Want it delivered daily to your inbox?

-

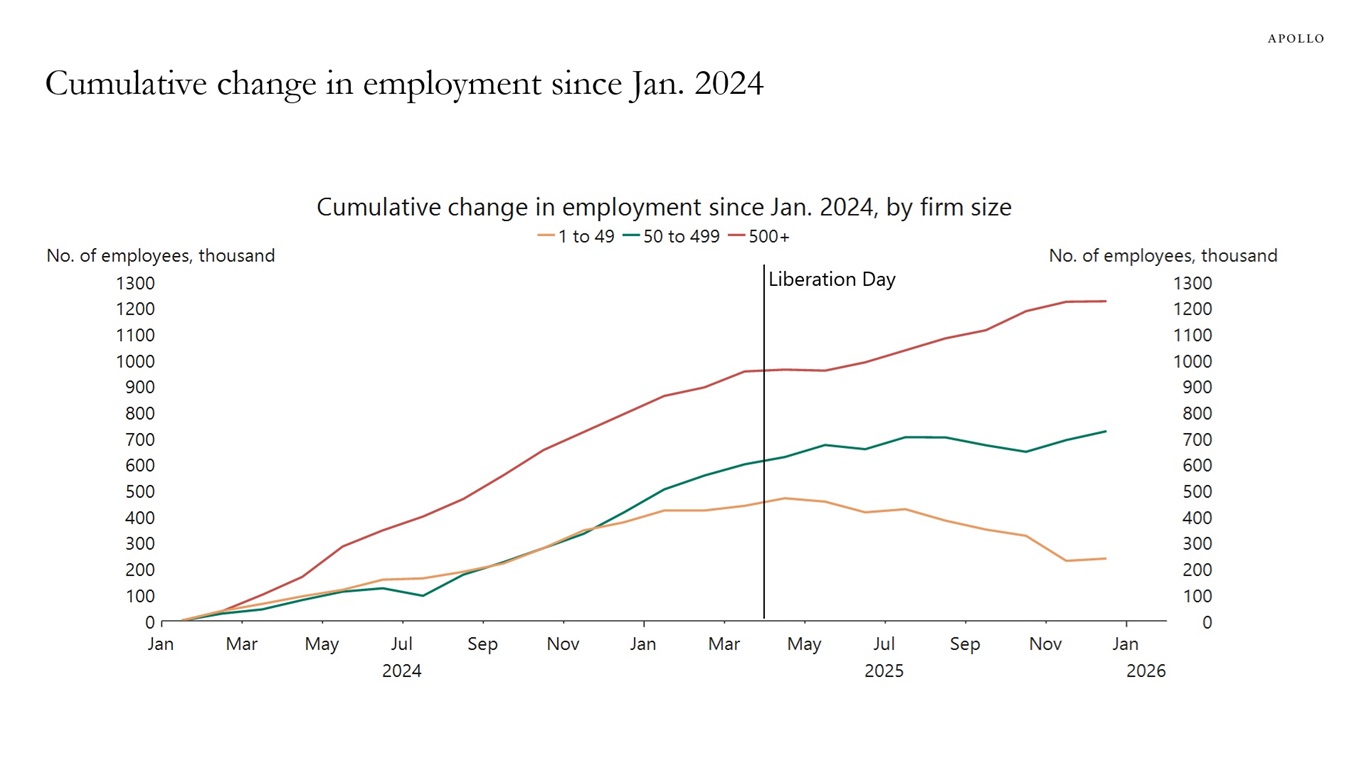

Employment growth in large companies is outpacing job growth in smaller companies.

The source of the underperformance of small businesses could be AI or it could be the trade war.

Sources: Automatic Data Processing, Inc. (ADP), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

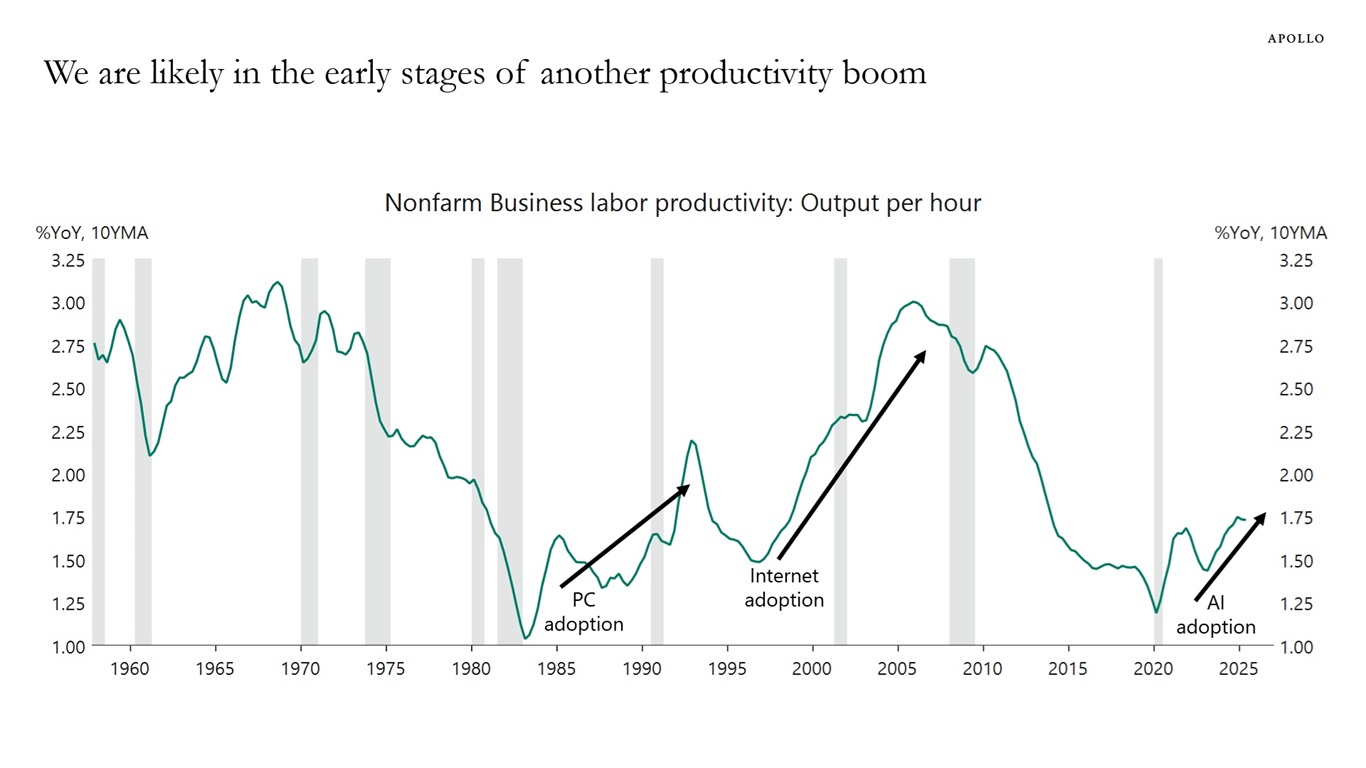

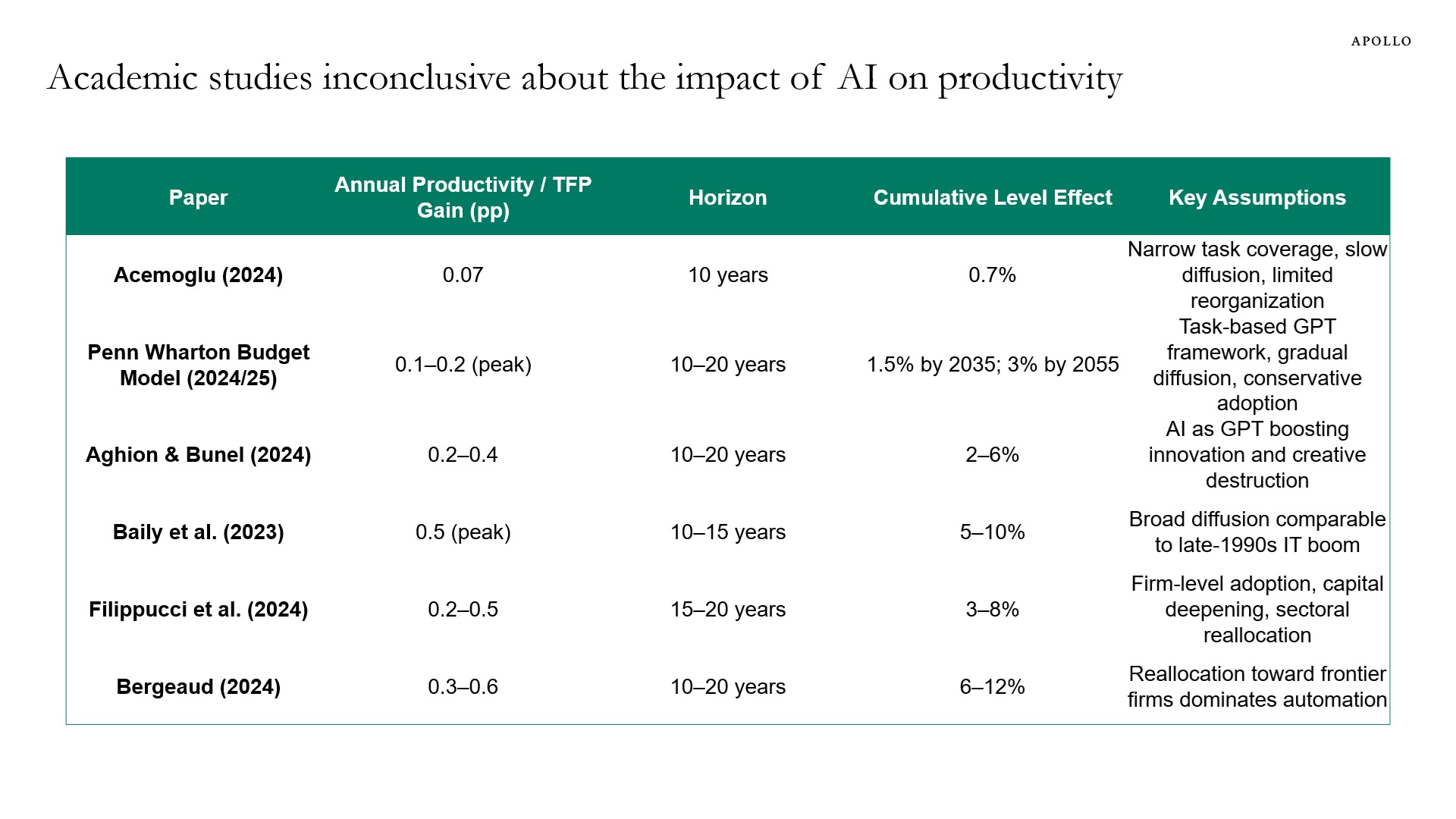

Academic papers are inconclusive about the impact of AI on productivity, but we believe we are in the early stages of a boom in labor productivity, see charts below and our chart book (available here). While there are questions about the magnitude of the impact at the macro level, it is clear that there are already significant sector impacts including in DevOps software, robotic process automation and content management systems.

Sources: US Bureau of Labor Statistics (BLS), Macrobond, Apollo Chief Economist

Source: Apollo Chief Economist See important disclaimers at the bottom of the page.

-

This chart book looks at demand and supply in the Treasury market, including recent developments in Treasury auction metrics. There are 10 conclusions:

1. For every $5 the government collects in taxes, a dollar goes to paying interest on debt.

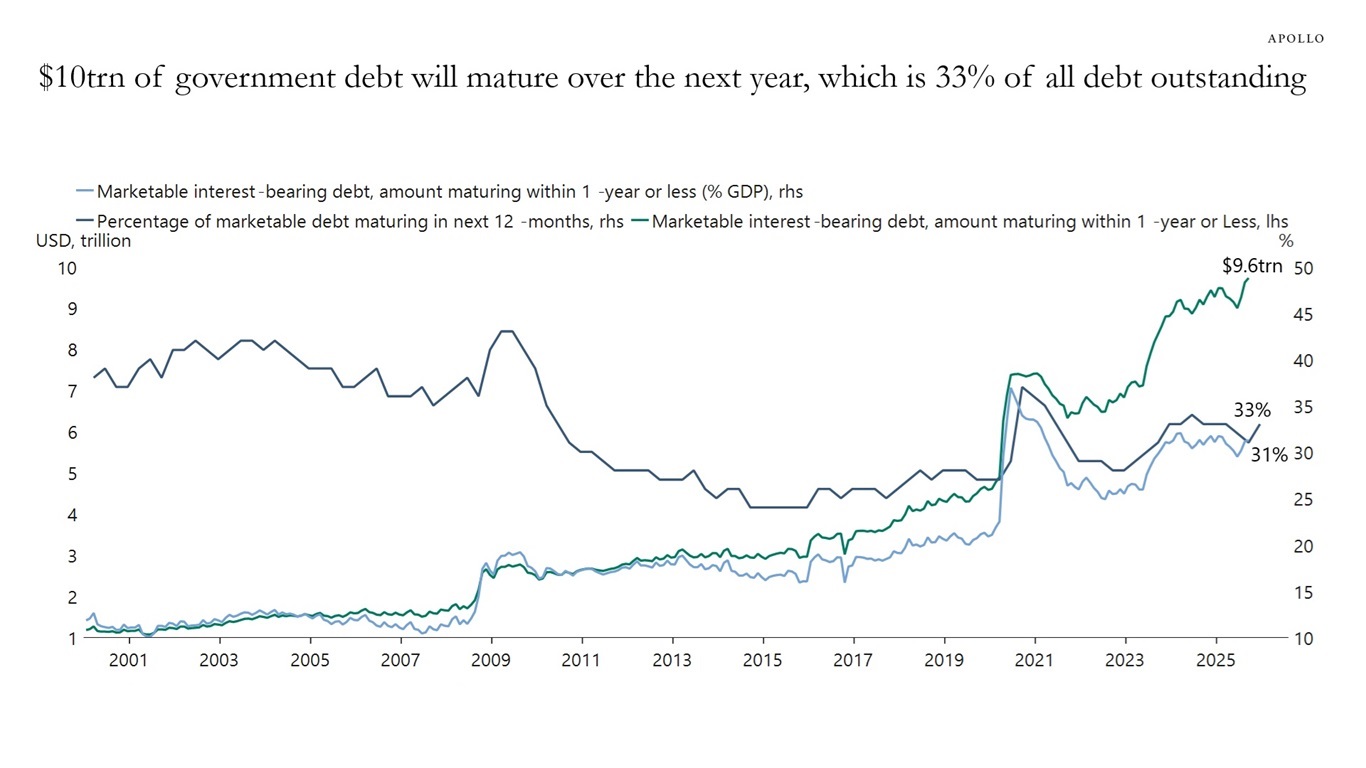

2. $10 trillion of government debt will mature over the next year, which is 33% of all debt outstanding.

3. The share of T-bills outstanding has increased to 22%, and 85% of Treasury gross issuance is T-bills.

4. The average federal net interest expense per day, including weekends, is now $3.5 billion.

5. Foreign ownership of Treasuries has declined to 25% of the total outstanding, down from 33% a decade ago.

6. Japan has been increasing its holdings of Treasuries while China has been lowering its holdings.

7. In Treasury auctions, tails and stop-through have been small and relatively balanced, implying that there is still solid demand across the curve.

8. Treasury auction metrics show that indirect bidding, often a proxy for foreign central bank demand, has been declining over the past year, particularly for notes.

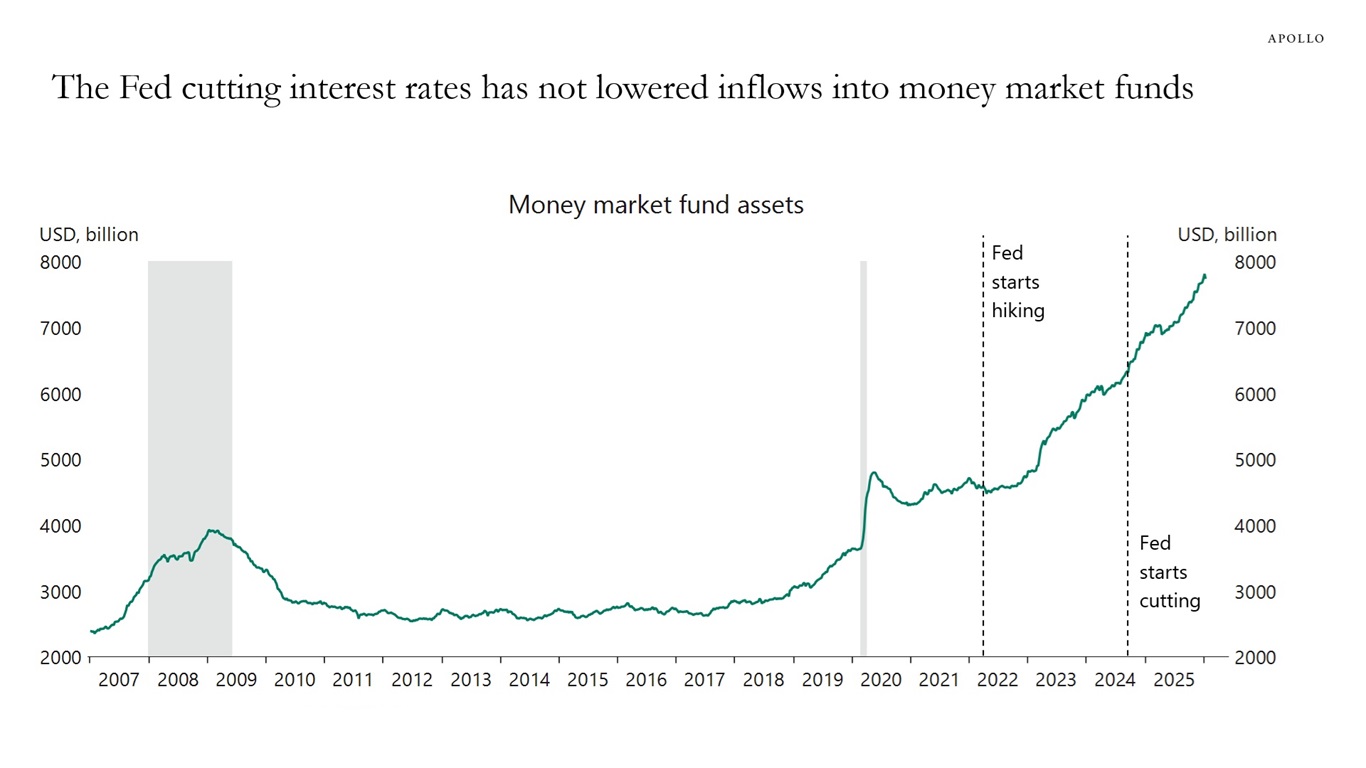

9. The Fed cutting interest rates has not lowered inflows into money market funds, implying that “money on the sidelines” is not as interest rate sensitive as many people think.

10. 89% of US government debt is fixed rate, and 22% of debt outstanding is in bills.

Sources: US Department of Treasury, Macrobond, Apollo Chief Economist

Sources: Investment Company Institute (ICI), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

We have updated our chart book with daily and weekly indicators, and the latest data shows that:

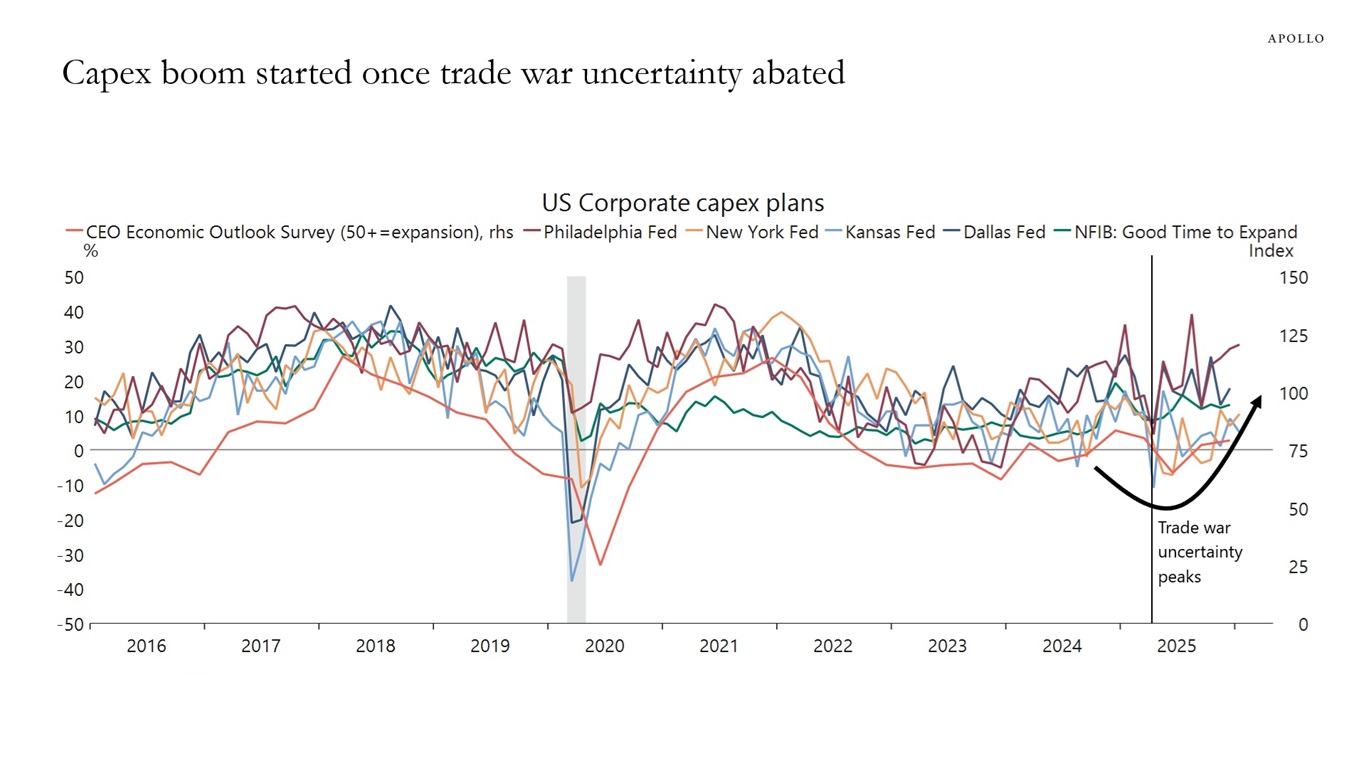

1. There is a capex boom underway, and corporate capex plans are moving higher driven by the One Big Beautiful Bill.

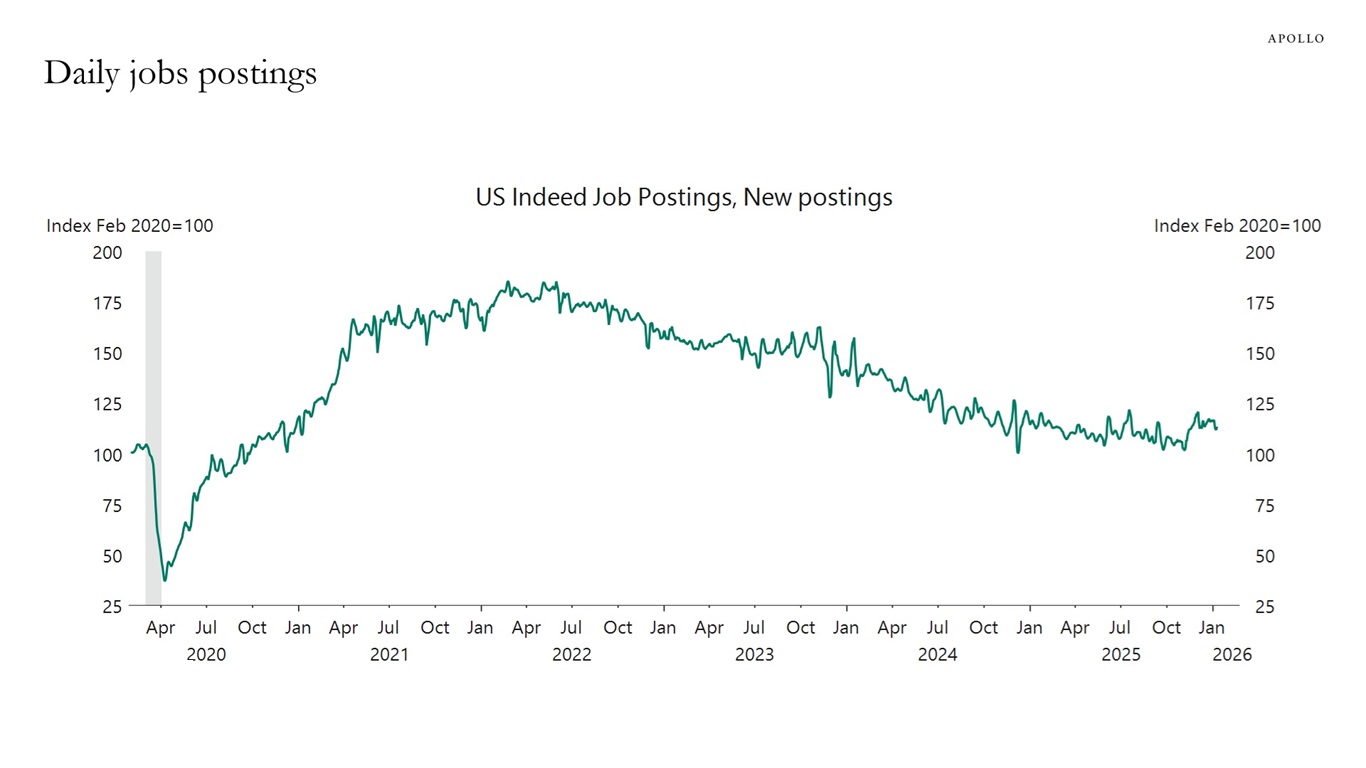

2. Daily data for job postings are rising.

3. Withheld income taxes are at higher levels than normal in January.

4. Weekly data for Broadway show attendance is also at higher levels than normally seen in January.

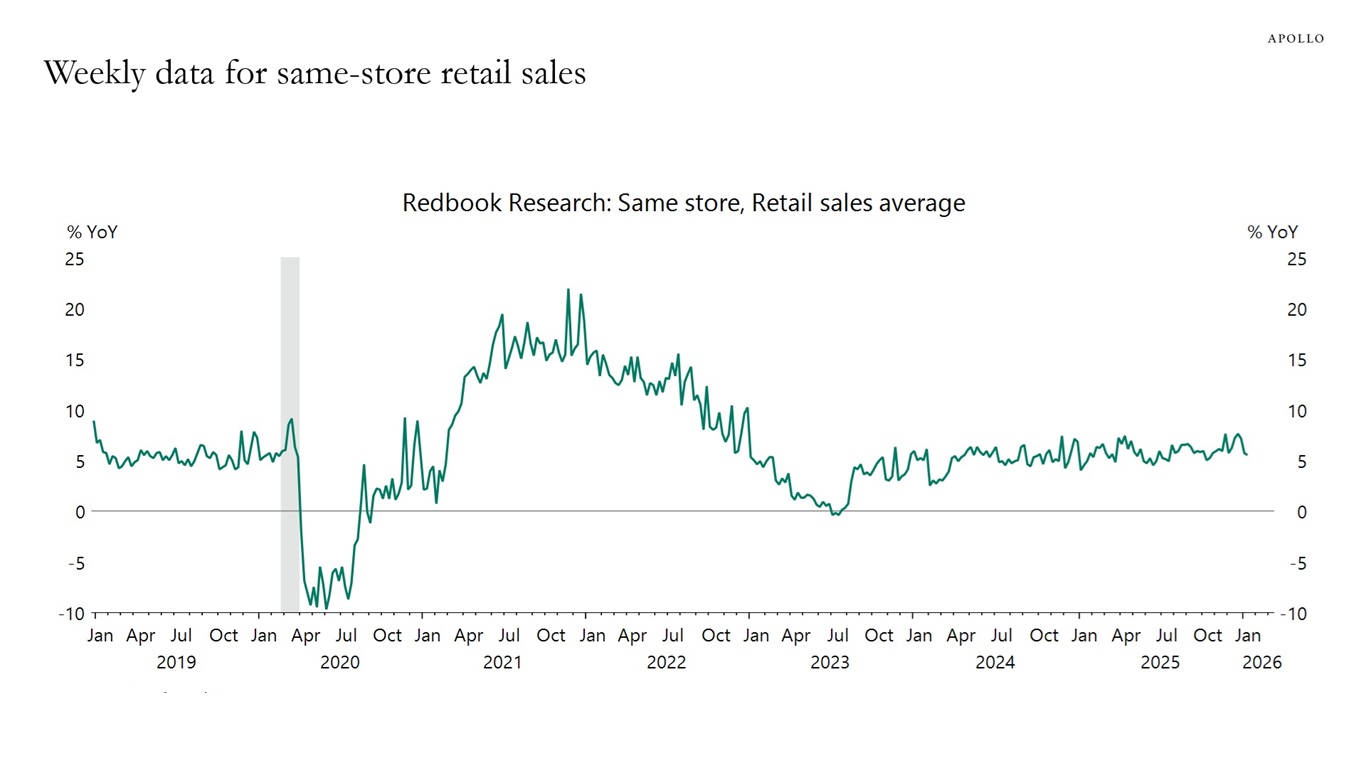

5. Weekly data for Redbook same-store retail sales continue to show solid growth in consumer spending.

The bottom line is that the US economy continues to perform well.

Sources: National Federation of Independent Business, Federal Reserve Bank of Dallas, Federal Reserve Bank of Kansas City, Federal Reserve Bank of New York, Federal Reserve Bank of Philadelphia, Business Roundtable,

Macrobond, Apollo Chief Economist

Sources: Indeed, Bloomberg, Macrobond, Apollo Chief Economist

Sources: Redbook Research Inc., Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

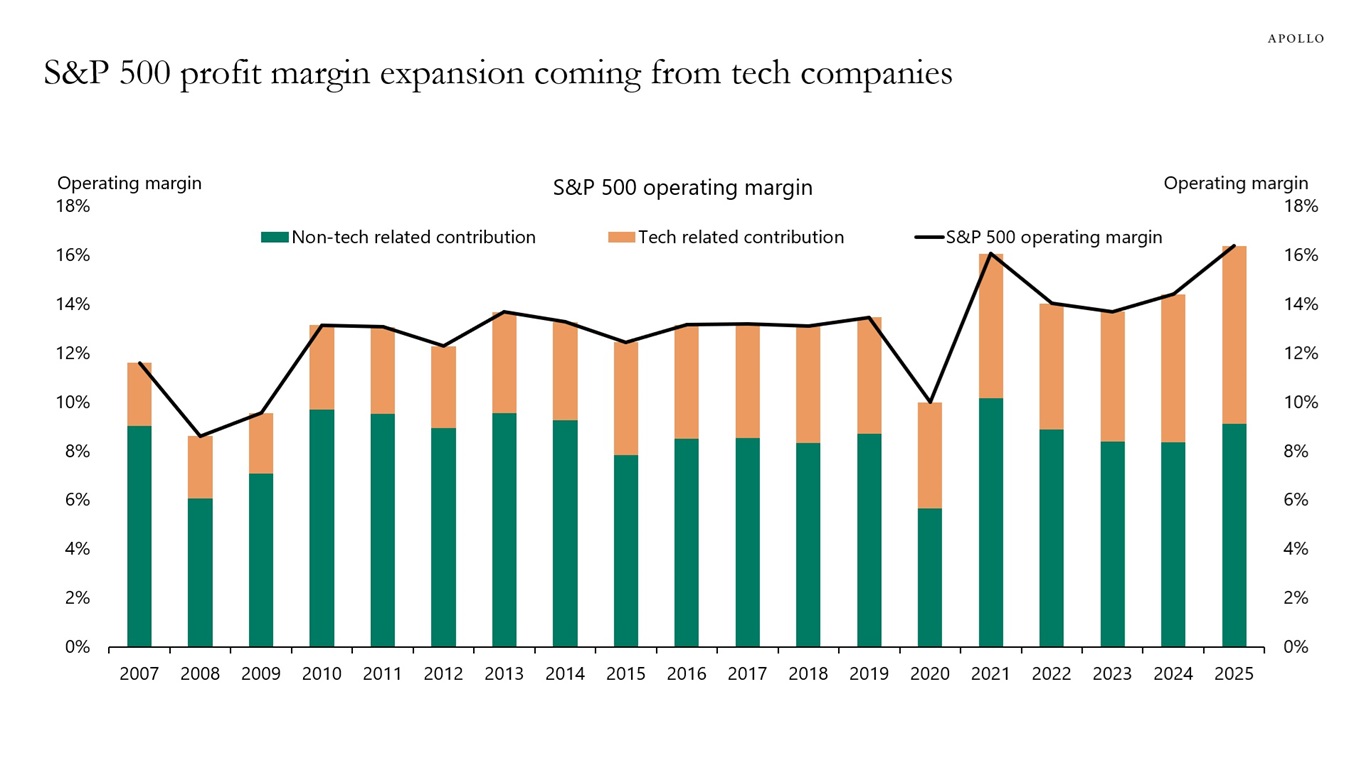

Operating margin measures the share of revenue left after covering operating expenses such as wages, materials and overhead. The chart below shows that over the past 20 years, all of the increase in the S&P 500’s operating margin has come from tech‑related sectors, while operating margins for non‑tech companies have stayed near 9%.

Note: Tech related includes communication services, consumer discretionary and information technology. Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

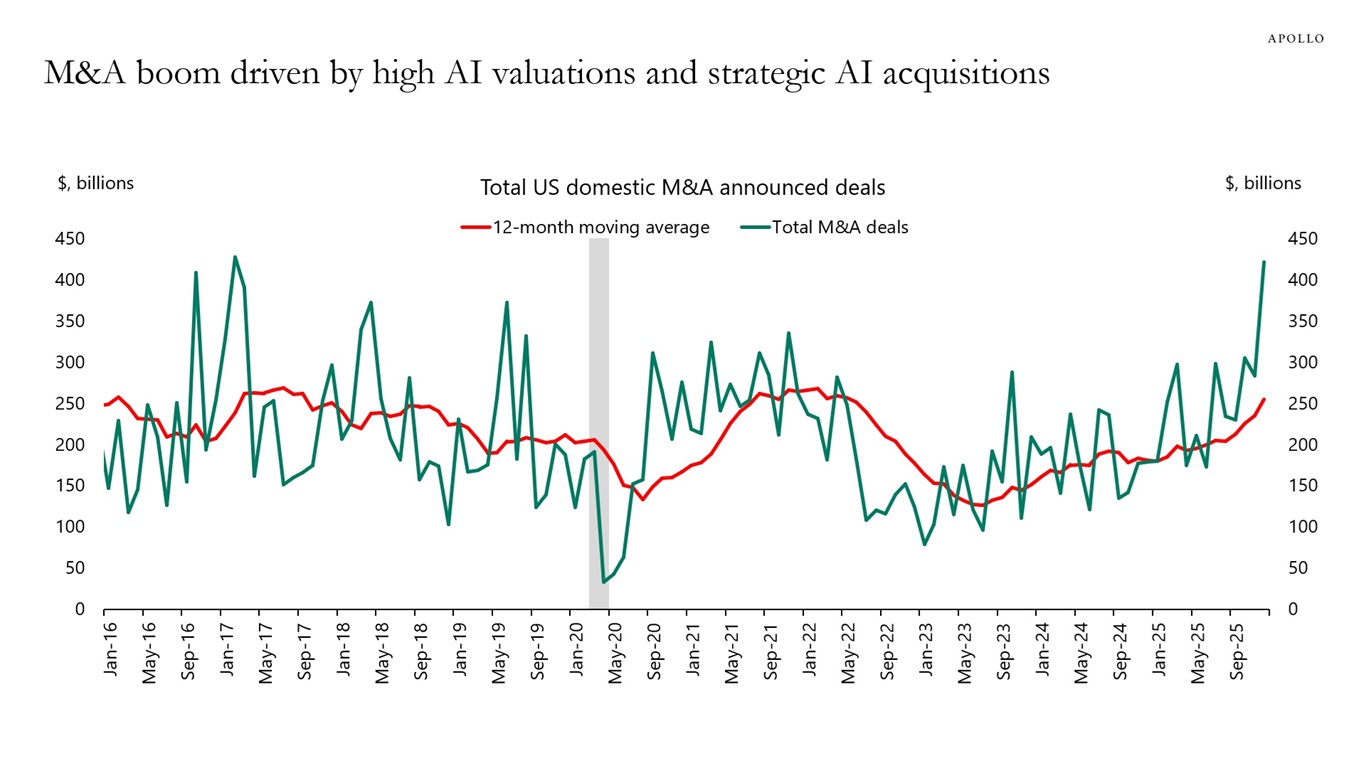

AI has become one of the key themes underpinning current M&A activity, with AI‑related transactions representing a meaningful share of megadeals, see chart below.

Note: Data through December 2025. Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

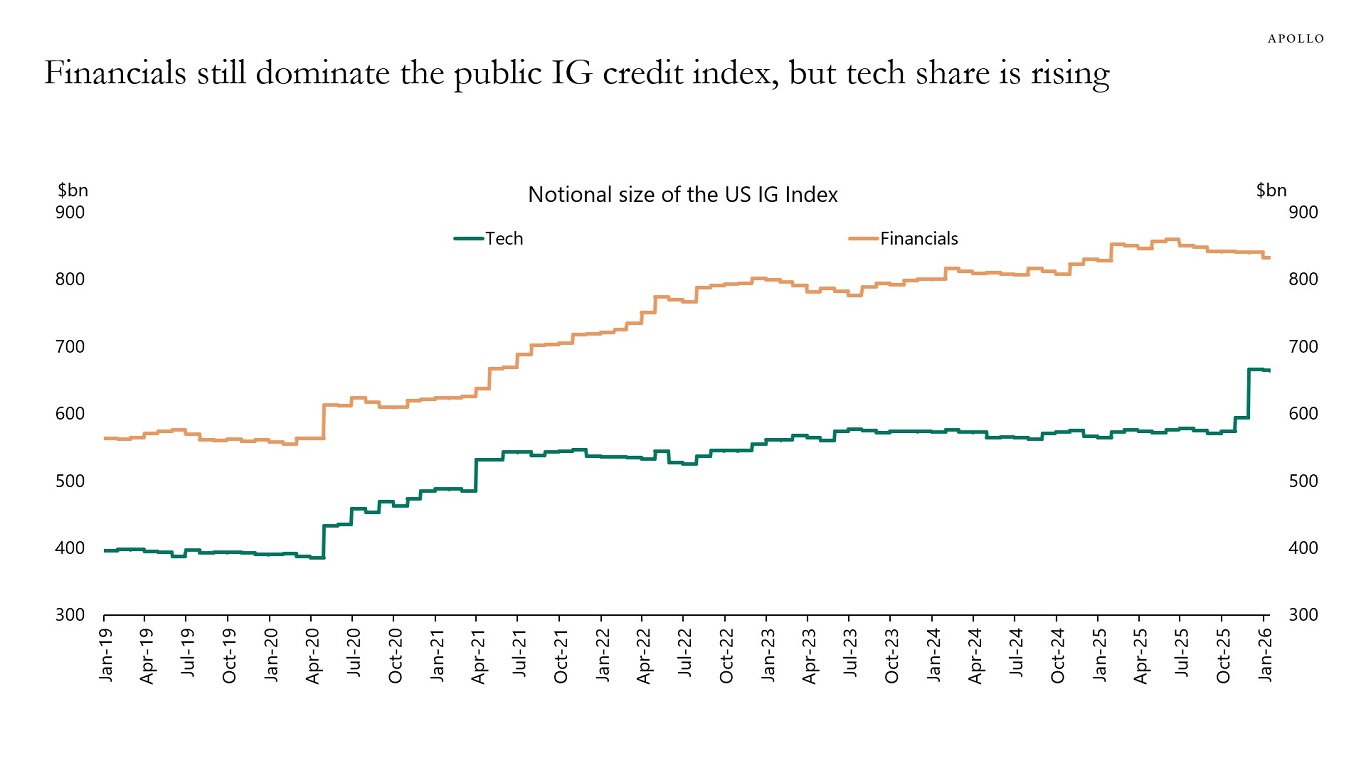

For many years, the investment grade credit index has been dominated by banks. But that is changing as hyperscalers take on more debt and become a larger share of the index, see chart below.

Note: Tech includes hyperscaler and telecom/cable companies. Financials include six big banks. Sources: ICE BofA Indices, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

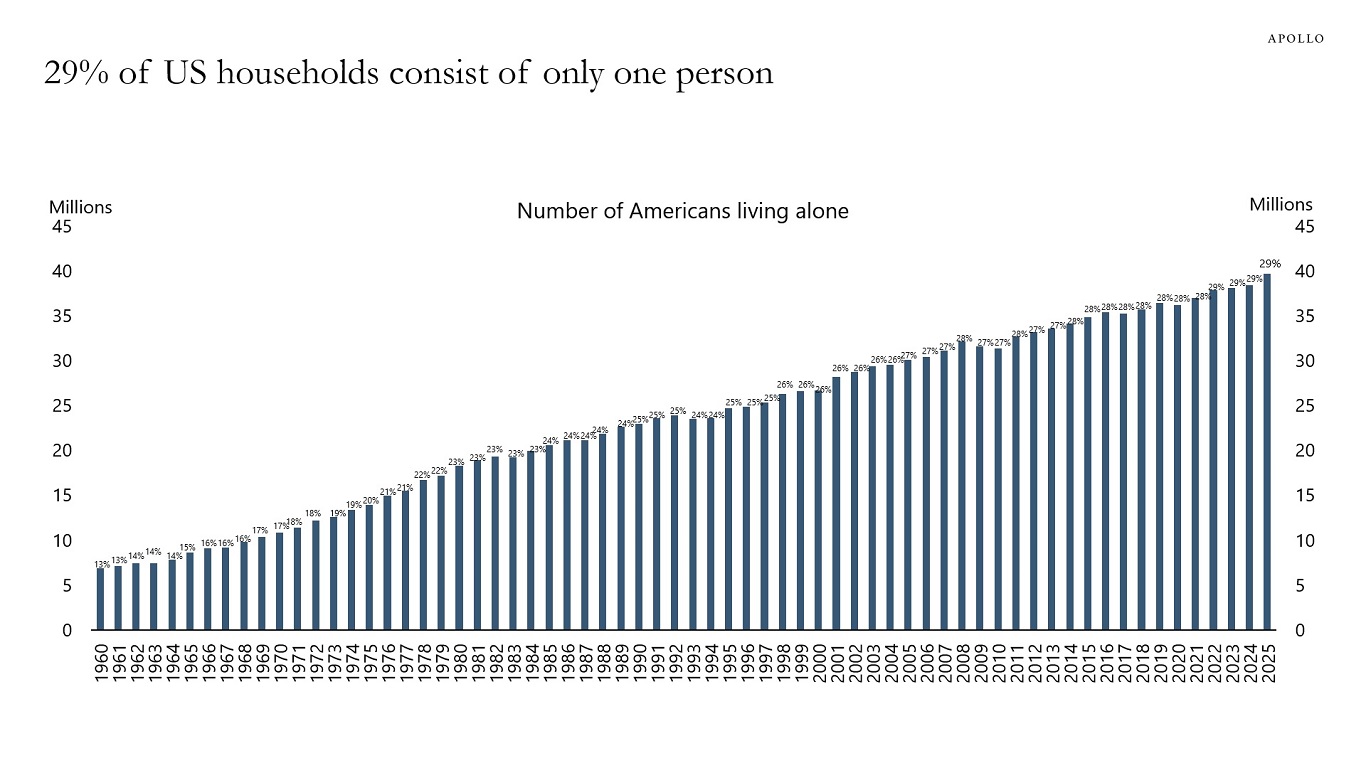

The proportion of US households composed of a single individual continues to rise, see chart below.

Sources: US Census Bureau, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

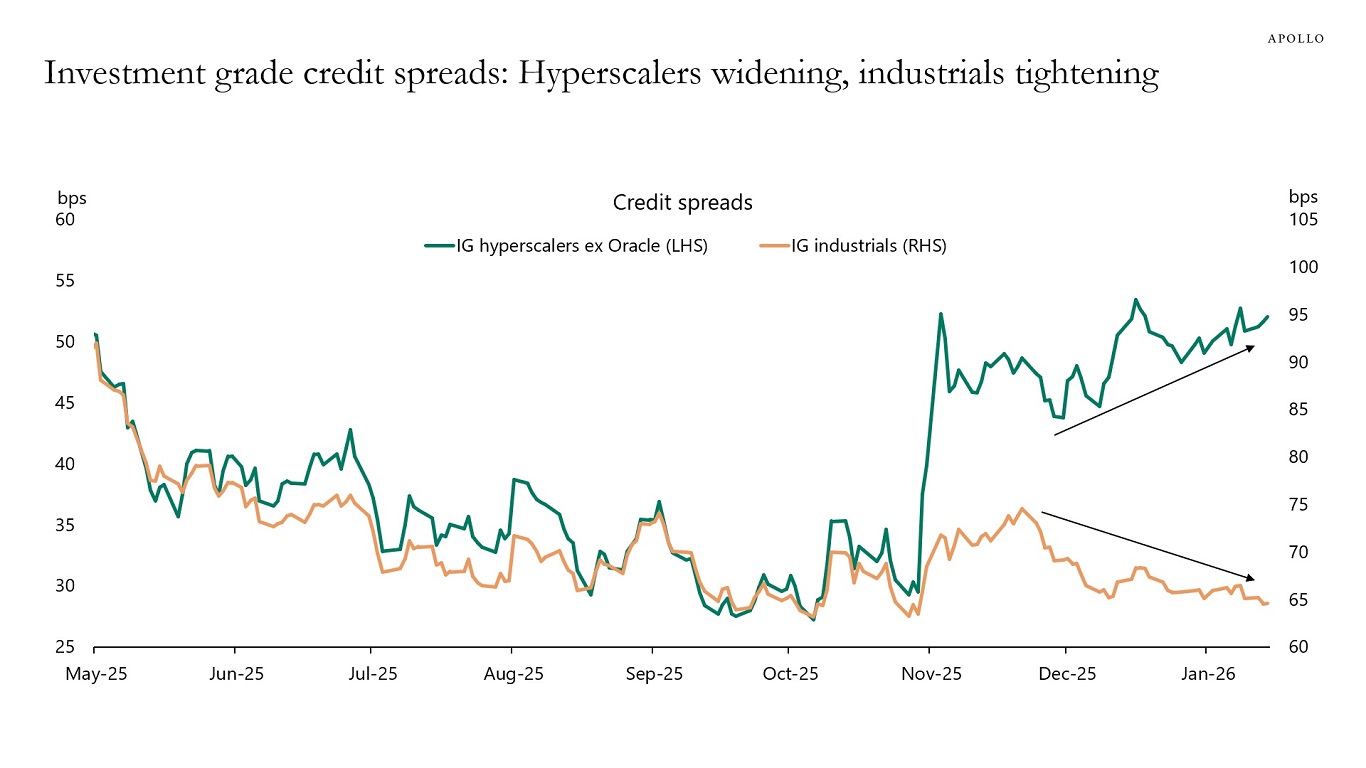

Investment grade credit spreads are widening for hyperscalers and tightening for industrials, see chart below.

Note: 7 to 11 year maturity. Sources: ICE BofA Indices, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

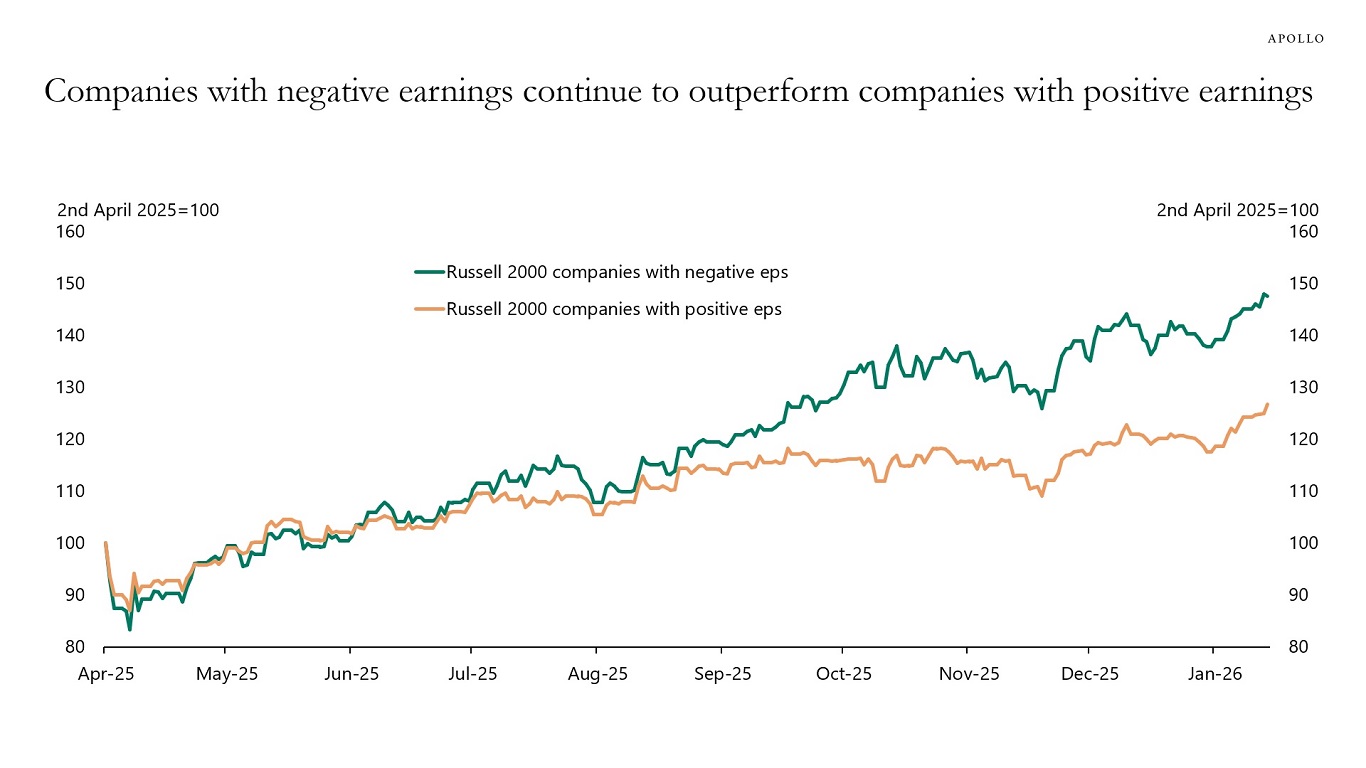

Stock prices of companies with negative earnings continue to outperform stock prices of companies with positive earnings, see chart below.

Note: Using Russell 2000 companies as of 2025 with trailing EPS, 1,120 companies have positive EPS, and 806 companies have negative EPS. Sources: Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.