Want it delivered daily to your inbox?

-

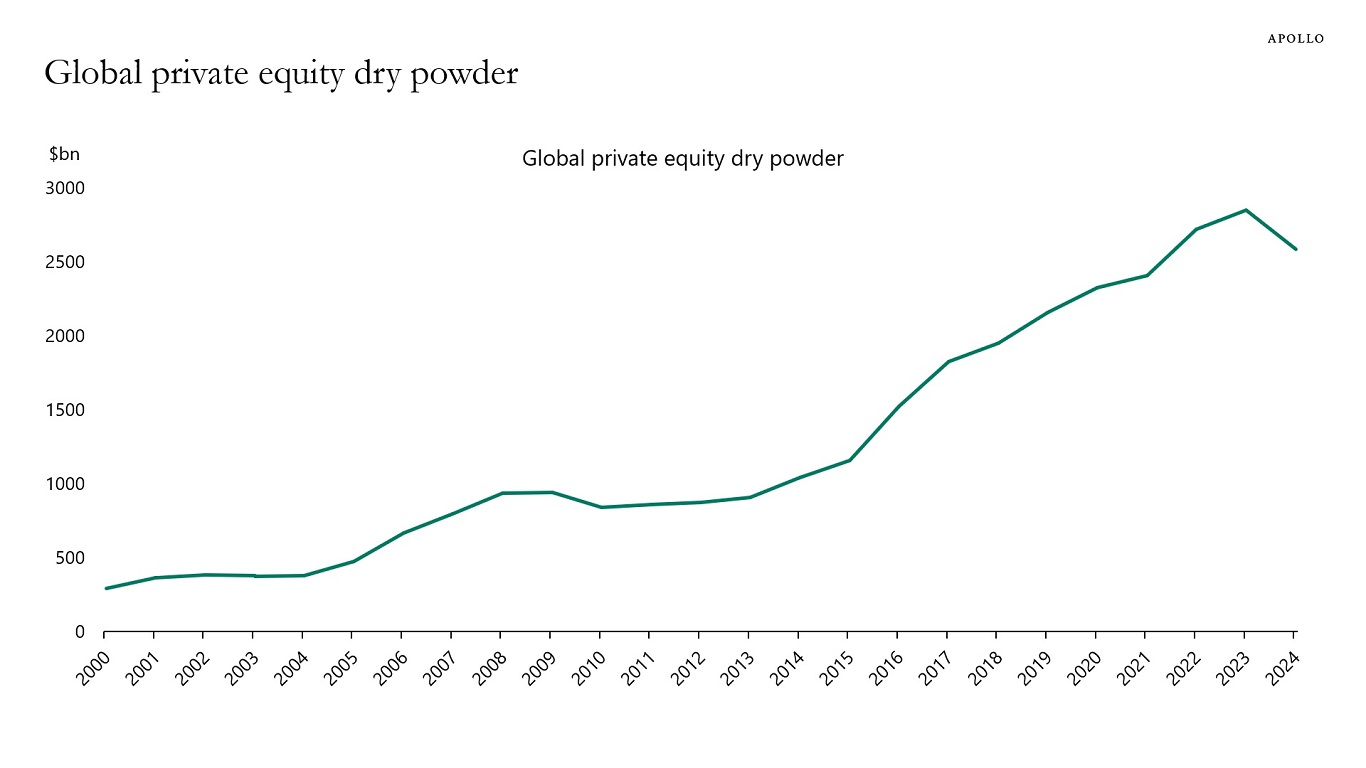

The amount of dry powder in global private equity has started to decline from the peak in 2023, see chart below.

Note: Data as of November 2024. Source: Preqin, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

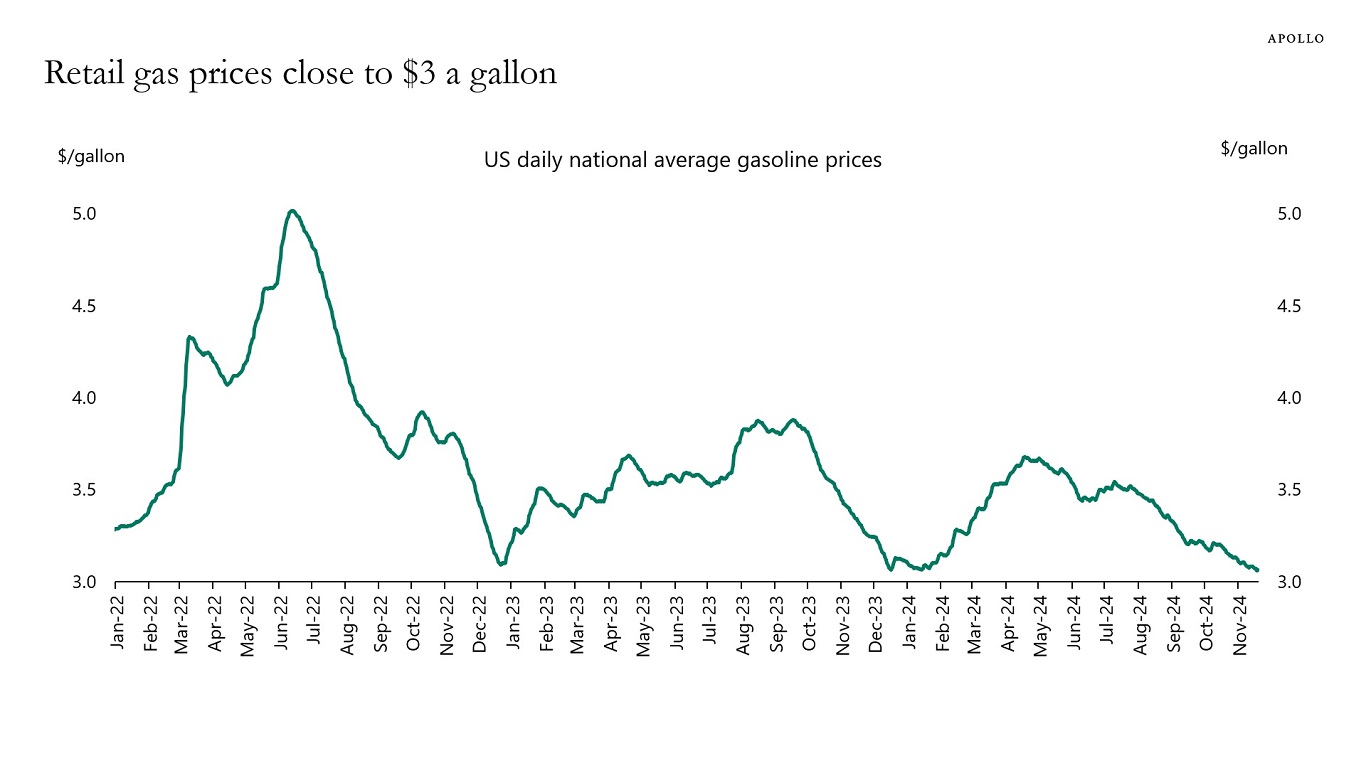

Gas prices at the pump continue to decline, which is another tailwind to consumer spending, see chart below. The decline in oil prices is driven by significant supply and production in the US and lower growth in China.

Source: AMA, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

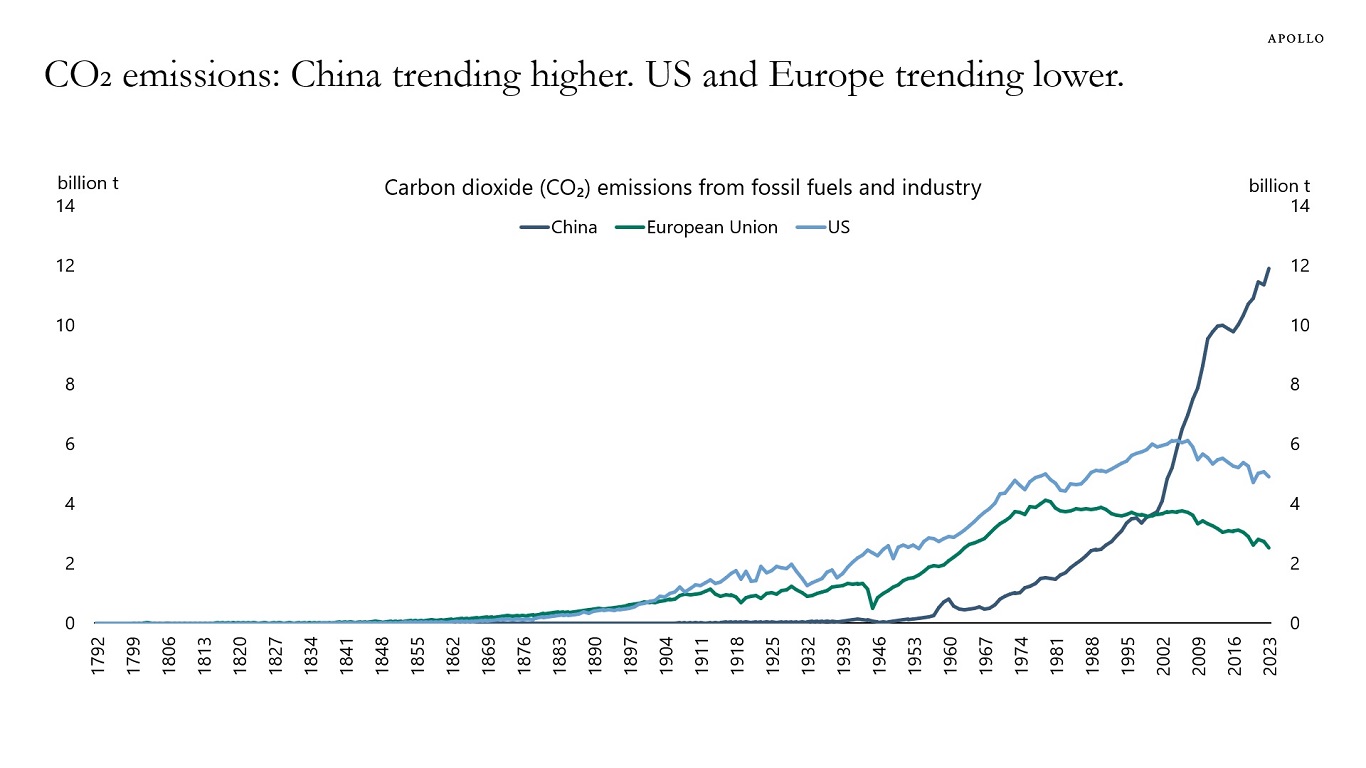

Total CO2 emissions from fossil fuels and industry in China are more than double the CO2 emissions in the US, see chart below, and six times bigger than CO2 emissions in Europe.

Note: t = metric tons. Source: OurWorldinData.org, Global Carbon Budget (2024), Apollo Chief Economist See important disclaimers at the bottom of the page.

-

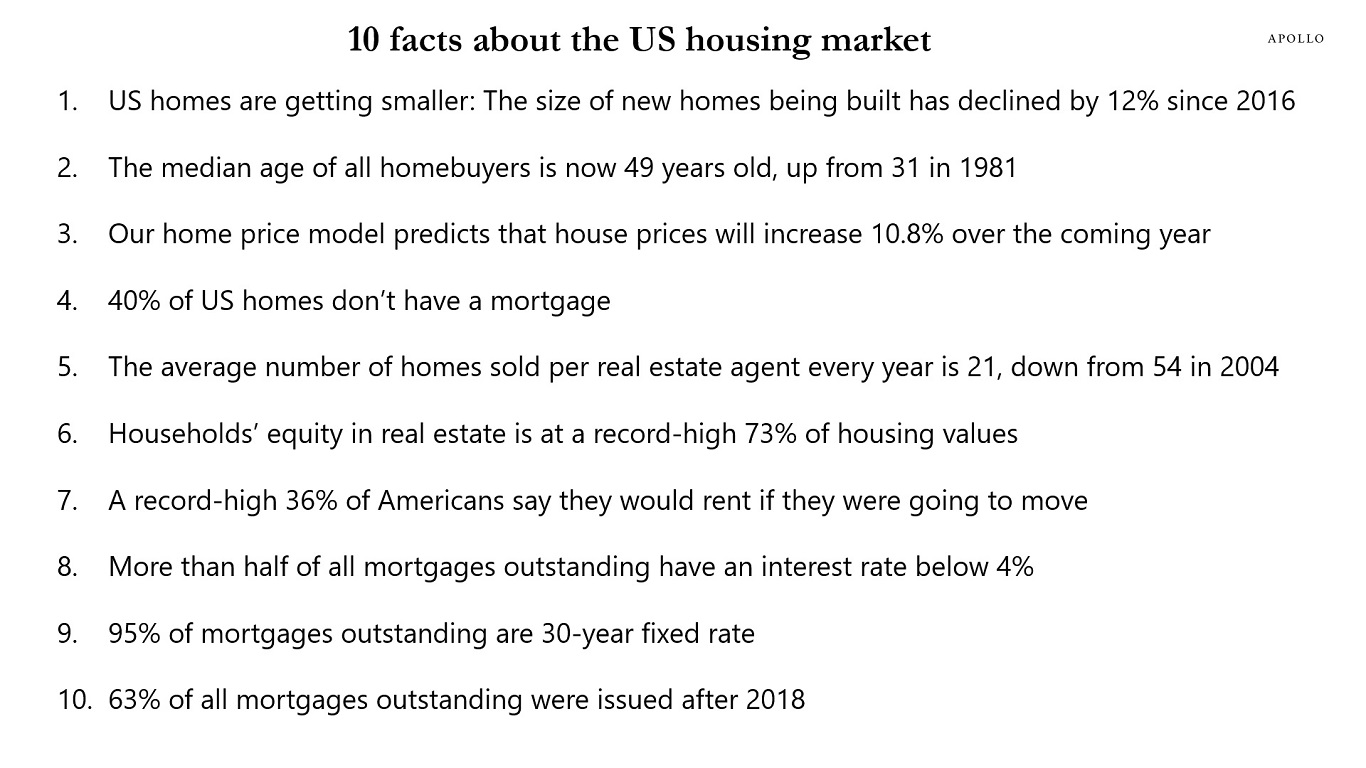

Our latest housing outlook is available here. Higher mortgage rates are weighing on demand, but the inventory of homes for sale remains very low, and housing demand is supported by solid wage growth, high stock prices, and high cash flows to owners of fixed income, including private credit.

Source: Apollo Chief Economist See important disclaimers at the bottom of the page.

-

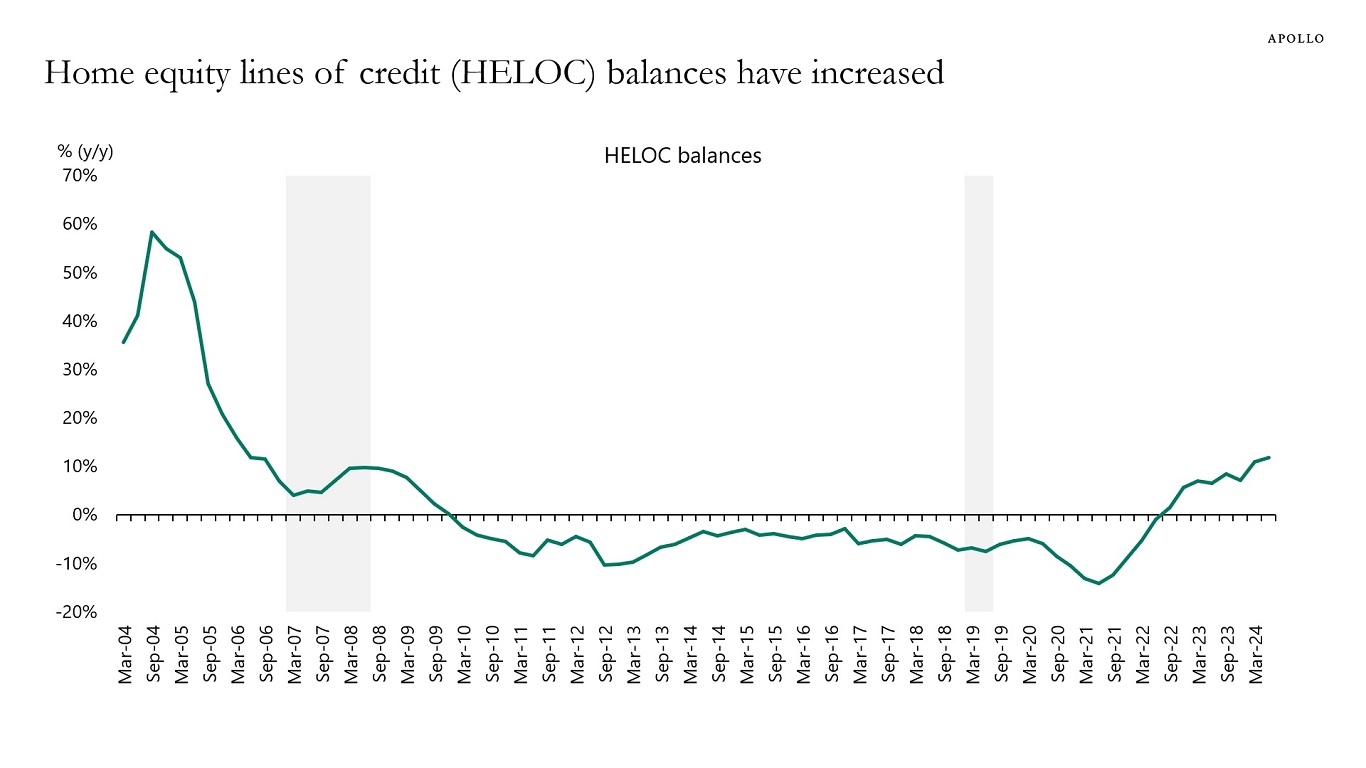

As home prices continue to rise, more and more households are taking out HELOCs to finance consumer spending, see chart below.

In other words, homeowners are liquifying their home price gains and using the proceeds for consumption.

Combined with low jobless claims, strong wage growth, high stock prices, and solid cash flows from fixed income, including private credit, the US consumer continues to do well.

Source: New York Fed Consumer Credit Panel/Equifax, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

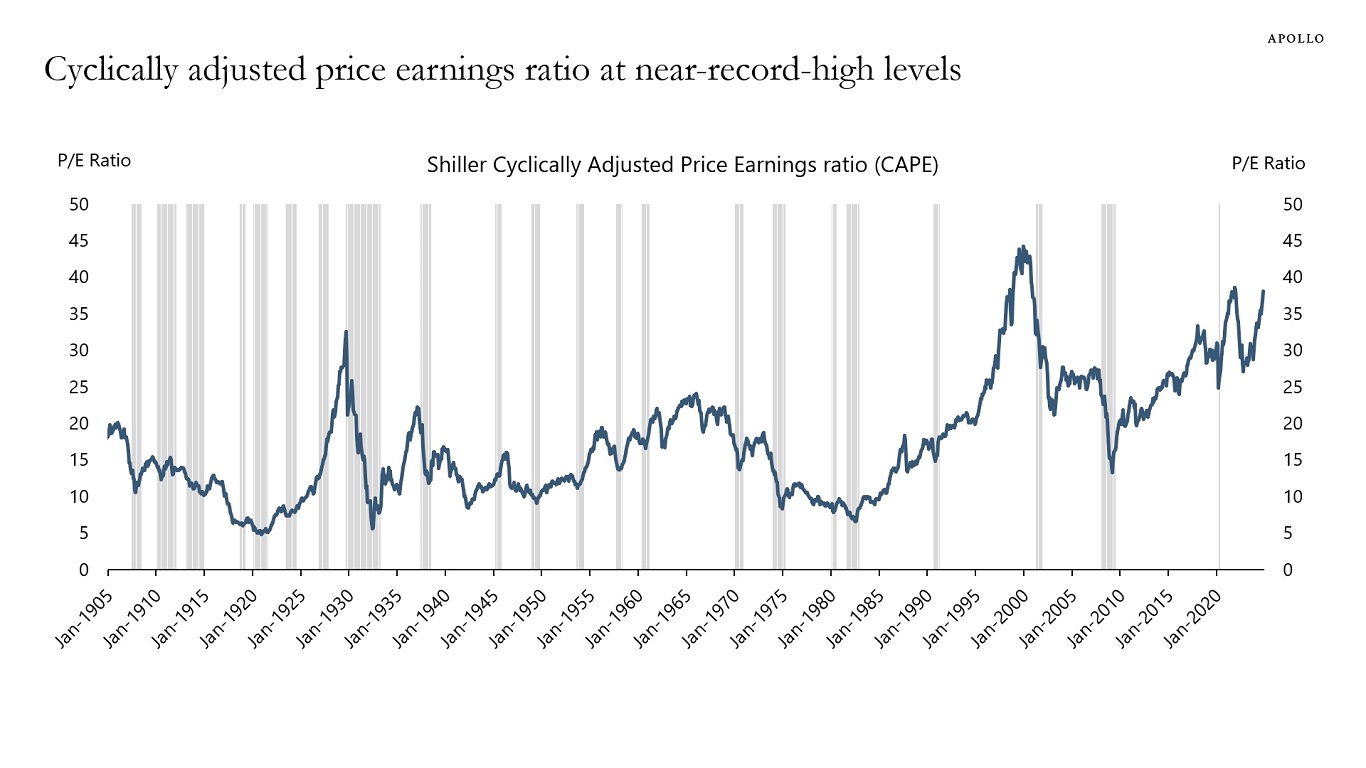

When growth is strong, corporate earnings are high. When growth is weak, corporate earnings are low. This makes it difficult to find out if companies are cheap or expensive.

One way to analyze if stocks are cheap or expensive is to remove the business cycle by taking the 10-year average of earnings, and doing so shows that stocks are very expensive at the moment.

Specifically, the cyclically adjusted price earnings ratio at 38 is near all-time highs, significantly above its long-term average at 17, see chart below.

Source: Robert J. Shiller, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

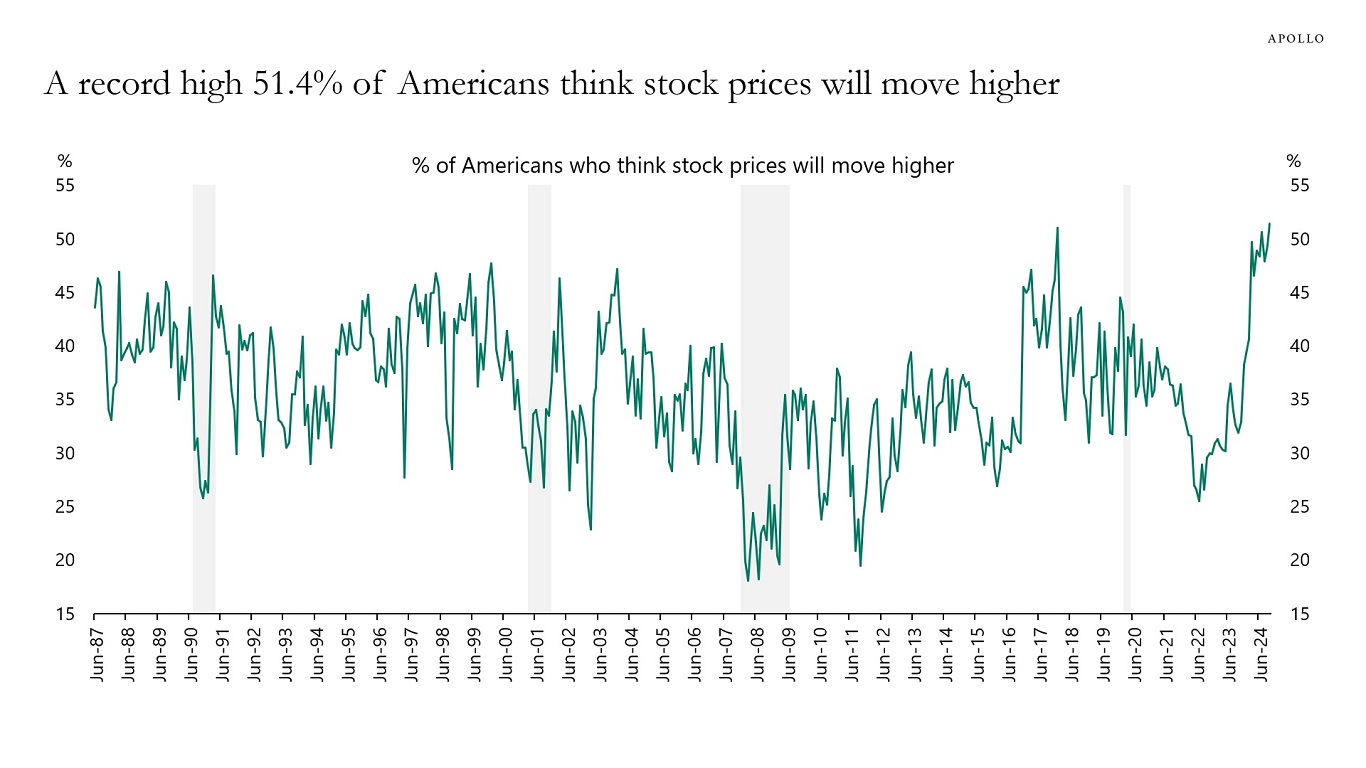

The Conference Board asks US households about their outlook for the stock market, and a record high of 51.4% say that stock prices will move higher, see chart below.

Our chart book with daily and weekly indicators for the US economy is available here.

Source: Conference Board, Haver Analytics, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

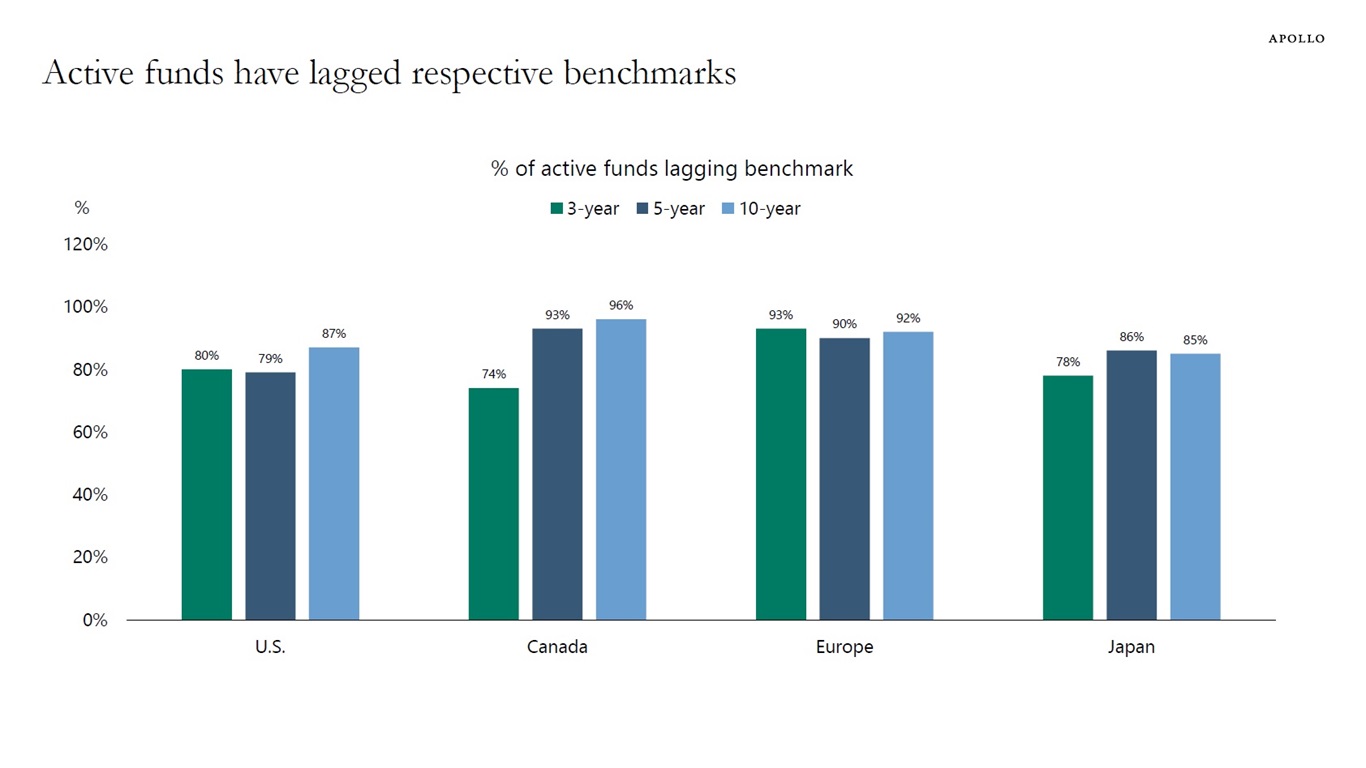

The rise of passive investing has had a significant impact on financial markets in the last three decades, especially on its contribution to higher asset-price volatility, reduced liquidity, and possible contribution to heightened market concentration. By analyzing the substantial shift of assets from active to passive strategies—particularly through the growth of ETFs and retirement-savings plans, such as a 401(k)—this paper illustrates how passive investors, who primarily track major indices, have contributed to reduced price elasticity and market responsiveness, which, in turn, have led to amplified price movements, decreased liquidity, potential macroeconomic inefficiencies, and a disproportionate concentration of market influence in a few dominant stocks, such as the Magnificent Seven.

Source: Morningstar, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

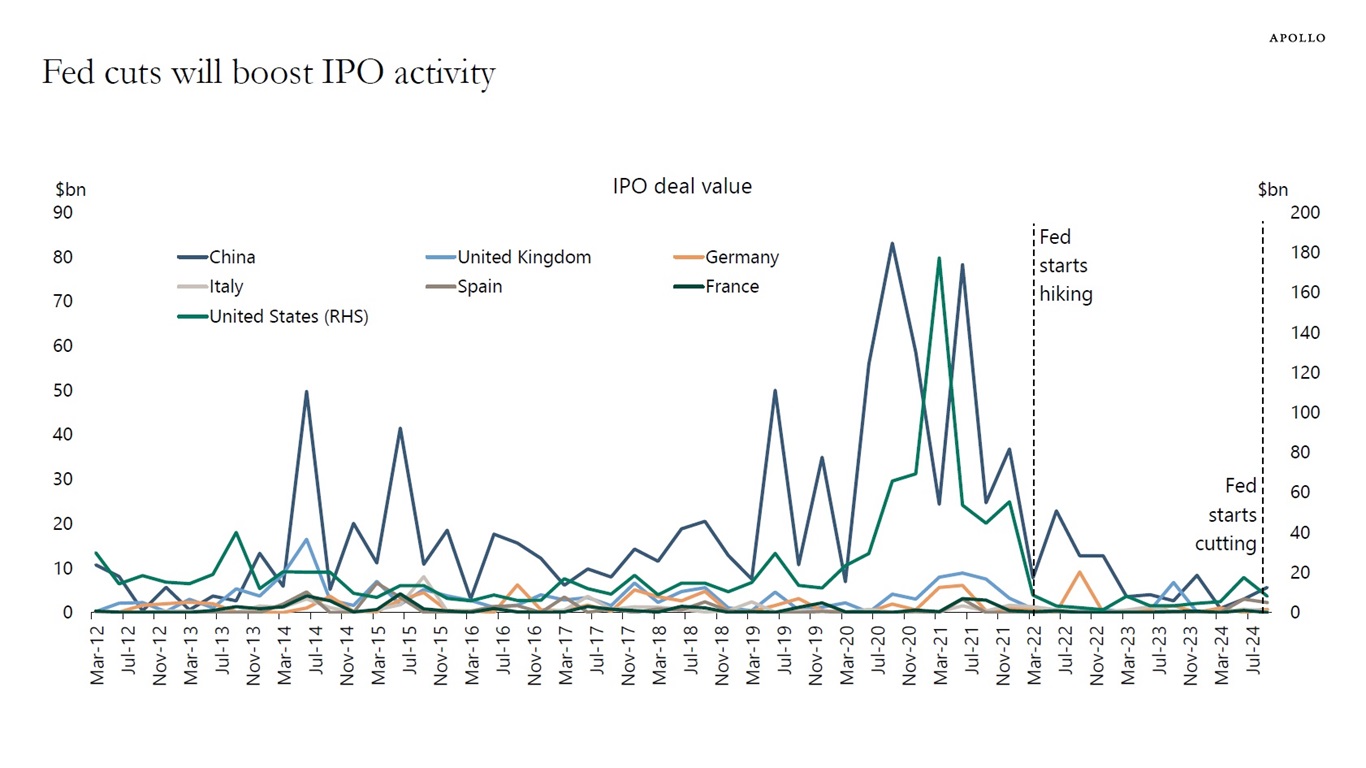

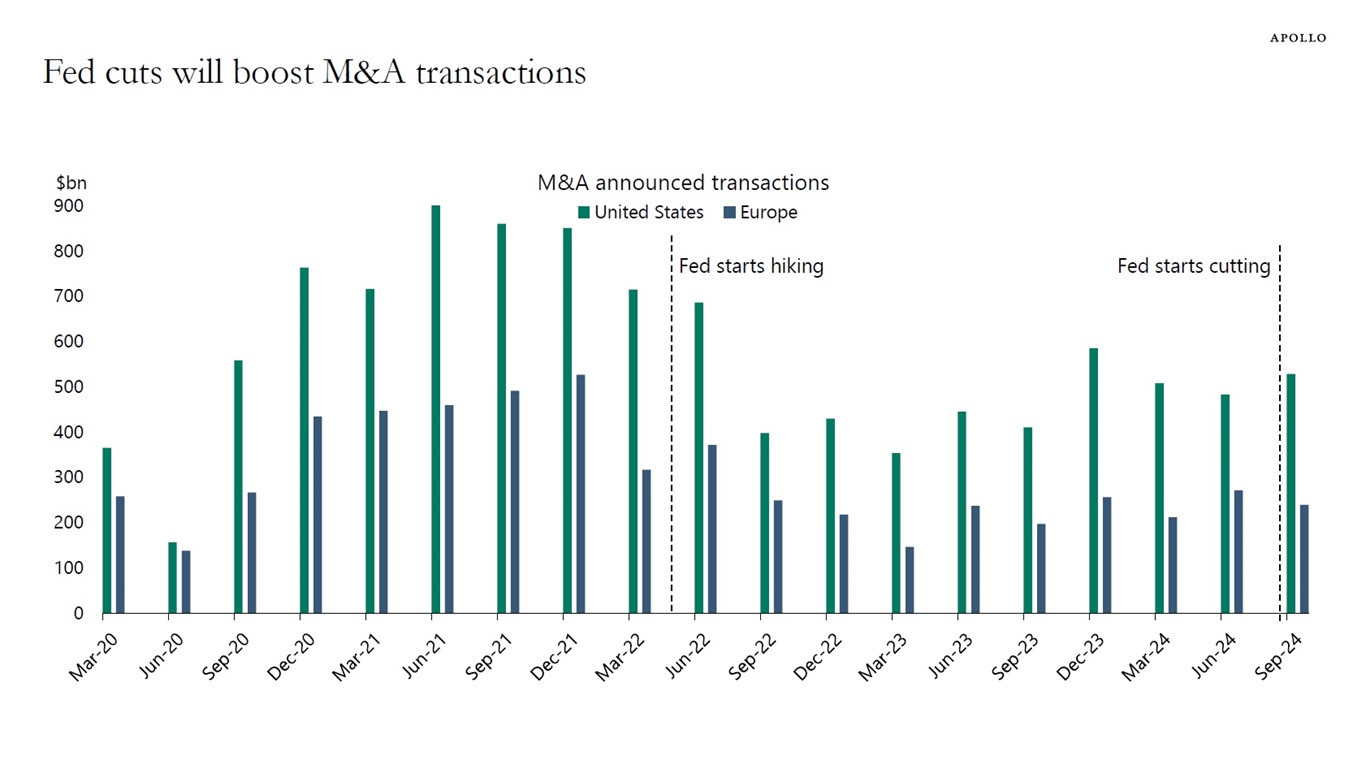

Fed cuts, tight credit spreads, and higher animal spirits will boost M&A and IPO activity over the coming quarters, see charts below.

Note: IPO as of announced date. Source: Bloomberg, Apollo Chief Economist

Note: M&A announced transactions, US/Europe, is the daily sum of mergers, acquisitions, divestitures, self-tenders and spin-offs announced involving either a US/Europe target or acquirer. Source: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

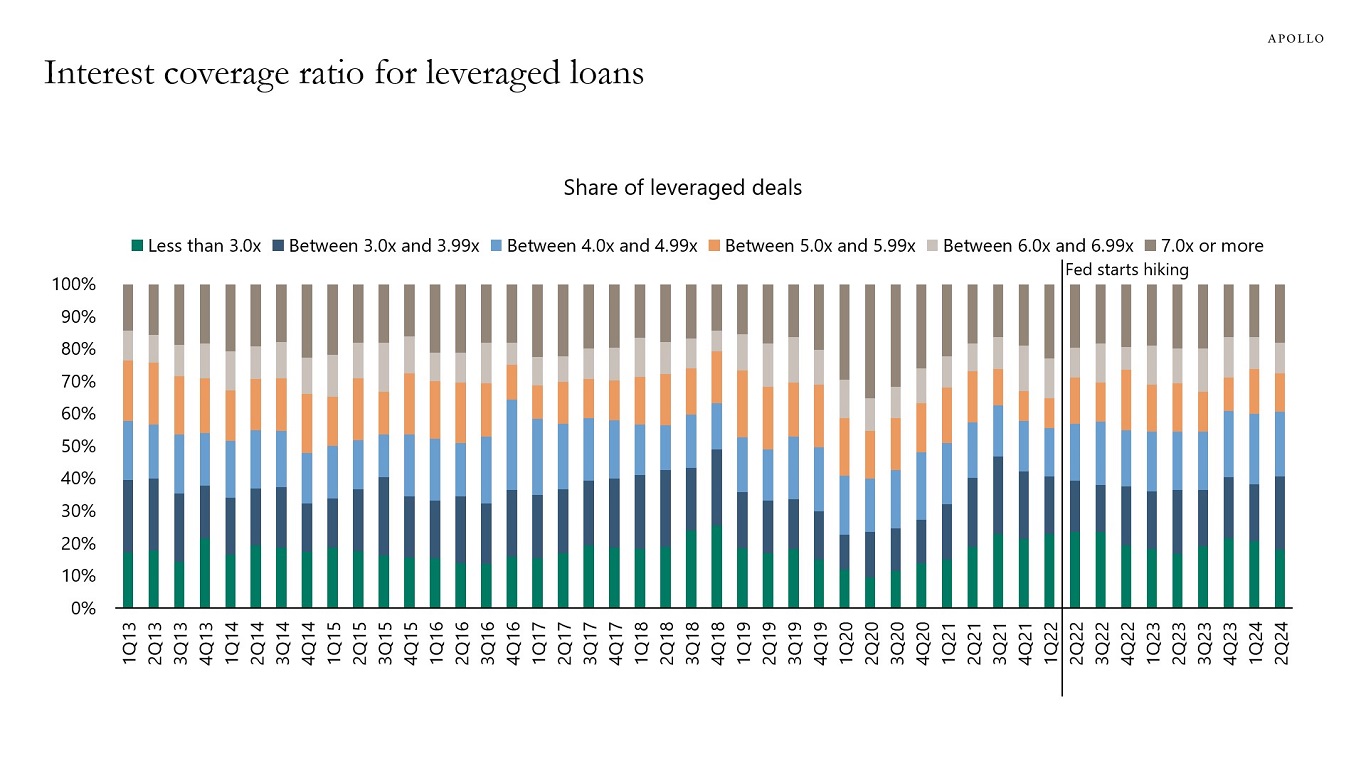

The distribution of interest coverage ratios for leveraged loan deals has remained remarkably stable during the Fed hiking cycle, see chart below. For more discussion, see here.

Source: PitchBook LCD, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.