Want it delivered daily to your inbox?

-

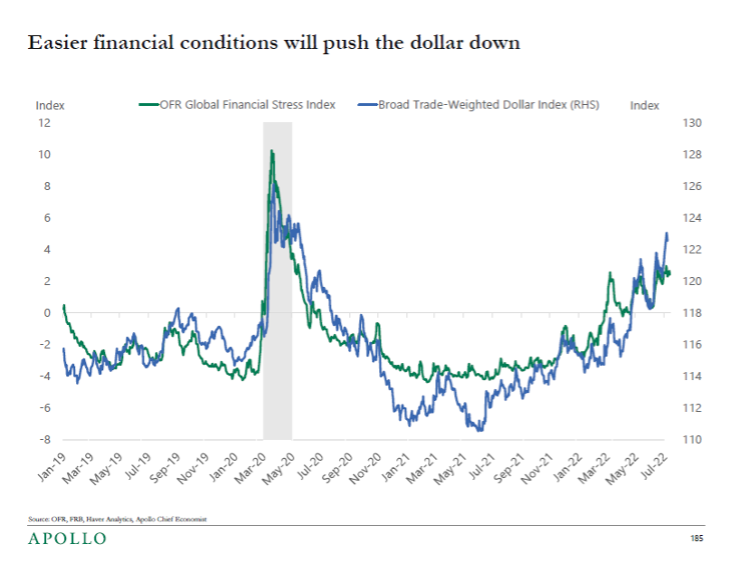

The risks are rising that sometime over the next three months, the Fed will go from “inflation is a problem” to “growth is a problem.” Once that happens, the FOMC will slow down Fed hikes, and this pivot from very hawkish to less hawkish will push down long rates. And once financial conditions move from tightening to easing, the dollar will begin to go down, see chart below.

See important disclaimers at the bottom of the page.

-

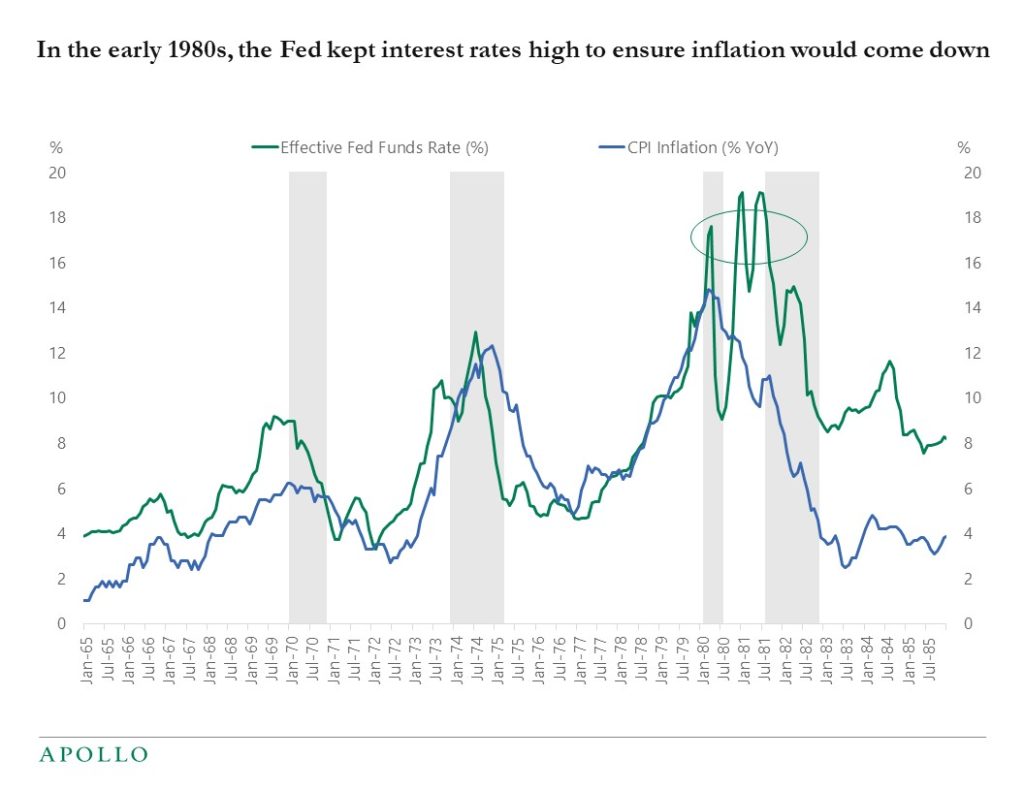

The market is pricing that the Fed will begin to cut rates in the first quarter of 2023, and I think that view is correct. With inflation expectations well-anchored the Fed doesn’t need to keep the Fed funds rate elevated for several years the way it did in the early 1980s, see chart below. With reference to the dual mandate, the Fed will later this year begin to talk about how the downside risks to growth are intensifying, and those recession risks will ultimately outweigh the shrinking upside risks to inflation.

Source: FRB, BLS, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

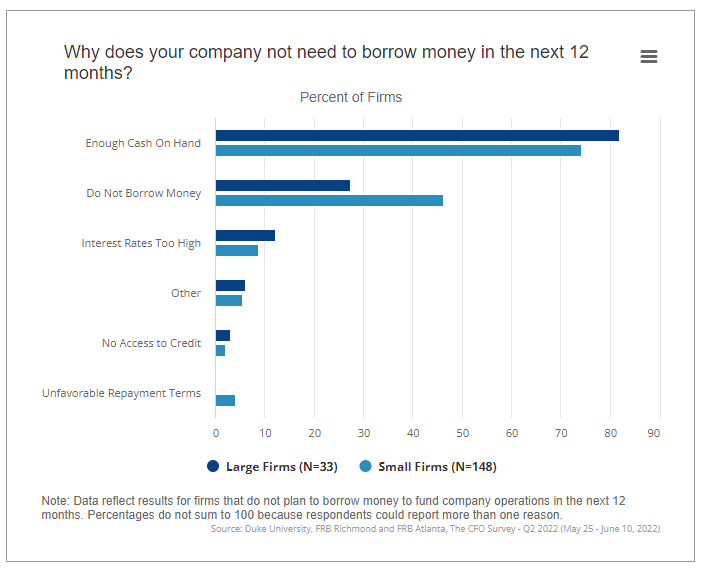

Why does your company not need to borrow money in the next 12 months? That is a question in the latest Fed/Duke CFO survey below, and 80% of companies respond that they don’t need to borrow because they have enough cash on their balance sheets. Only 10% of companies think that interest rates are too high. For more see here.

See important disclaimers at the bottom of the page.

-

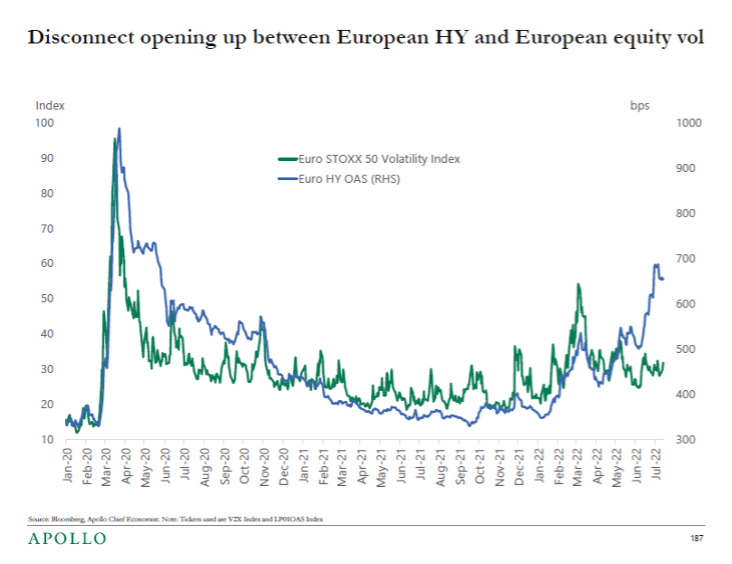

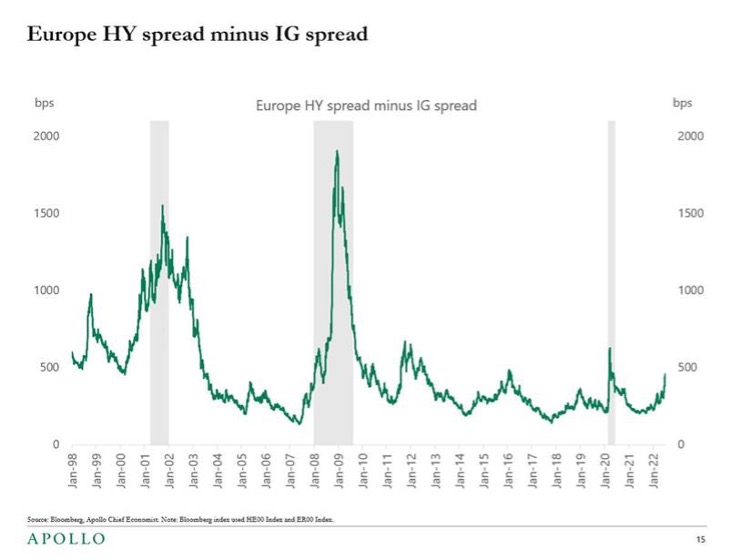

European high yield spreads have been trading wider, driven by intensifying recession risks, but European equity implied vol has remained relatively subdued. The outlook for Europe is very worrying, and either equity vol has to increase or high yield OAS has to narrow, see chart below.

See important disclaimers at the bottom of the page.

-

Blanchard and Summers: Bad news for the Fed from the Beveridge space

https://www.piie.com/publications/policy-briefs/bad-news-fed-beveridge-space

Just How Big Are Federal Interest Payments?

https://www.crfb.org/blogs/just-how-big-are-federal-interest-payments

Fed: The Increase in Inflation Compensation: What’s Up?

https://www.frbsf.org/wp-content/uploads/sites/4/el2022-18.pdf

See important disclaimers at the bottom of the page.

-

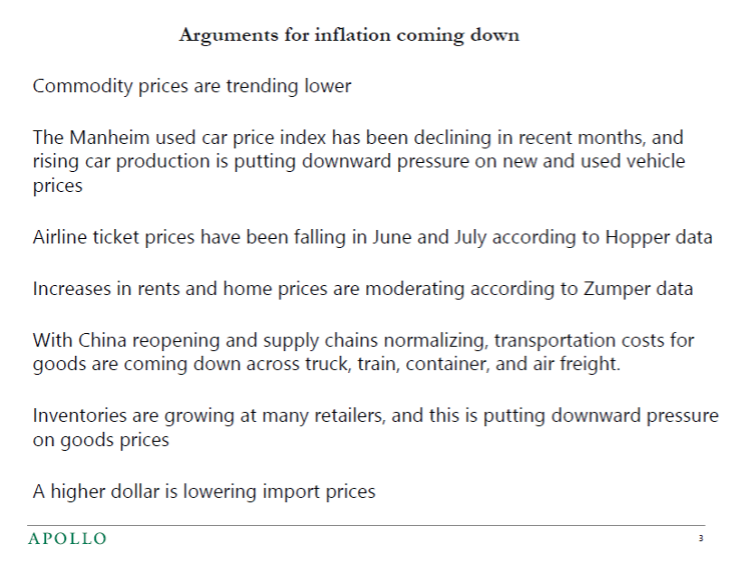

Inflation this week came in higher than expected at 9.1%, but the list of reasons why inflation will soon be coming down keeps growing, see below. Our weekly Slowdown Watch with daily and weekly indicators for the US economy is available here.

See important disclaimers at the bottom of the page.

-

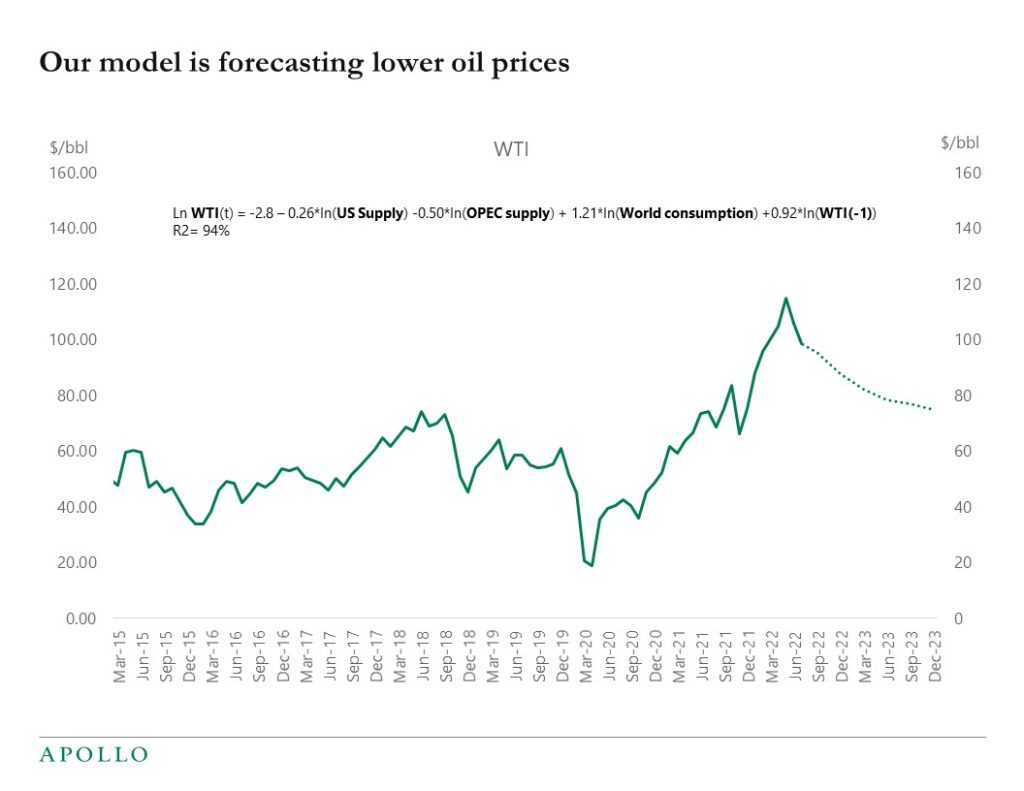

We have built a model where oil prices are explained by US supply, OPEC supply, World consumption, and lagged oil prices. All variables are statistically significant. With slower economic growth ahead and supply increasing, the model currently forecasts that oil prices will decline over the coming 12 months, see chart below.

Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

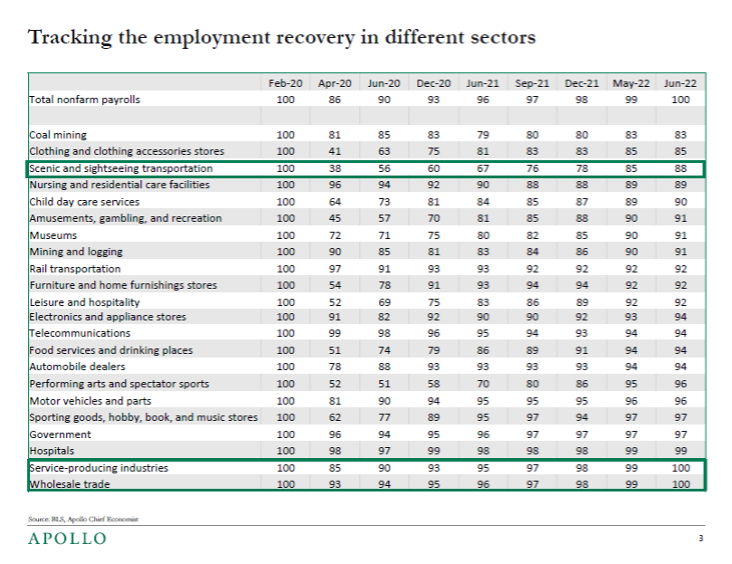

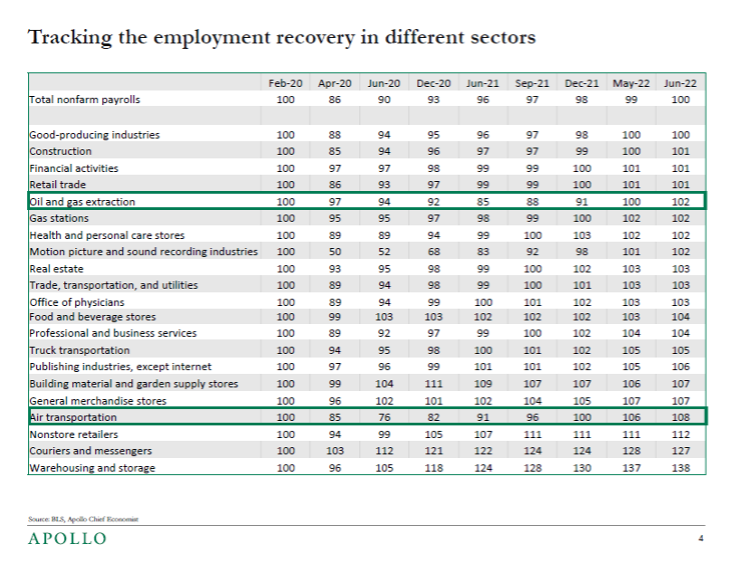

Since employment declined by 22 million jobs during the pandemic, about 21.5 million jobs have been created. But the distribution of the jobs created has been uneven, with some sectors today having employment above February 2020 levels and others having employment levels below. Most noteworthy was the fast recovery in the goods sector and the current strong growth in jobs in the economy’s service sector. The table shows the level of employment in different industries with February 2020 = 100.

See important disclaimers at the bottom of the page.

-

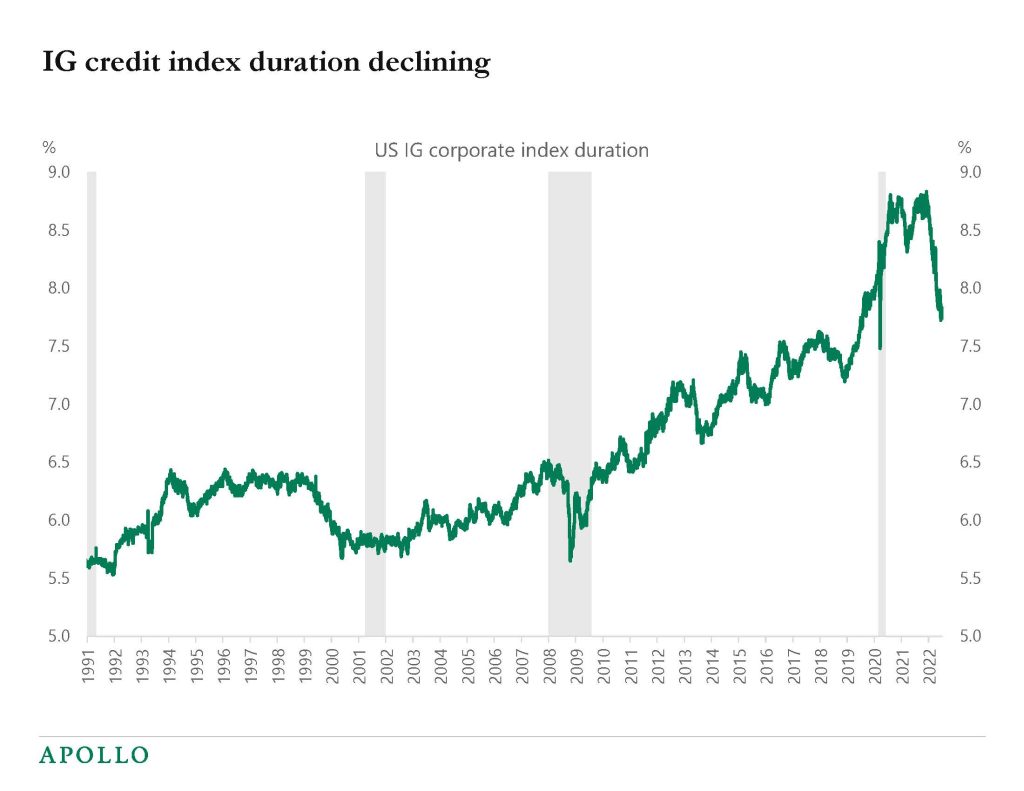

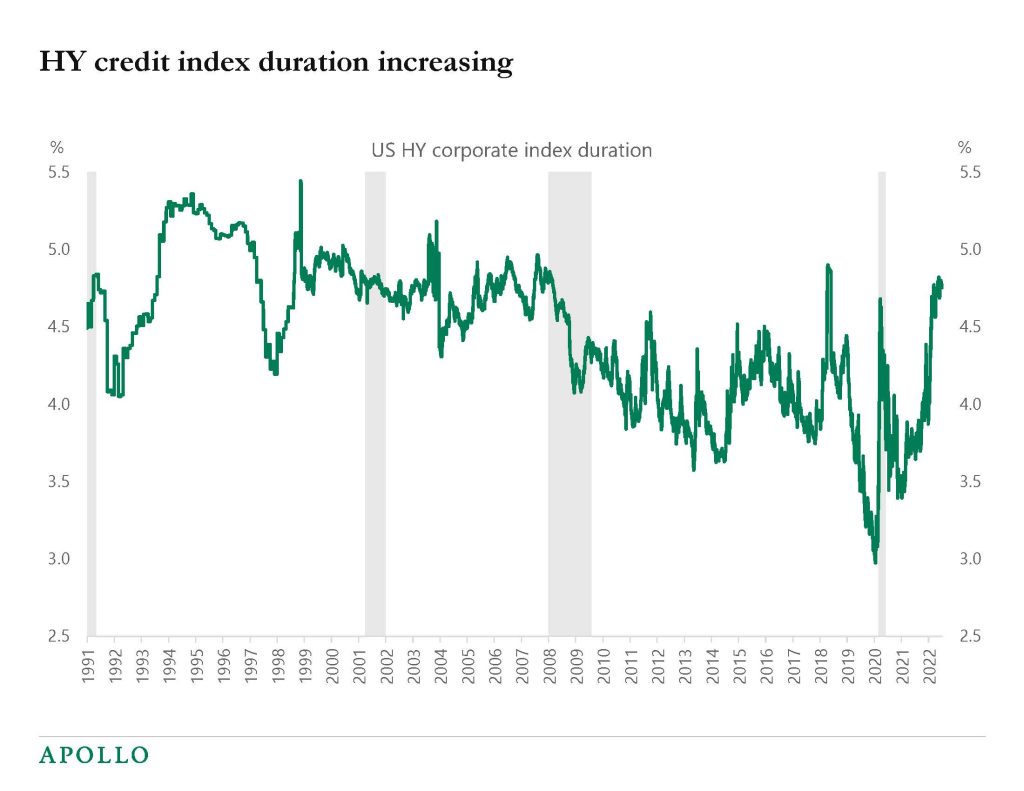

IG index duration has been declining, and HY index duration has been increasing, see charts below. If inflation starts to come down over the coming months as the consensus expects, this shift has important implications for the expected performance of IG relative to HY in case 10-year rates rally from 3% down to, say, 2%.

Source: Bloomberg, Apollo Chief Economist. Note: The measure used is modified duration, which measures the expected change in a bond’s price to a 1% change in interest rates.

Source: Bloomberg, Apollo Chief Economist. Note: The measure used is modified duration, which measures the expected change in a bond’s price to a 1% change in interest rates. See important disclaimers at the bottom of the page.

-

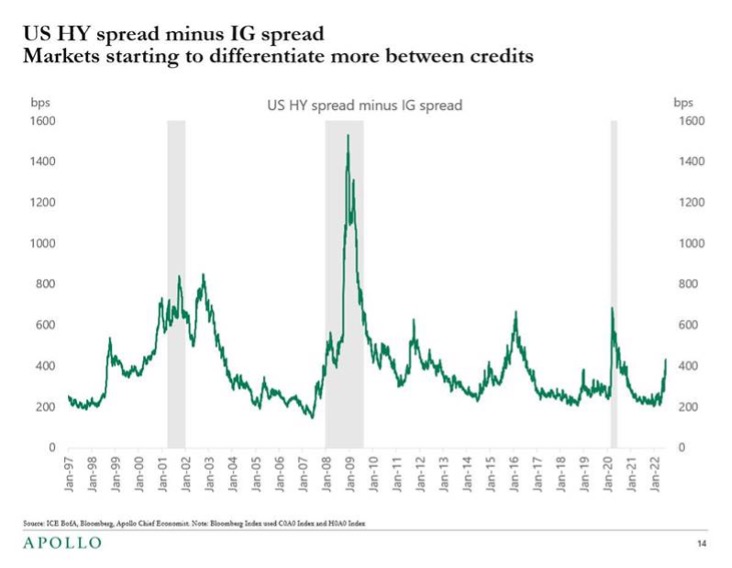

In this PDF we have re-drawn all our charts for credit spreads and yields going back in time as far as possible, and the bottom line is that the ongoing spread widening is still relatively modest seen in a historical context, see also charts below.

See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.