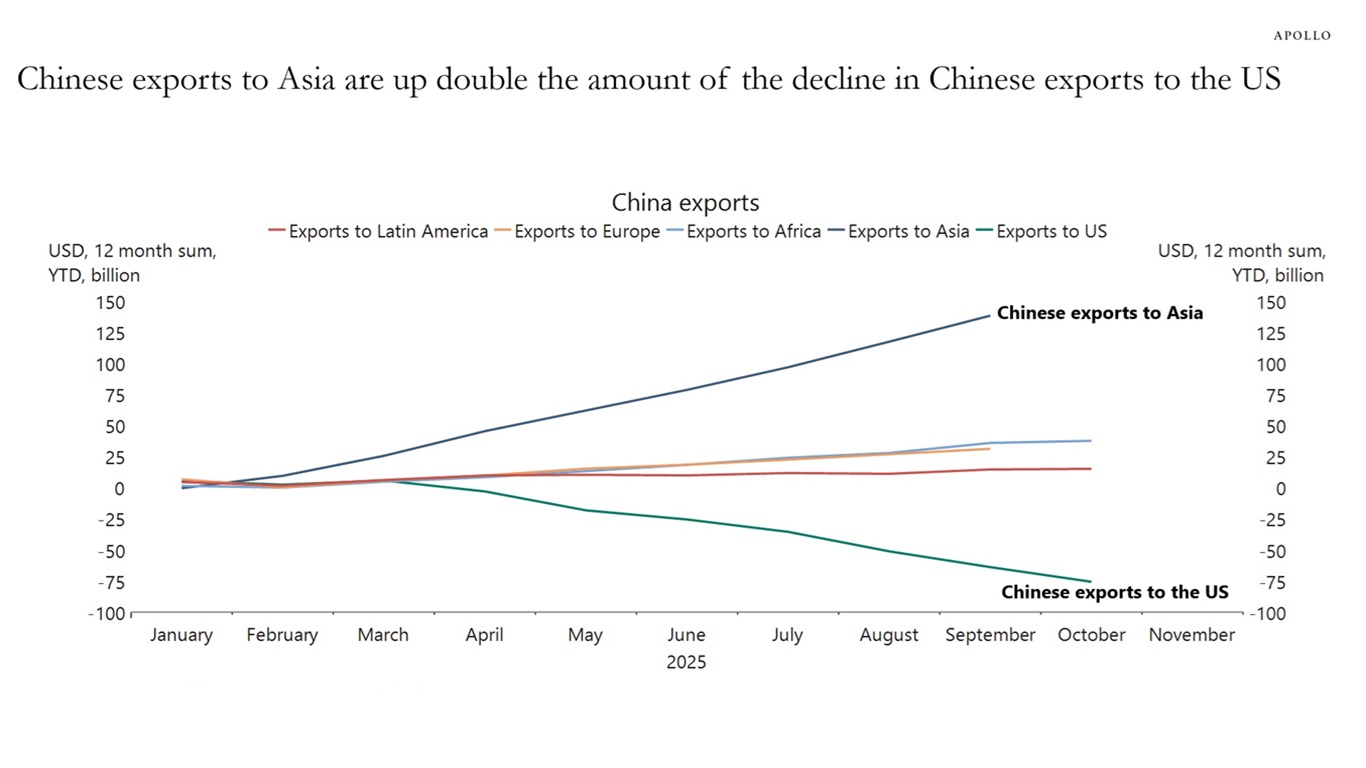

Germany used to dominate the global production of machinery and technology-intensive goods. But that has changed in 2025.

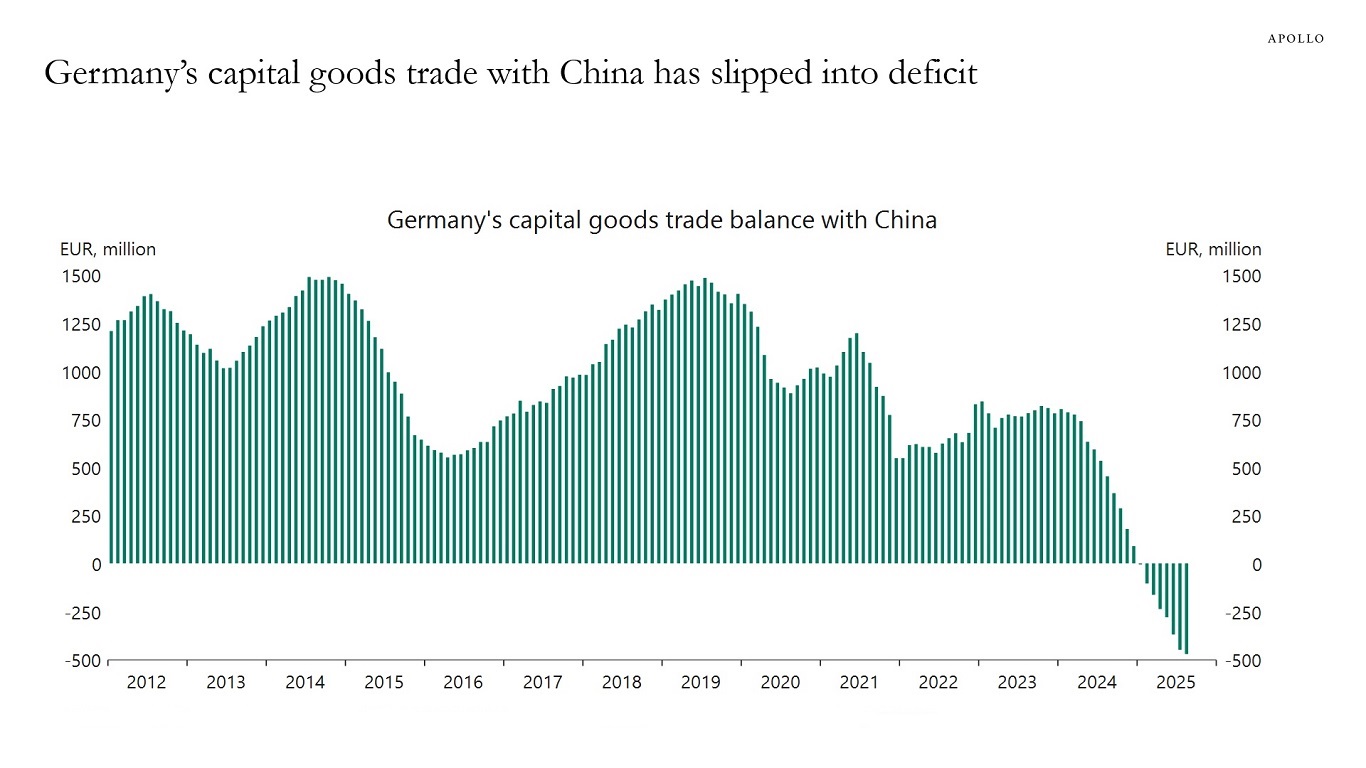

Germany now buys more capital goods from China than China buys from Germany, see chart below.

The competitive pressure on one of Germany’s core sectors is prompting the country to rethink its trade and industrial policies to reduce its dependence on China and bolster innovation at home.

This is not only happening in Germany. It is also taking place in many other countries.

Many countries are focusing on homeshoring advanced manufacturing capacity, investing in infrastructure, energy, defense, and supply chains.

It is not only deglobalization. We are entering a global industrial renaissance.