Want it delivered daily to your inbox?

-

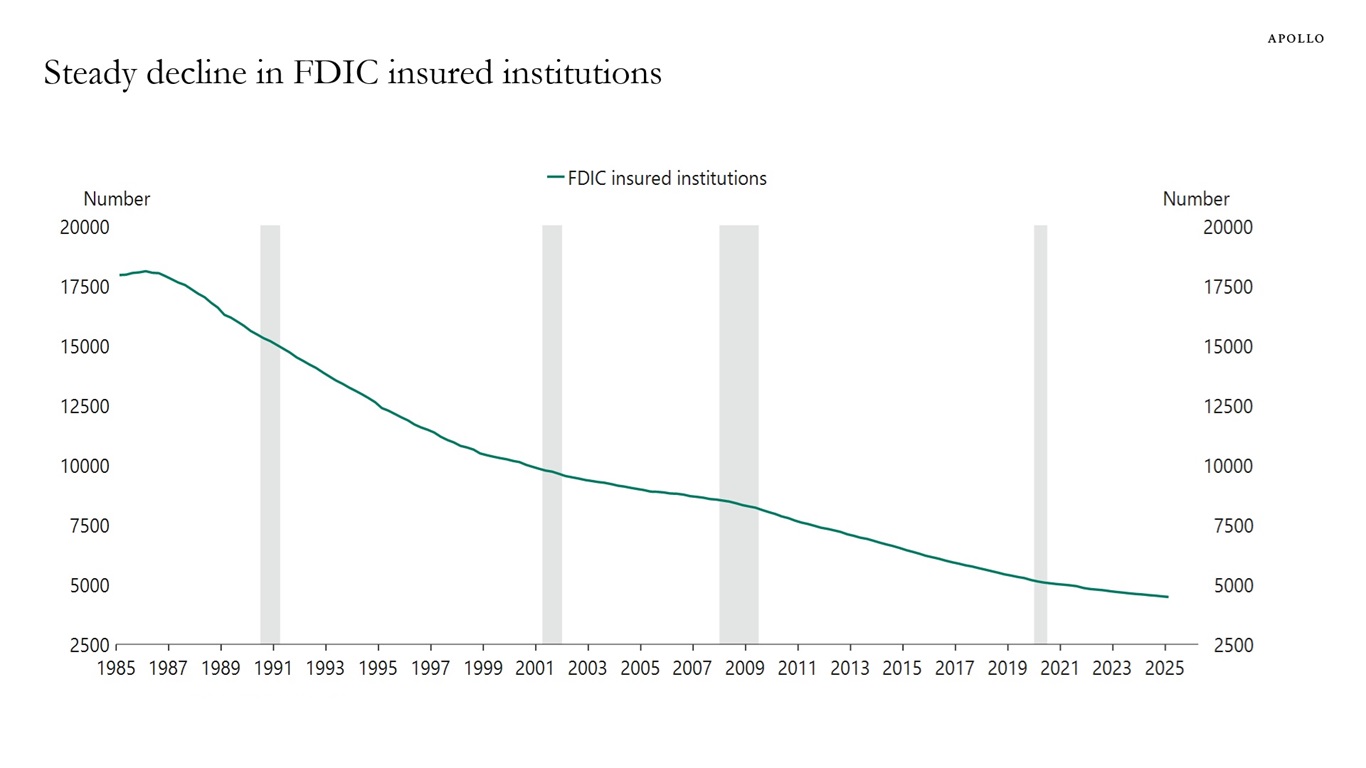

The number of banks in the US has declined significantly over the past 40 years, see chart below.

Sources: Federal Deposit Insurance Corporation, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

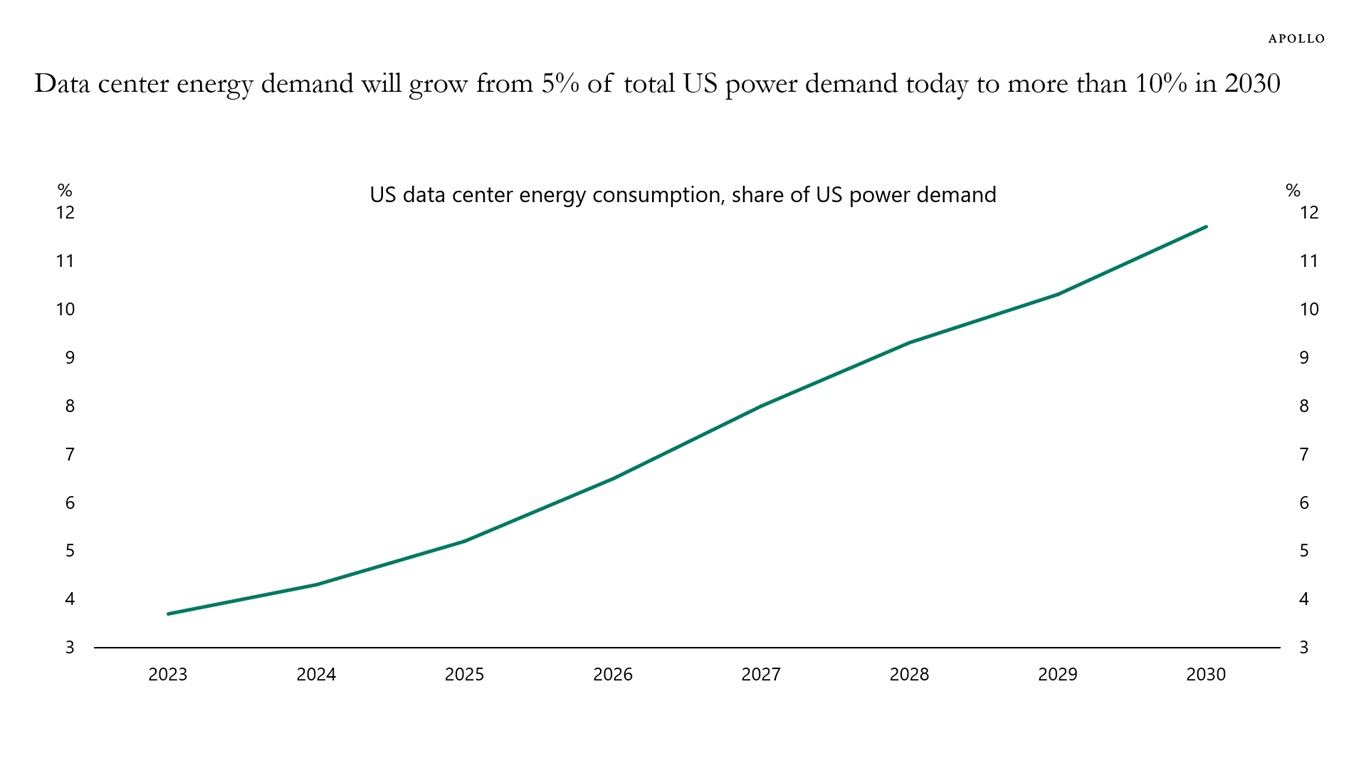

Forecasts show that data center energy demand will grow from 5% of total US power demand today to more than 10% in 2030, see also here.

Sources: Data centers and AI: How the energy sector can sate power demand | McKinsey, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

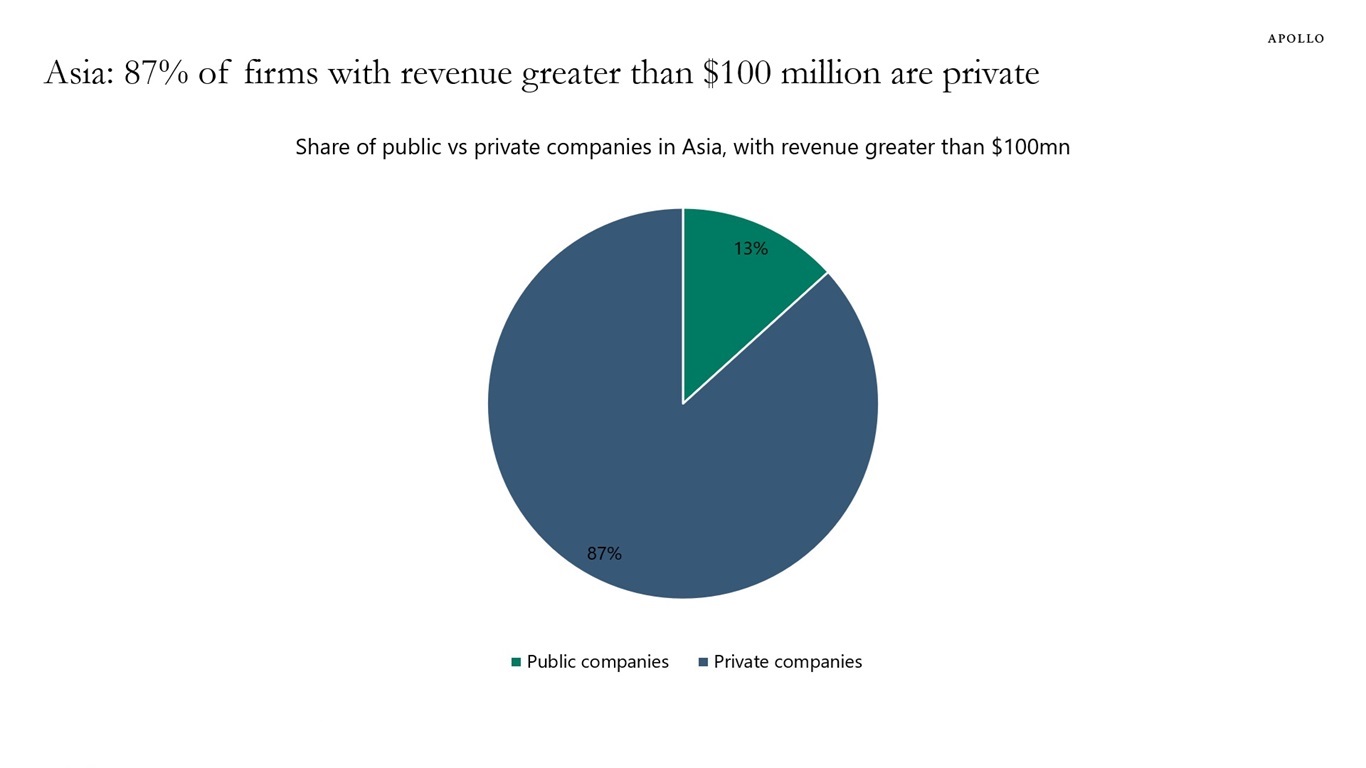

The total addressable market for direct lending to large-cap companies in Asia is enormous. Eighty-seven percent of firms in Asia with revenue greater than $100 million are private, see chart below.

Note: For companies with last 12-month revenue greater then $100mn by count. Sources: S&P Capital IQ, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

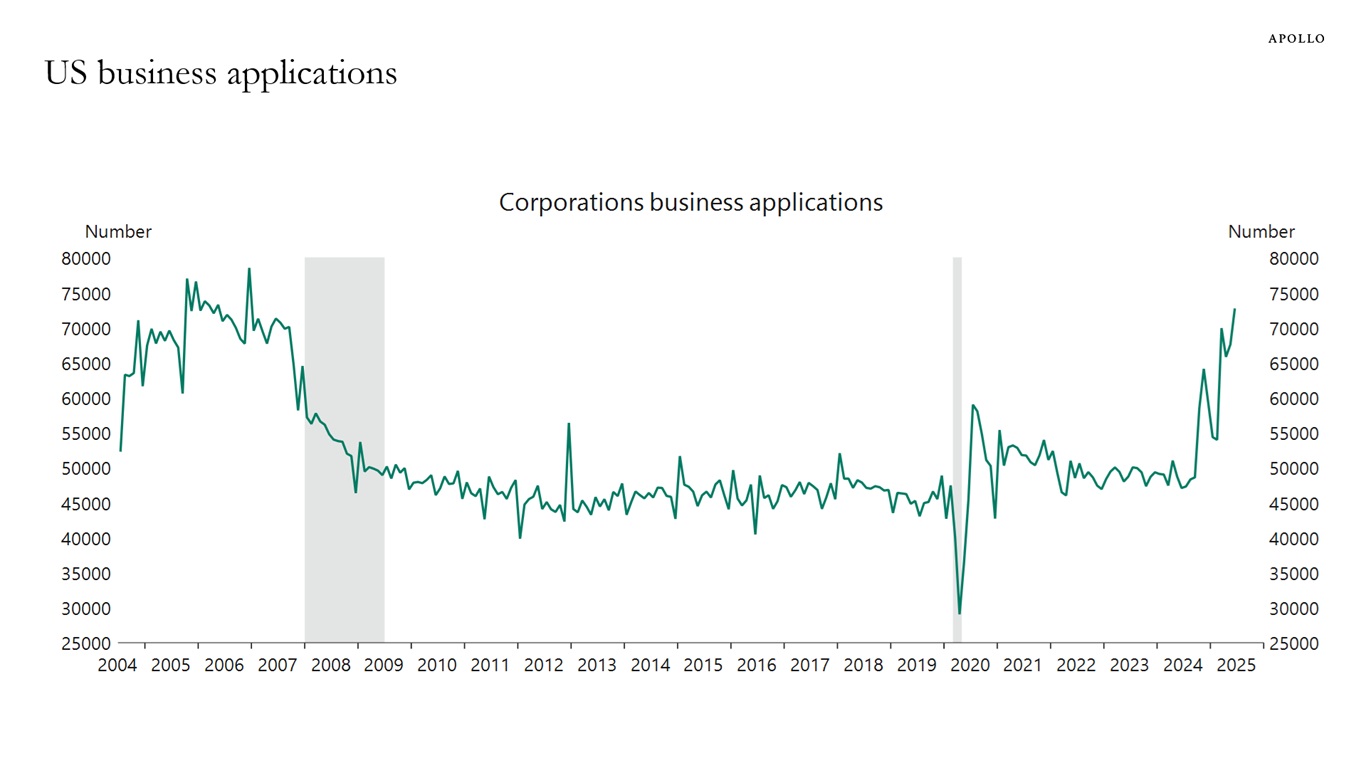

The number of new businesses created in the US has increased significantly since Trump won the election in November 2024, see chart below.

Sources: US Census Bureau, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

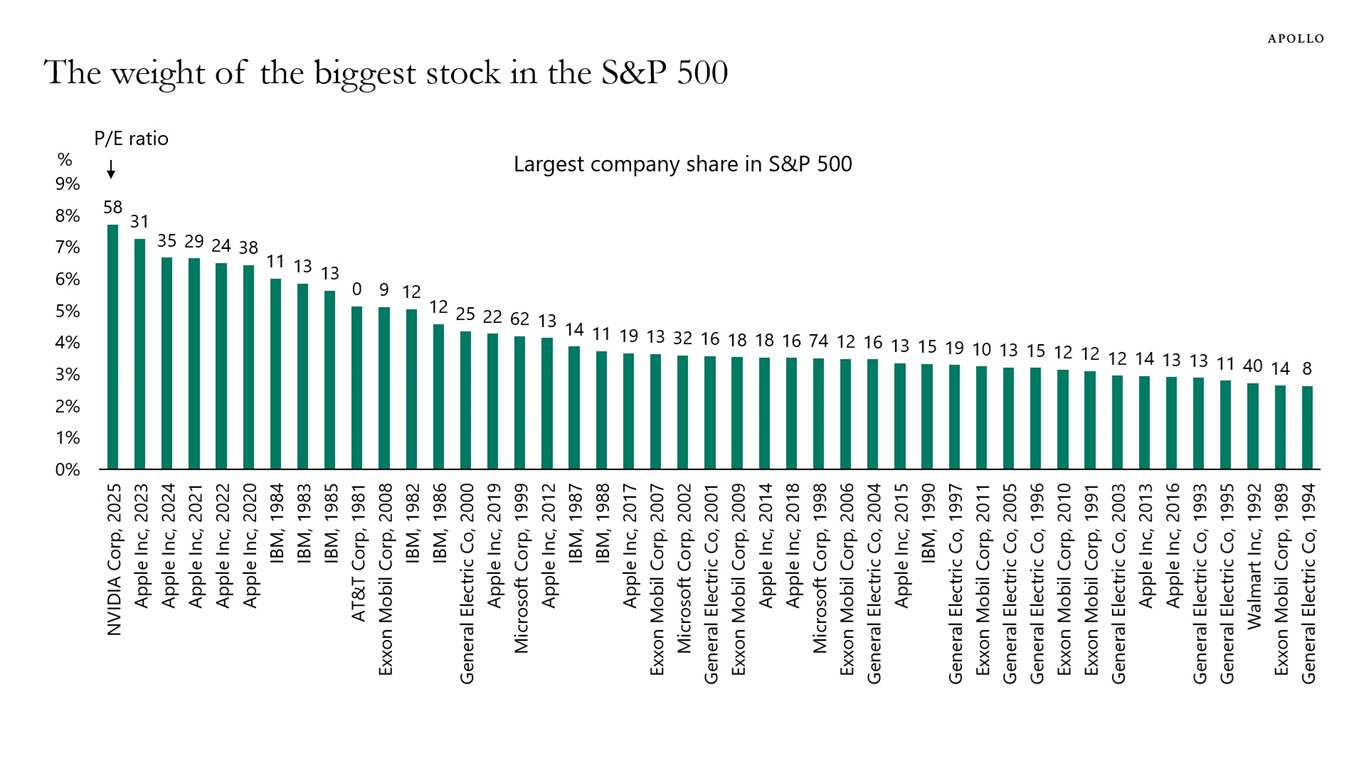

The chart below shows the biggest stock by market cap in the S&P 500, and it confirms the extreme AI concentration in the market today. Nvidia now has the biggest weight in the S&P 500 of any individual stock since the data began in 1981.

Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

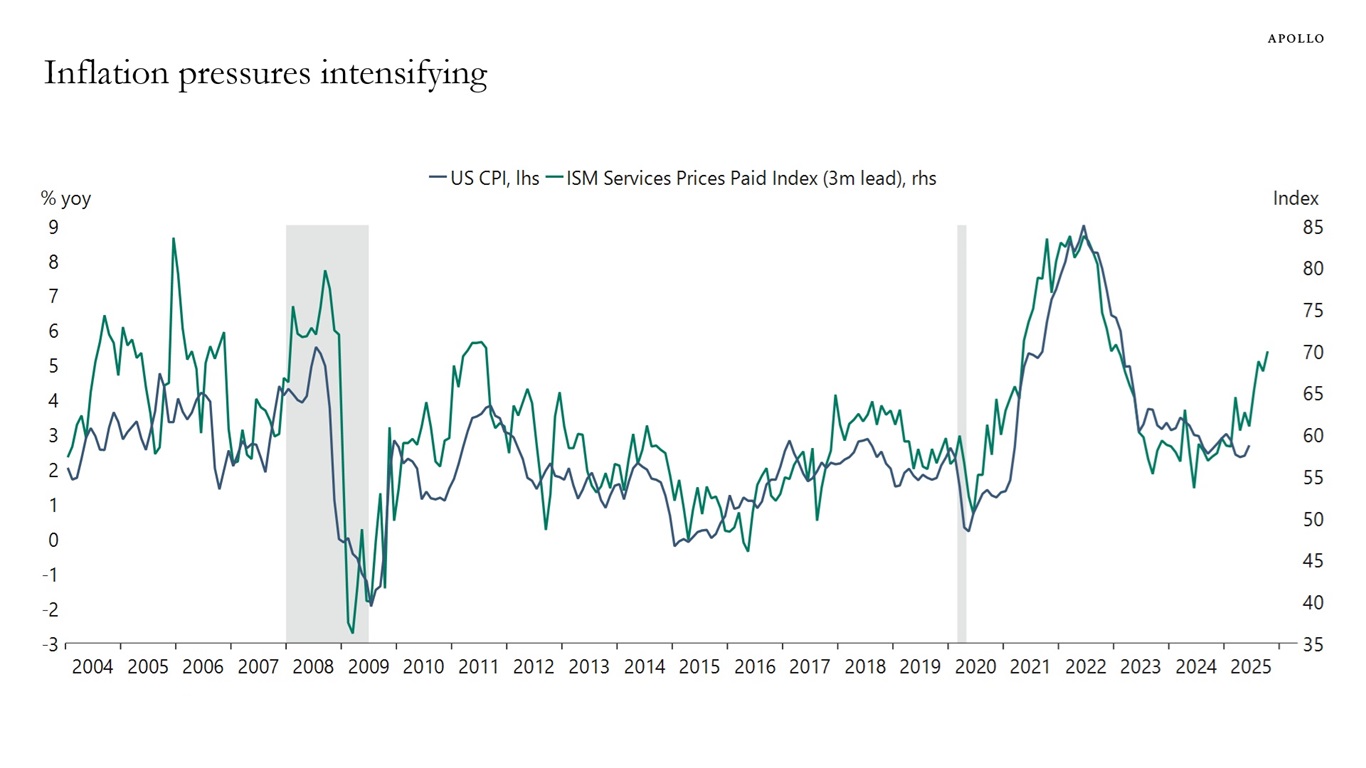

ISM Services Prices Paid for July shows that inflation pressures in the service sector are intensifying, pointing to upside risks to CPI inflation over the coming months, see chart below.

At the same time, employment growth is slowing down and the unemployment rate is rising.

The sources of this stagflation impulse are tariffs, deportations and the depreciation of the dollar.

This is a problem for the Fed. Should the FOMC focus on rising inflation and hike rates, or on slowing growth and cut rates?

The market is clearly expecting cuts, but the upside risks to inflation are significant, and investors should be carefully watching survey-based and market-based measures of inflation expectations.

The bottom line is that the stagflation theme in markets is intensifying.

For more discussion, see our mid-year outlook from June here.

Sources: Institute for Supply Management (ISM), US Bureau of Labor Statistics (BLS), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

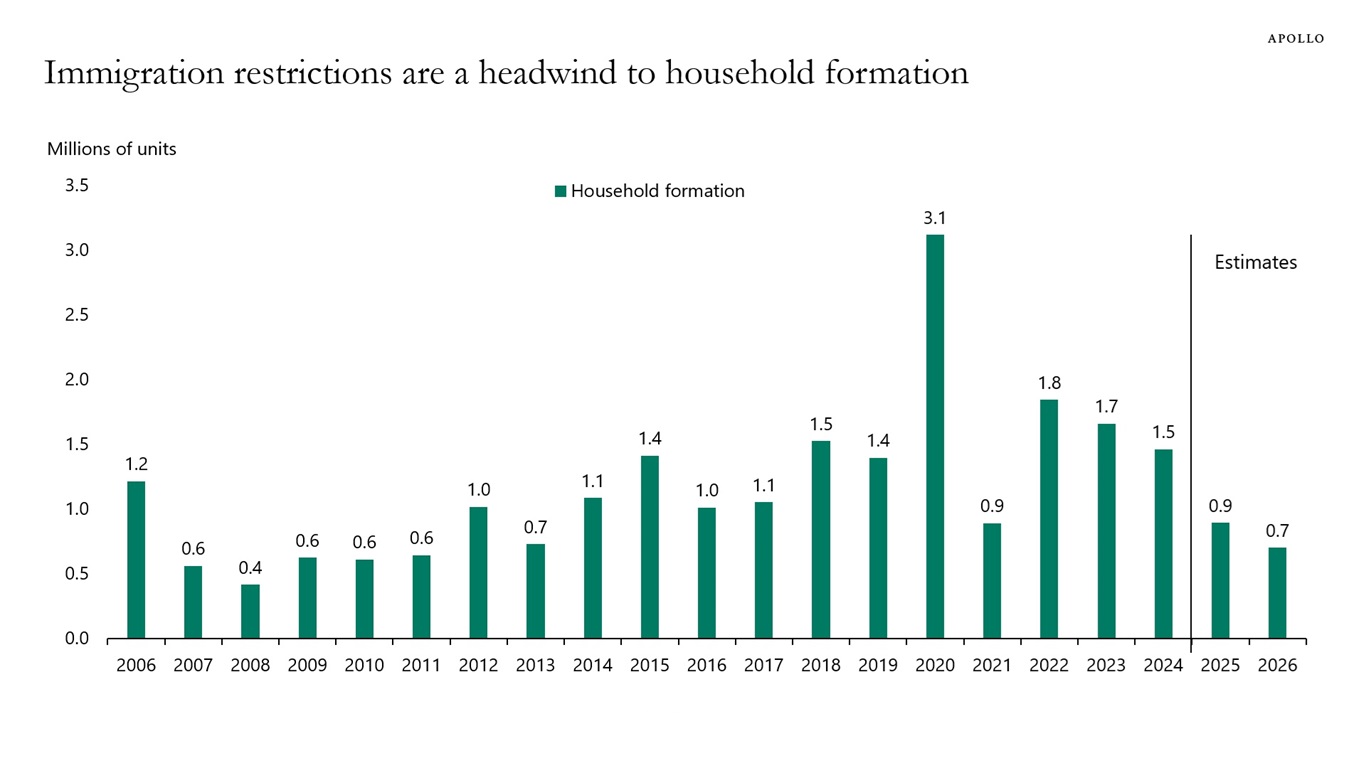

Household formation could decline by 50% from 2024 to 2026 due to deportations and immigration restrictions, see chart below and the Daily Spark here.

A significant decline in household formations has important implications for consumer spending, housing demand and home prices.

Note: Household formation estimates for 2025 and 2026 are based on projected natural population growth and legal immigration. We assumed unauthorized immigration drops to zero. To reflect this, we used natural population growth plus 65% total net migration—based on CBO estimates and Migration Policy Institute’s estimates of 0.9 million rise in unauthorized immigrants in 2023—divided by the average US household size. Sources: Census Bureau, Haver, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

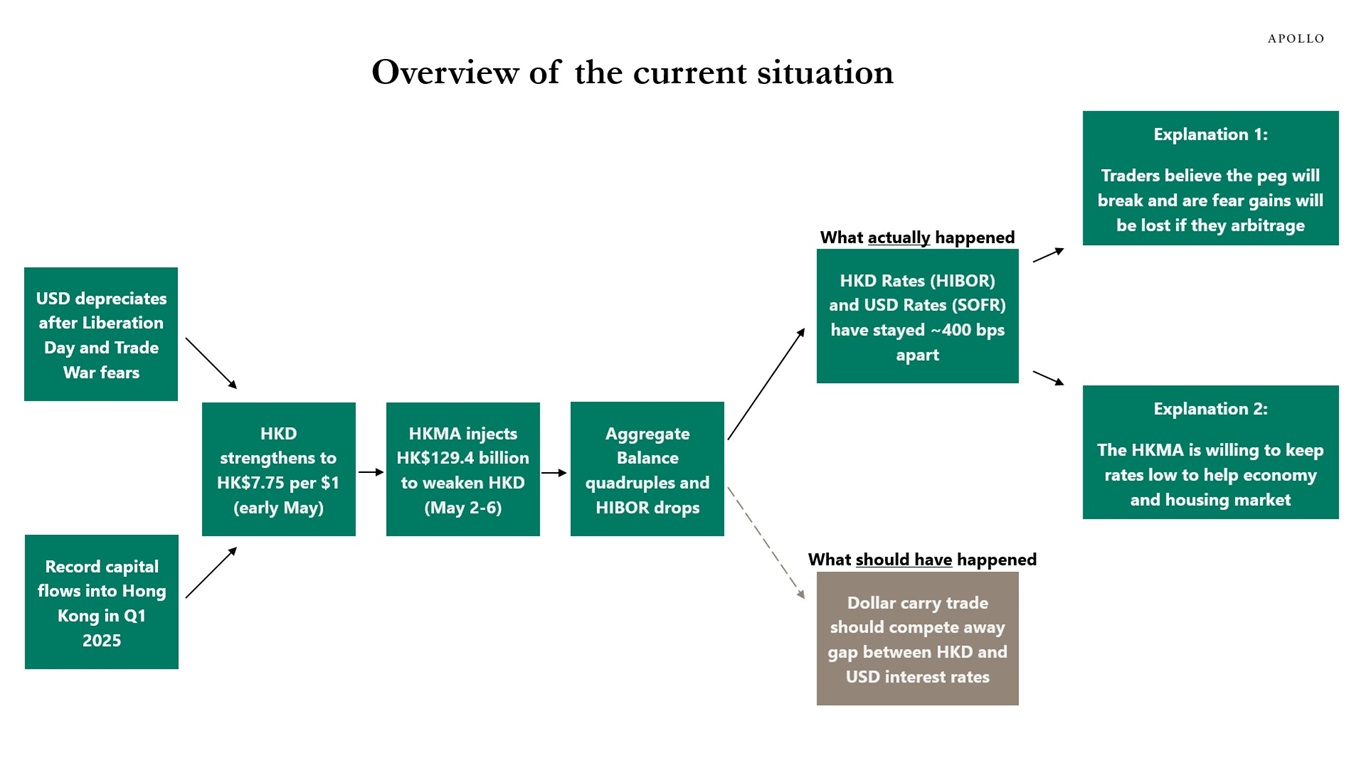

We expect that the Hong Kong dollar peg will hold. The Hong Kong Monetary Authority (HKMA) has large reserves to intervene, and the peg is a cornerstone of Hong Kong’s success as a global financial center.

But there are pressures on the Hong Kong dollar peg. After Liberation Day, the US dollar depreciated significantly. As a result, capital started flowing into Hong Kong, and the Hong Kong dollar appreciated so much that it reached the strong limit of the trading band relative to the US dollar.

In response, a few weeks after Liberation Day, the HKMA lowered Hong Kong interest rates to zero. As a result, there is now a significant gap between interest rates in the US and in Hong Kong, which is putting pressure on the peg because investors can now borrow in Hong Kong dollars and invest in US dollars, earning a significant return as long as the peg holds.

This has increased discussion among macro investors about the Fleming-Mundell policy trilemma, which says that a country cannot simultaneously have 1) a fixed exchange rate, 2) free capital movement and 3) an independent monetary policy.

The bottom line is that we expect the Hong Kong dollar peg to hold. But investors should be aware of the mounting pressures, as abandoning the peg would have significant implications for global markets.

We put together a chart book to understand this topic better, and it is available here.

Note: All references to Hong Kong refer to the Hong Kong SAR, China. Source: Apollo Chief Economist

See important disclaimers at the bottom of the page.

-

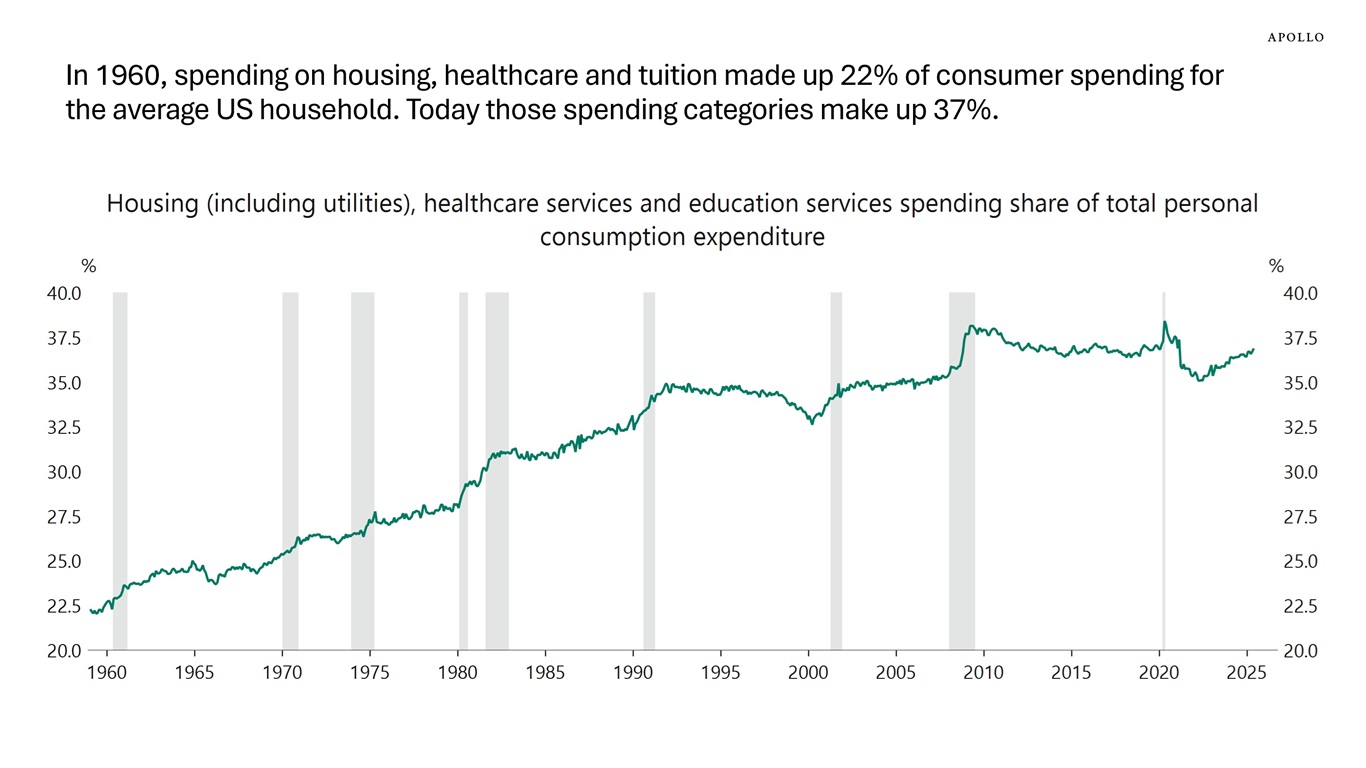

Housing, healthcare and tuition make up a bigger and bigger share of spending for the average US household, which means relatively fewer dollars are available for discretionary spending, see chart below.

Sources: US Bureau of Economic Analysis (BEA), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

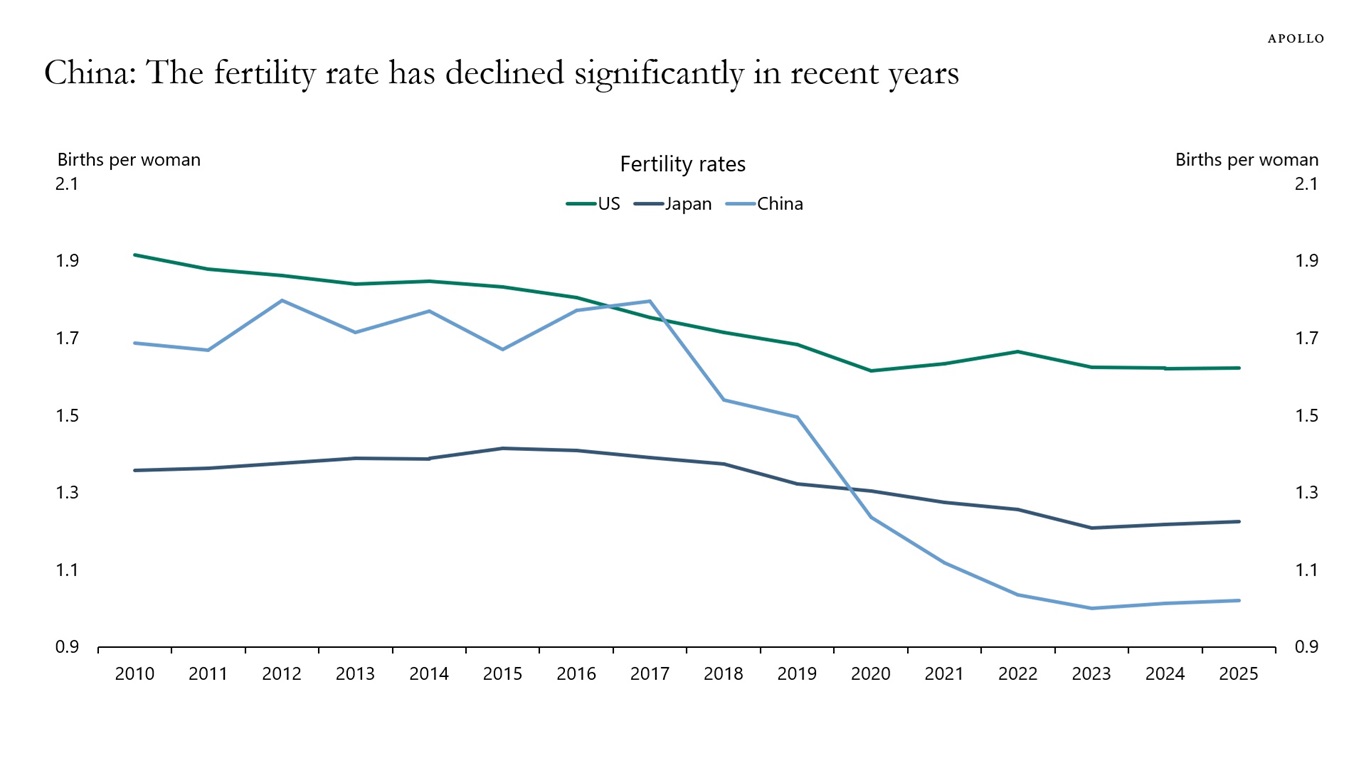

The number of births per woman has declined significantly in China, from 1.8 in 2017 to 1 today, see chart below. Also, the Chinese population has been shrinking since 2022.

Sources: United Nations, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.