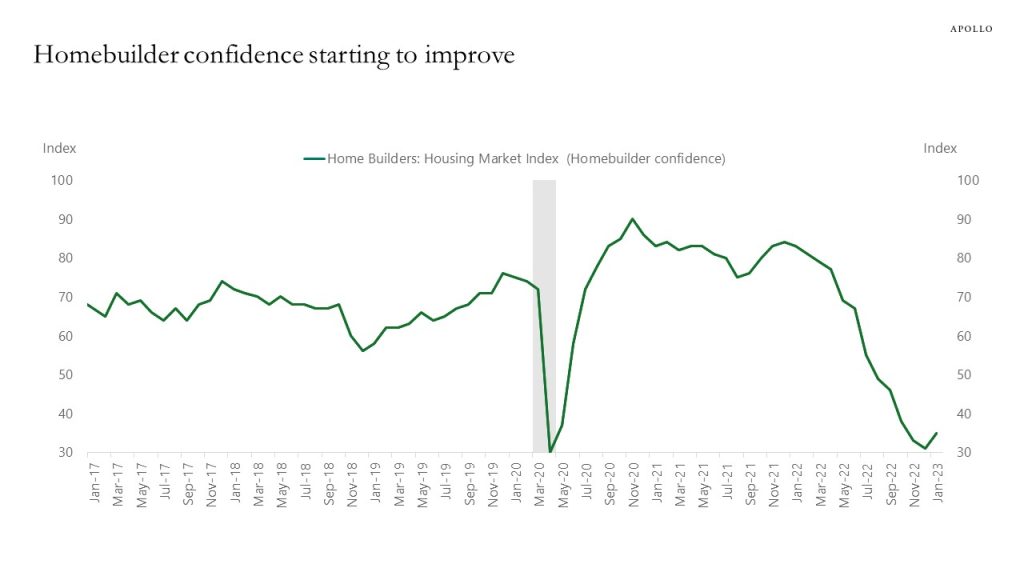

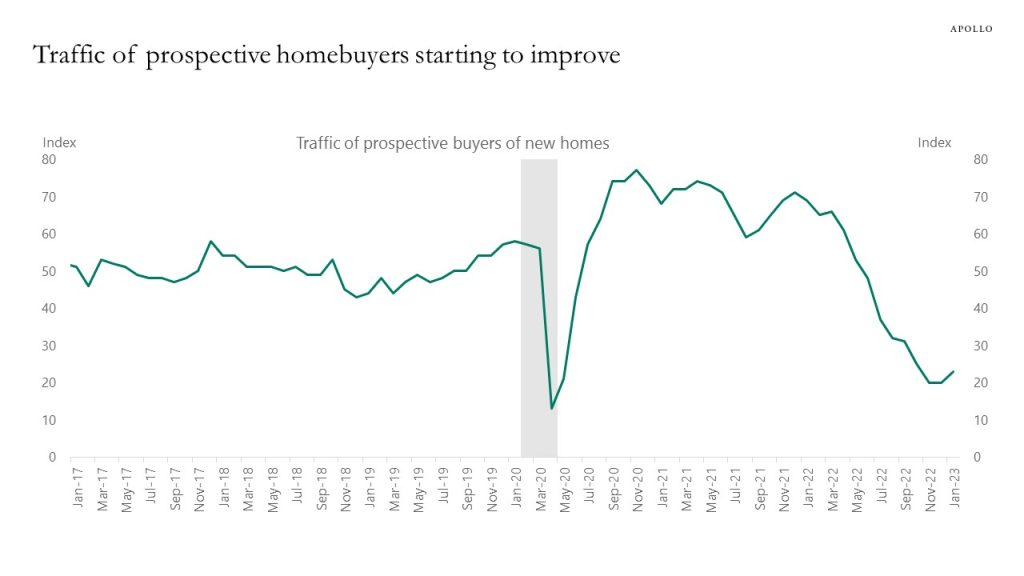

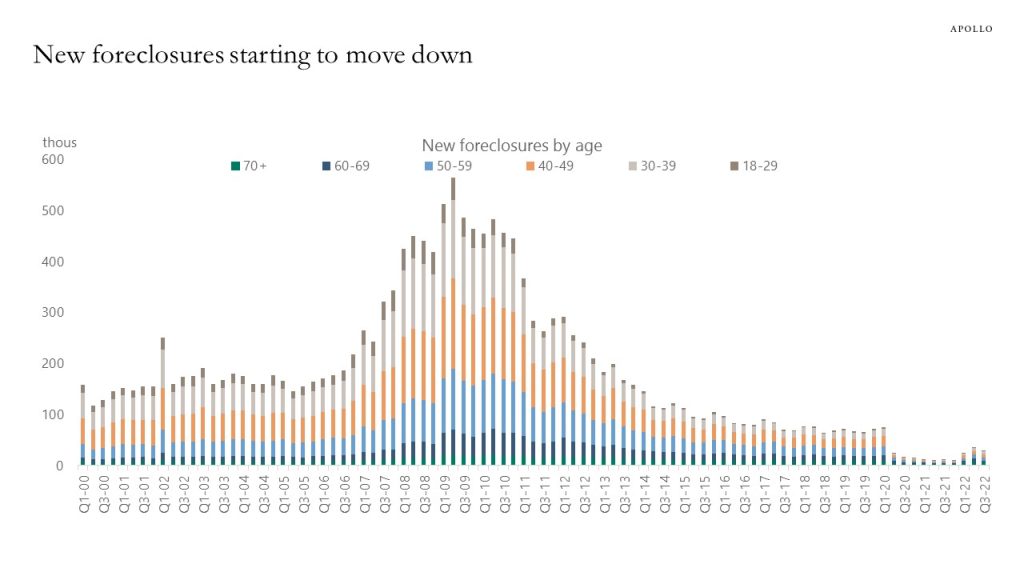

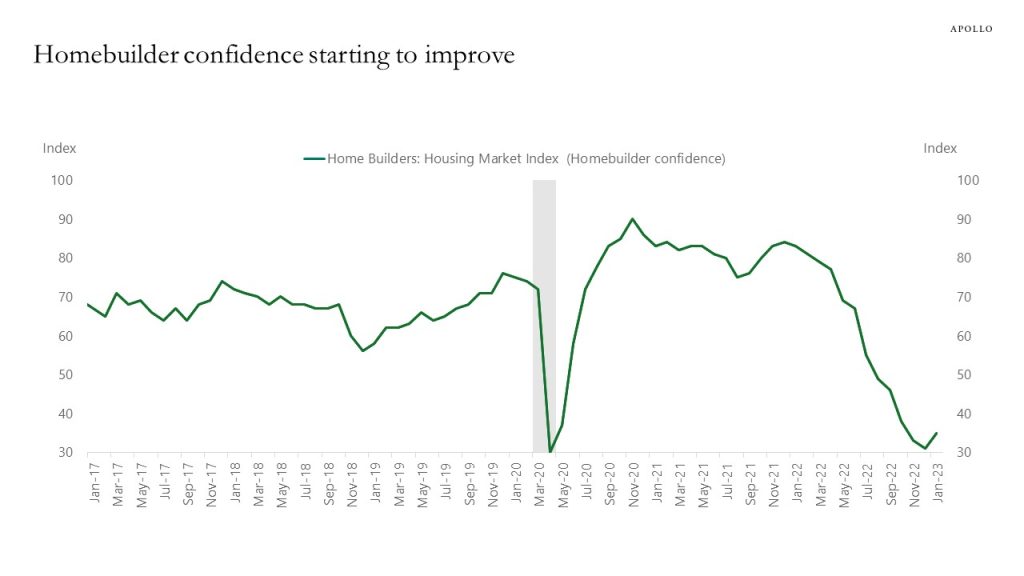

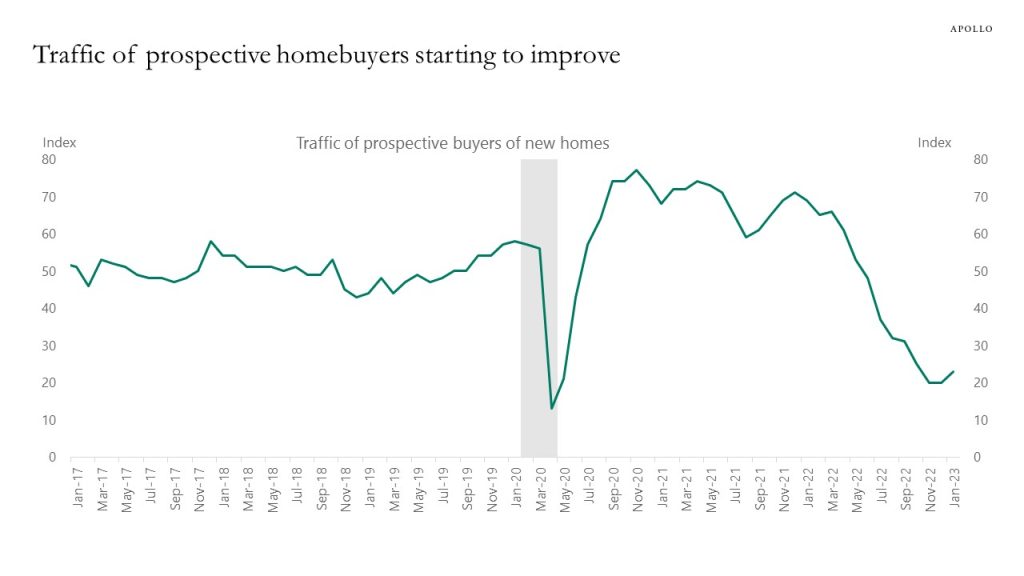

The charts below show that homebuilder confidence is starting to improve, traffic of prospective homebuyers has bottomed, and the number of homeowners going into foreclosure has peaked.

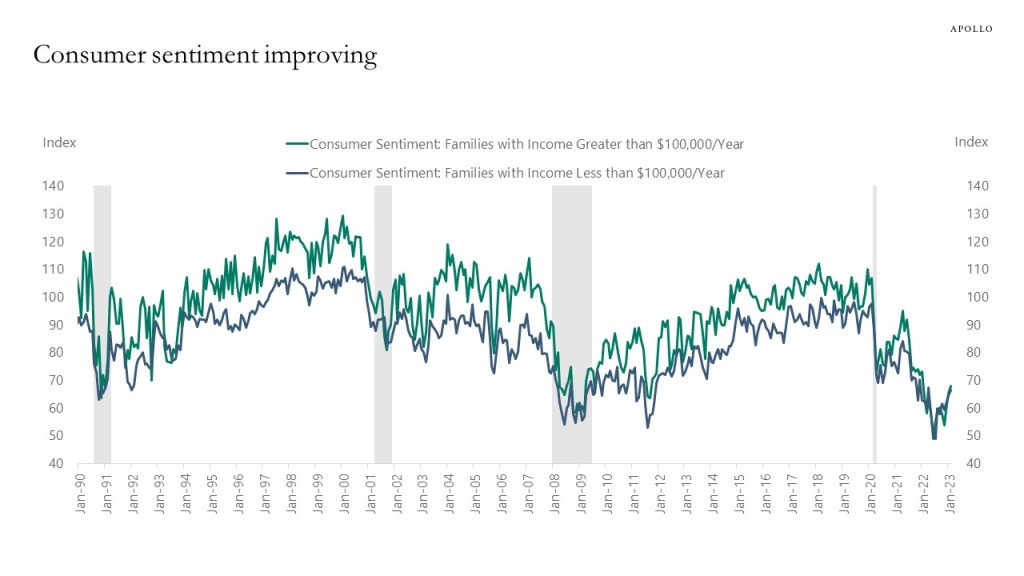

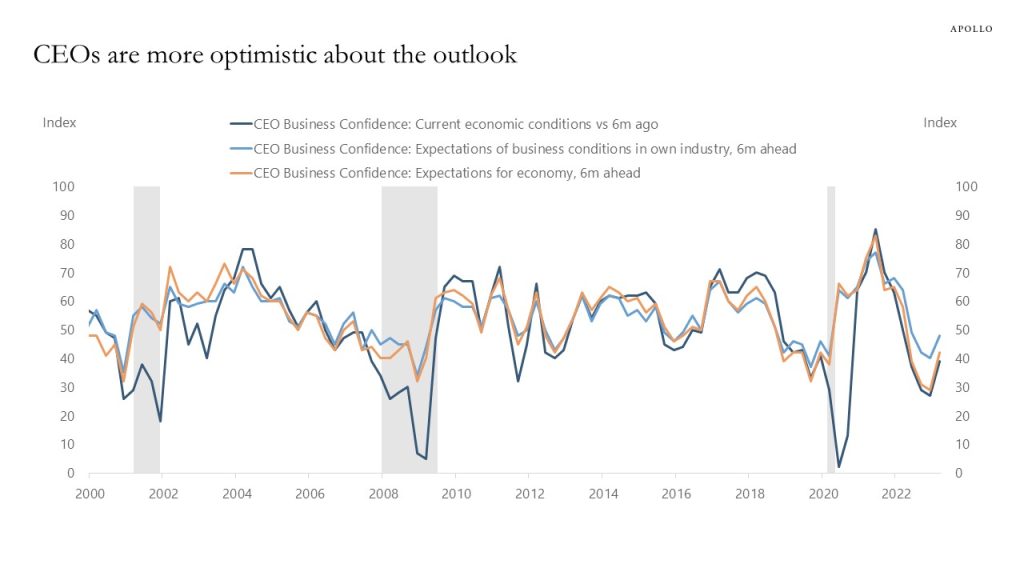

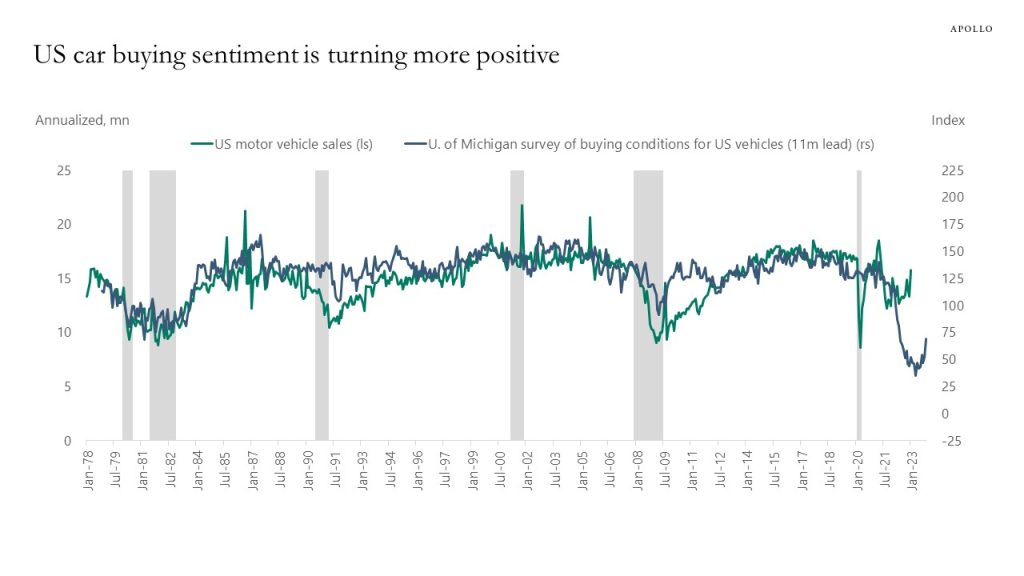

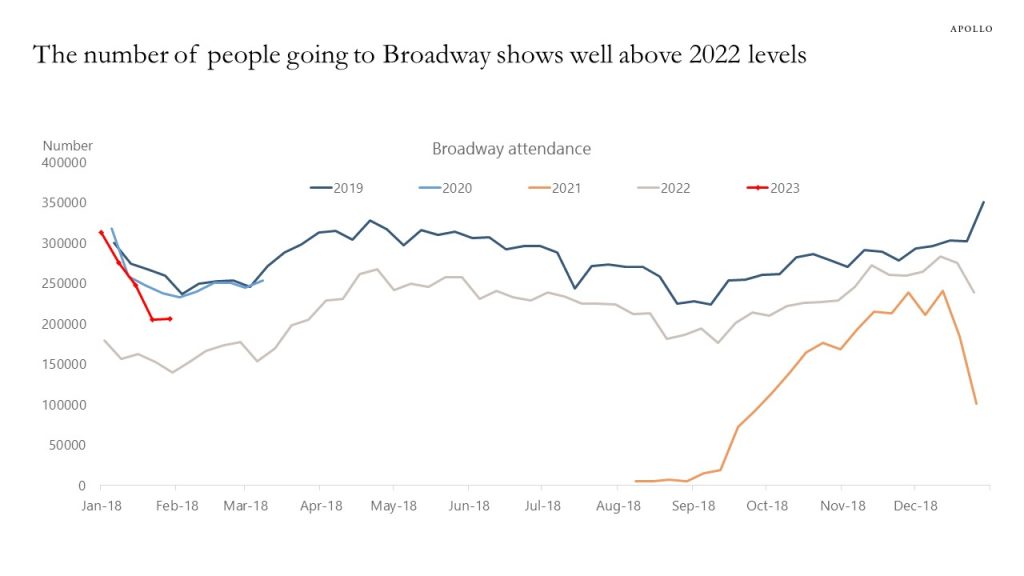

Consumer sentiment has bottomed, CEO confidence has bottomed, and car buying confidence is turning more positive.

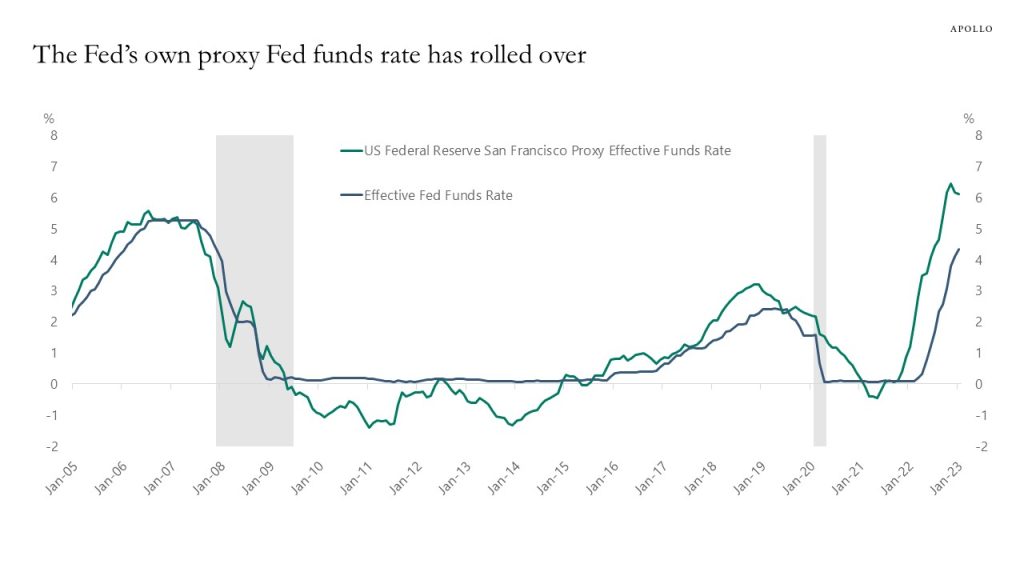

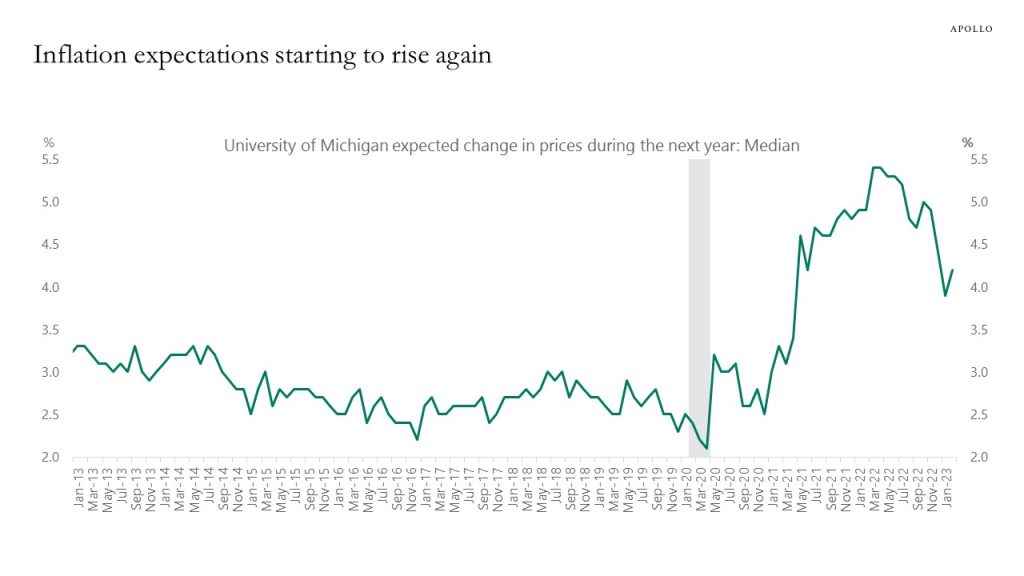

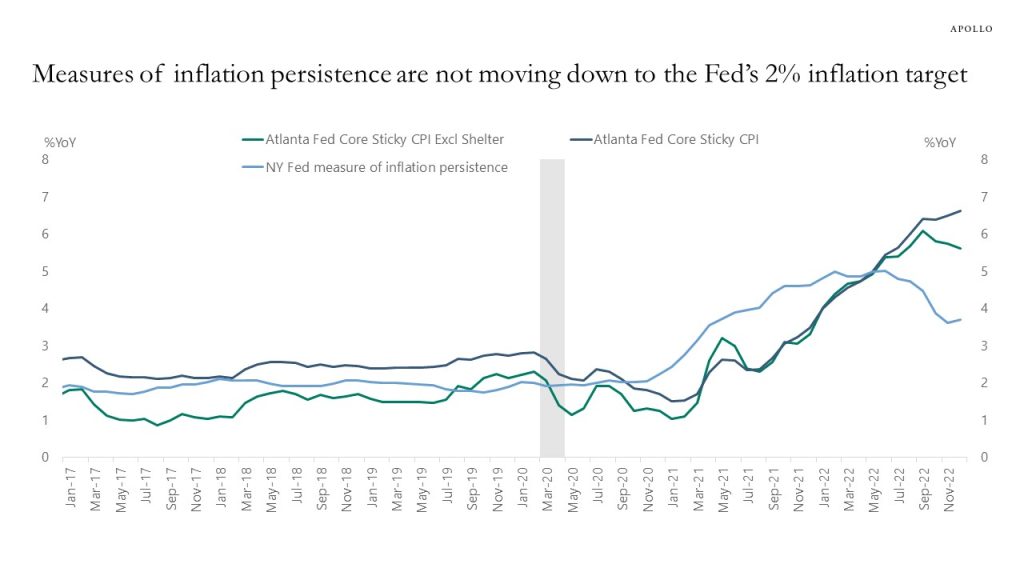

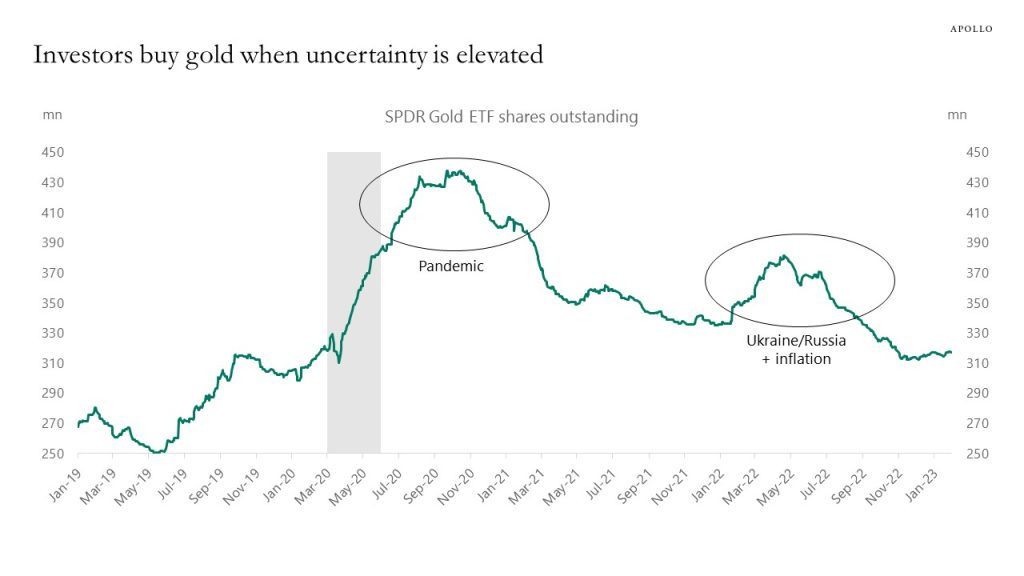

The Fed’s own measure of the true Fed funds rate has peaked, and, perhaps most importantly, inflation expectations are rising again.

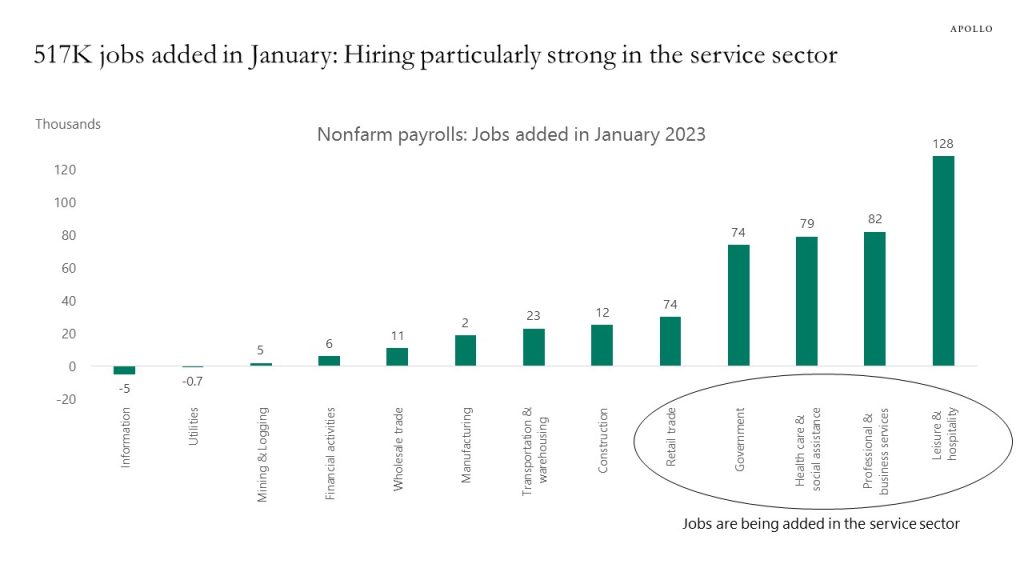

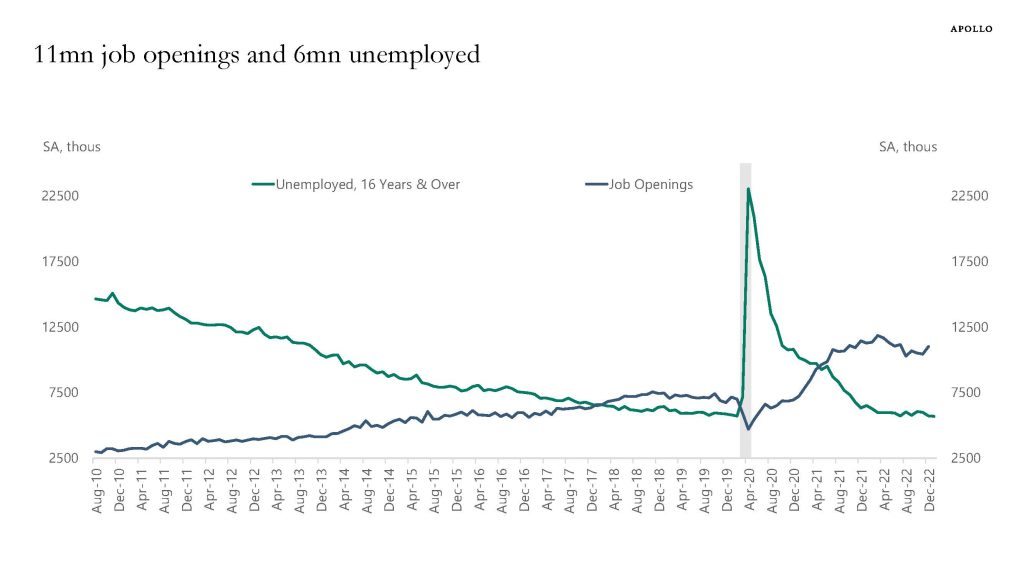

Combined with strong nonfarm payrolls, very low jobless claims, and the lowest unemployment rate in more than 50 years, the bottom line is that the US economy is starting to reaccelerate.

This is a problem for the Fed with inflation at 6.5%. The risks are rising that inflation will be sticky at levels well above the Fed’s 2% inflation target.

In short, the Fed will be raising rates more than the market is currently pricing and keeping rates higher for longer than the market is currently pricing.

Our daily and weekly indicators for the US economy are available here.