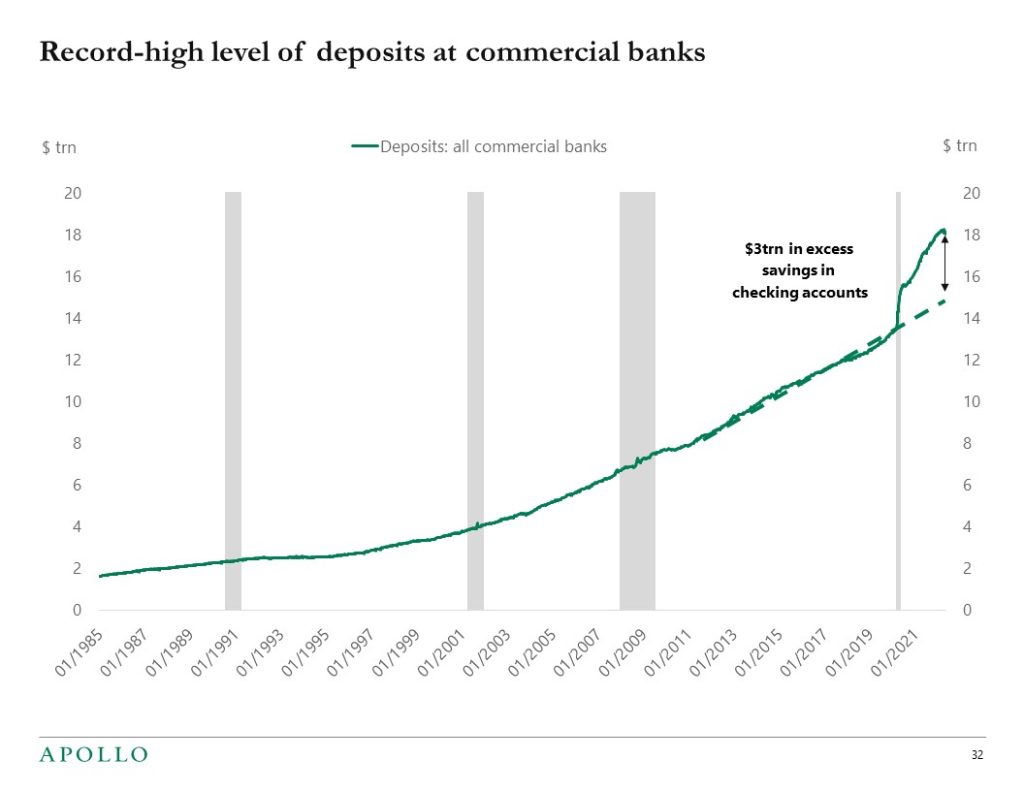

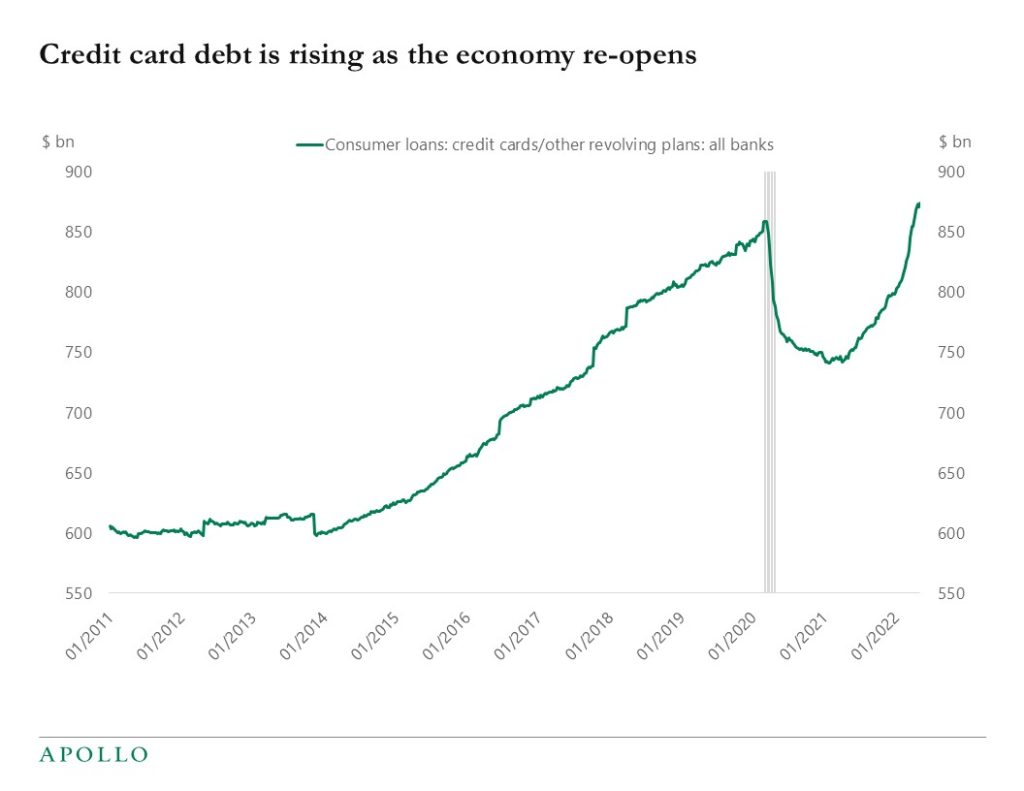

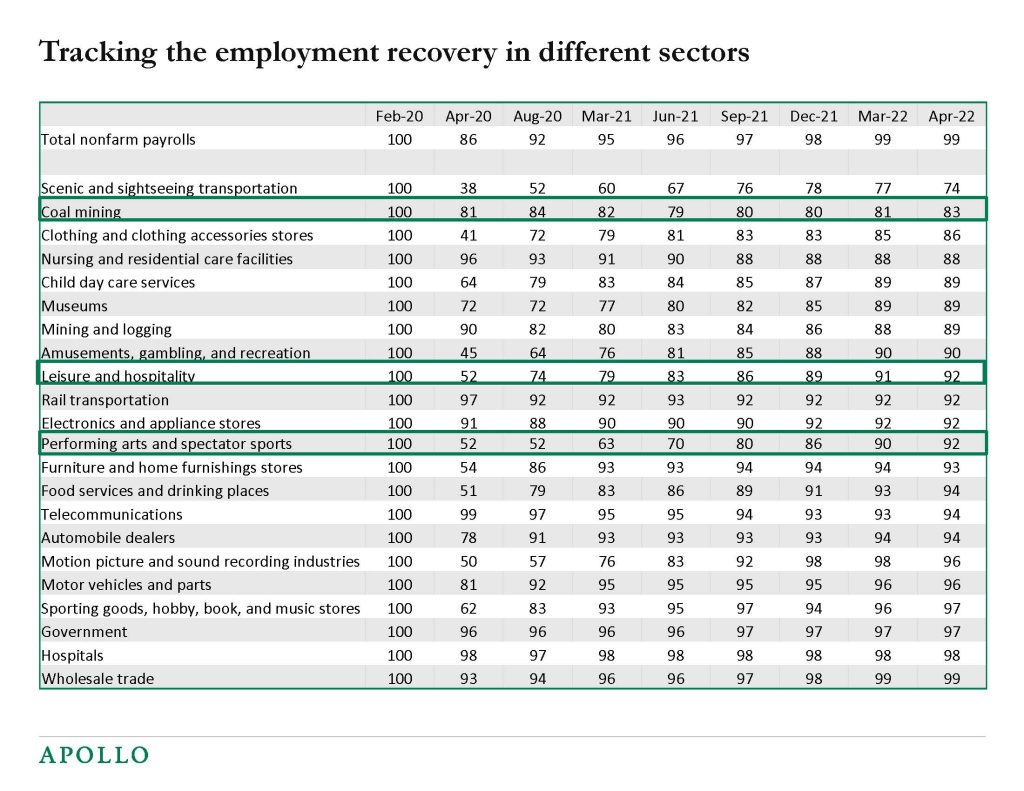

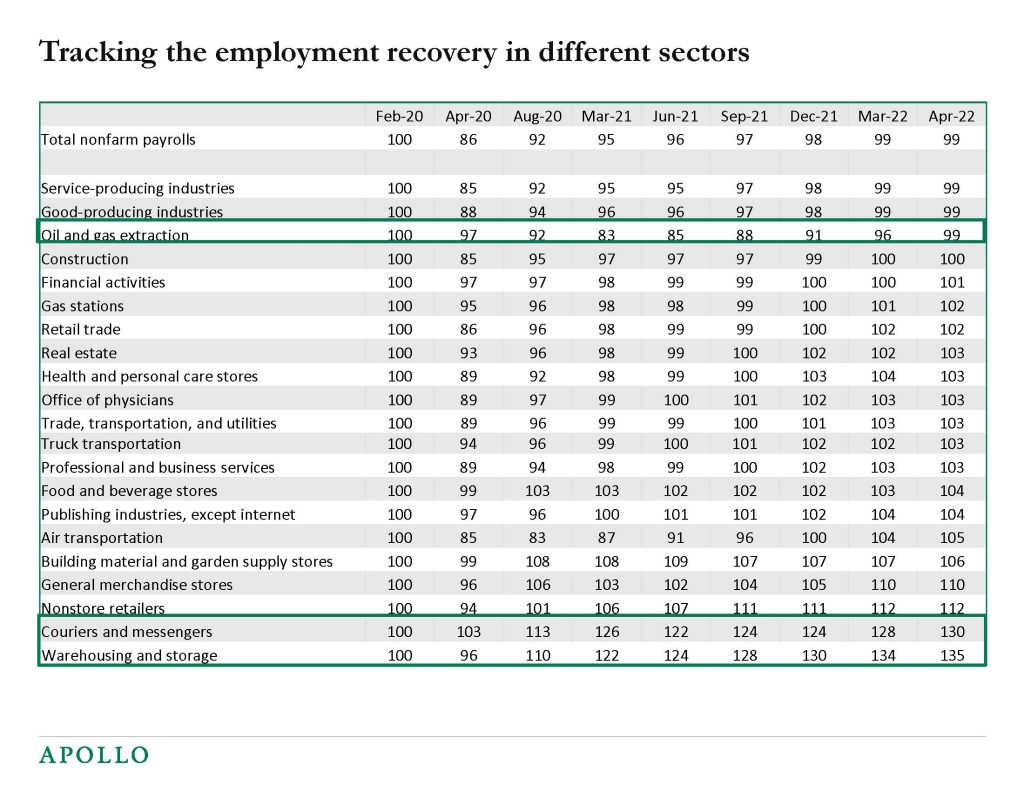

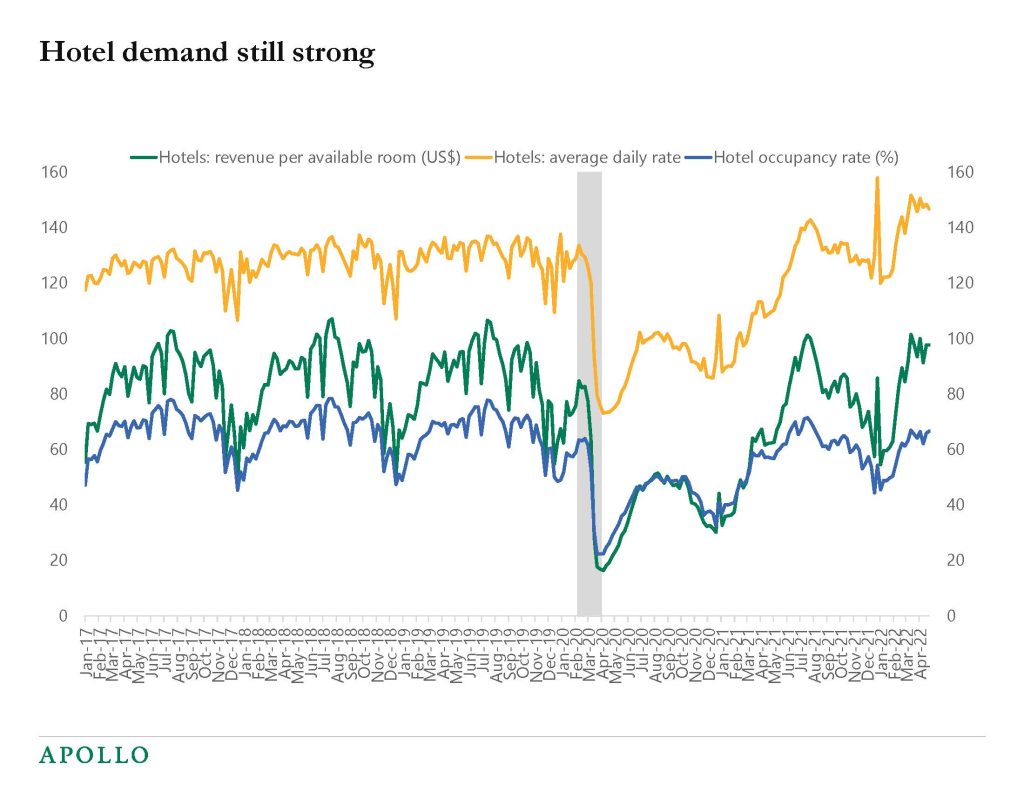

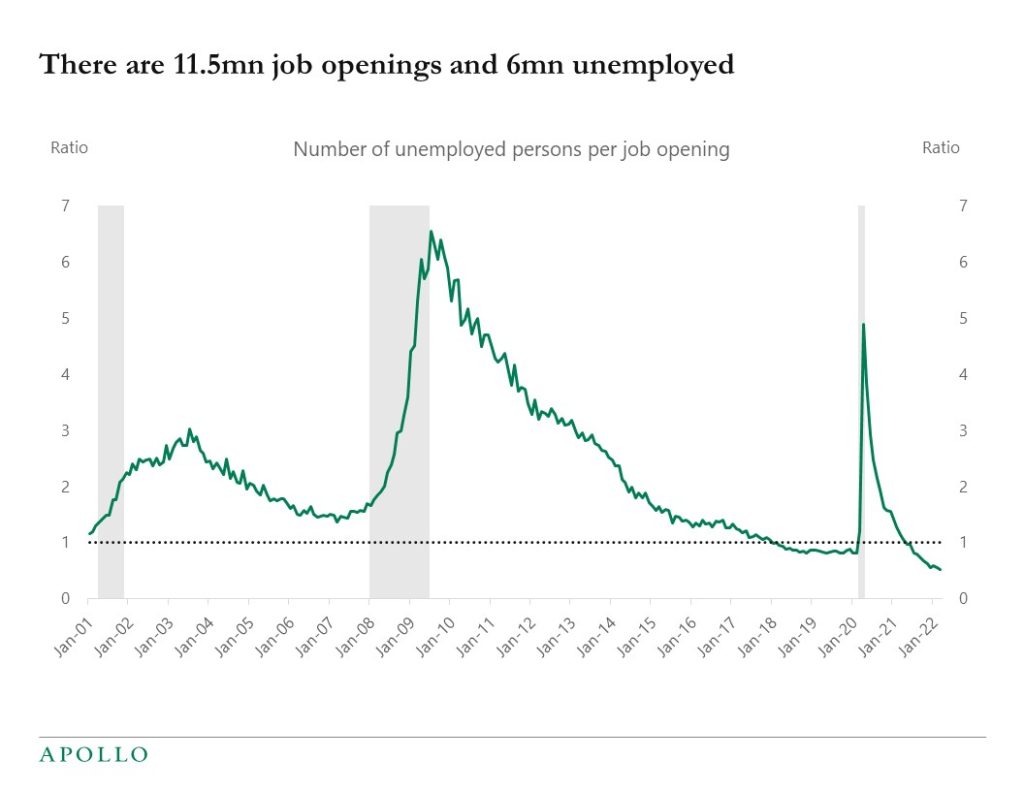

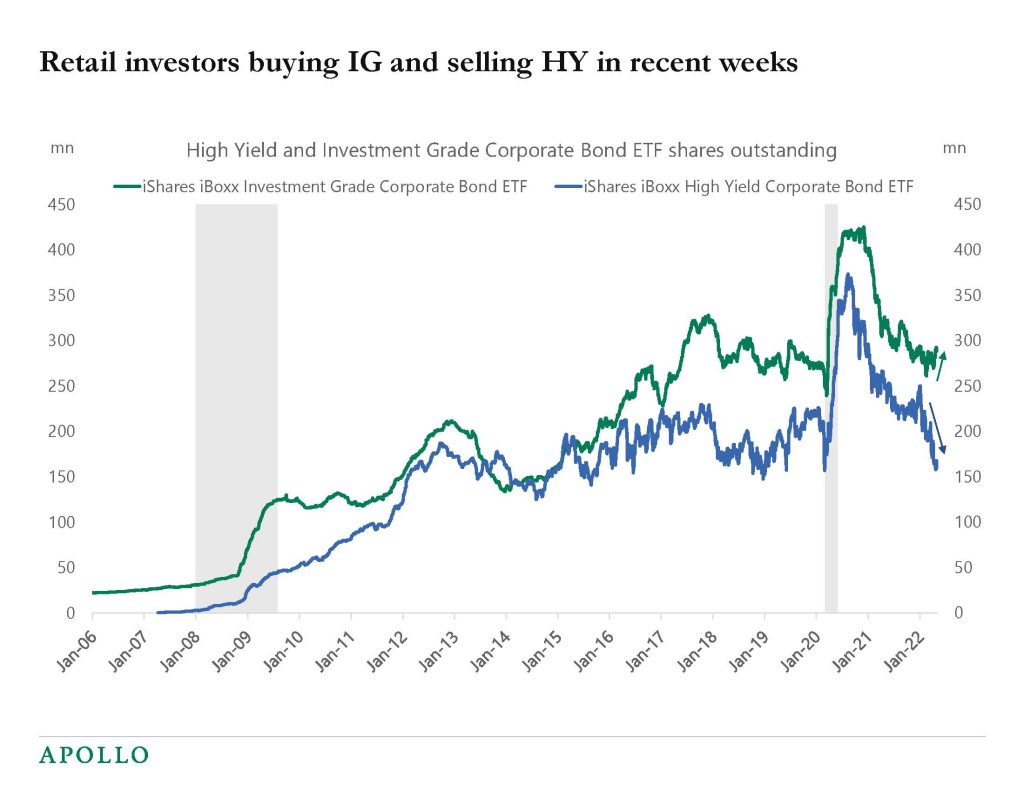

Our chartbook with daily and weekly economic indicators is available here, and while financial conditions continue to tighten, there are still no signs of the economy slowing down. Importantly, consumers and corporates hold about $4trn extra in cash, see the first chart below, which is very supportive for US consumer spending. Note also that the recent increase in the level of credit card debt seen in the second chart is NOT because consumers are running out of cash but simply because the virus is subsiding, and more people are going out to shop, eat at restaurants, and stay at hotels etc. The bottom line for markets is that the Fed still has a lot of work to do to slow this economy down. In plain English: Demand in the economy is simply too strong.