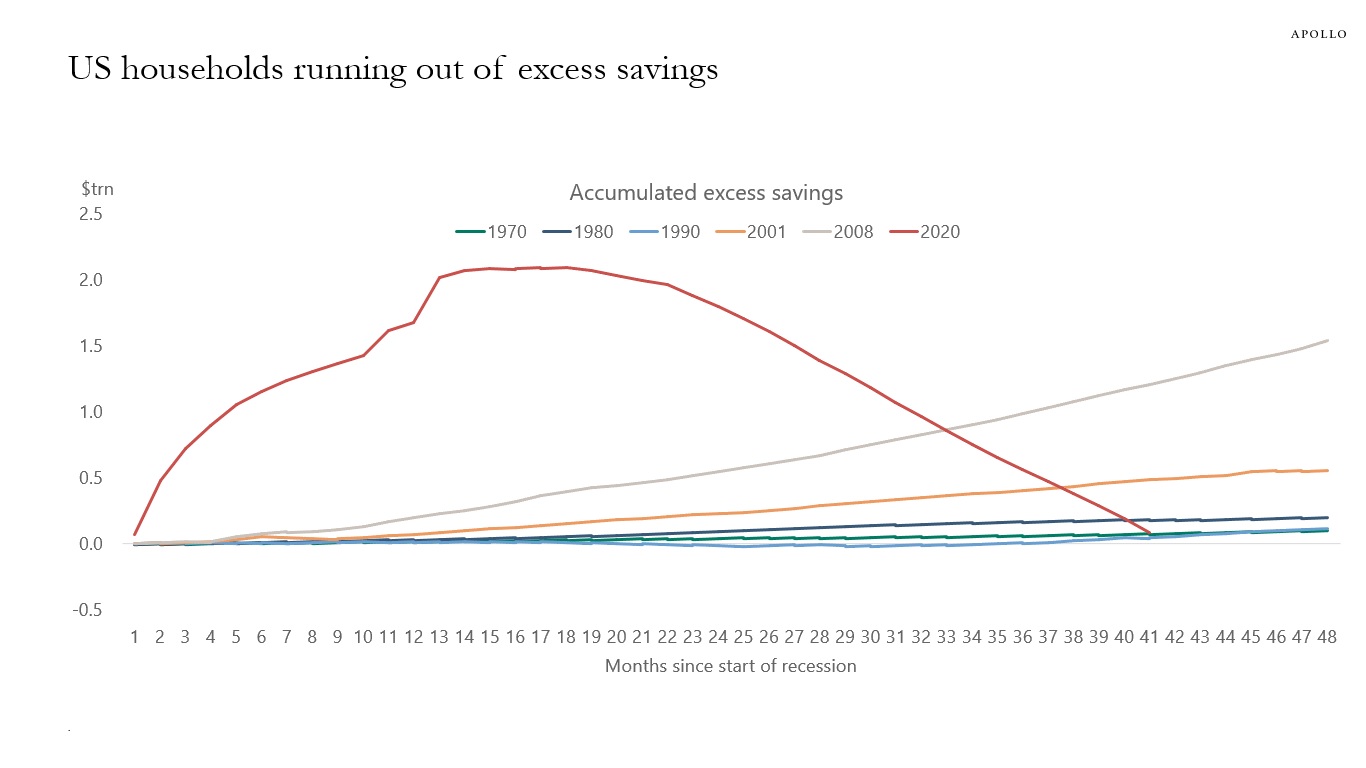

We have updated our estimates of how much excess savings households have left using the Fed’s methodology, and the conclusion is that consumers are almost out of pandemic savings, see chart below.

Note: Excess savings are calculated as the accumulated difference between actual personal savings and the trend implied by data for the 48 months leading up to the first month of each recession, as defined by the NBER.