Key themes for credit investors:

1) New issuance rallying sharply as demand remains strong from pension, annuity sales, and retail. Credit spreads continue to tighten and are trading near the tight end of the two-year range. Beta compression remains a key theme across credit, with the exception of CCCs.

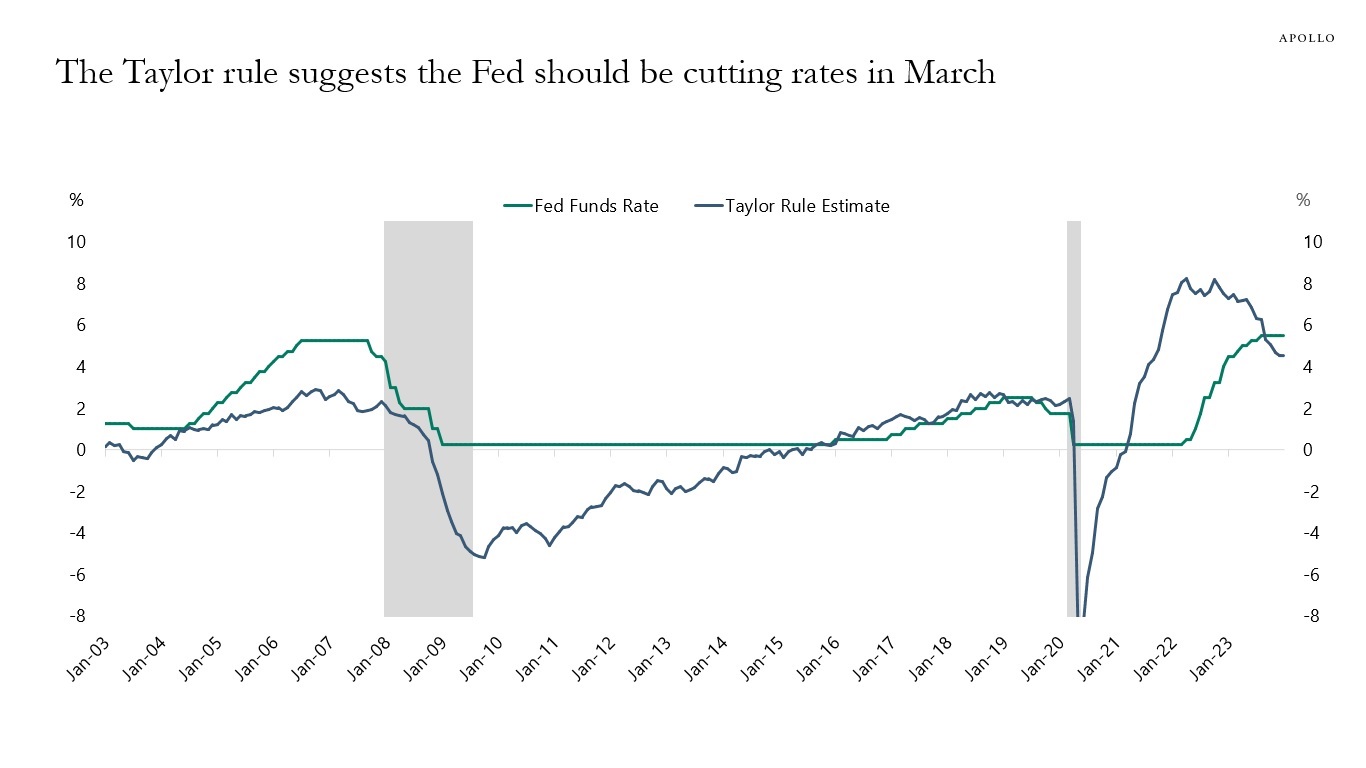

2) Credit spreads are tight, but all-in yields are attractive with a Fed cutting outlook. Strong demand from yield buyers should limit the extent of any spread widening, barring a material worsening in the macro backdrop.

3) Uncertainty about the ongoing soft landing will keep volatility elevated. Hard landing or reacceleration in inflation are still possible scenarios.

4) Mid-beta credit such as BBB debt offers the attractive combination of wide spreads and stronger sponsorship from yield-driven demand. Financial conditions have eased recently but funding costs remain high, which combined with slowing growth could impact firms with weak balance sheets. Elevated cash balances on investment grade corporate balance sheets could drive a pick-up in M&A activity.