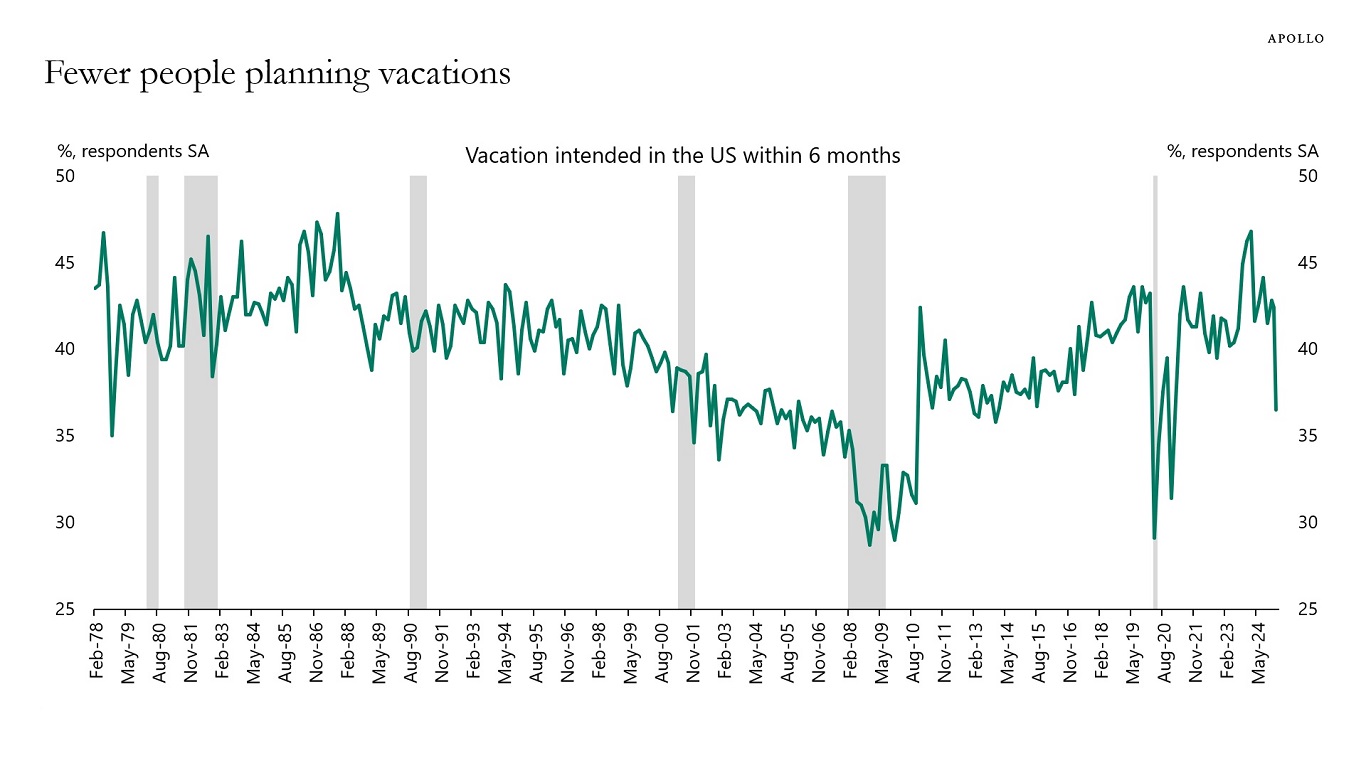

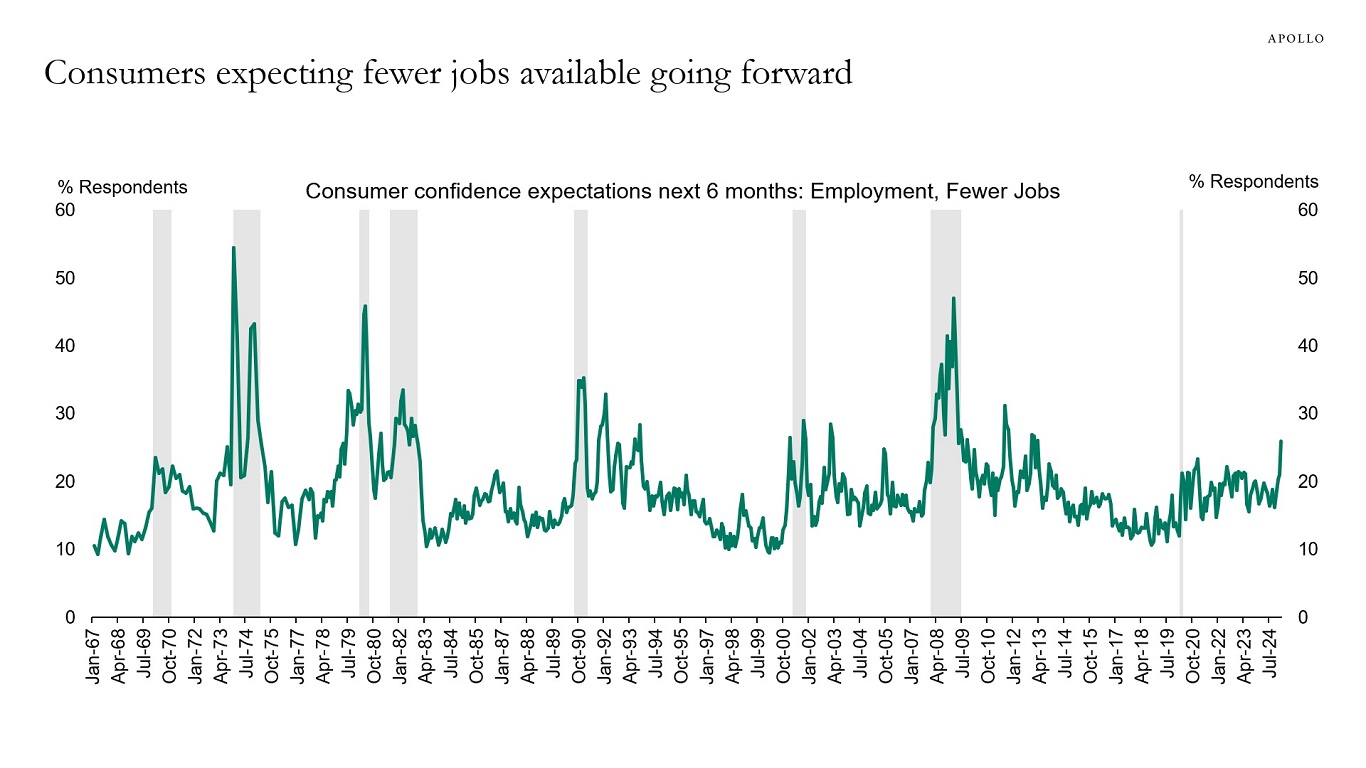

What characterizes a wait-and-see economy is that consumers and firms are more cautious about spending decisions. Consumers are more reluctant to plan vacations, to buy cars, and to buy new washers and dryers. Similarly, firms are more reluctant to hire and more reluctant to do capex.

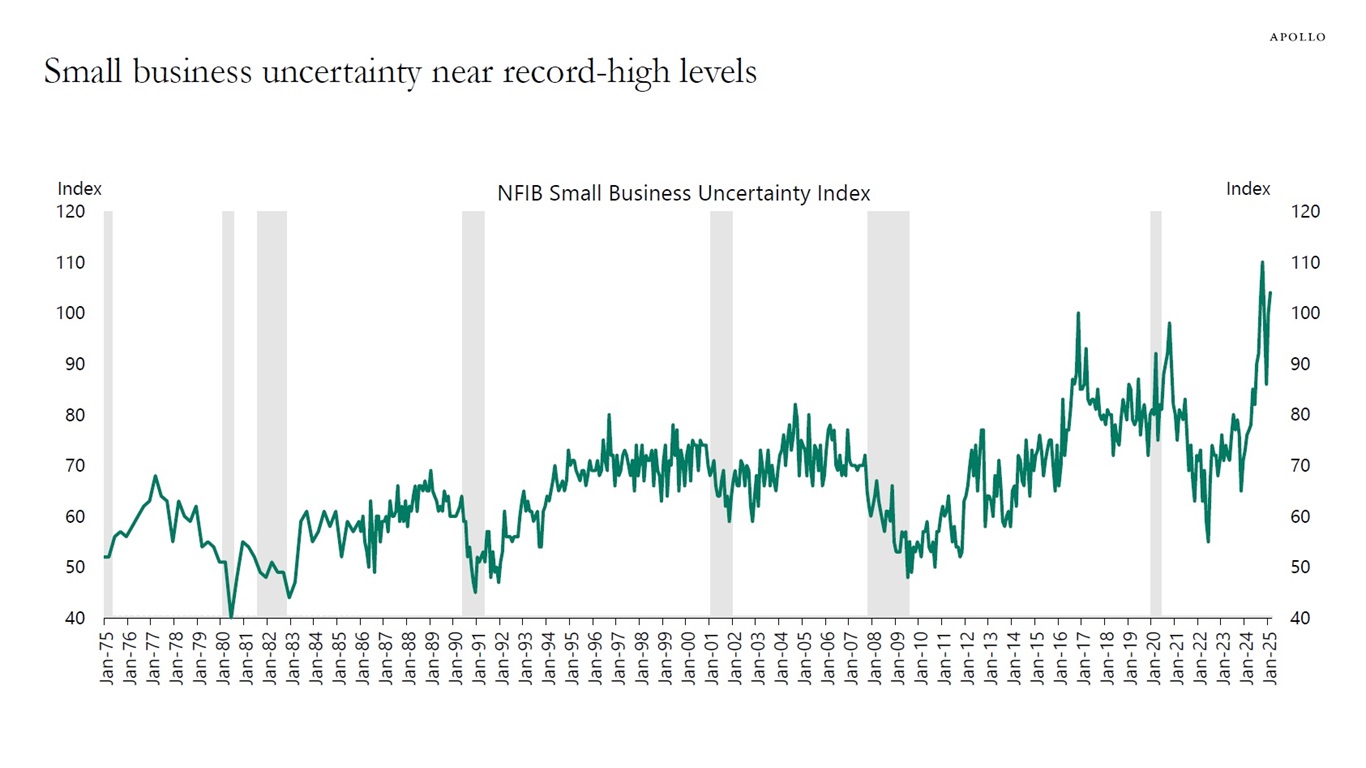

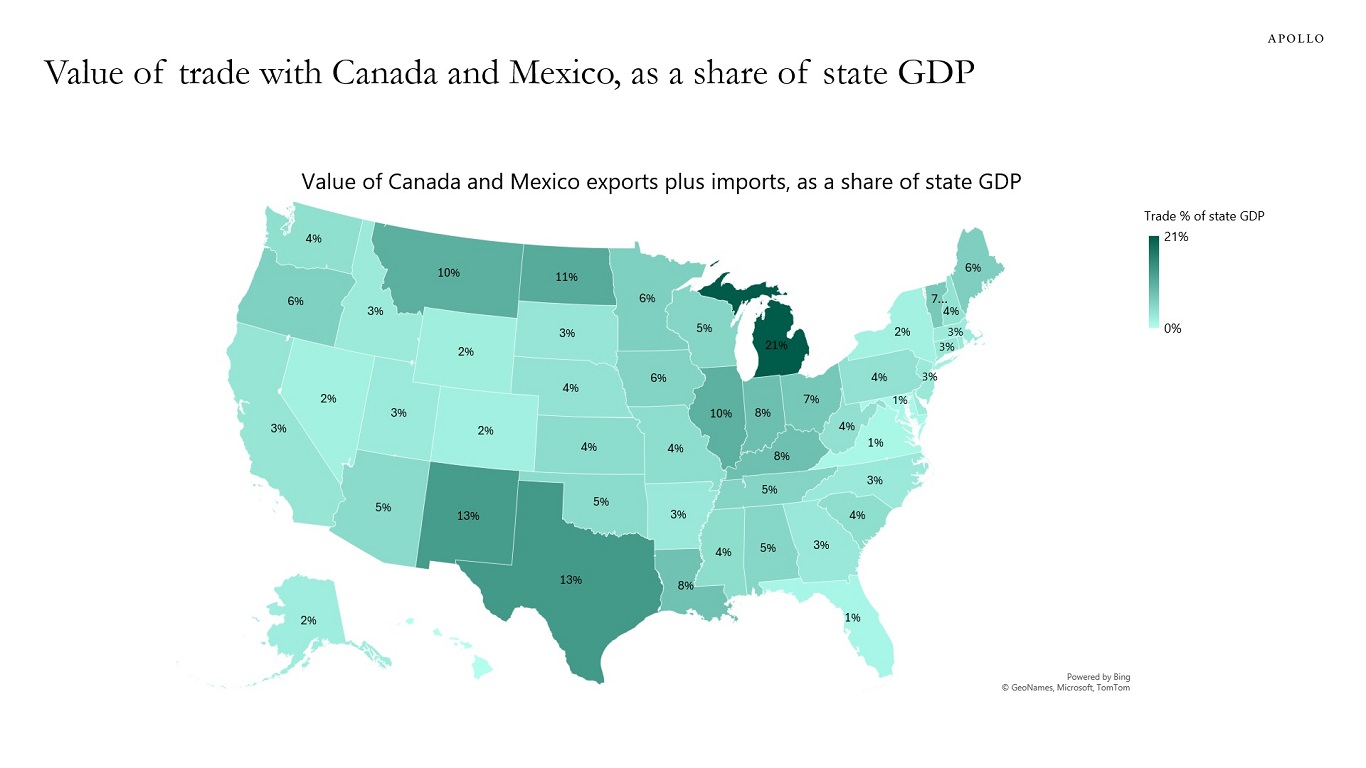

The wait-and-see economy is no longer just for companies directly involved in trade with Canada and Mexico. Uncertainty for small businesses is near all-time high levels. This is a problem because small businesses are the foundation of the economy, accounting for more than 80% of total US employment, see the first chart below.

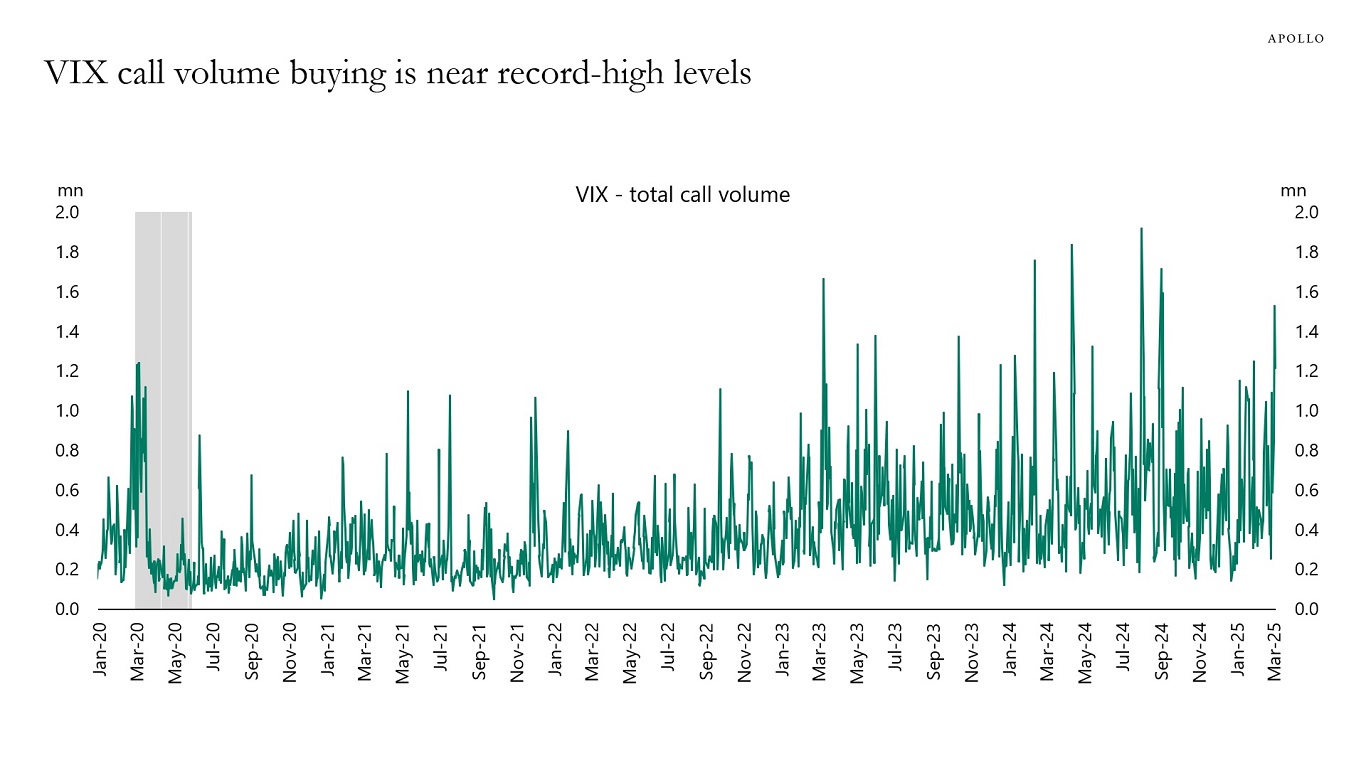

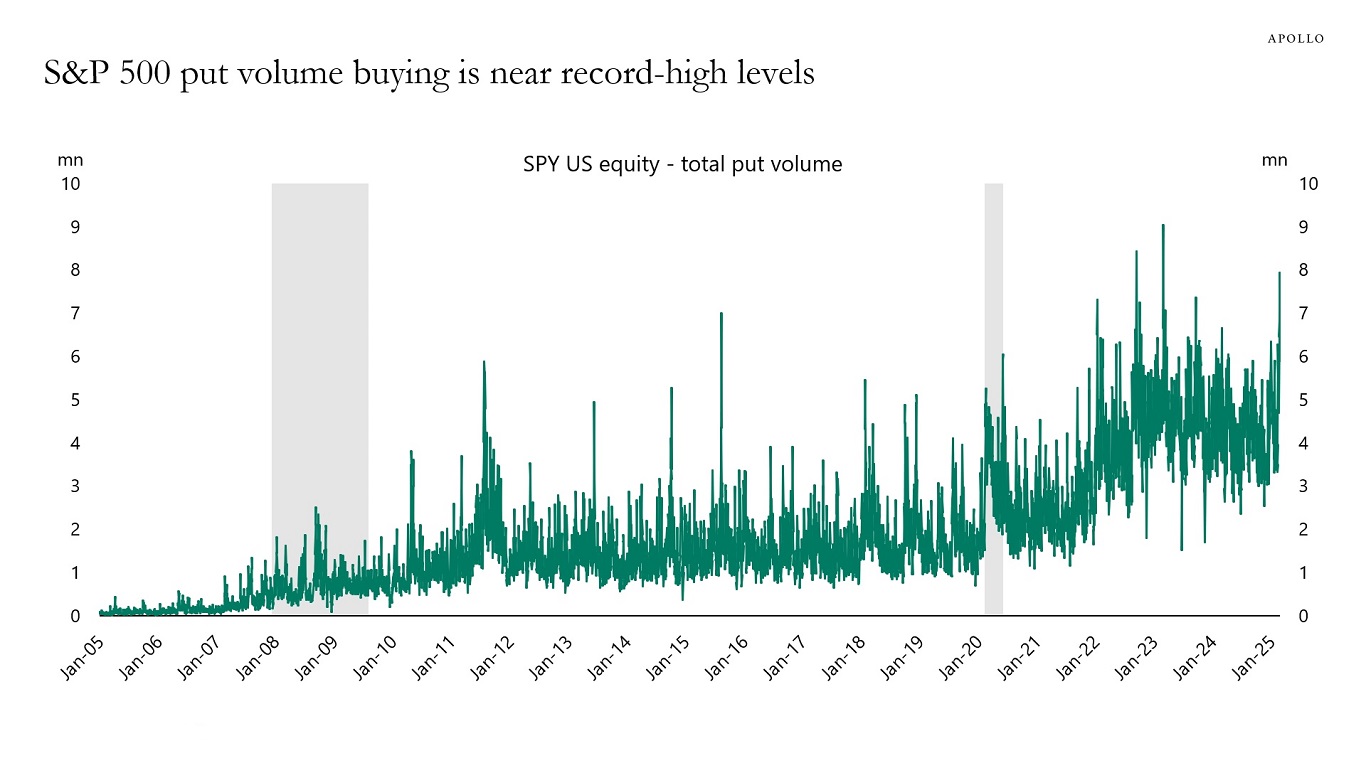

Markets are not yet pricing in the coming slowdown in the hard data. The spread between CCC and single-B has only widened modestly and is still significantly tighter than where it was during the summer of 2022—when the economy was doing just fine—see the second chart. In a slowdown scenario, investors would start to migrate to higher-quality names.

The bottom line is that a wait-and-see economy eventually leads to a slowdown in the hard data. And markets should prepare for that scenario.