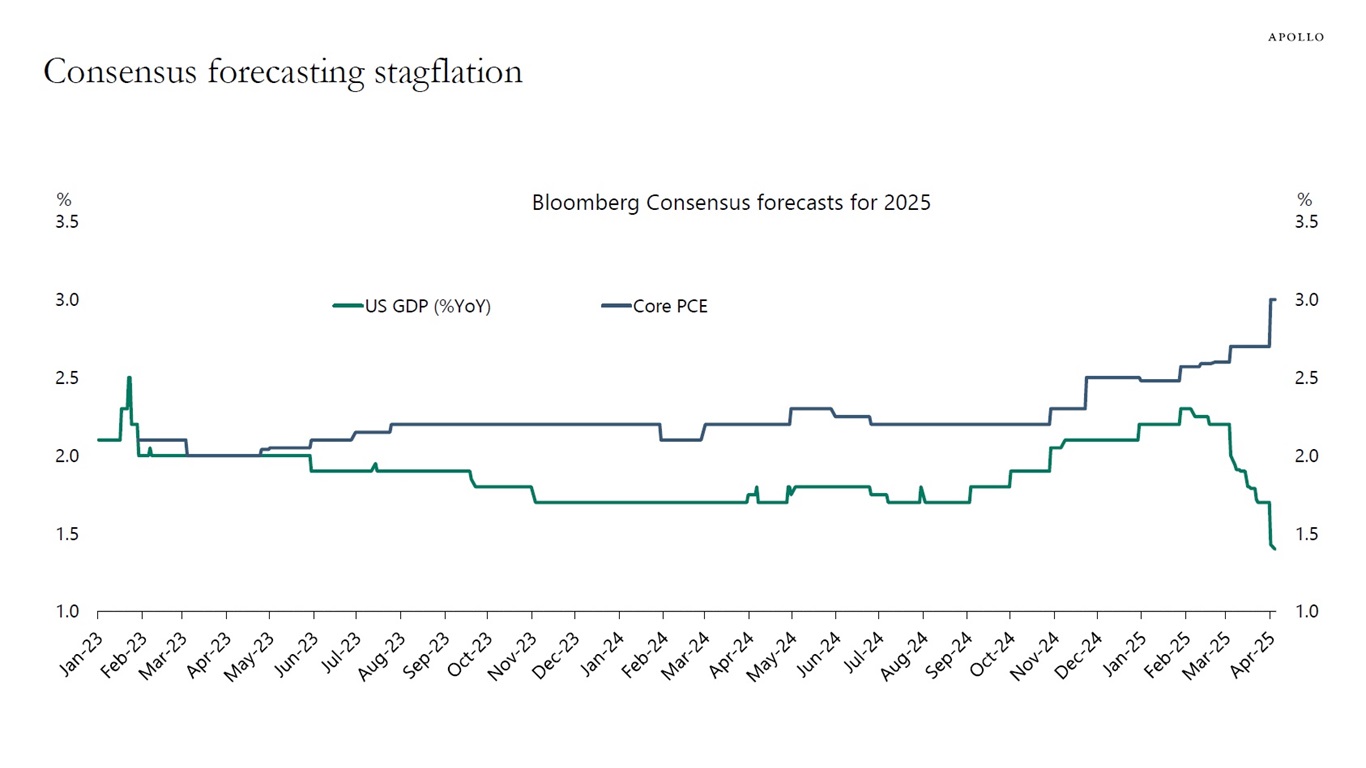

Since the trade war began in March, consensus expectations for growth have been revised down, and consensus expectations for inflation have been revised up, see the first chart below. This is the definition of stagflation: higher inflation and lower growth.

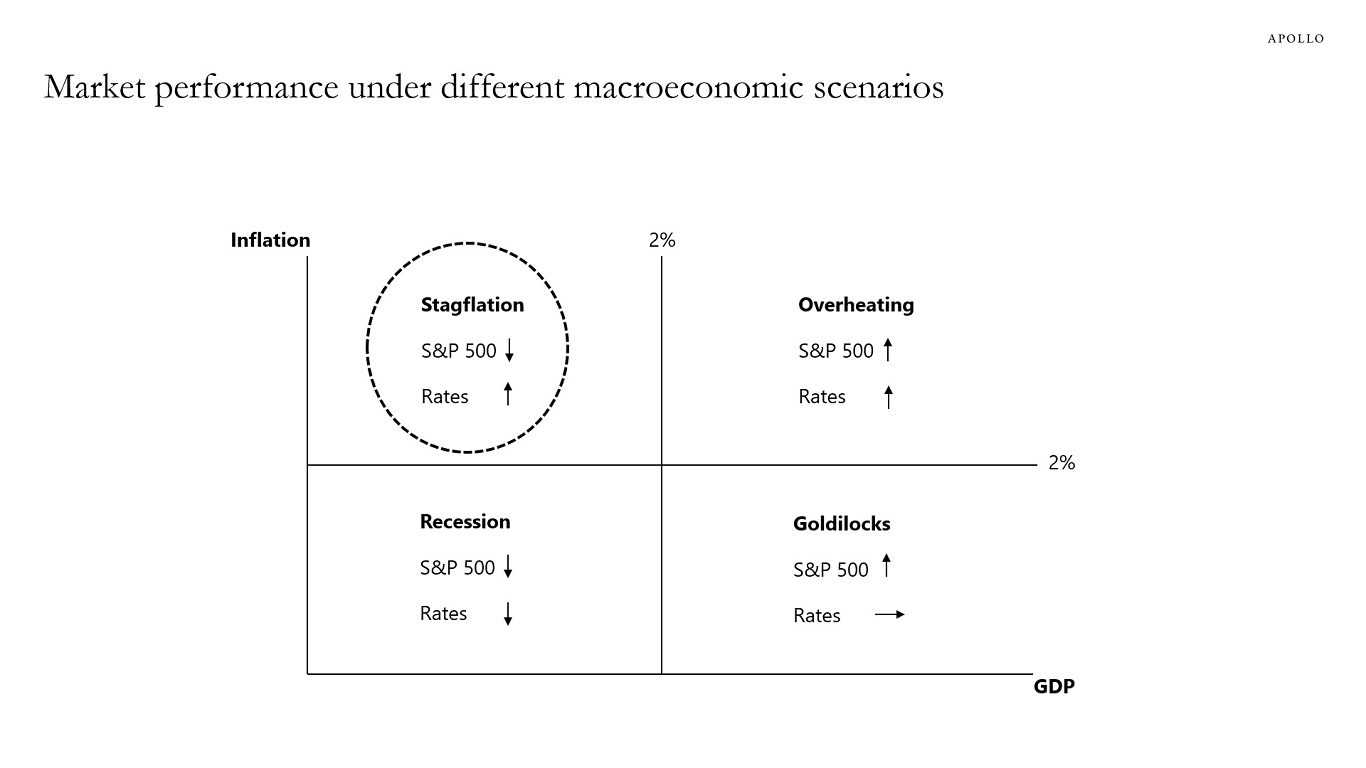

Under stagflation, with higher rates and slower growth, investors should stay away from growth equity and growth credit and be up in quality and invest in companies with earnings to protect against the downside risk of a recession, see the second chart.

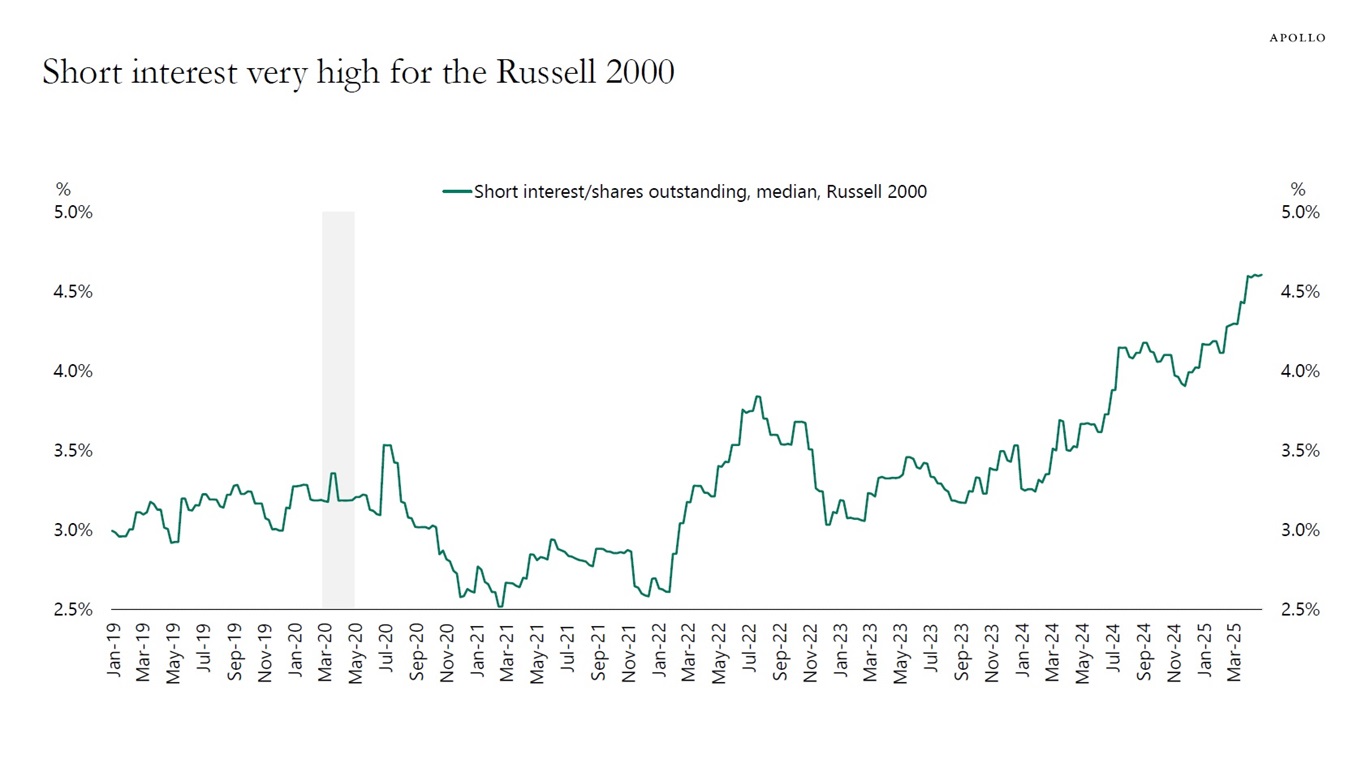

This happens to also be how investors in public markets are positioned. Short interest in small-cap companies is at the highest level seen in many years, see the third chart. This is not surprising as 40% of companies in the Russell 2000 have negative earnings, and middle market and small-cap companies are hit by the triple whammy of higher tariffs, slower growth, and higher rates because of inflation staying higher for longer.