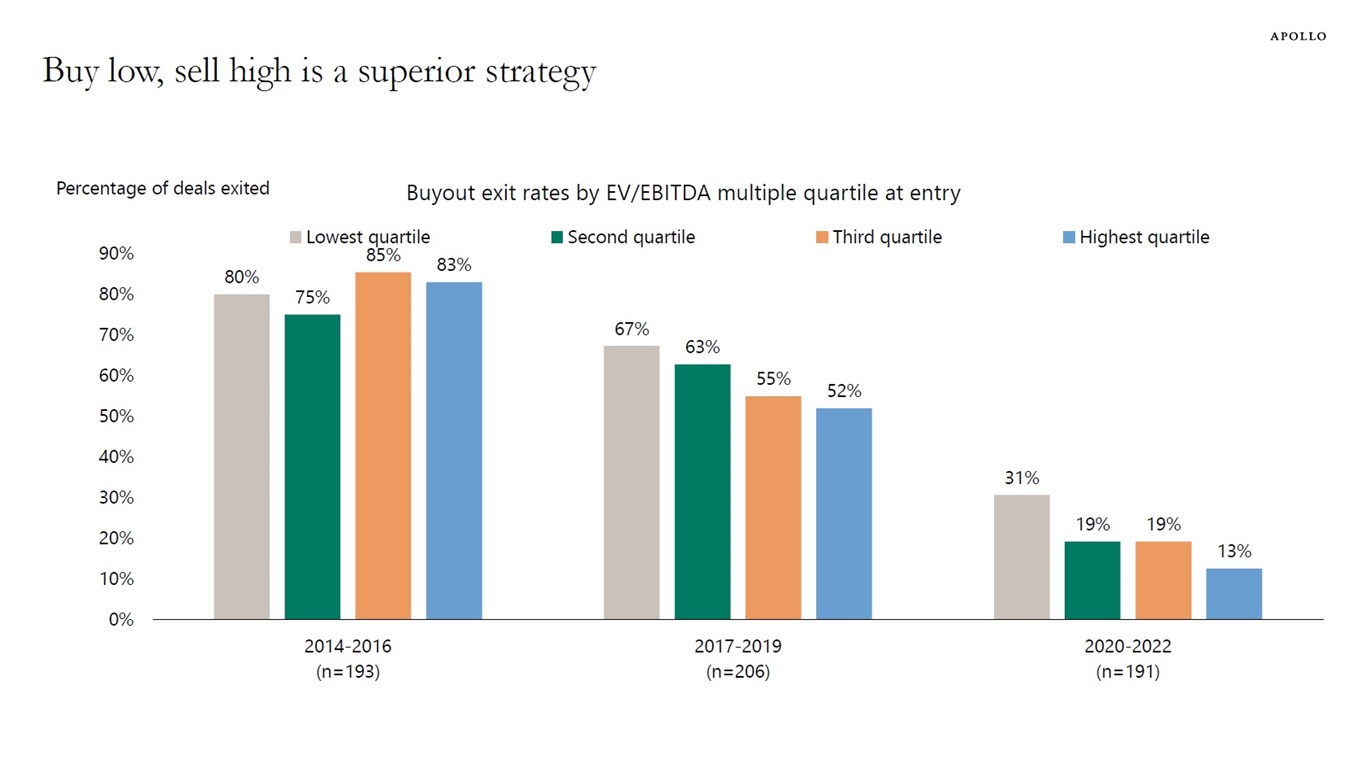

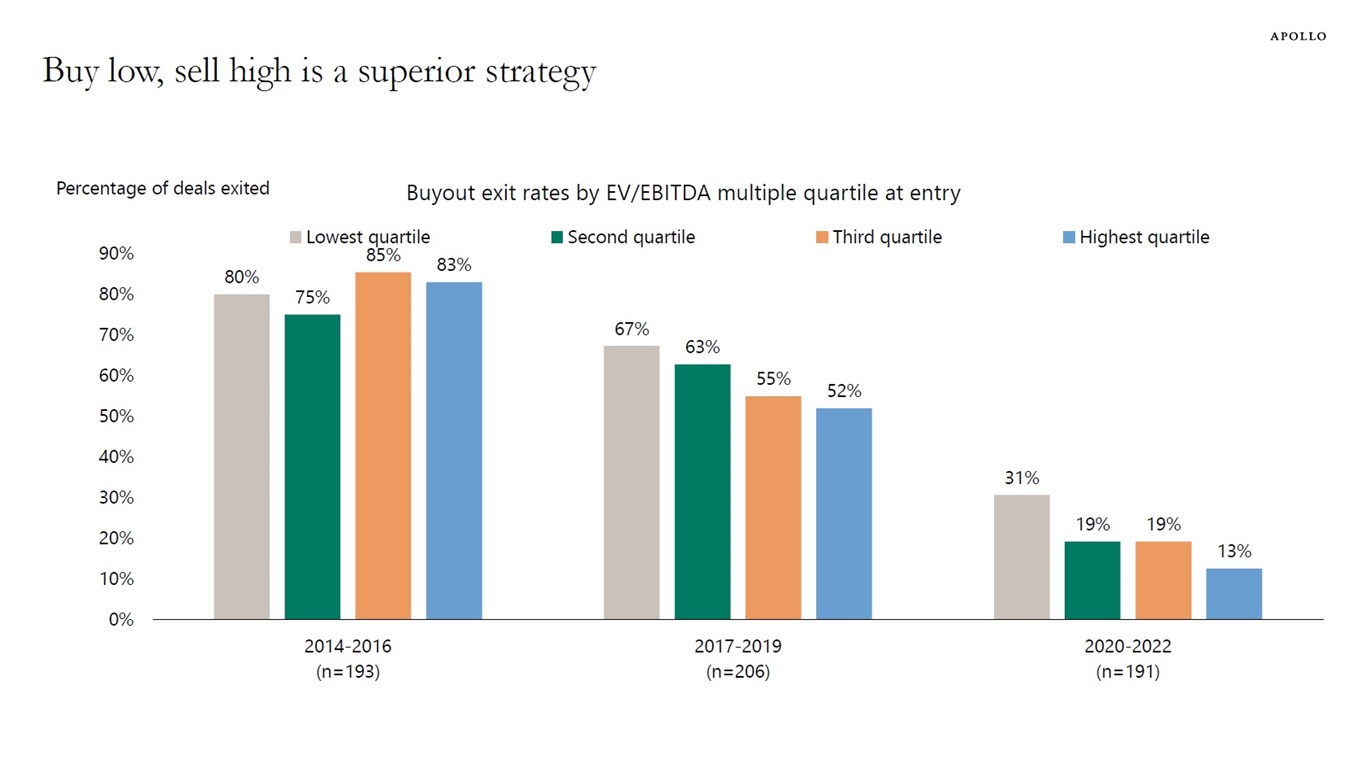

Data from PitchBook shows that it takes significantly longer for PE portfolio companies purchased at higher multiples to exit relative to portfolio companies bought at lower multiples, see chart below. Purchase price matters.

Data from PitchBook shows that it takes significantly longer for PE portfolio companies purchased at higher multiples to exit relative to portfolio companies bought at lower multiples, see chart below. Purchase price matters.

As the Fed cut rates at its September meeting, tensions surfaced—between growth, inflation, employment, and the expectation of more cuts to come. In this episode of The View from Apollo, Torsten Sløk, Apollo’s Chief Economist, unpacks these crosscurrents and what they could mean for markets and portfolios.

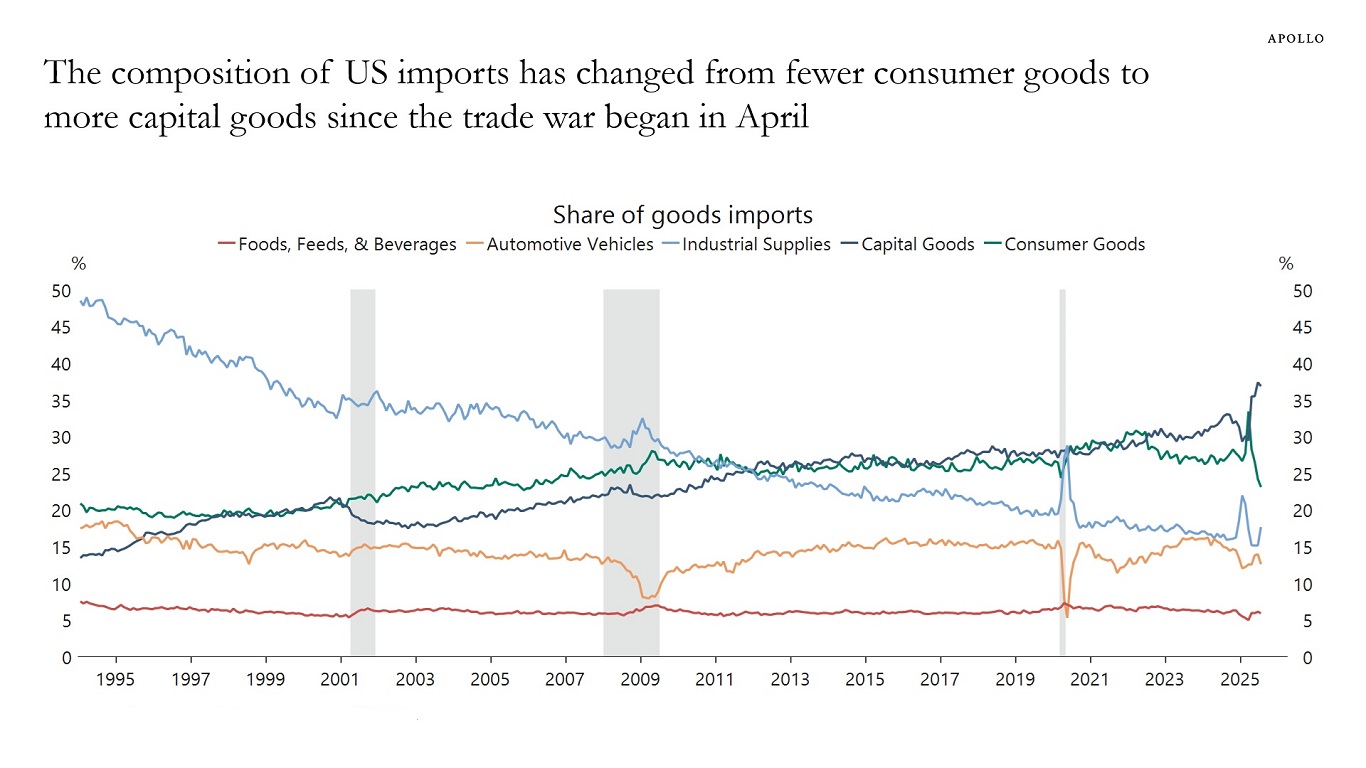

Consumers are more sensitive than companies to price changes of imported goods, see also here.

As a result, the composition of US imports has changed dramatically since Liberation Day, with a sharp decline in imports of consumer goods, see chart below.

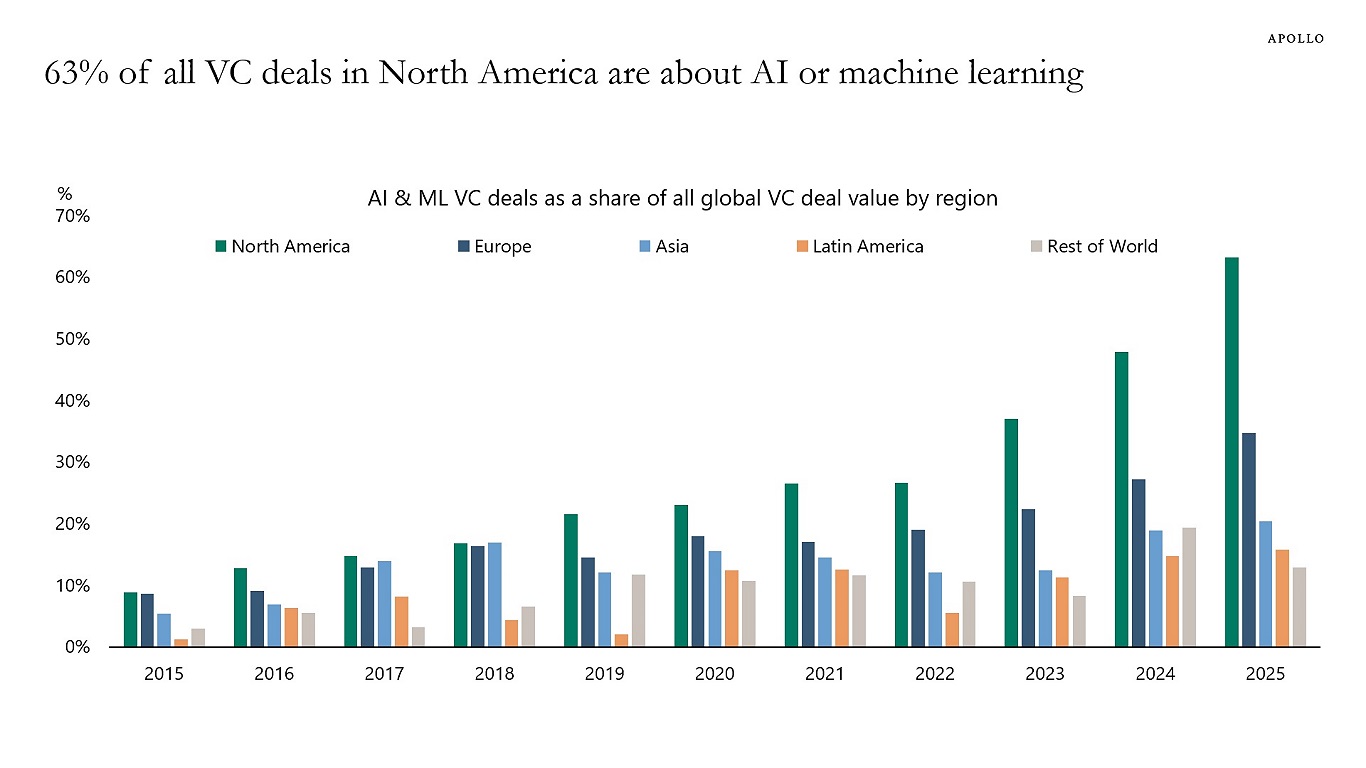

A rising share of VC activity globally is AI deals, and 63% of all VC deals in North America are now AI or machine learning, see chart below.

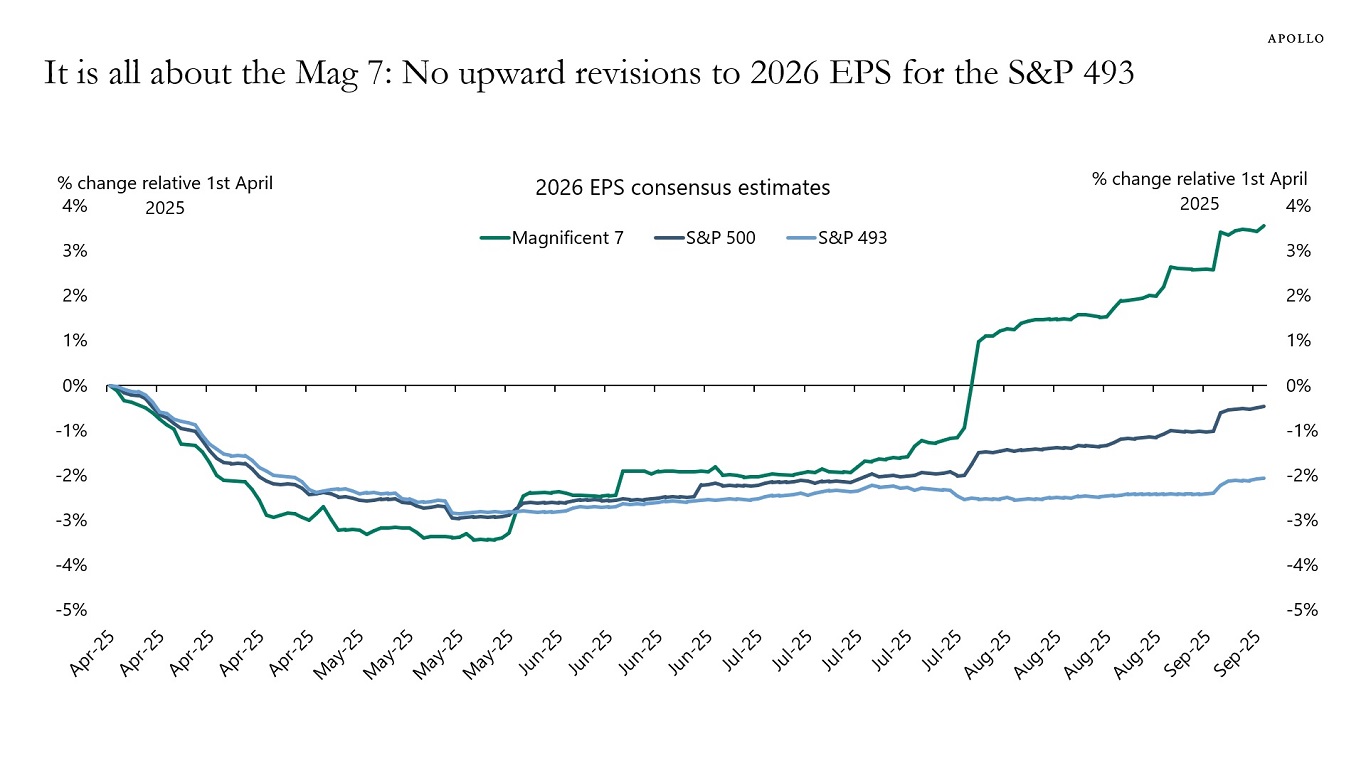

The upward consensus revision to 2026 earnings for the S&P 500 since Liberation Day comes entirely from the Magnificent 7, see chart below.

The outlook for the rest of the economy is much more bearish: Earnings expectations for the S&P 493 have remained suppressed and are not moving higher.

The bottom line is once again that there is an extreme degree of concentration in the S&P 500, and equity investors are dramatically overexposed to AI.

For more discussion, see also our chart book here.

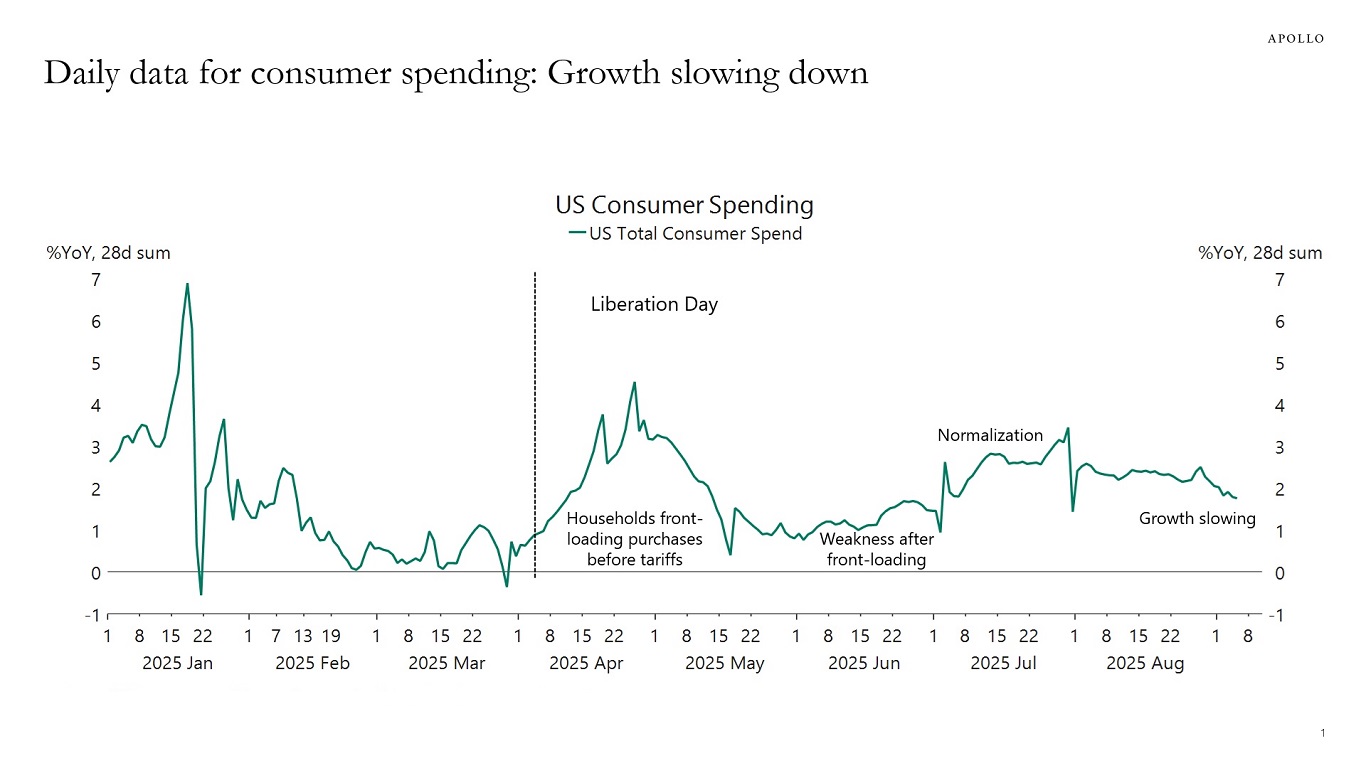

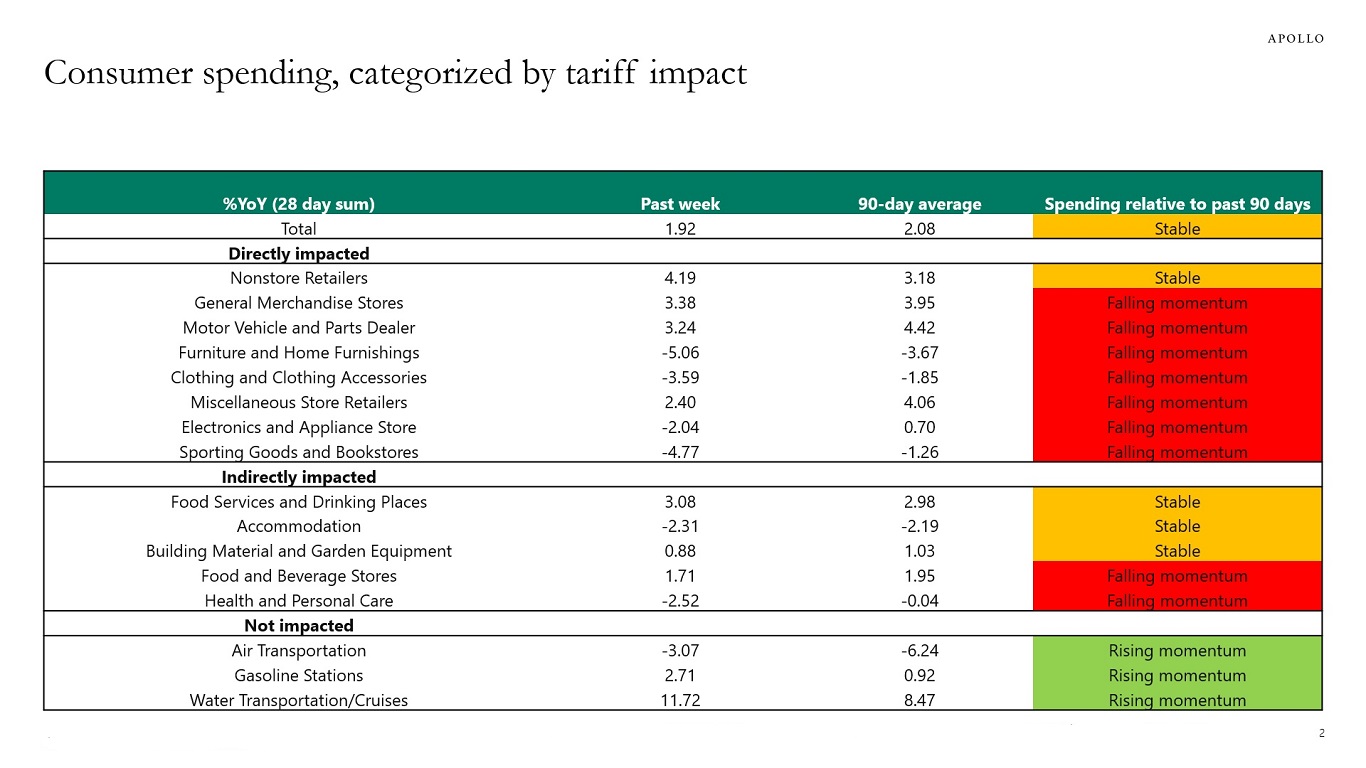

The daily data for consumer spending has slowed down modestly in recent weeks, and the slowdown is more pronounced in sectors impacted by tariffs, see charts below and in this chart book.

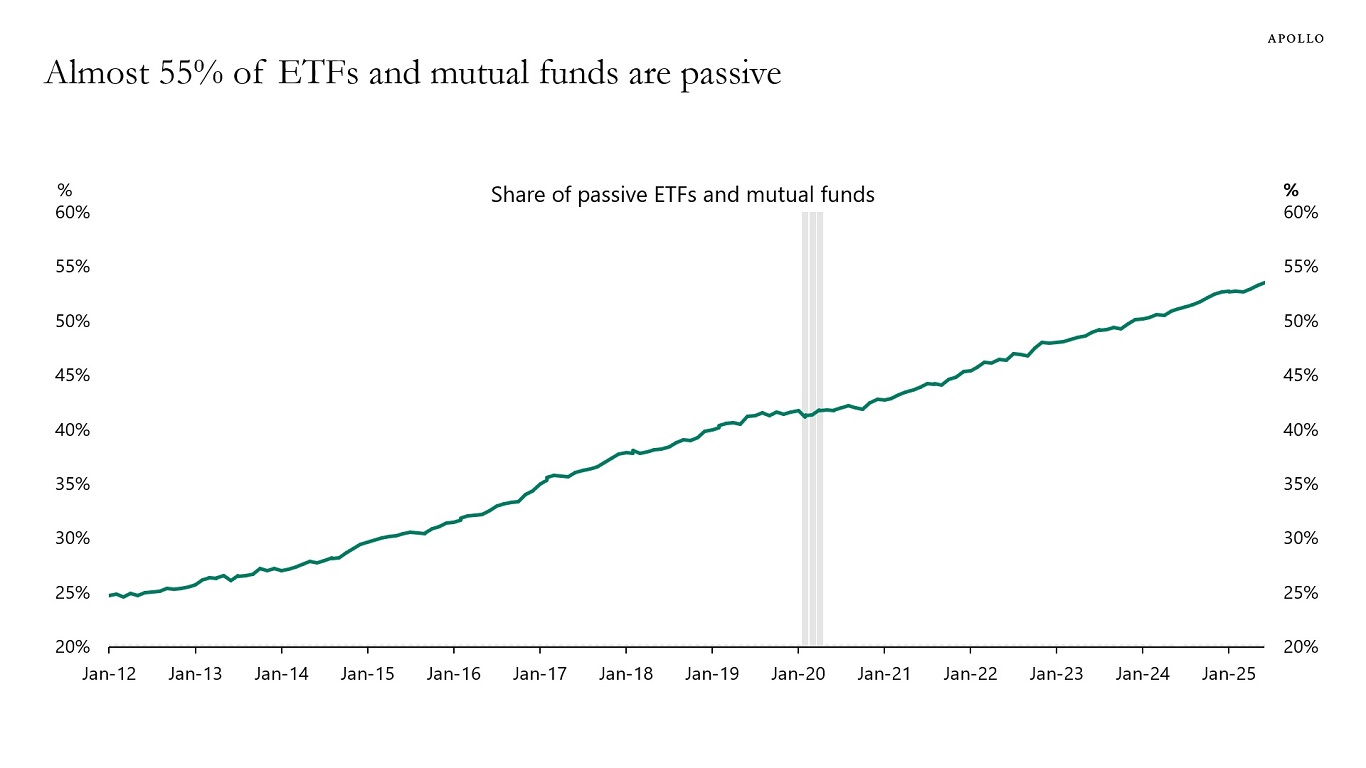

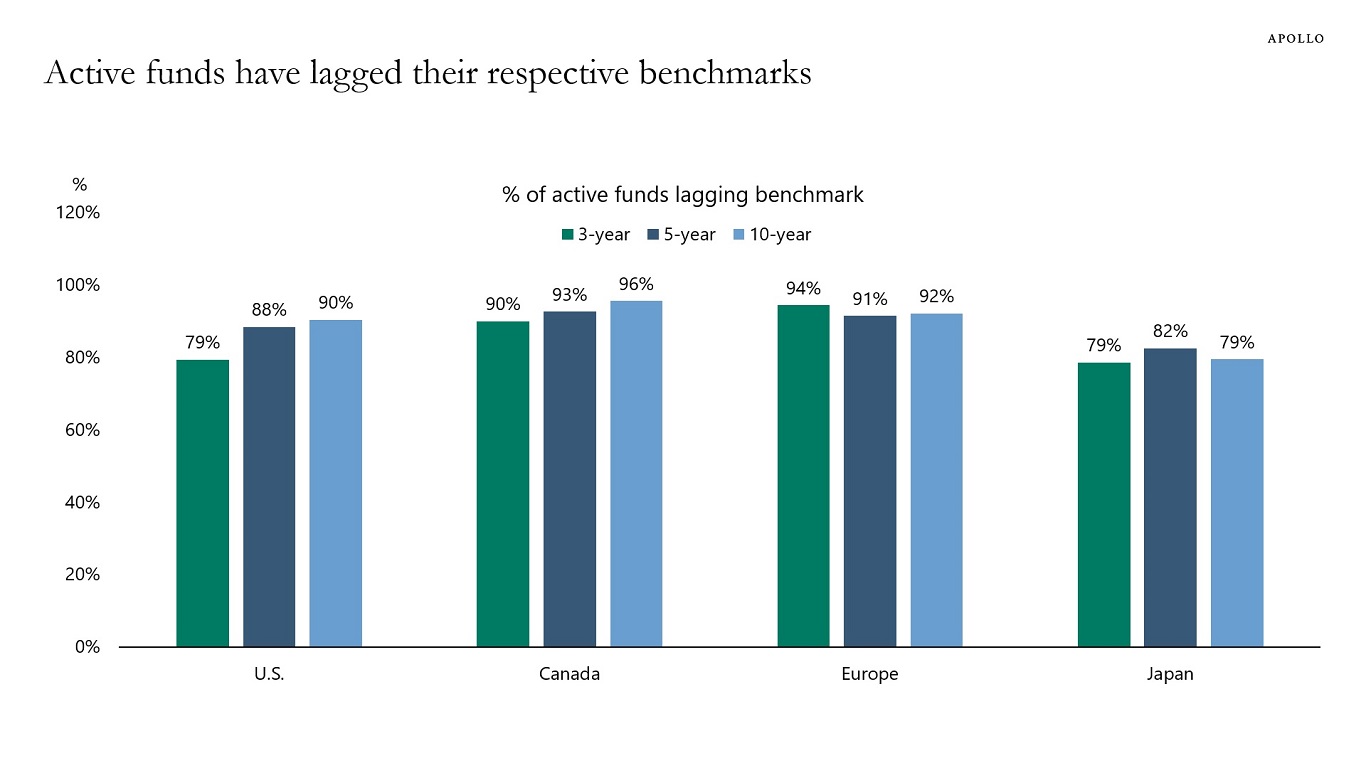

The amount of money in passive investing continues to grow, see charts below.

There are three consequences of this development:

1) Reduced market efficiency and price discovery

2) Increased market concentration and volatility

3) Growing correlation and systemic risk

For more discussion, see here.

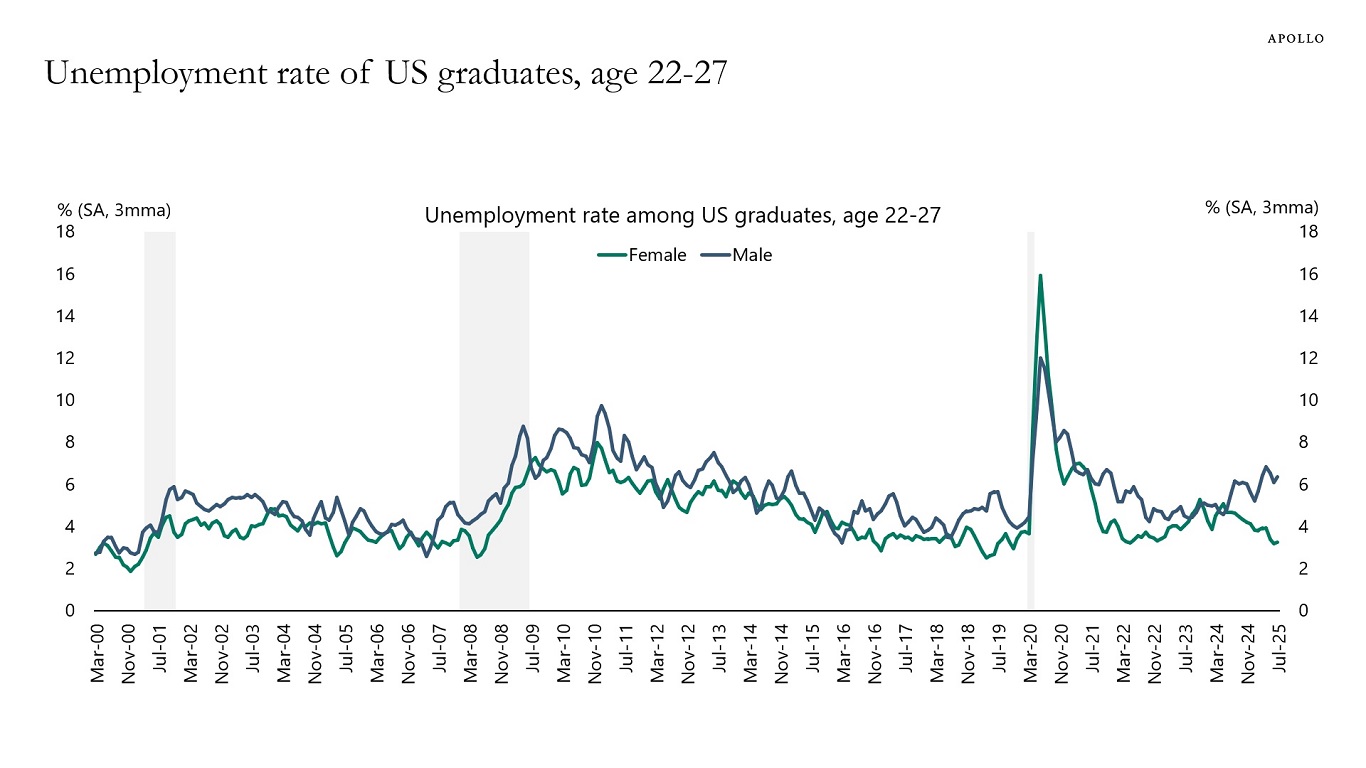

The unemployment rate for recent college graduates is rising for men and falling for women, see chart below.

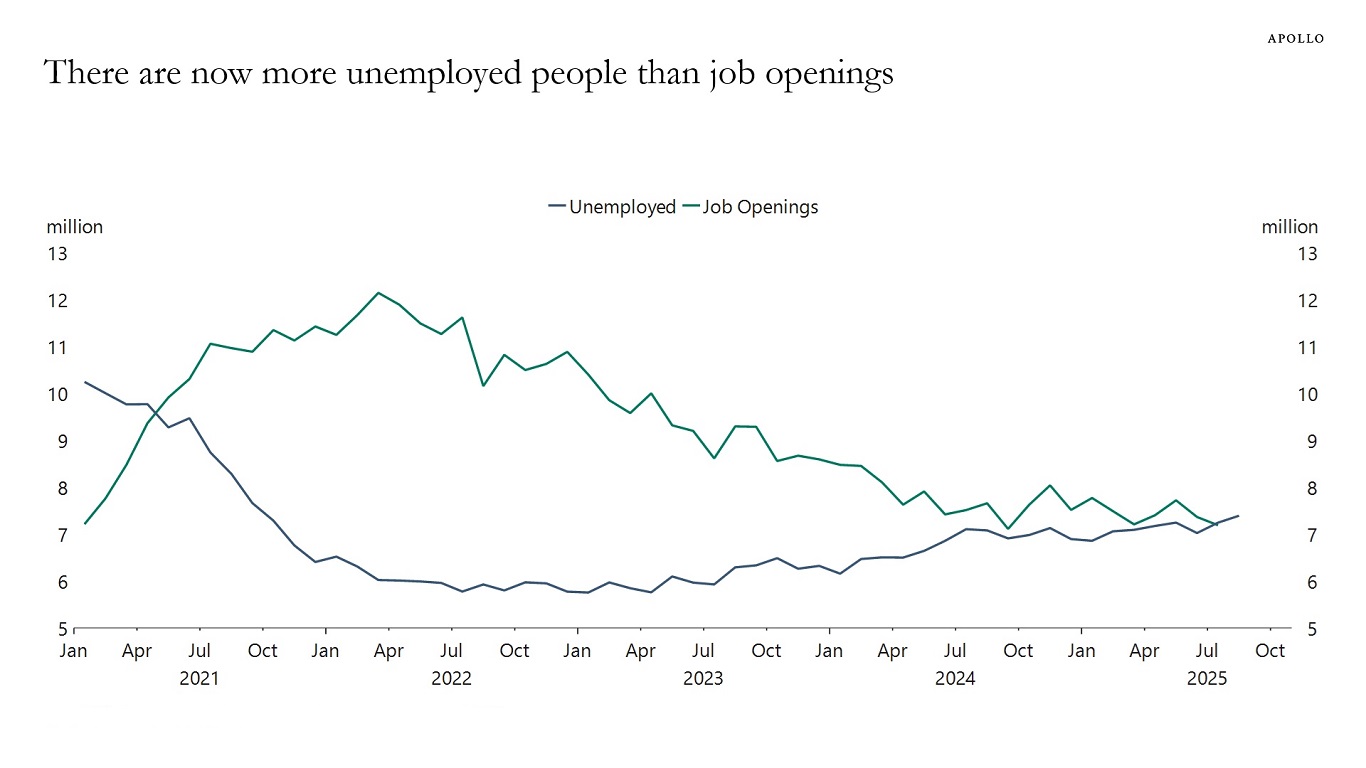

There are currently 7.4 million unemployed people and 7.2 million job openings, see chart below.

It is the first time since 2021 when we have had more unemployed than job openings.

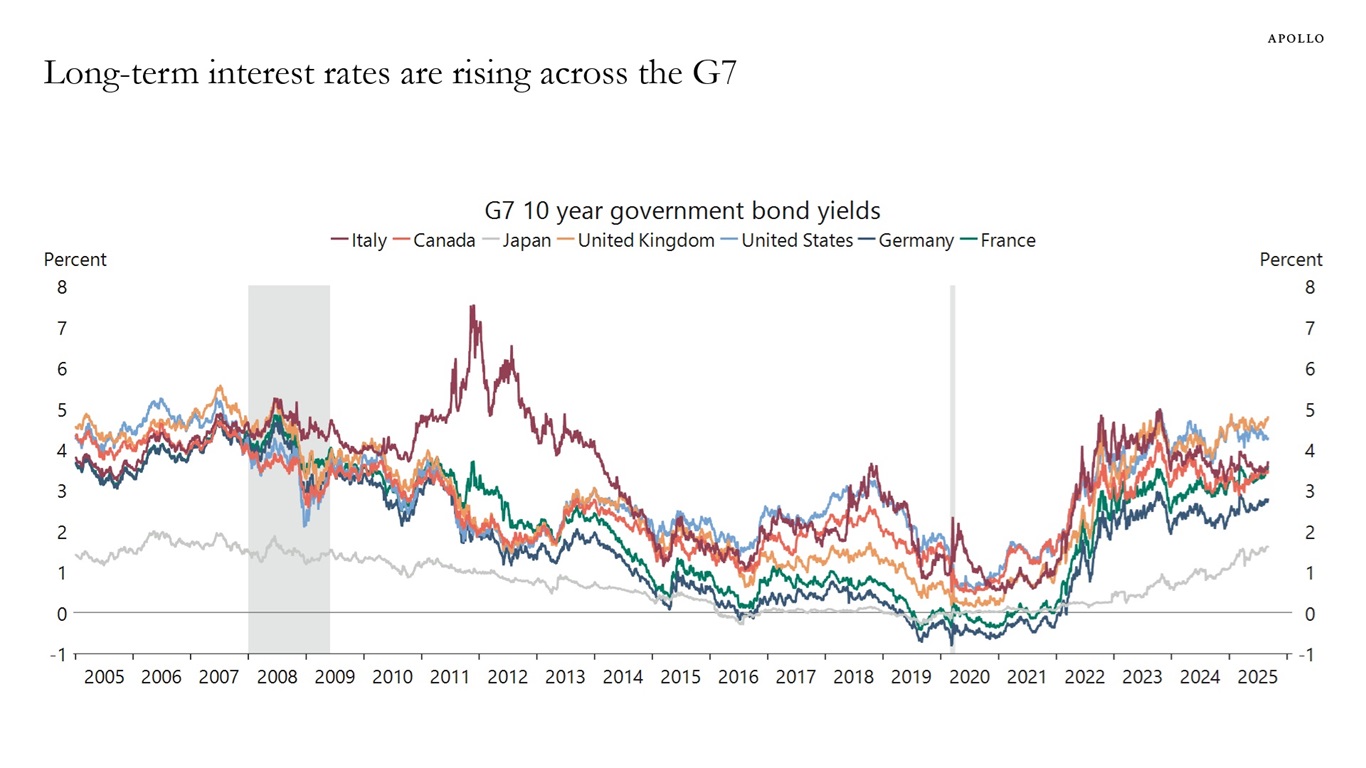

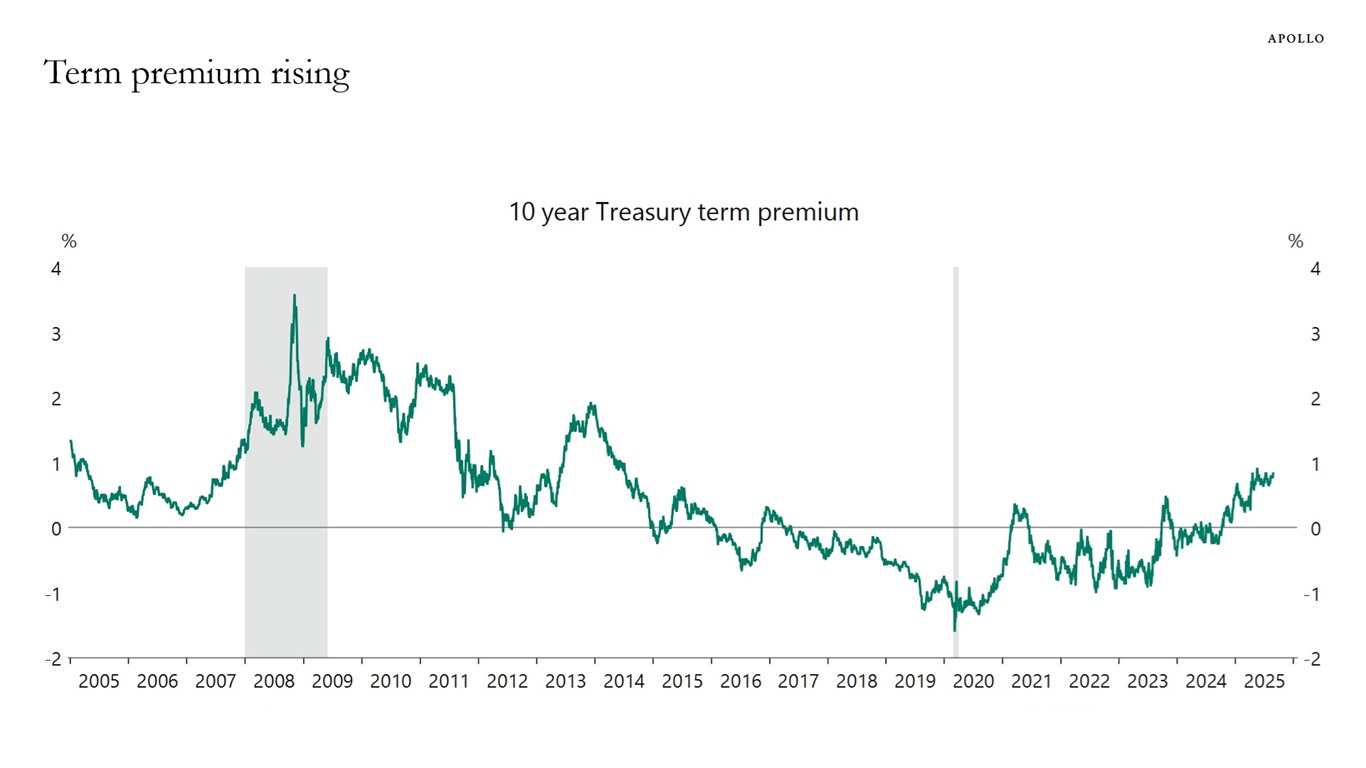

There are fiscal challenges in most countries, and government debt levels, yield levels and the term premium are rising across the G7, see charts below.

This raises questions about debt sustainability and the ability of governments to repay their debt, particularly in Europe and Japan, where growth is structurally weak due to demographics and years of policy choices that have dampened growth.

What are the consequences if the risk-free asset is no longer risk-free?

1) Higher government borrowing costs and, as a result, higher borrowing costs for consumers and firms.

2) Loss of monetary policy effectiveness, as cuts by the central bank don’t lower long-term interest rates.

3) Financial instability, because the risk-free rate is used for valuing assets and pricing risk.

In extreme cases, the central bank may decide to do YCC or QE to lower long-term interest rates. But this comes at the risk of a dramatic depreciation of the currency, as the central bank essentially intervenes to support fiscal policy and, as a result, the central bank loses credibility among investors.

For more discussion see here, here and here.