China’s business cycle used to be highly correlated with the US business cycle because of Chinese exports to the US.

But the business cycles in China and the US have decoupled for three reasons:

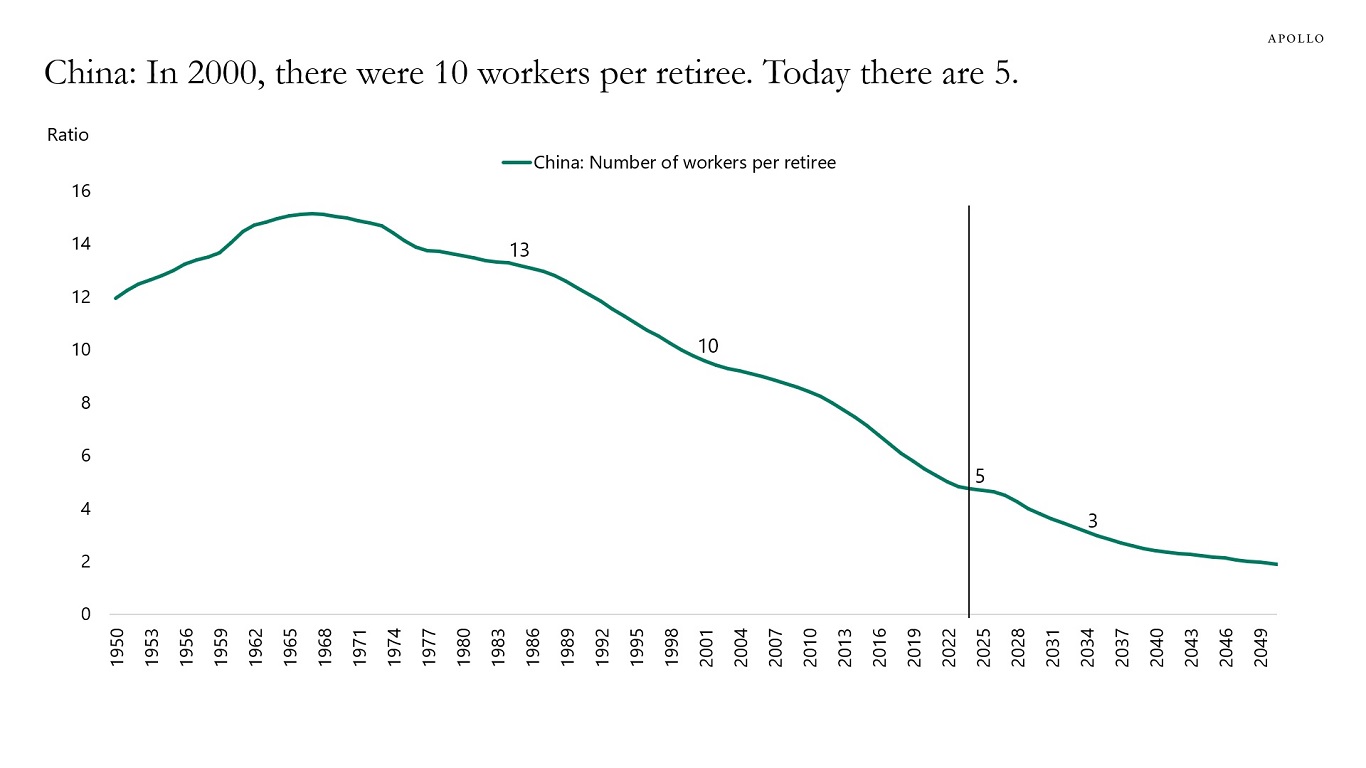

1) China’s working-age population is declining. The US working-age population is growing.

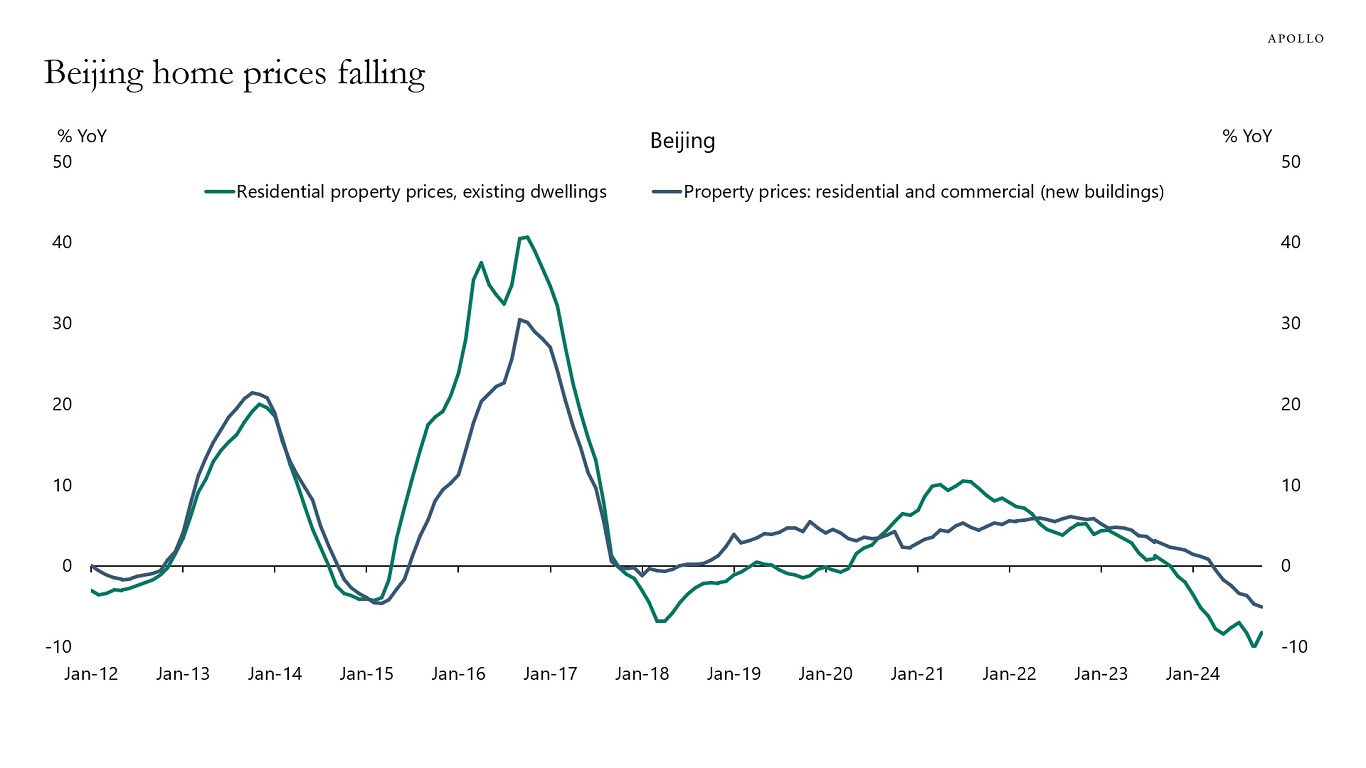

2) Chinese home prices are falling. US home prices are rising.

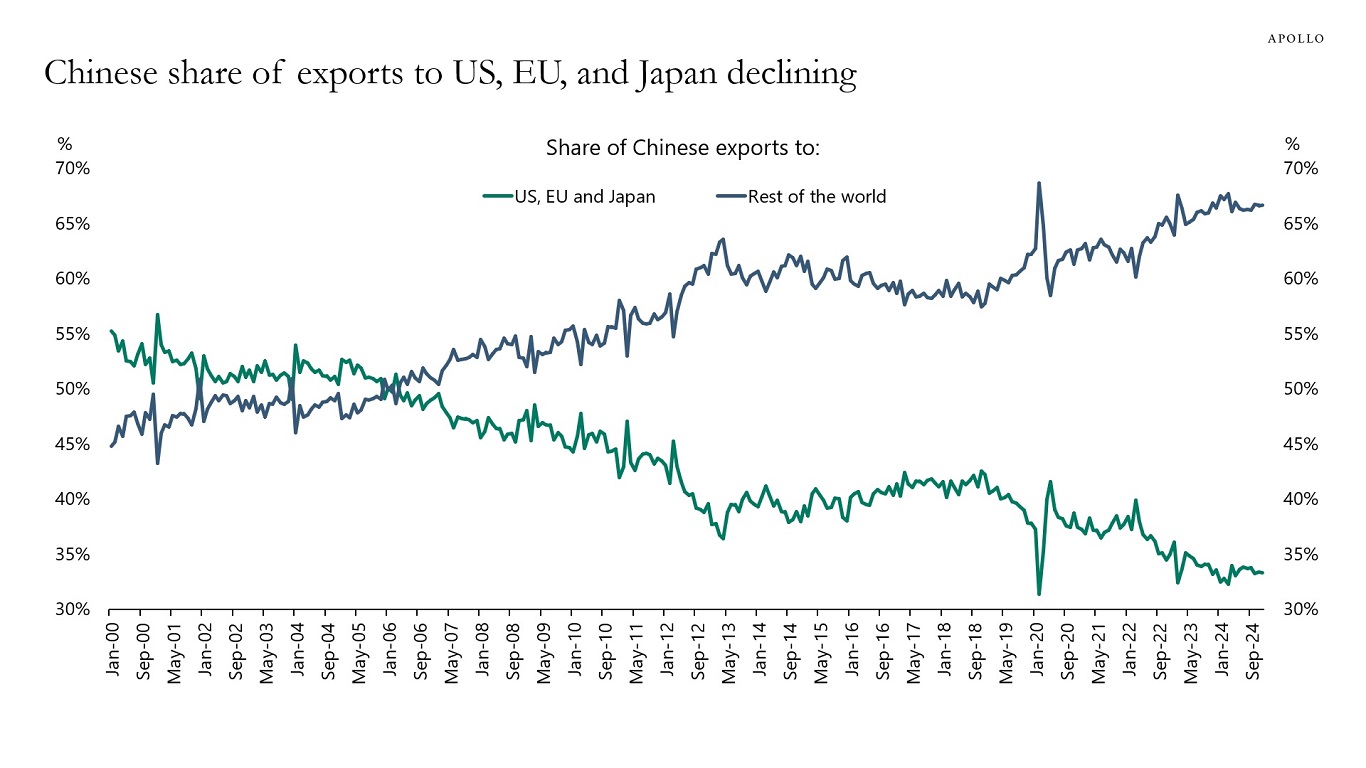

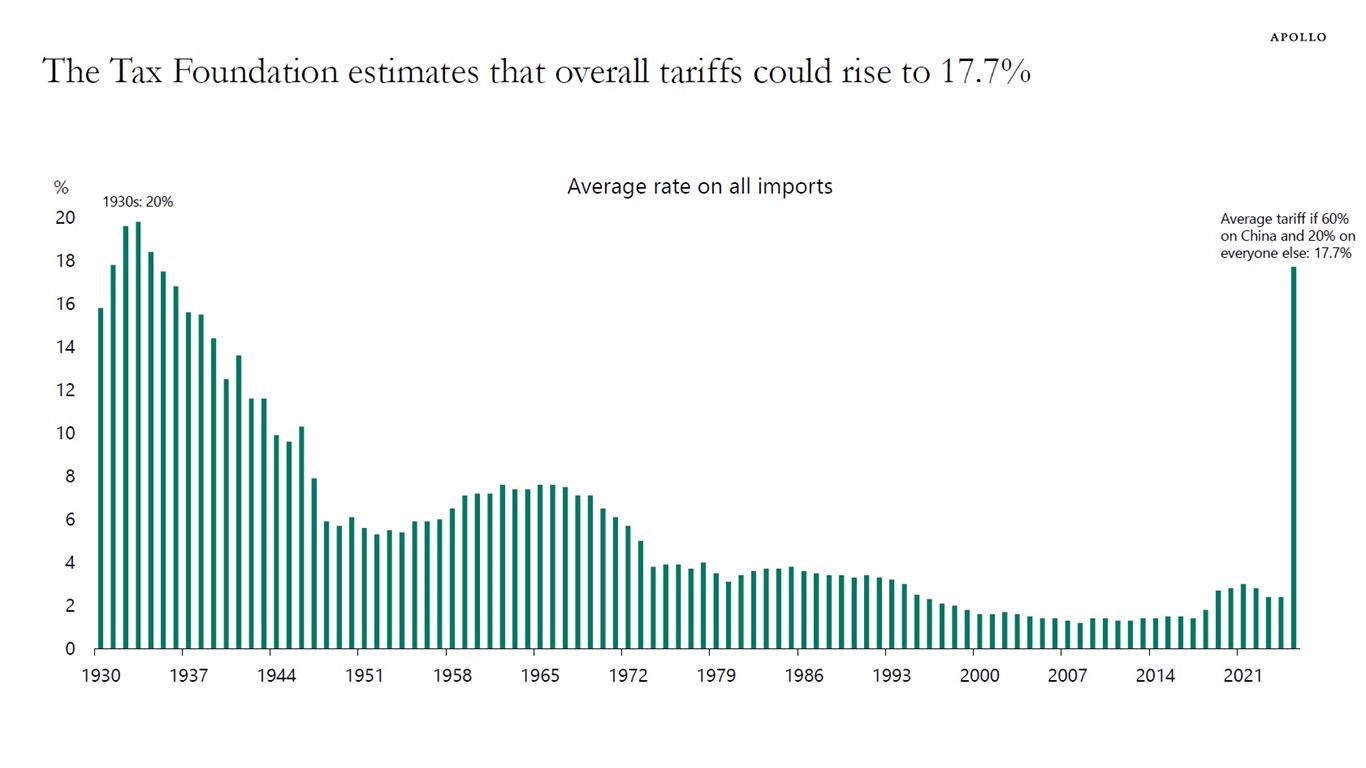

3) The US and Europe have imposed tariffs and want to produce more goods at home. This is negative for Chinese exports.

The bottom line is that the Chinese economy is facing three significant headwinds from demographics, housing, and trade that are weighing on growth.

Our latest outlook for China is available here.