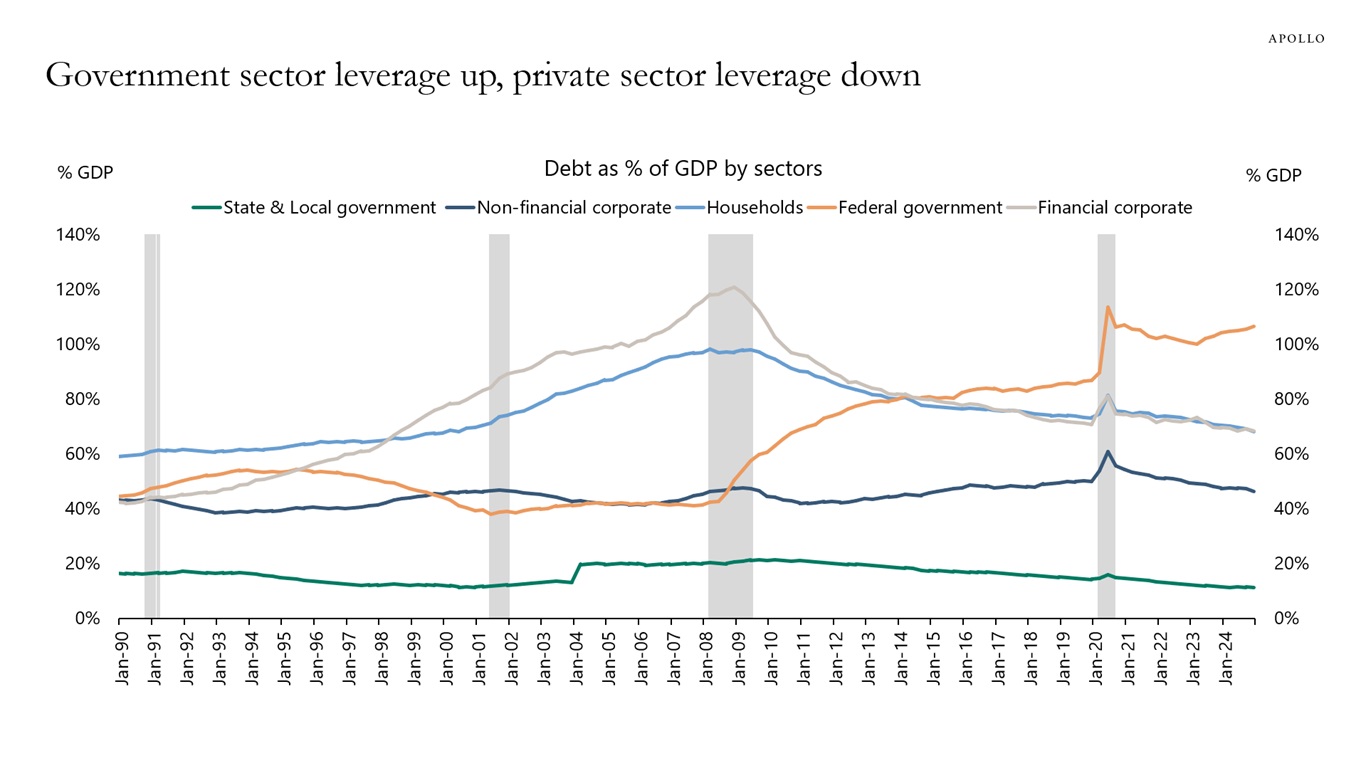

Household sector leverage and banking sector leverage have declined significantly since 2008, see chart below. Over the same period, federal government leverage has increased significantly, and corporate leverage has moved sideways.

The bottom line is that the private sector in the US is in incredibly good shape.