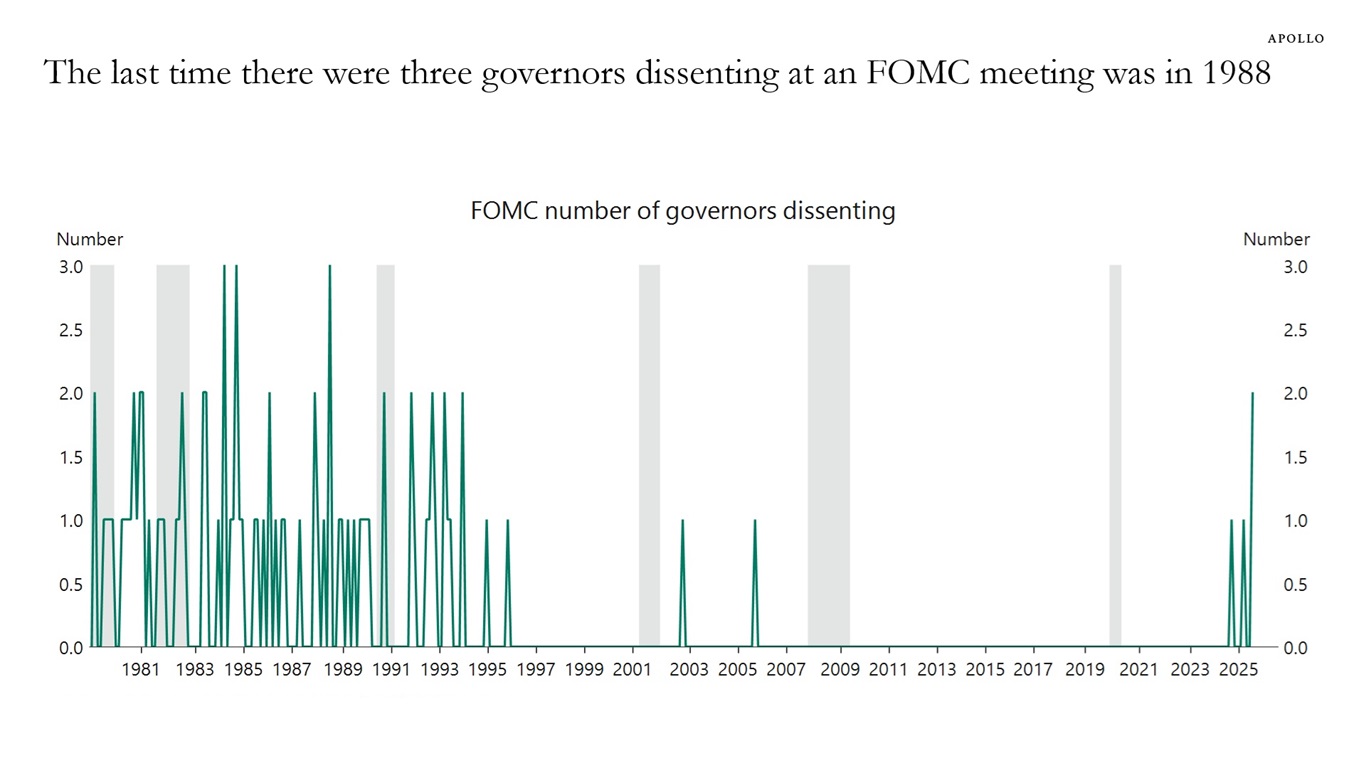

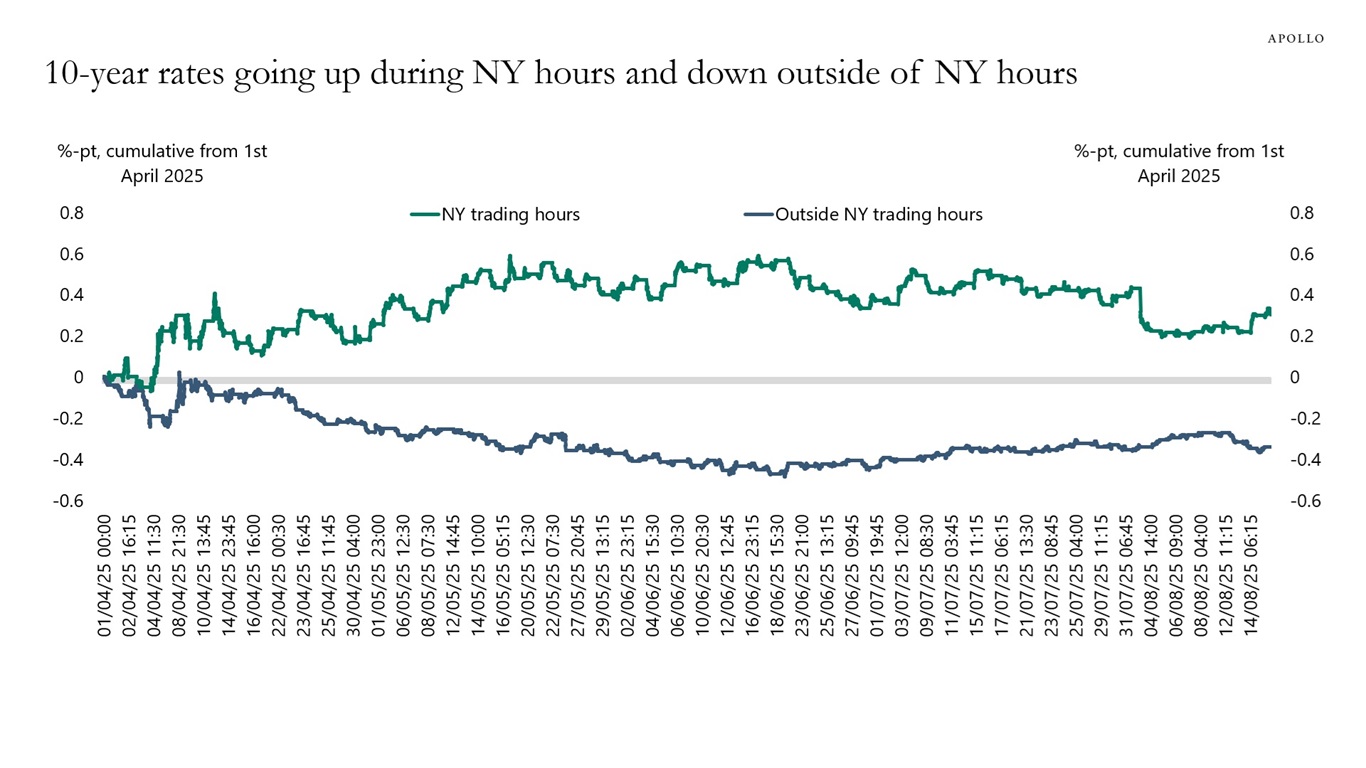

There is upside pressure on inflation and inflation expectations from tariffs, dollar depreciation and growing disagreement on the FOMC about how much weight to put on rising inflation relative to slowing employment.

The risks are rising that we could see another “inflation mountain” emerge over the coming months, see chart below.