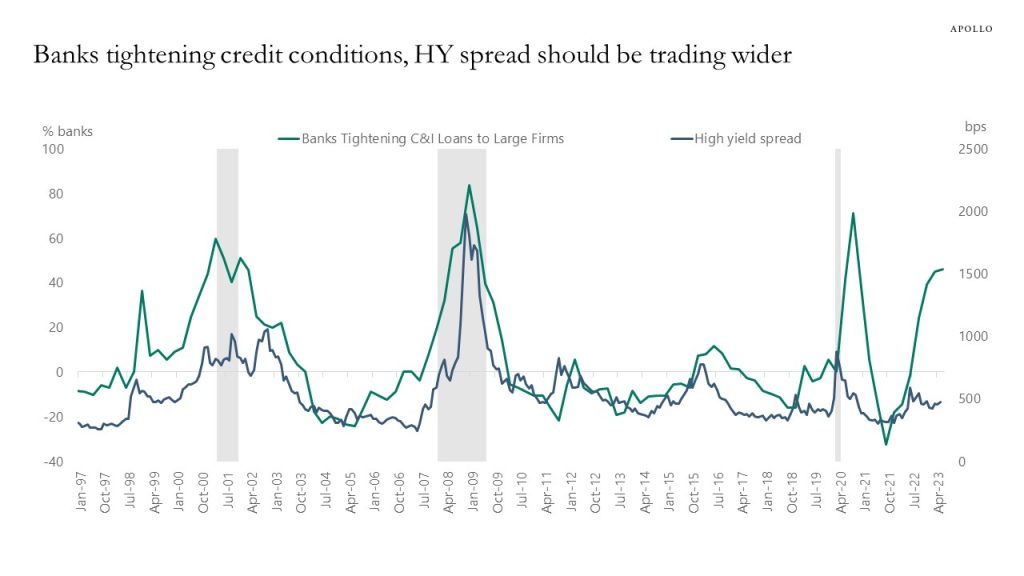

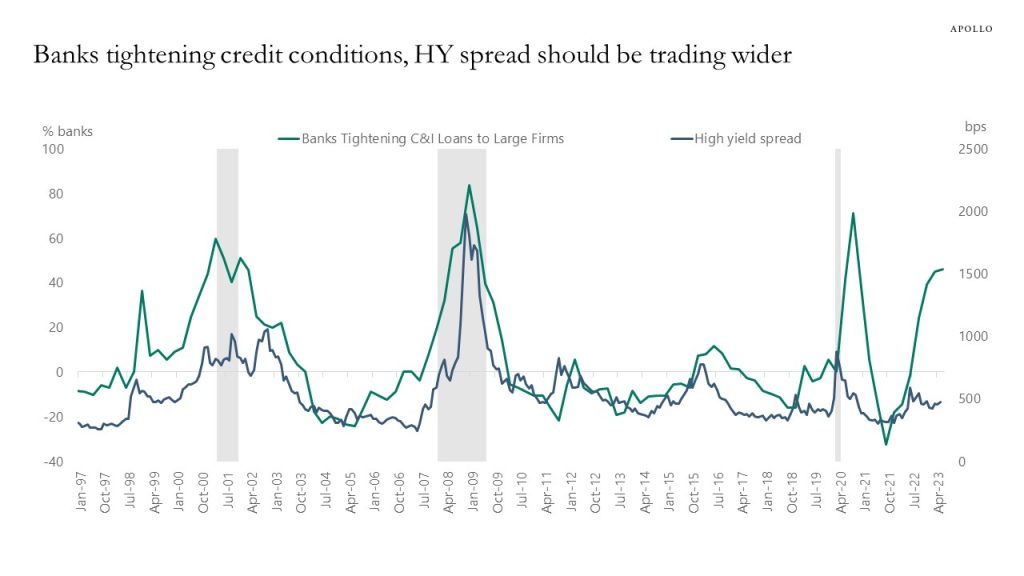

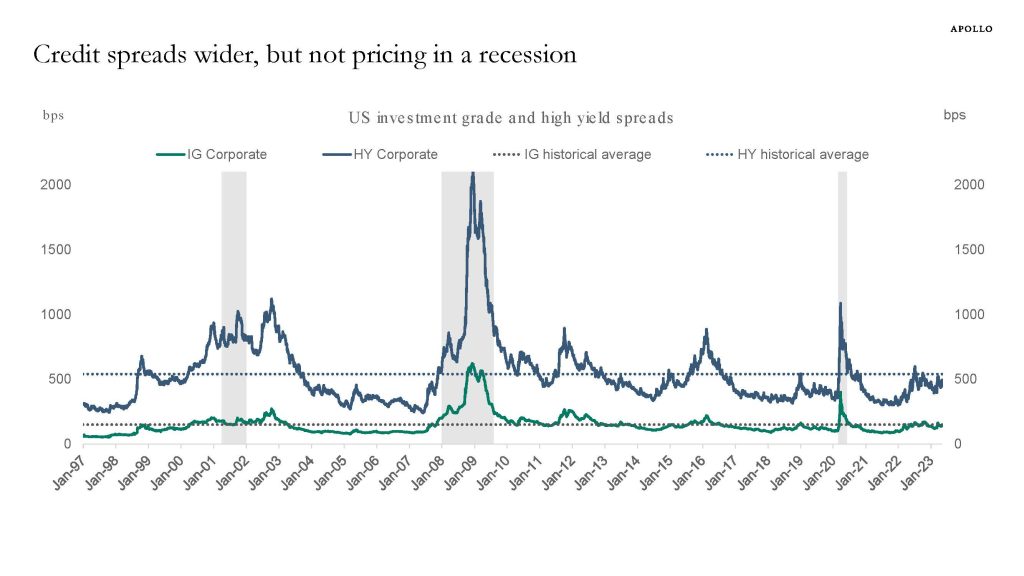

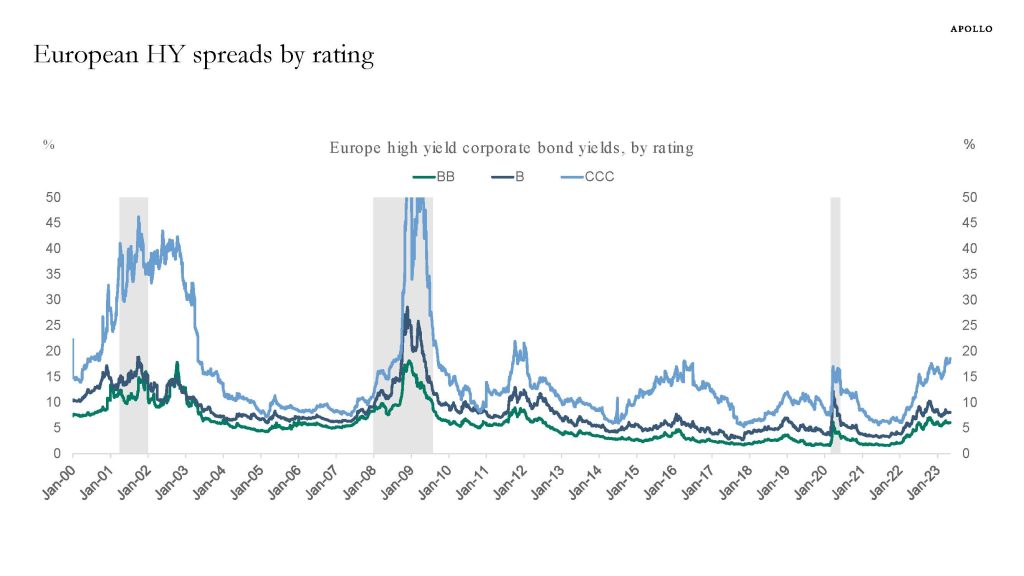

It is surprising how narrow high yield credit spreads are given the ongoing tightening in credit conditions in the banking sector, see chart below.

It is surprising how narrow high yield credit spreads are given the ongoing tightening in credit conditions in the banking sector, see chart below.

Last week, we learned that both headline and core CPI inflation fell slightly in April, but still remain far above the Federal Reserve’s 2% target. There has been progress made with getting inflation from 9% to 5%, but much work remains to get it from 5% to 2%. That will likely require a slowdown in wage inflation as well as housing. Broadly speaking, the economy is starting to slow. In fact, recent data from the National Restaurant Association’s Restaurant Performance Index shows that both expectations and current demand are falling after several months of strength. We’re carefully monitoring for evidence of softening in the consumer services side of the economy. In that context, this is an indicator that should be getting some attention.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

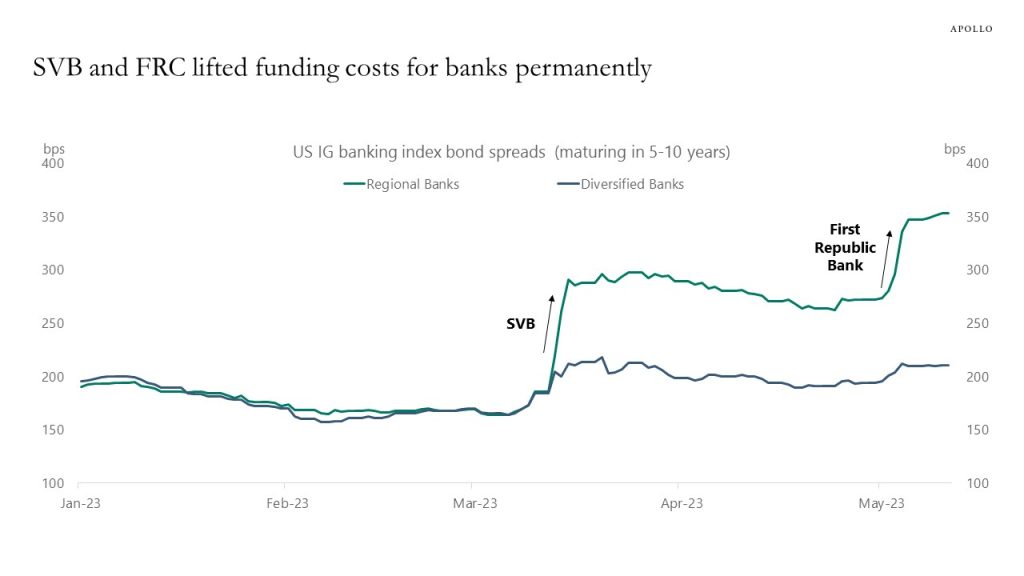

One way to calculate how much the ongoing banking crisis corresponds to in Fed hikes is to look at how much borrowing costs have increased for regional banks and money center banks since Silicon Valley Bank collapsed.

The chart below shows that since SVB failed, IG credit spreads for regional banks have widened 200bps and for diversified banks 50bps.

And for all banks, the spread widening has stayed at a new higher level because many banks have been downgraded. Spreads first moved up to a higher level after SVB and then another higher level after FRC, showing that the ongoing banking crisis is having a permanent negative effect on the economy.

Put differently, the increase in borrowing costs since SVB failed corresponds to a 200bps permanent Fed hike for regional banks and 50bps permanent Fed hike for large banks. Weighing these estimates together using the shares of loans and leases accounted for by small and large banks, respectively, gives an economy-wide Fed tightening of a bit more than 100bps for the entire banking sector.

In short, the jump in funding costs for banks is permanent, and it has become a lot more expensive for many banks to run their business, and the banking crisis is not over.

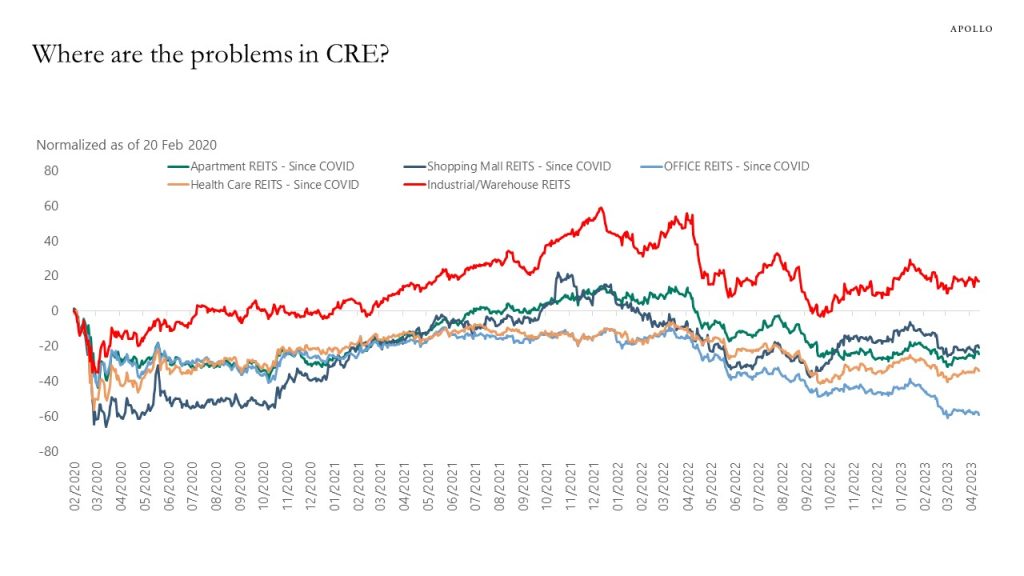

There are some important differences in CRE, with some sectors such as office having negative performance and industrial and warehouses showing positive performance, see chart below.

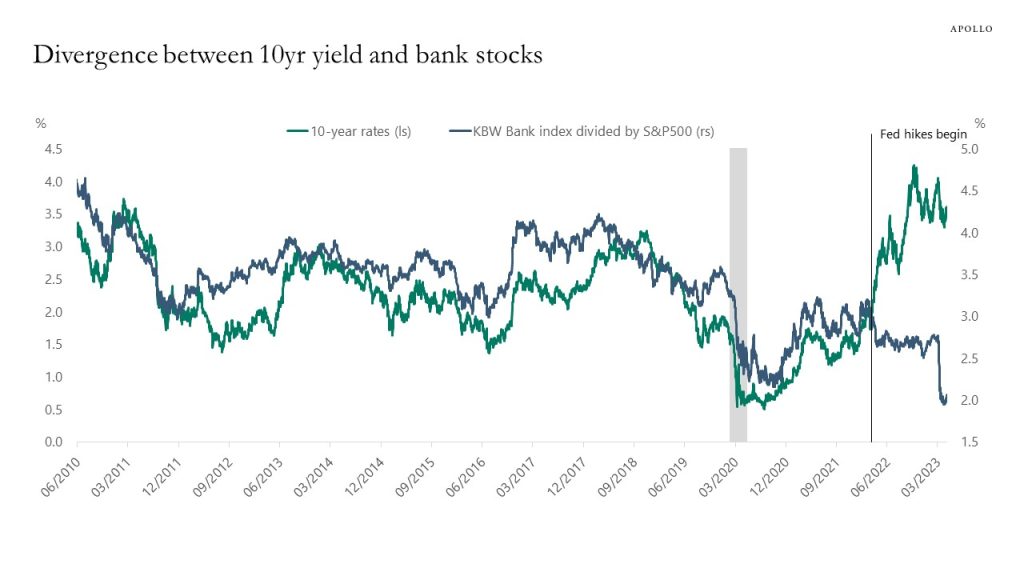

It used to be the case that higher long-term interest rates were positive for banks because higher long rates meant wider net interest margins.

But since the Fed started hiking rates last year, this correlation has broken down, see chart below.

Now higher rates are negative for banks because it has a negative impact on their assets, and higher rates and an inverted yield curve increase the risks of a recession and hence credit losses.

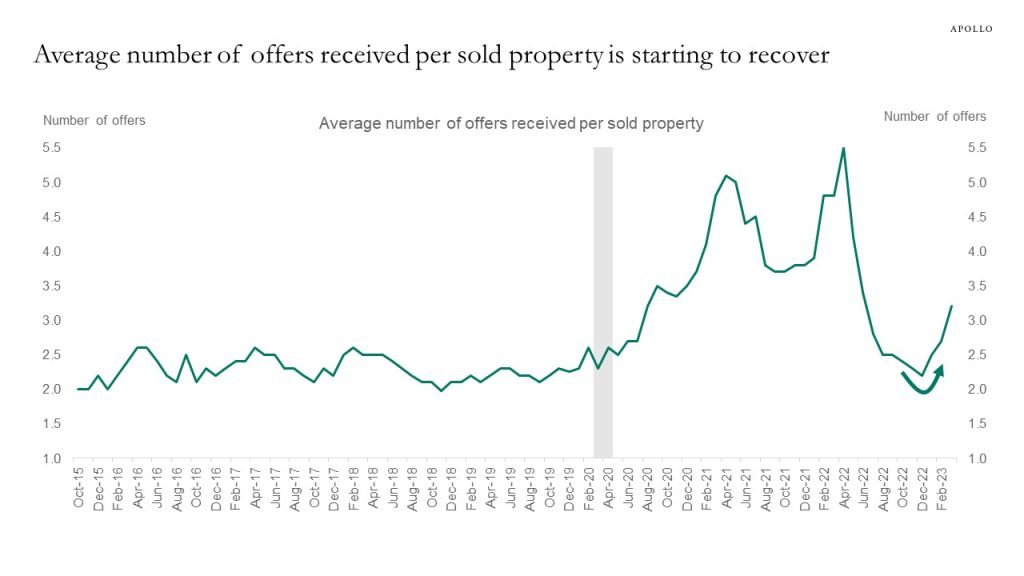

The housing market has started to recover, and this is a problem for the Fed because more demand for housing will boost home prices and rents, and with housing having a weight of 40% in the CPI, this will make it more difficult to get inflation down from currently 5% to the Fed’s 2% inflation target.

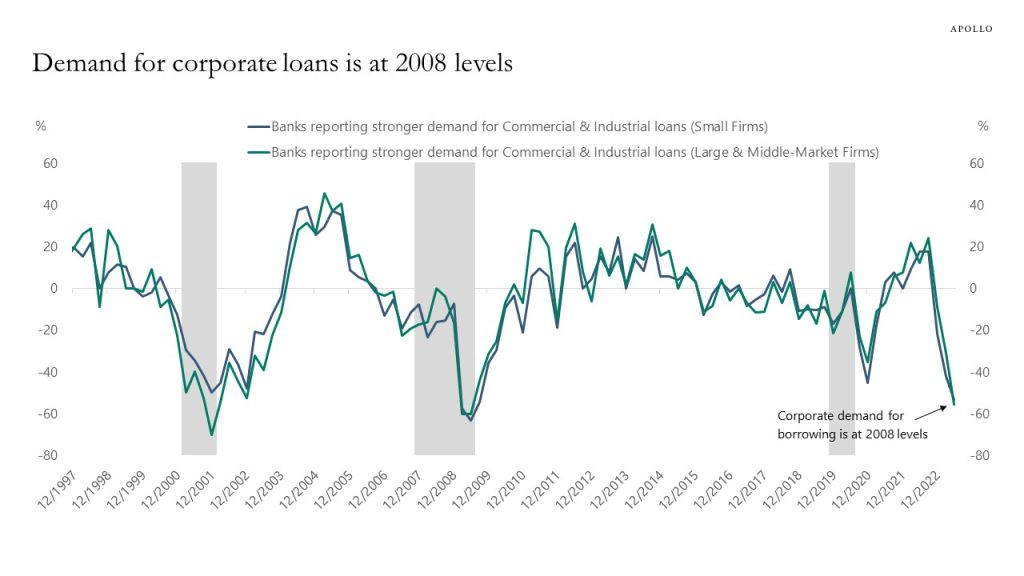

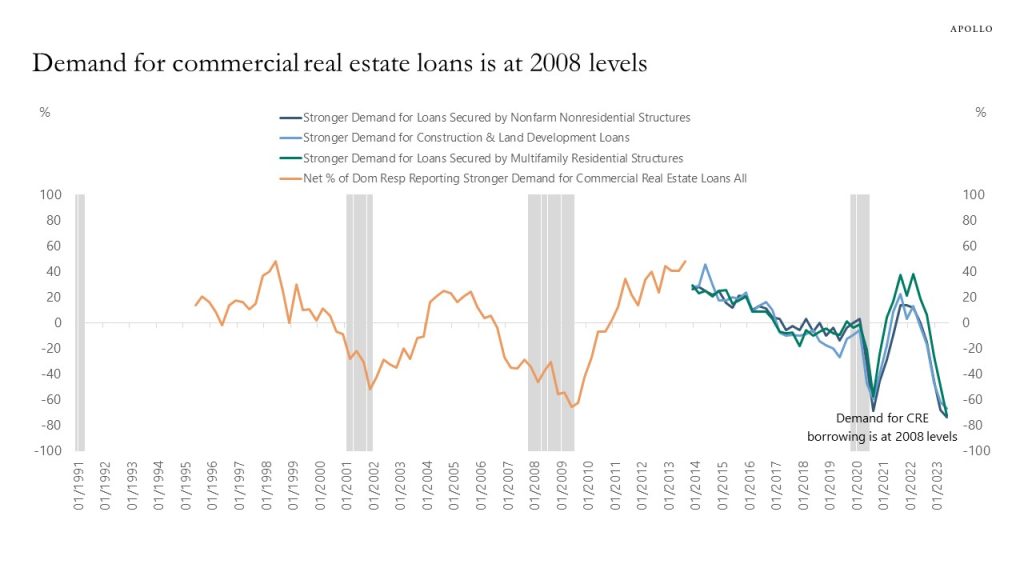

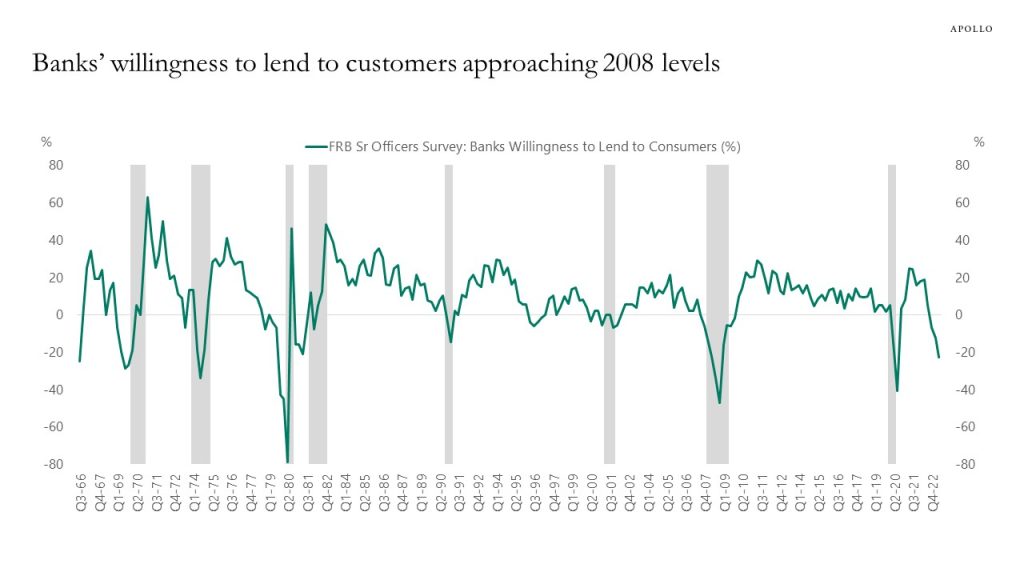

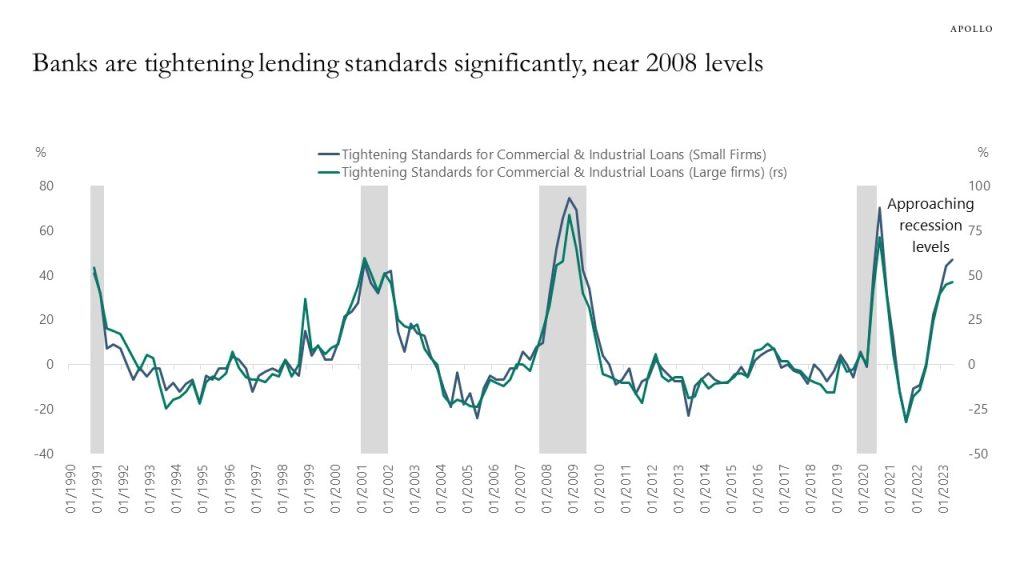

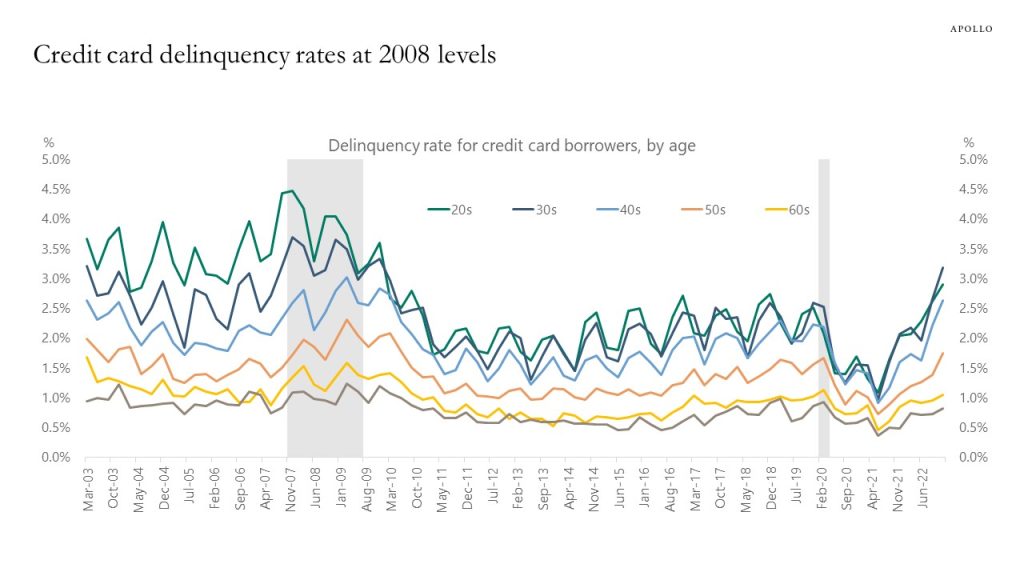

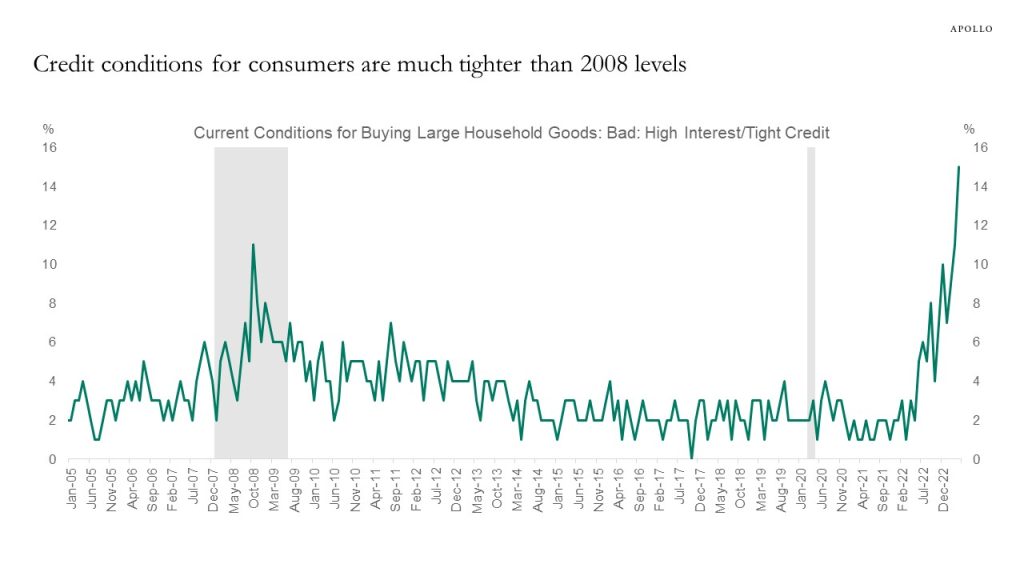

The Fed’s Senior Loan Officer Survey for Q2 was done in April after SVB but before First Republic Bank, and it shows an ongoing tightening in credit conditions across all types of lending.

Specifically, the survey asks banks if they have tightened lending standards for firms and households relative to last quarter, and across all indicators for demand for loans and supply of loans, we are now at or close to 2008 levels, see charts below.

In addition, the first sentence in the notes to the Fed’s Senior Loan Officer Survey shows that it only covers large banks out of the roughly 4,000 banks in the US, so credit conditions in small and medium-sized banks are likely tightening even more than seen in the charts below.

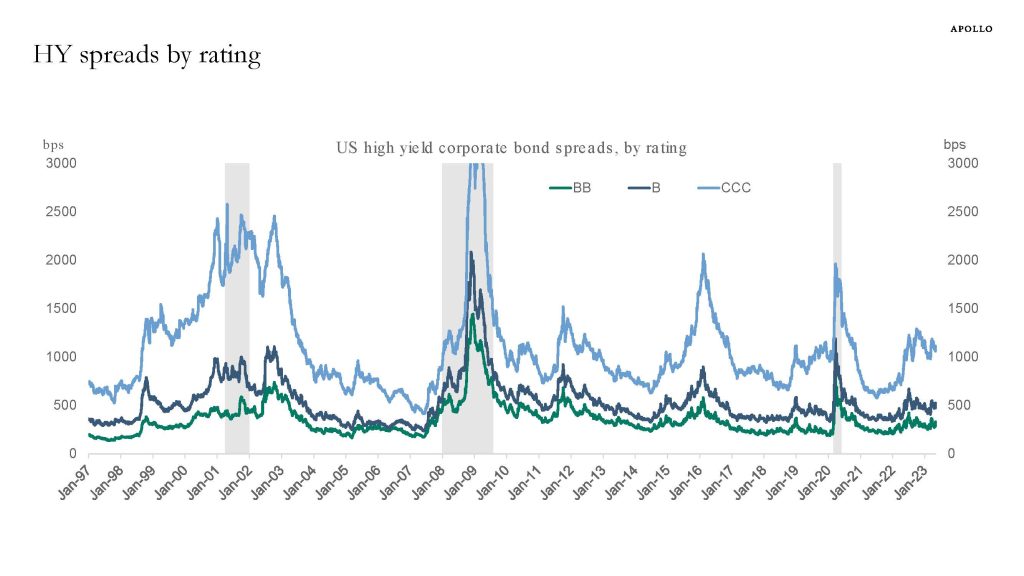

The bottom line for markets is that with inflation still at 5%, well above the FOMC’s 2% inflation target, and the Fed not cutting rates anytime soon, credit conditions will continue to tighten, and as a result, a recession is coming that could be deeper or longer than the consensus currently expects.

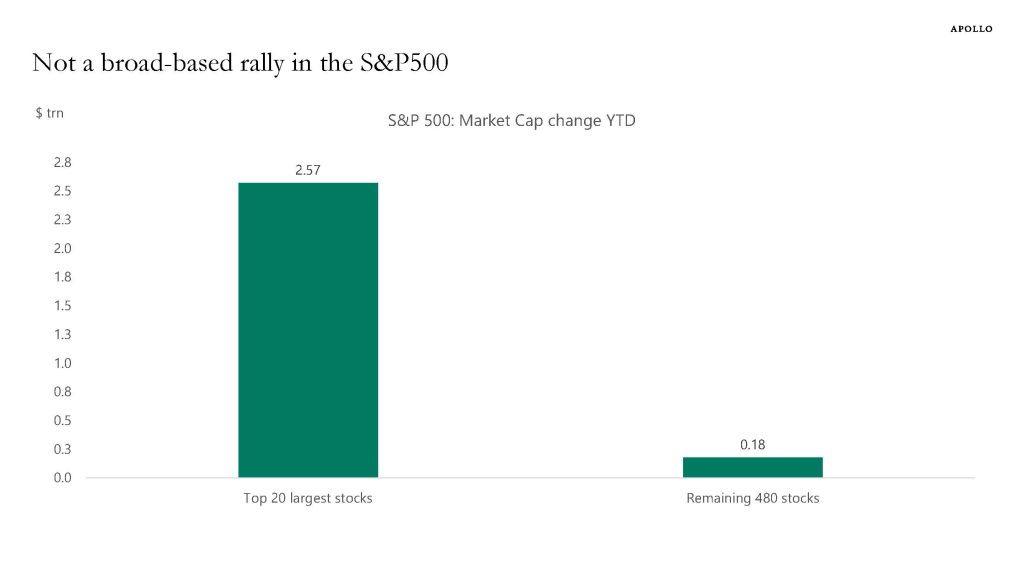

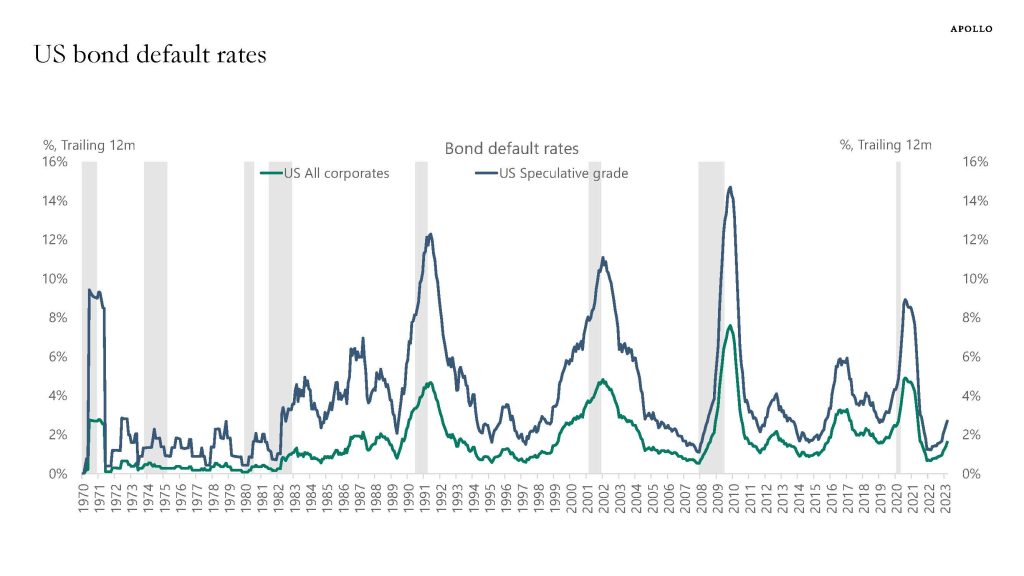

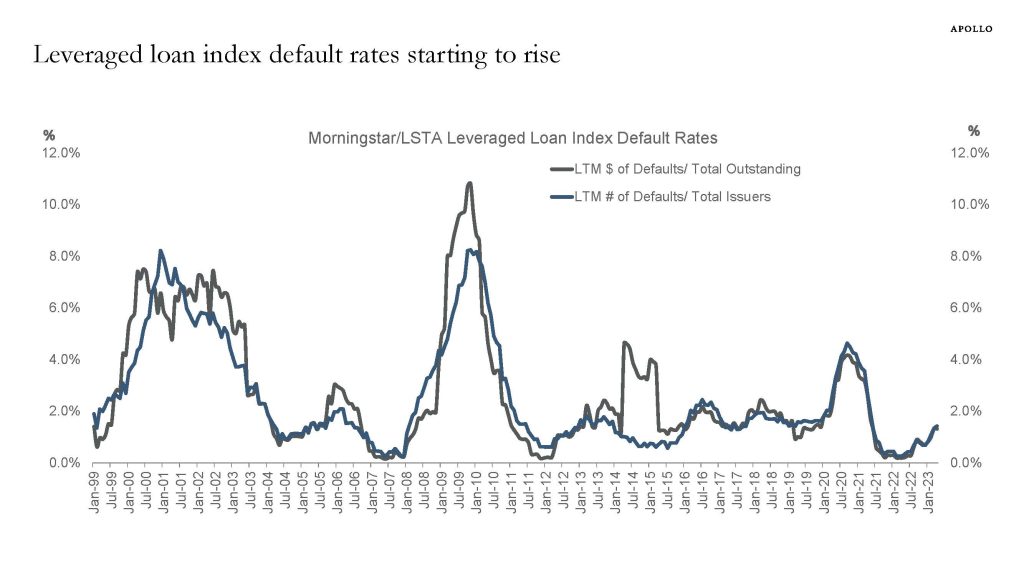

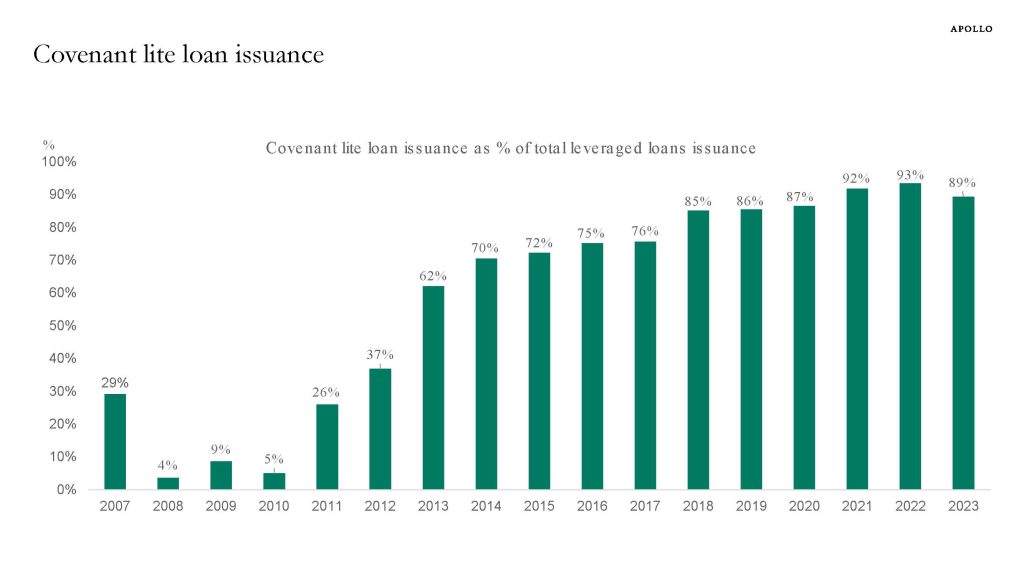

There is an ongoing banking crisis, the consensus expects a recession, and a default cycle has started. But markets are pricing that this will only have a mild negative impact on lower-rated credits and small and medium-sized companies. Our monthly credit market outlook is available here.

Listen to Co-Head of Private Equity Matt Nord and Chief Economist Dr. Torsten Slok discuss the current private equity investment landscape and how capital markets dislocations have helped create an attractive entry point into the asset class.

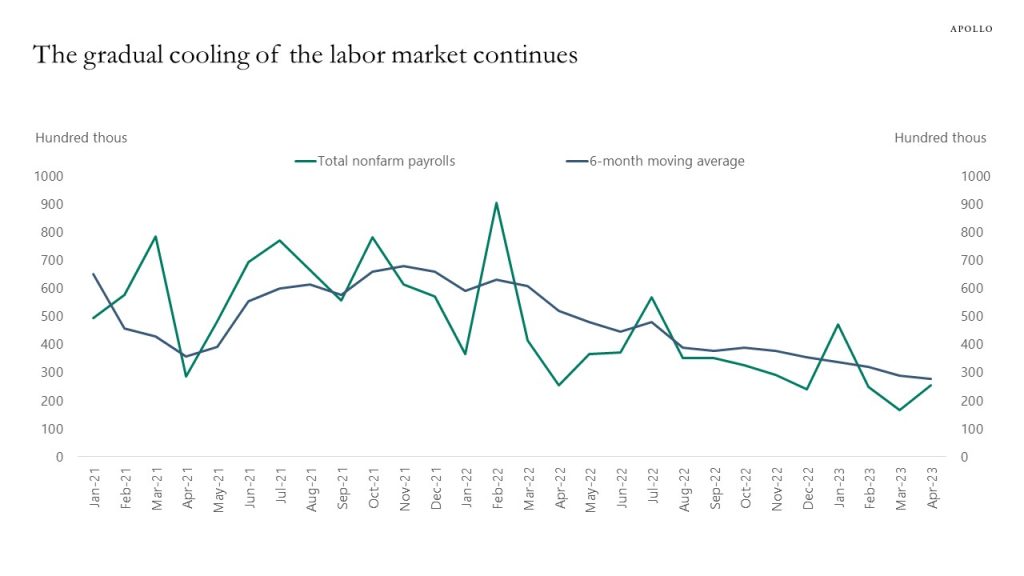

The labor market continues to soften, but the speed of the cooling is slower than expected, driven by increased labor force participation and higher immigration, see chart below and our chart book available here.