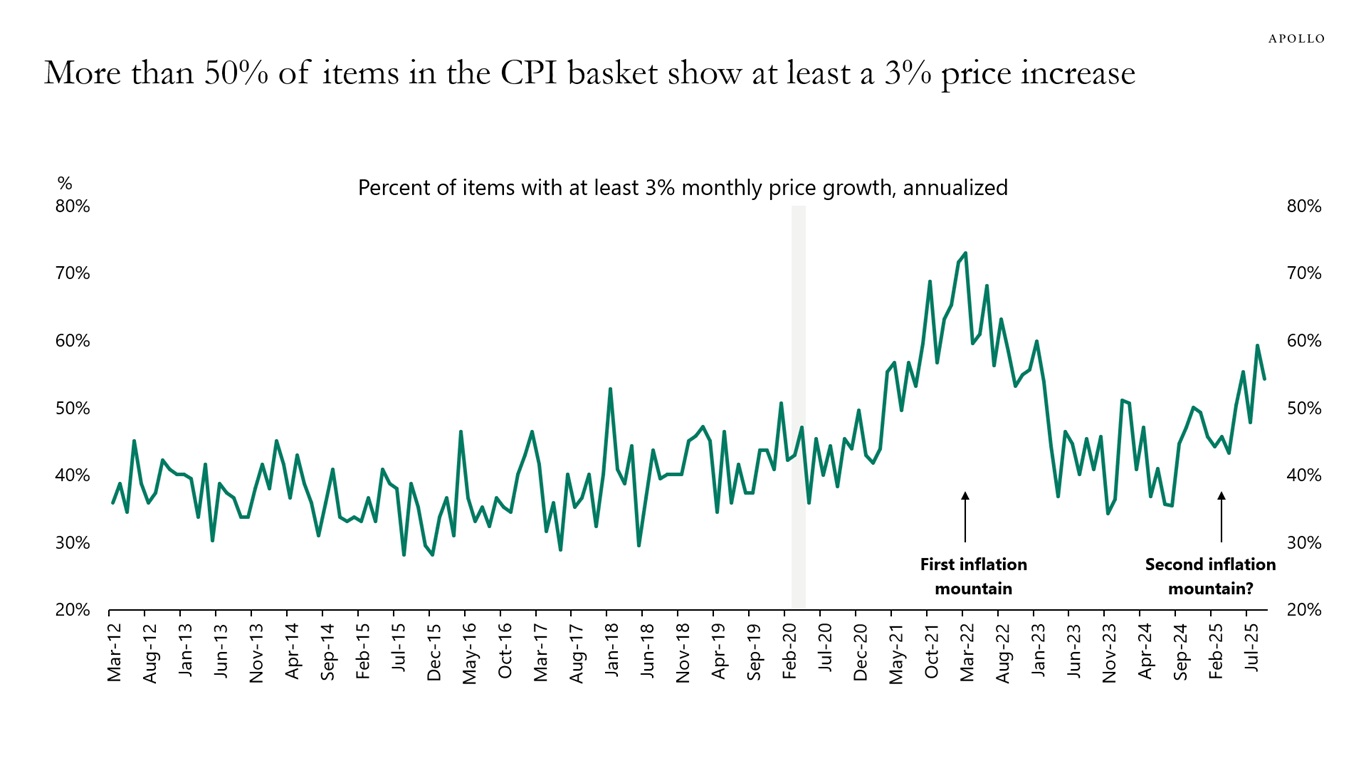

Looking at annualized month-over-month growth rates shows that 55% of items in the CPI basket are growing faster than 3%, see chart below. This is the reason why it is difficult for the Fed to cut interest rates in December.

Sources: BLS, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

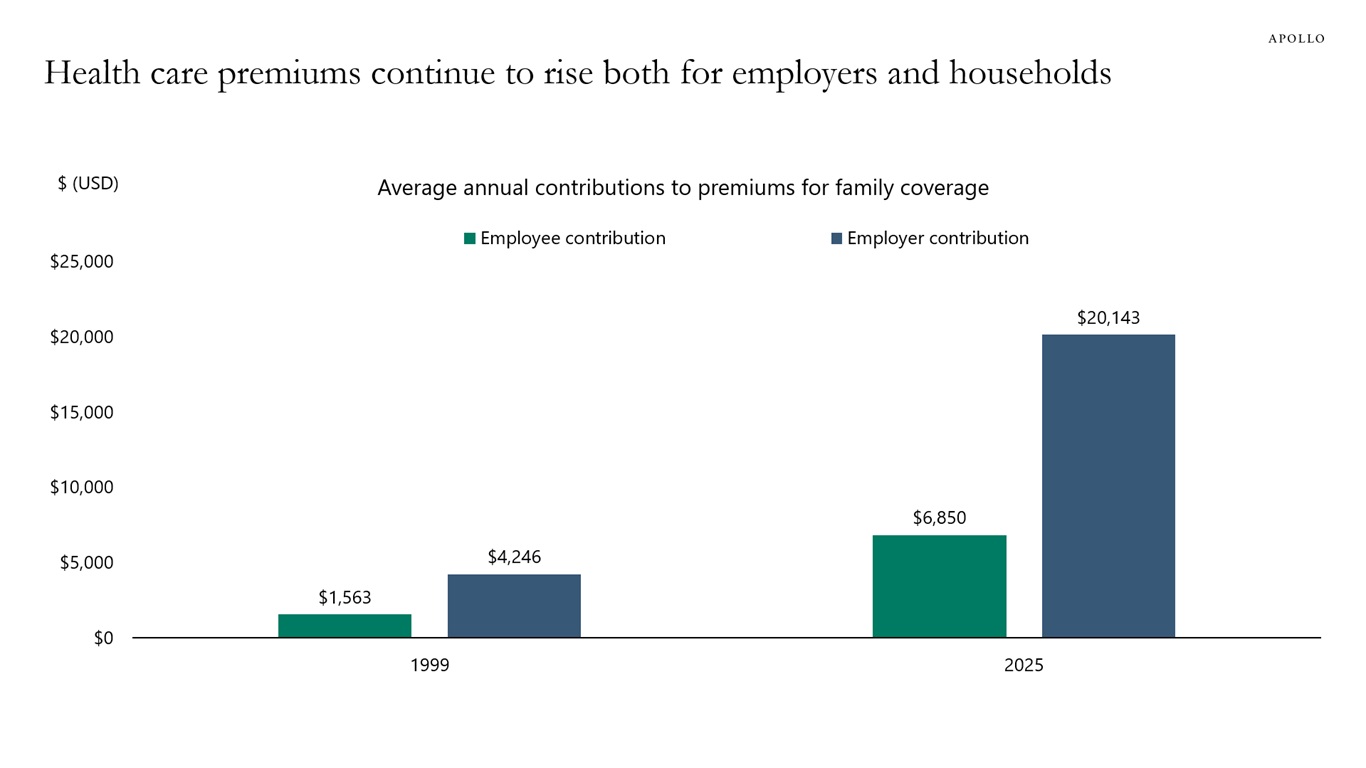

The average family in the US currently pays $6,850 annually for health insurance, and the average annual payment for employers is $20,143, see chart below.

That is a total annual cost for health insurance per family of $26,993

Note: Family coverage refers to health insurance coverage for an employee and at least one family member (spouse and/or dependent children). Sources: Kaiser Family Foundation, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.