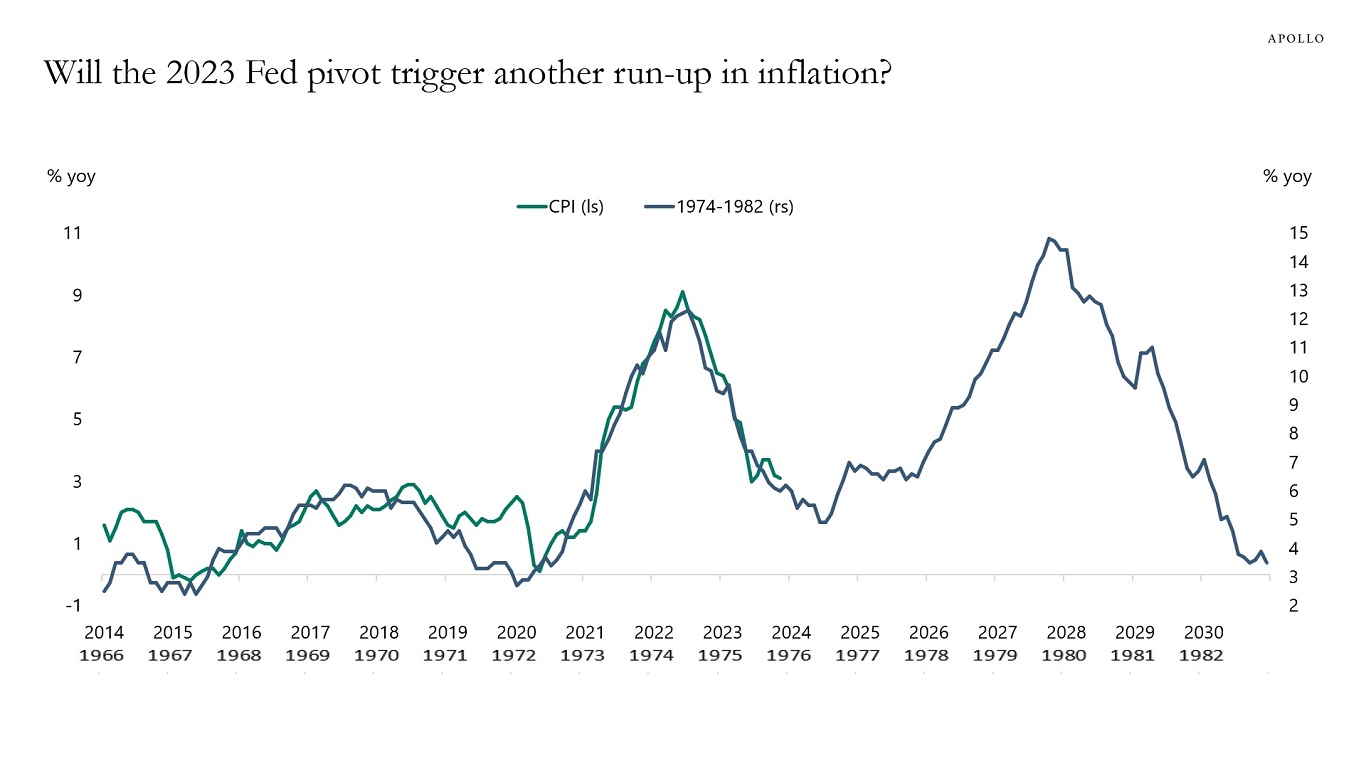

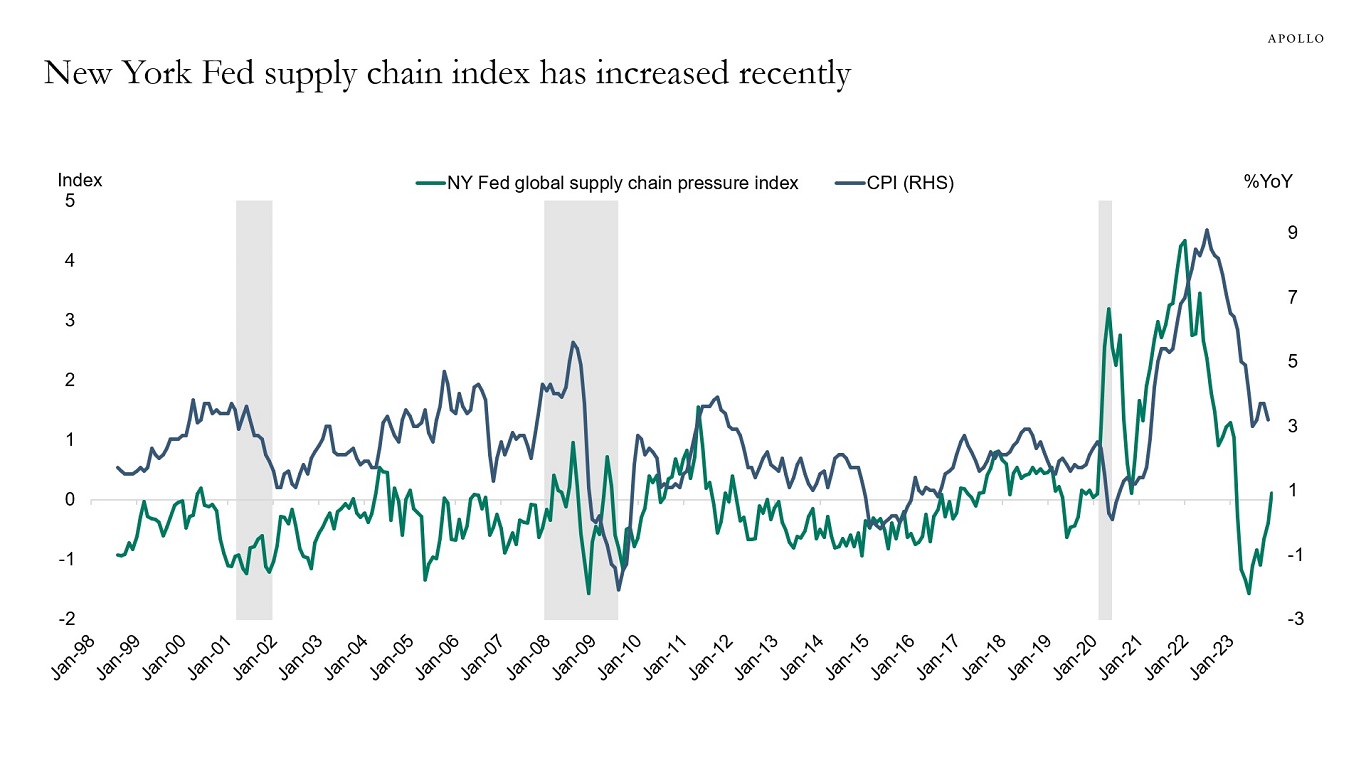

With the Fed worrying less about inflation and more about growth, the risks are rising that easier financial conditions triggered by the Fed’s pivot could start another rise in inflation driven by higher prices on housing, labor, services, and goods, see chart below.