Want it delivered daily to your inbox?

-

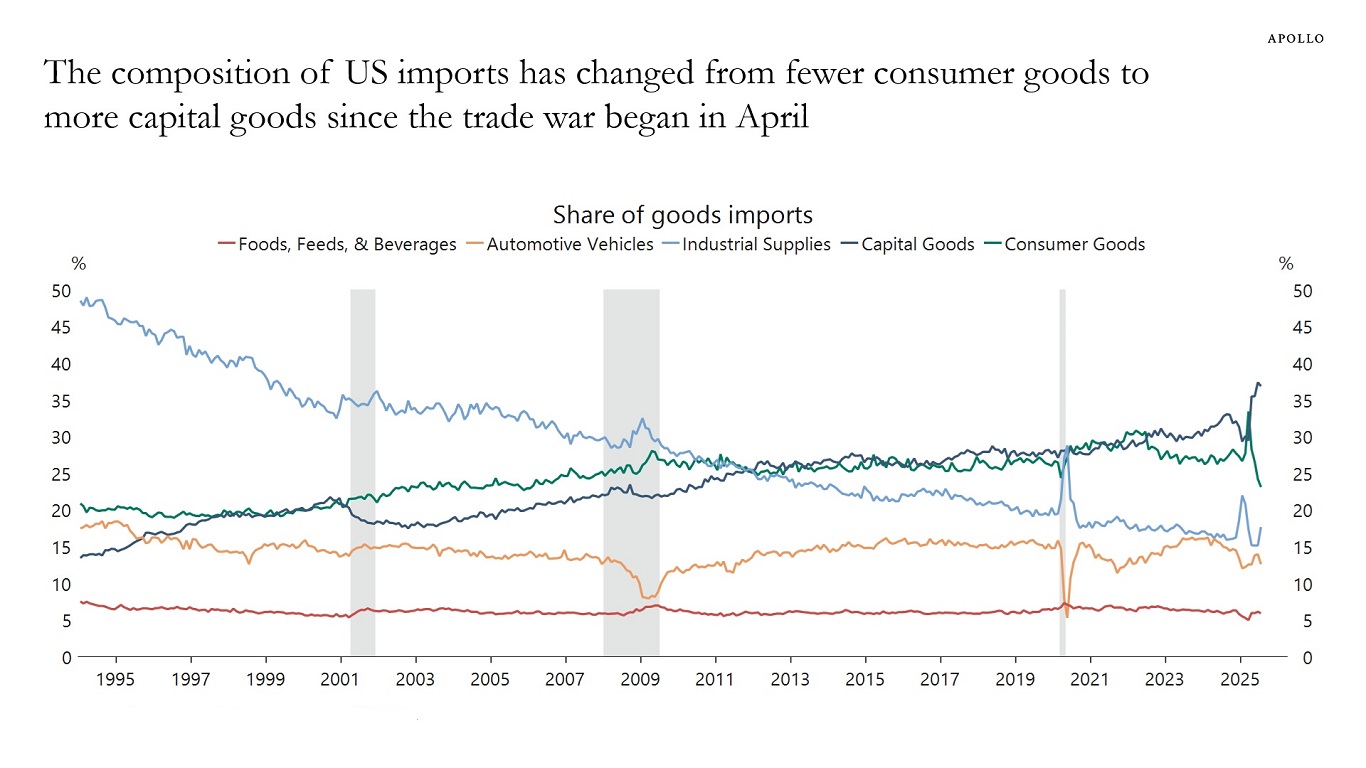

Consumers are more sensitive than companies to price changes of imported goods, see also here.

As a result, the composition of US imports has changed dramatically since Liberation Day, with a sharp decline in imports of consumer goods, see chart below.

Sources: US Census Bureau, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

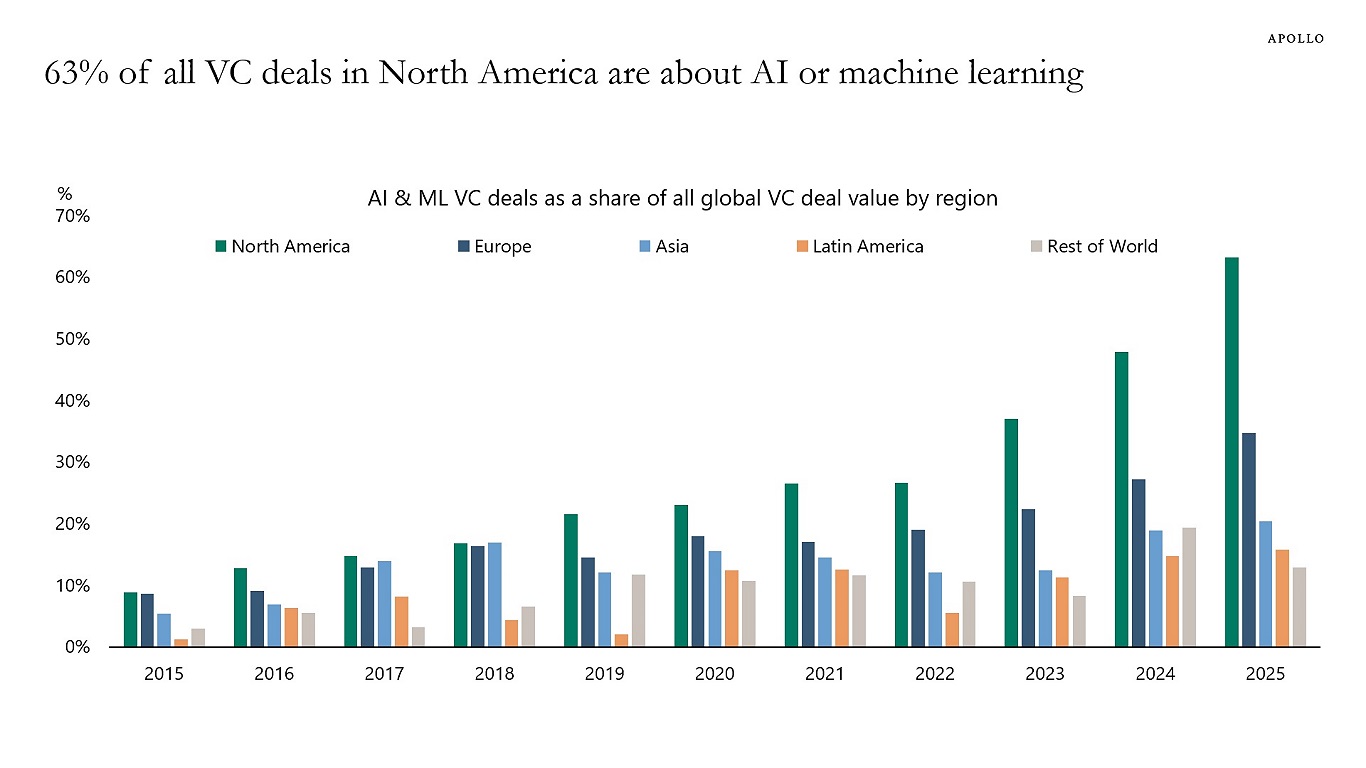

A rising share of VC activity globally is AI deals, and 63% of all VC deals in North America are now AI or machine learning, see chart below.

Sources: PitchBook, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

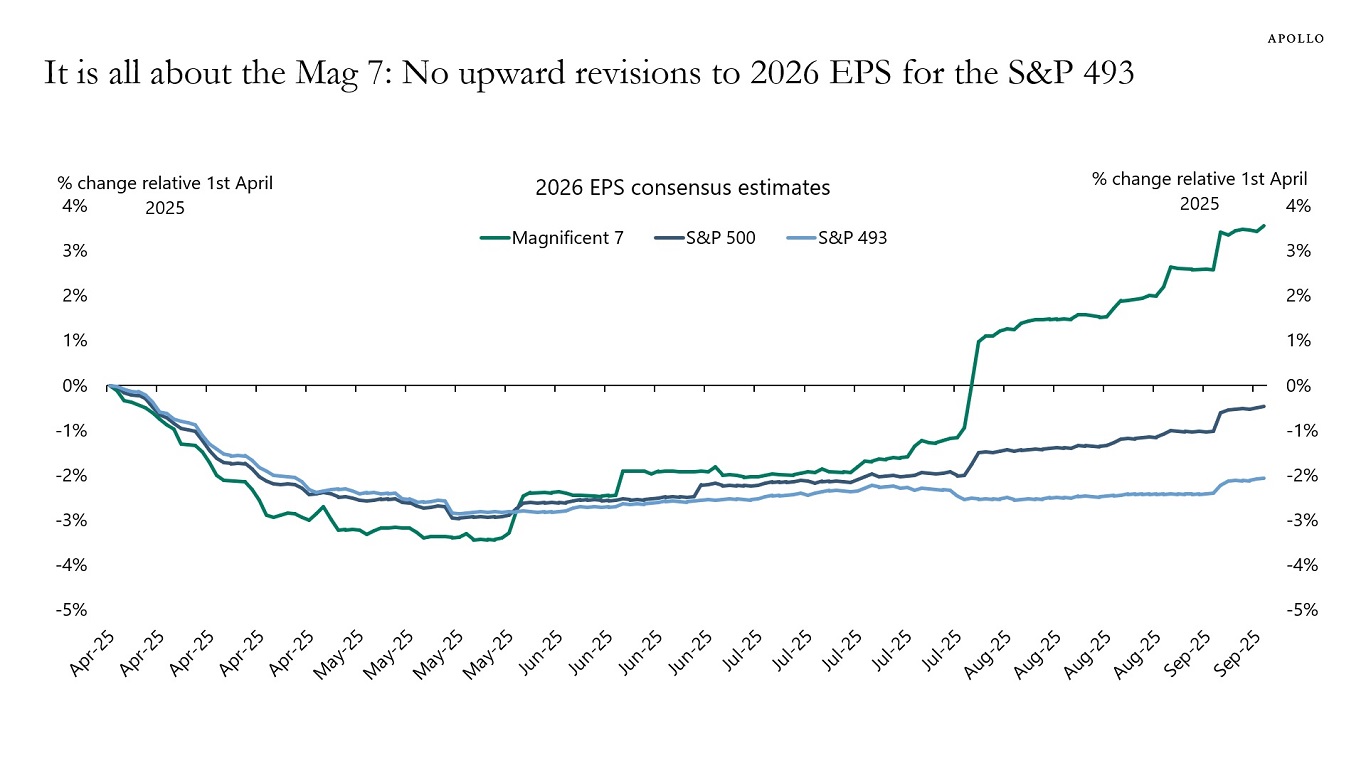

The upward consensus revision to 2026 earnings for the S&P 500 since Liberation Day comes entirely from the Magnificent 7, see chart below.

The outlook for the rest of the economy is much more bearish: Earnings expectations for the S&P 493 have remained suppressed and are not moving higher.

The bottom line is once again that there is an extreme degree of concentration in the S&P 500, and equity investors are dramatically overexposed to AI.

For more discussion, see also our chart book here.

Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

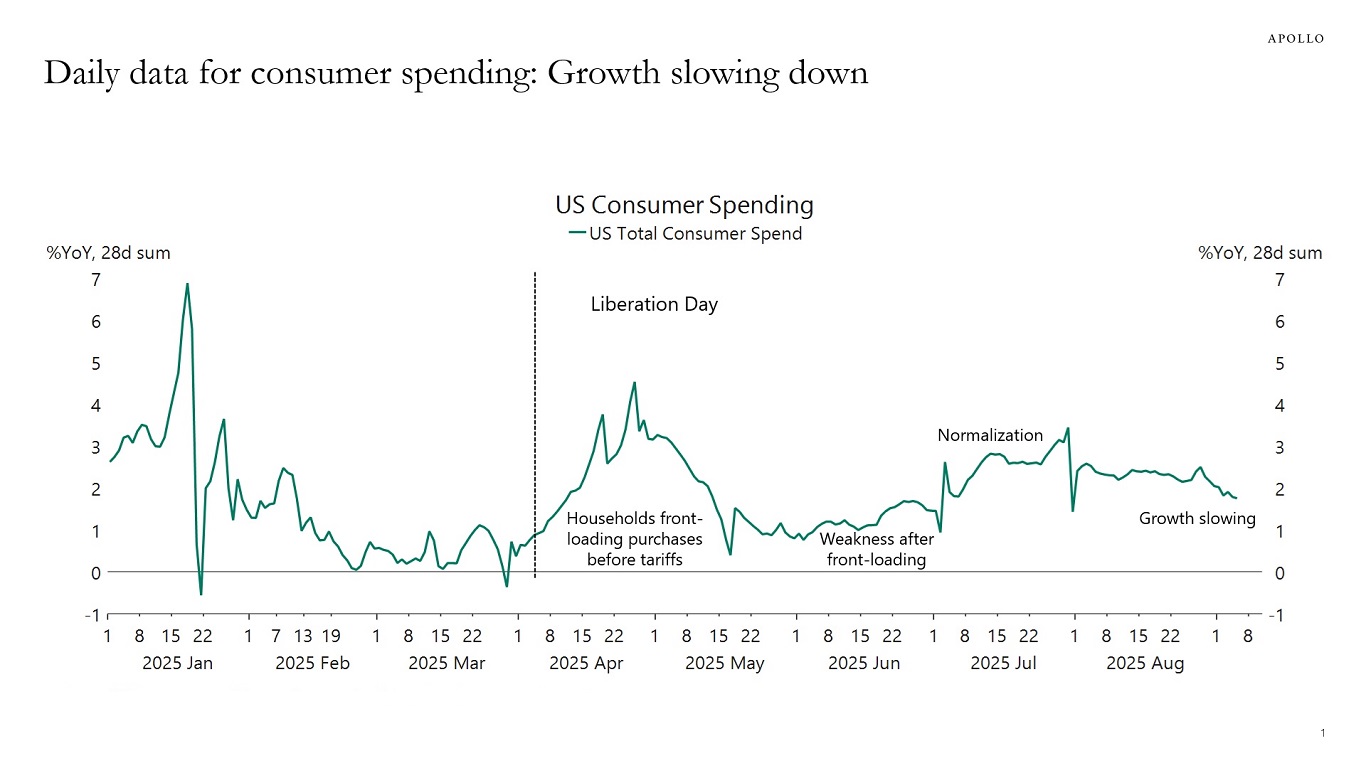

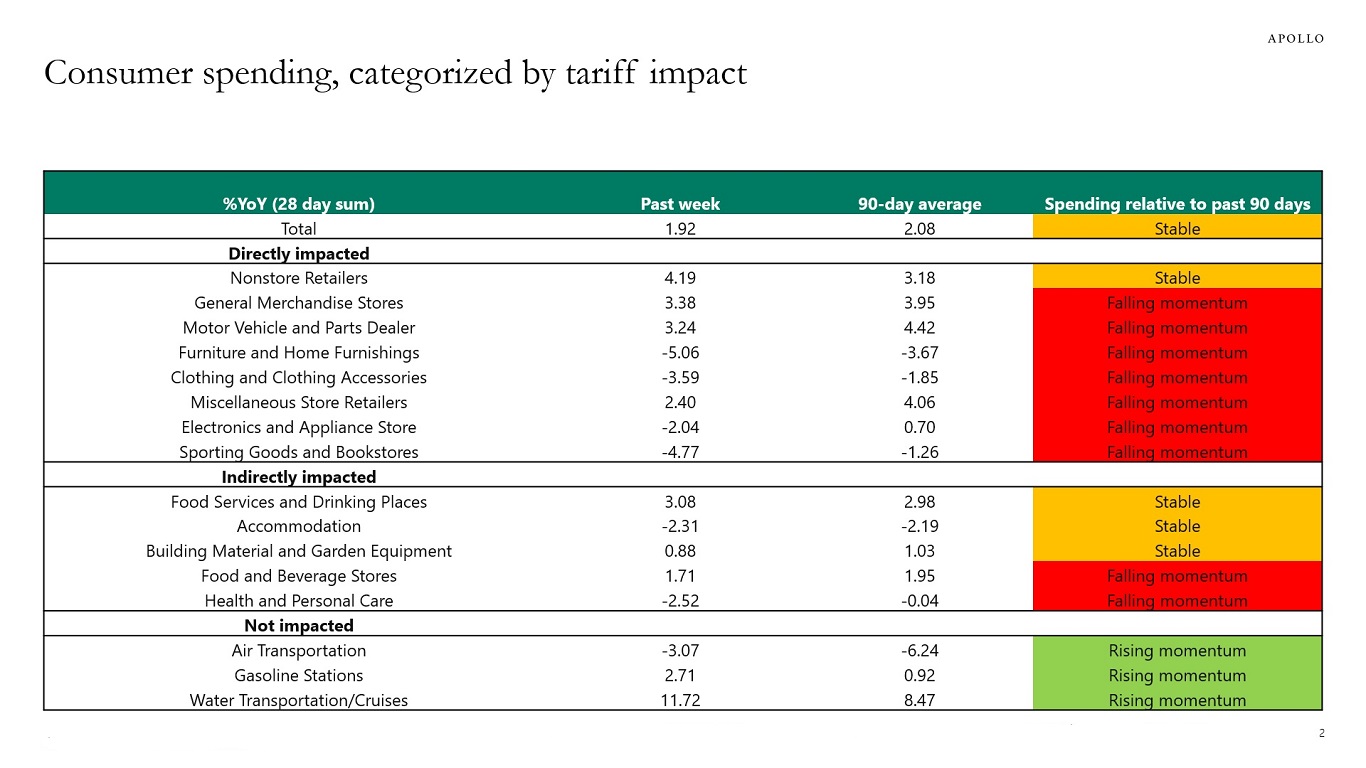

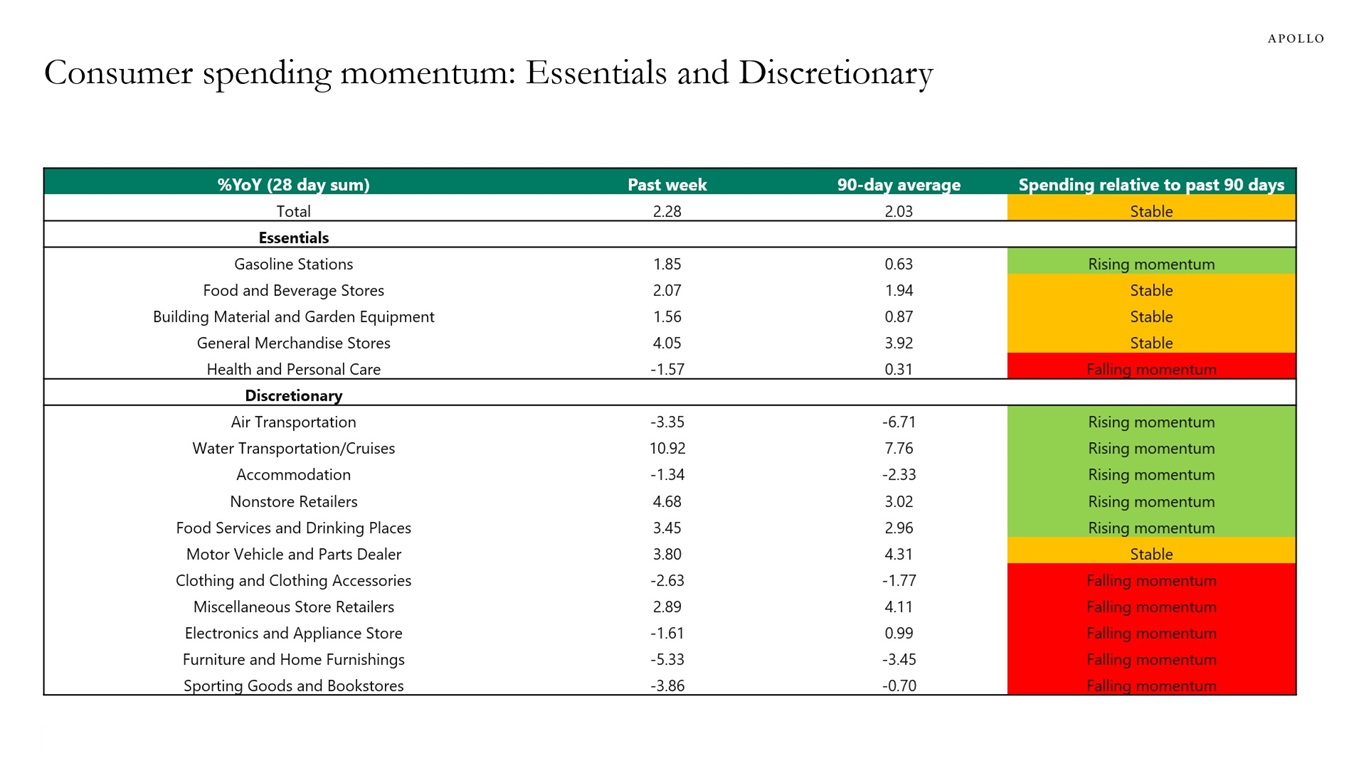

The daily data for consumer spending has slowed down modestly in recent weeks, and the slowdown is more pronounced in sectors impacted by tariffs, see charts below and in this chart book.

Sources: US Bloomberg Second Measure Consumer Spend, Macrobond, Apollo Chief Economist

Note: Stable is defined as growth falling between 0.5 to -0.5 standard deviation of the past 90 days, rising momentum is higher than 0.5 standard deviation and falling momentum is -0.5 standard deviation. Past week ends on September 5, 2025. Sources: US Bloomberg Consumer Spend, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

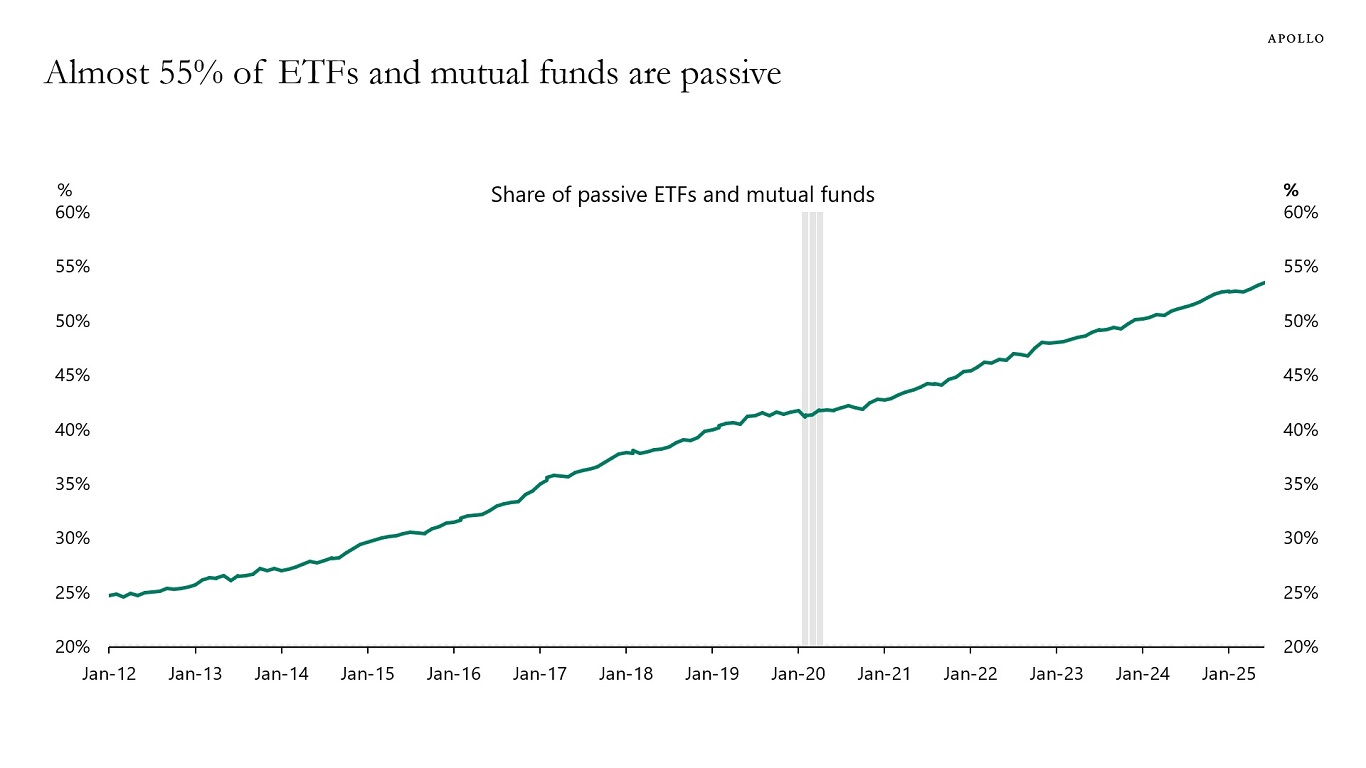

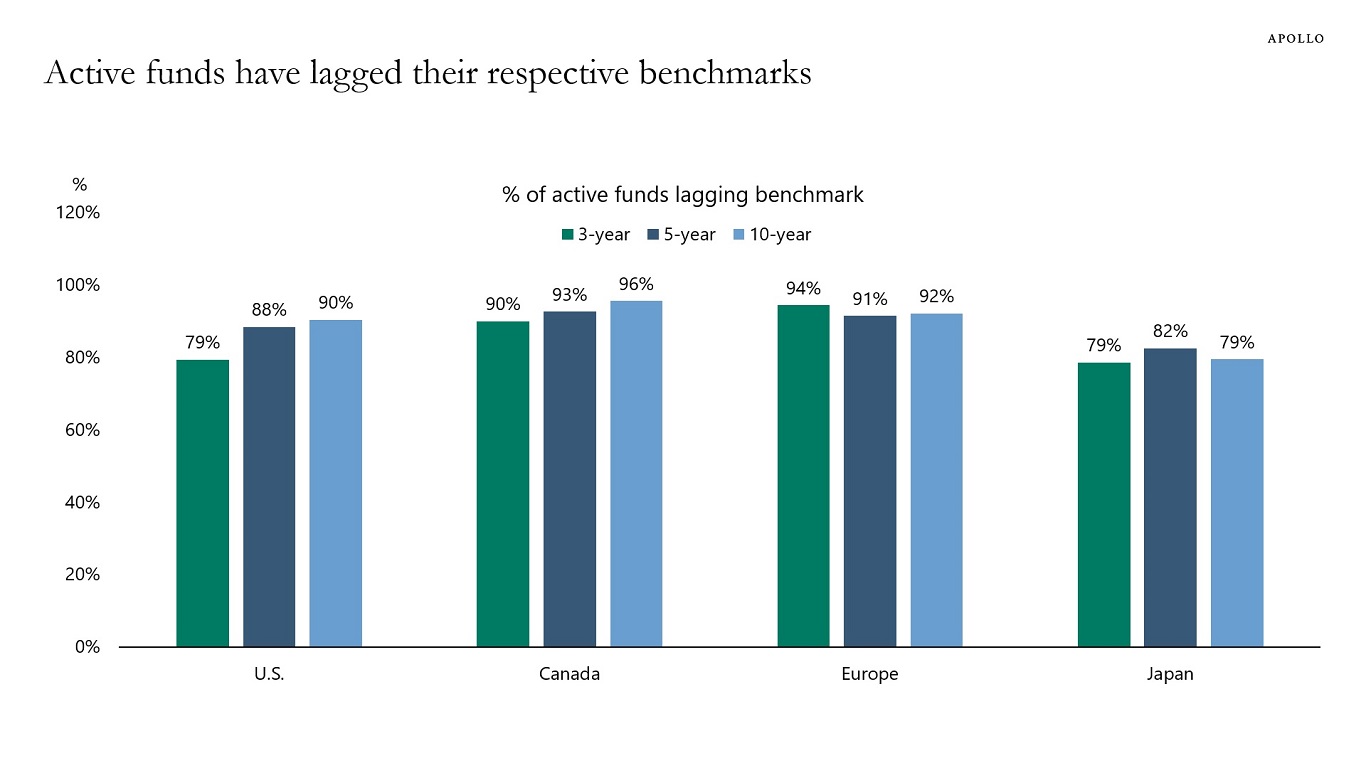

The amount of money in passive investing continues to grow, see charts below.

There are three consequences of this development:

1) Reduced market efficiency and price discovery

2) Increased market concentration and volatility

3) Growing correlation and systemic risk

For more discussion, see here.

Sources: Bloomberg, Apollo Chief Economist

Sources: SPIVA | S&P Dow Jones Indices, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

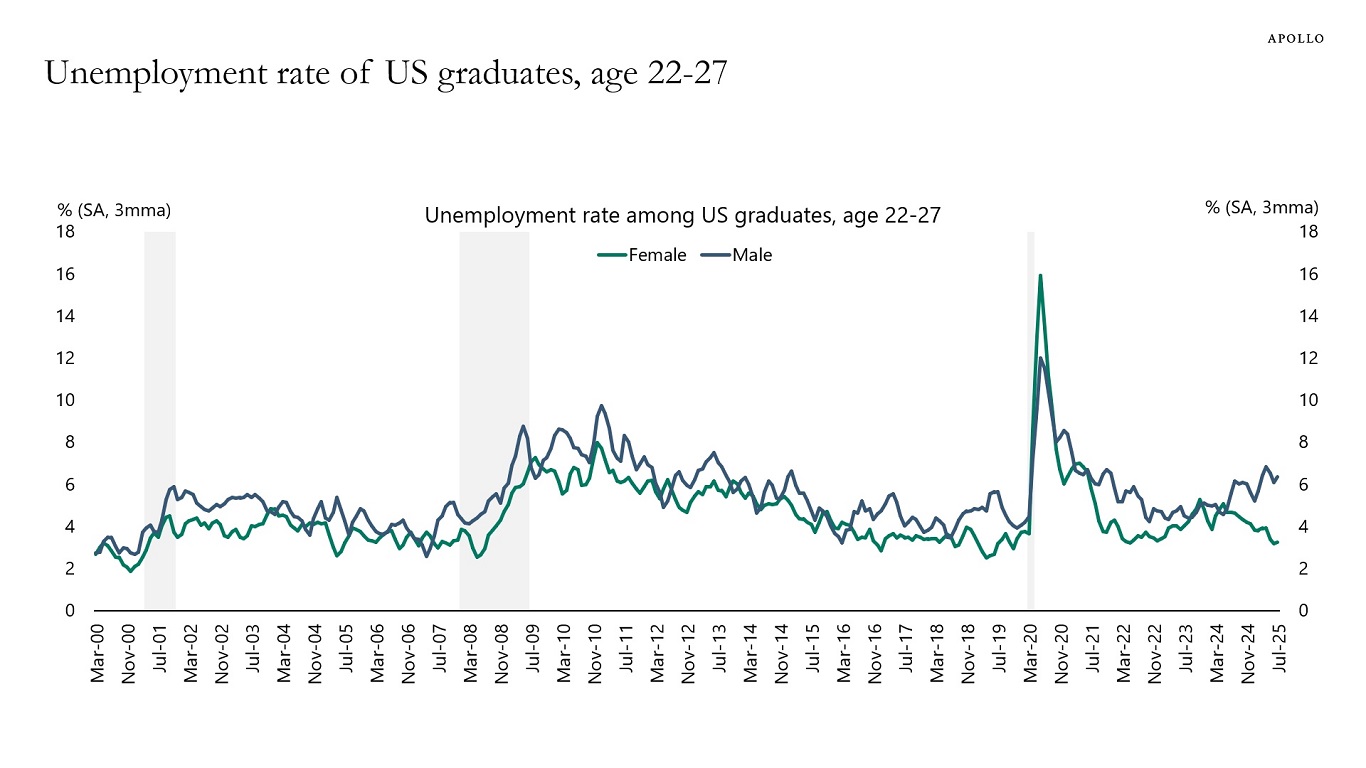

The unemployment rate for recent college graduates is rising for men and falling for women, see chart below.

Note: This data is based on IPUMS-CPS microdata (monthly CPS basic 2000 – present). Sample restricted to 22–27-year-olds with BA+, unemployment rates weighted by CPS survey weights and smoothed with 3 month rolling average. Source: Apollo Chief Economist See important disclaimers at the bottom of the page.

-

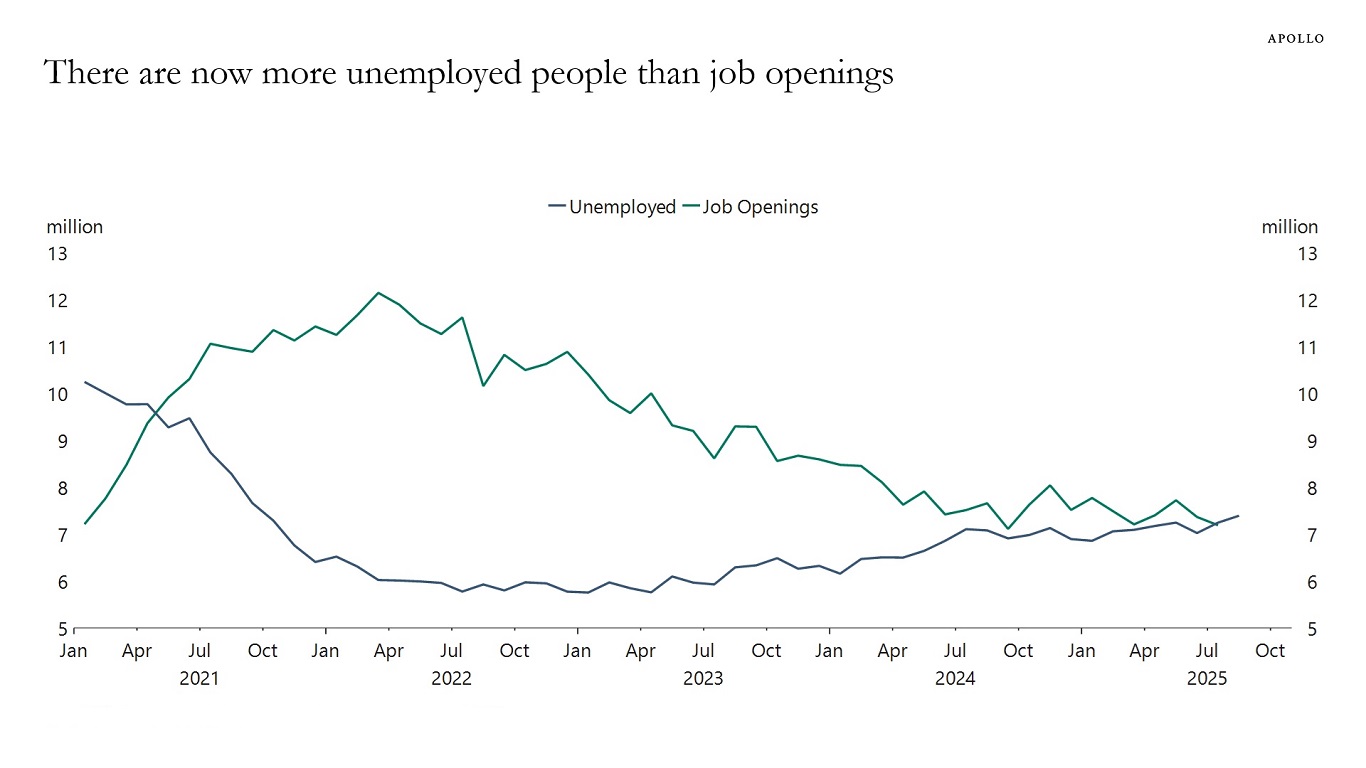

There are currently 7.4 million unemployed people and 7.2 million job openings, see chart below.

It is the first time since 2021 when we have had more unemployed than job openings.

Sources: Bureau of Labor Statistics (BLS), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

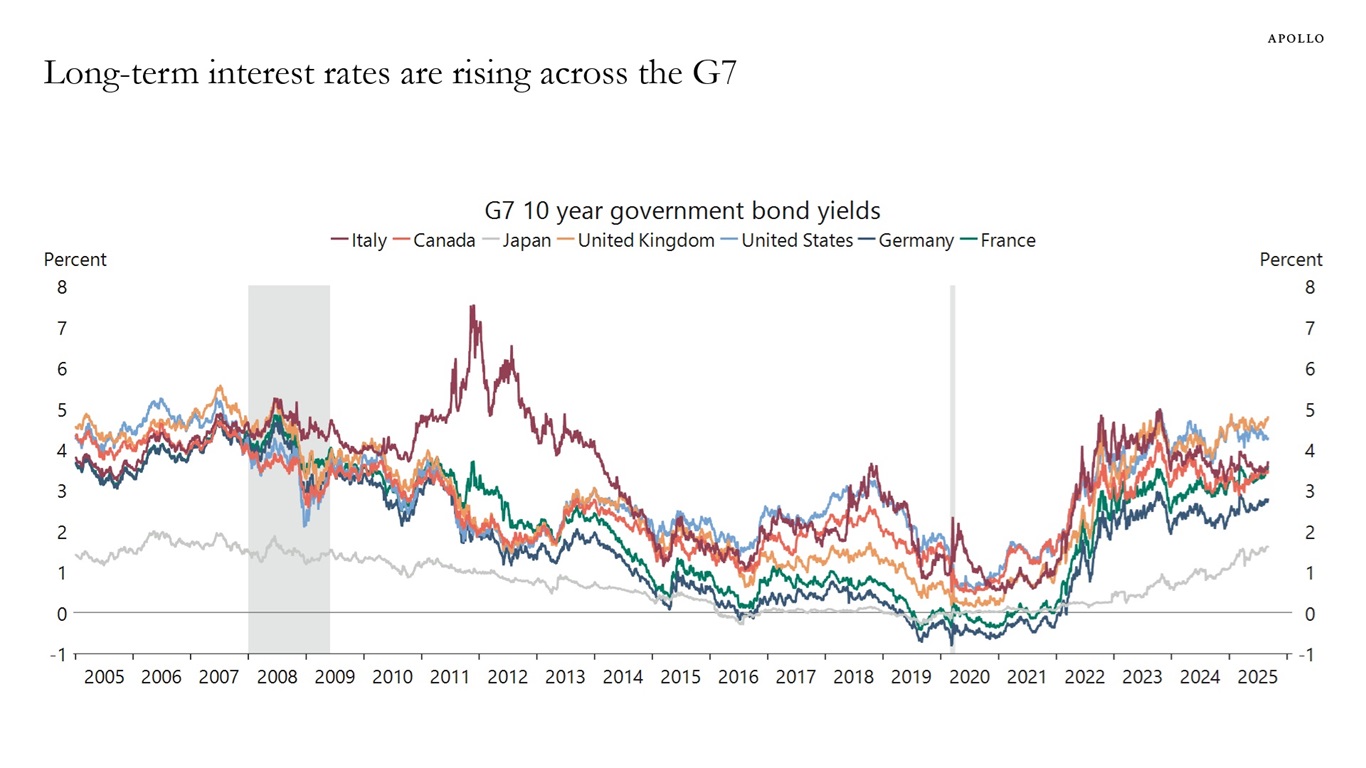

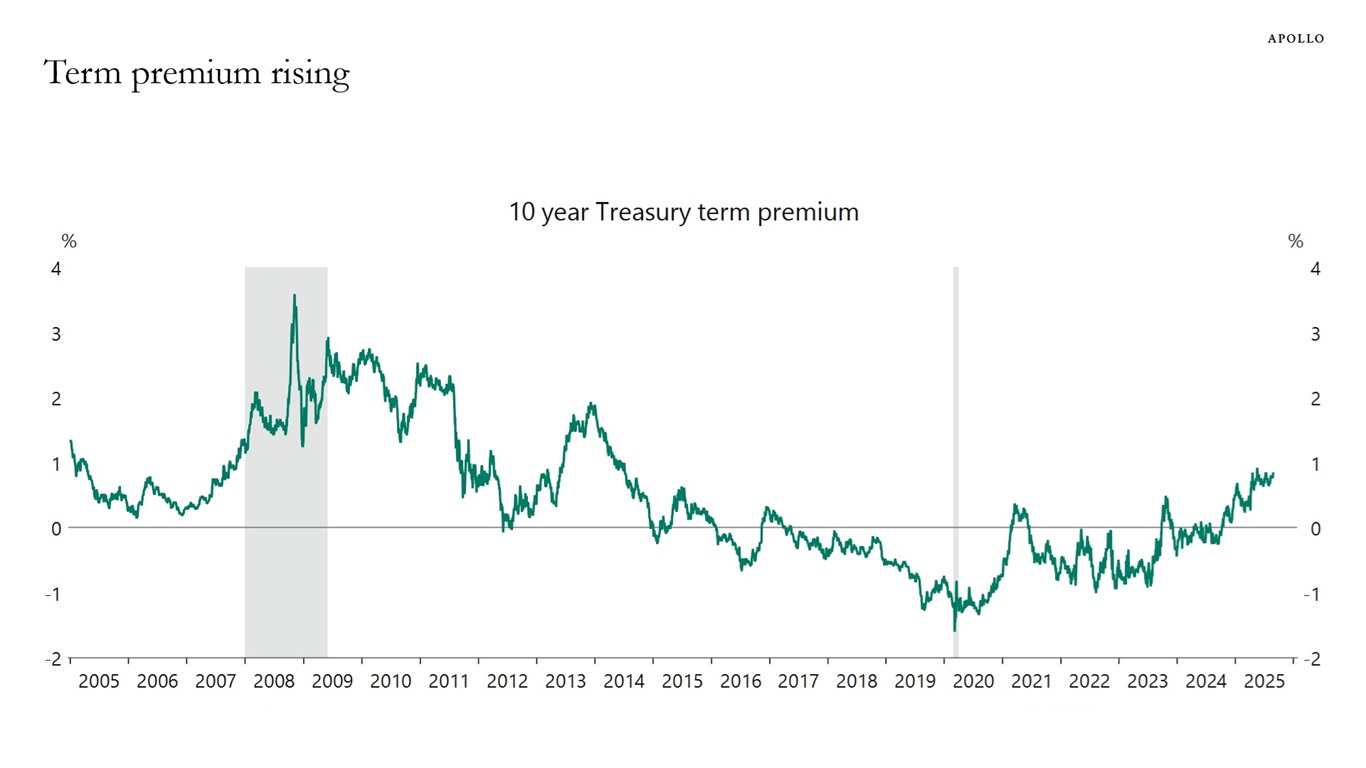

There are fiscal challenges in most countries, and government debt levels, yield levels and the term premium are rising across the G7, see charts below.

This raises questions about debt sustainability and the ability of governments to repay their debt, particularly in Europe and Japan, where growth is structurally weak due to demographics and years of policy choices that have dampened growth.

What are the consequences if the risk-free asset is no longer risk-free?

1) Higher government borrowing costs and, as a result, higher borrowing costs for consumers and firms.

2) Loss of monetary policy effectiveness, as cuts by the central bank don’t lower long-term interest rates.

3) Financial instability, because the risk-free rate is used for valuing assets and pricing risk.

In extreme cases, the central bank may decide to do YCC or QE to lower long-term interest rates. But this comes at the risk of a dramatic depreciation of the currency, as the central bank essentially intervenes to support fiscal policy and, as a result, the central bank loses credibility among investors.

For more discussion see here, here and here.

Sources: US Department of Treasury, Macrobond, Apollo Chief Economist

Note: The NY Fed measure for the term premium is based on a five-factor, no-arbitrage model. Sources: Federal Reserve Bank of New York, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

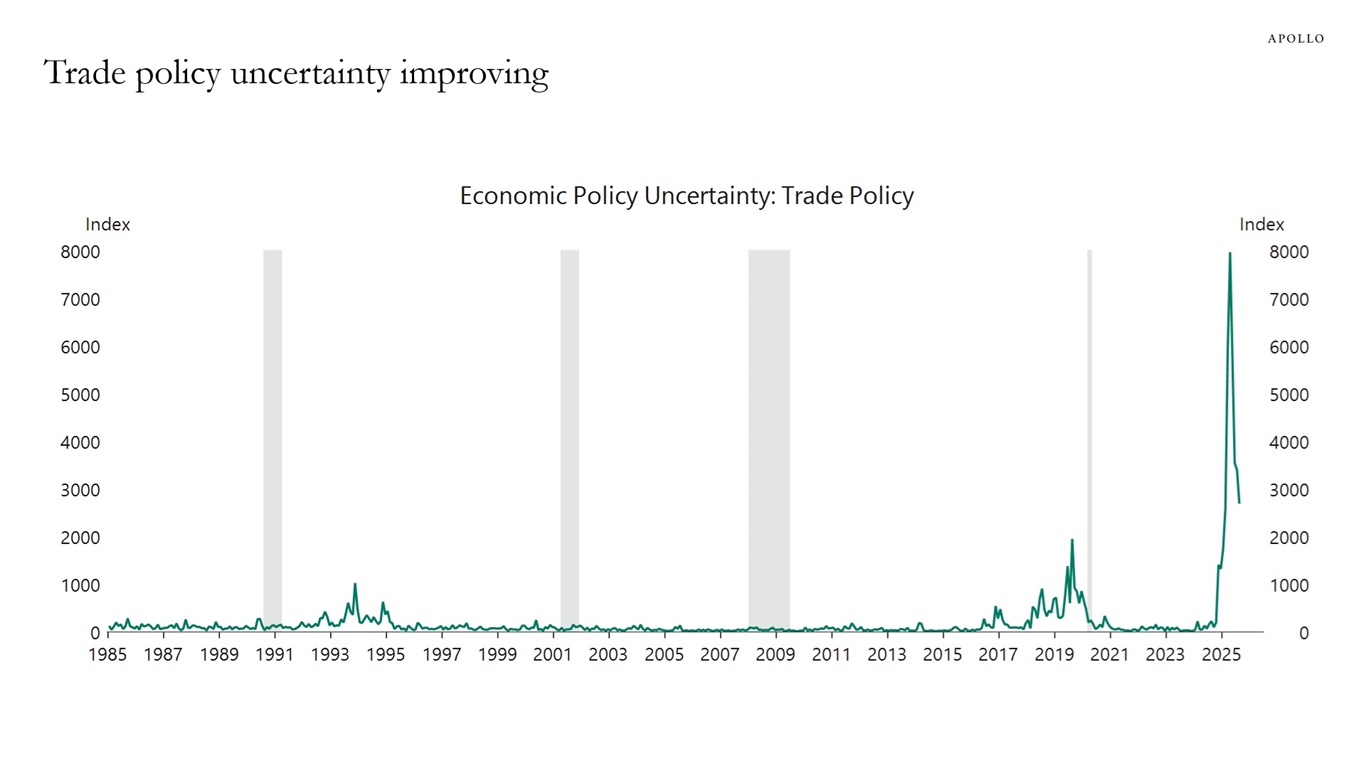

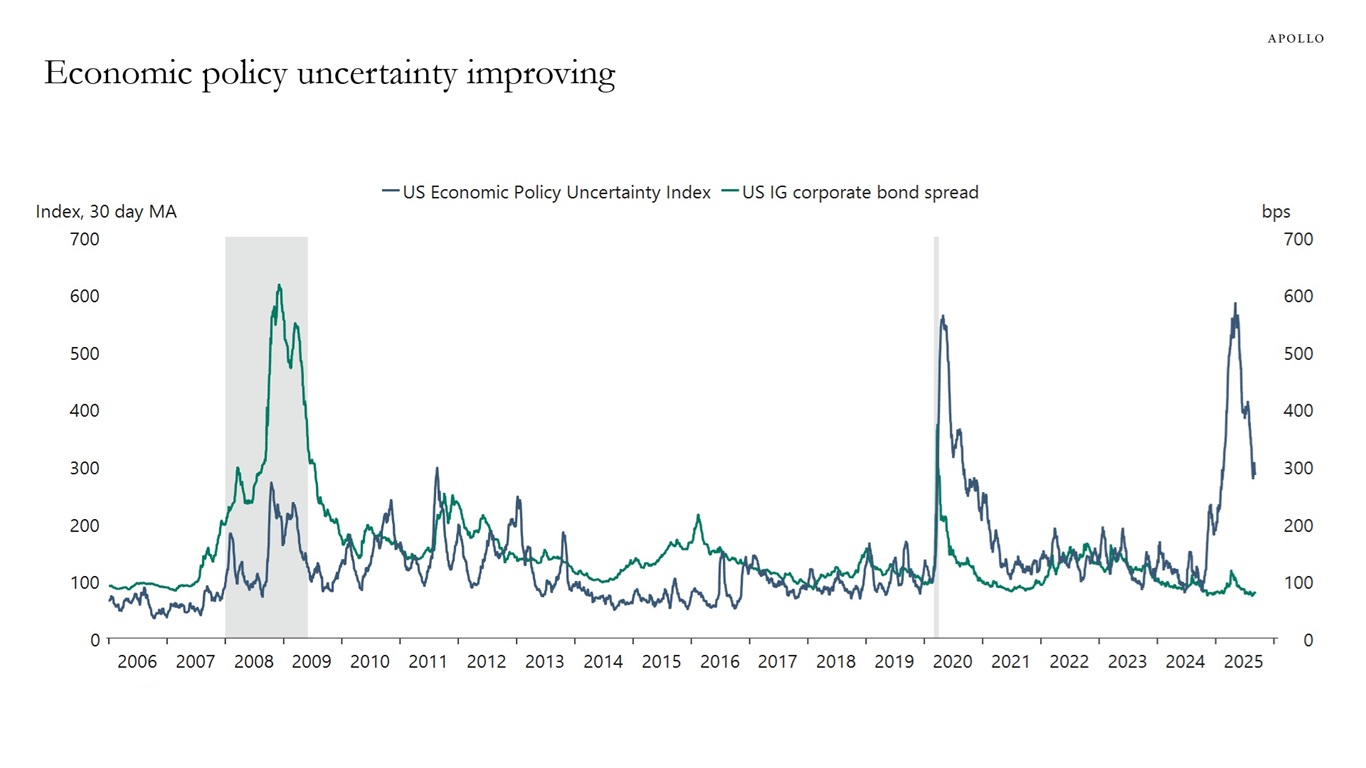

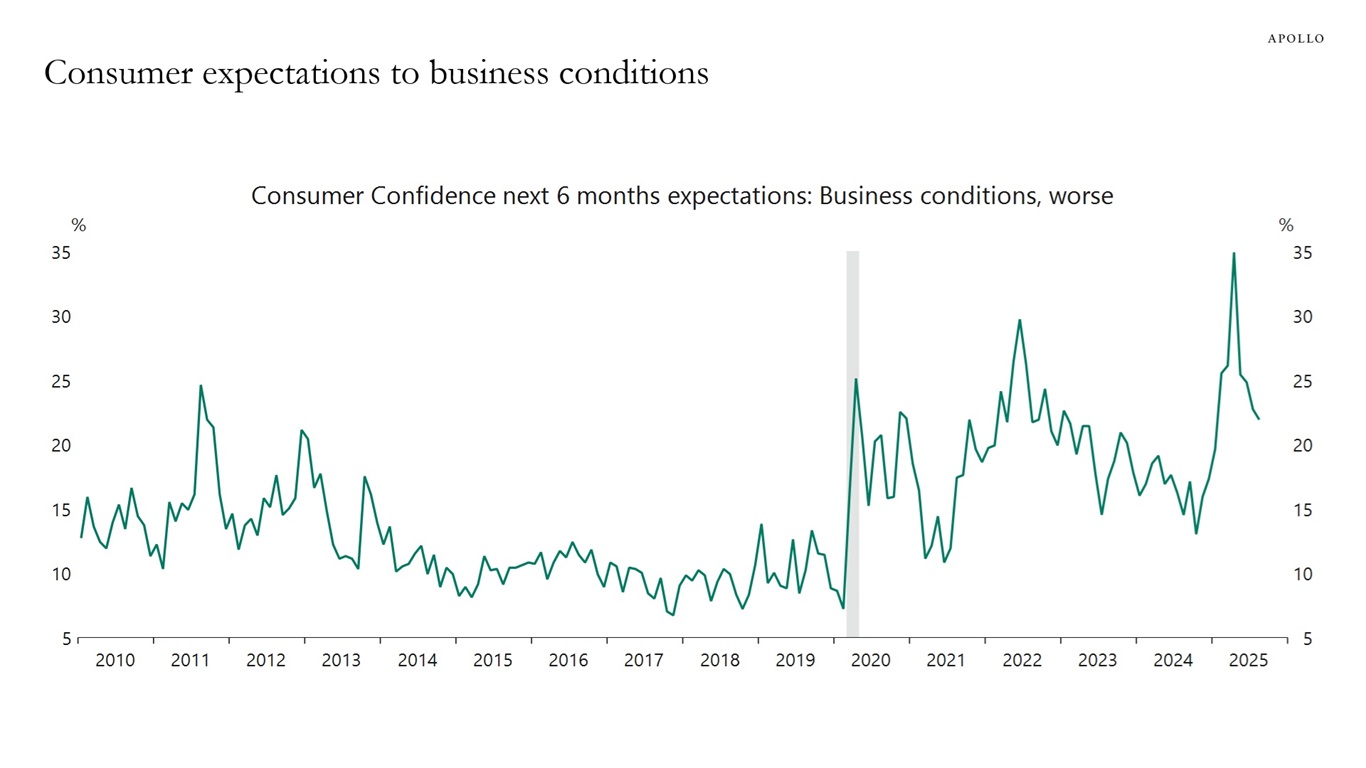

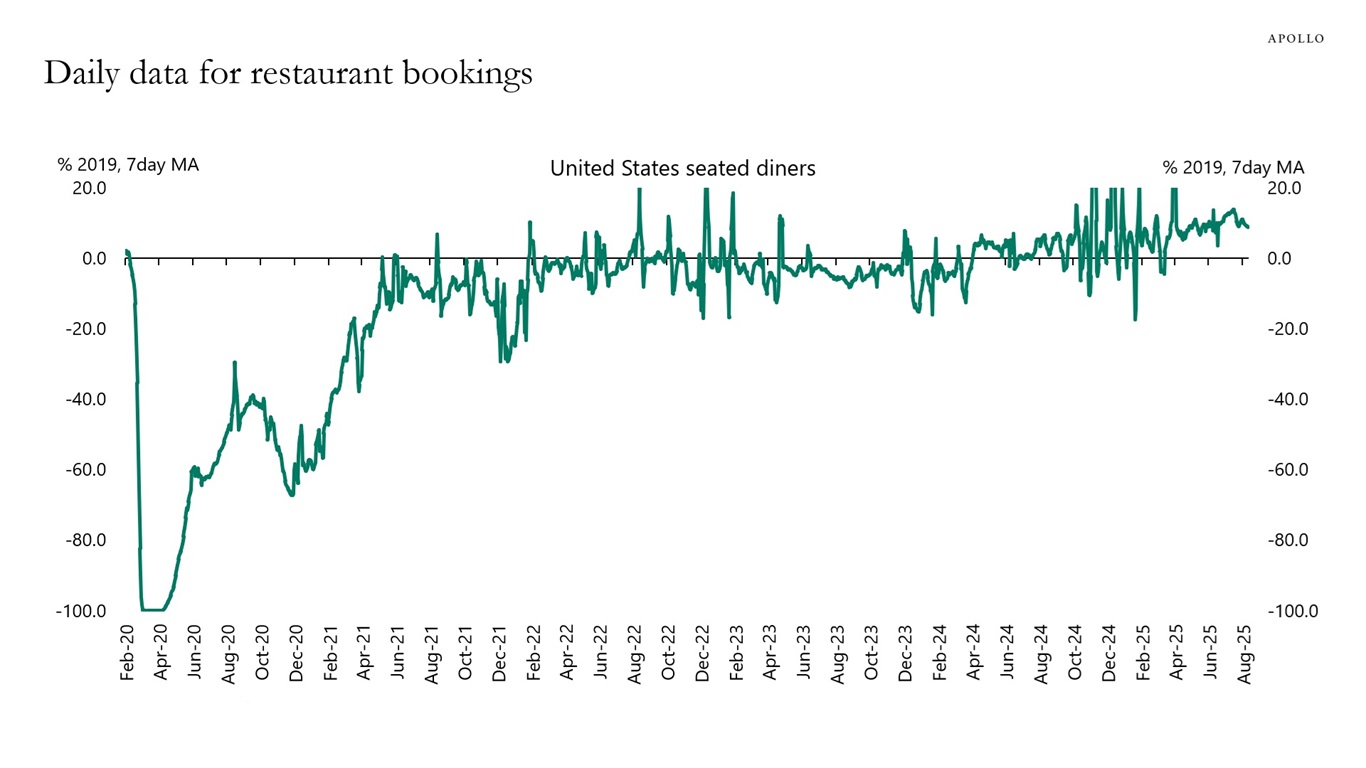

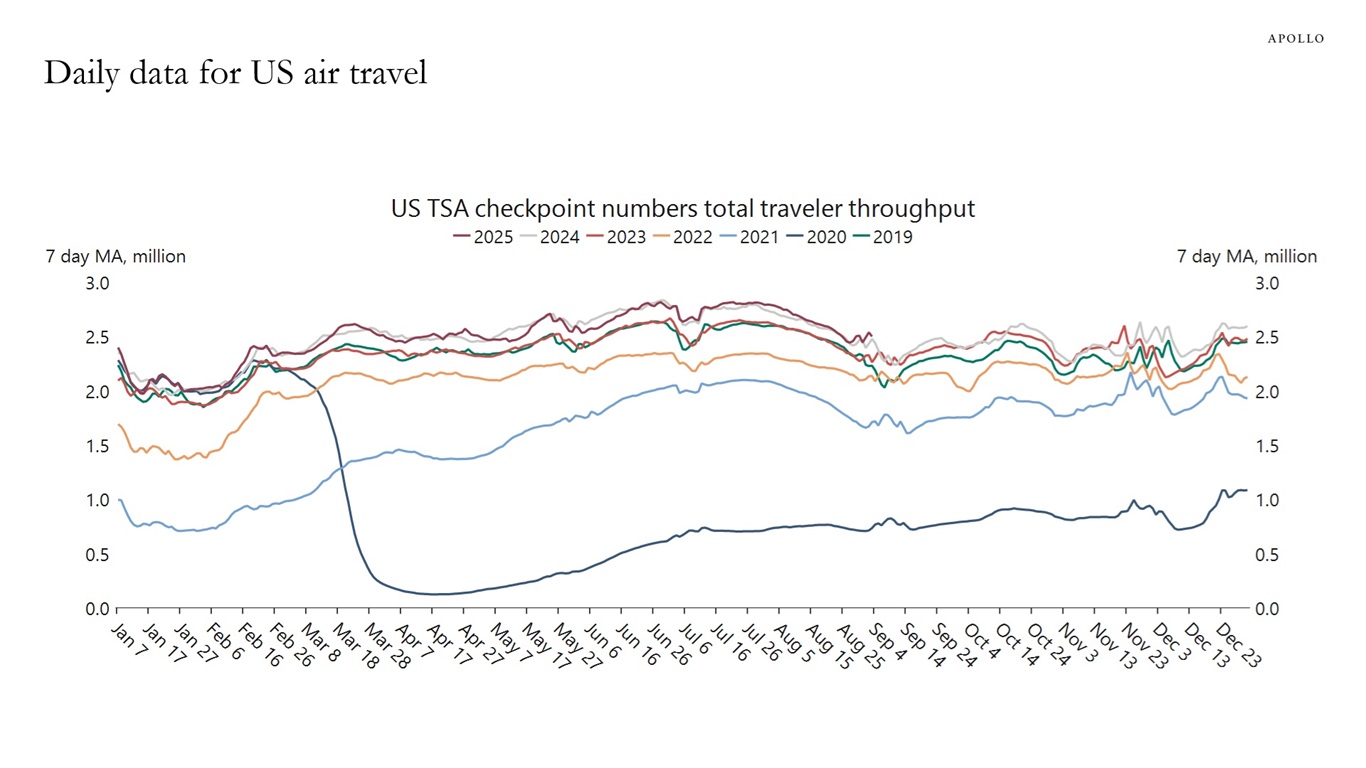

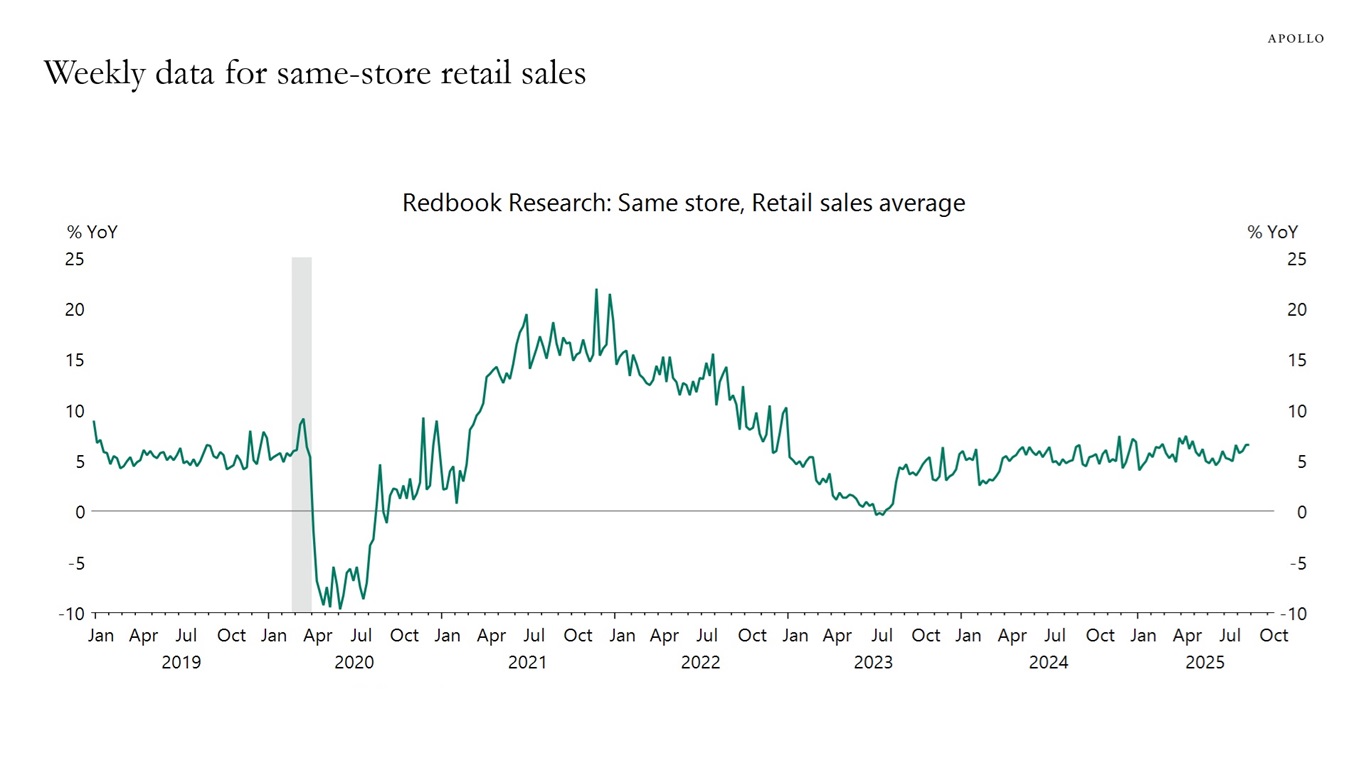

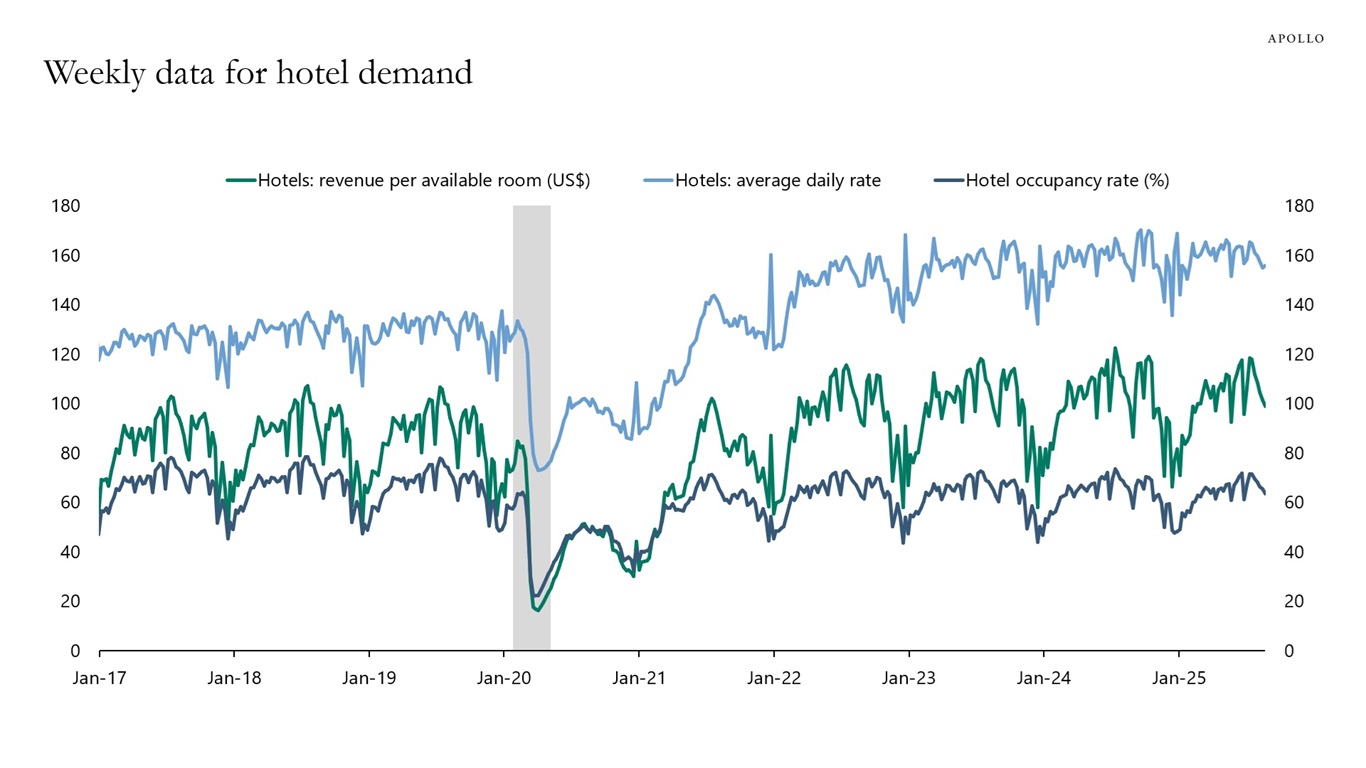

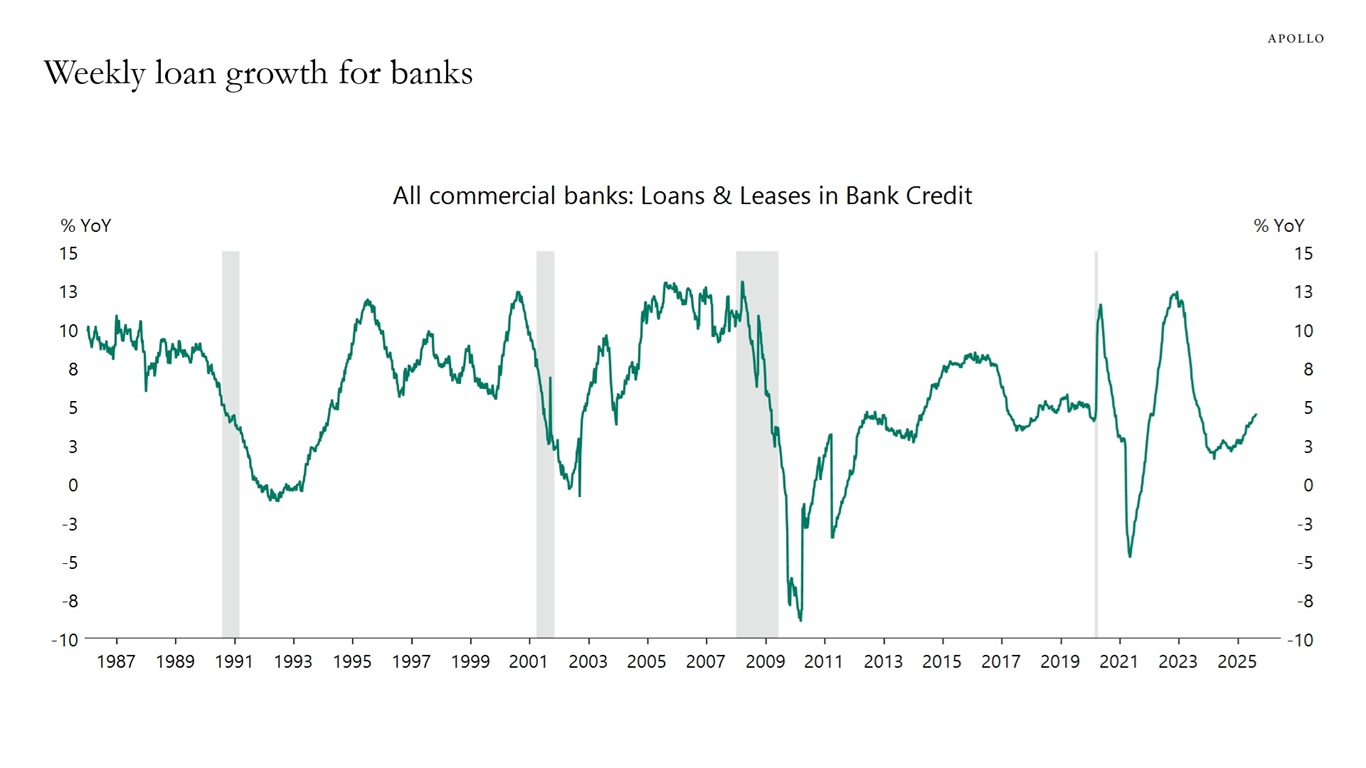

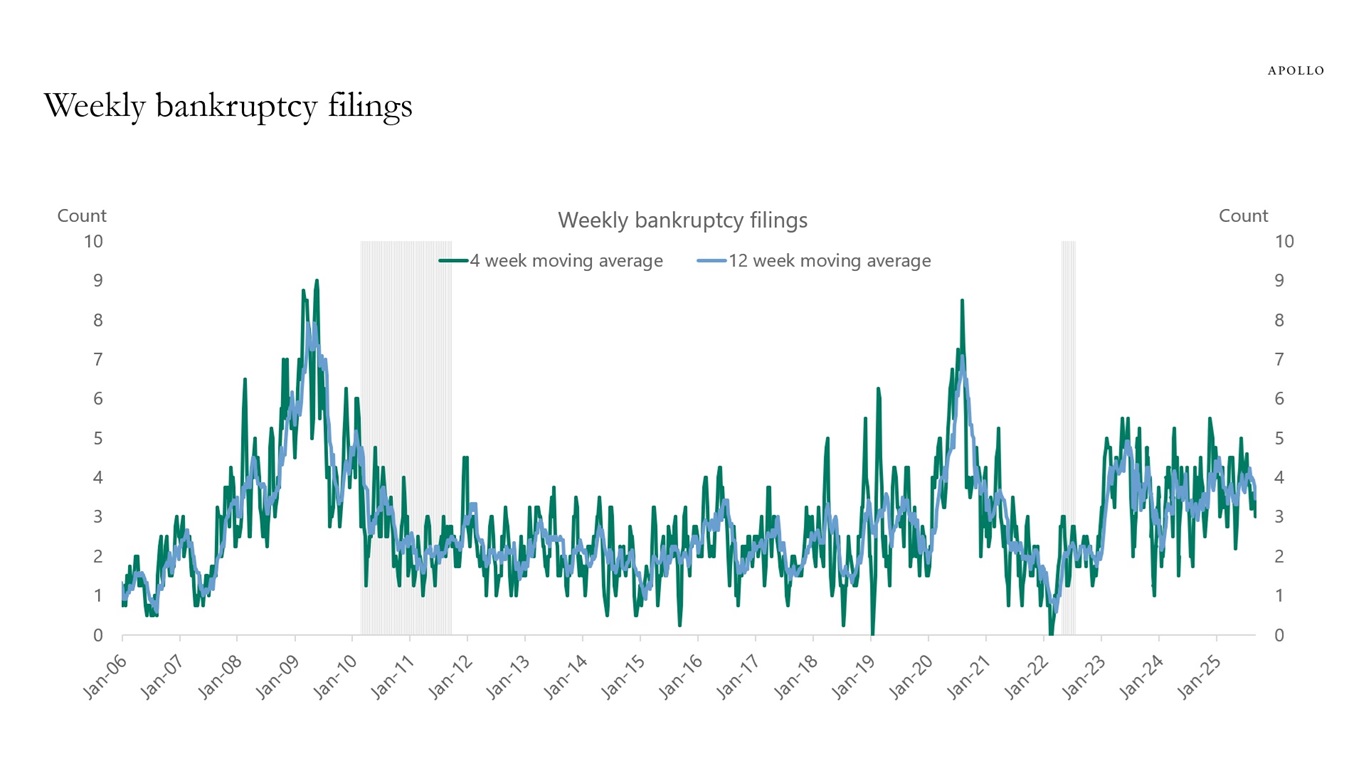

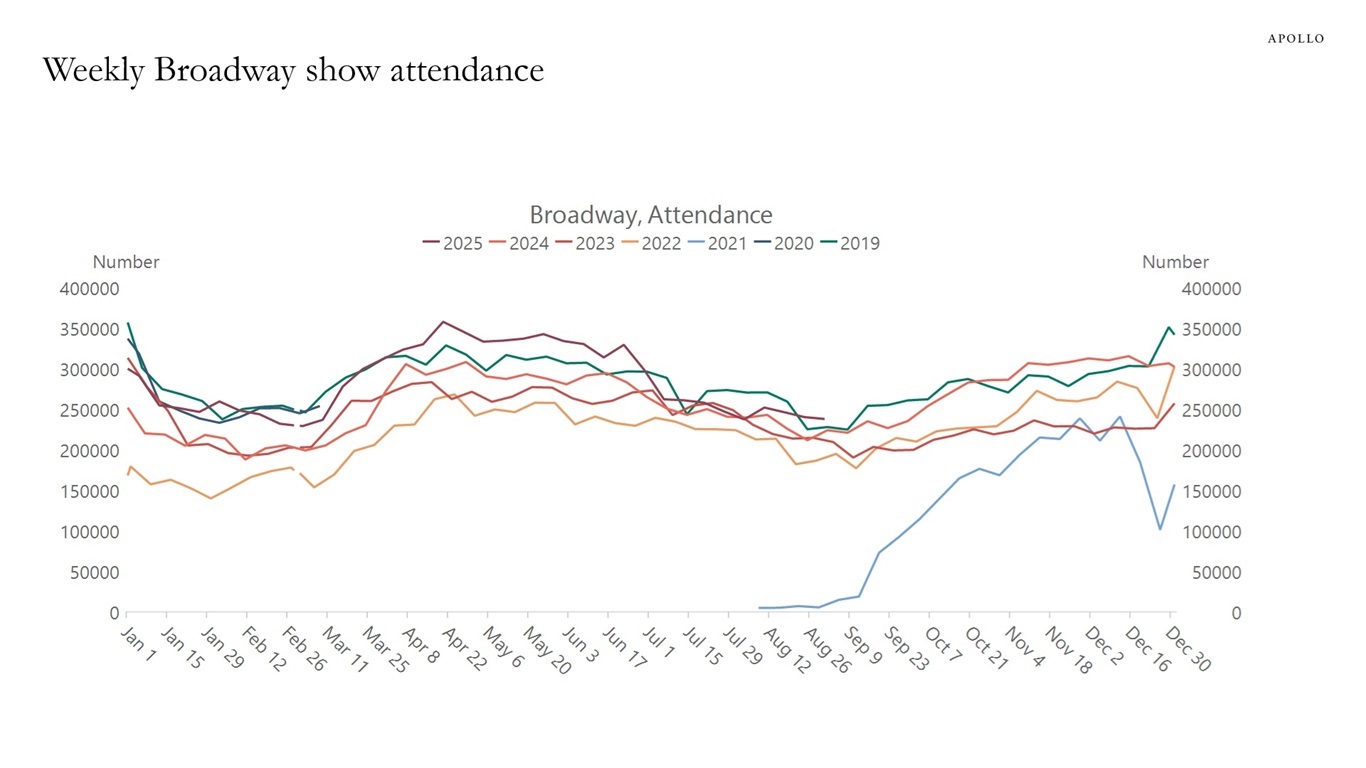

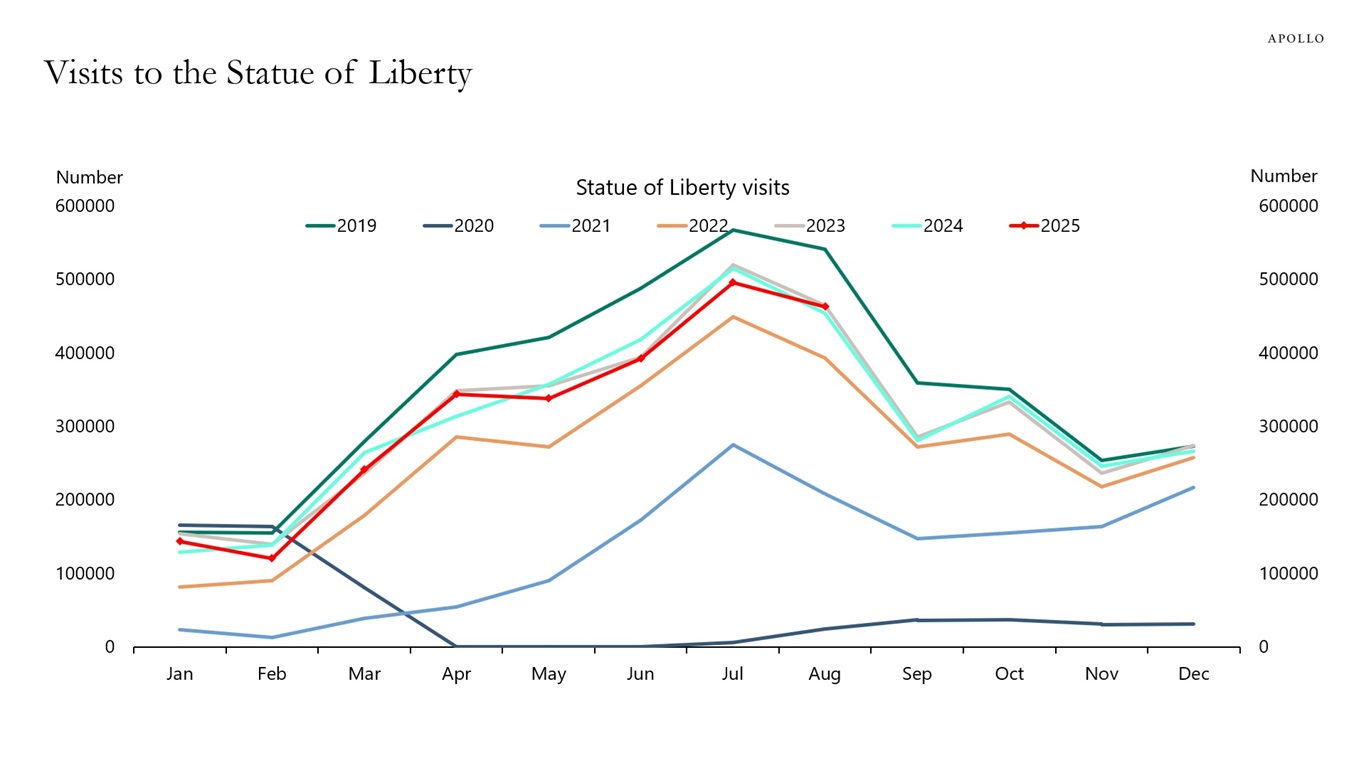

Daily and weekly data for the US economy shows that:

1) Trade policy uncertainty is returning to more normal levels

2) Economic policy uncertainty is returning to more normal levels

3) Restaurant bookings remain solid

4) US air travel remains robust

5) Las Vegas visitor volumes and total nights occupied remain solid

6) Same-store retail sales remain solid

7) Hotel bookings remain solid

8) Banks’ loan growth is increasing

9) Bankruptcy filings are stable

10) Broadway attendance and visits to the Statue of Liberty remain at normal levels

Maybe the reason the labor market is softening is because of lower immigration and not because of a slowdown in the broader economy?

Sources: Economic Policy Uncertainty, Macrobond, Apollo Chief Economist

Sources: Economic Policy Uncertainty, Macrobond, Apollo Chief Economist

Sources: Conference Board, Macrobond, Apollo Chief Economist

Sources: OpenTable, Apollo Chief Economist

Sources: US Department of Homeland Security, Macrobond, Apollo Chief Economist

Sources: Bloomberg, Macrobond, Apollo Chief Economist

Sources: Redbook Research Inc., Macrobond, Apollo Chief Economist

Sources: STR, Haver Analytics, Apollo Chief Economist

Sources: Federal Reserve, Macrobond, Apollo Chief Economist

Note: Filings are for companies with more than $50 mn in liabilities. For week ending on September 4th, 2025. Sources: Bloomberg, Apollo Chief Economist

Sources: The Broadway League, Macrobond, Apollo Chief Economist

Sources: irma.nps.gov, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

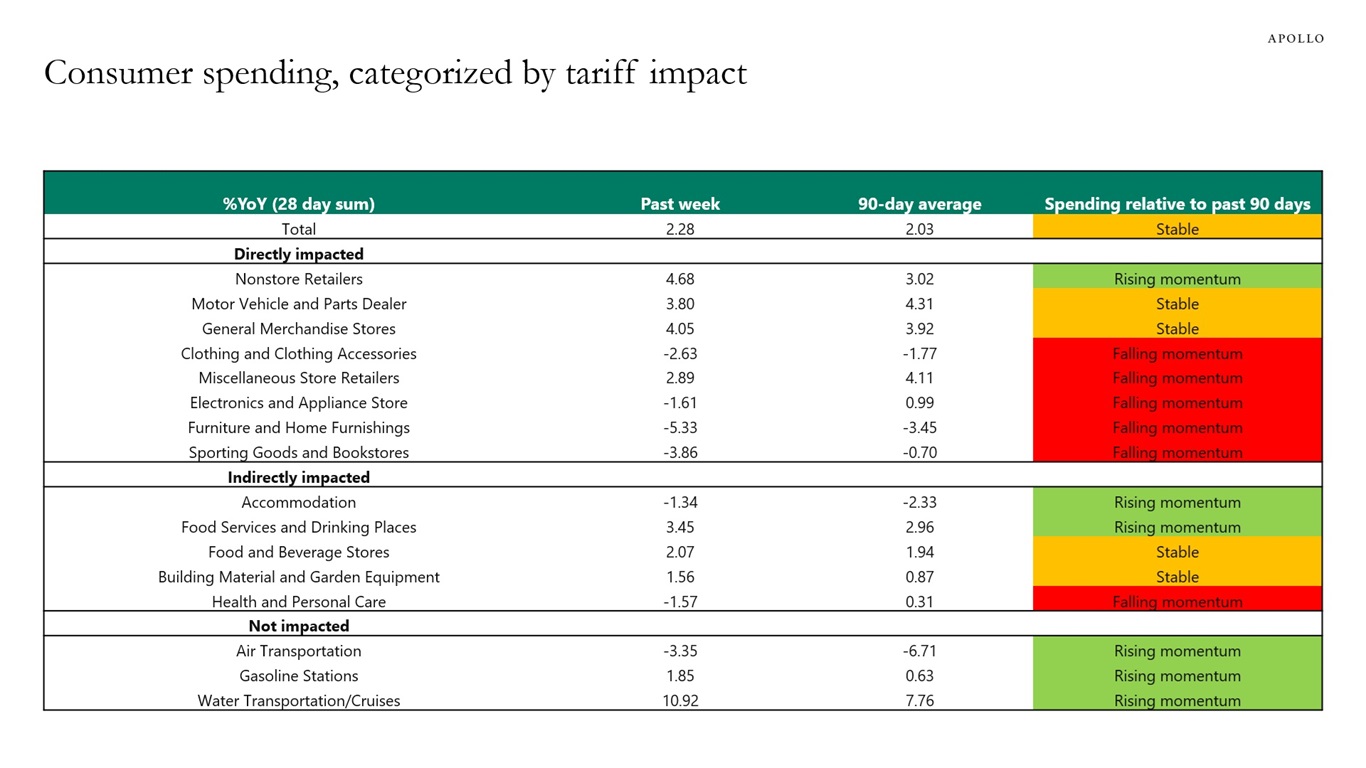

Daily data for consumer spending shows growth is slowing in discretionaries and on goods that are impacted by tariffs, see tables below.

Our chart book with daily data for consumer spending is available here.

Note: Stable is defined as growth falling between 0.5 to -0.5 standard deviation of the past 90 days, rising momentum is higher than 0.5 standard deviation and falling momentum is -0.5 standard deviation. Past week ends on 29th August 2025. Sources: US Bloomberg Consumer Spending, Apollo Chief Economist

Note: Stable is defined as growth falling between 0.5 to -0.5 standard deviation of the past 90 days, rising momentum is higher than 0.5 standard deviation and falling momentum is -0.5 standard deviation. Past week ends on 29th August 2025. Sources: US Bloomberg Consumer Spending, Apollo Chief Economist. See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.