Want it delivered daily to your inbox?

-

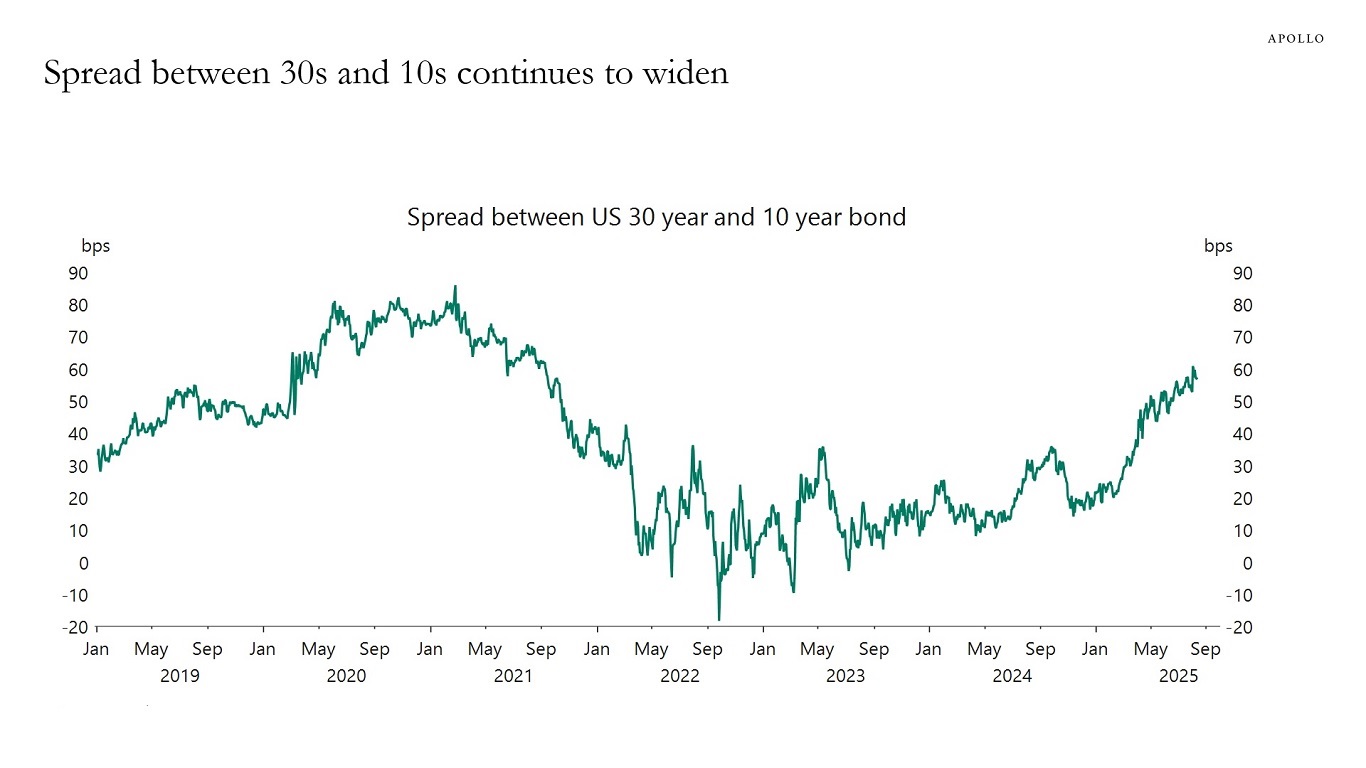

The US yield curve has started steepening, not only 2s10s but also 10s30s, see the first chart below.

There are three reasons why this is happening:

1. The Fed is cutting rates.

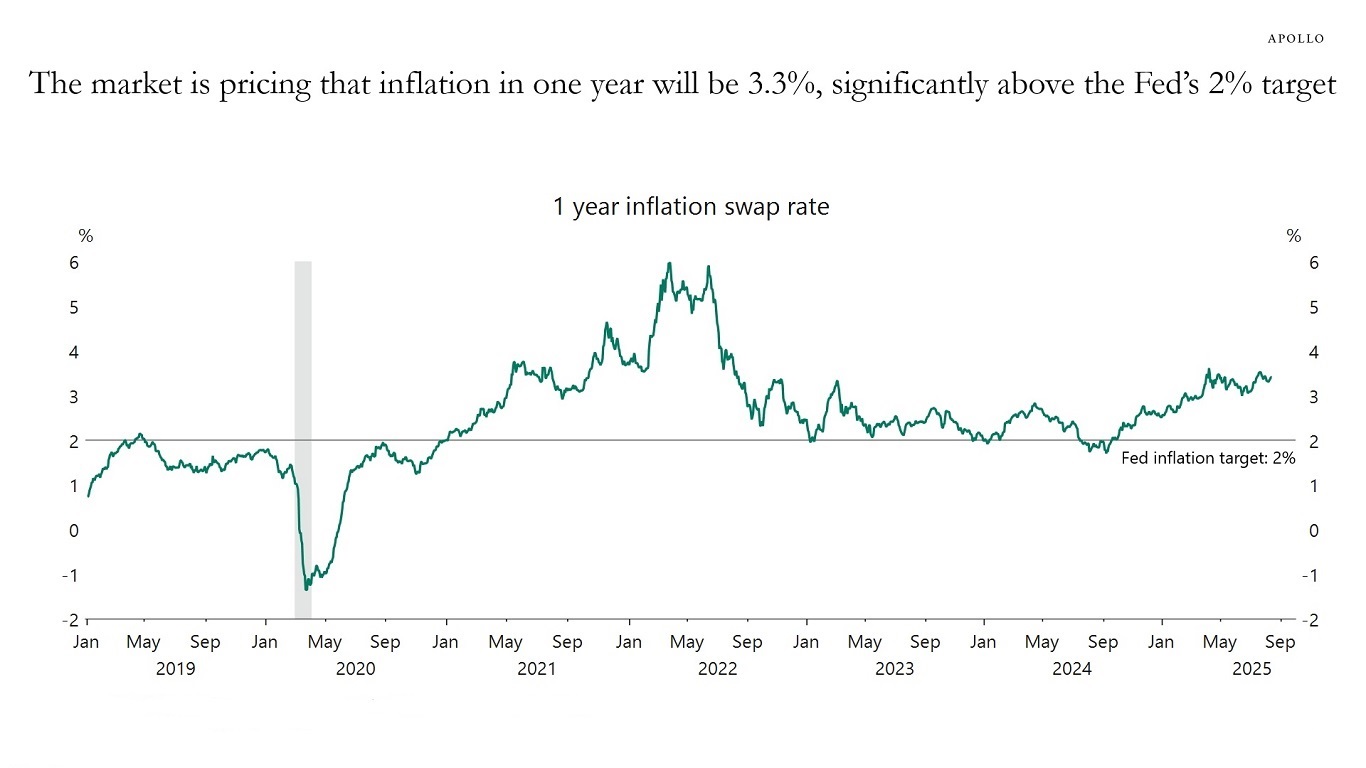

2. If the market thinks the Fed is cutting for political reasons, it puts upward pressure on inflation expectations and ultimately long rates, which also steepens the curve, see the second chart.

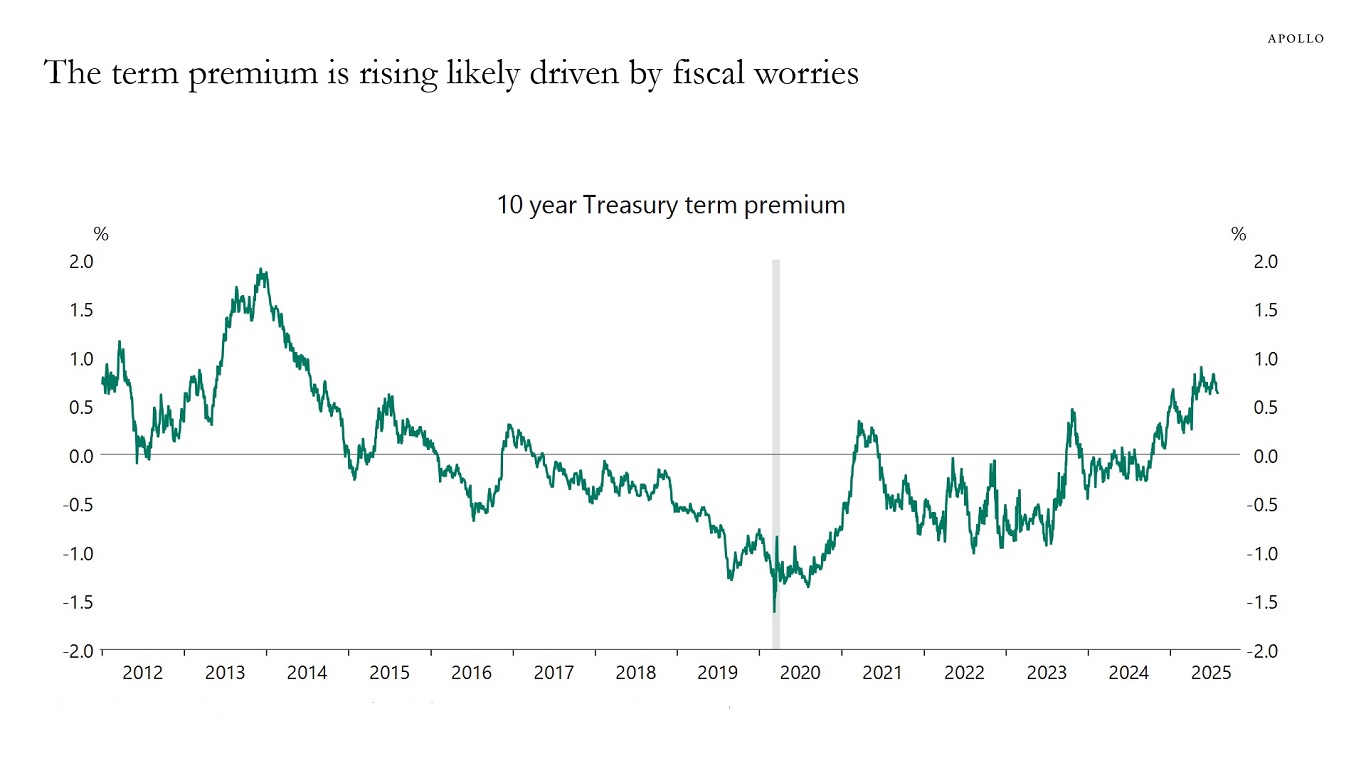

3. Growing Treasury issuance is putting upward pressure on long rates, see the third chart.

If Fed Chair Powell, in his Jackson Hole speech on Friday, is going to signal less commitment to the Fed’s 2% inflation target, the curve will steepen further.

We have put together a chart book looking at this topic, including some of the recent weakness in Treasury auctions. It is available here.

Sources: Bloomberg, Macrobond, Apollo Chief Economist

Note: Ticker used USSWIT1 Currency. Sources: Bloomberg, Macrobond, Apollo Chief Economist

Note: The NY Fed measure for the term premium is based on a five-factor, no-arbitrage term structure model. Sources: Federal Reserve Bank of New York, Macrobond, Apollo Chief Economist

See important disclaimers at the bottom of the page.

-

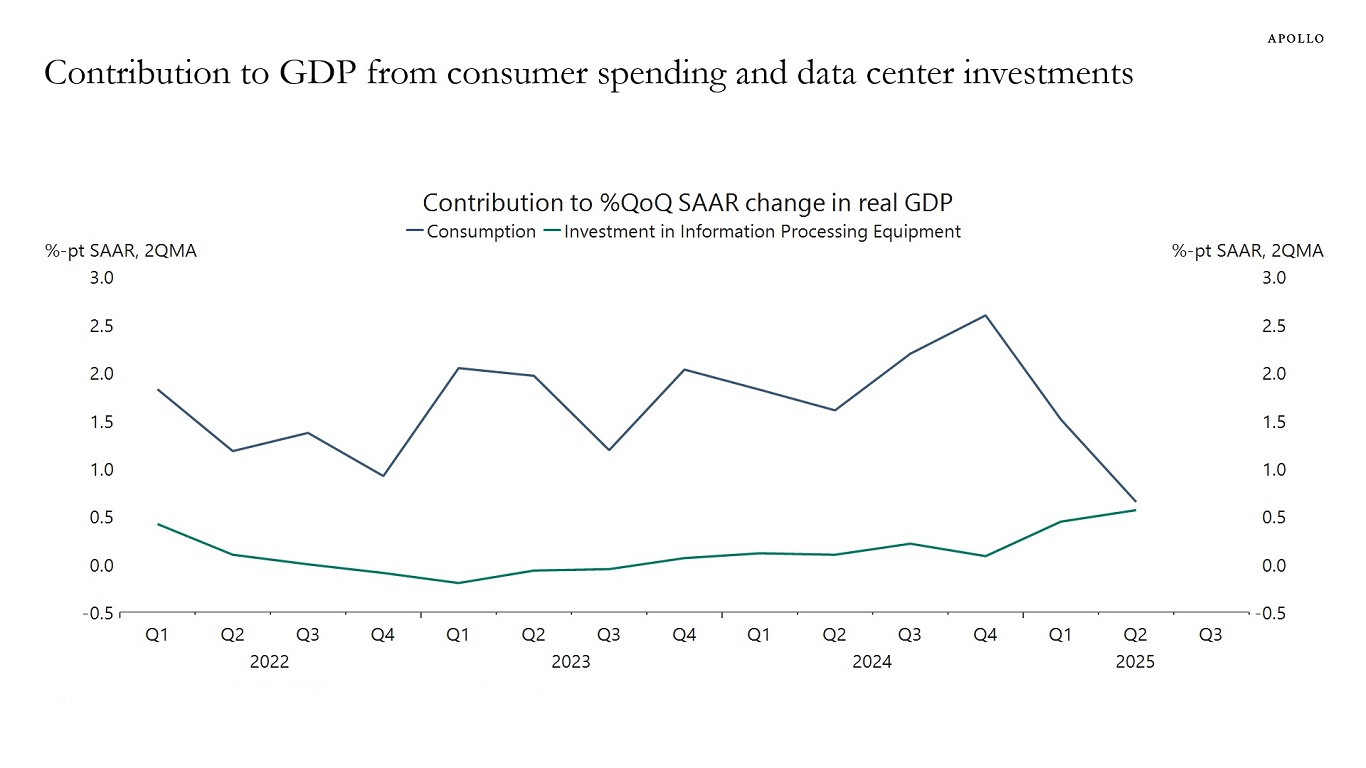

Consumer spending makes up 70% of GDP, and private consumption is usually the key driver of GDP growth.

But that has changed in 2025.

Over the first half of this year, the contribution to GDP growth from data center investments has been the same as the contribution from consumer spending, see chart below. The contribution from consumer spending has been decreasing, and the contribution from data center construction has been increasing.

Sources: US Bureau of Economic Analysis (BEA), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

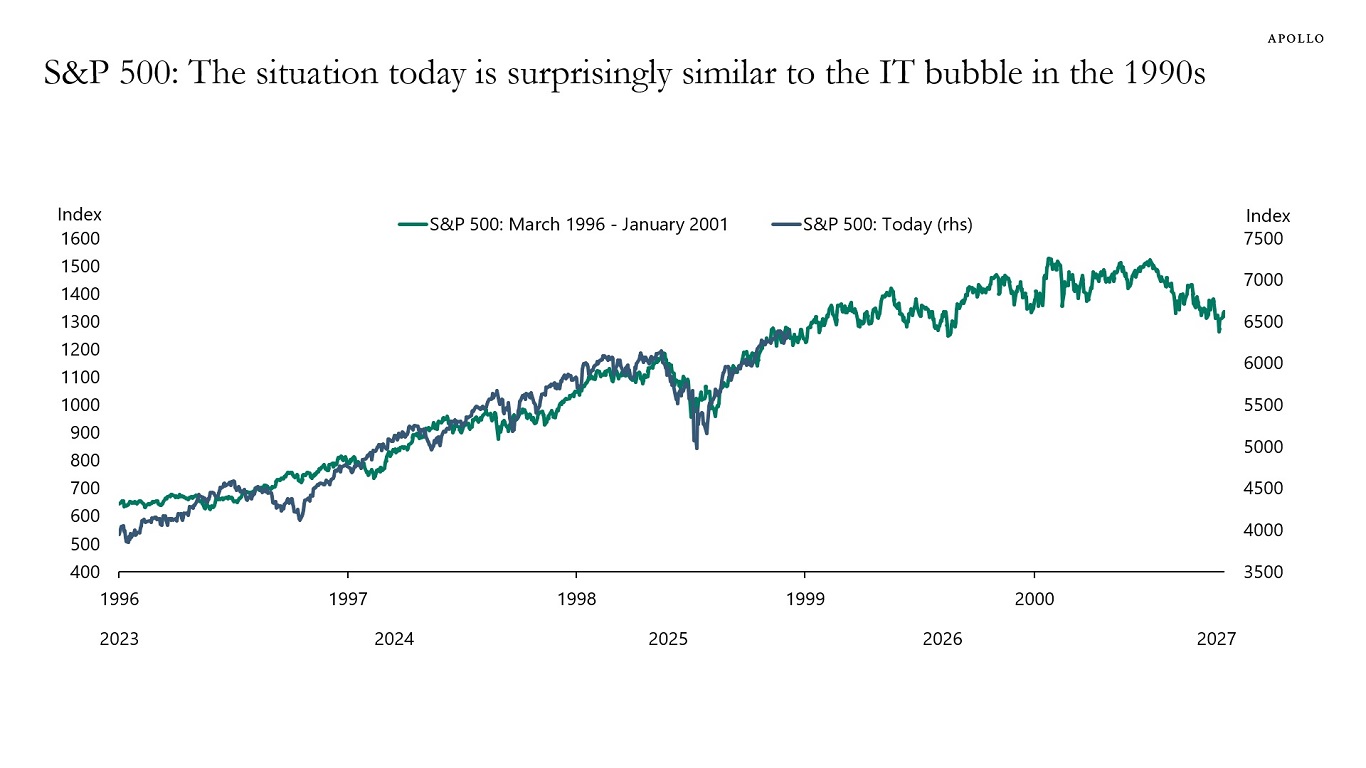

AI will have a significant impact on our lives and productivity. But that doesn’t mean that the tech companies in the S&P 500 are correctly priced.

The P/E ratio for Tesla is almost 200, and the P/E ratio for Nvidia is around 60. Many software companies are likely to go out of business because of ChatGPT.

The bottom line is that it is not clear that the tech stocks in the S&P 500 are the best choices when investing in the AI theme, and the chart below shows that the situation today is surprisingly similar to the IT bubble in the 1990s.

Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

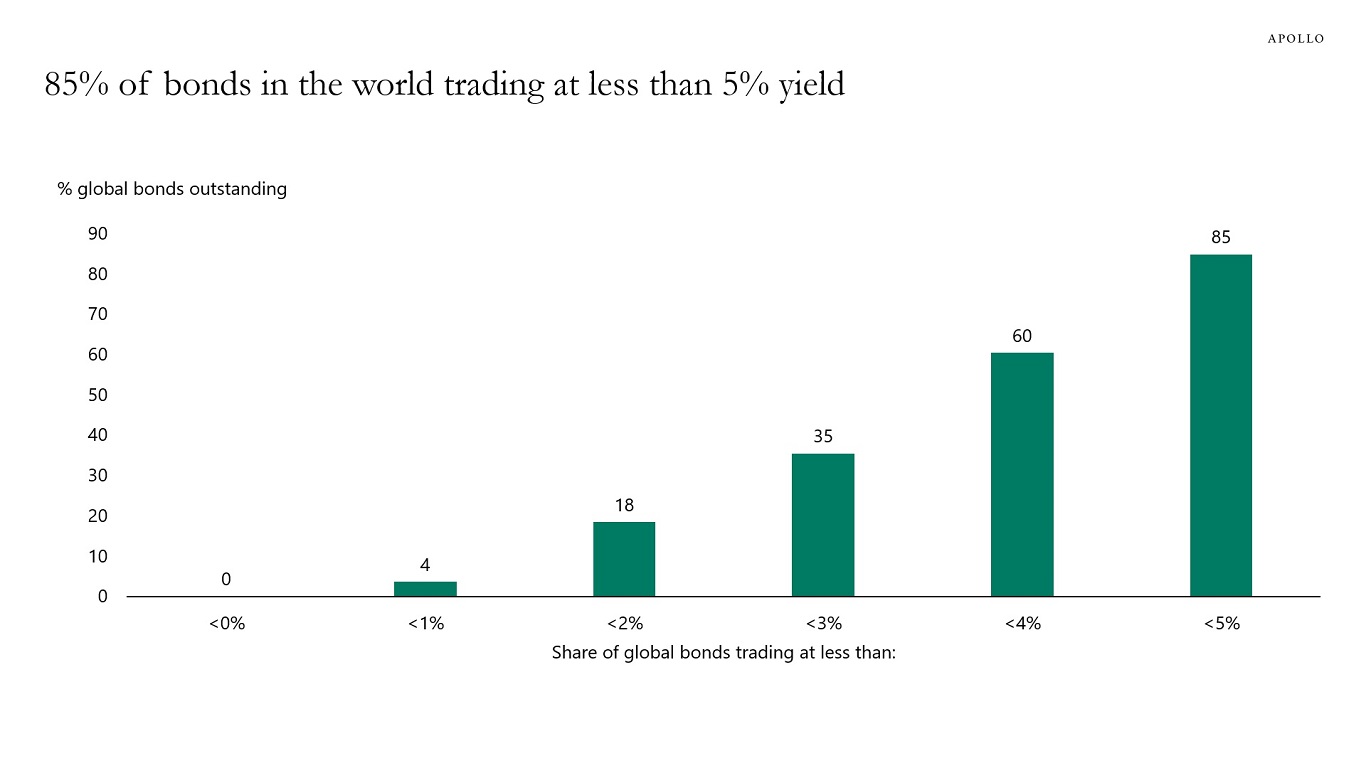

Solid macro and corporate fundamentals, coupled with persistent institutional demand and limited net new supply, have anchored credit spreads and performance. While downside risks have increased, we expect fundamentals and technicals to remain supportive through year-end. Our latest credit market outlook write-up is available here, and our latest credit market chart book is available here.

Note: Data as of August 10, 2025. Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

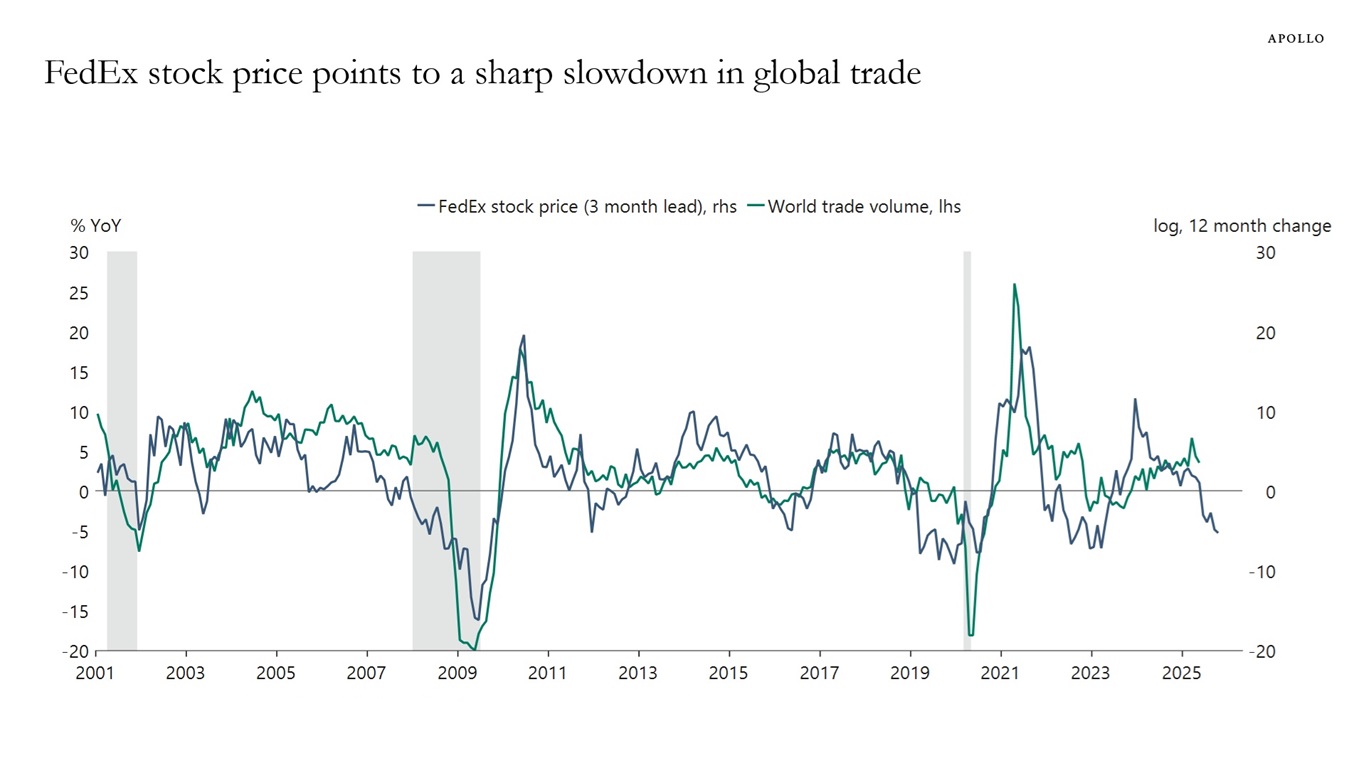

FedEx’s stock price is a leading indicator of global trade, see chart below.

Sources: Netherlands Bureau for Economic Policy Analysis (CPB), Bloomberg, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

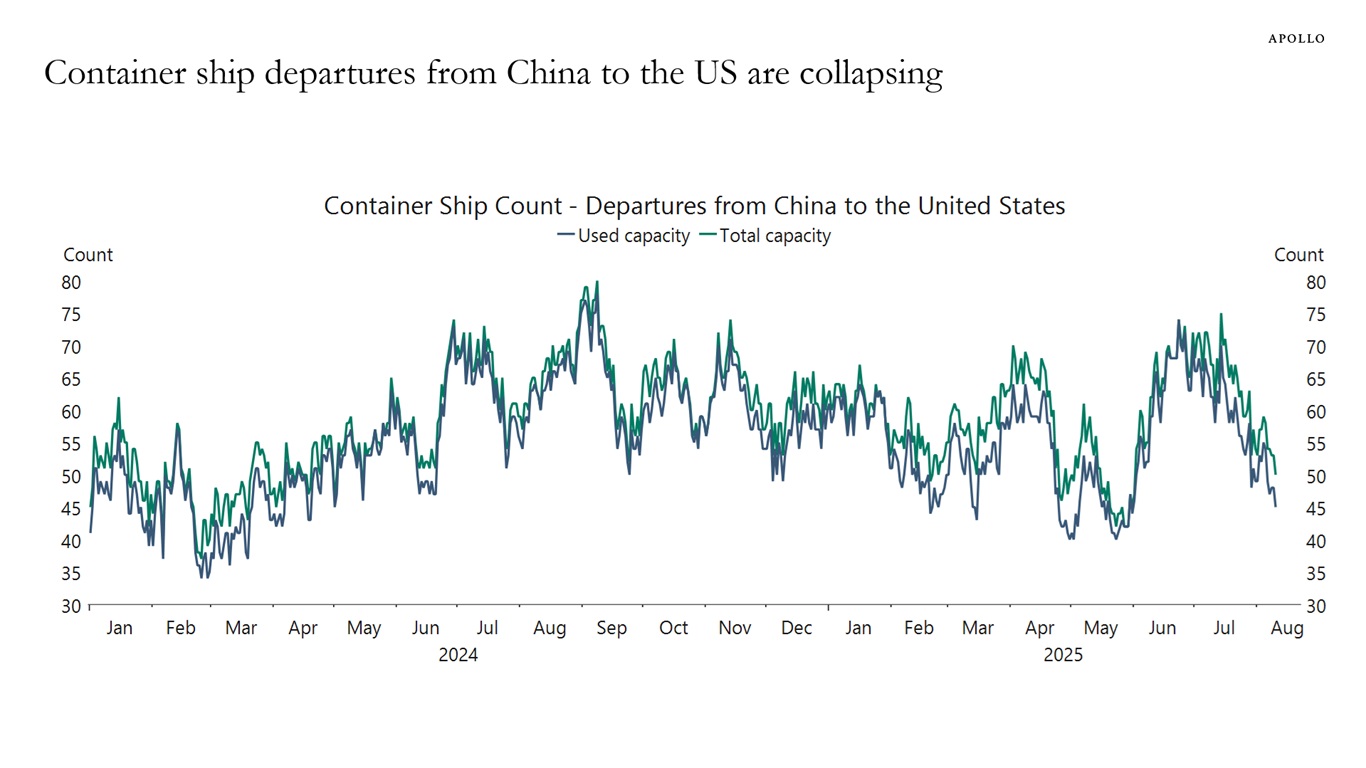

Container ship departures from China to the US are collapsing, see the first chart.

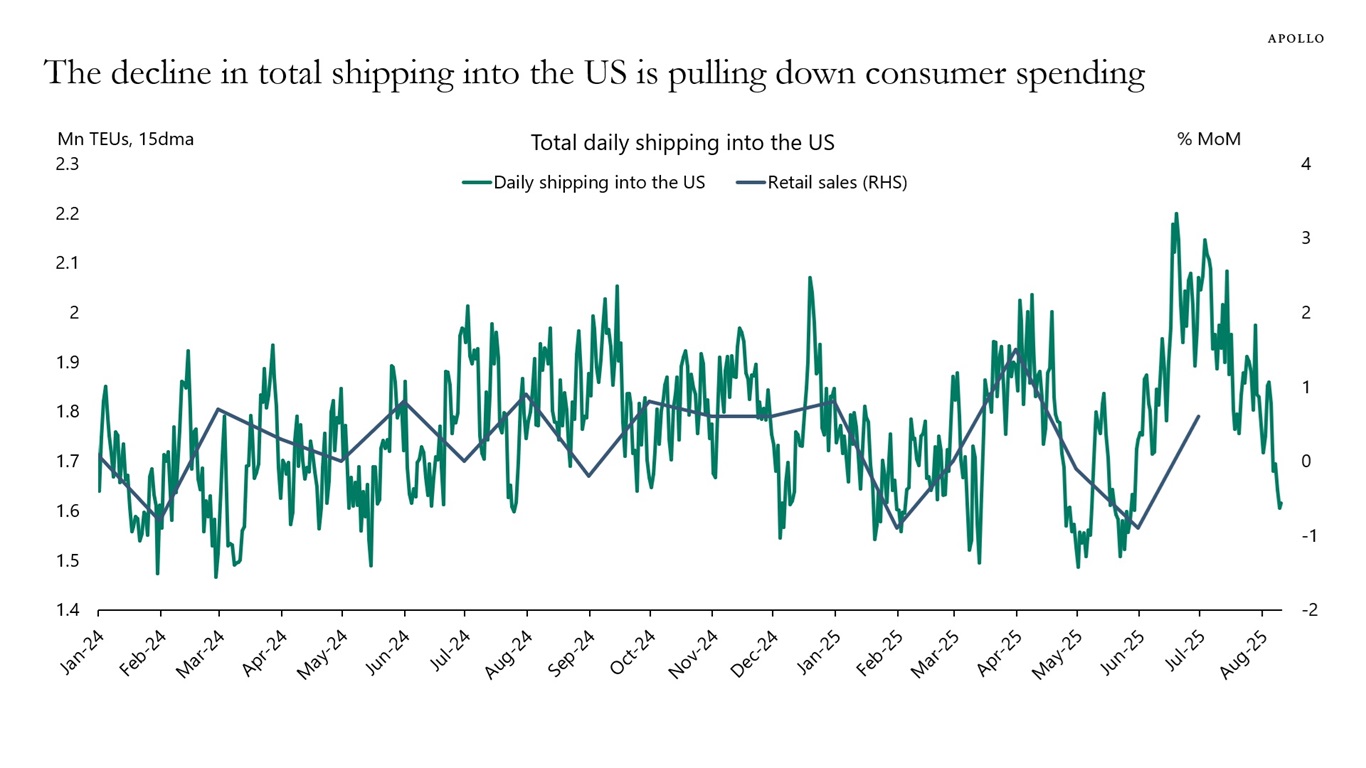

When consumers cannot get the products that they want from abroad, and the products that are imported are more expensive because of tariffs, the outcome is a slowdown in US consumer spending, see the second chart.

The bottom line is that US consumer spending is facing headwinds from tariffs, relatively high interest rates, student loan payments restarting and deportations lowering the number of consumers.

Note: Displays the estimated number of container vessels departing China for the United States, focusing on dry cargo ships. Aggregates data using a 15-day rolling average to reduce short-term volatility and provide a clearer view of broader trends in vessel activity. Sources: Bloomberg, Macrobond, Apollo Chief Economist

Sources: US Census Bureau, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Our latest outlook for credit markets, authored by my colleagues John Cortese, Rob Bittencourt, Akila Grewal, Shobhit Gupta, and Tal Barak Harif, is available here.

Key Takeaways

- Tariff-driven headline risk, geopolitical volatility and fiscal policy shifts disrupted markets in the year’s first half—but failed to derail the credit cycle. Strong macro and corporate fundamentals, steady institutional demand and limited new supply helped anchor spreads. While downside risks have grown, fundamentals and technicals are expected to remain supportive through the end of the year.

- The investment-grade bond market has become increasingly bifurcated, with most liquidity concentrated in a small set of recent issues, while older bonds trade infrequently and offer little spread pickup. This dynamic was put to the test during the volatility surrounding Liberation Day. For long-term investors, private credit may offer a better alternative—providing similar liquidity with higher spread compensation.

- Global capital is rebalancing away from the US: In the wake of the geopolitical tensions and US domestic policy shifts during the first half of the year, early signs of capital rotation out of US assets may be starting to emerge. Sovereign funds and central banks are reallocating toward Europe—fueling strong inflows into the region’s equity and credit markets.

- Europe’s private credit market is large, underpenetrated and gaining momentum. Non-bank lending accounts for an estimated 12% of corporate financing versus 75% in the US. Structural tailwinds—regulatory reform, fiscal stimulus and favorable pricing—are creating a scalable growth opportunity, positioning Europe as a key market for direct lending.

- The generative AI boom is no longer just an equity story—it’s increasingly being financed through credit. Hyperscalers are issuing billions to fund data centers, while early-stage AI firms are tapping debt markets to scale. As capex soars and adoption accelerates, credit investors are helping fund the physical backbone of the AI economy.

See important disclaimers at the bottom of the page.

-

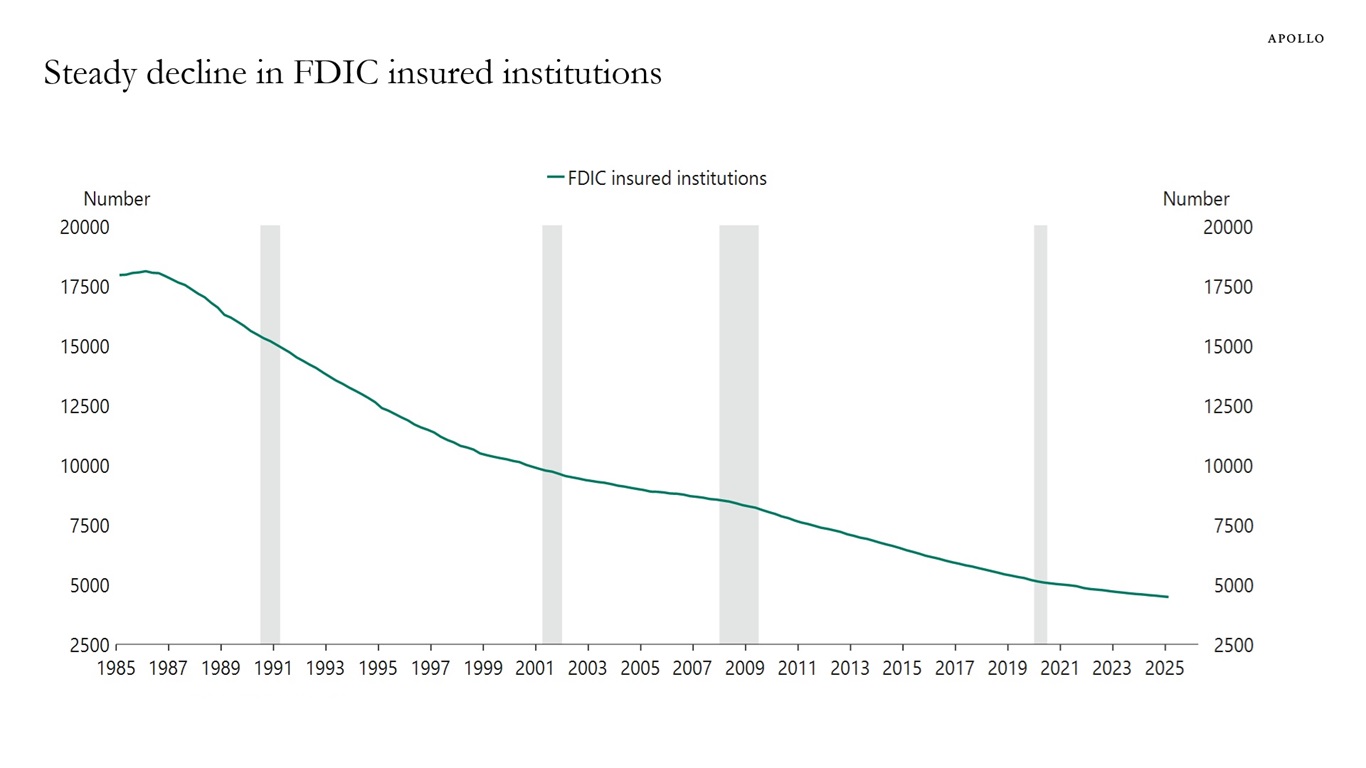

The number of banks in the US has declined significantly over the past 40 years, see chart below.

Sources: Federal Deposit Insurance Corporation, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

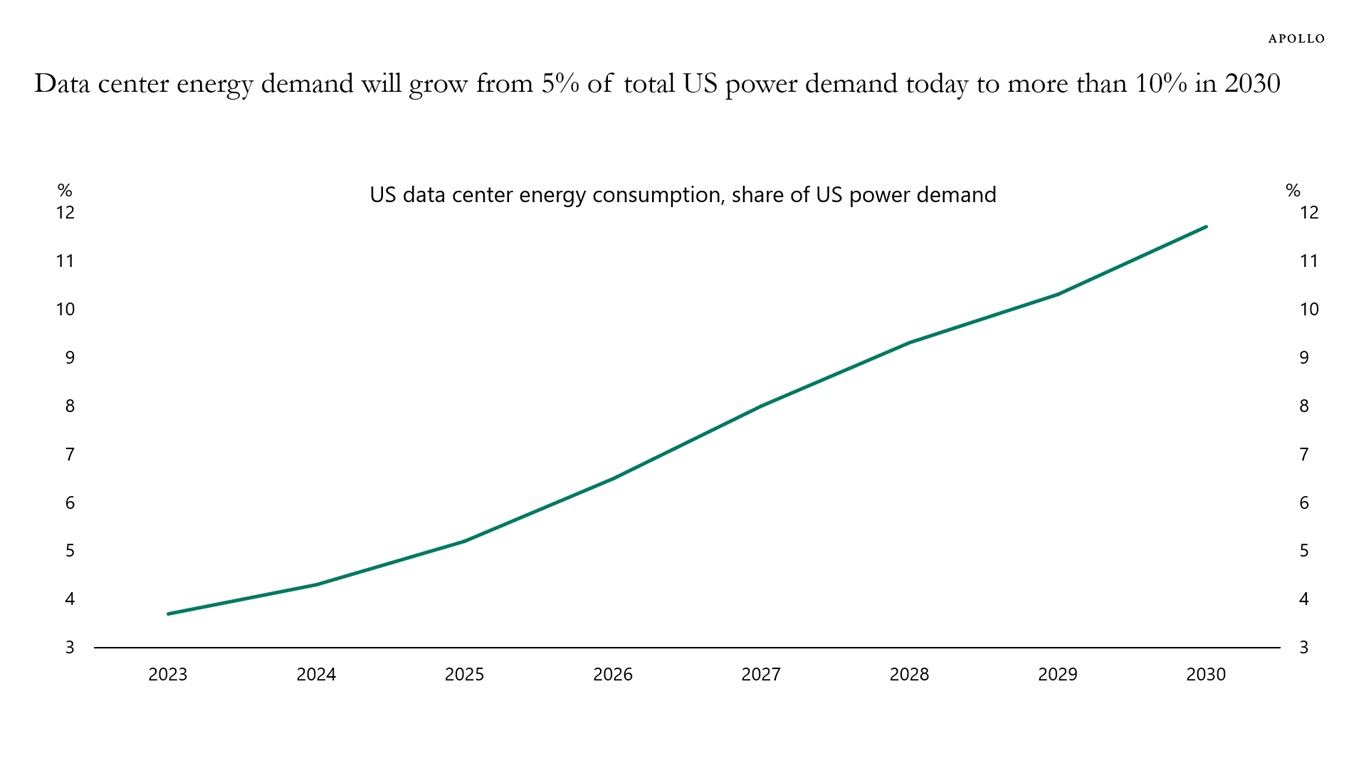

Forecasts show that data center energy demand will grow from 5% of total US power demand today to more than 10% in 2030, see also here.

Sources: Data centers and AI: How the energy sector can sate power demand | McKinsey, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

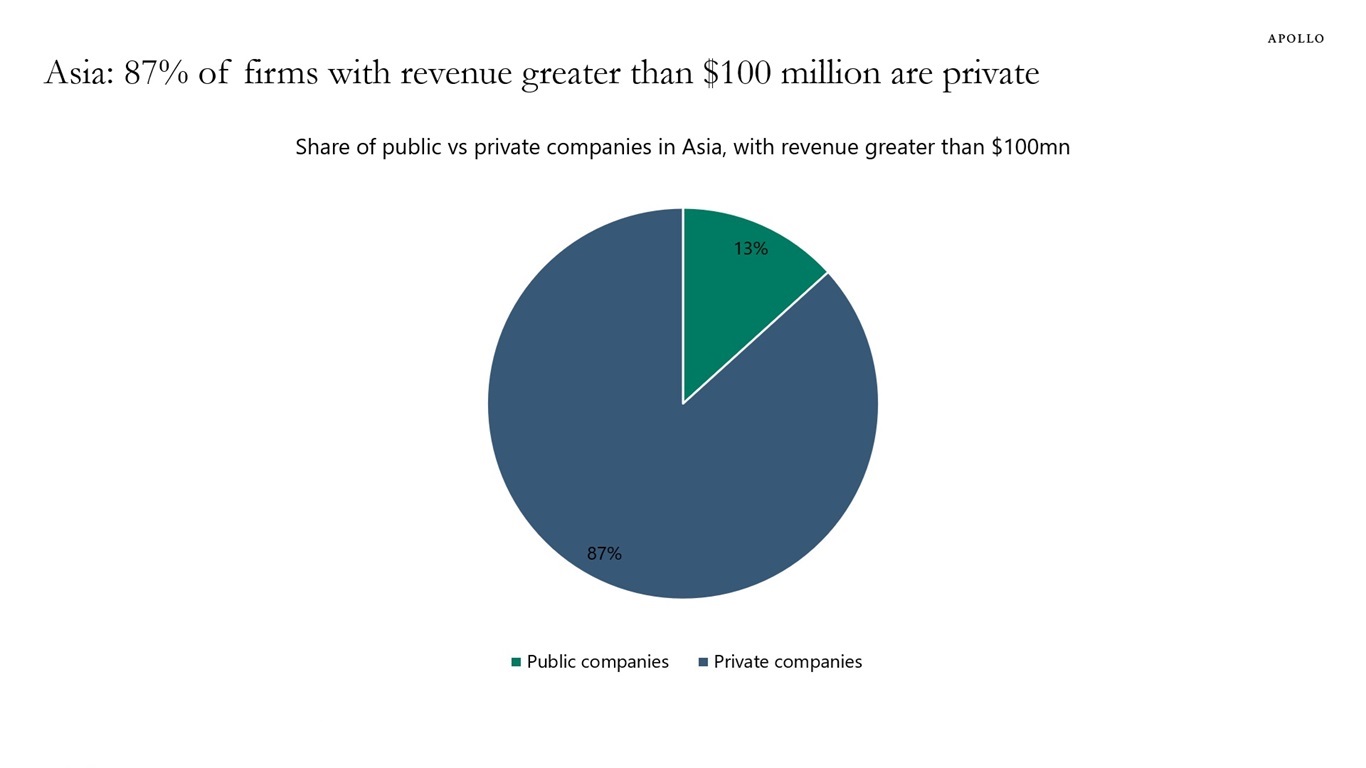

The total addressable market for direct lending to large-cap companies in Asia is enormous. Eighty-seven percent of firms in Asia with revenue greater than $100 million are private, see chart below.

Note: For companies with last 12-month revenue greater then $100mn by count. Sources: S&P Capital IQ, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.