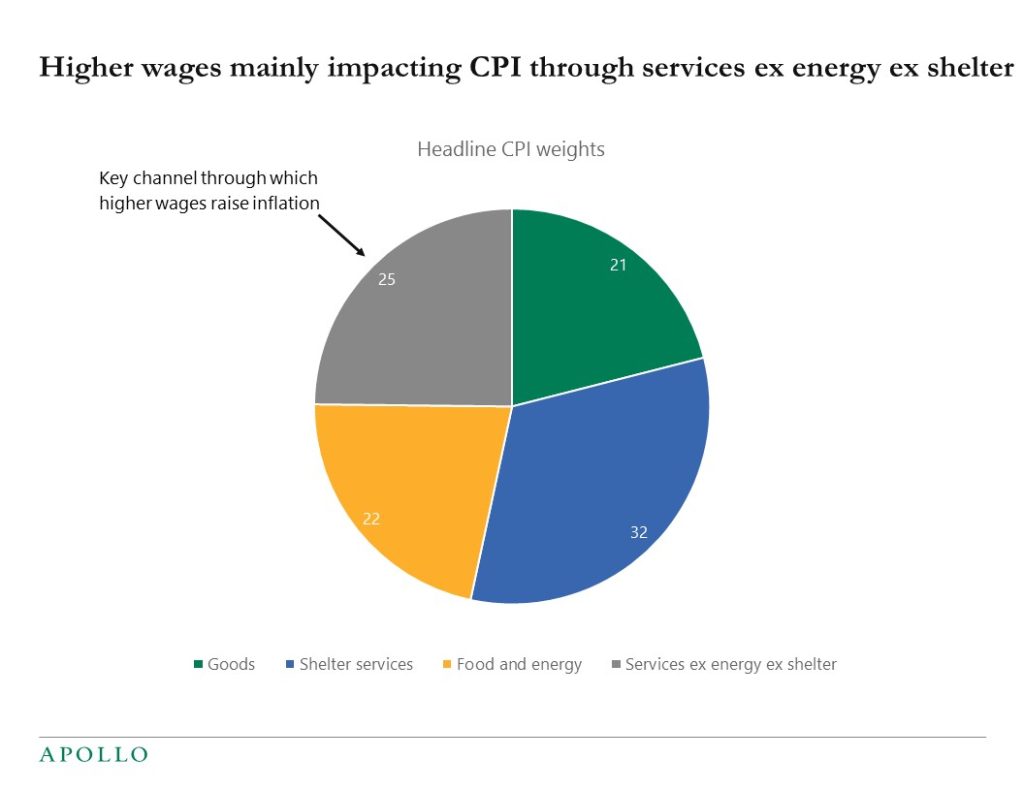

Wage inflation has a weight of 25% in the CPI basket via Services ex-energy ex-shelter. The transmission channel is that higher wages in consumer services such as restaurants and hotels increase the price of eating out and staying at hotels.

The impact of higher wage inflation on the remaining 75% of the CPI index is more complex, see chart below.

With wages having a limited weight in the CPI basket, it is entirely possible to have higher wage inflation for a period while consumer price inflation is coming down as supply chains get better, rent inflation declines, car price inflation declines etc. In other words, the 25% of the CPI basket that is directly impacted by wages may be rising while at the same time, inflation in the remaining 75% of the basket is declining.

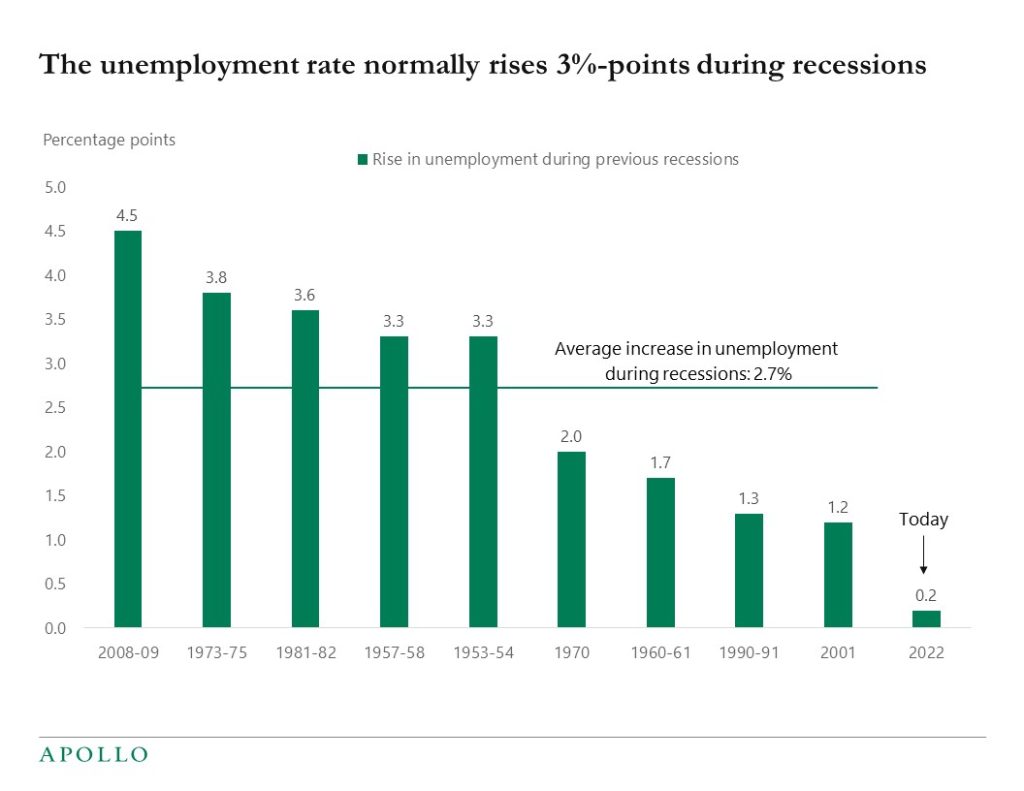

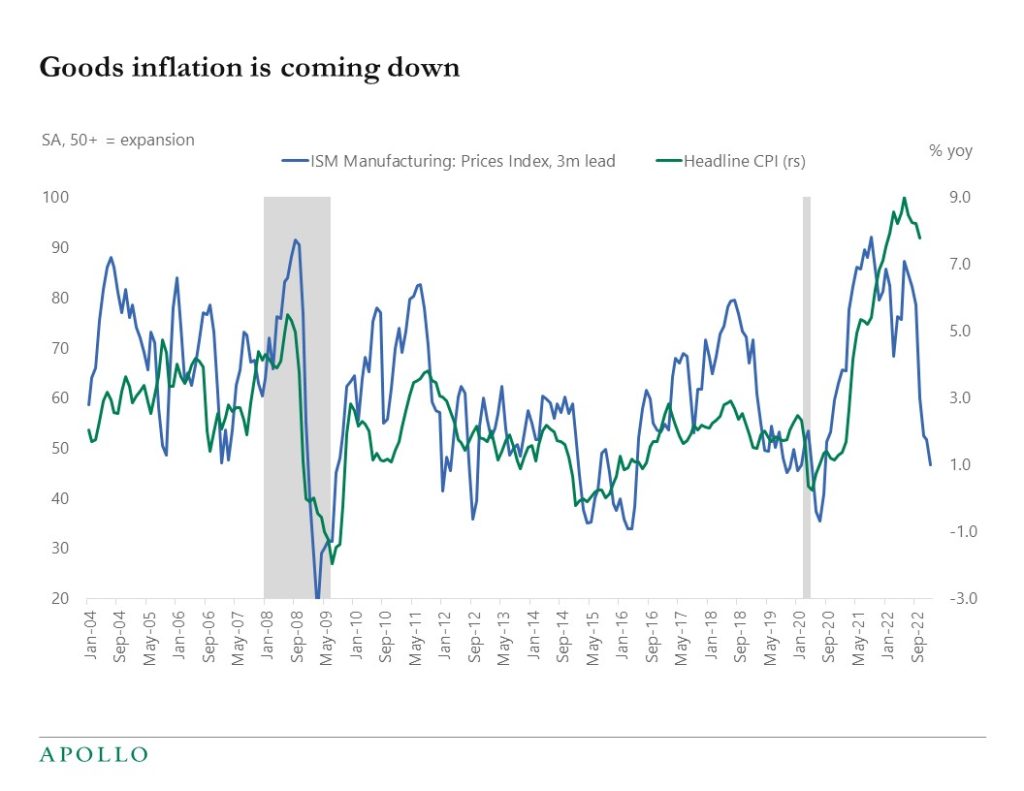

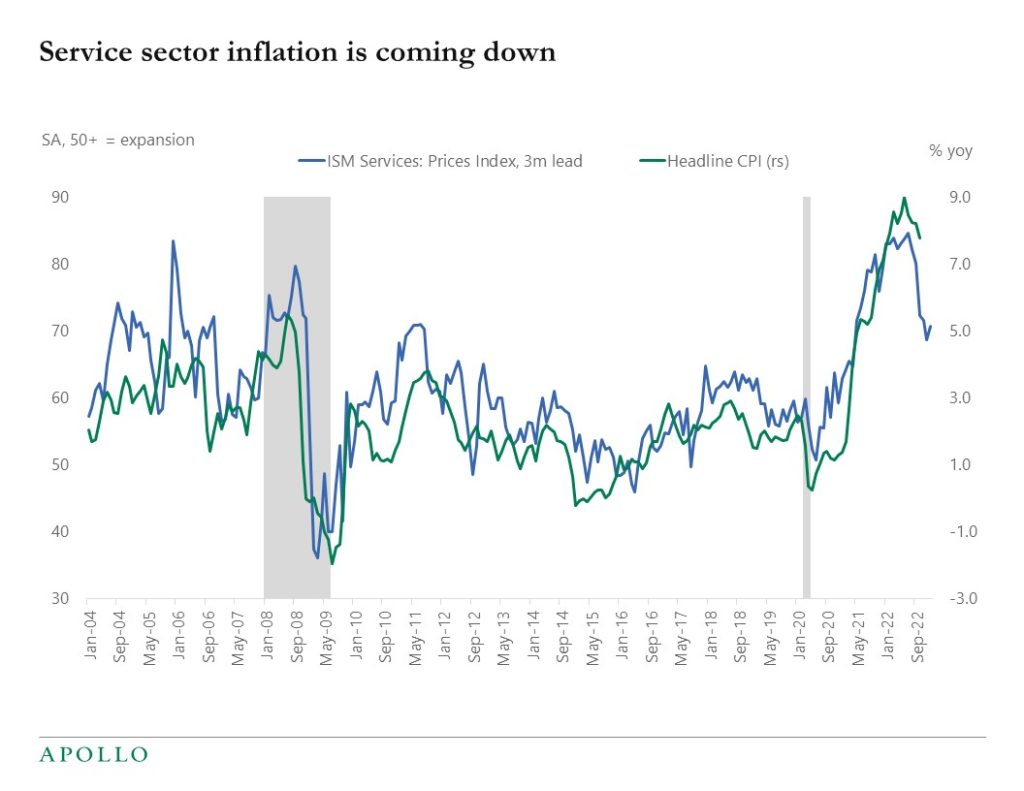

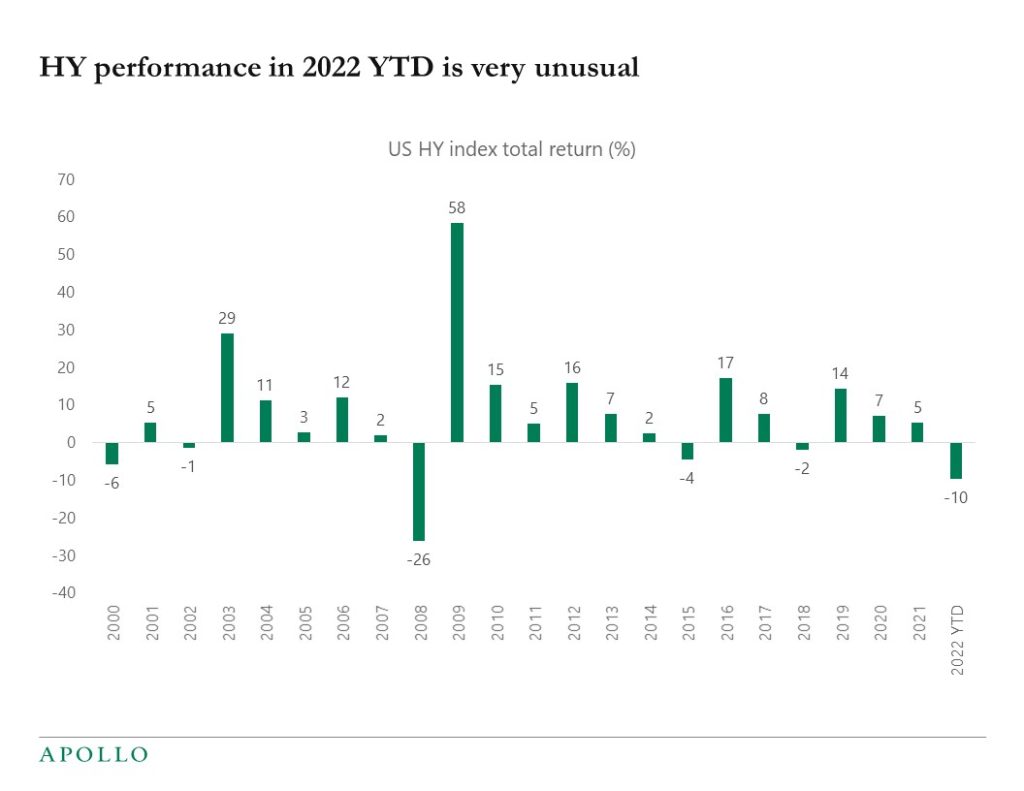

The bottom line is that with inflation currently at 7.7% and declining rent inflation, declining car price inflation, declining transportation inflation, declining import price inflation, and elevated inventory levels, we may not need a dramatic amount of demand destruction and a significant increase in the unemployment rate for inflation to come down to the Fed’s 2% inflation target.

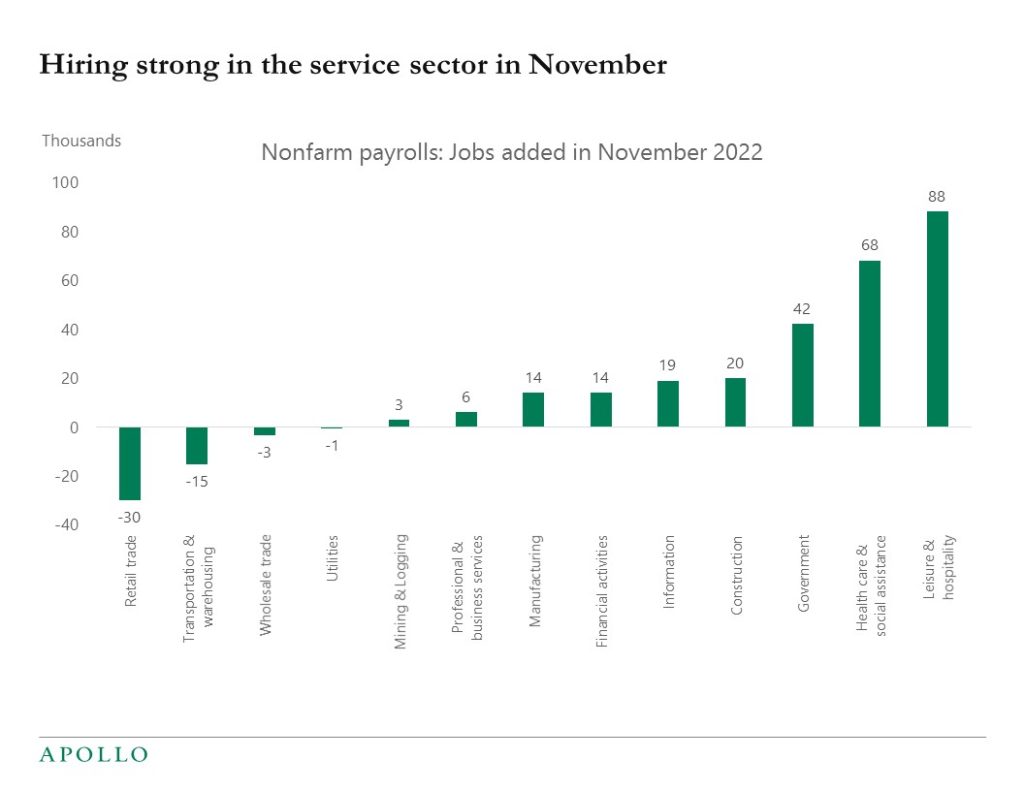

In short, with inflation declining and the labor market remaining solid, the probability of a soft landing is rising.