Want it delivered daily to your inbox?

-

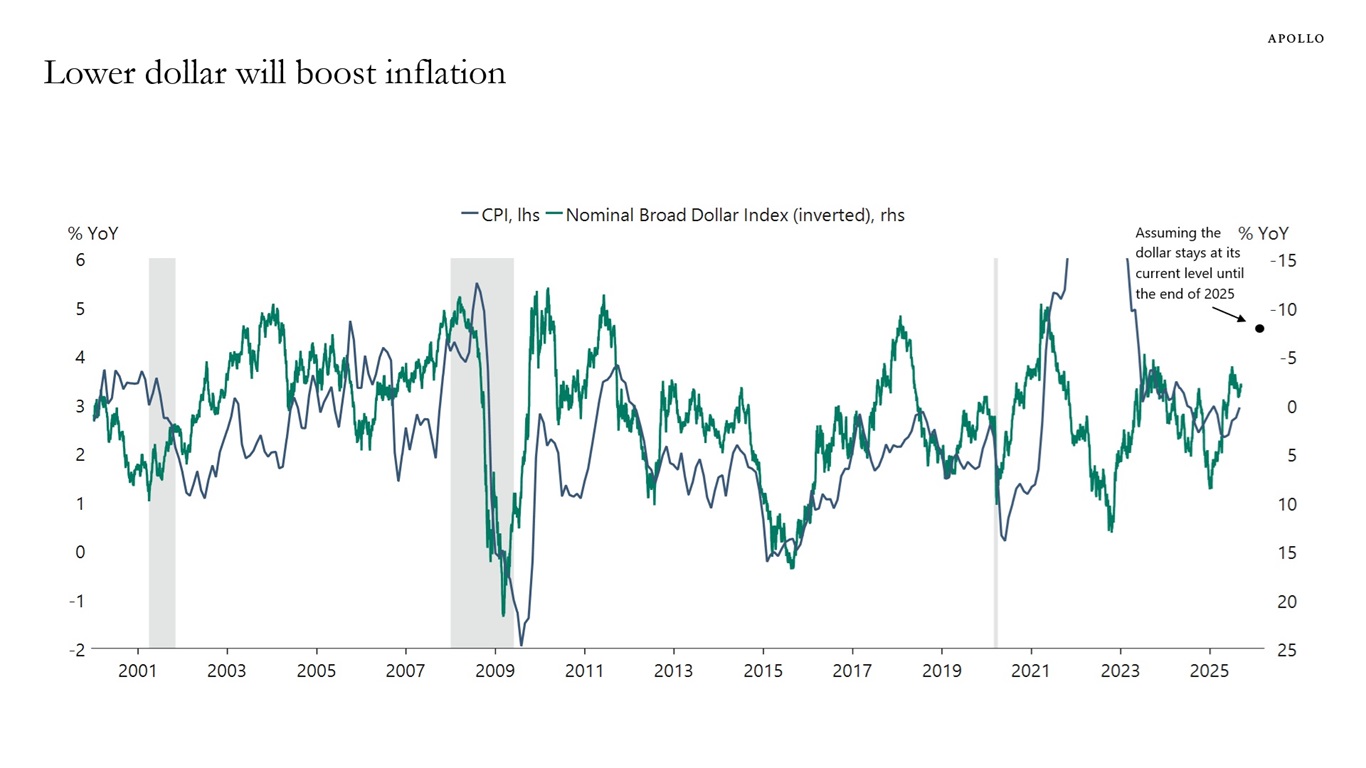

The US dollar has depreciated almost 10% since the beginning of the year, and the Fed’s model for the US economy finds that a 10% depreciation results in a 0.3% boost to inflation. Put differently, there is not only upward pressure on inflation from tariffs and immigration restrictions but also from the ongoing dollar depreciation, see chart below.

Sources: Federal Reserve, US Bureau of Labor Statistics (BLS), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

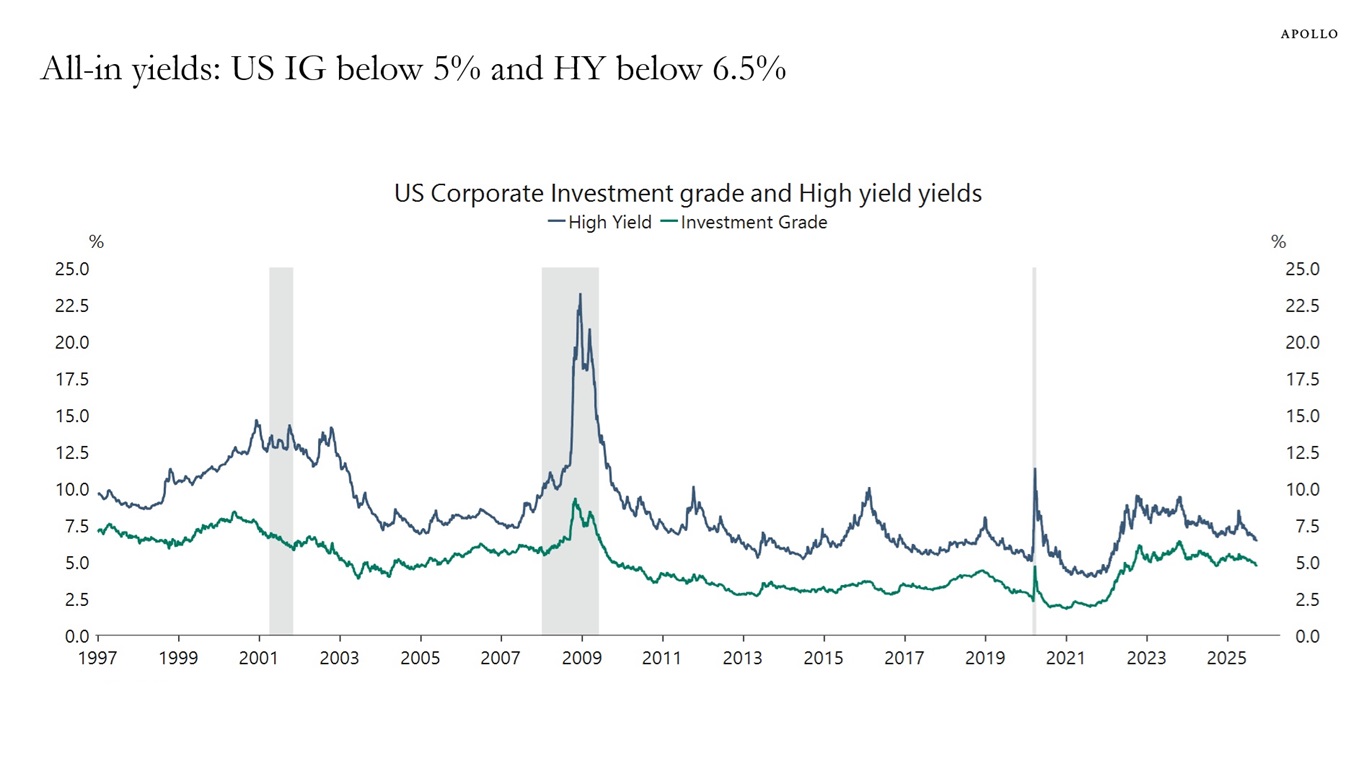

The all-in yield for public IG is now below 5%, and the all-in yield for public HY is below 6.5%, see chart below.

Sources: ICE BofAML, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

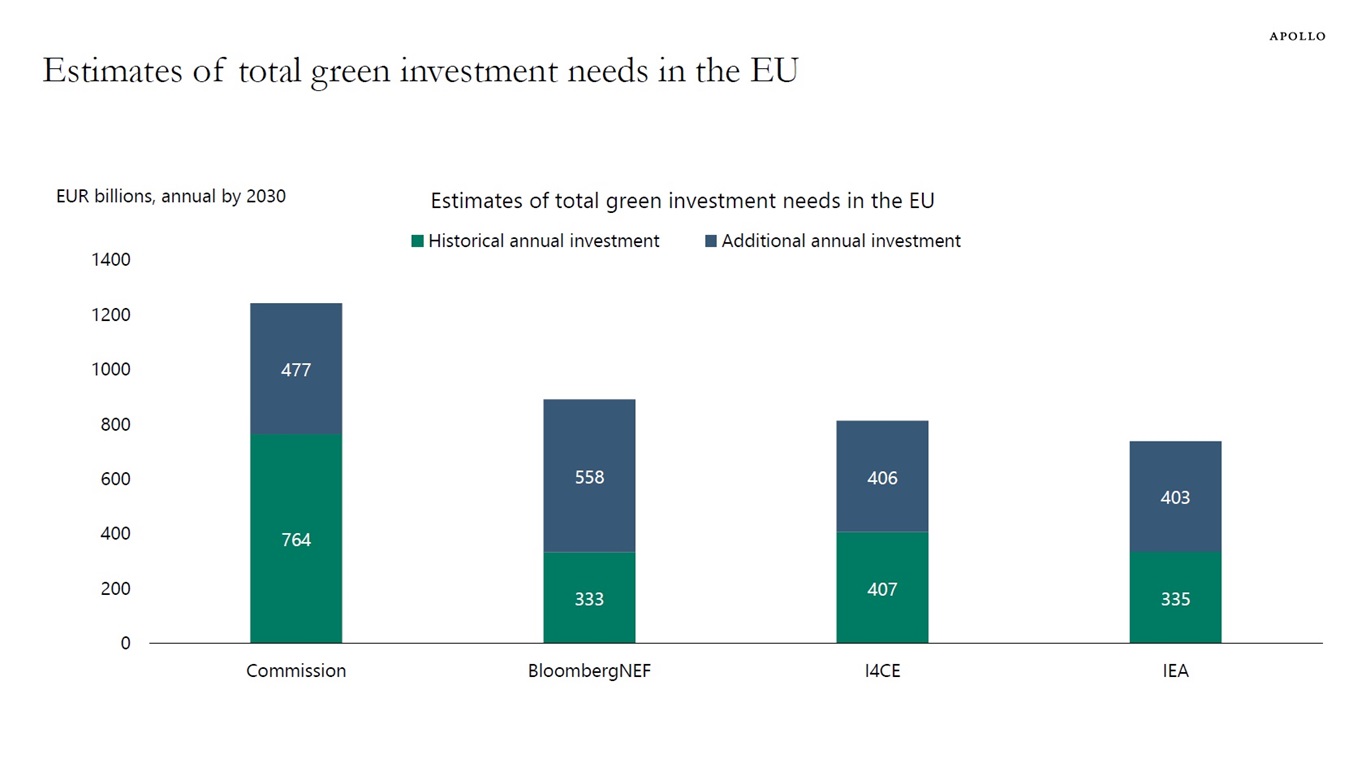

There is a need for additional green investment in the EU of 400 to 500 billion euros by 2030, see chart below.

Notes: The additional investment estimates reflect the annual needs until 2030 in addition to past investment to achieve the Green Deal targets for 2030. Total green investment needs are the sum of the historical and additional investment in the EU. Chart shows the various institutions’ estimates of annual green investment needs until 2030. Historical investment refers to annual averages: European Commission (2011-20), BloombergNEF (2023), I4CE (2022) and IEA (2021-23). The IEA and BNEF estimates are adjusted for fossil fuel investments. Regarding BloombergNEF, the historical investment figure pertains to the EU27, whereas the estimate for additional investment needs includes the EU27 together with Norway and Switzerland, as no EU average is available. Sources: European Commission, BloombergNEF, Institute for Climate Economics, and International Energy Agency. See important disclaimers at the bottom of the page.

-

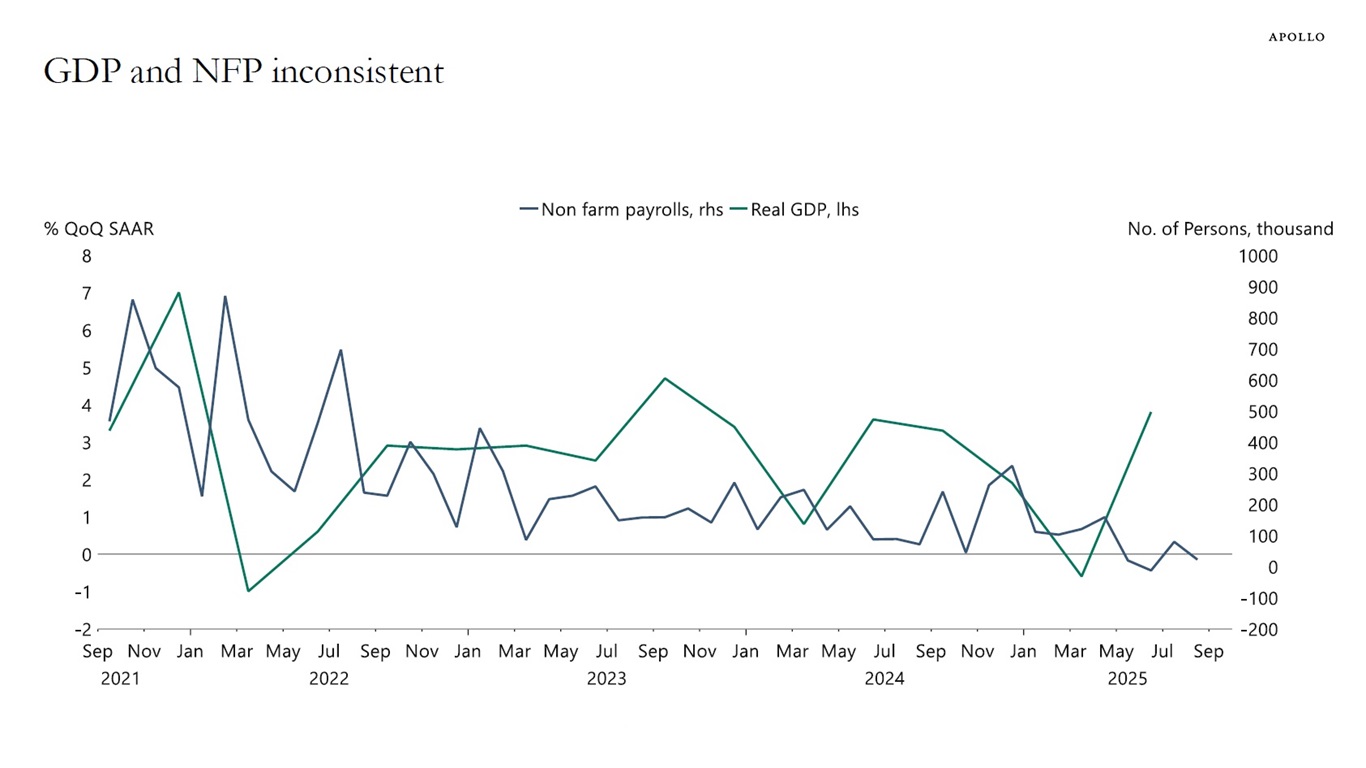

The just-released GDP data shows that the economy was accelerating during the quarter with Liberation Day.

The strength in GDP growth over the summer is inconsistent with the observed slowdown in employment growth over the same period, see chart below.

The economy cannot be on the brink of a recession with a weaker labor market, and at the same time accelerating with stronger GDP growth.

What is likely happening is that job growth is weaker because of AI implementation and lower immigration.

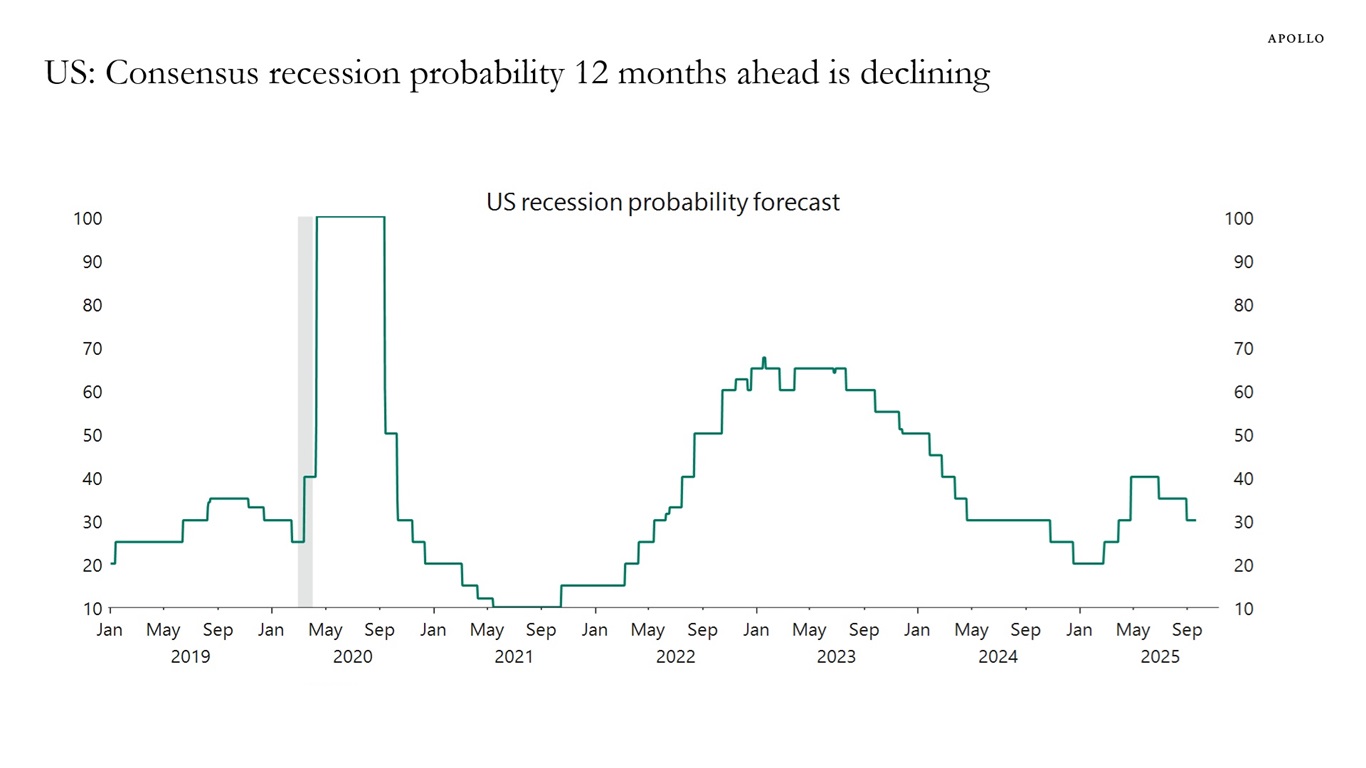

At the same time, the trade war shock is fading into the background, and the probability of a recession is falling.

Following the release of the GDP data, we have revised down the 12-month recession probability to 20%.

With GDP growth at 3.8% and inflation at 2.9% and rising, it is becoming more and more difficult to argue for additional Fed cuts.

Sources: US Bureau of Economic Analysis (BEA), US Bureau of Labor Statistics (BLS), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

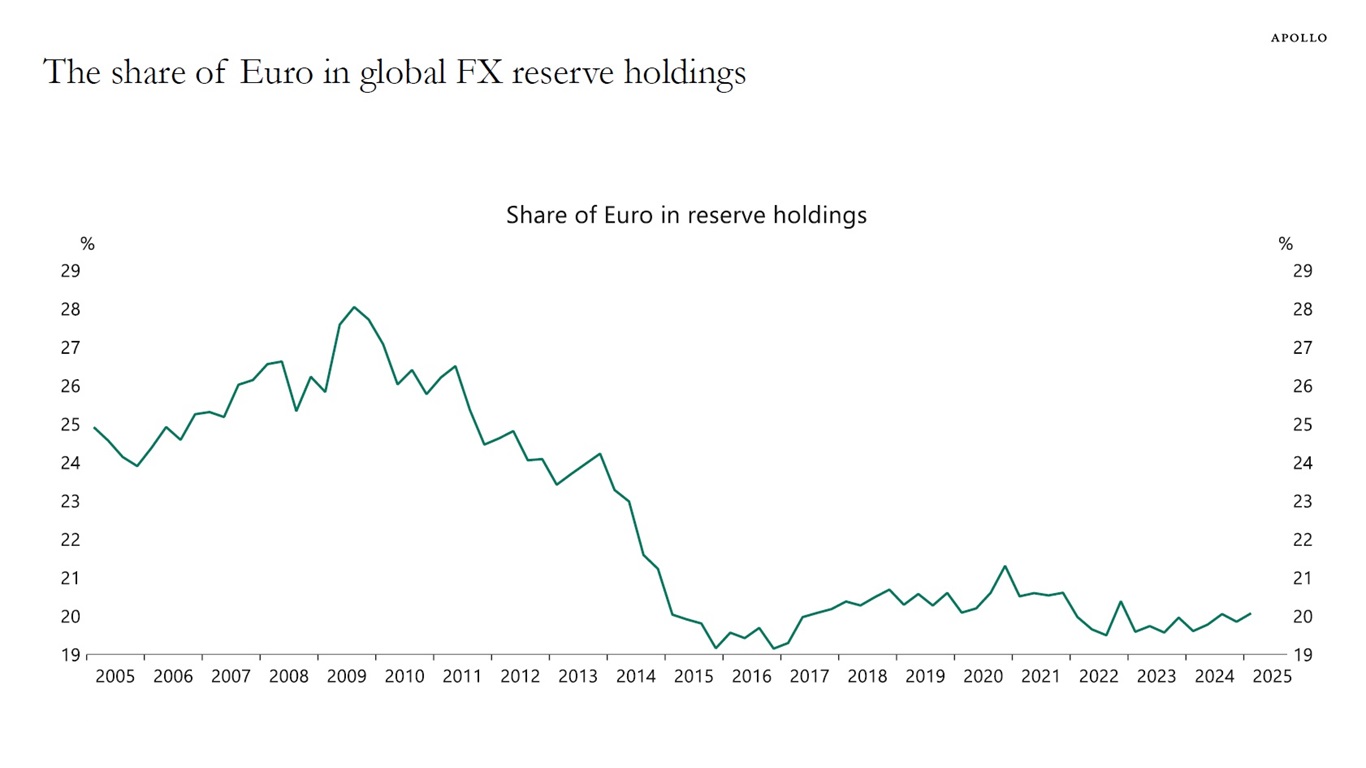

IMF data for global central bank FX reserves shows that the share of euros in global FX reserves is not going up and remains low at 20%, see chart below.

Sources: International Monetary Fund (IMF), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

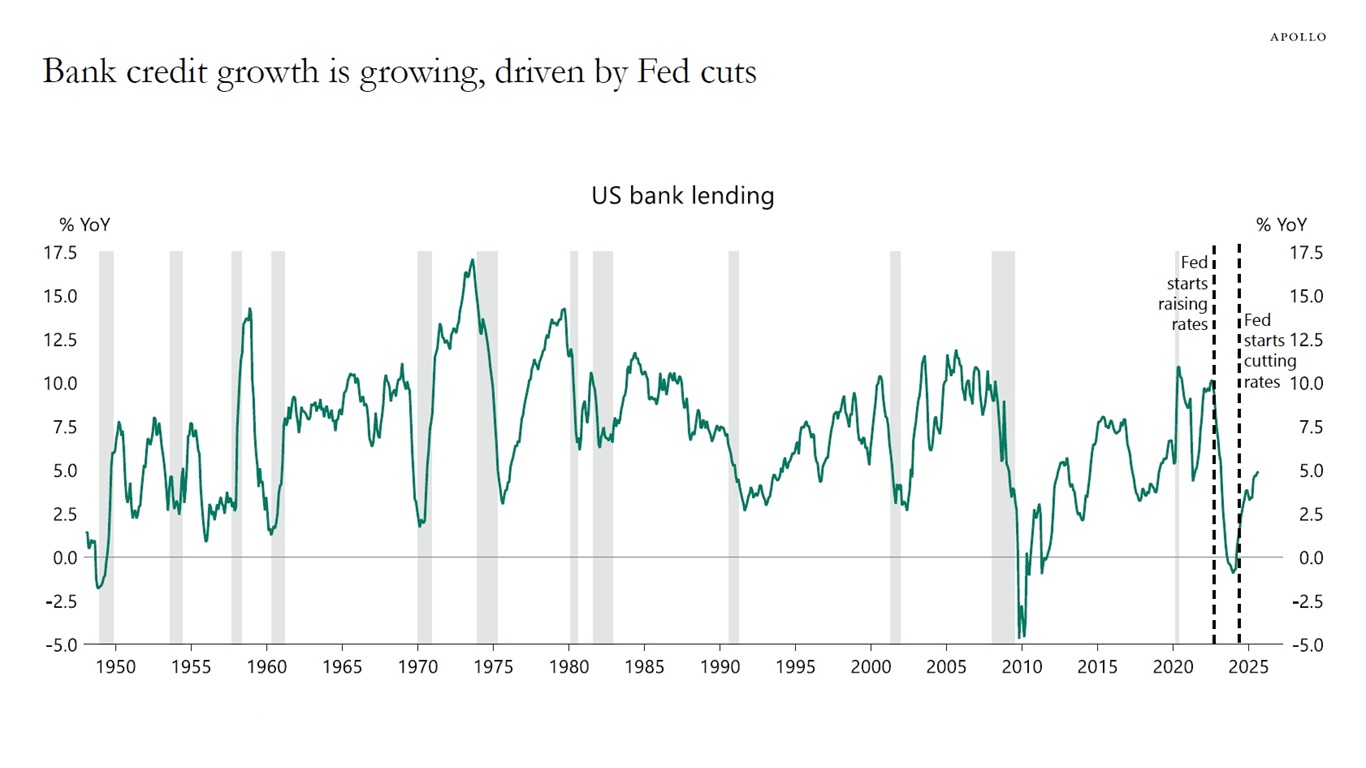

Banking sector balance sheets are generally in good shape, and credit growth is positive, driven by large-bank lending.

Delinquency rates are high on credit cards and auto loans. Restarting student loan payments is a headwind to credit quality and credit growth.

The trade war has not yet had much impact on the banking sector or credit growth.

Higher interest rates are putting downward pressure on commercial real estate prices for office, multifamily and healthcare facilities. This remains a problem, in particular for regional banks.

Our updated banking sector chart book is available here.

Sources: Federal Reserve, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

The consensus probability of a recession over the next 12 months continues to decline and currently stands at 30%, see chart below.

Sources: Bloomberg, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

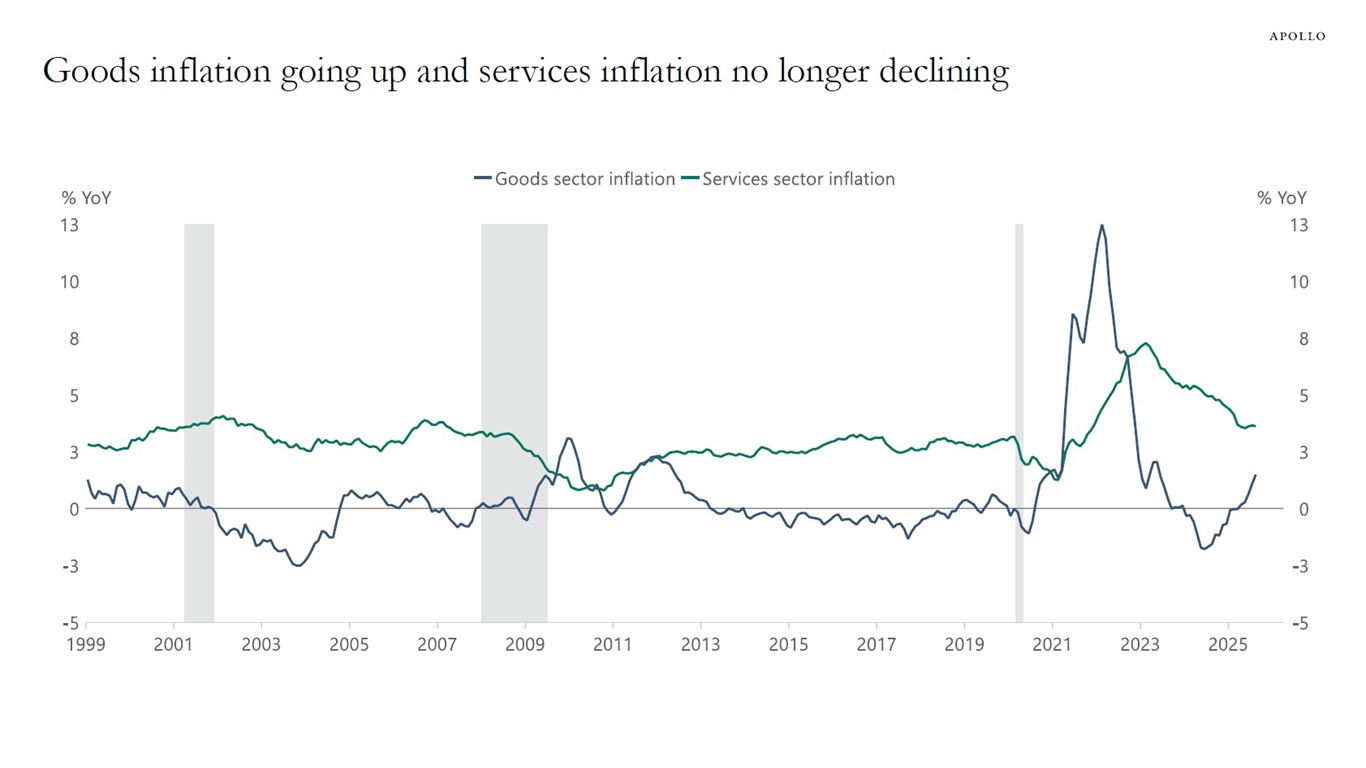

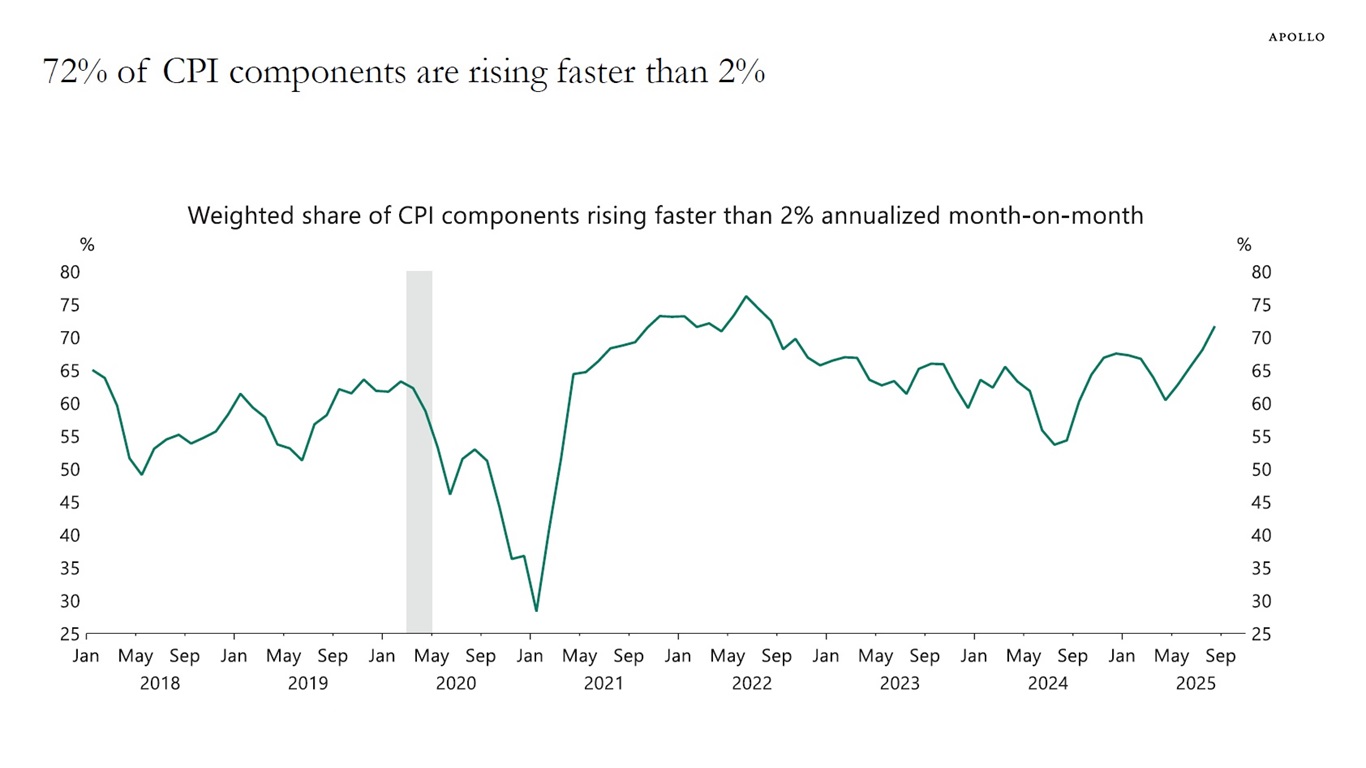

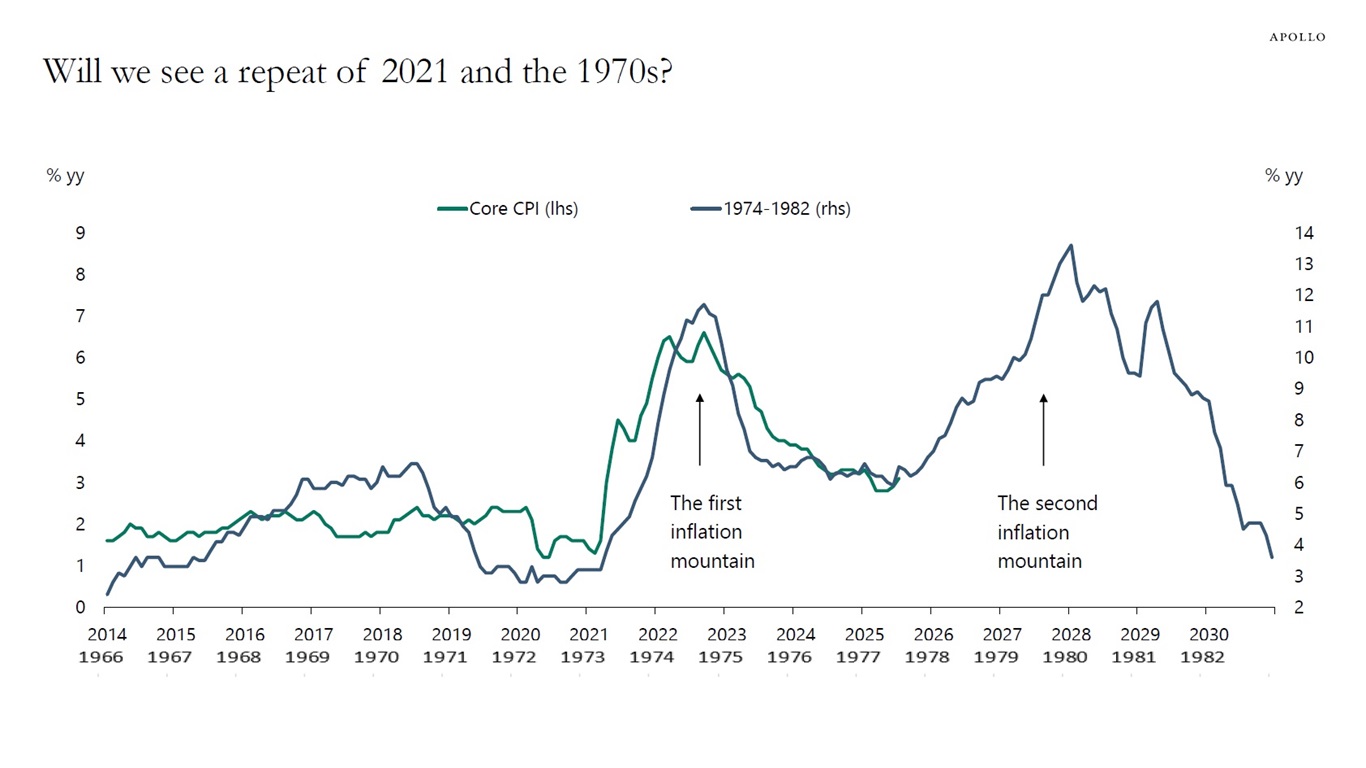

Goods inflation is rising because of tariffs, and services inflation is no longer declining, see the first chart below.

At the same time, 72% of the CPI components are growing faster than the Fed’s 2% inflation target, see the second chart below.

The bottom line is that inflation is still not under control, and this increases the risk of a steeper curve, a higher term premium, and a rise in TIPS and breakevens, see the third chart below.

Sources: US Bureau of Labor Statistics (BLS), Macrobond, Apollo Chief Economist

Sources: Bloomberg, Macrobond, Apollo Chief Economist

Sources: BLS, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

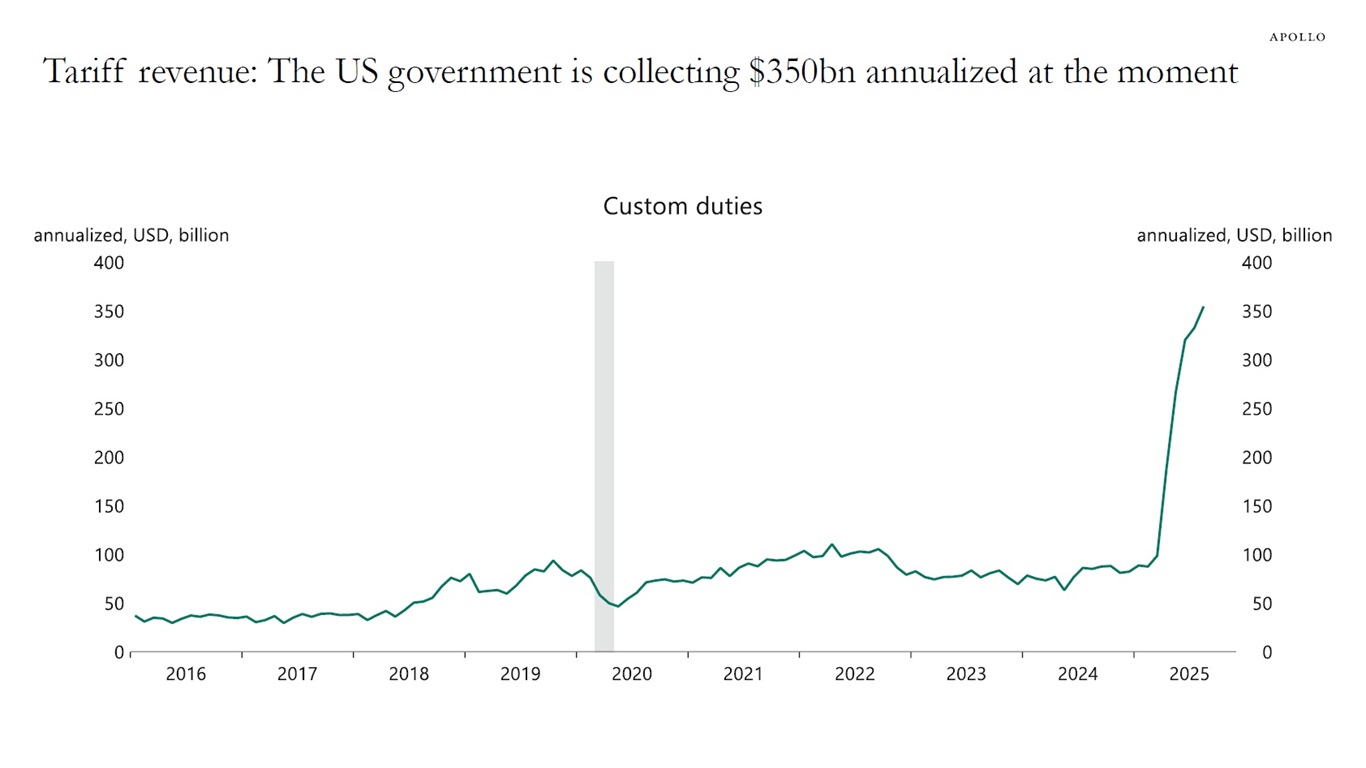

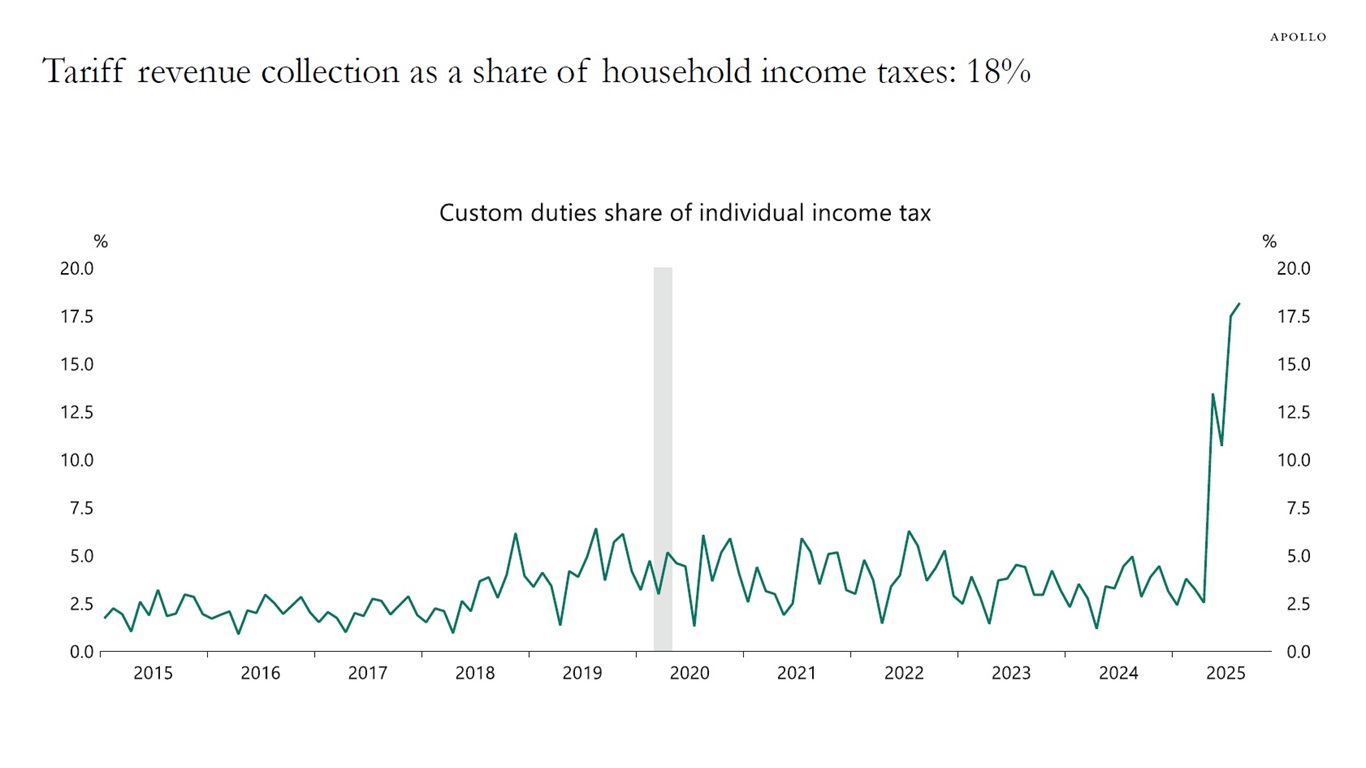

The US government currently collects about $350 billion in tariffs at an annualized rate, which corresponds to 18% of annual household income tax payments, see charts below.

The bottom line is that the amount of money collected in tariff revenue is very significant.

Sources: US Department of Treasury, Macrobond, Apollo Chief Economist

Sources: US Department of Treasury, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

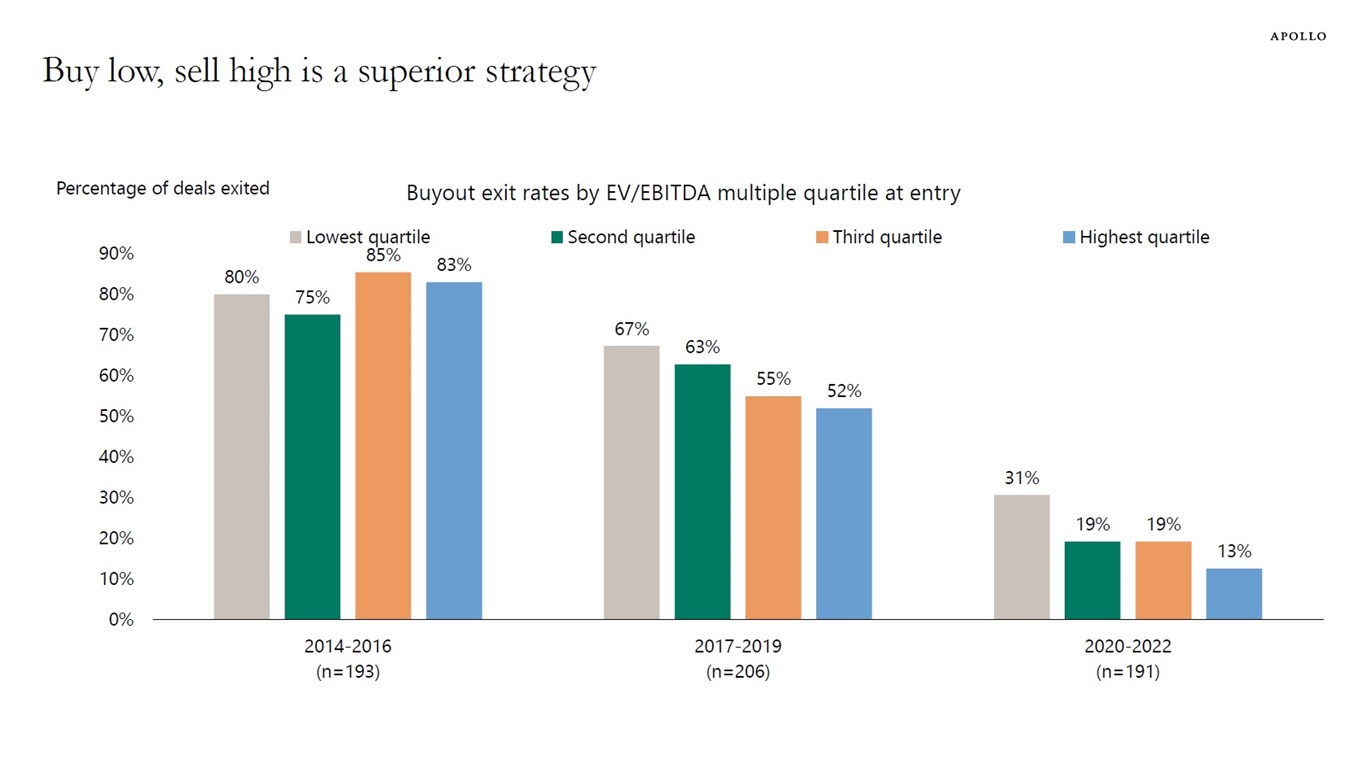

Data from PitchBook shows that it takes significantly longer for PE portfolio companies purchased at higher multiples to exit relative to portfolio companies bought at lower multiples, see chart below. Purchase price matters.

Sources: PitchBook, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.