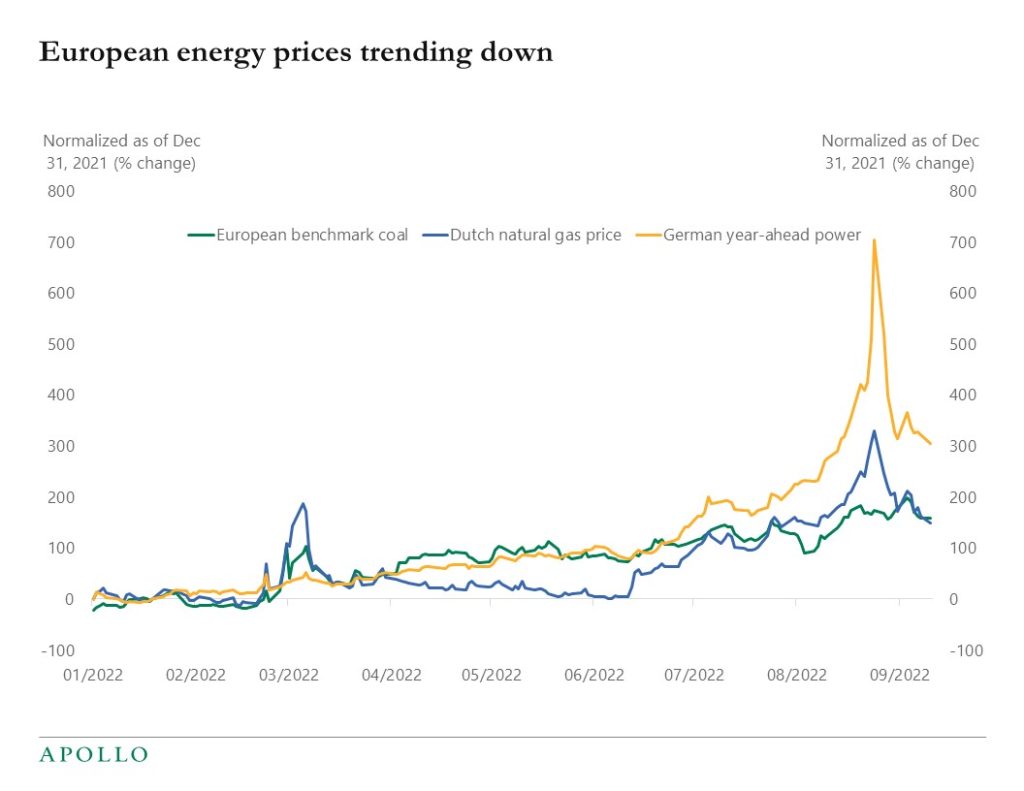

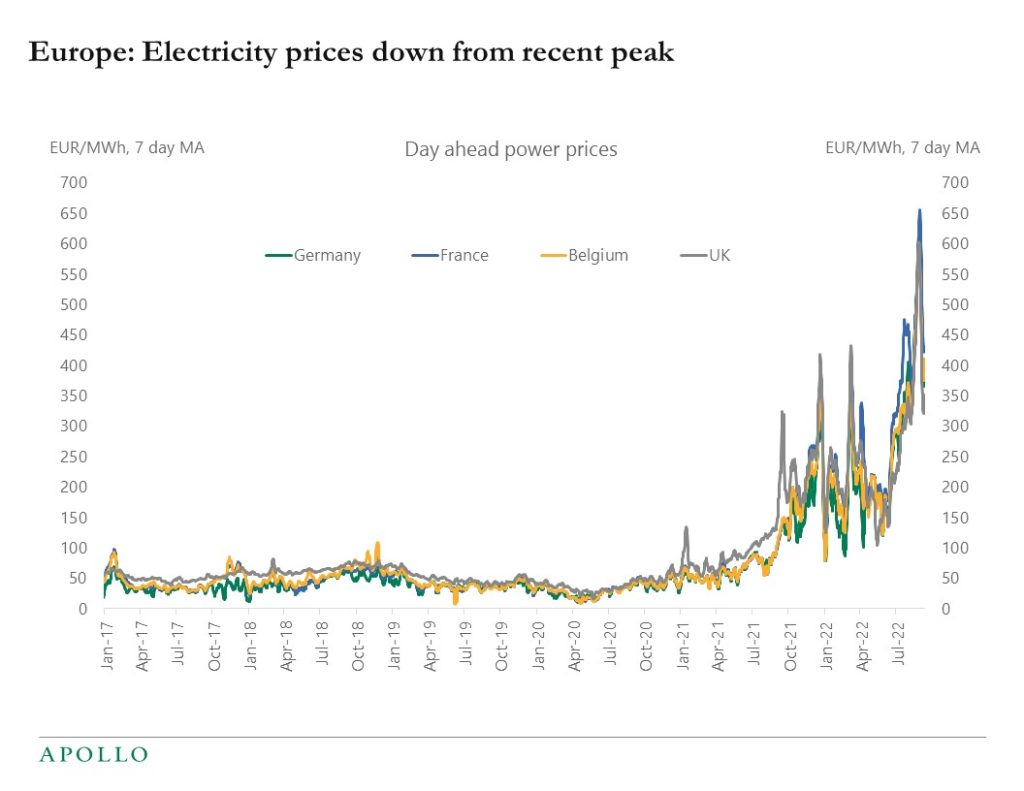

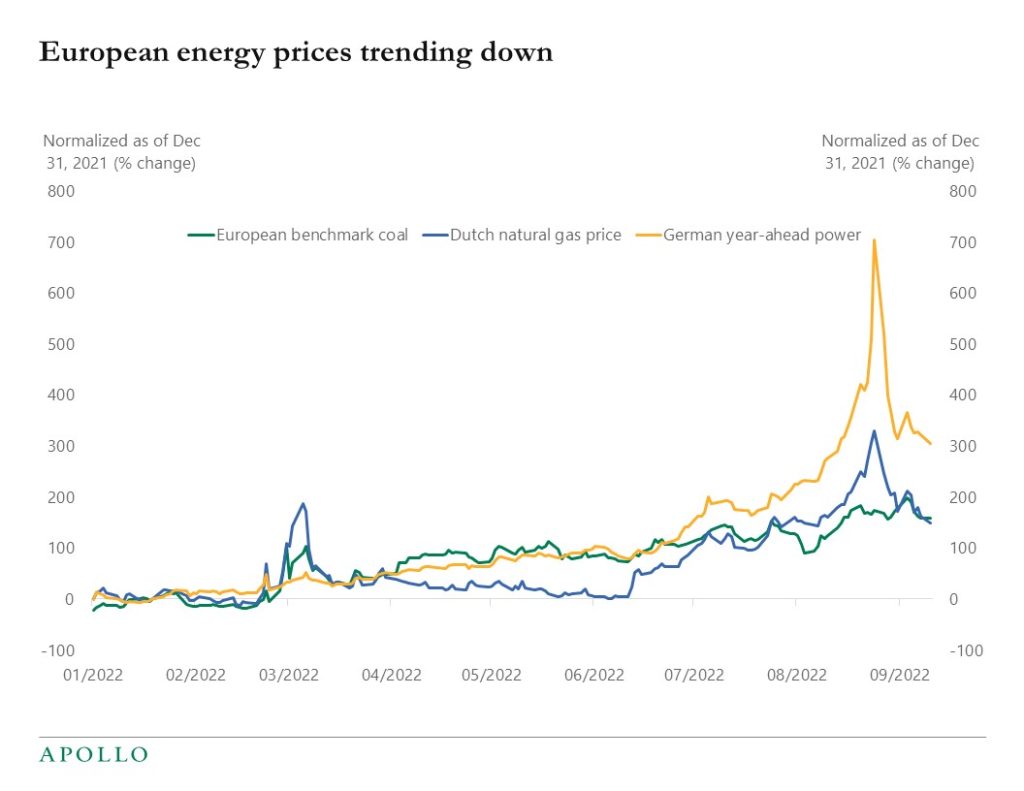

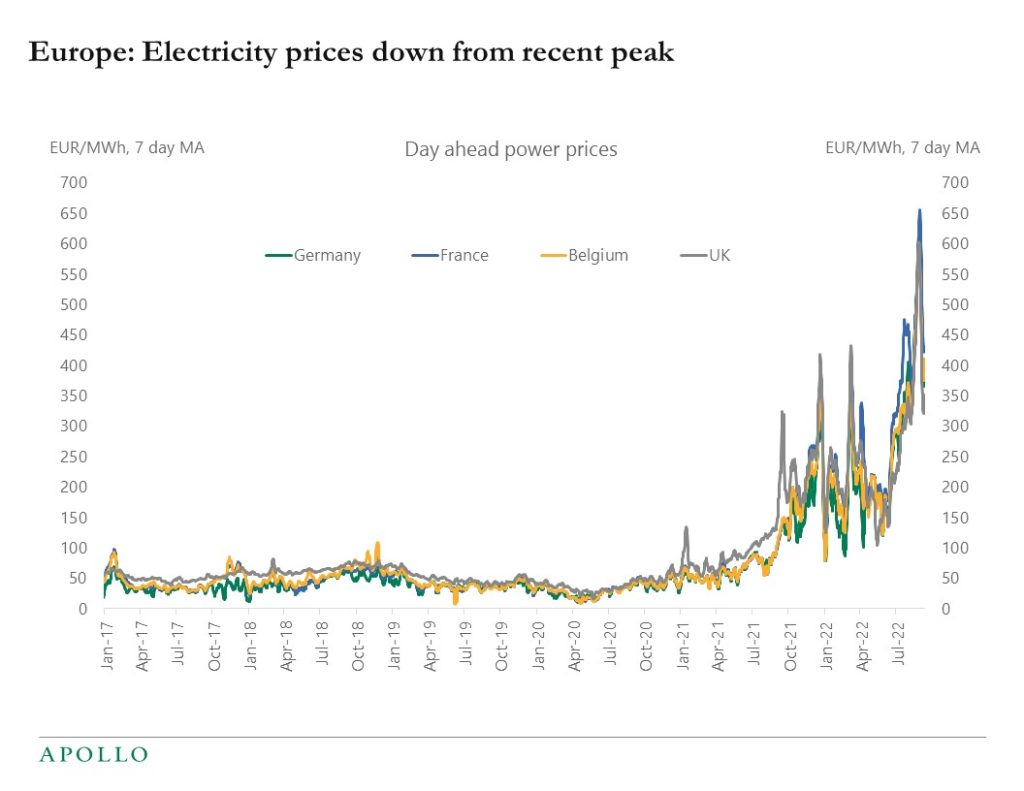

European energy prices are coming down from recent peaks. Our weekly energy PDF is available here.

European energy prices are coming down from recent peaks. Our weekly energy PDF is available here.

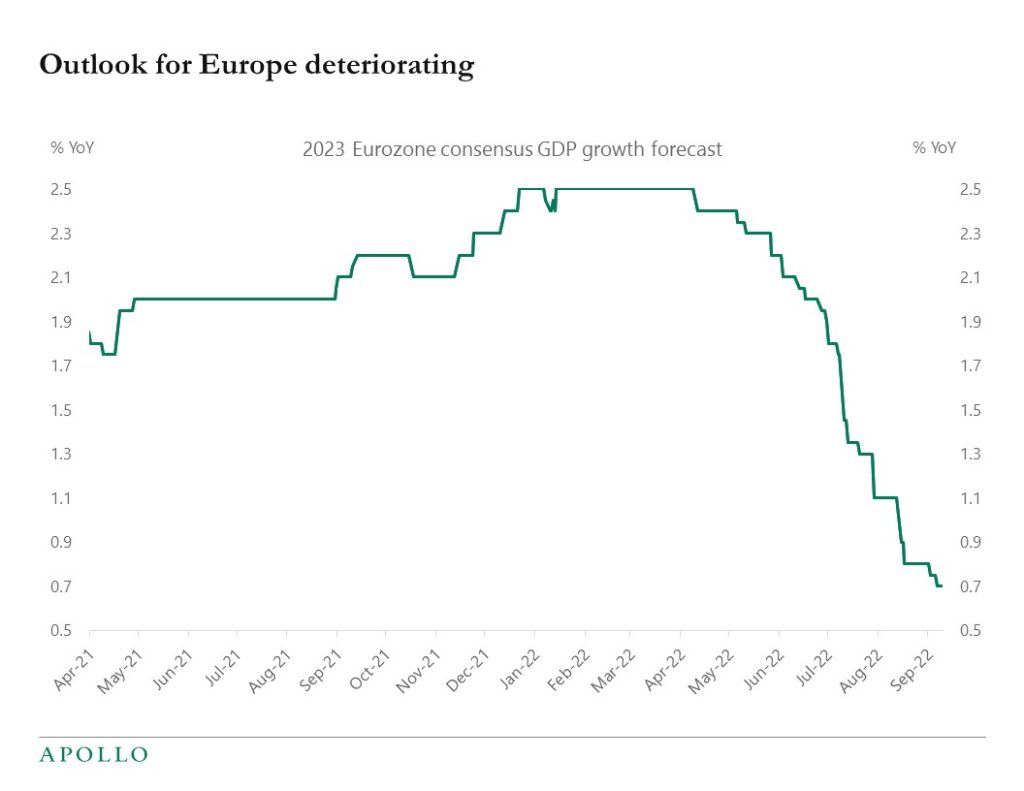

The consensus is close to forecasting a recession in Europe in 2023, see chart below.

Last week, the European Central Bank (ECB) raised interest rates by a significant 75 basis points, which takes European short-term interest rates out of negative territory for the first time in years. This comes against a backdrop of elevated inflation and slowing growth in the region. In fact, the consensus has dramatically downgraded their 2023 forecasts for Europe to the point where they are close to expecting a recession. Because of impacts from the situation in Ukraine, growth is slowing much faster in Europe than in the US. This could result in fewer rate hikes from the ECB when compared to US Federal Reserve. Looking ahead to this week, on Tuesday we will get August CPI inflation data. In July, inflation came in at 8.5% and the consensus is expecting the August numbers to slightly tick down to 8.1%. Although inflation is trending in the right direction, it still remains dramatically higher than the Fed’s 2% target.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

Fed: Credit Card Profitability

https://www.federalreserve.gov/econres/notes/feds-notes/credit-card-profitability-20220909.html

Air Pollution and Economic Opportunity in the United States

Fed: Anticipated FOMC Policy, Inflation and Credibility

https://www.richmondfed.org/publications/research/economic_brief/2022/eb_22-37

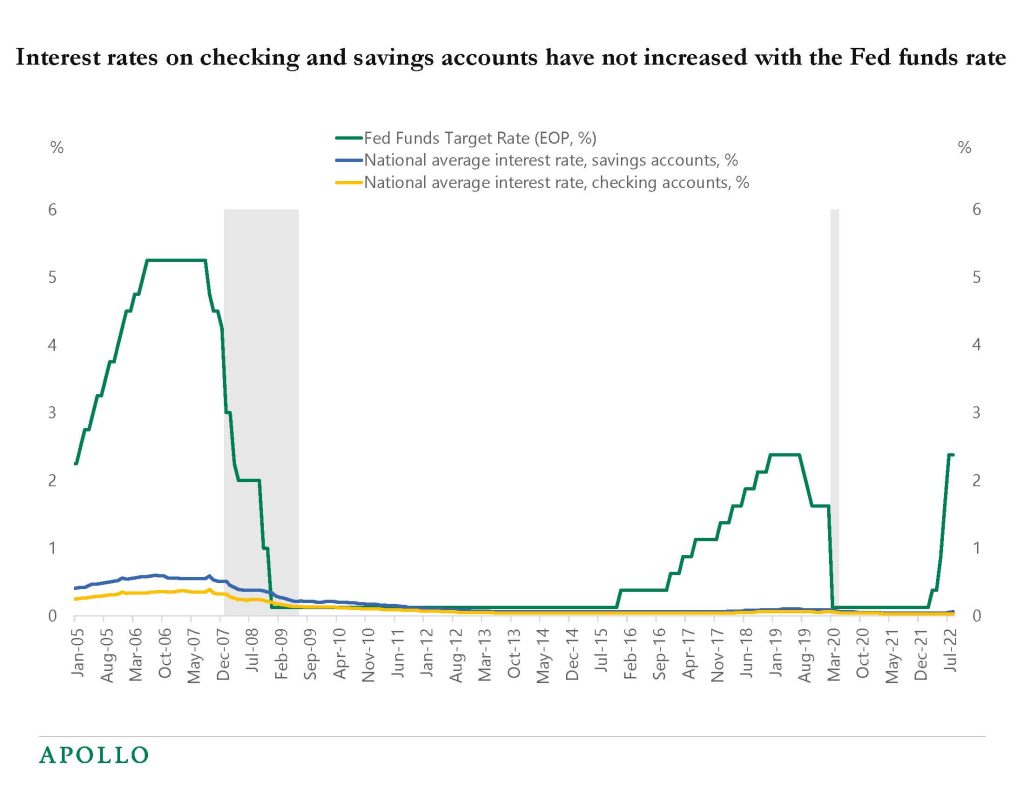

The Fed has been increasing the Fed funds rate, but banks have not increased interest rates on checking accounts and savings accounts, see chart below.

Households that want to benefit from rising short rates need to actively take money out of their bank accounts and into CDs, money market funds, or floating rate credit funds.

The implication for markets is that the transmission mechanism for monetary policy is weaker because the idea with a higher Fed funds rate is to attract money into savings and away from consumer spending.

With very high household savings and very high levels of deposits in banks, this lack of an increase in interest rates on checking accounts and savings accounts is likely a contributing reason why consumer spending is still so strong.

Our weekly Slowdown Watch PDF is linked here.

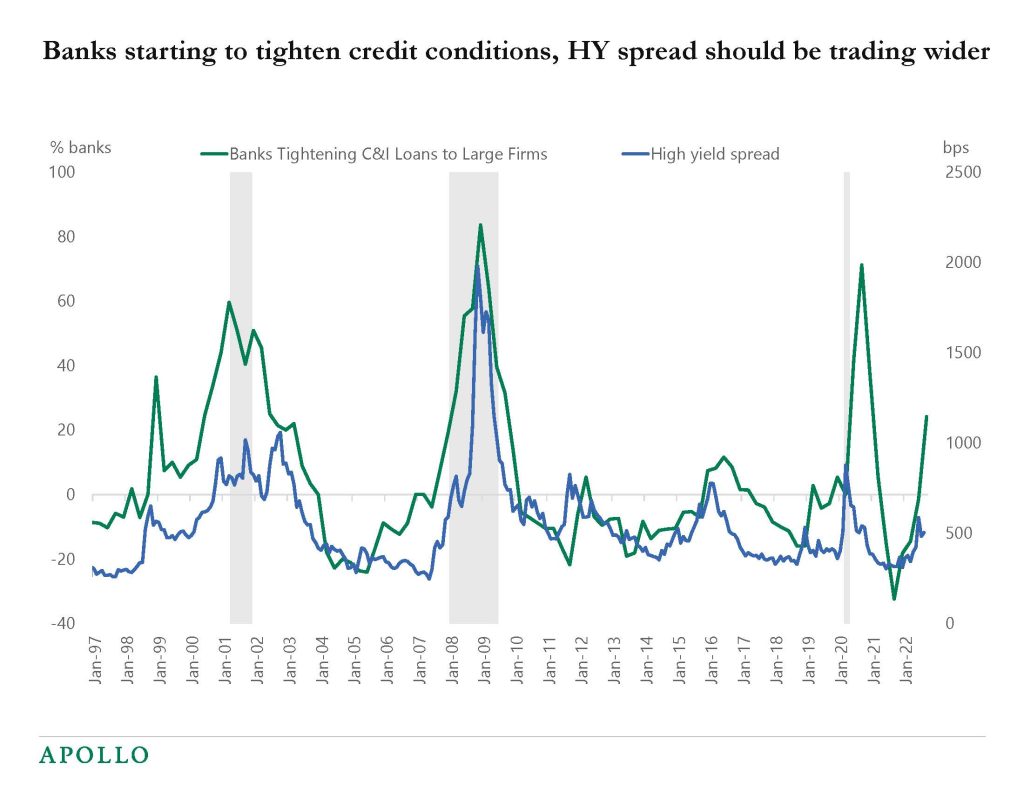

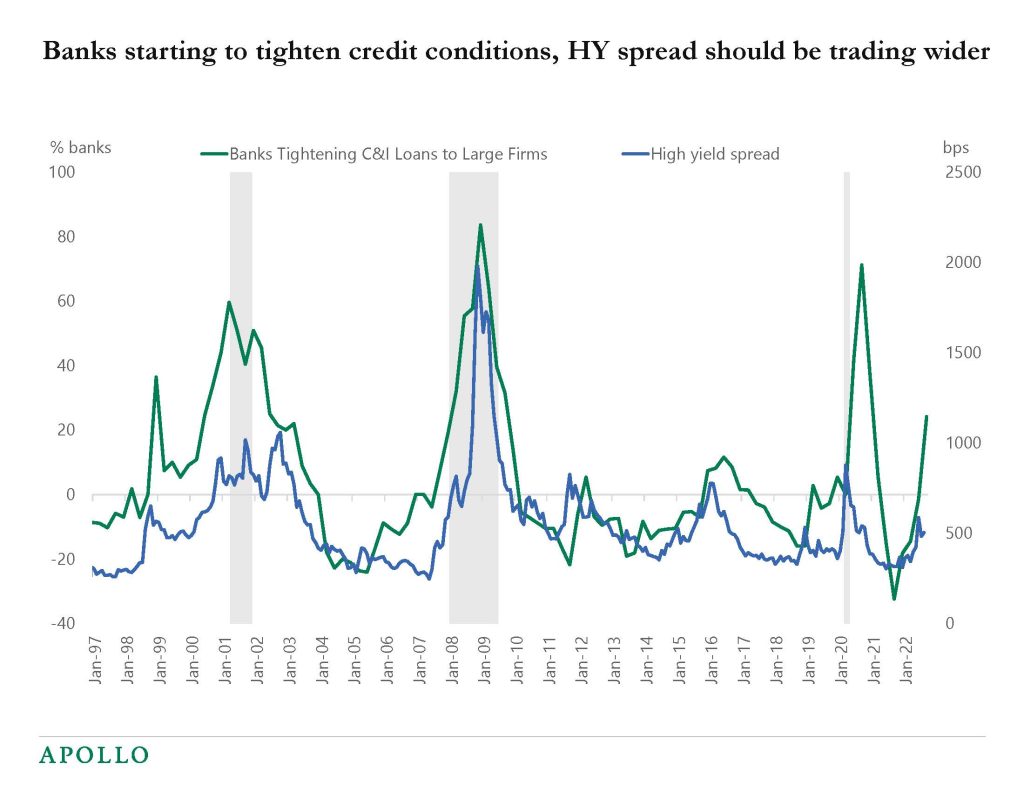

The Fed asks banks about credit conditions for firms and consumers, and the latest Senior Loan Officer Survey shows that banks are starting to tighten lending standards on commercial and industrial loans.

This is what the Fed wants to see because the goal for the FOMC is to slow down hiring and capex spending and, ultimately, inflation.

The challenge for the Fed is that the ongoing tightening in lending standards has not yet resulted in a corresponding widening in high yield spreads, see chart below.

The Fed’s goal is to tighten financial conditions and credit conditions, and if credit spreads don’t widen out further, then the Fed will have to do more with rates. Financial conditions are not tightening as much as the Fed would like to see, and as a result, the Fed will have to do more of the work by raising short-term interest rates further. Because the Fed is fully committed to getting inflation down from the current level at 8.5% to the Fed’s 2% inflation target.

For markets the conclusion is straightforward: The Fed wants to tighten financial conditions and investors should be positioned accordingly.

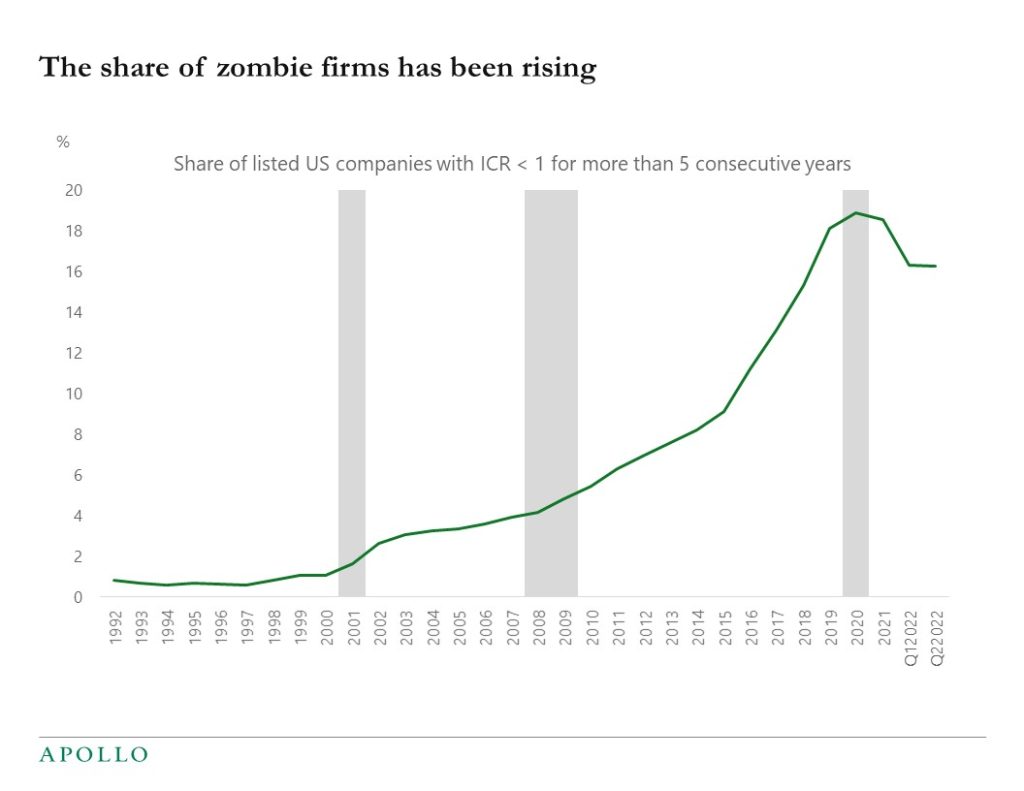

There are about 4500 publicly listed companies in the US, and about 16% are zombies, see chart below. A zombie company is a firm that has existed for ten years and had an interest coverage ratio of less than one for more than five consecutive years. After the financial crisis in 2008, interest rates were kept at zero for a decade, and low borrowing costs made it possible for many firms to continue to operate. With high inflation and rising interest rates, the number of zombie firms is likely to come down as the costs of capital continue to rise. For more discussion see this Fed publication and this BIS publication.

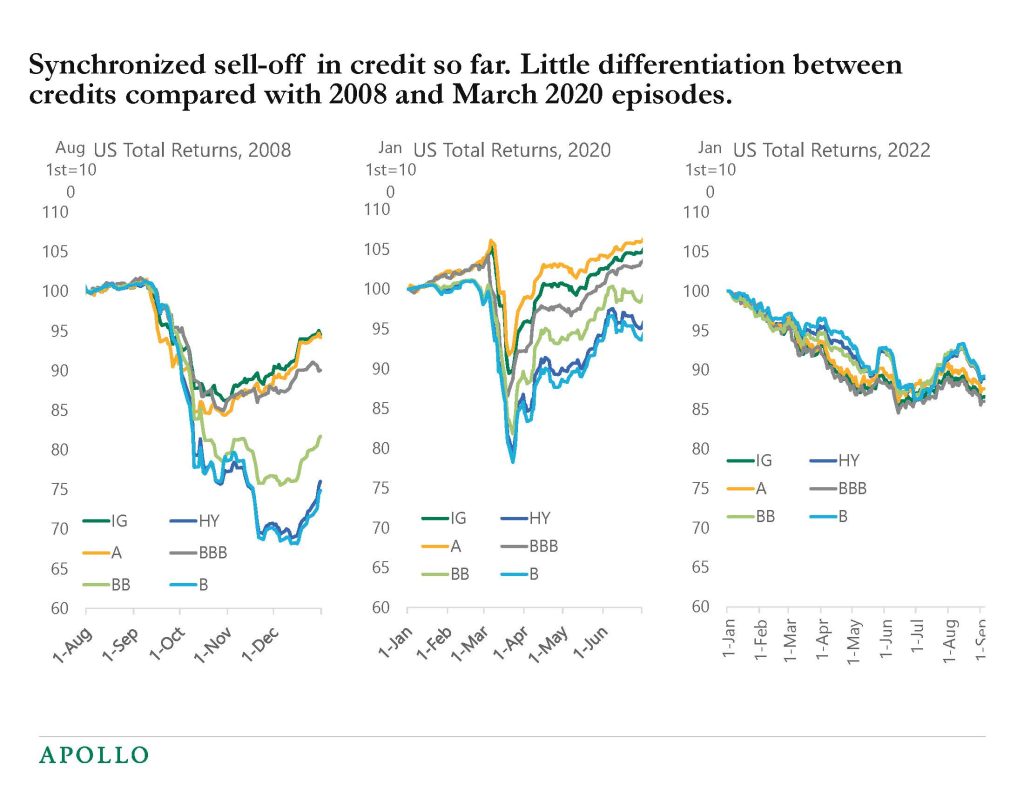

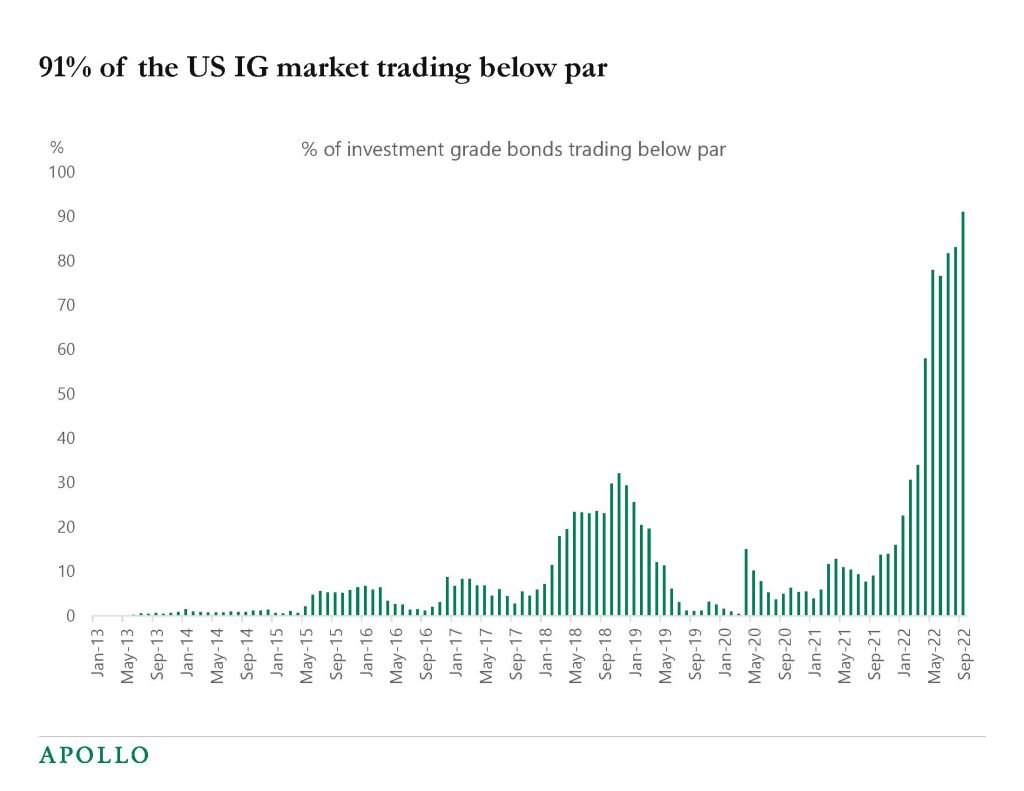

The 2022 sell-off in credit has been highly synchronized across credit ratings compared to the sell-offs in 2008 and 2020, see the first chart below. In other words, markets are currently not pricing in a recession with significant differentiation across credits. Our latest credit market outlook presentation is linked here.

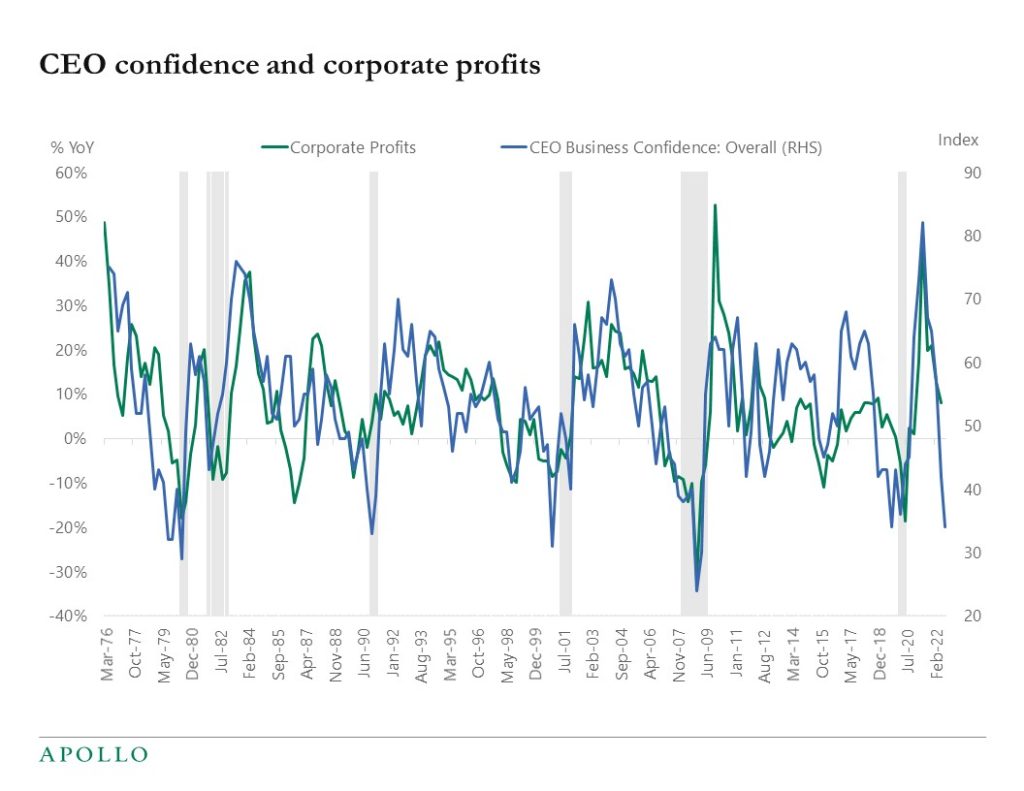

CEO confidence is a leading indicator of corporate profits, and the chart below suggests that markets should be more worried about the outlook for earnings.

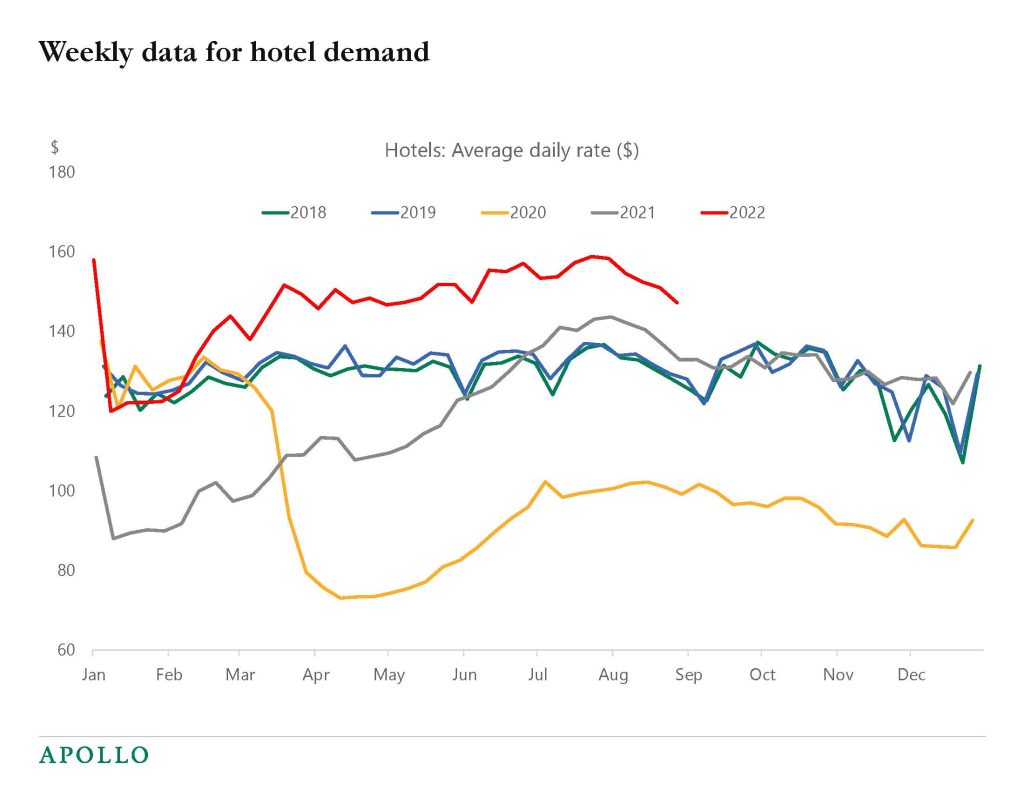

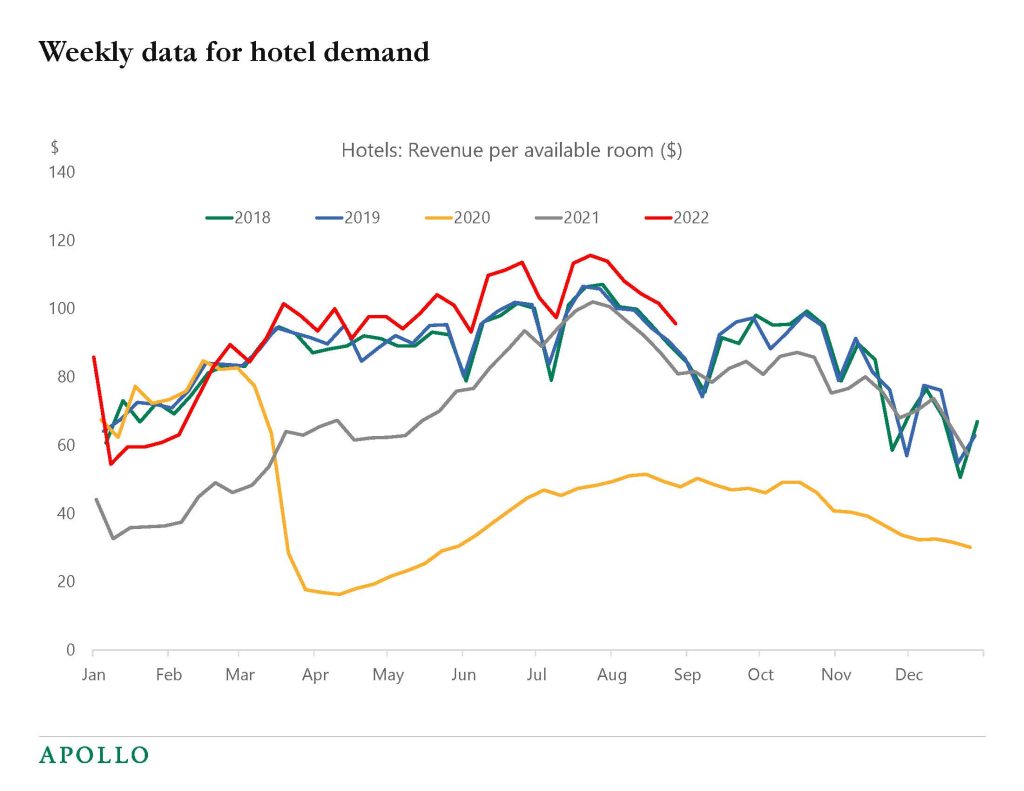

Weekly hotel indicators, including occupancy rates, are softening for seasonal reasons, but the Average daily rate and RevPar are still well above pre-pandemic levels, see charts below. Our weekly Slowdown Watch presentation is linked here.