We have updated our outlook for private markets, it is available here.

We have updated our outlook for private markets, it is available here.

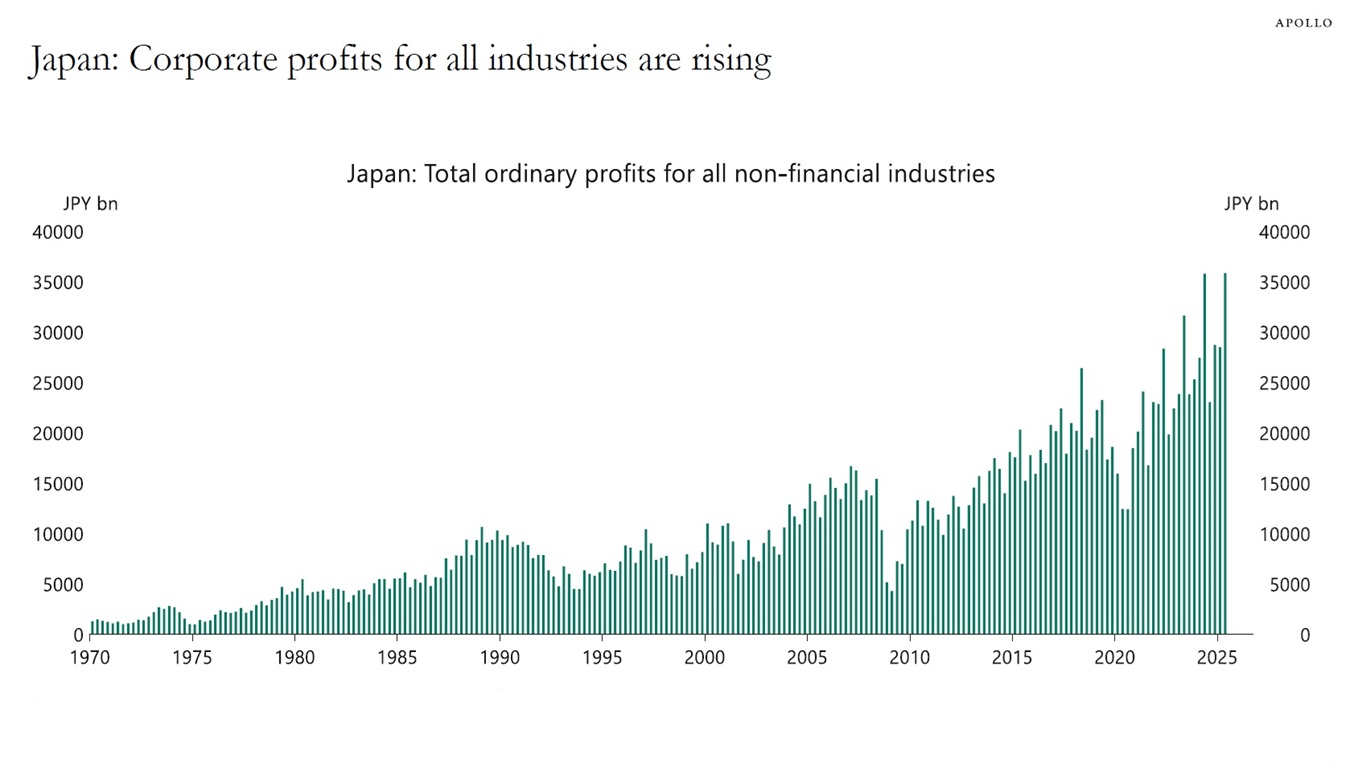

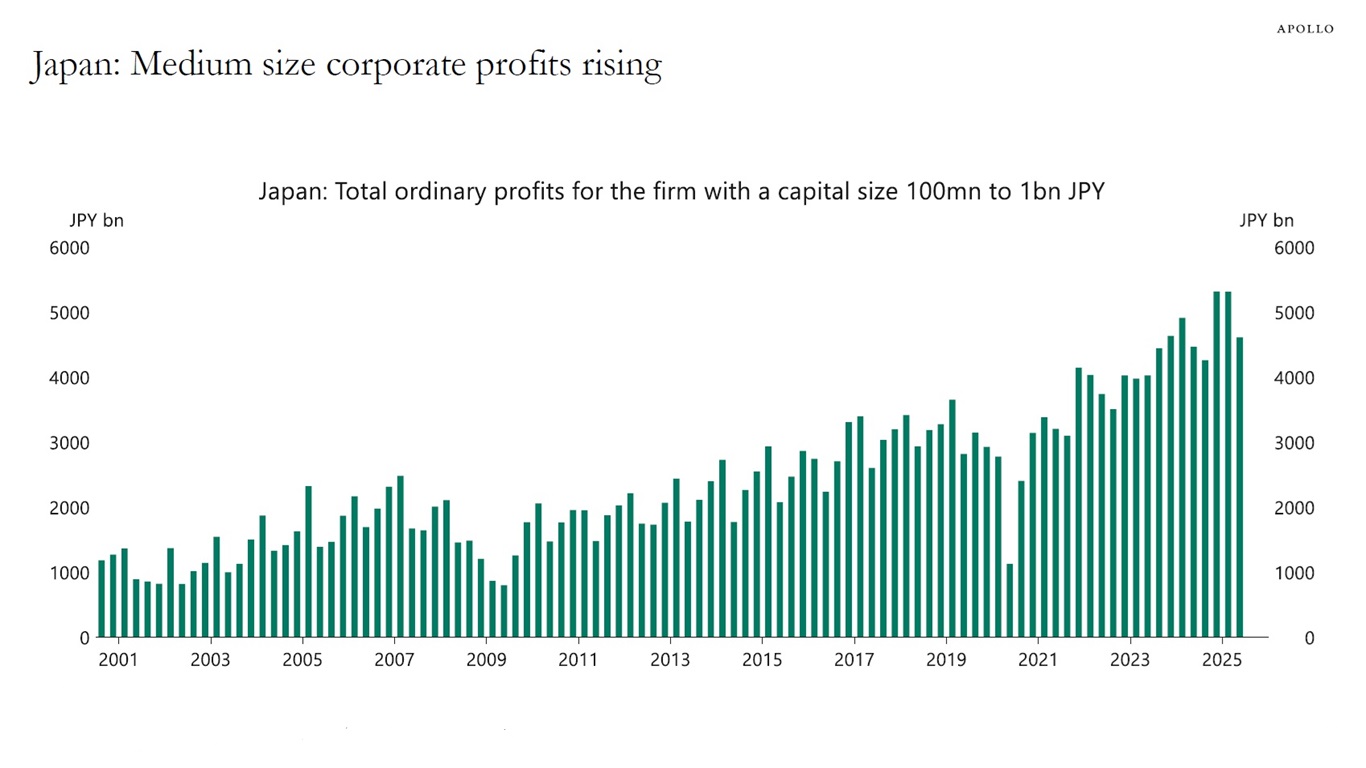

We are bullish on Japan. Corporate profits are trending higher, growth is expected to accelerate over the next 12 months and inflation is expected to decline from its current elevated levels. For more, see charts below and our latest outlook for Japan here.

We are hosting our Apollo Global Industrial Renaissance Conference in Tokyo on October 20, where Apollo’s senior management and investment professionals will discuss opportunities to invest in key sectors like digital infrastructure, the energy transition and manufacturing, see also here.

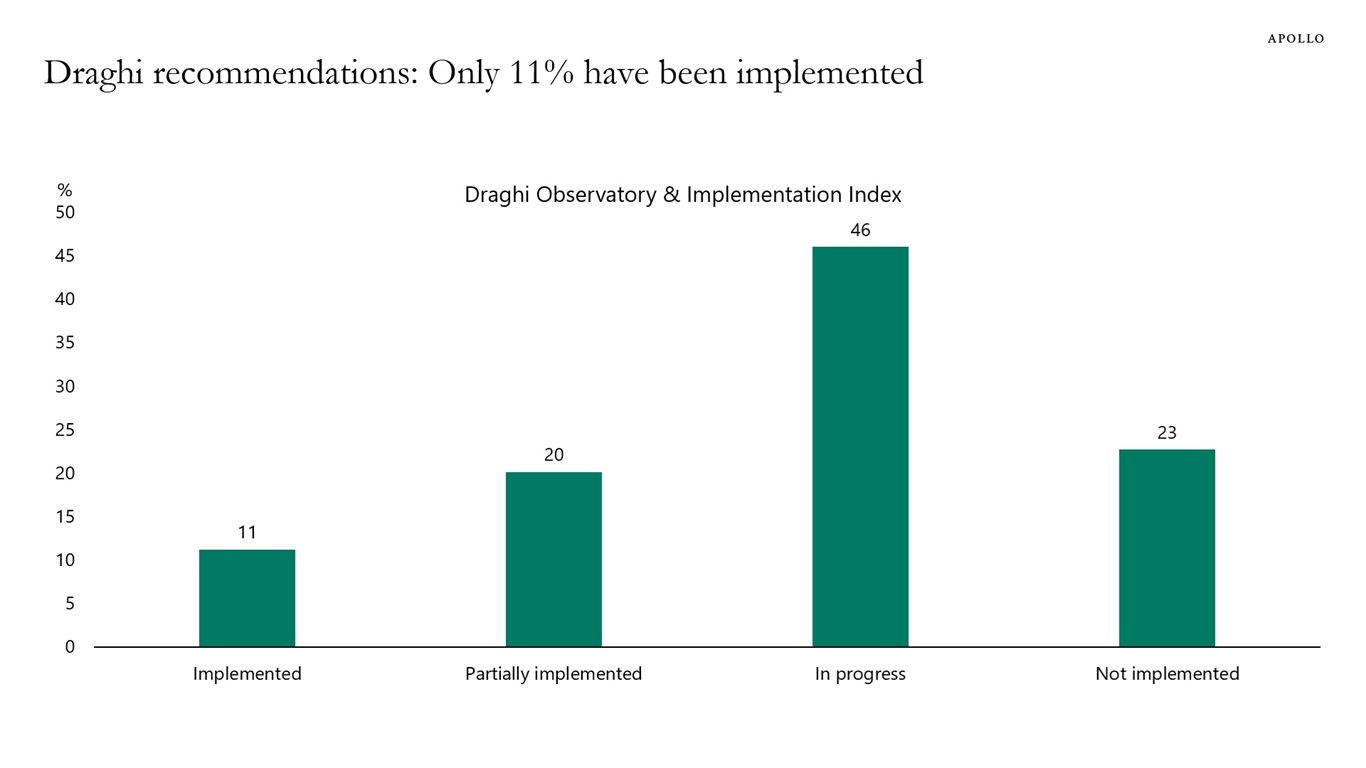

A year ago, former ECB president and Italian prime minister Mario Draghi laid out 383 policy recommendations to make the European economy more competitive, and so far, only 11% of his proposals have been implemented, see chart below.

Growth is weak in Europe, and European politicians need to move much faster if they want to make the European economy more competitive.

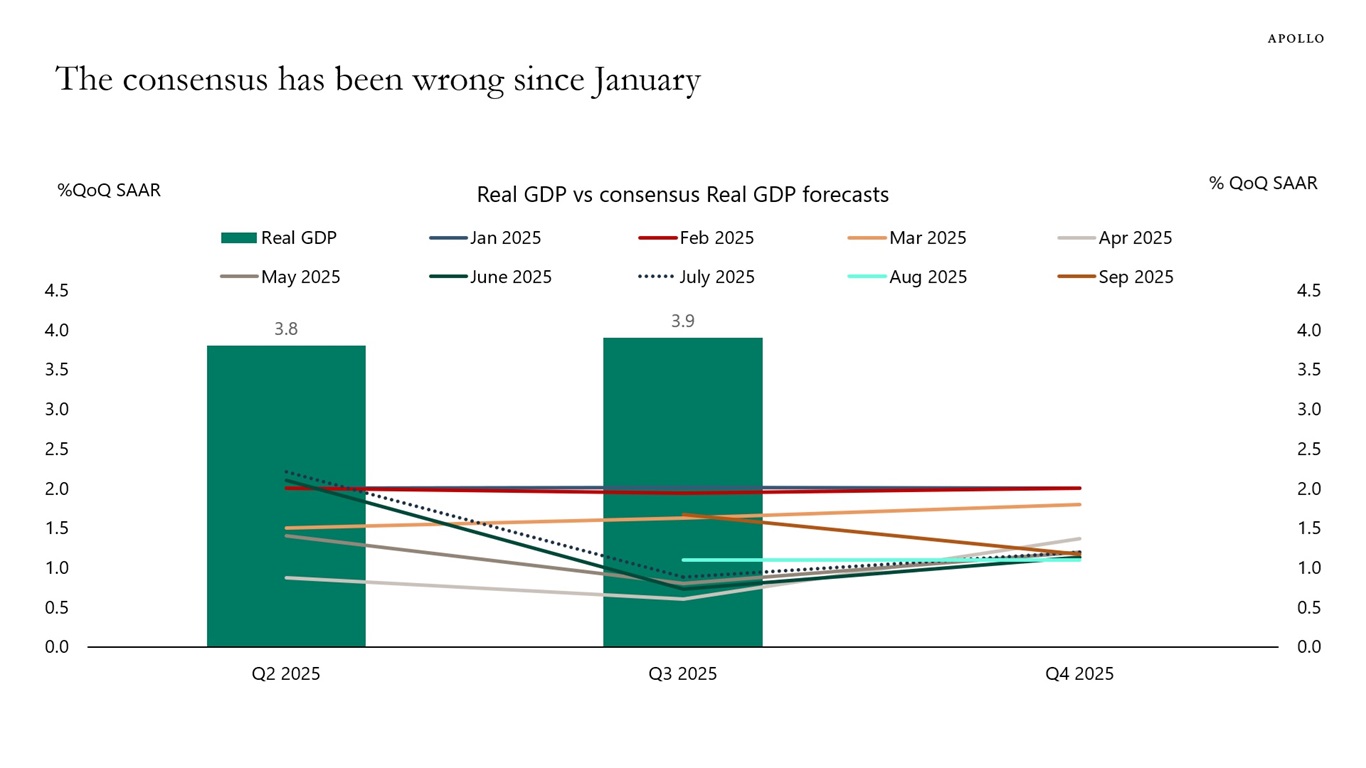

The consensus has been wrong since January. The forecast for the past nine months has been that the US economy would slow down. But the reality is that it has simply not happened, see chart below. GDP growth in the second quarter was 3.8%, and the Atlanta Fed predicts that GDP in the third quarter will be 3.9%. Yes, job growth is slowing, but this is the result of slowing immigration.

The bottom line is that the US economy remains remarkably resilient, and it is becoming increasingly difficult to argue that we are still waiting for the delayed negative effects of what happened six months ago on Liberation Day in April.

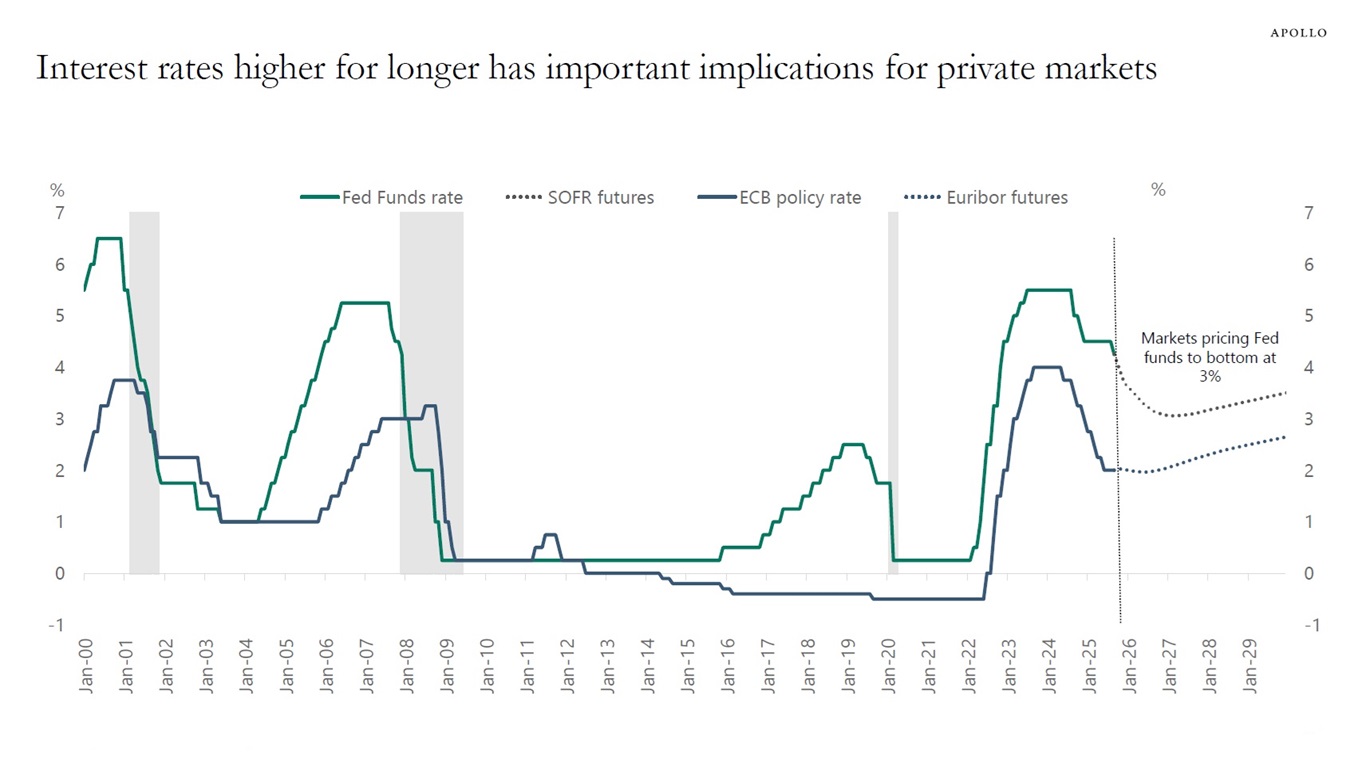

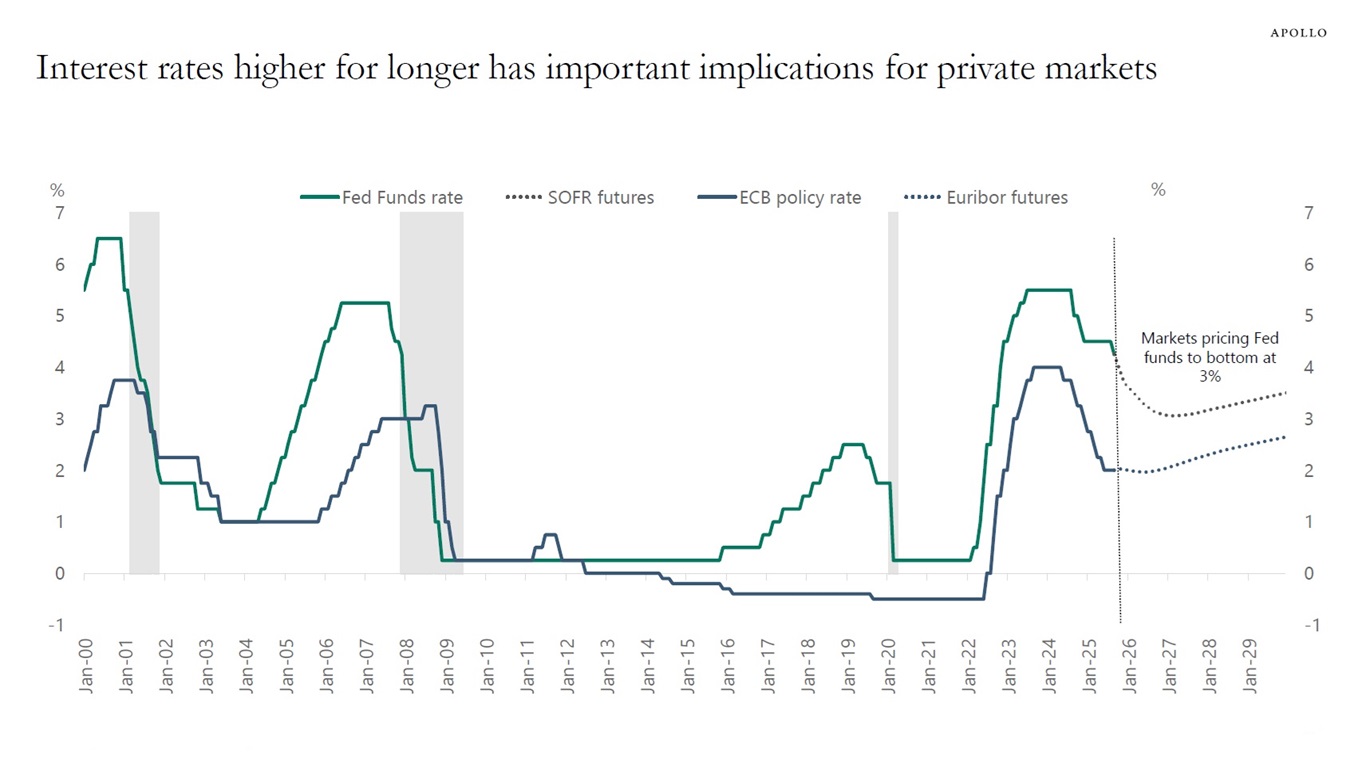

For investors, this means that the upside risks to inflation are growing, particularly if the Fed continues to cut rates.