Want it delivered daily to your inbox?

-

We expect that the Hong Kong dollar peg will hold. The Hong Kong Monetary Authority (HKMA) has large reserves to intervene, and the peg is a cornerstone of Hong Kong’s success as a global financial center.

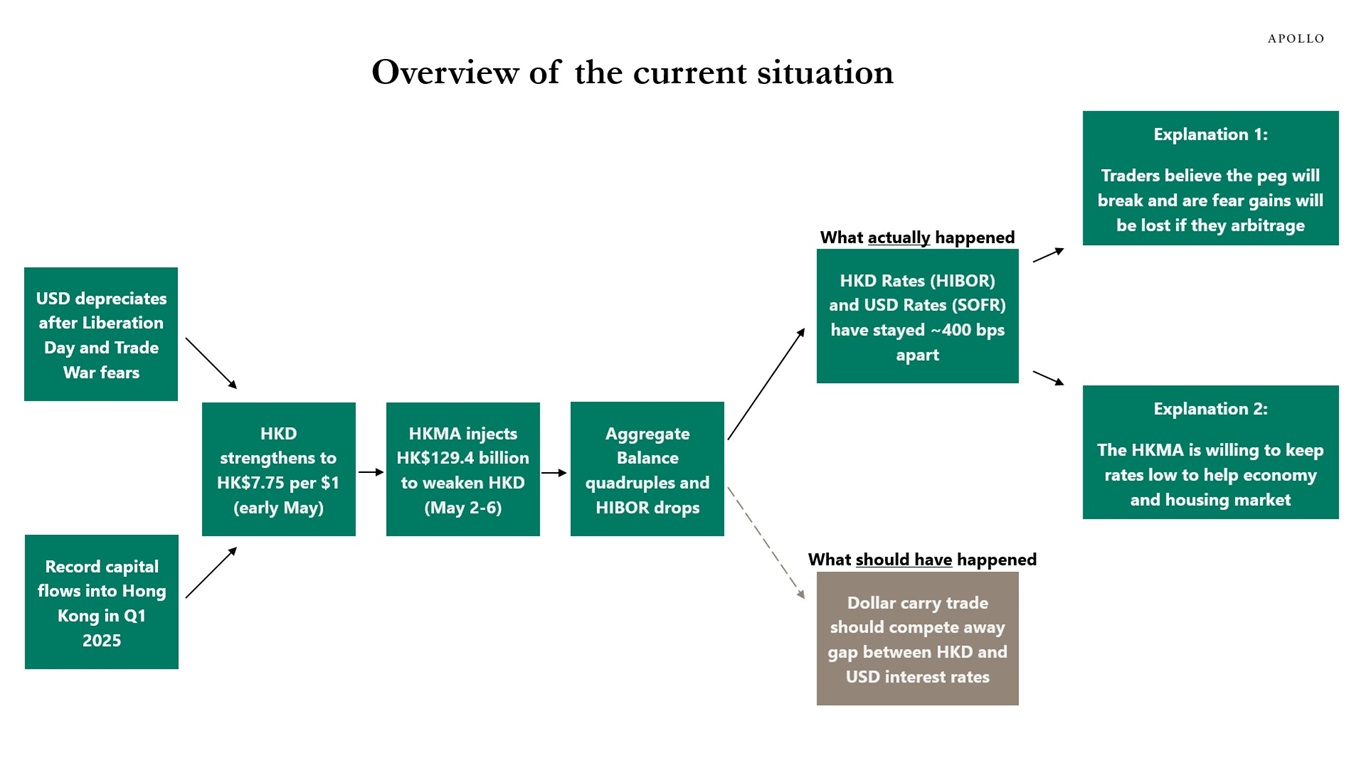

But there are pressures on the Hong Kong dollar peg. After Liberation Day, the US dollar depreciated significantly. As a result, capital started flowing into Hong Kong, and the Hong Kong dollar appreciated so much that it reached the strong limit of the trading band relative to the US dollar.

In response, a few weeks after Liberation Day, the HKMA lowered Hong Kong interest rates to zero. As a result, there is now a significant gap between interest rates in the US and in Hong Kong, which is putting pressure on the peg because investors can now borrow in Hong Kong dollars and invest in US dollars, earning a significant return as long as the peg holds.

This has increased discussion among macro investors about the Fleming-Mundell policy trilemma, which says that a country cannot simultaneously have 1) a fixed exchange rate, 2) free capital movement and 3) an independent monetary policy.

The bottom line is that we expect the Hong Kong dollar peg to hold. But investors should be aware of the mounting pressures, as abandoning the peg would have significant implications for global markets.

We put together a chart book to understand this topic better, and it is available here.

Note: All references to Hong Kong refer to the Hong Kong SAR, China. Source: Apollo Chief Economist

See important disclaimers at the bottom of the page.

-

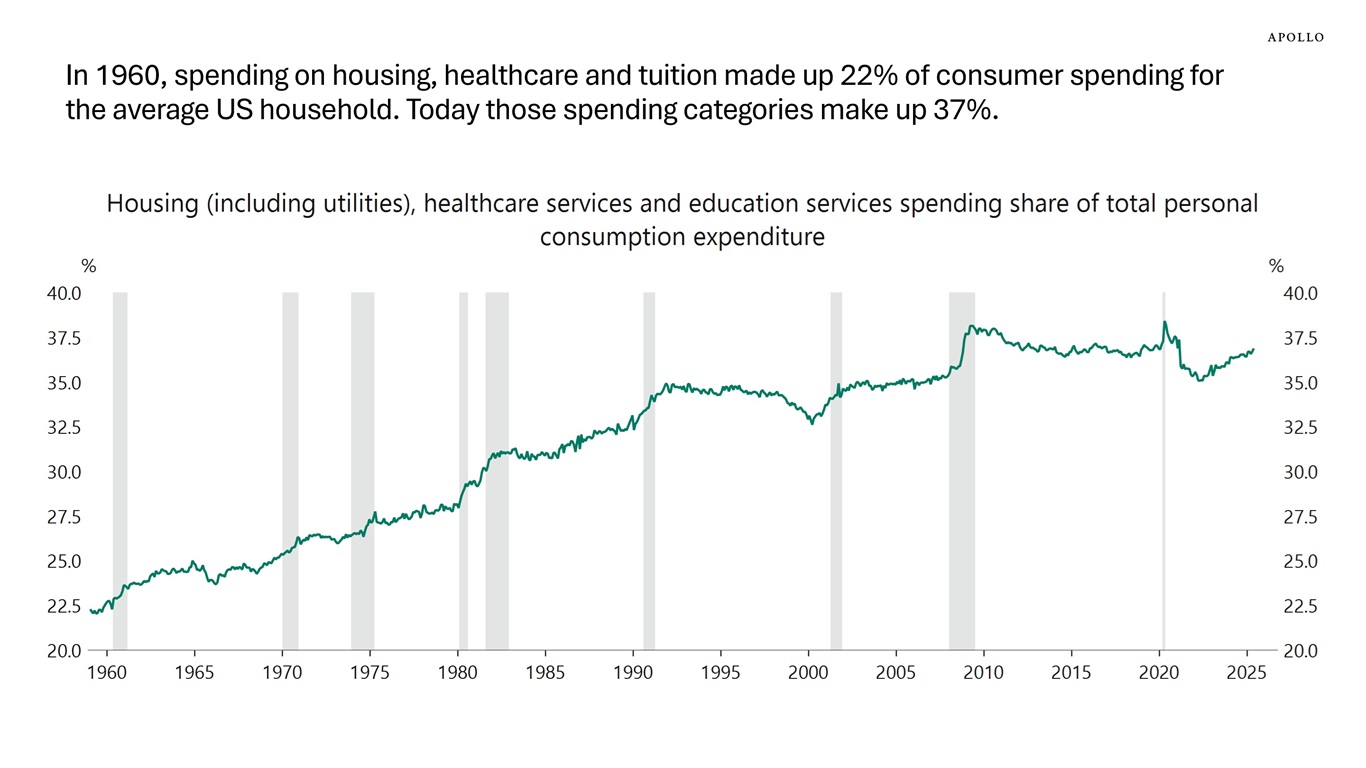

Housing, healthcare and tuition make up a bigger and bigger share of spending for the average US household, which means relatively fewer dollars are available for discretionary spending, see chart below.

Sources: US Bureau of Economic Analysis (BEA), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

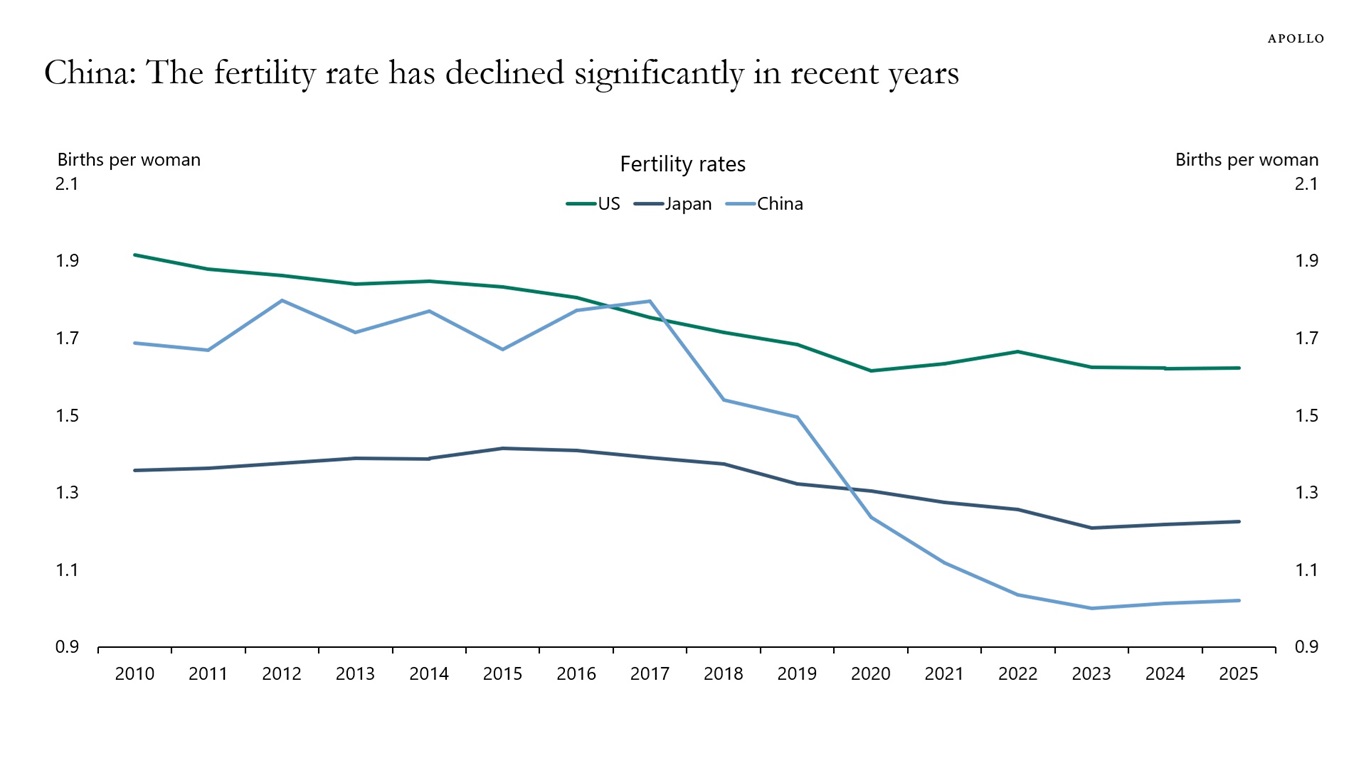

The number of births per woman has declined significantly in China, from 1.8 in 2017 to 1 today, see chart below. Also, the Chinese population has been shrinking since 2022.

Sources: United Nations, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

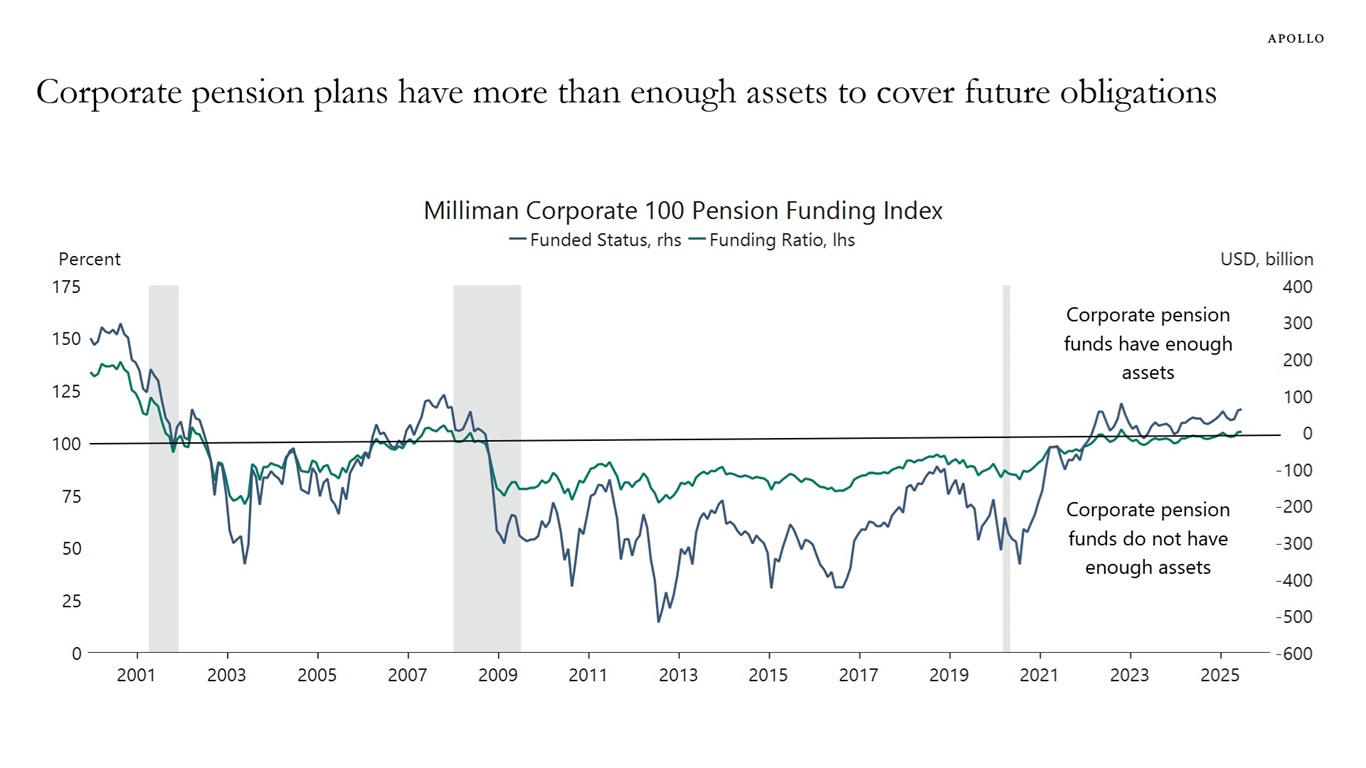

The Milliman 100 Pension Funding Index tracks the funded status of the 100 largest corporate defined benefit pension plans sponsored by US public companies.

Specifically, the index monitors the financial health of corporate pension plans by comparing their total assets to their projected liabilities, and the latest reading of the funded ratio (assets divided by liabilities) shows that corporate pension plans have more than enough assets to cover future obligations, see chart below.

Note: Funded status measures planned assets minus projected benefit obligation. Sources: Milliman, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

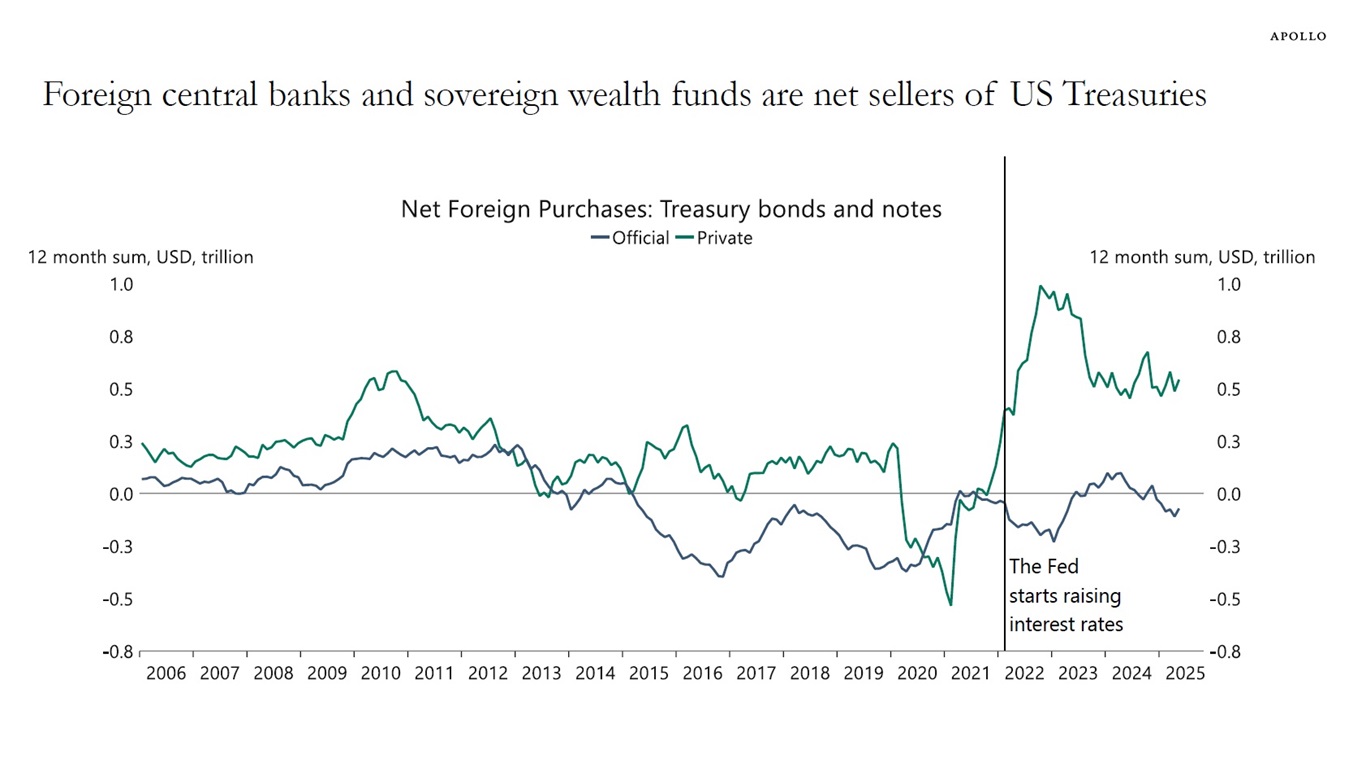

When the Fed started raising interest rates in early 2022, foreign private investors started buying more US Treasuries, despite the associated increase in hedging costs for foreigners, see chart below.

The bottom line is that foreign private investors like higher nominal US yields. But demand from foreign central banks and sovereign wealth funds is not sensitive to changes in yields.

Sources: US Department of Treasury, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

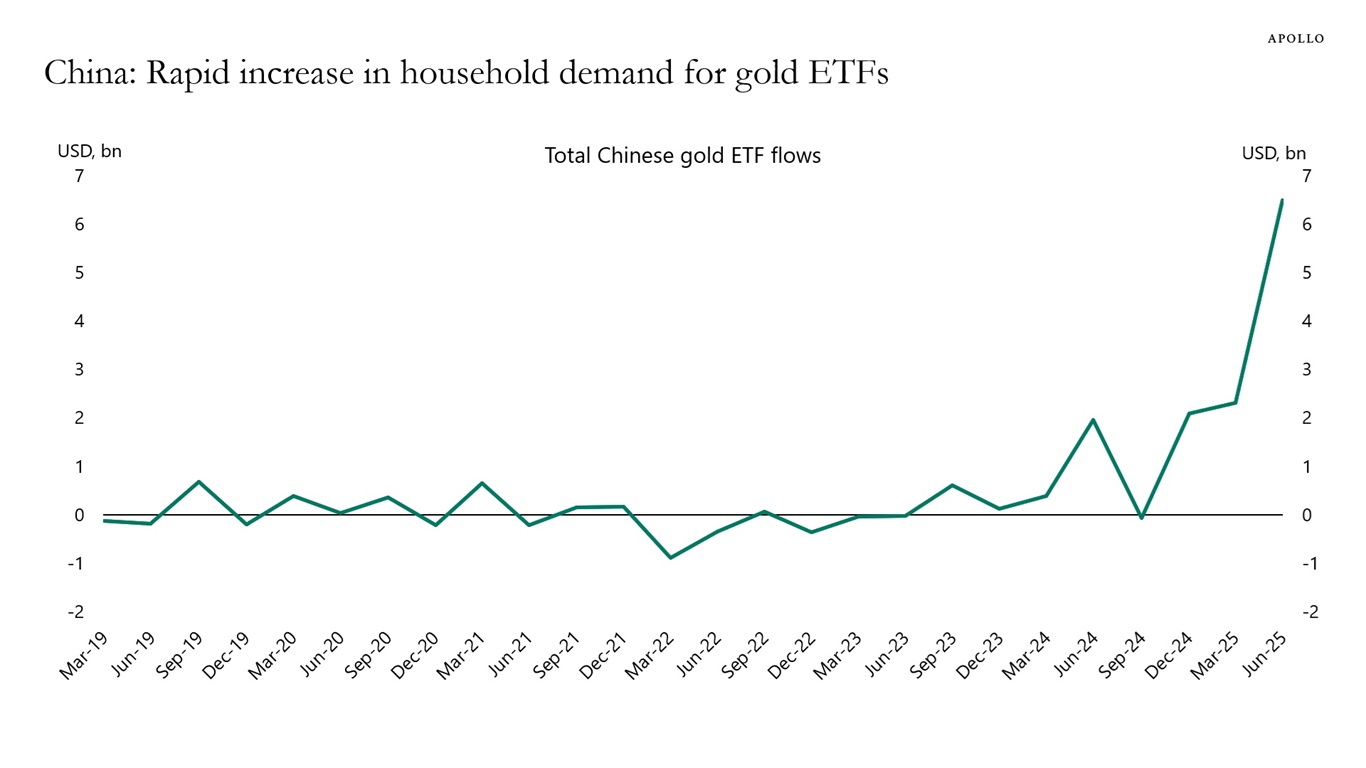

Demand for gold has increased significantly among households in China. This trend likely reflects the strong rally in gold prices, concerns about the ongoing decline in home prices, and worries about deflation and the weakening of the yuan, see chart below.

Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

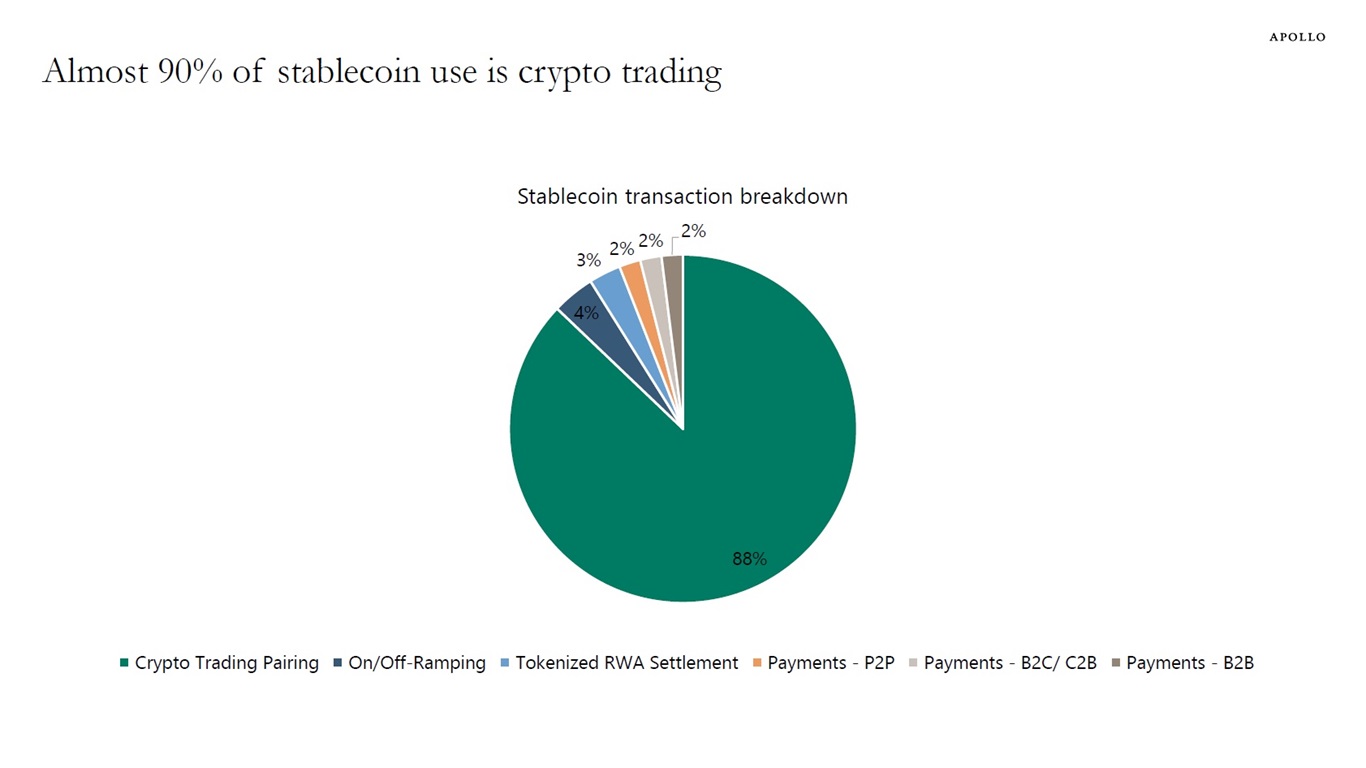

Almost 90% of stablecoin use is crypto trading, which will likely continue to grow.

The big breakthrough will be if US dollar stablecoins will be used for retail payments globally.

If the US dollar stablecoin market grows into the trillions, it will significantly grow demand for US T-bills.

There are financial stability risks because money will be moved around quickly if depositors lose confidence in a stablecoin issuer.

For more discussion, see our chart book here.

Note: USDT is as of Q125 and USDC as of May 2025. Sources: US Treasury, Macrobond, Circle, Tether, Apollo Chief Economist

Note: Total may not sum to 100% due to rounding. Sources: BCG, Stablecoins-five-killer-tests-to-gauge-their-potential.pdf, Apollo Chief Economist

Sources: Artemis, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

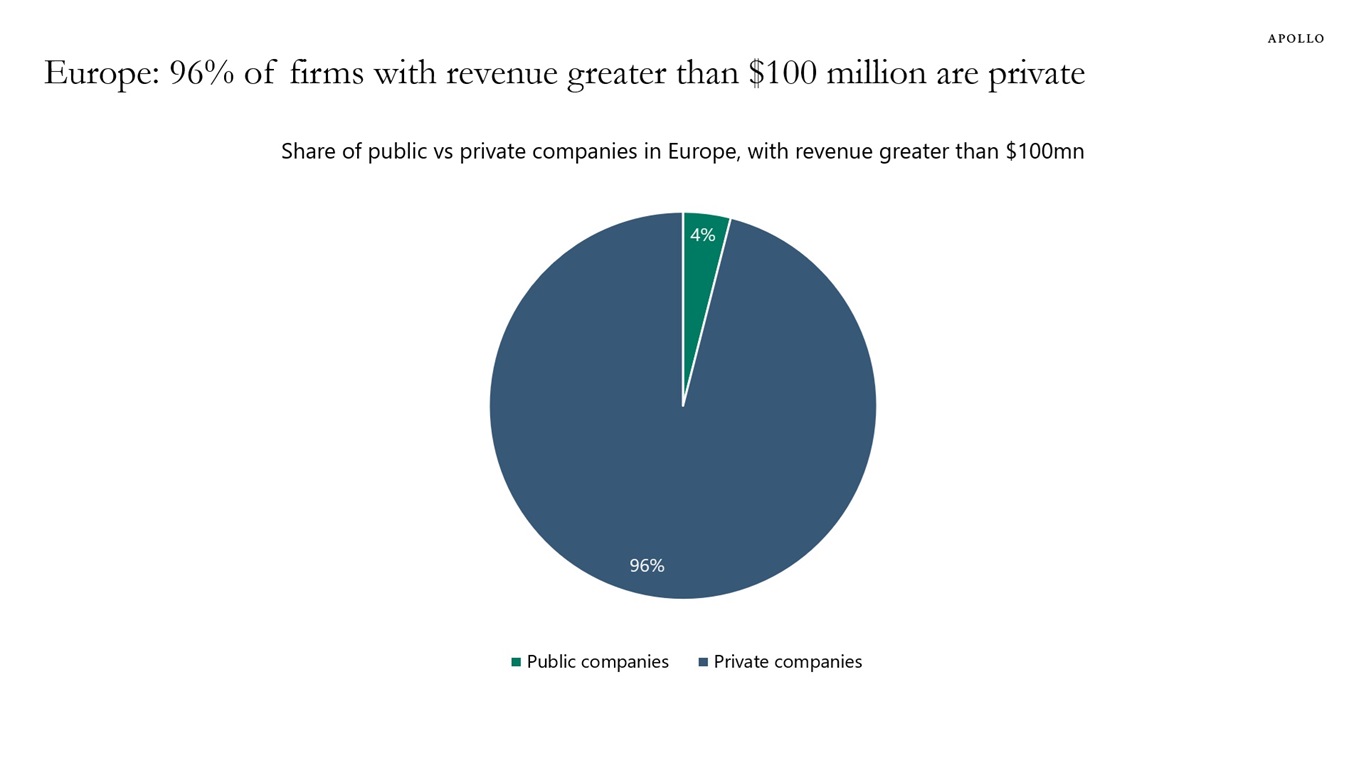

The total addressable market for European direct lending to large-cap companies is enormous. Ninety-six percent of firms in Europe with revenue greater than $100 million are private, see chart below.

Note: For companies with last 12-month revenue greater than $100 million by count. Sources: S&P Capital IQ, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

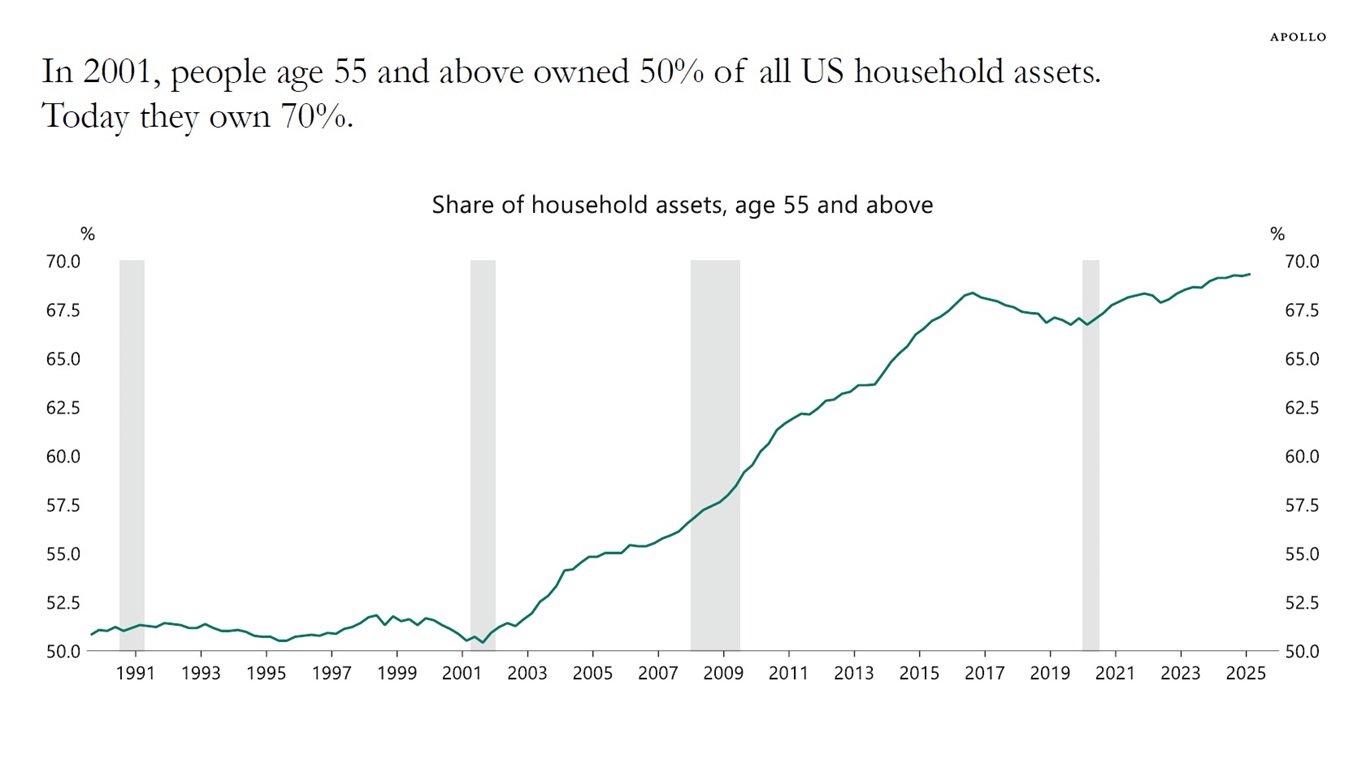

A growing share of US household assets is owned by people age 55 and above, see chart below. A contributing factor is the aging of the population, as there are more and more people in this age group.

Sources: Federal Reserve, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

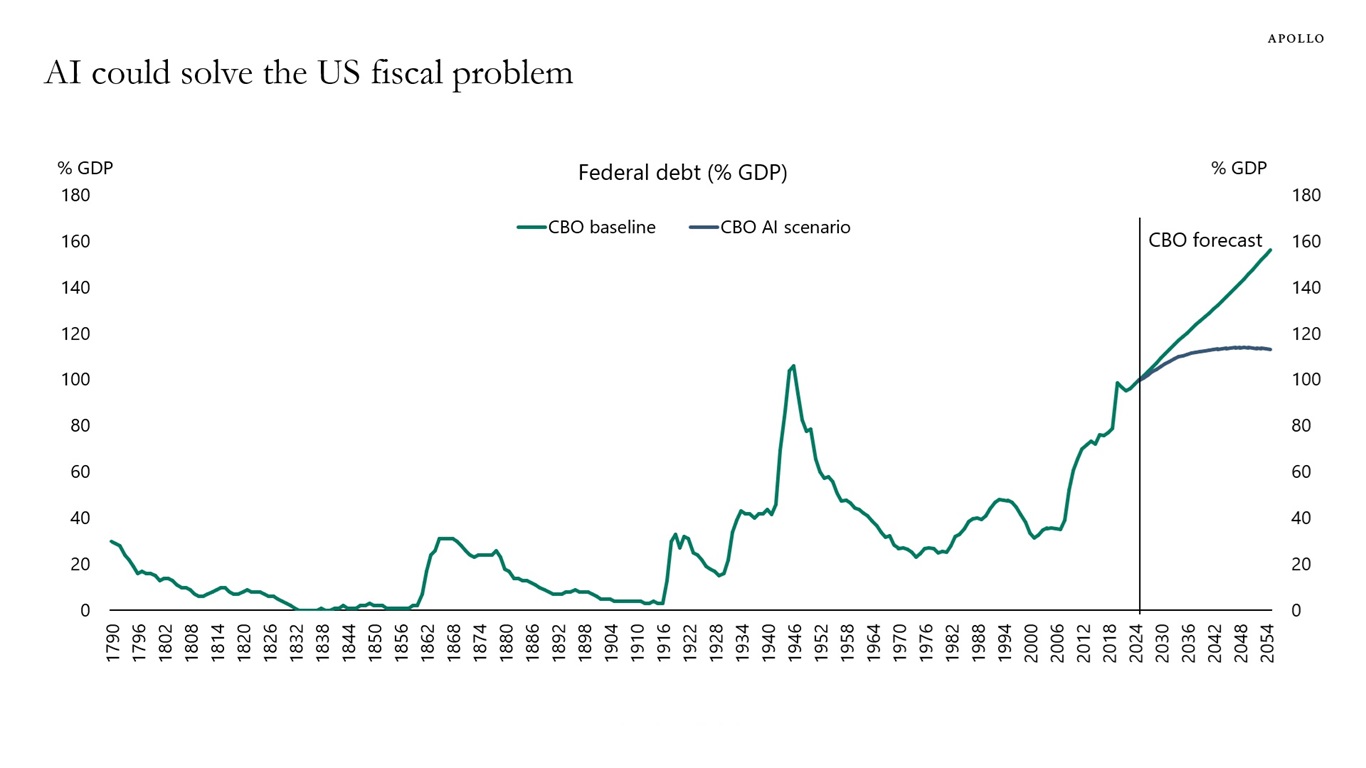

The Congressional Budget Office estimates that if AI results in permanently higher GDP growth and permanently lower inflation, it could solve the US fiscal problem, see chart below.

Sources: The Long-Term Budget Outlook Under Alternative Scenarios for the Economy and the Budget | Congressional Budget Office, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.