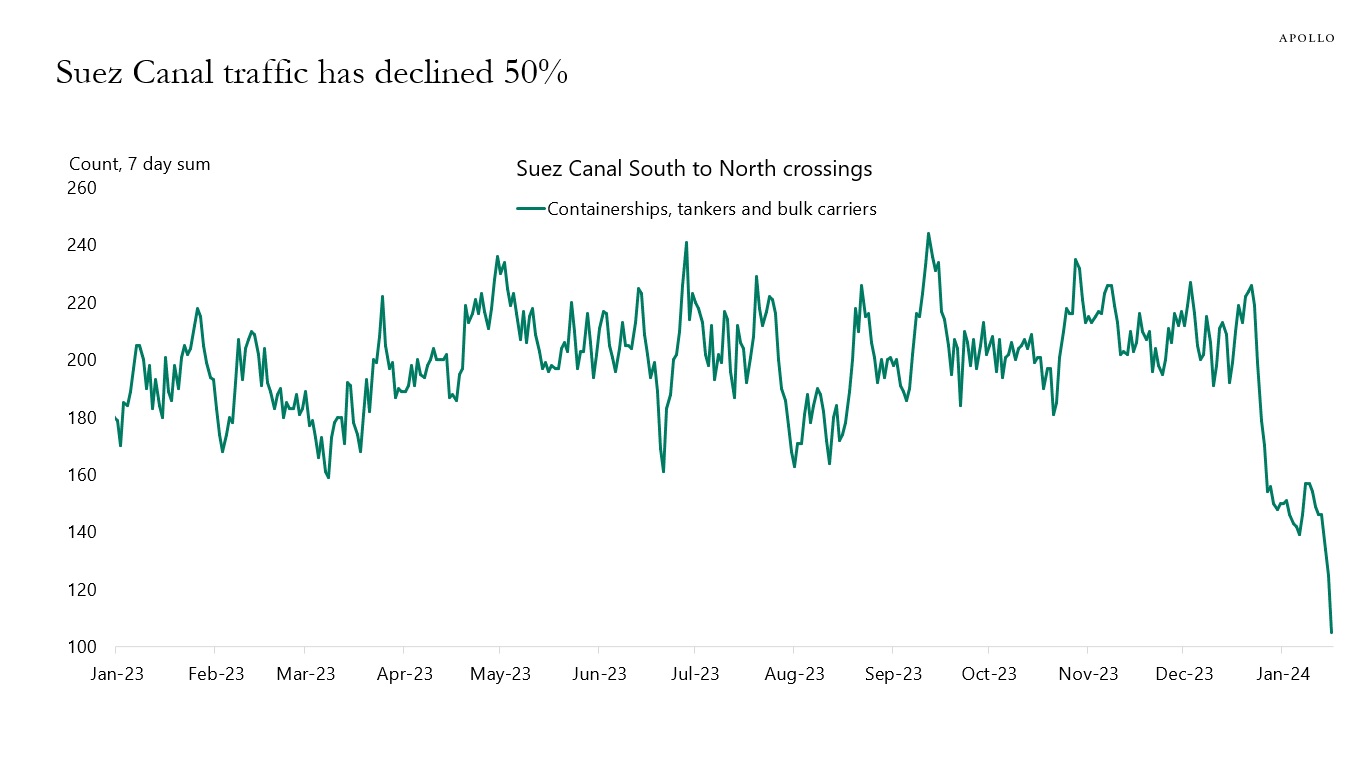

Normally, 200 ships travel through the Suez Canal from south to north over a week, but that number has recently declined to 100, see the first chart.

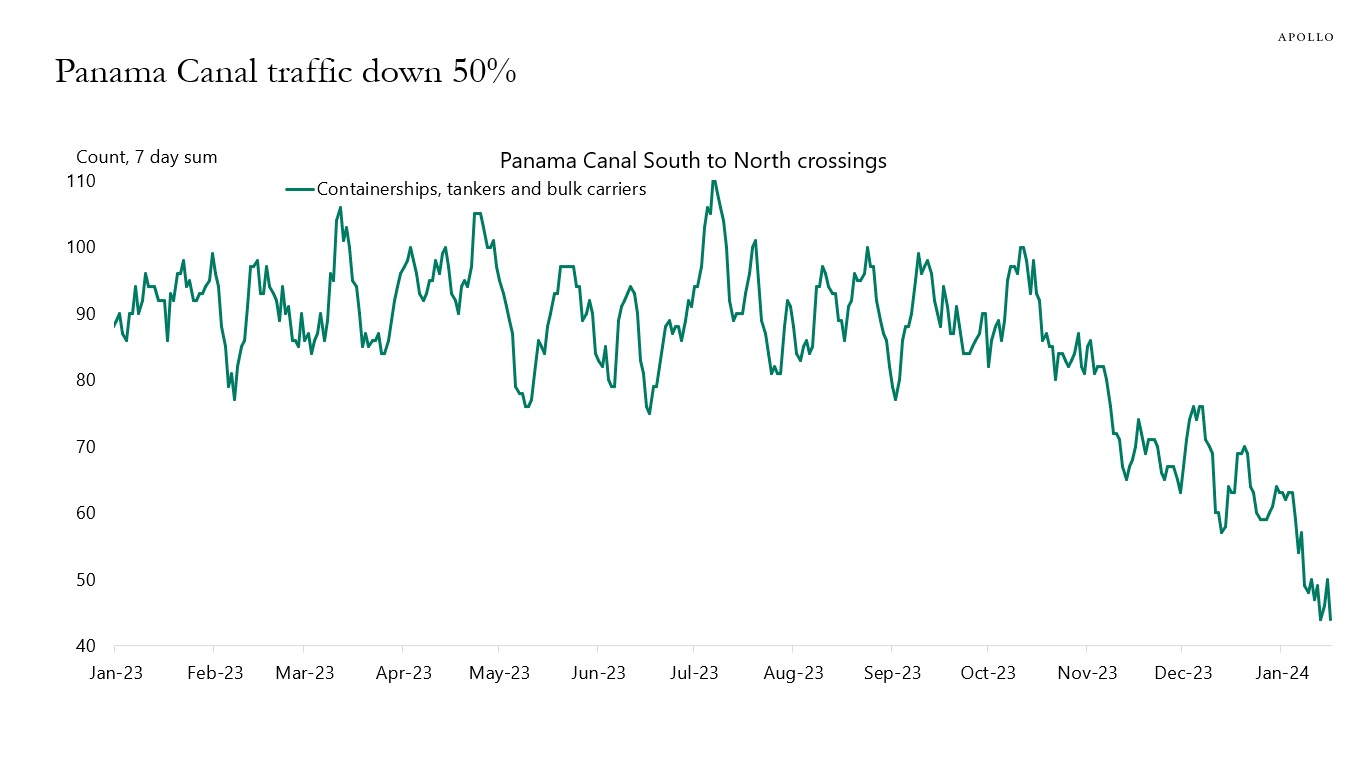

For the Panama Canal, northbound traffic has also declined 50%, from 90 ships per week to 45, see the second chart.

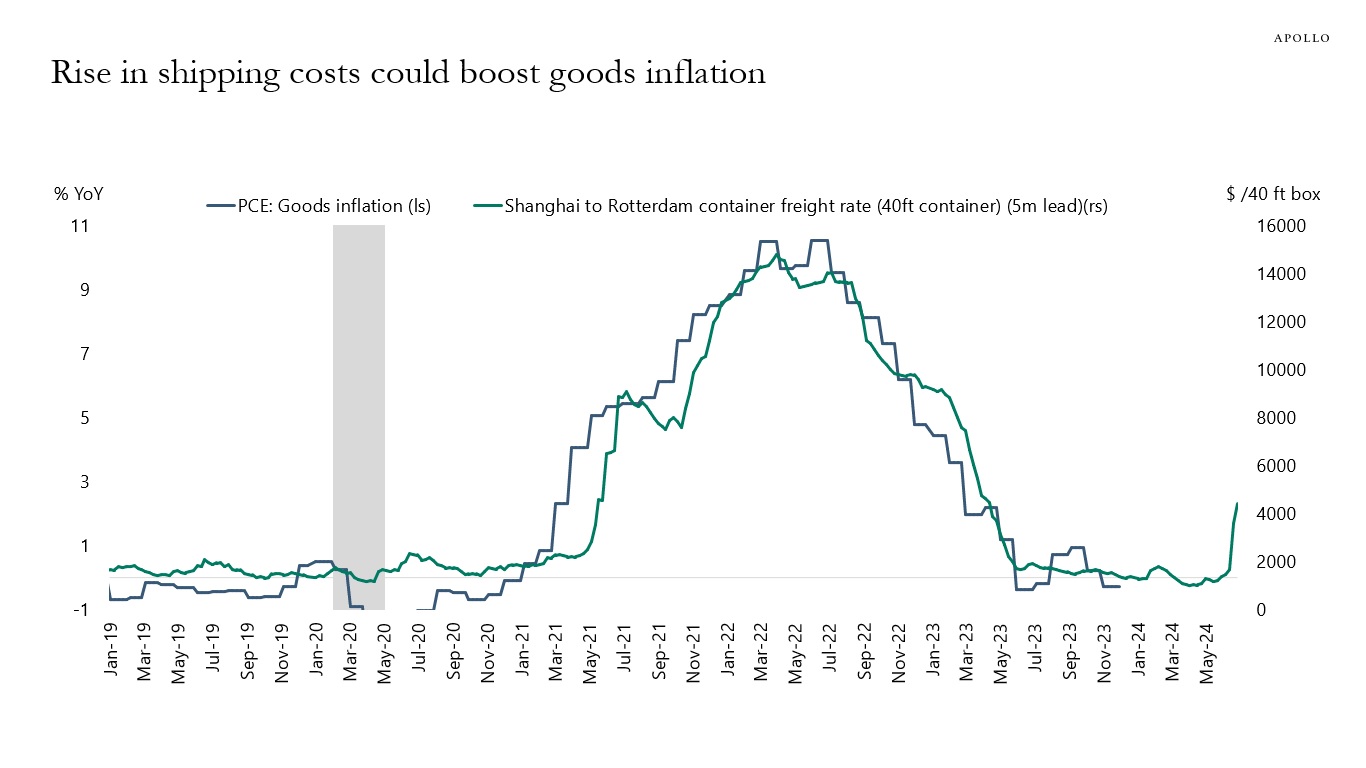

The third chart shows that the price of transporting a container from Shanghai to Rotterdam has tripled.

The bottom line is that higher transportation costs are putting upward pressure on goods inflation.