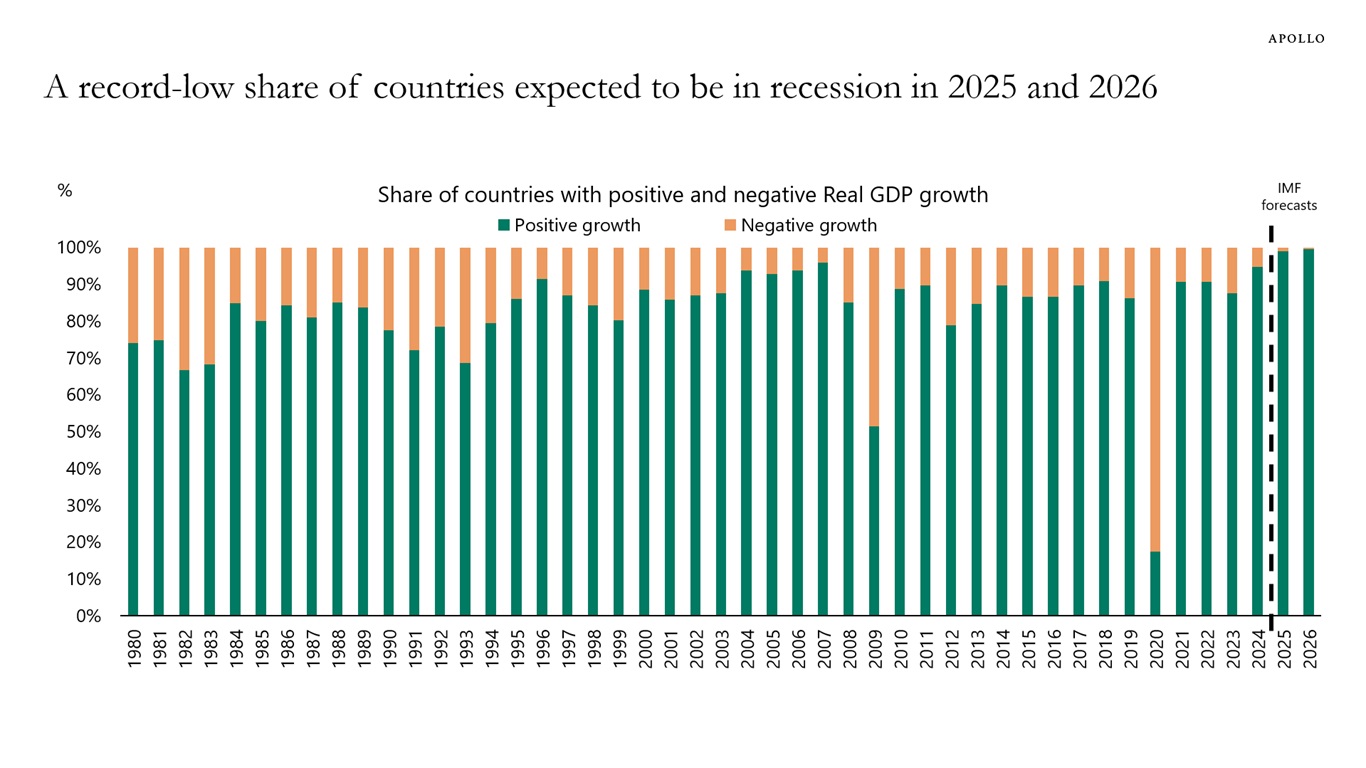

The IMF produces forecasts for 196 countries in the world, and their latest forecast shows that a record-low share of countries are expected to be in recession in 2025 and 2026, see chart below.

The IMF produces forecasts for 196 countries in the world, and their latest forecast shows that a record-low share of countries are expected to be in recession in 2025 and 2026, see chart below.

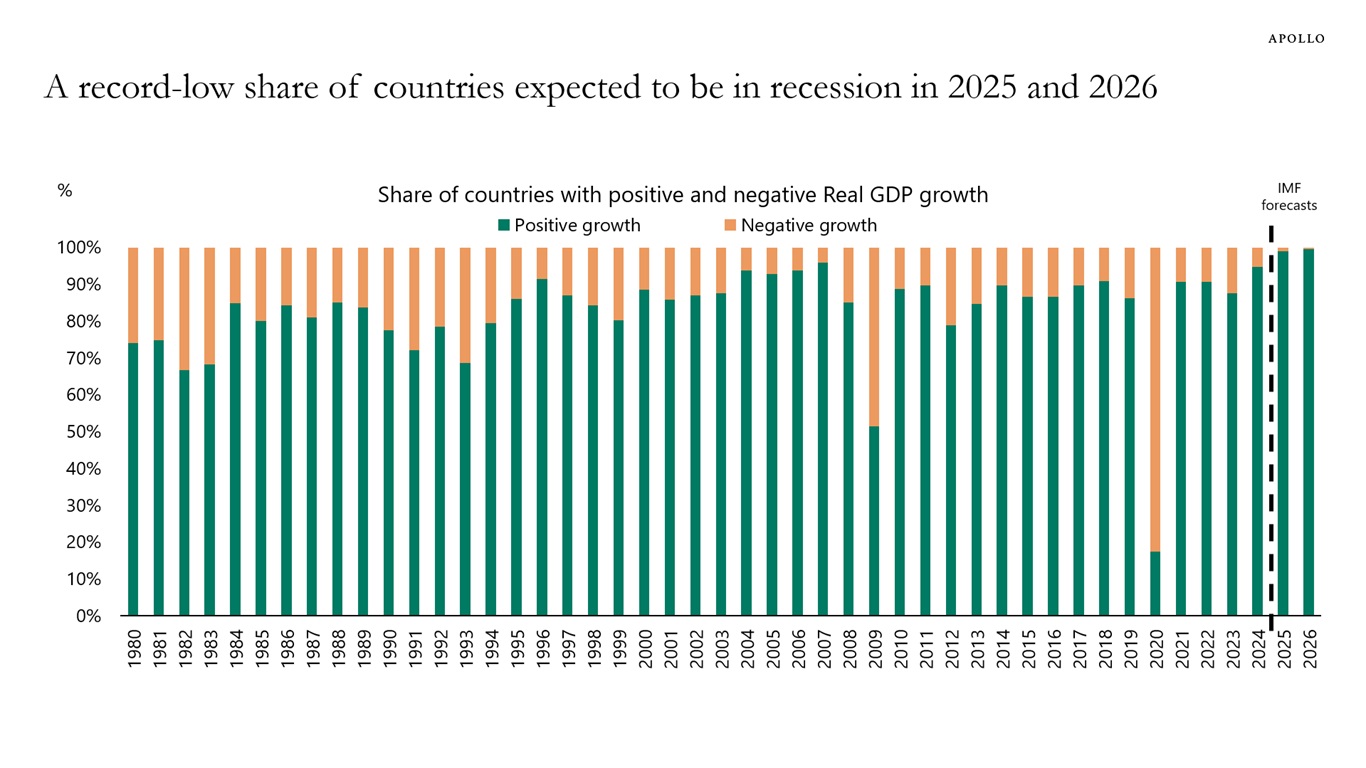

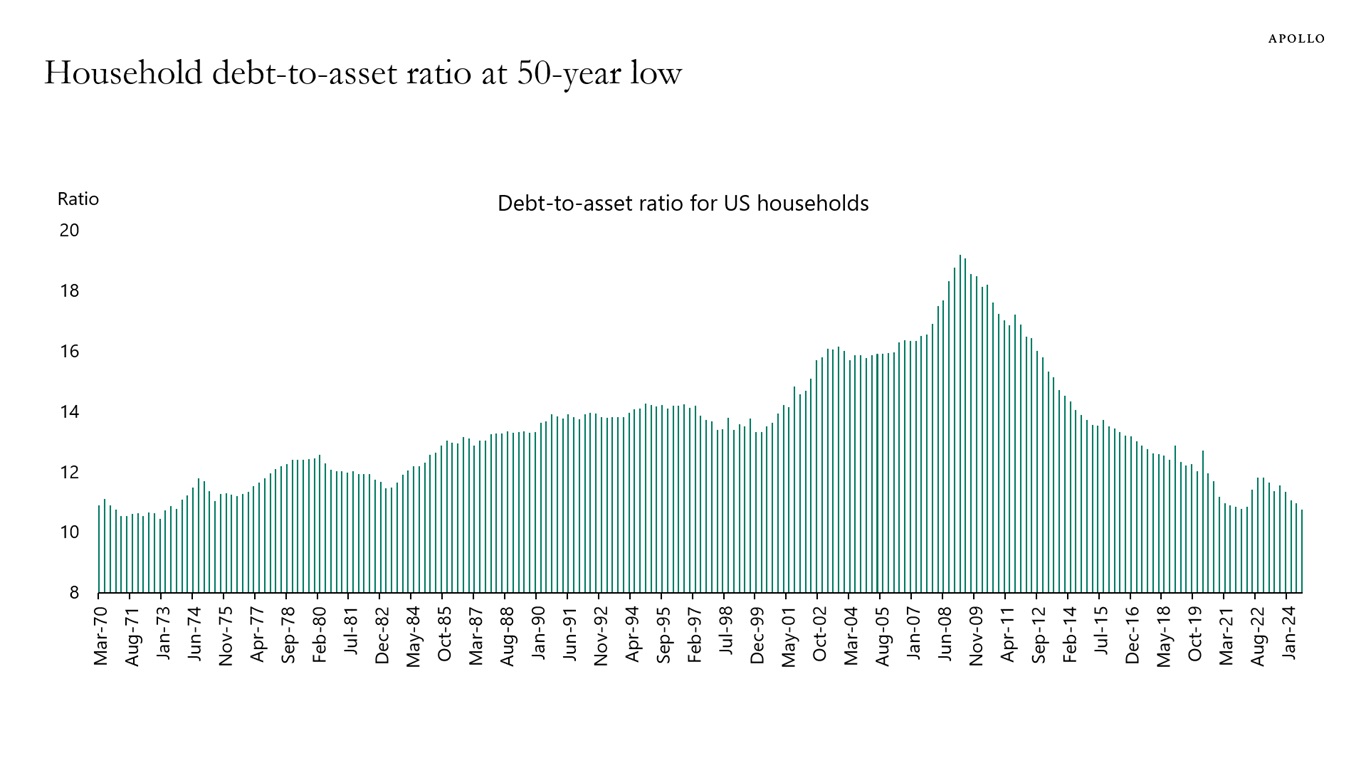

US stock prices and home prices have increased much faster than US household debt over the past 15 years, see chart below.

As a result, debt in the US household sector is at the lowest level in 50 years relative to assets.

In other words, US households benefit tremendously from the exceptional performance in US financial markets and the continued rise in US home prices.

The narrative in markets is that the outlook for the US is great, and the outlook for Europe, UK, and China is not good.

For markets, the problem with this narrative is that 41% of revenues in the S&P 500 come from abroad. If we have a recession in Europe and a continued slowdown in China, it will have a significant negative impact on earnings for S&P 500 companies.

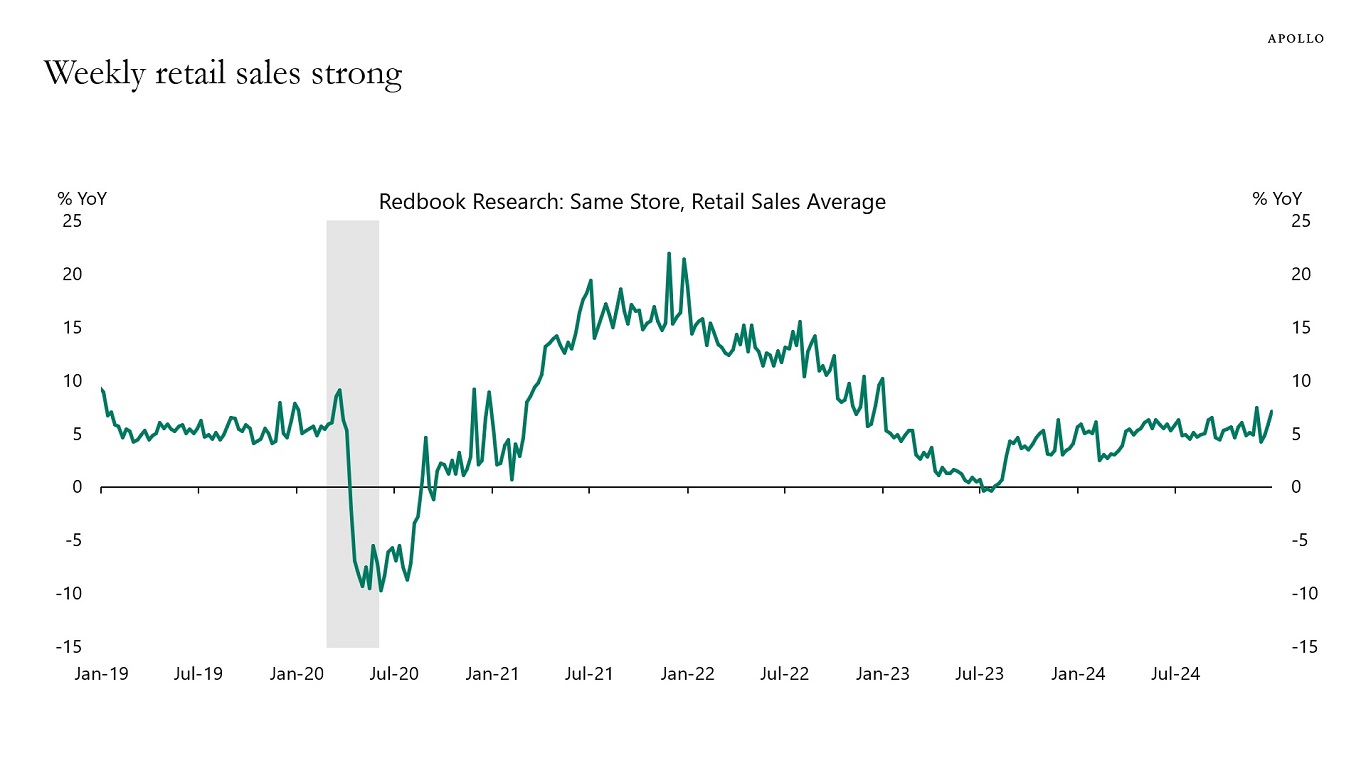

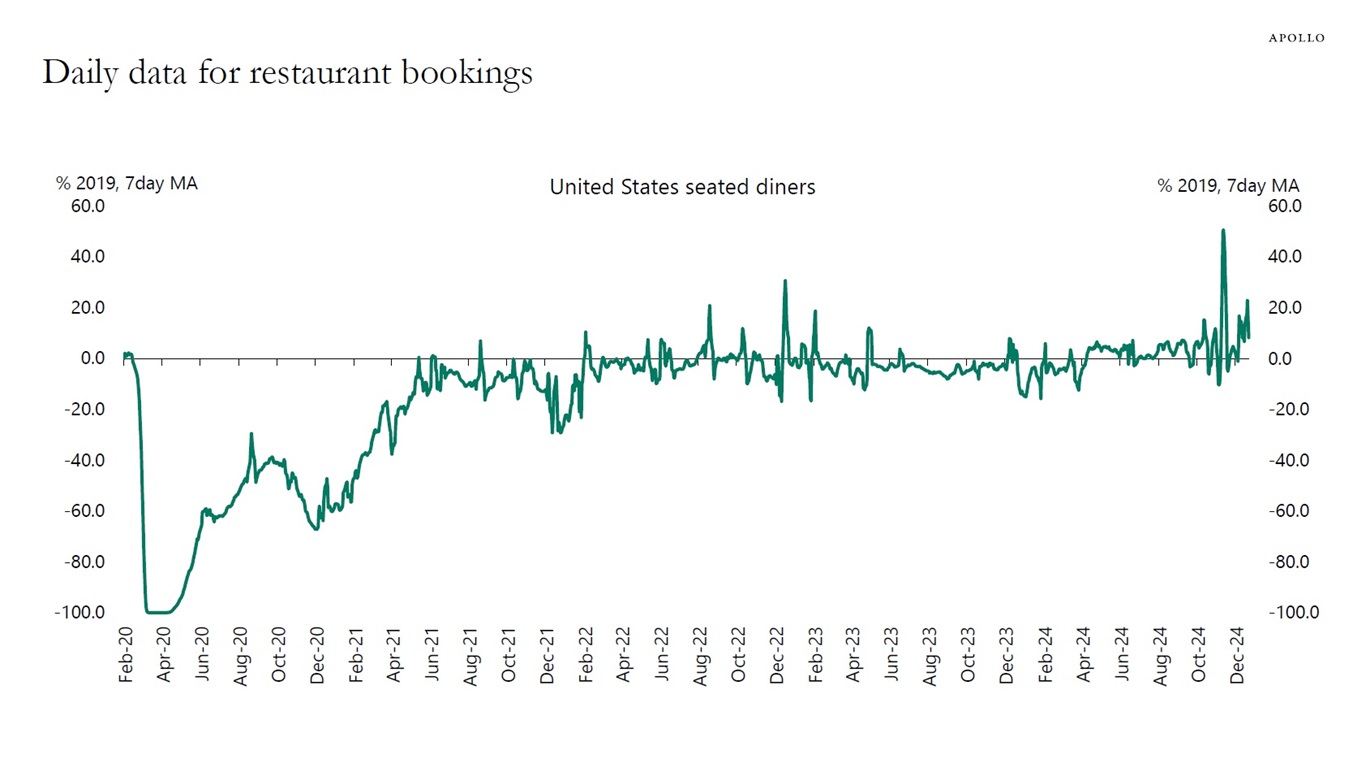

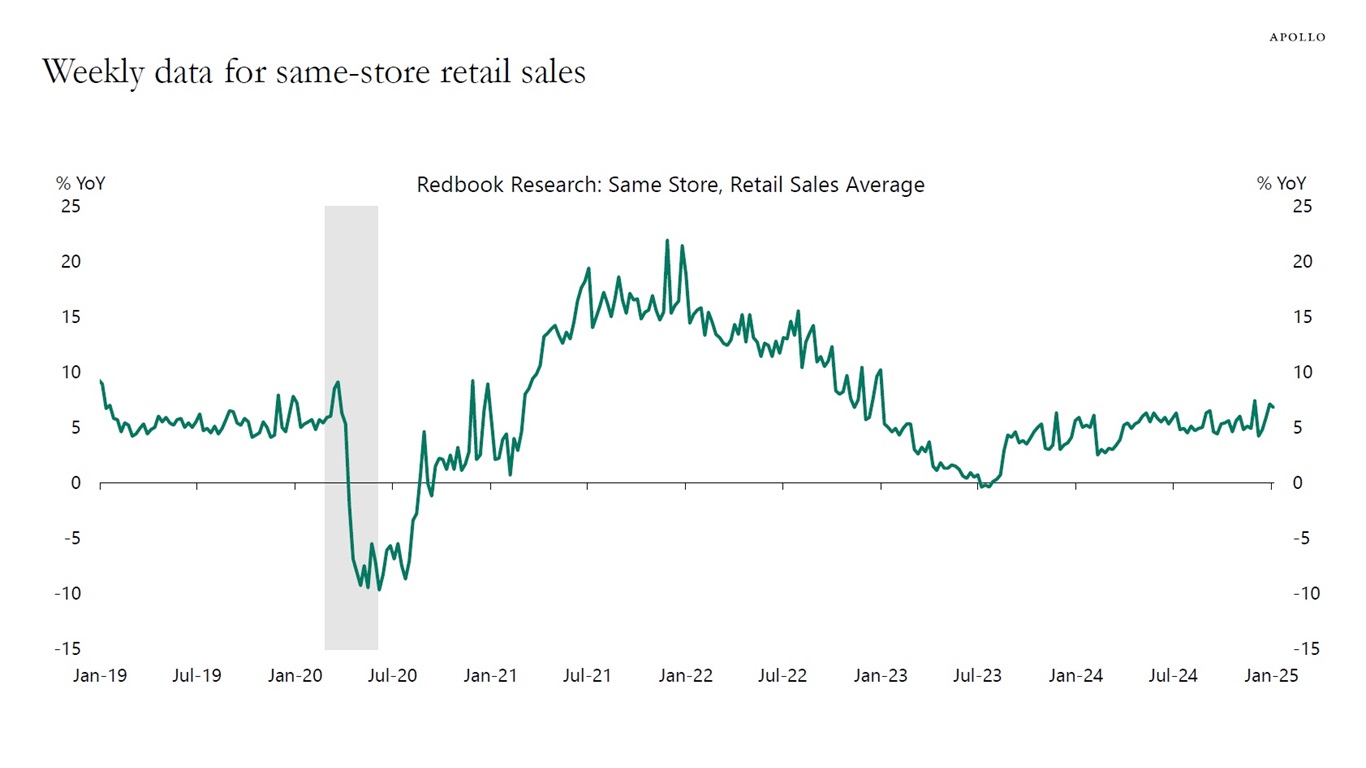

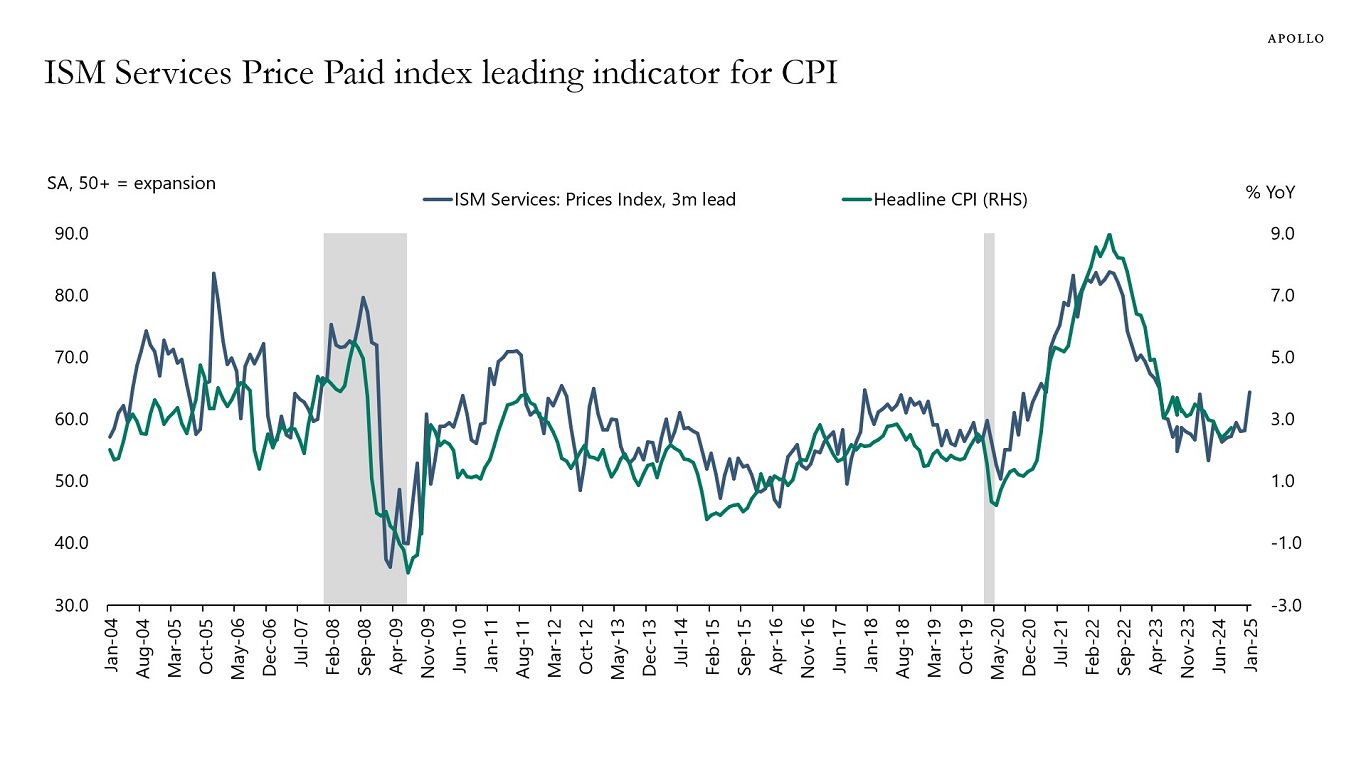

This week, the employment report came in stronger than expected, weekly same-store retail sales were better than expected, and Prices Paid for ISM Services came in higher than expected.

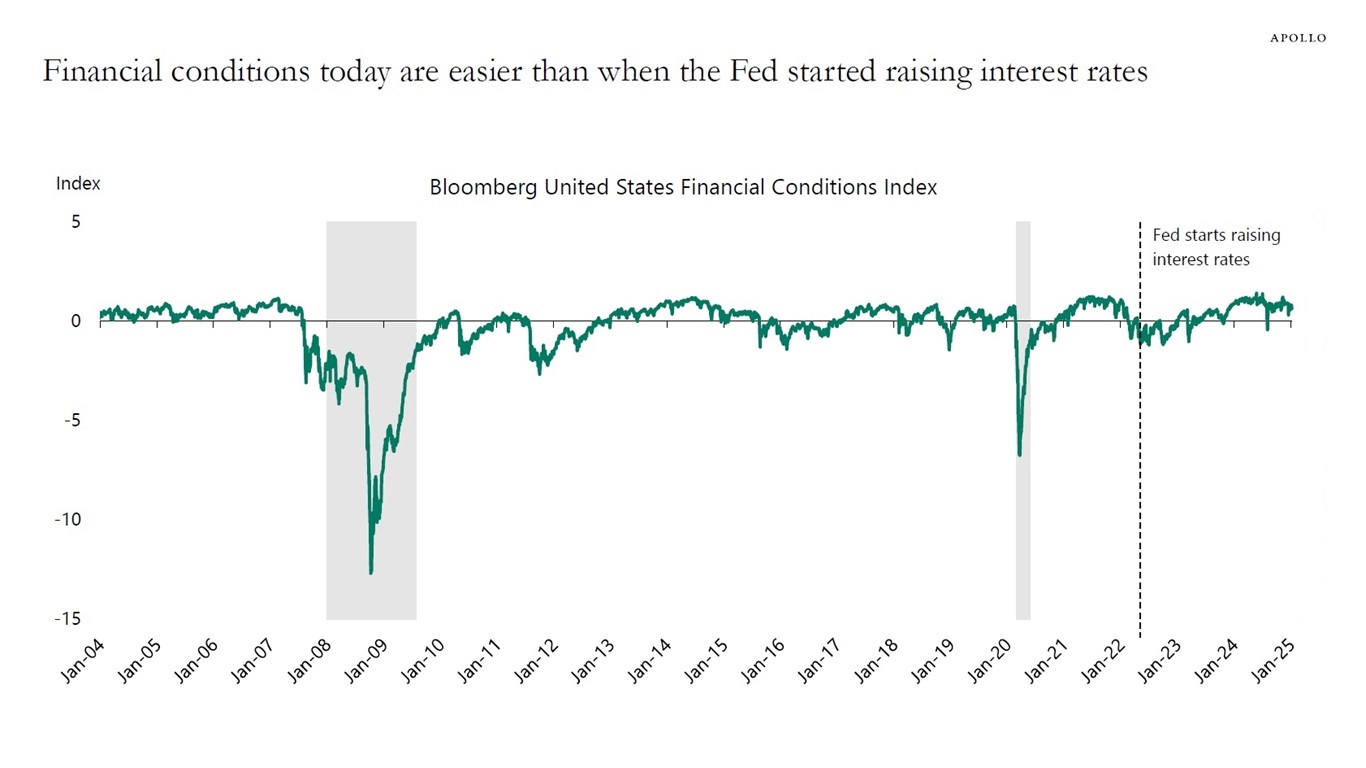

The bottom line is that momentum in the economy is strong, and the narrative that monetary policy is restrictive is wrong.

Combined with higher animal spirits and the latest Atlanta Fed GDP estimate at 2.7%, we see a 40% probability that the Fed will hike rates in 2025.

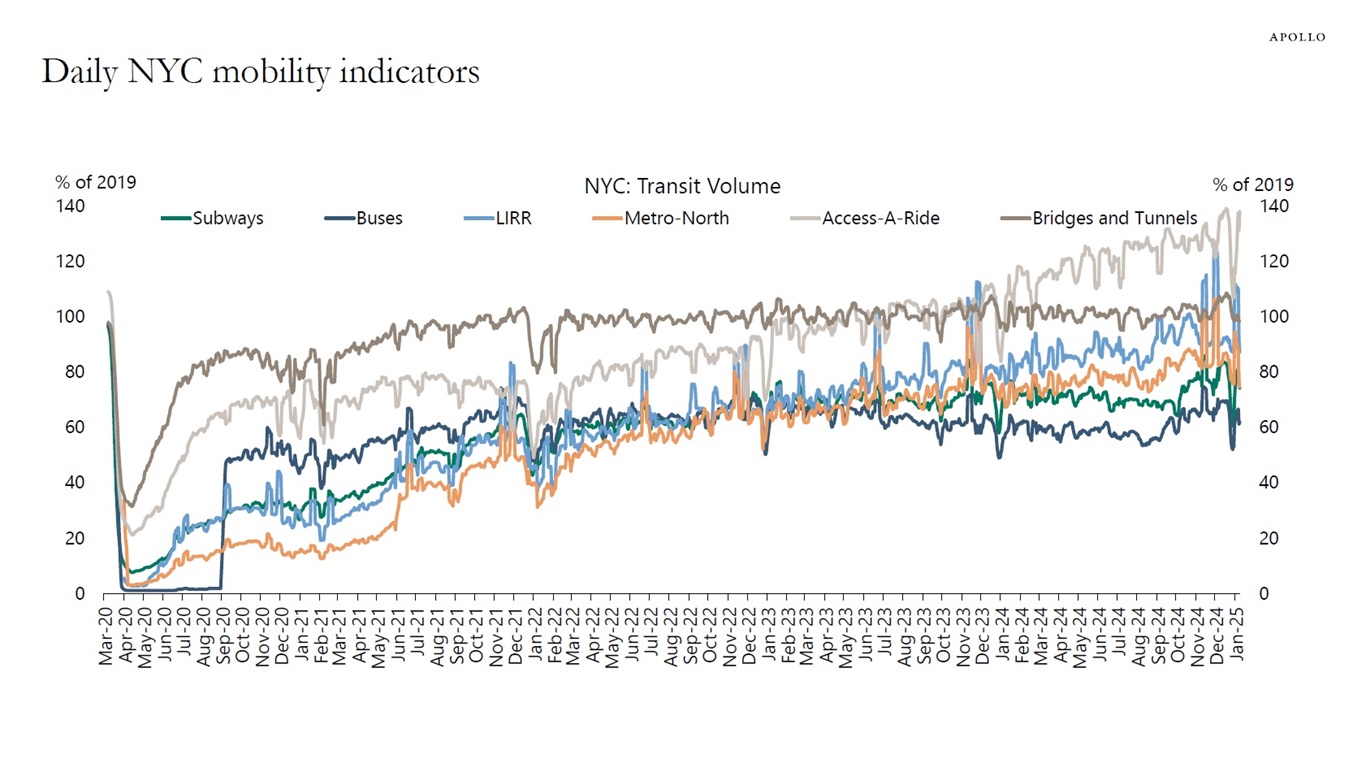

Our latest chart book with daily and weekly indicators for the US economy is available here.

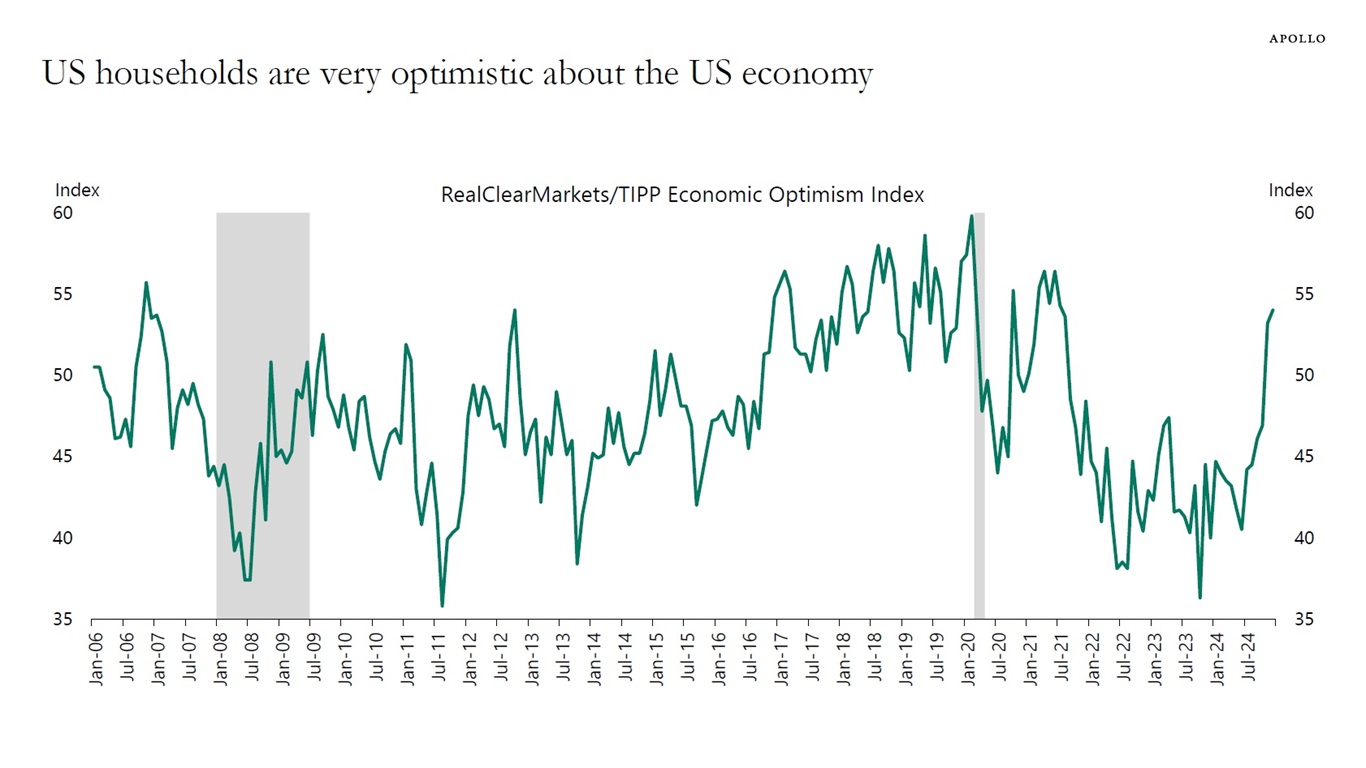

The RealClearMarkets/TIPP Economic Optimism Index measures Americans’ optimism about the US economy.

Specifically, the index is based on a nationwide survey of 1,300 adults and is made up of three subindexes, including one for the respondent’s economic outlook six months into the future, the respondent’s personal financial outlook, and how the respondent views current federal policies.

The latest data shows that US households have turned very optimistic about the US economic outlook in recent months, see chart below.

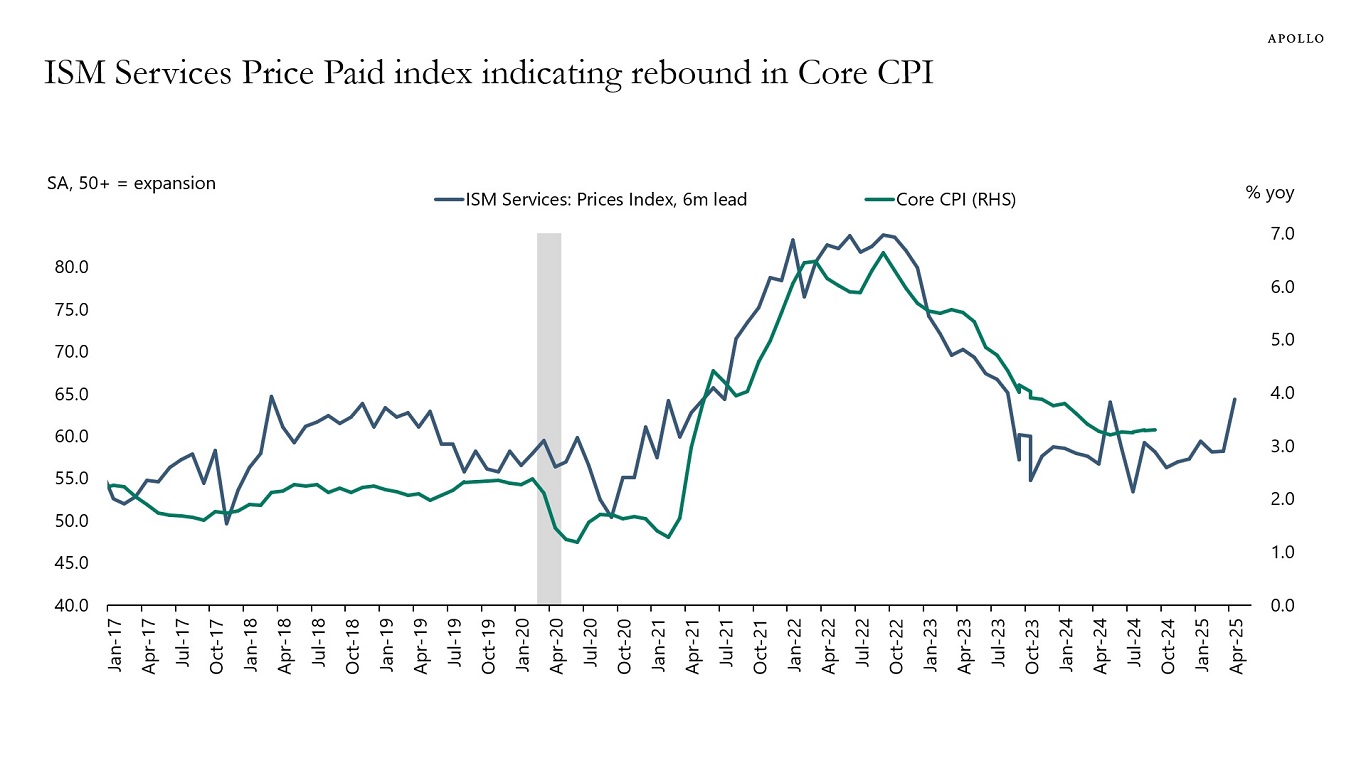

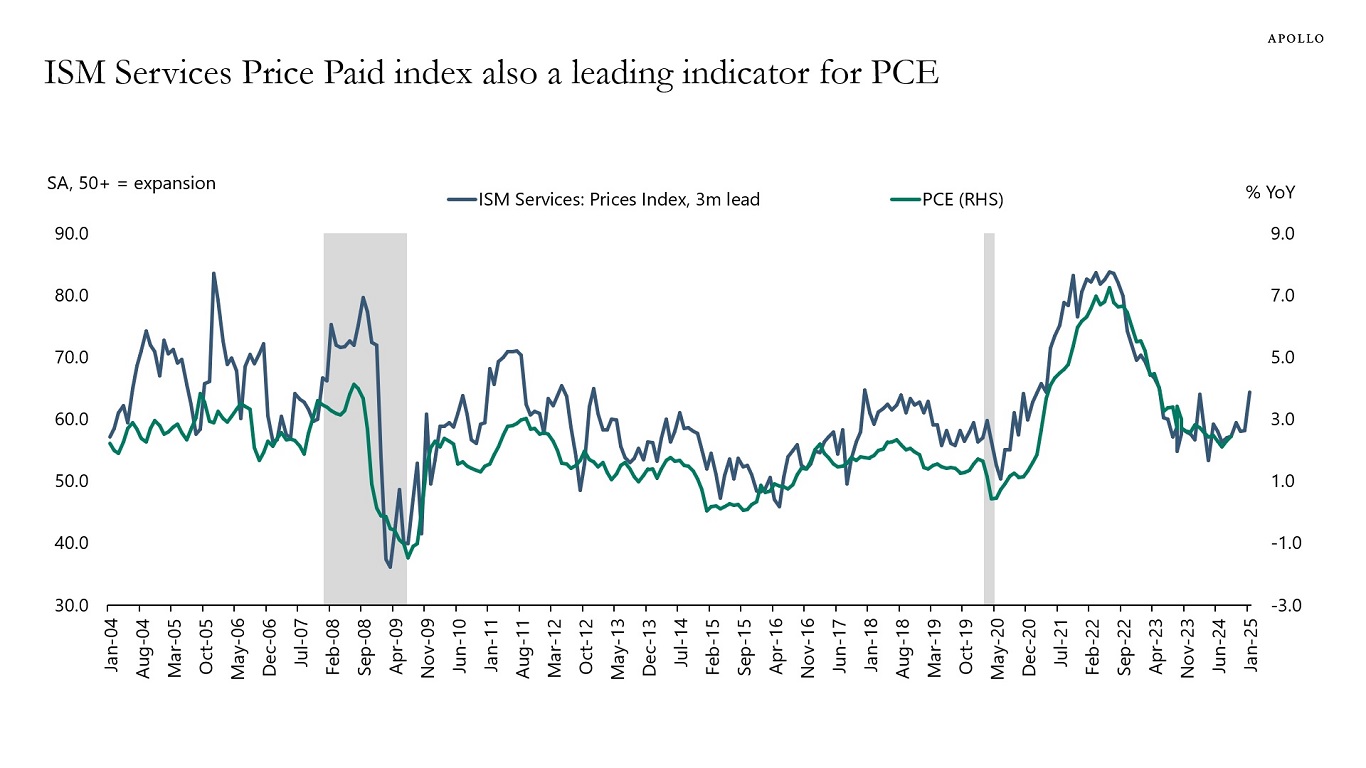

The recent jump in ISM Prices Paid points to a coming reacceleration in both headline and core inflation, see charts below.

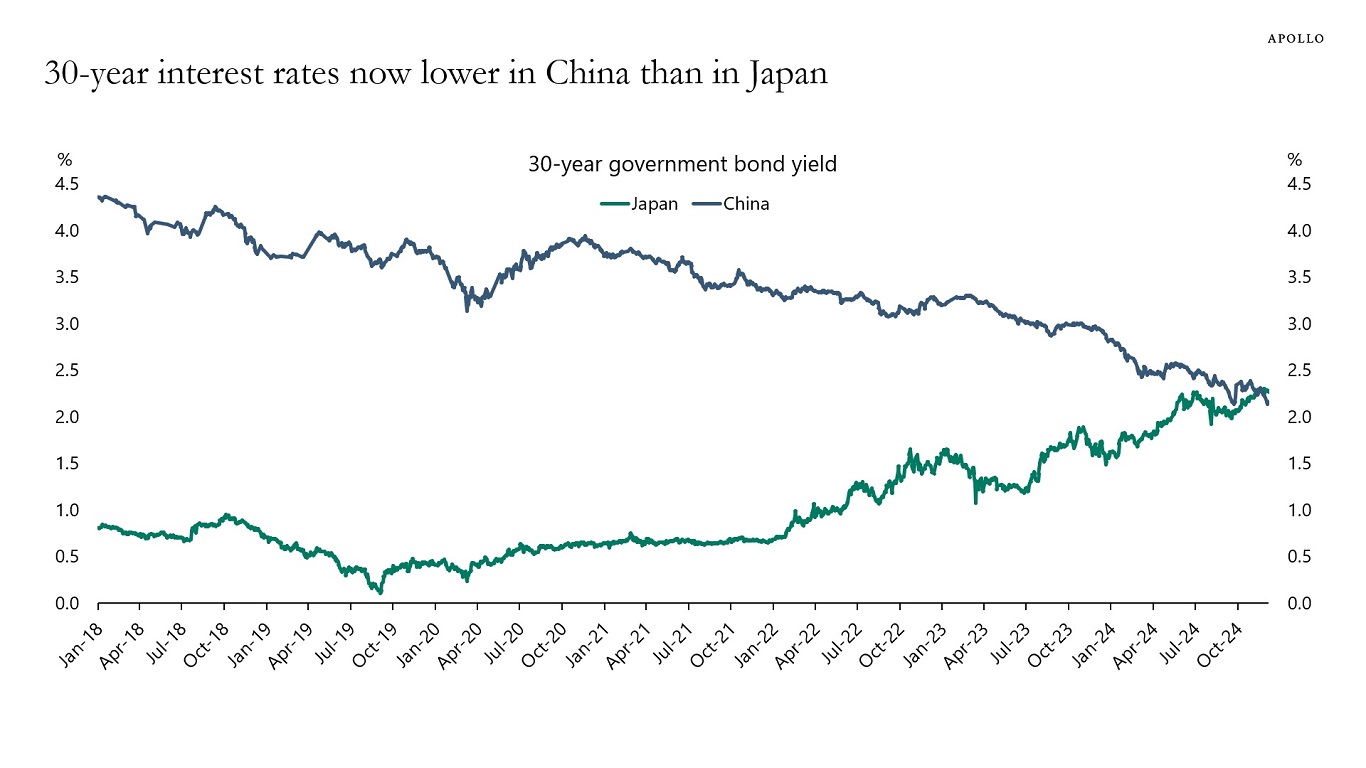

Growth and inflation are rising in Japan and falling in China. As a result, 30-year government bond yields are now lower in China than in Japan, see chart below.

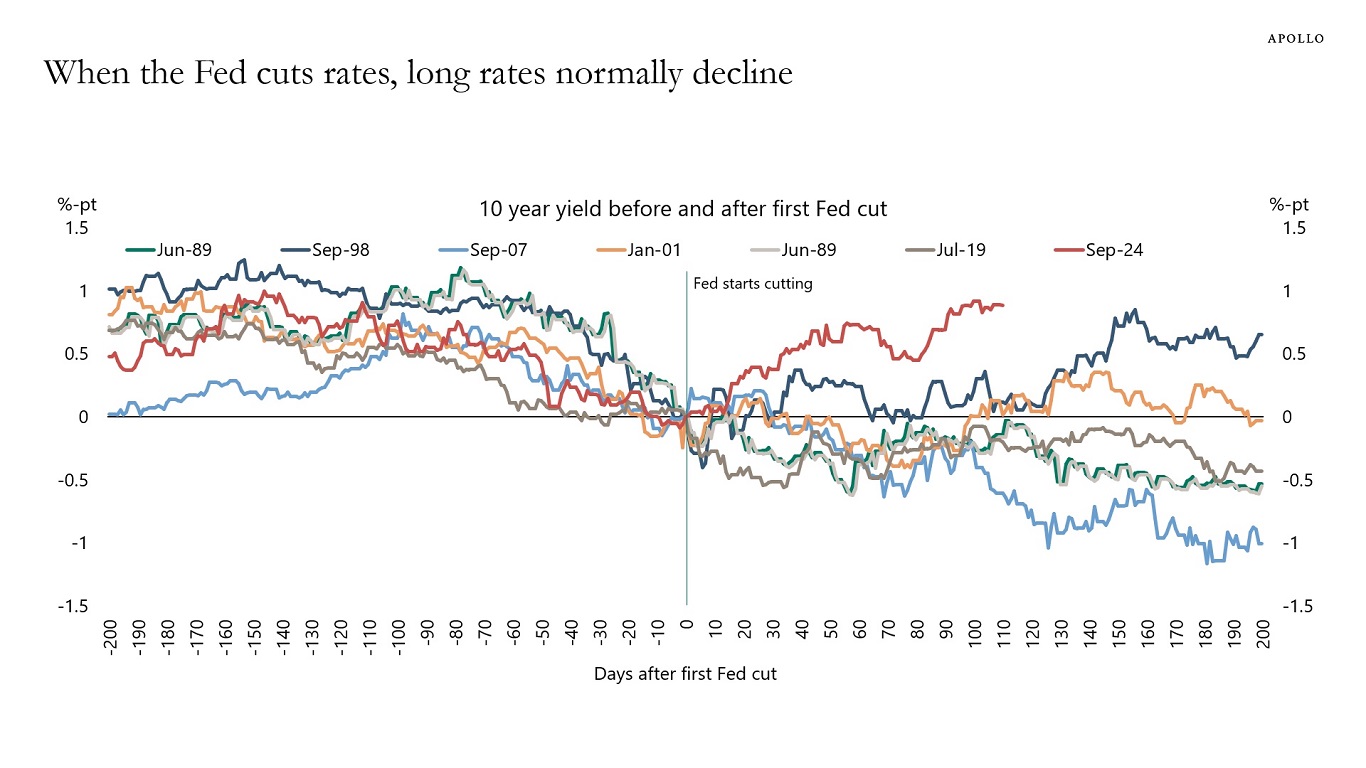

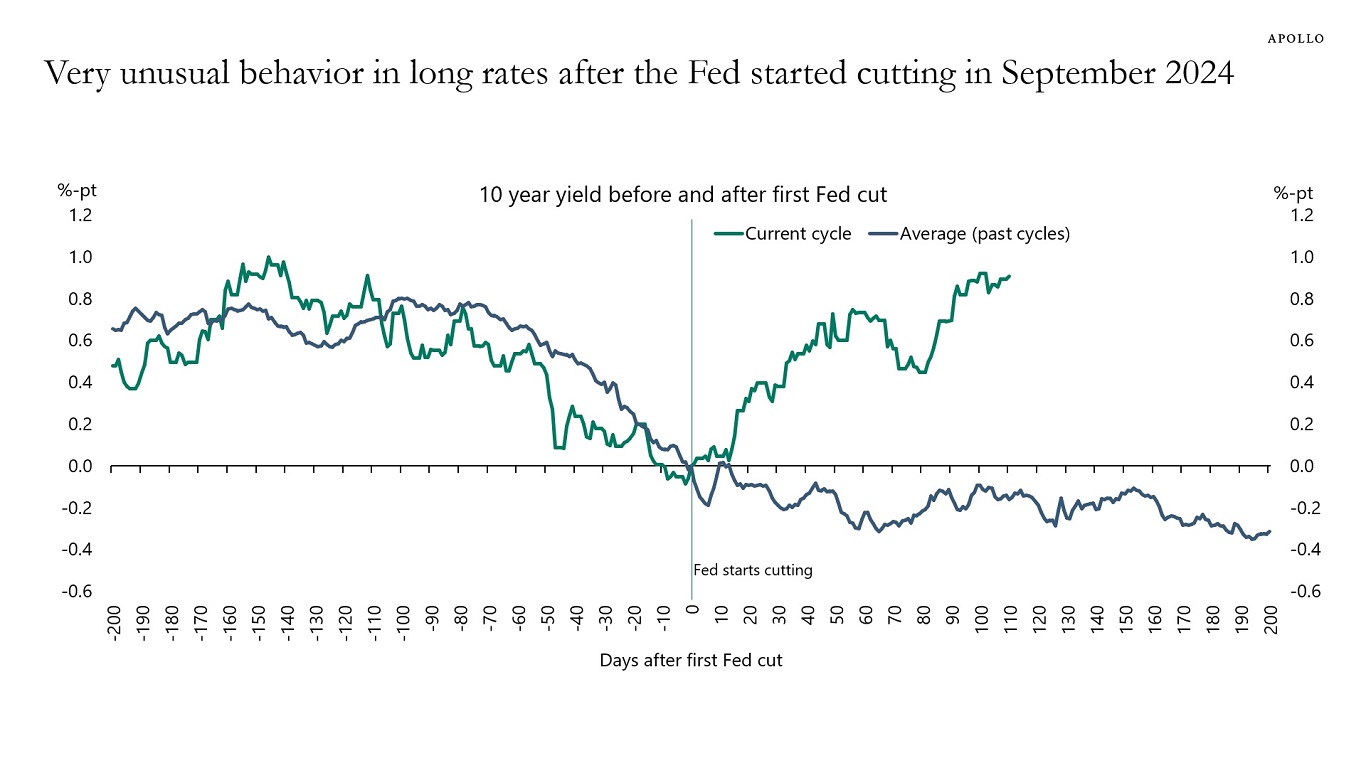

The Fed has cut interest rates 100 basis points since September, and over the same period, 10-year interest rates are up 100 basis points. This is highly unusual, see charts below. Is it fiscal worries? Is it less demand from abroad? Or maybe Fed cuts were not justified? The market is telling us something, and it is very important for investors to have a view on why long rates are going up when the Fed is cutting.

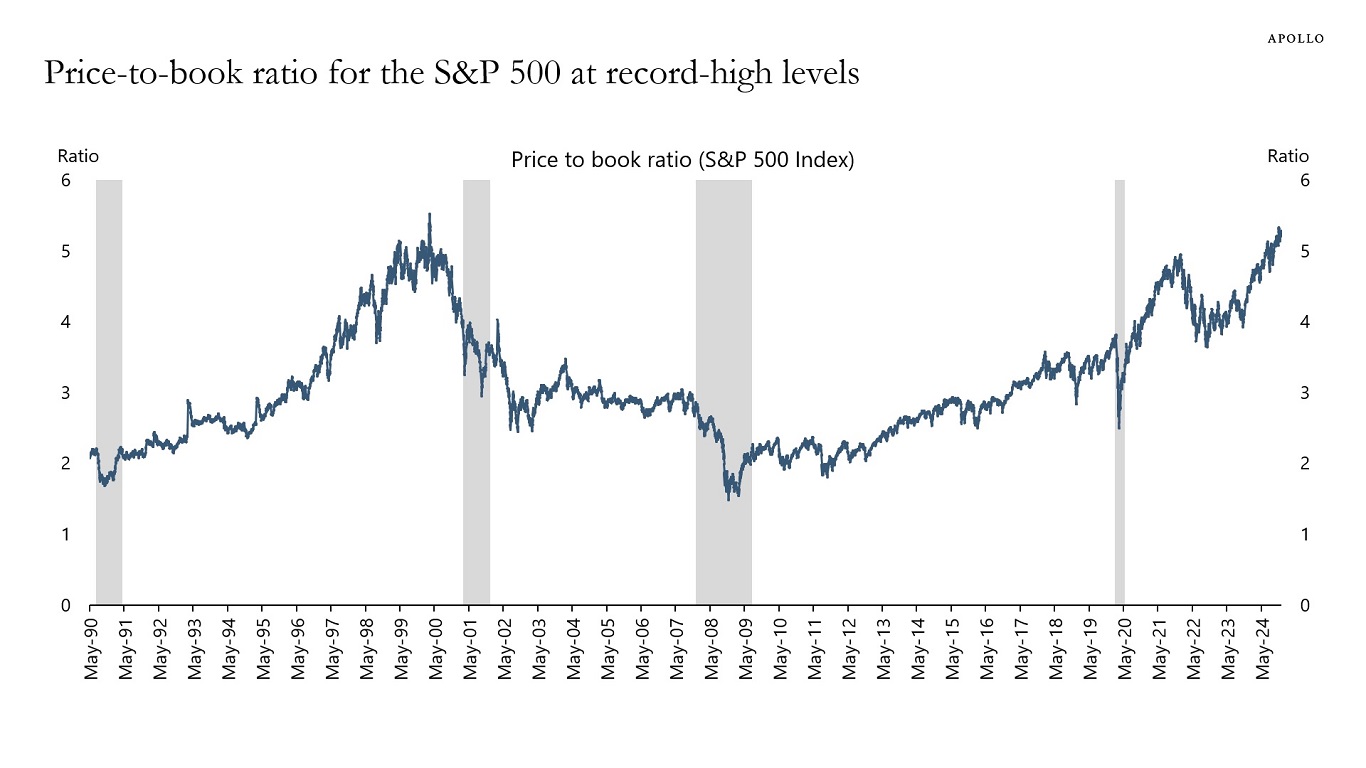

The price-to-book ratio for the S&P 500 is at record-high levels, see chart below. This is another piece of evidence that stocks are expensive at the moment.

The US consumer is in incredible shape.

Specifically:

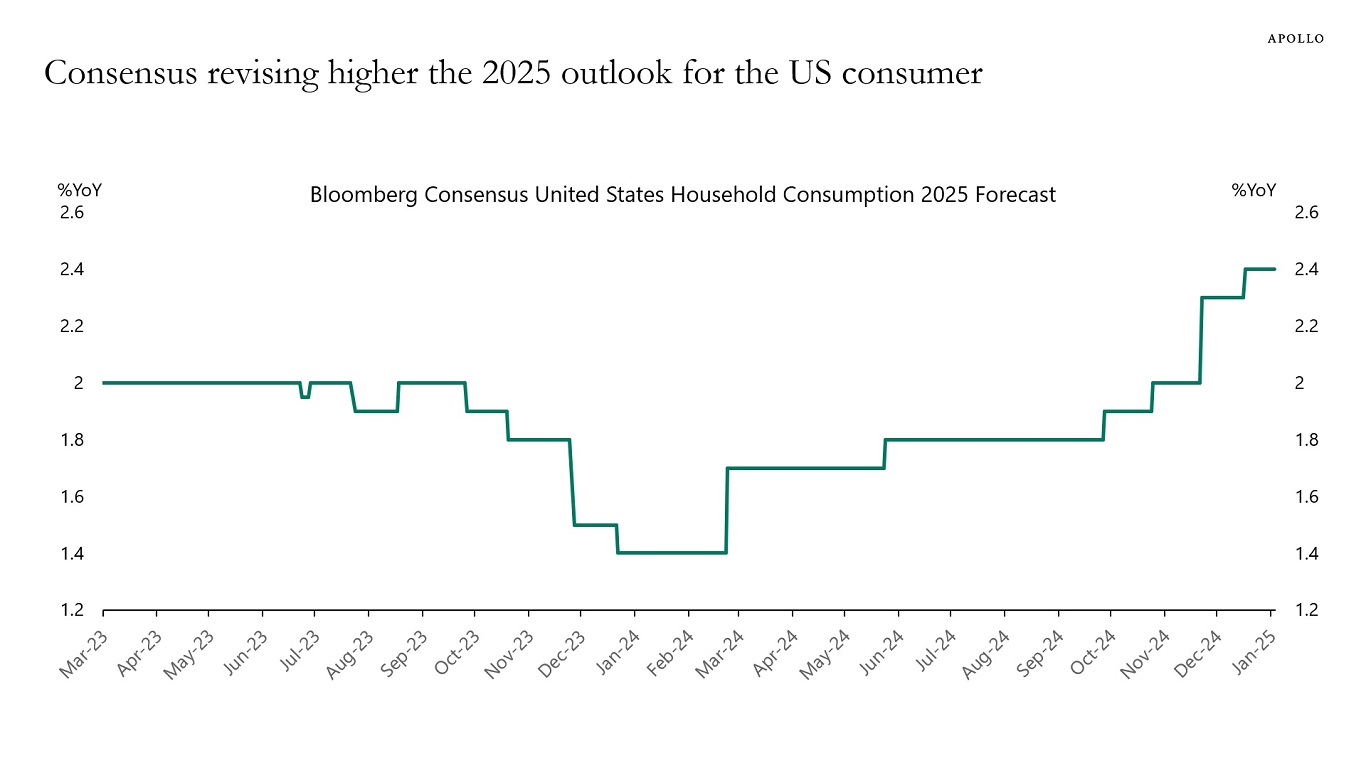

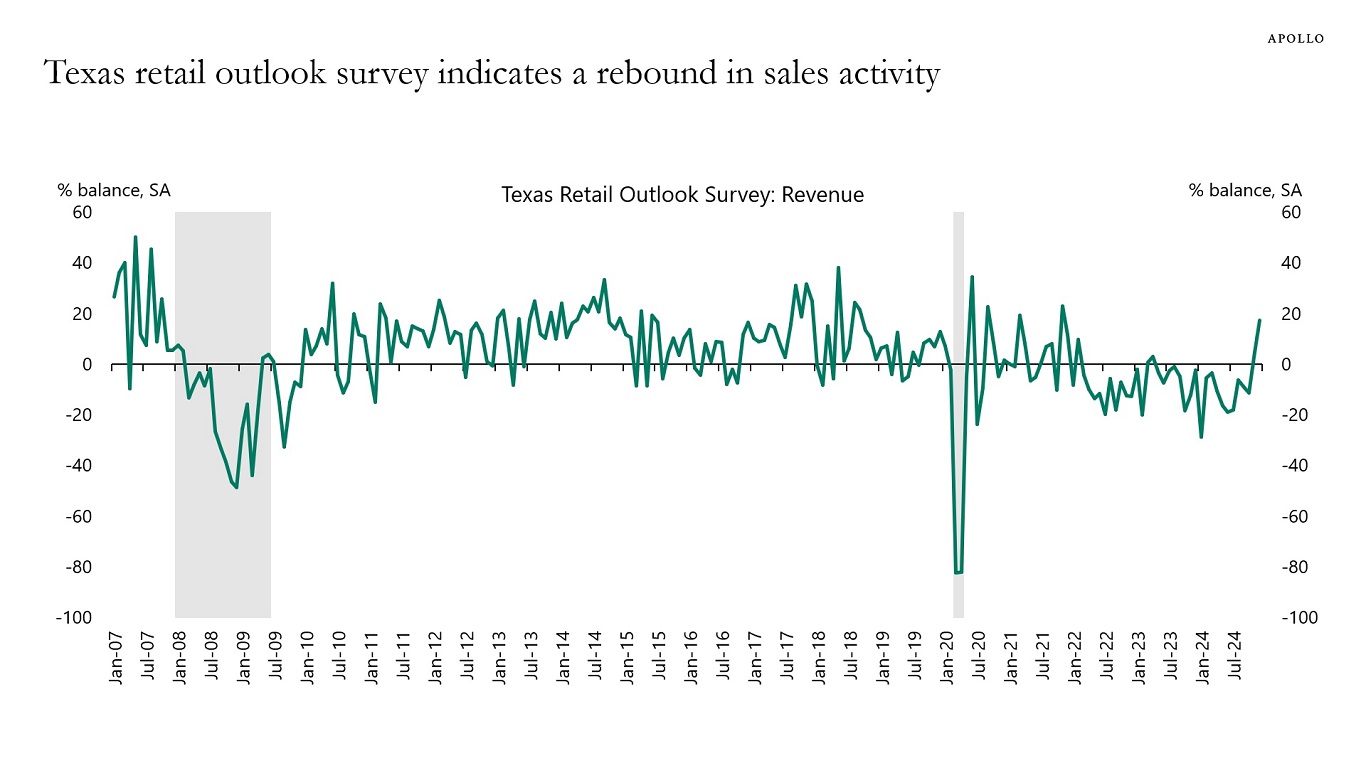

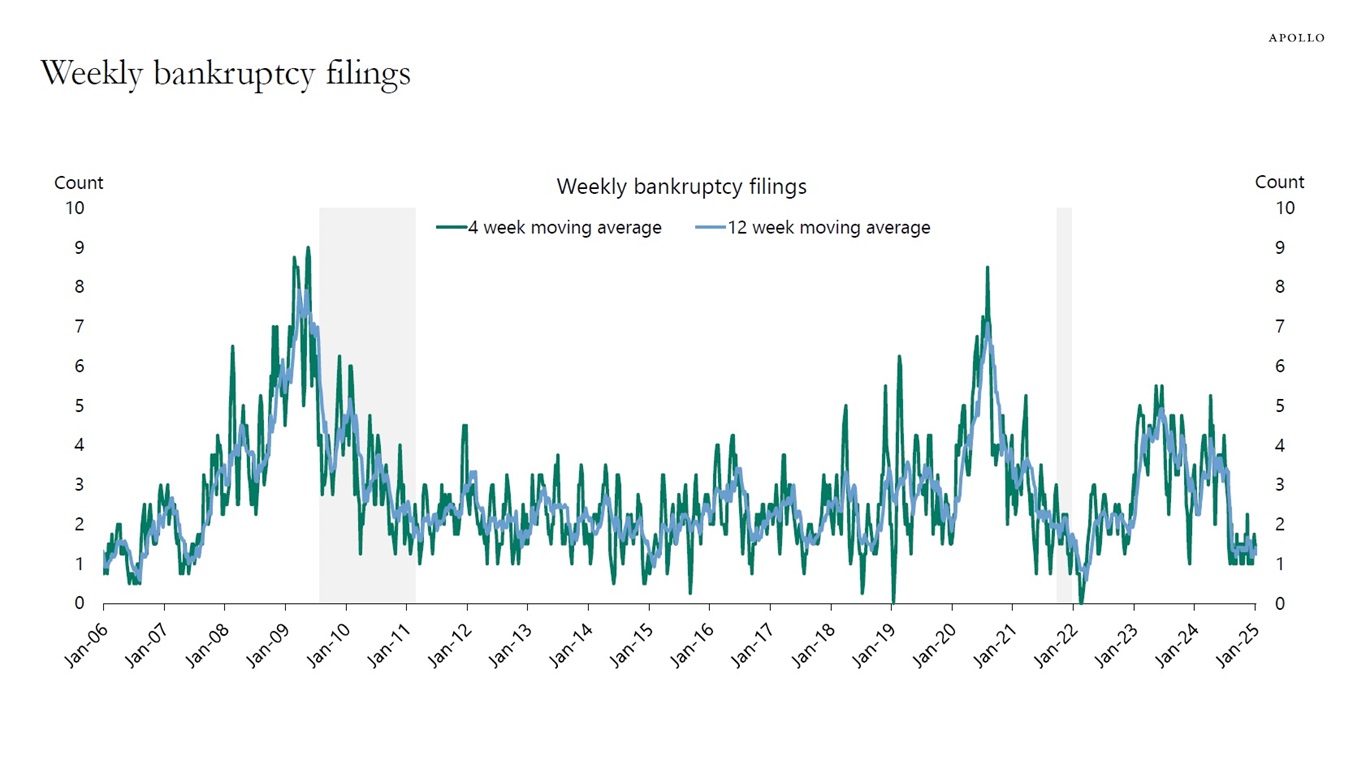

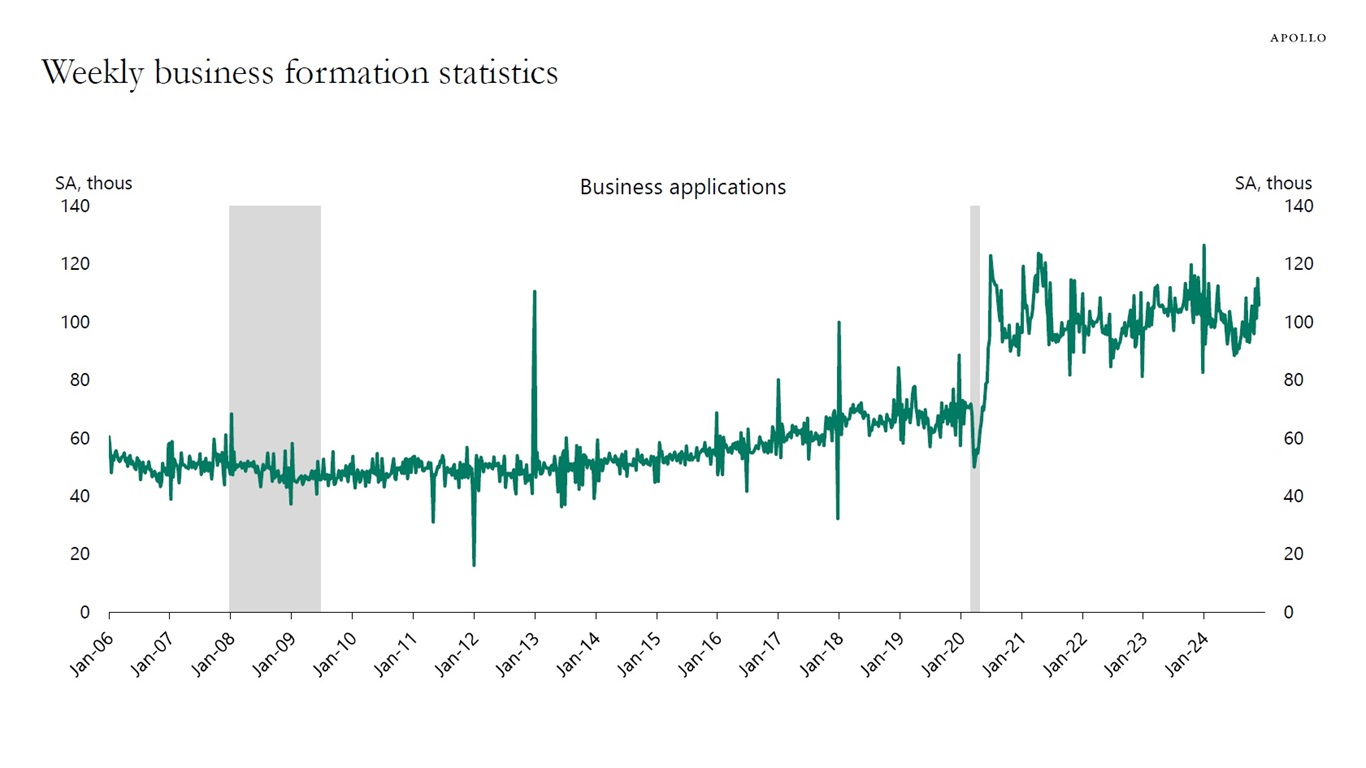

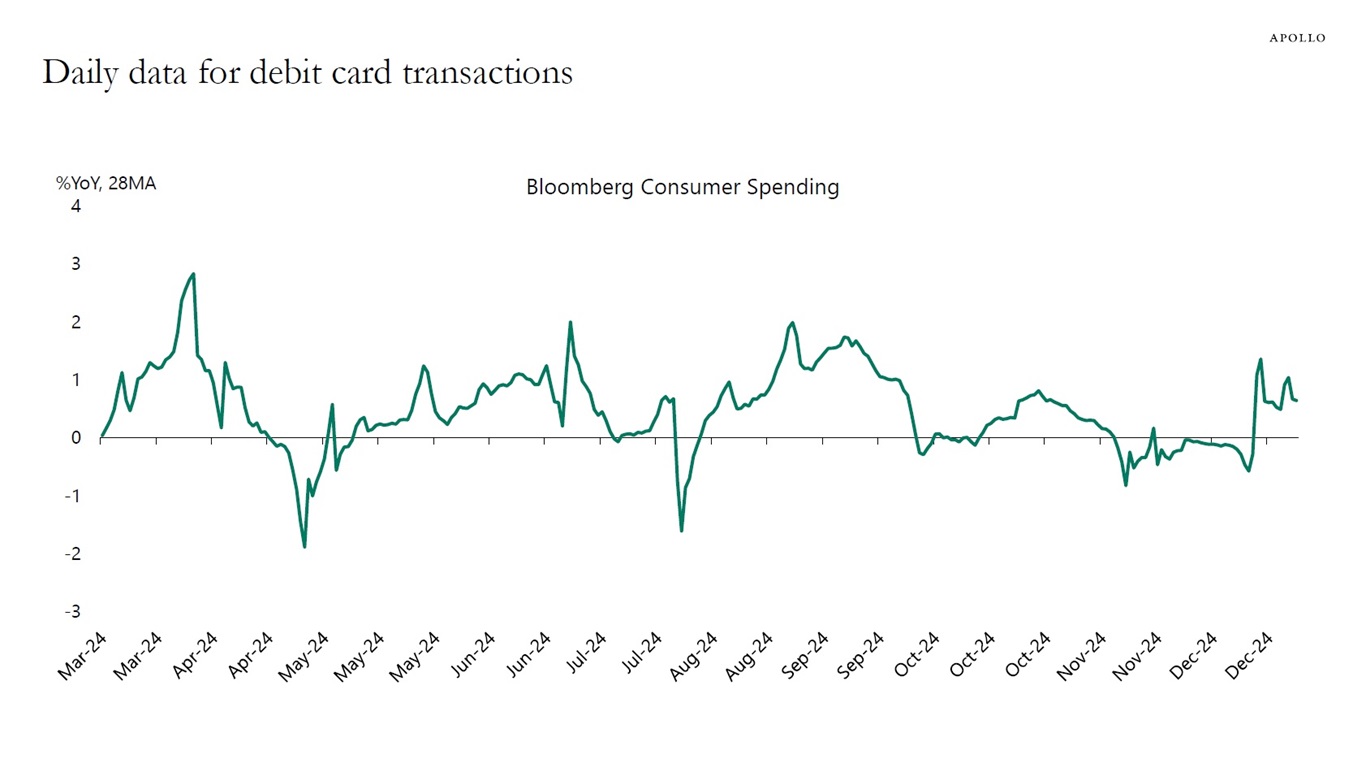

– The incoming weekly data shows continued strength in consumer spending, and outlook surveys show continued strength ahead (Charts 1 to 3).

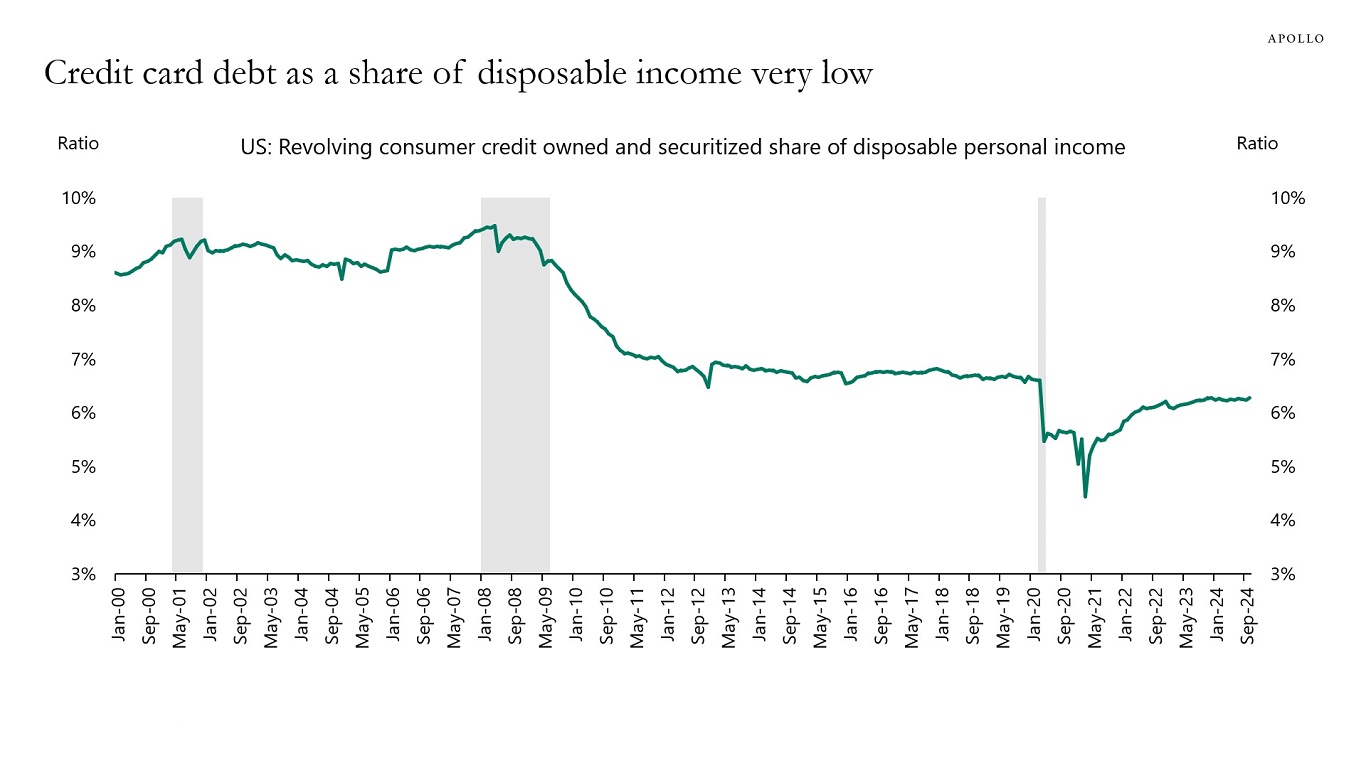

– Credit card debt as a share of disposable income is below pre-pandemic levels (Chart 4).

– The effective interest rate on mortgage debt outstanding is only 4% (Chart 5).

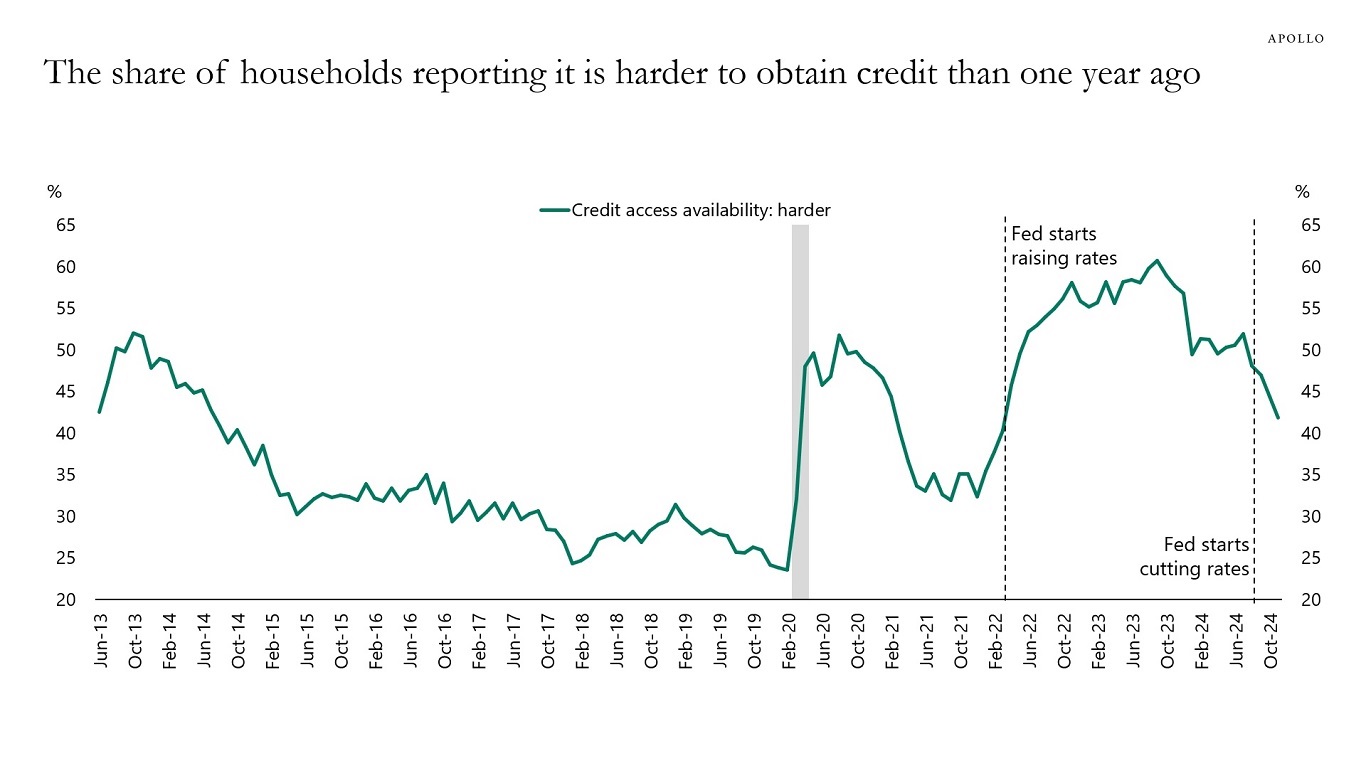

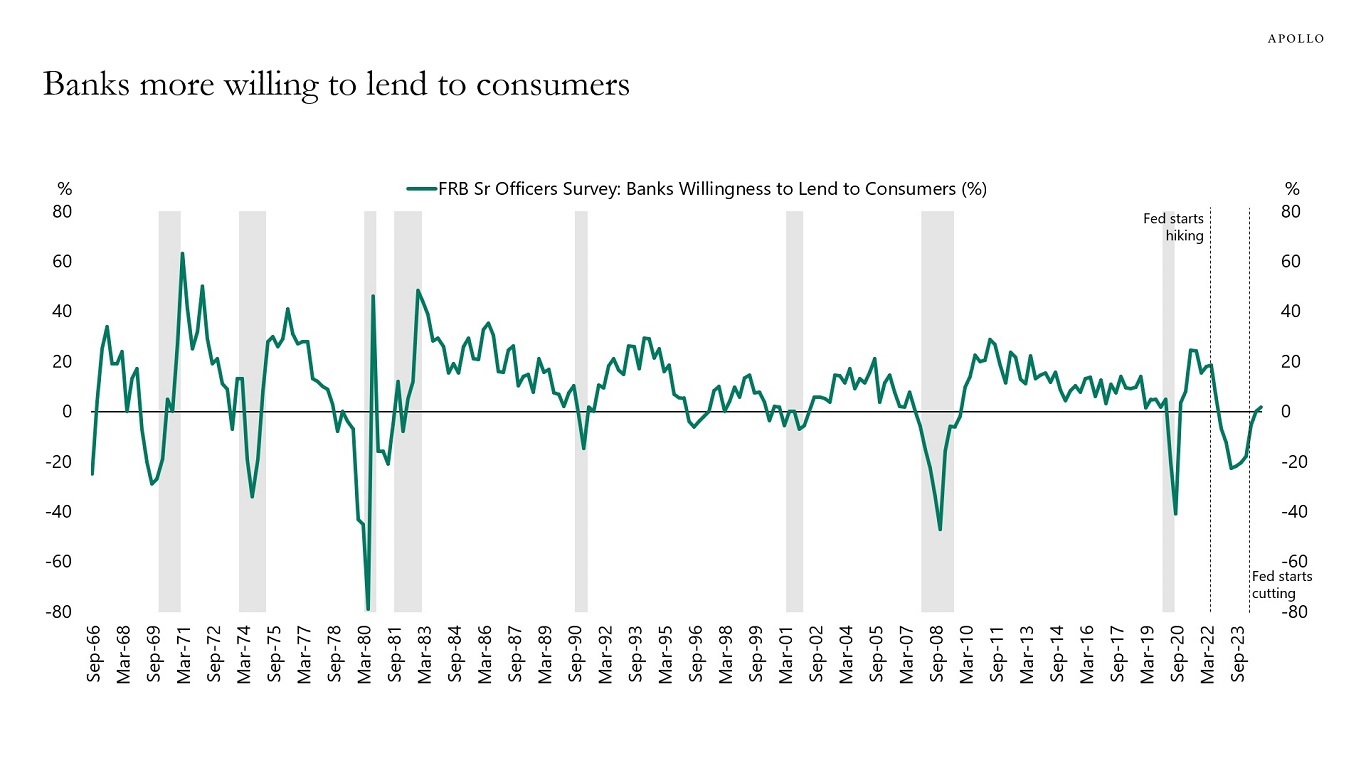

– Households are reporting that it is easier to get access to credit, and banks are more willing to lend to consumers (Charts 6 and 7).

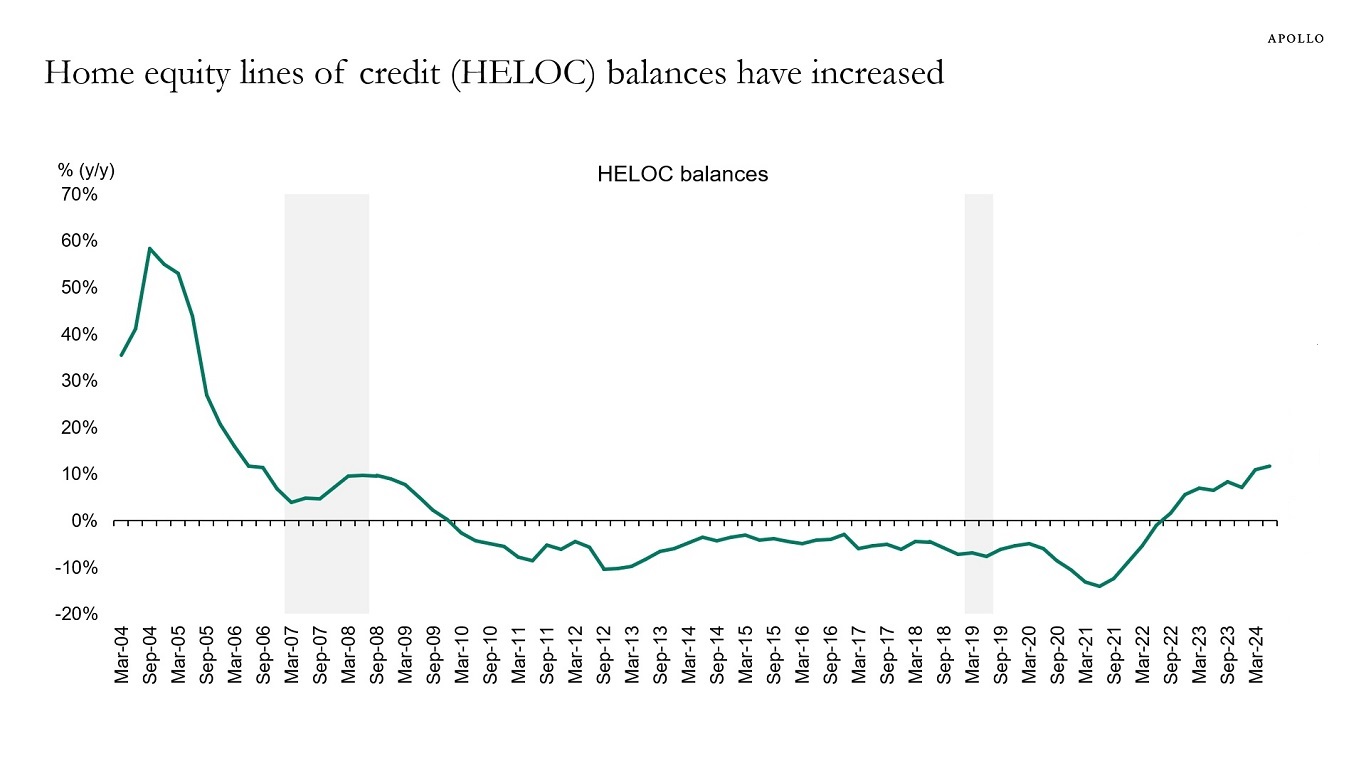

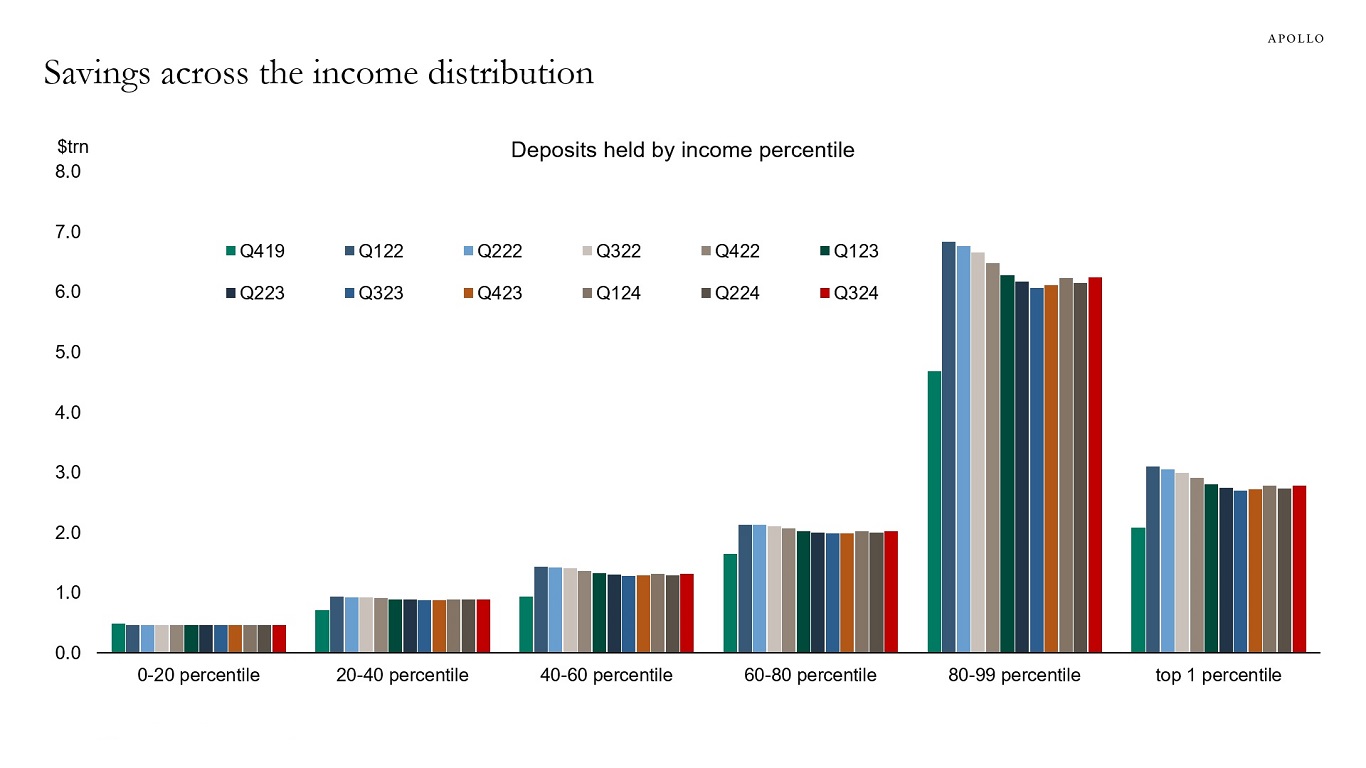

– HELOC balances are rising, and savings are rising for most households across the income distribution (Charts 8 and 9).

– Debt to disposable income is declining, and US households are in much better shape than households in Canada and Australia (Chart 10).

The bottom line is that incomes are high, stock prices are high, home prices are high, debt levels are low, interest rate sensitivity is low, and banks are more willing to lend to households.

There are significant upside risks to US growth, inflation, and interest rates as we enter 2025.