The consensus expects nonfarm payrolls for September to come in at 50,000, and I think that is too pessimistic. The charts below with incoming daily and weekly data for September show that:

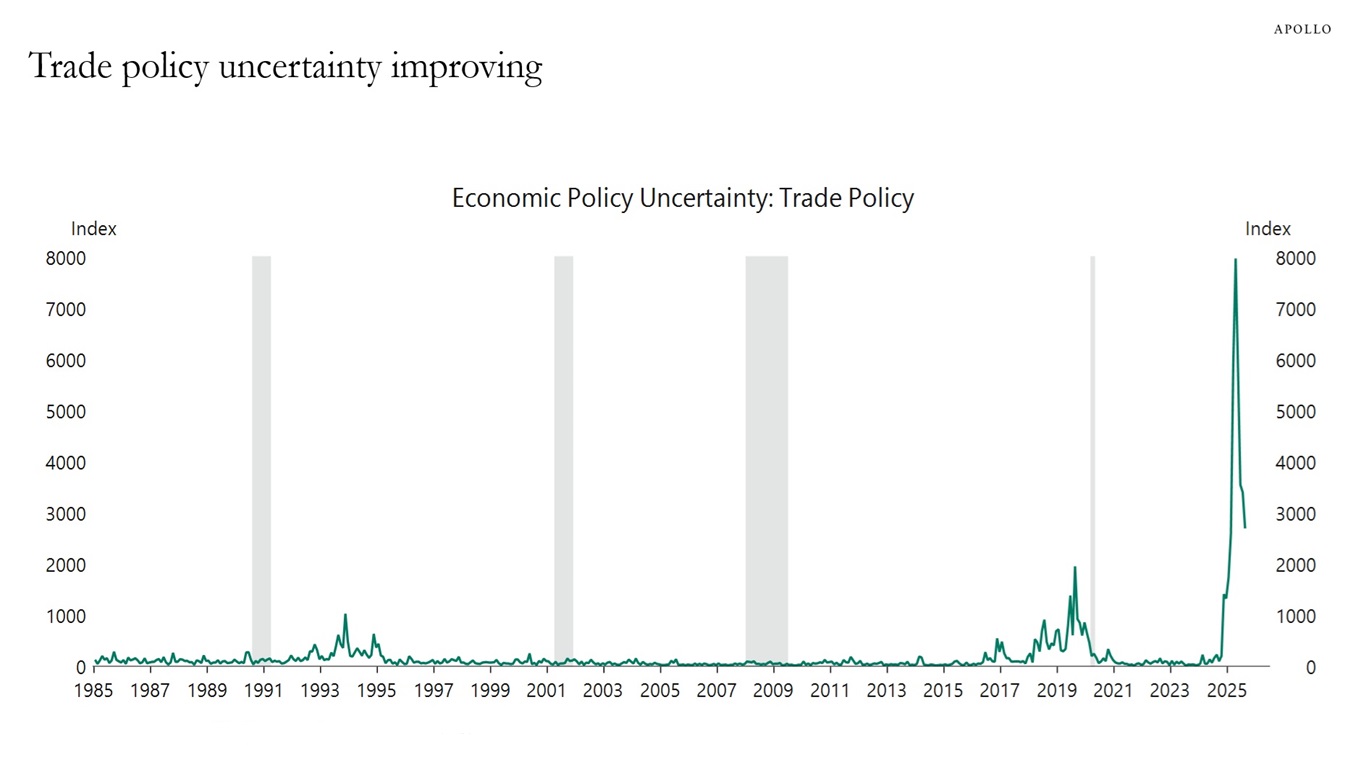

1) Trade policy uncertainty is improving

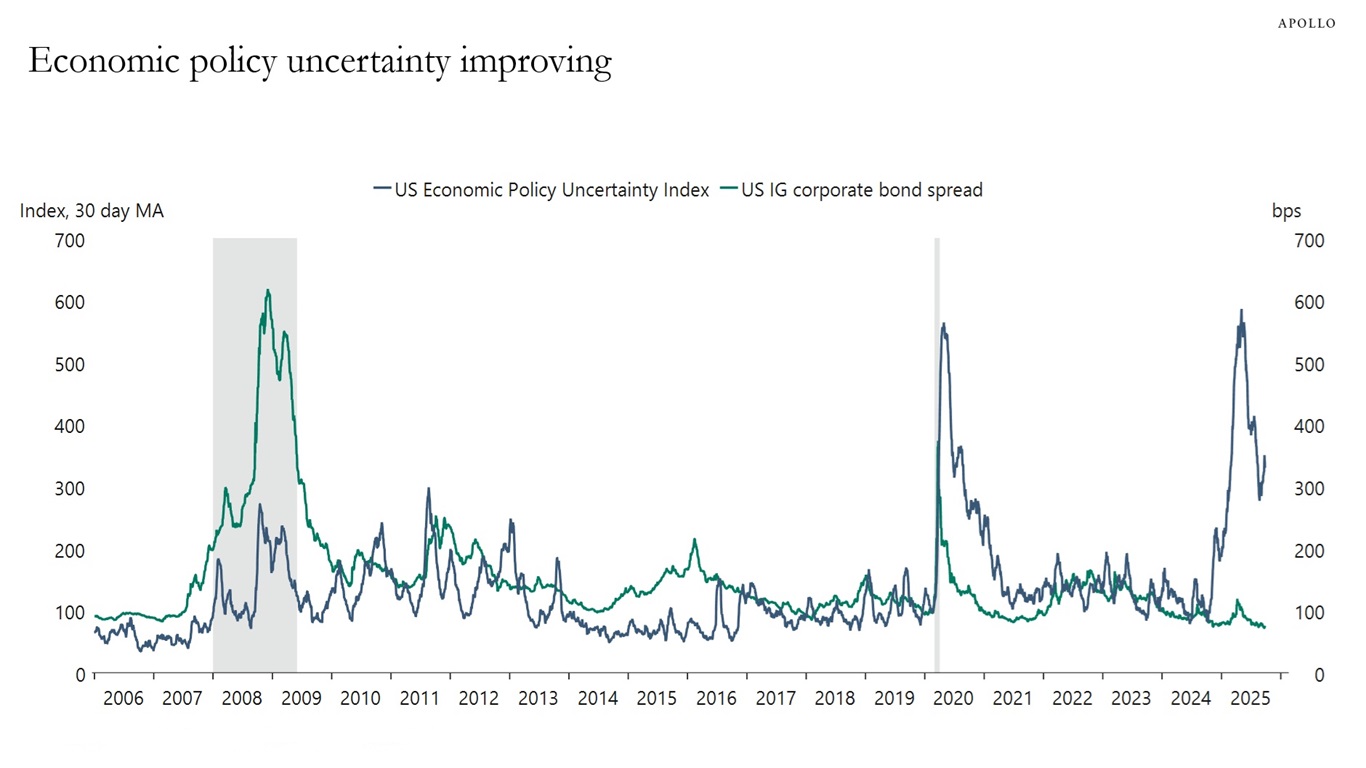

2) Economic policy uncertainty is improving

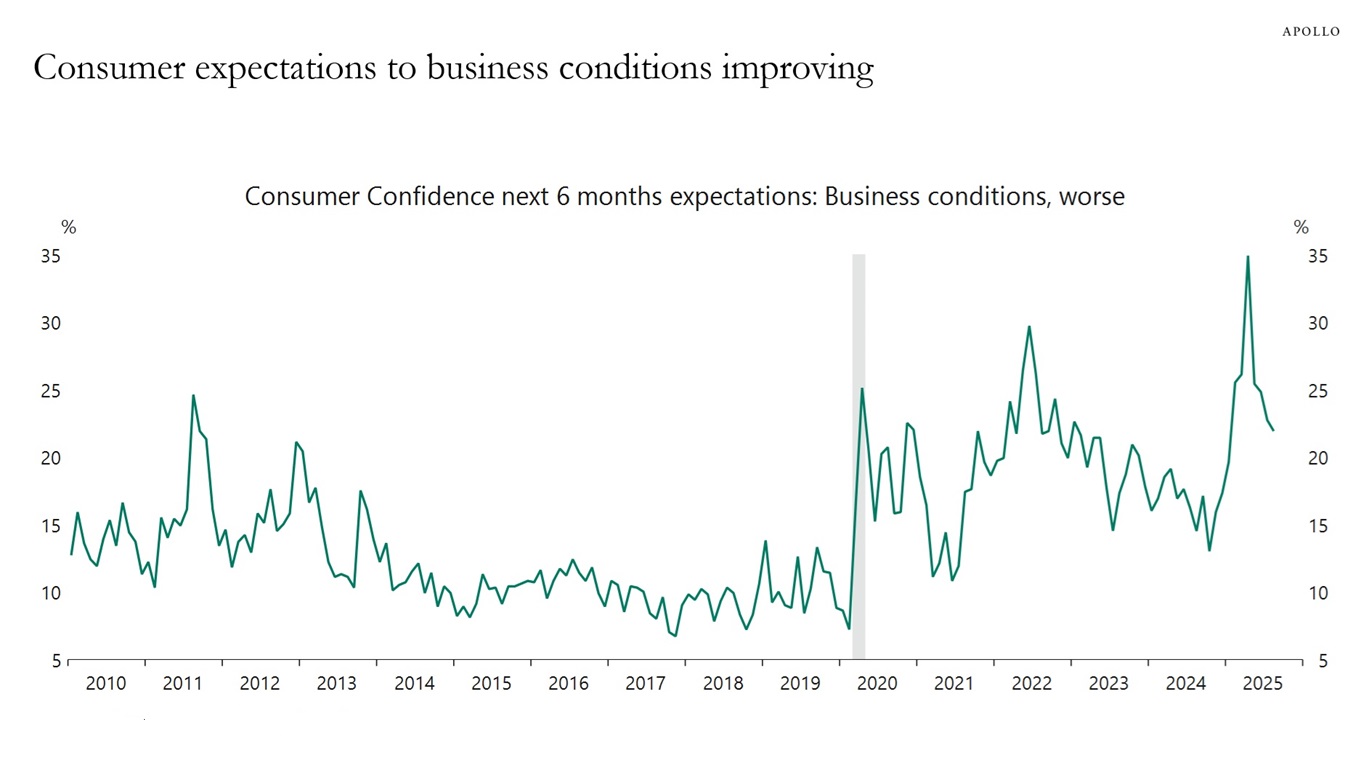

3) Consumer expectations to business conditions are improving

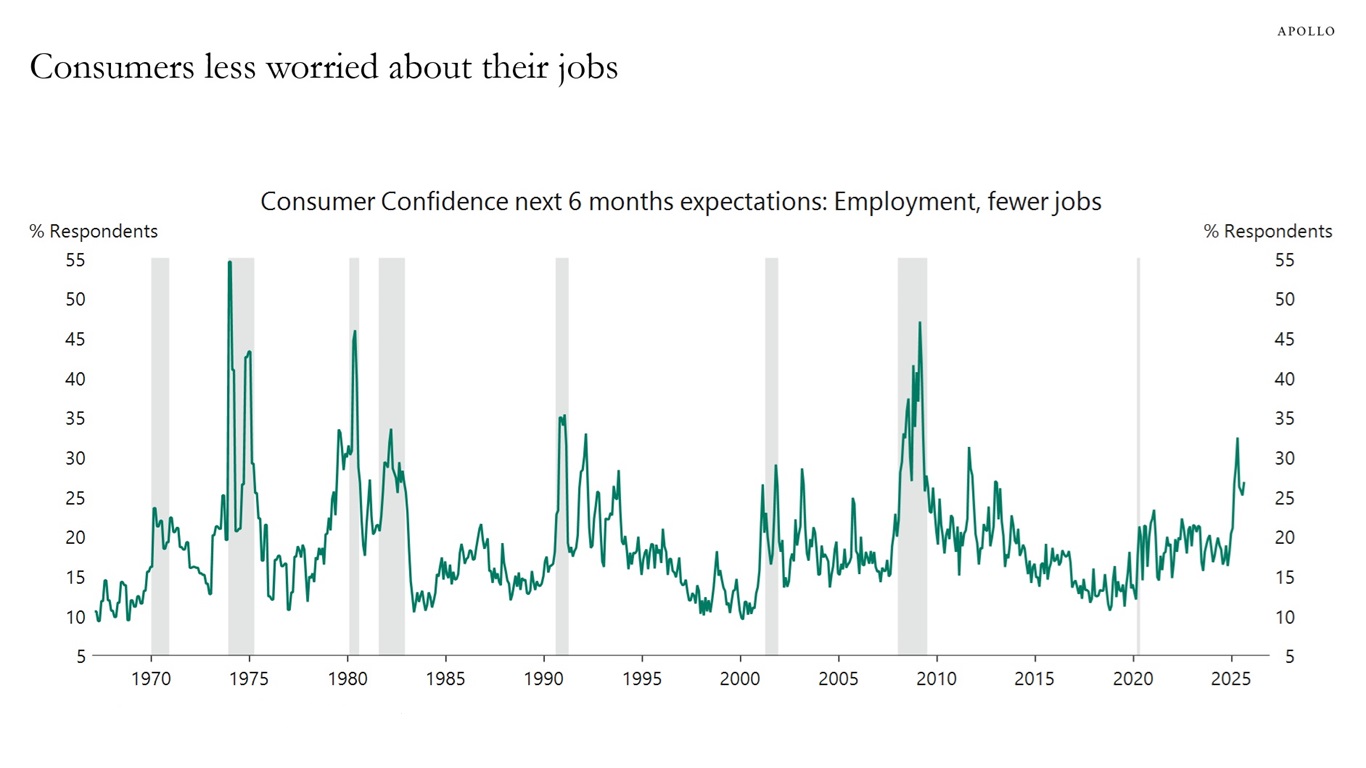

4) Consumers are less worried about losing their jobs

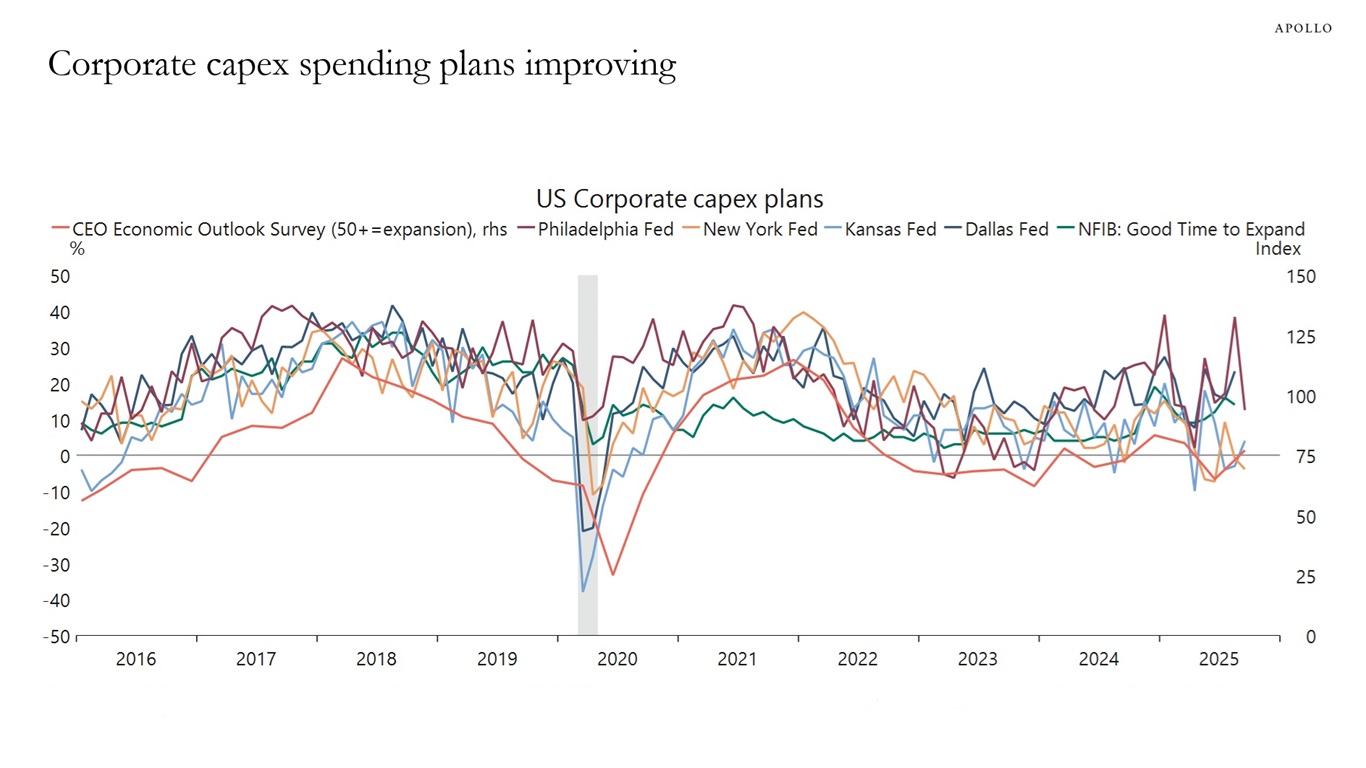

5) Corporate capex plans are improving, and jobless claims are still low

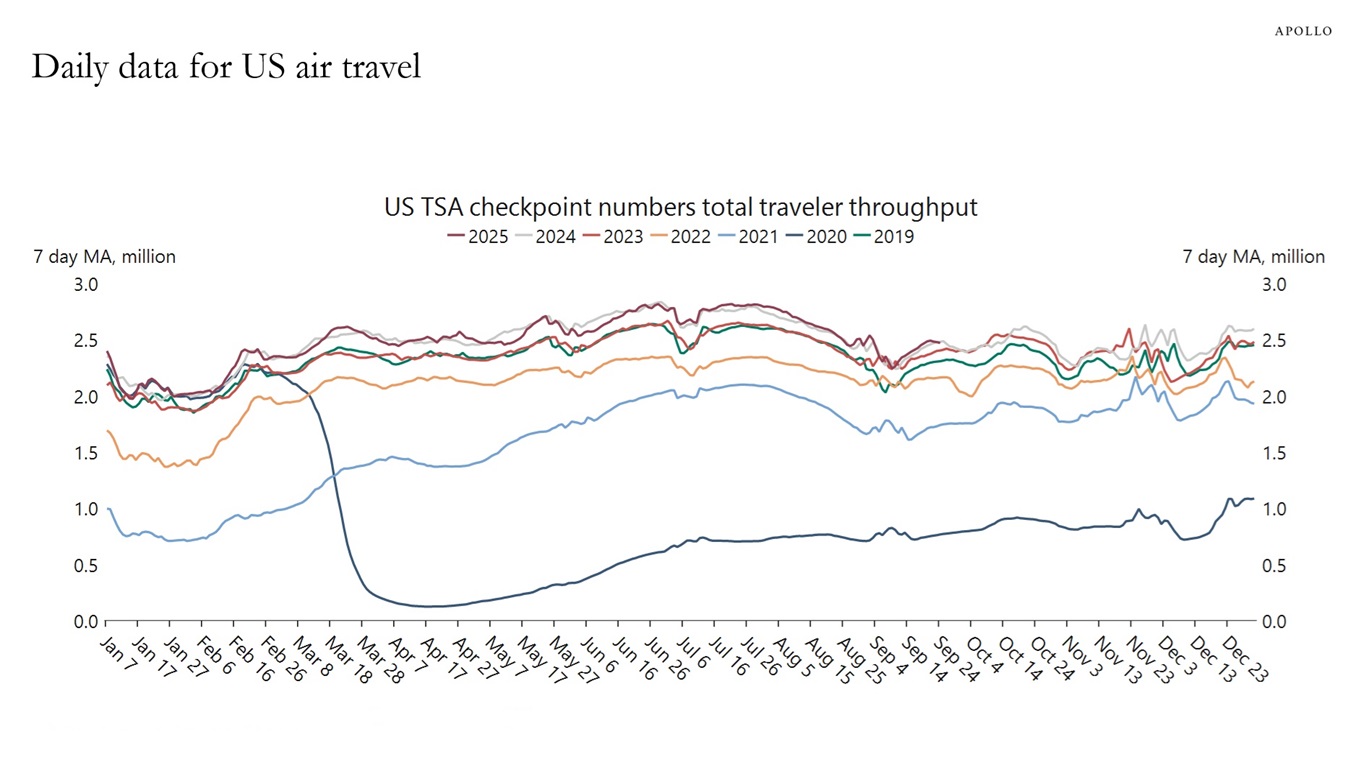

6) The daily TSA data for the number of people traveling on airplanes is strong

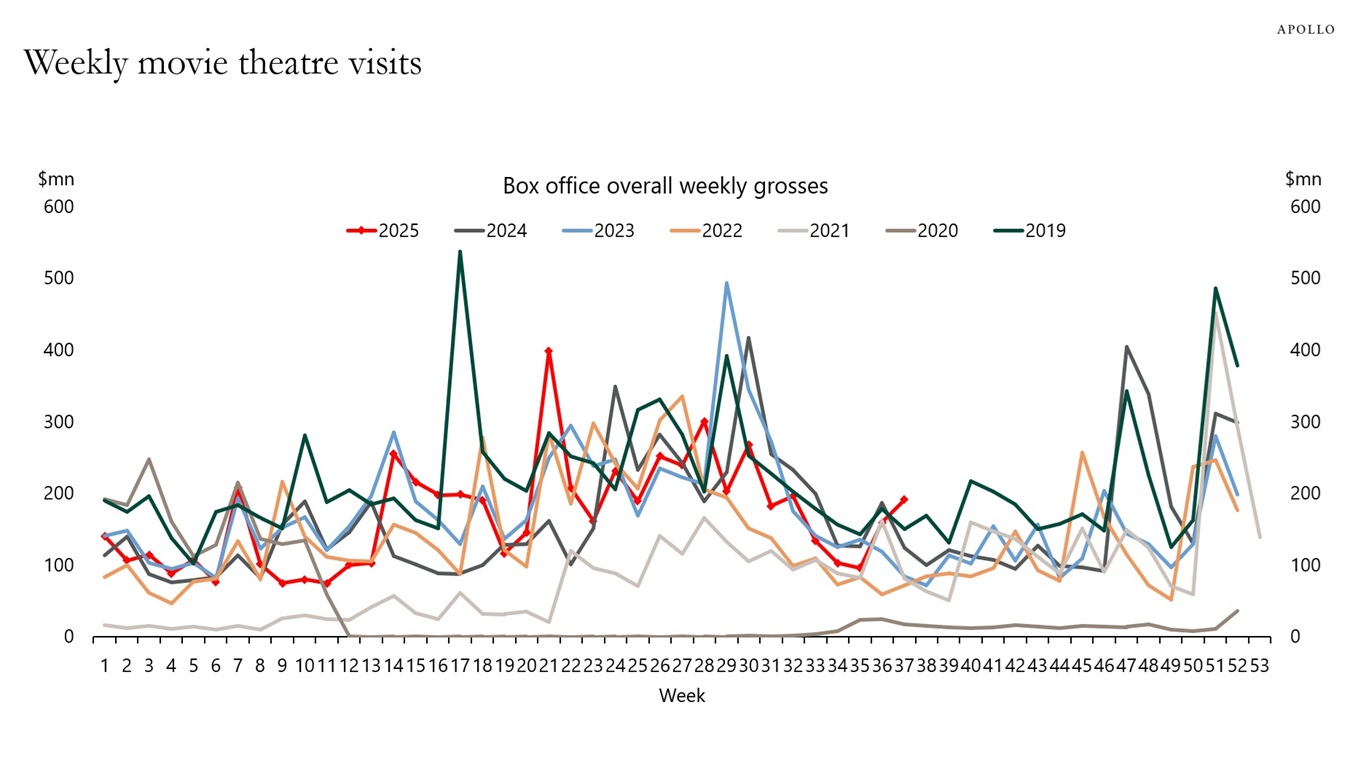

7) Data for the number of people going to Broadway shows, the movies and visiting the Statue of Liberty is strong

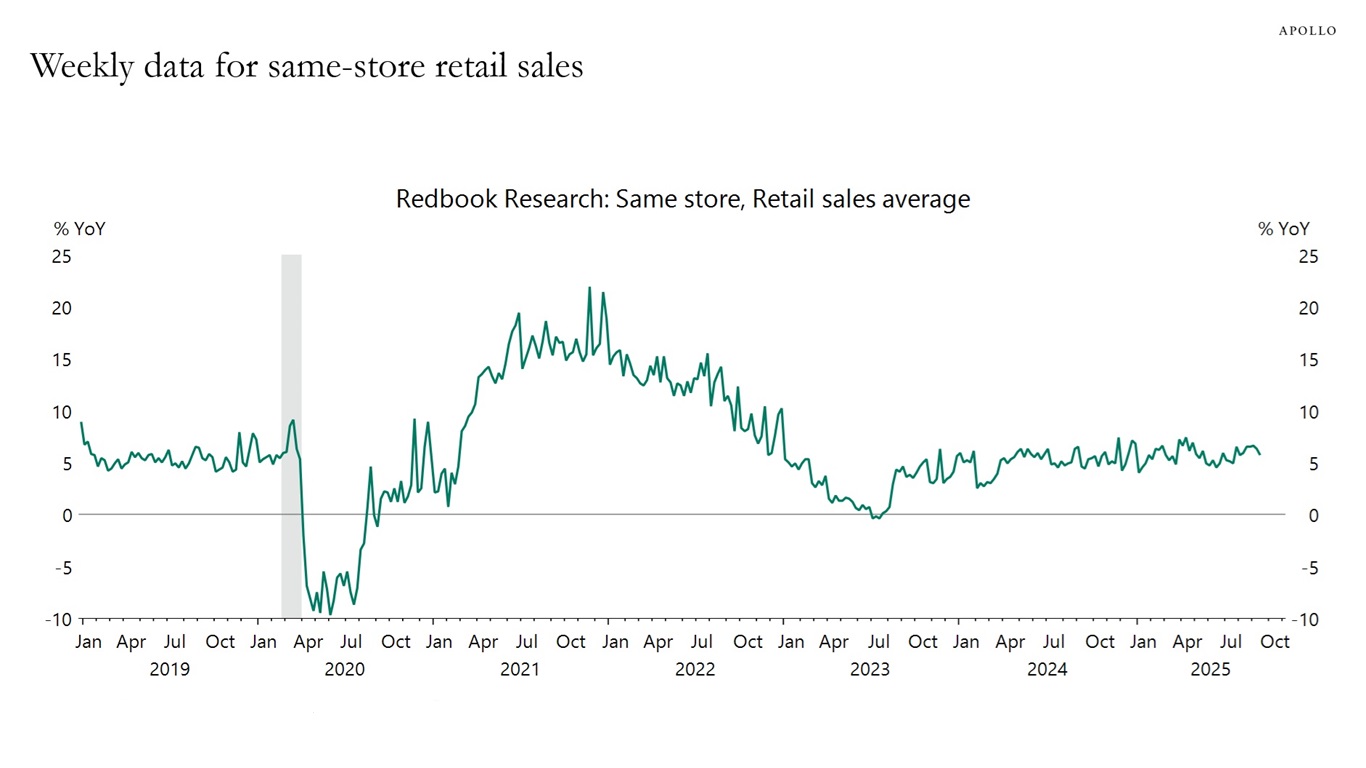

8) Weekly data for same-store retail sales is strong

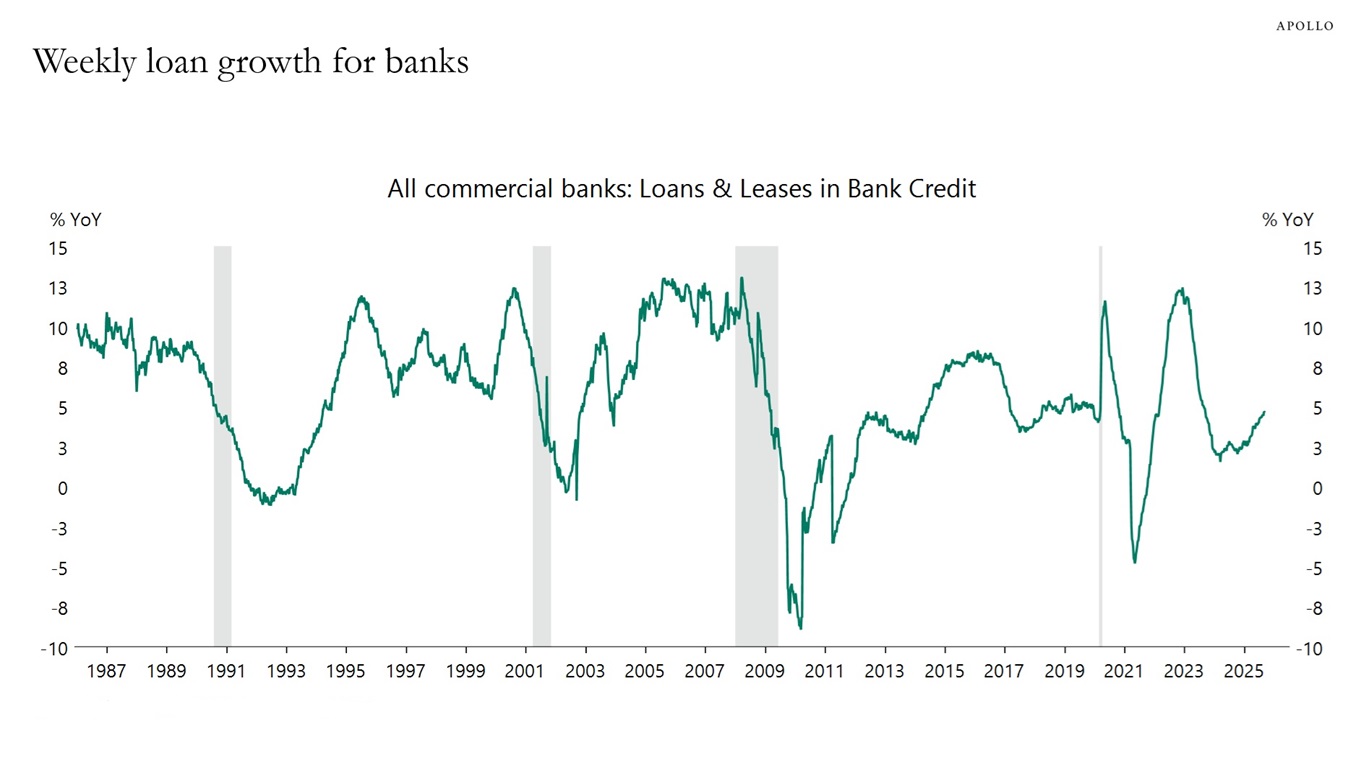

9) Weekly data for bank lending is accelerating

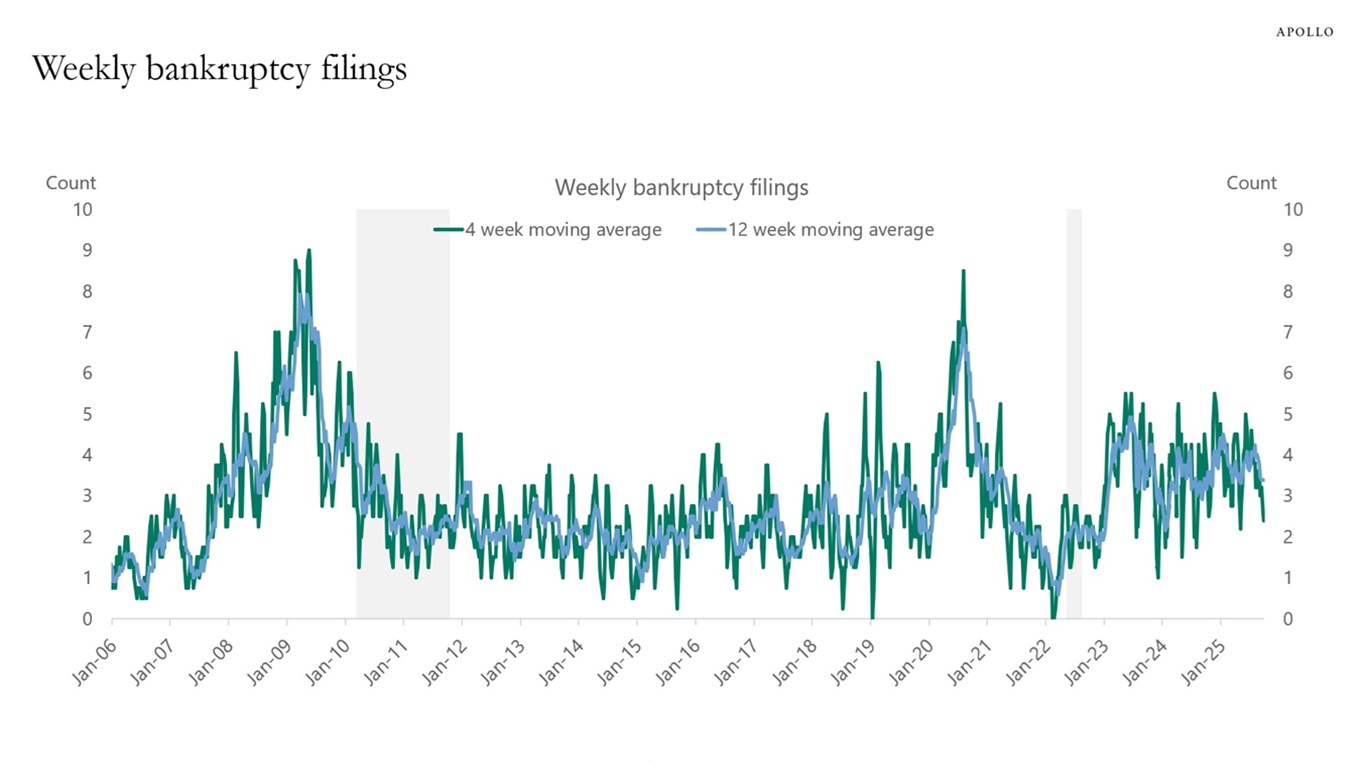

10) Weekly bankruptcy filings are starting to trend lower

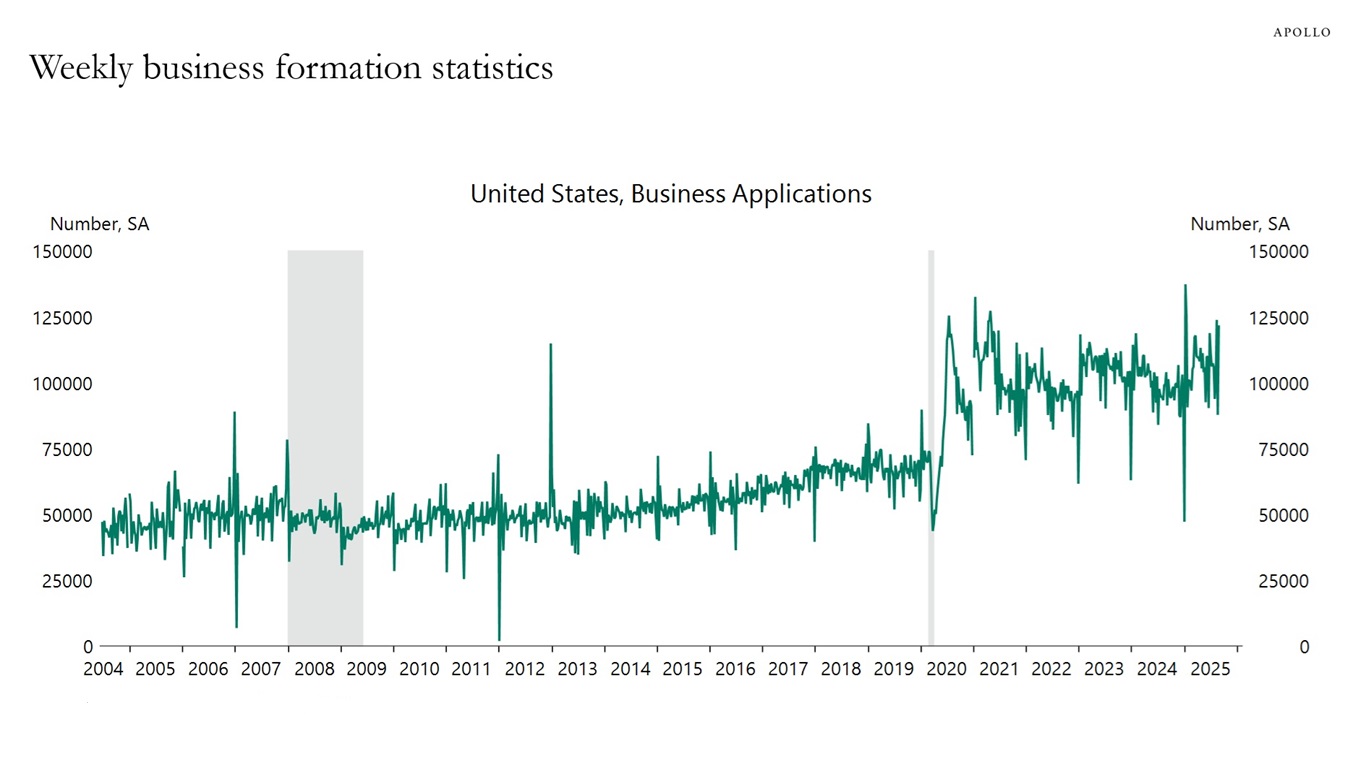

11) Weekly data for business formation is still strong

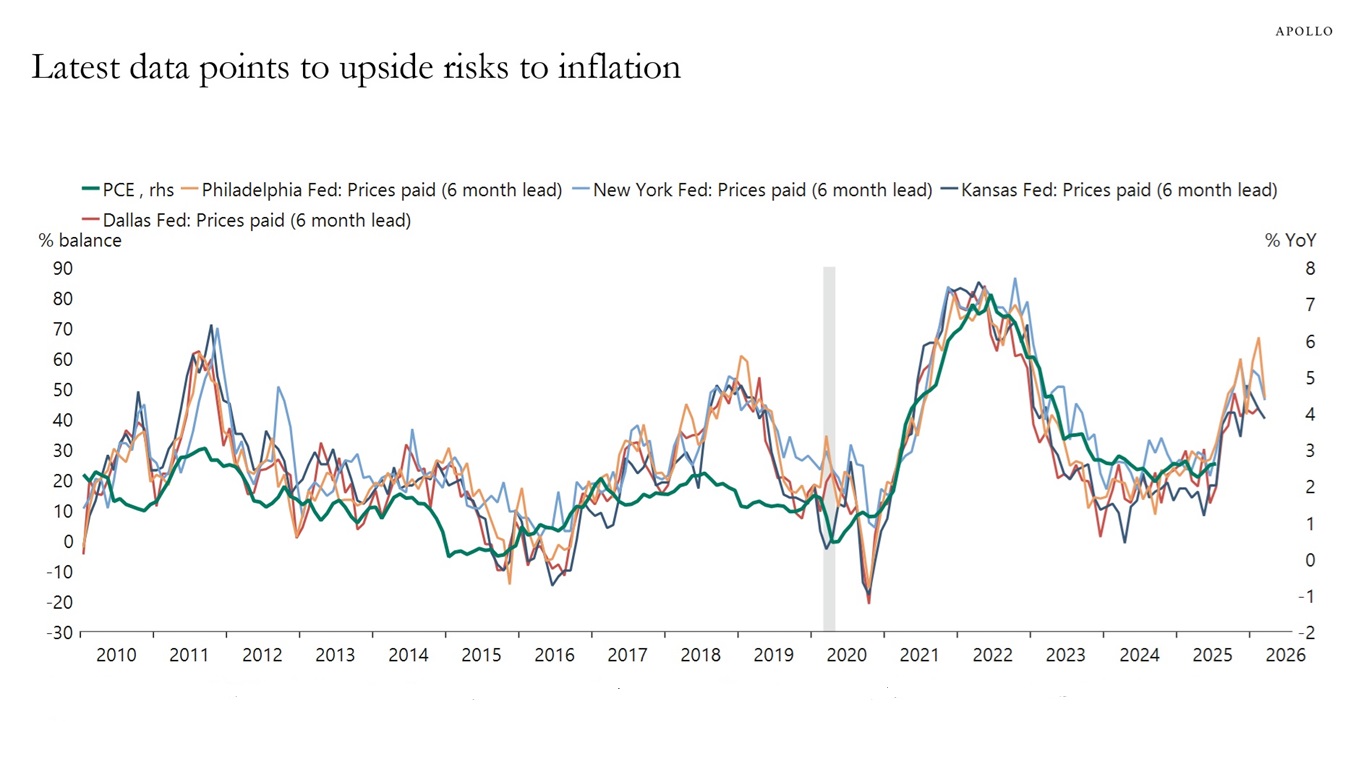

12) There are significant upside risks to inflation in the regional Fed surveys and in ISM services price paid

Combined with the Atlanta Fed expecting GDP growth in the third quarter at 3.9%, the bottom line is that the economy continues to do better than the consensus expects, and the labor market has likely weakened because of lower immigration and perhaps also AI implementation.

With continued strong growth and upside pressures on inflation from tariffs, immigration restrictions, and the declining dollar, the FOMC should really be talking about rate hikes rather than rate cuts.

Our chart book with high-frequency indicators for the US economy is available here.