Normally, when a firm goes bankrupt, you imagine a liquidation where all employees are fired and all assets are sold. But this is not what is happening at the moment. A record-high 70% of US bankruptcy filings this year have been reorganizations, see chart below.

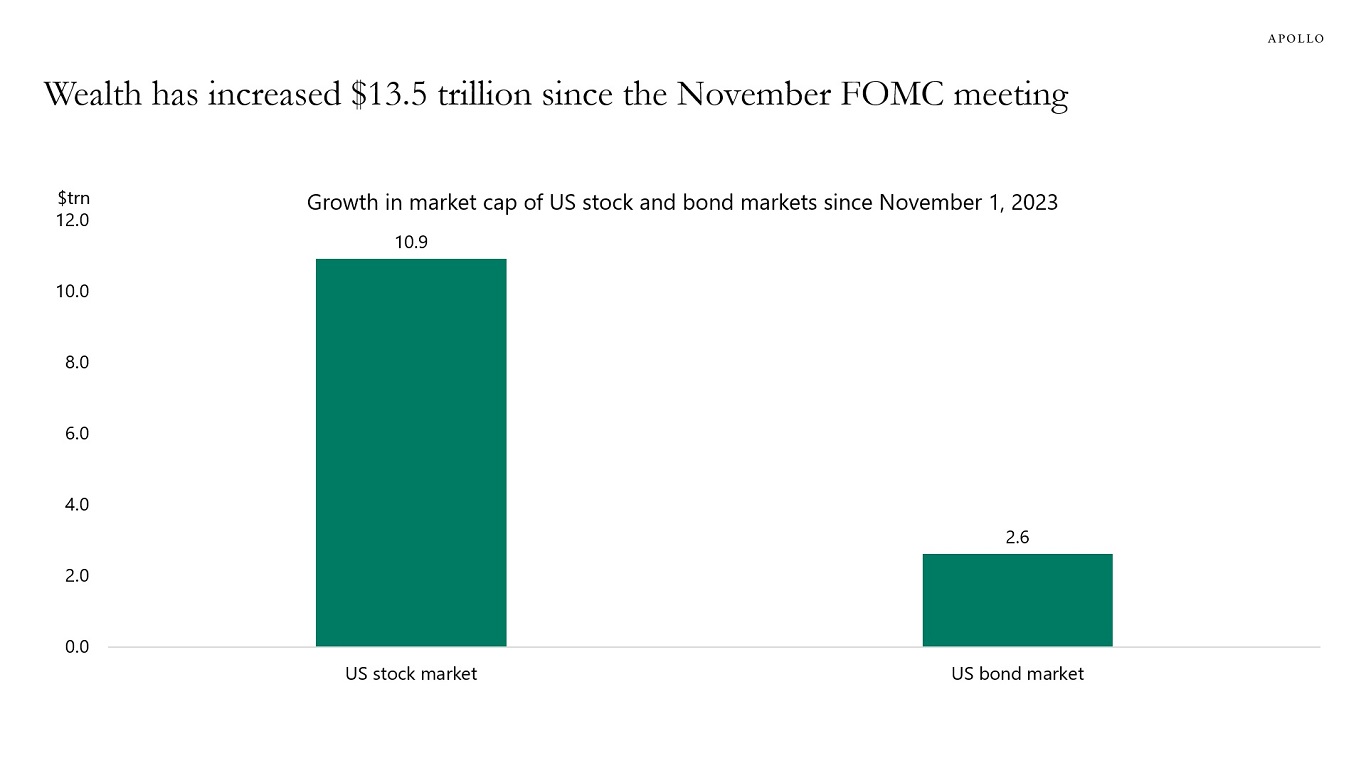

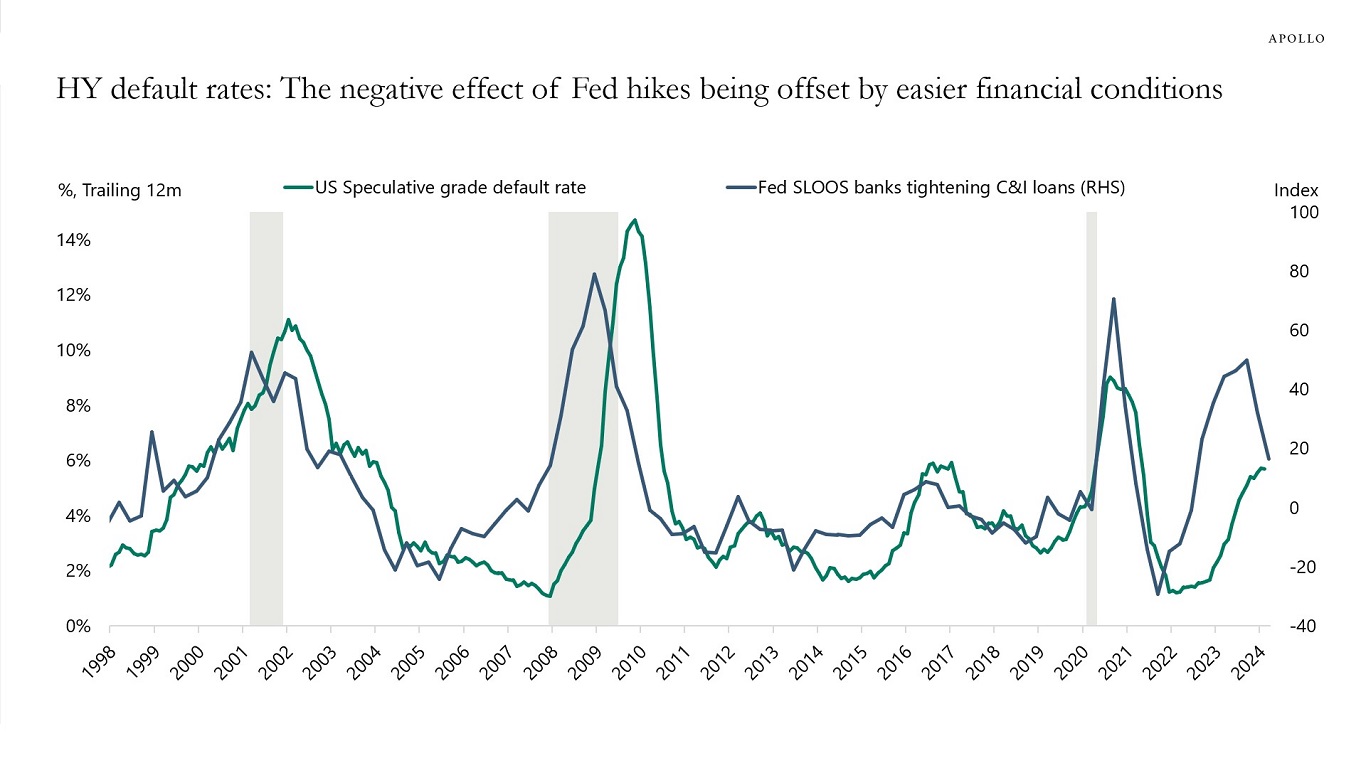

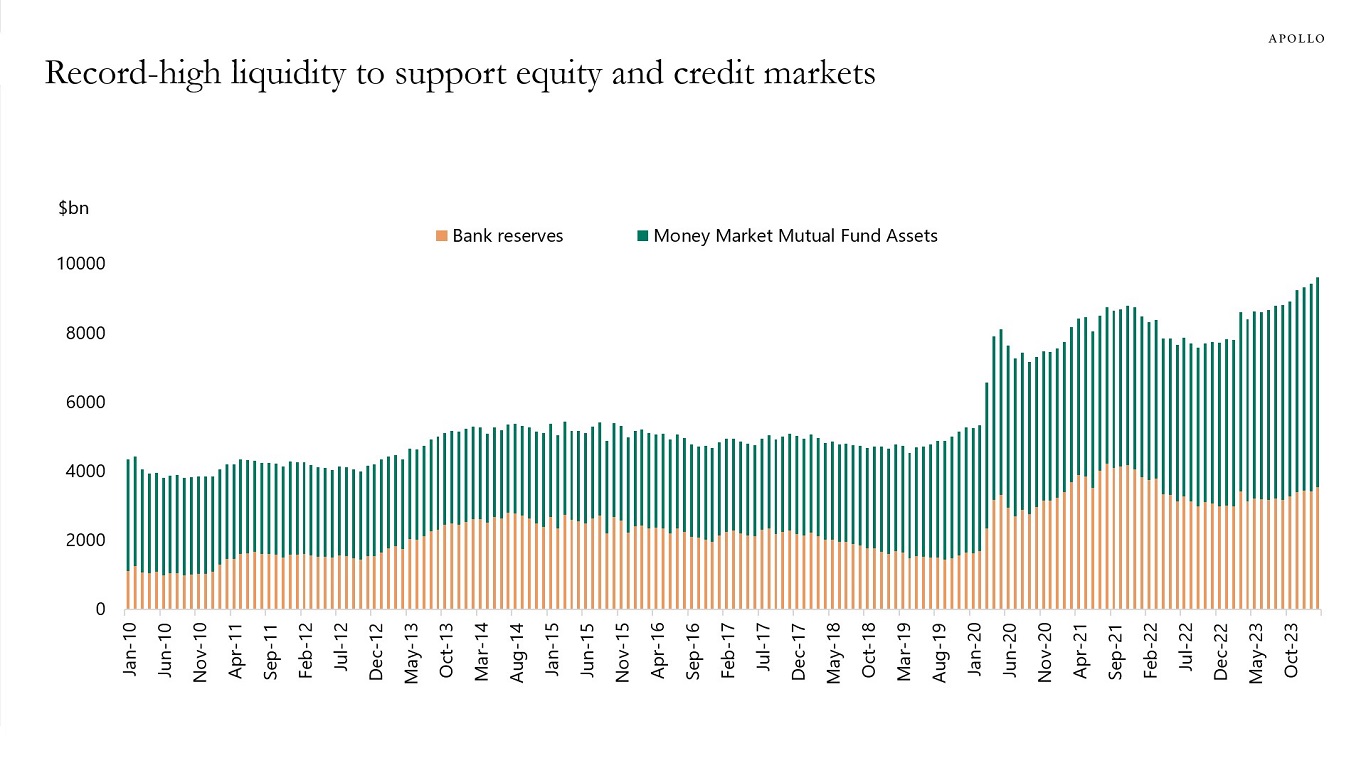

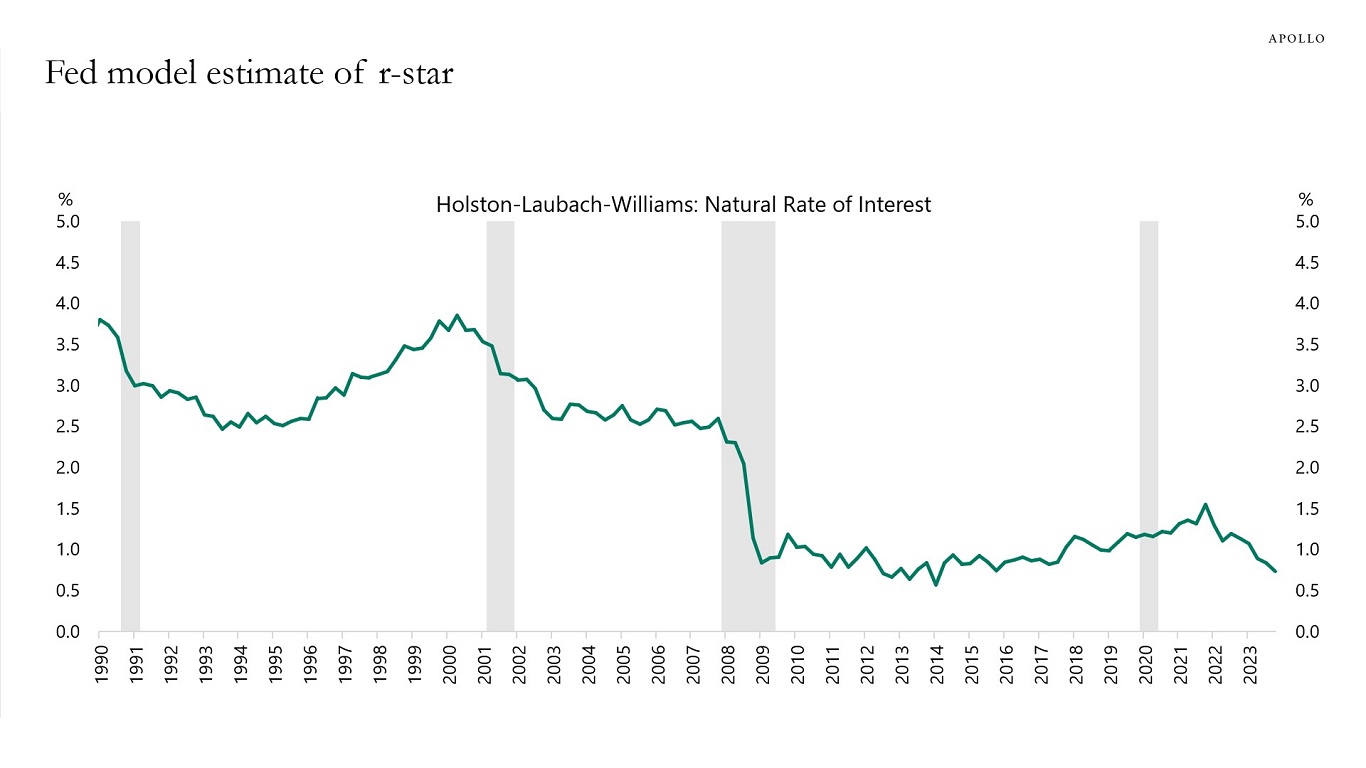

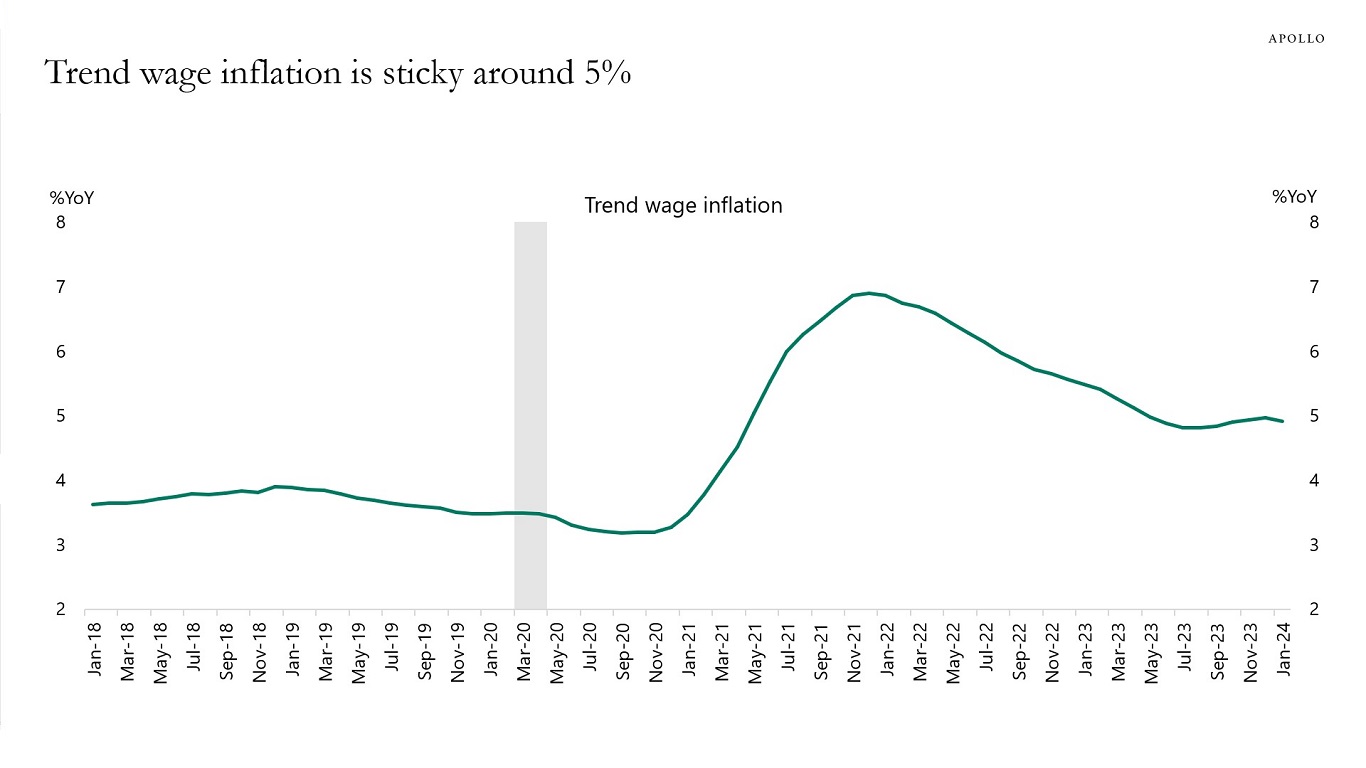

High stock prices and tight credit spreads help companies reorganize instead of liquidating. Combined with the wealth effect of easy financial conditions on consumers, it is harder for the Fed to get inflation under control when financial conditions continue to ease. Put differently, easy financial conditions dampen the traditional transmission mechanism of monetary policy.