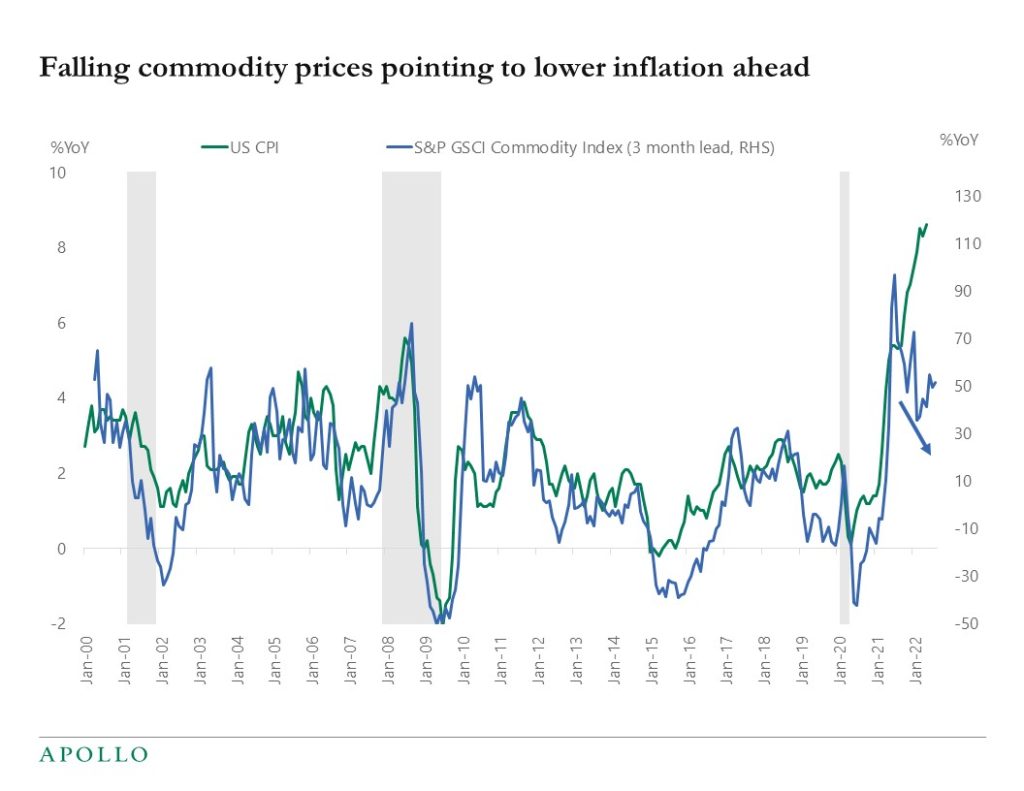

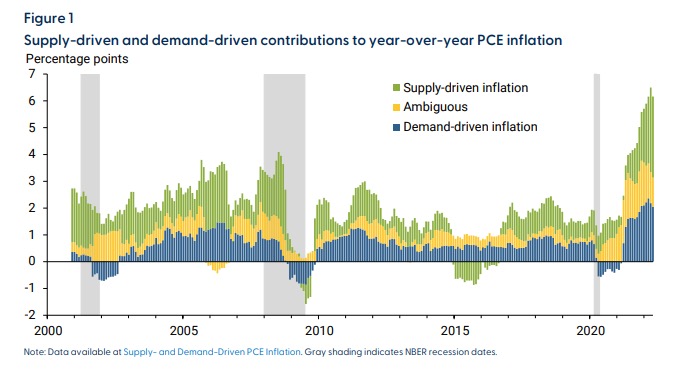

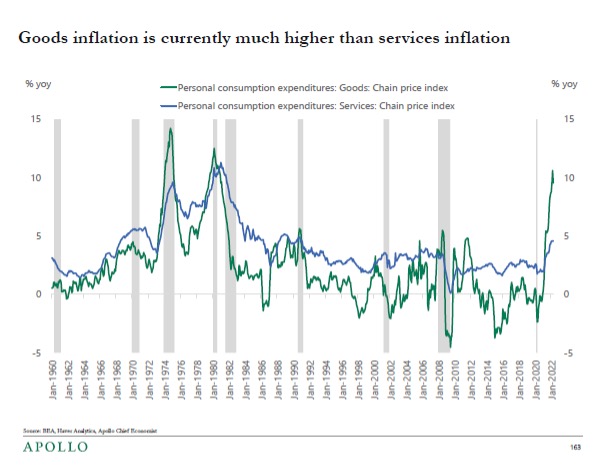

Inflation is the number one worry for markets and any signs of inflation coming down could trigger a rally in the stock market and credit markets. The arguments for inflation coming down are accumulating:

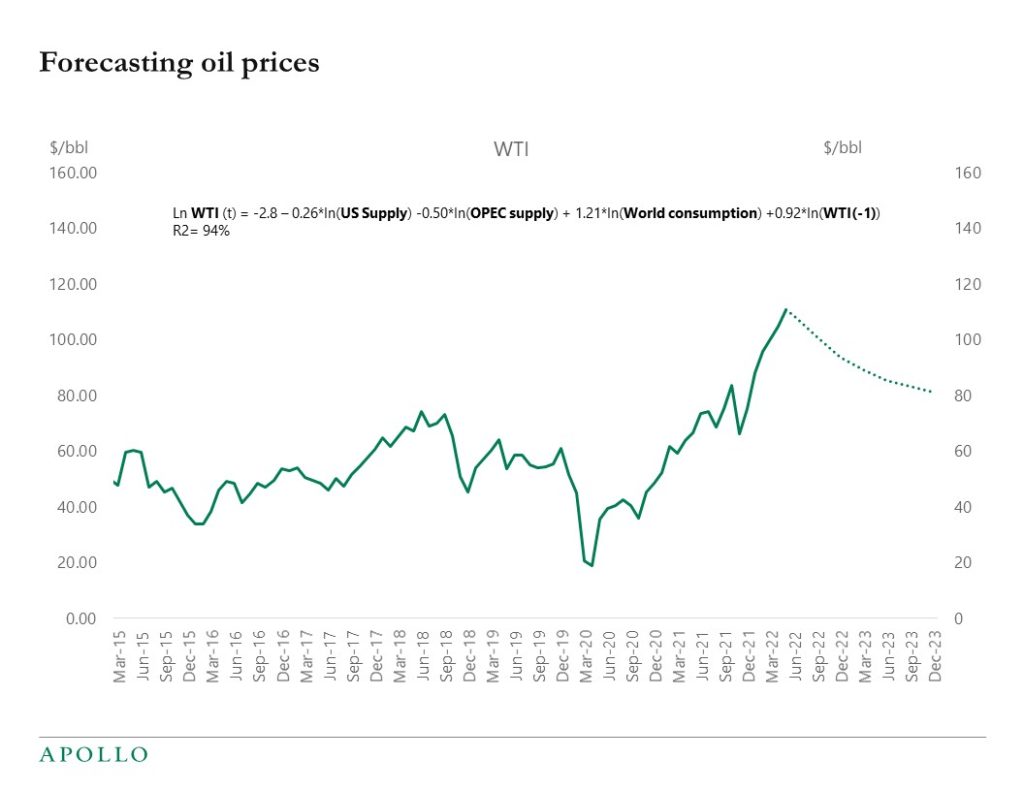

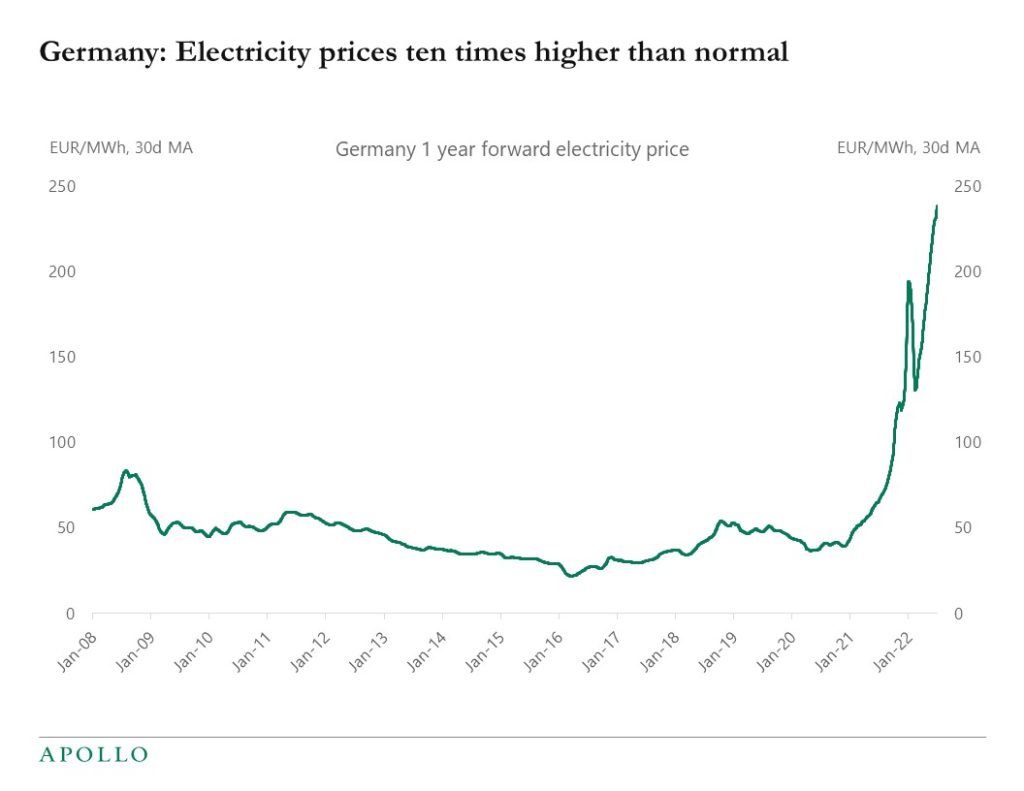

1) Commodity prices are trending lower

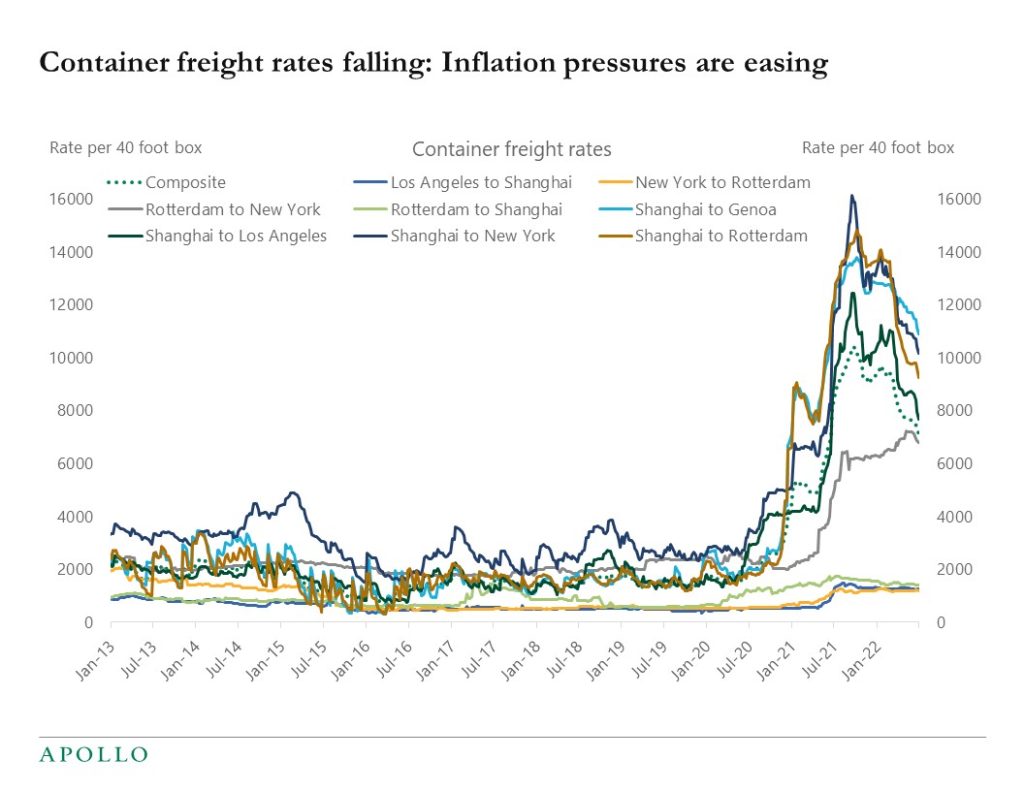

2) With China reopening and supply chains normalizing, transportation costs for goods are coming down

3) Inventories are growing at many retailers and this is putting downward pressure on goods prices

4) Rising car production is putting downward pressure on new and used vehicle prices

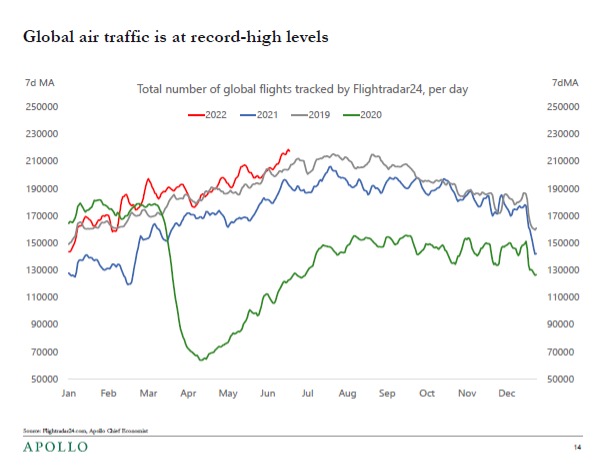

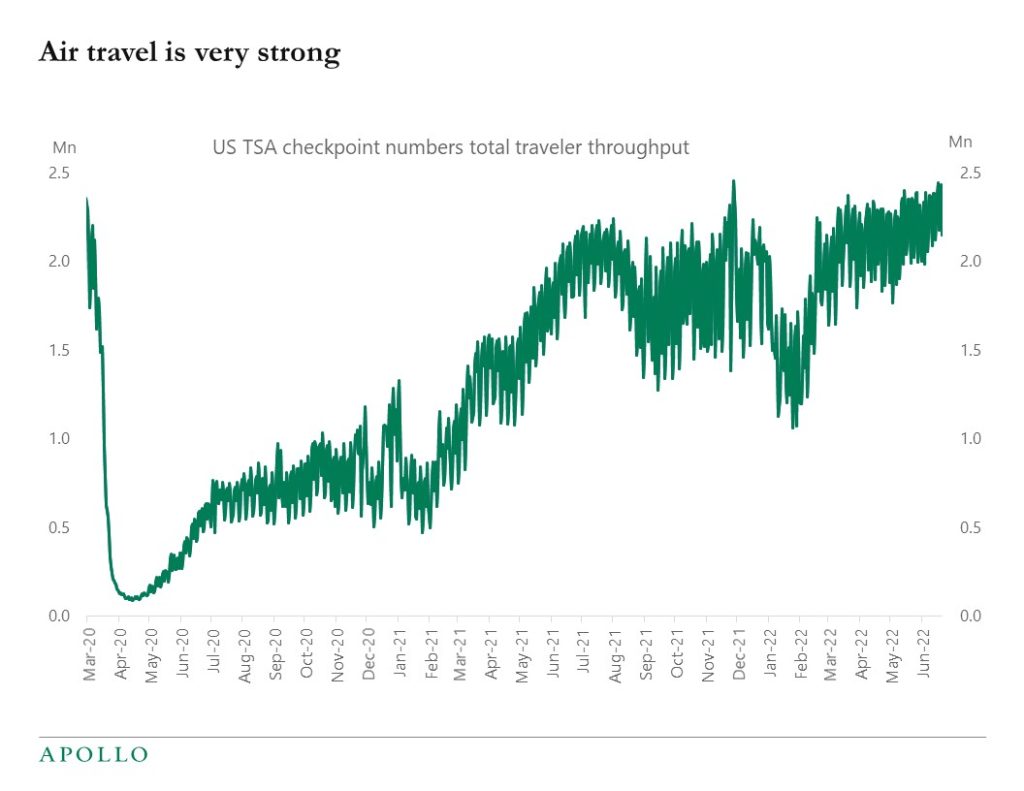

5) Airline ticket prices have been falling during June, see also here

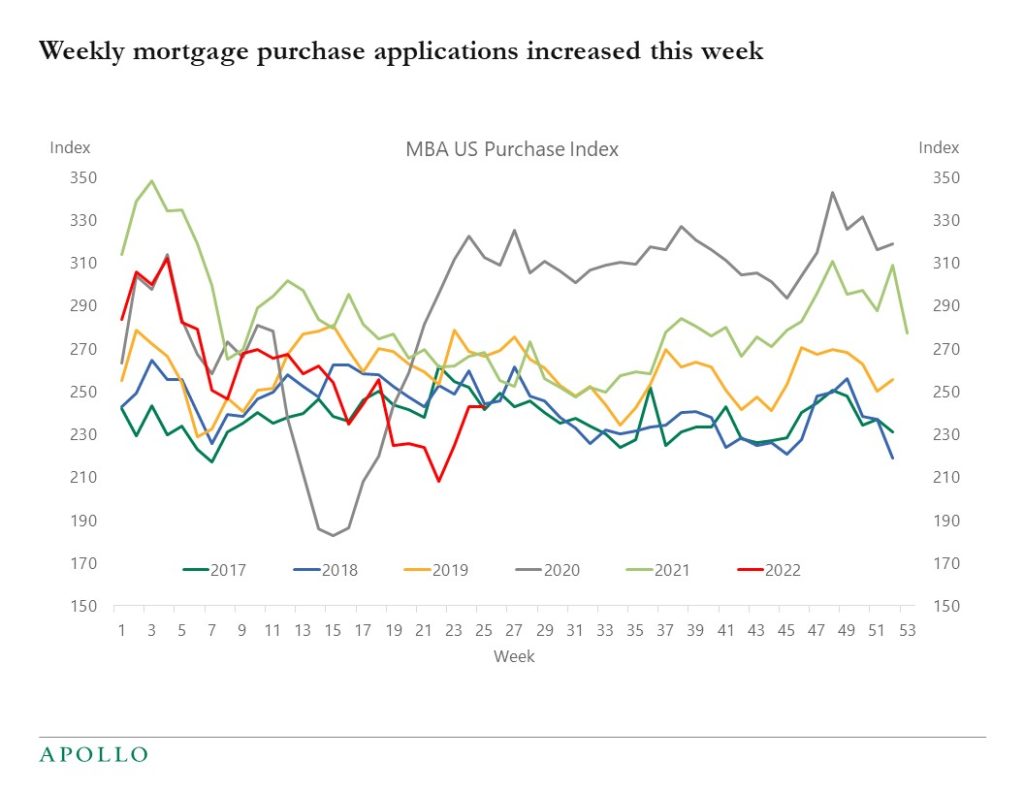

6) Increases in rents and home prices are moderating

7) A higher dollar is lowering import prices

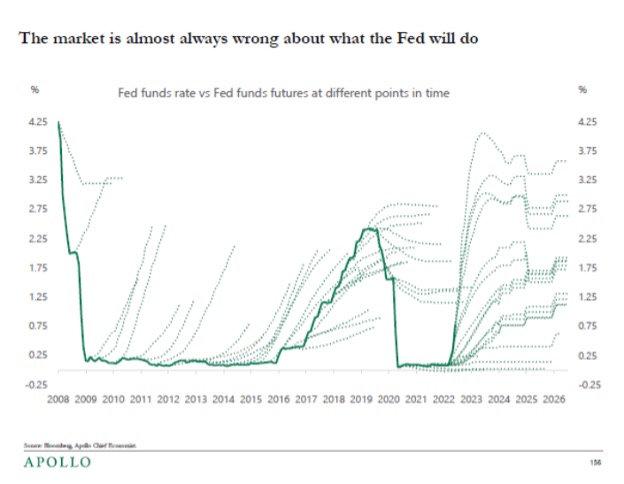

Inflation rolling over would also dampen recession worries because lower inflation would mean that the Fed doesn’t have to increase interest rates as much.

The bottom line is that inflation may stay elevated for another month or two, but given the trends listed above, the probability is rising that inflation going into the second half of this year could come down faster than the market currently expects.