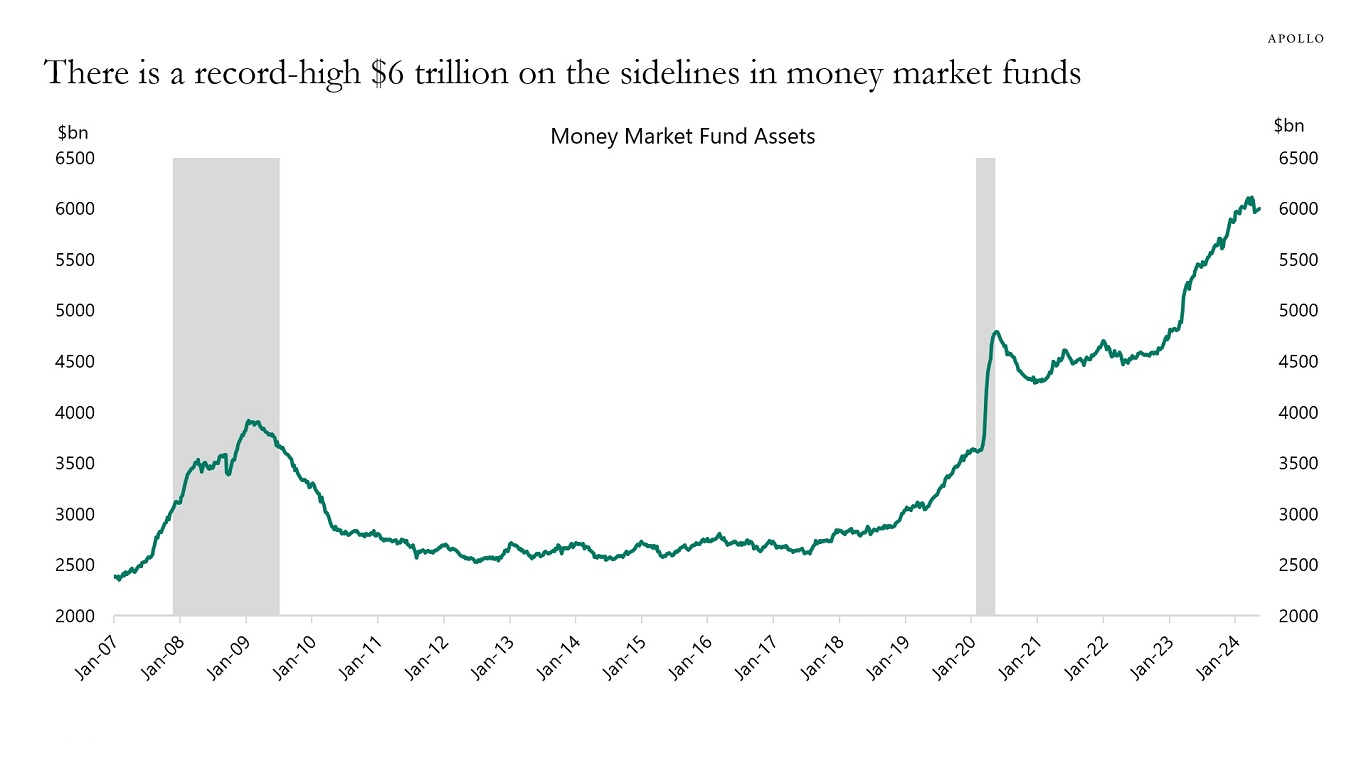

There is a puzzle in financial markets at the moment. How can the amount of money in money market accounts go up while the stock market goes up at the same time?

The finance textbook would have predicted that the Fed raising interest rates should increase the amount of money in money market funds and put downward pressure on equities and credit.

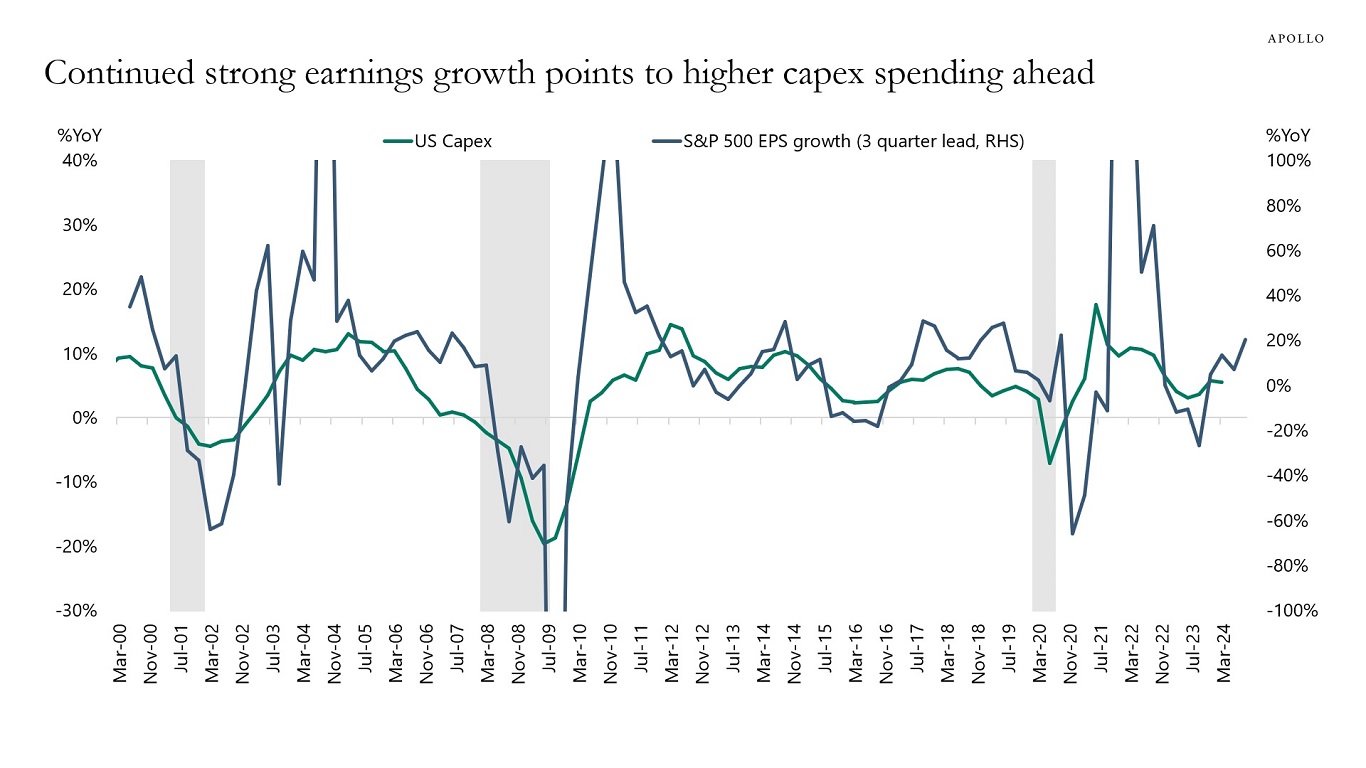

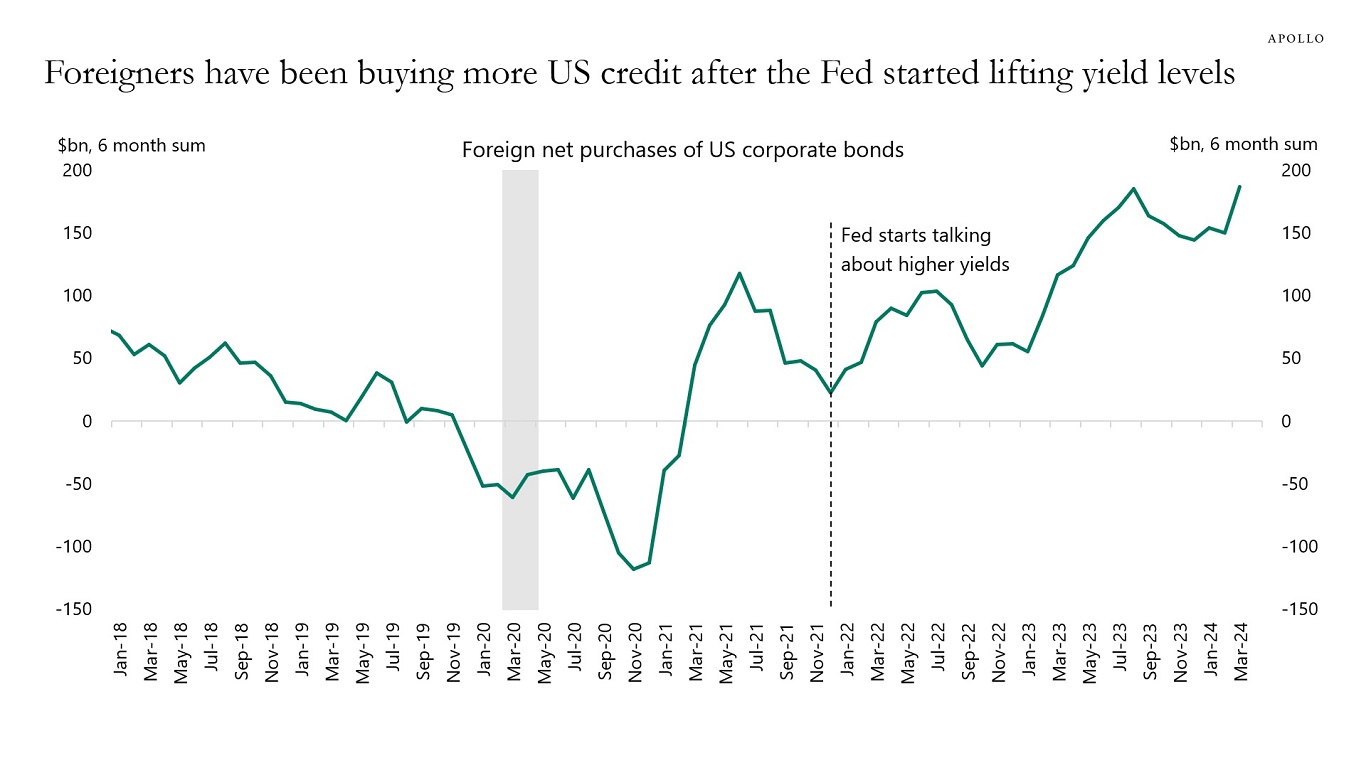

Maybe the answer is foreigners, who are aggressively buying risky assets such as credit because of higher yields and a better US economic outlook relative to the outlook for Europe, Japan, China, and EM. These portfolio flows would also put upward pressure on the US dollar.

Another explanation is that the AI story is boosting equities and credit no matter what interest rates are on money market accounts.

The bottom line is that there is still a lot of money on the sidelines, with $6 trillion in money market funds that can be used to purchase public and private credit and public and private equity.