There are significant differences in student loan delinquency rates by state, see chart below.

There are significant differences in student loan delinquency rates by state, see chart below.

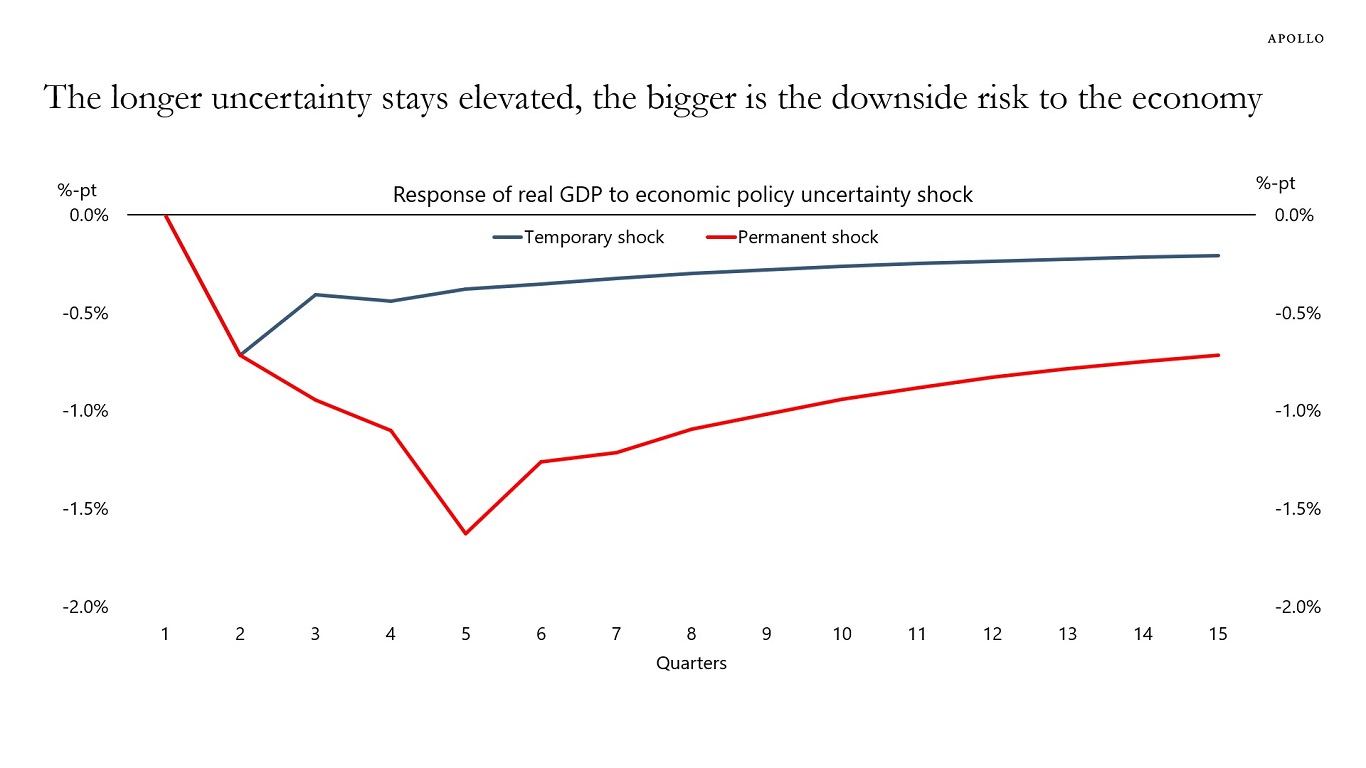

As we approach the Trump administration’s self-imposed 90-day deadline for trade deals, markets are starting to speculate about what comes next. The longer uncertainty remains elevated, the more negative its impact on the economy, as shown in the chart below.

Maybe the strategy is to maintain 30% tariffs on China and 10% tariffs on all other countries and then give all countries 12 months to lower non-tariff barriers and open up their economies to trade.

Extending the deadline one year would give countries and US domestic businesses time to adjust to the new world with permanently higher tariffs, and it would also result in an immediate decline in uncertainty, which would be positive for business planning, employment, and financial markets.

This would seem like a victory for the world and yet would produce $400 billion of annual revenue for US taxpayers. Trade partners will be happy with only 10% tariffs and US tax revenue will go up. Maybe the administration has outsmarted all of us.

Key Takeaways

The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions and views expressed reflect the current opinions and views of the authors and Apollo Analysts as of the date hereof and are subject to change. Please see the end of this document for important disclosure information.

Important Disclosure Information

This presentation is for educational purposes only and should not be treated as research. This presentation may not be distributed, transmitted or otherwise communicated to others, in whole or in part, without the express written consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

The views and opinions expressed in this presentation are the views and opinions of the author(s) of the White Paper. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Further, Apollo and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this presentation. There can be no assurance that an investment strategy will be successful. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially, and should not be relied upon as such. Target allocations contained herein are subject to change. There is no assurance that the target allocations will be achieved, and actual allocations may be significantly different than that shown here. This presentation does not constitute an offer of any service or product of Apollo. It is not an invitation by or on behalf of Apollo to any person to buy or sell any security or to adopt any investment strategy, and shall not form the basis of, nor may it accompany nor form part of, any right or contract to buy or sell any security or to adopt any investment strategy. Nothing herein should be taken as investment advice or a recommendation to enter into any transaction.

Hyperlinks to third-party websites in this presentation are provided for reader convenience only. There can be no assurance that any trends discussed herein will continue. Unless otherwise noted, information included herein is presented as of the dates indicated. This presentation is not complete and the information contained herein may change at any time without notice. Apollo does not have any responsibility to update the presentation to account for such changes. Apollo has not made any representation or warranty, expressed or implied, with respect to fairness, correctness, accuracy, reasonableness, or completeness of any of the information contained herein, and expressly disclaims any responsibility or liability therefore. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Investors should make an independent investigation of the information contained herein, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

The Standard & Poor’s 500 (“S&P 500”) Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies by market value.

Additional information may be available upon request.

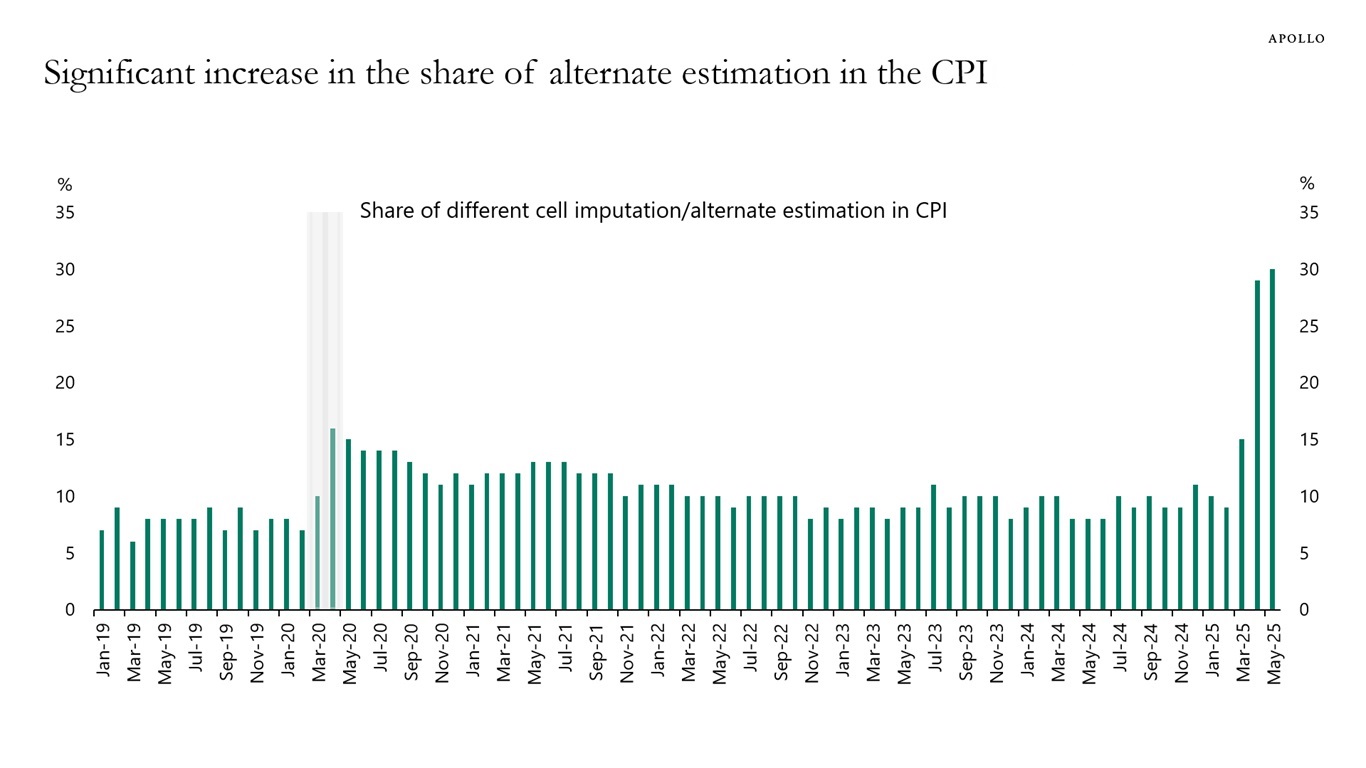

To calculate CPI inflation, BLS teams collect about 90,000 price quotes every month covering 200 different item categories, and there are several hundred field collectors active across 75 urban areas.

When data is not available, BLS staff typically develop estimates for approximately 10% of the cells in the CPI calculation. However, in May, the share of data in the CPI that is estimated increased to 30%, see chart below.

In other words, a rising share of prices going into the CPI at the moment are guesses based on other data collections in the CPI.

Foreigners have steadily increased their holdings of US equities and currently own 18% of the US stock market, see chart below.

This is the mirror image of a trade deficit. Foreigners selling goods to the US receive dollars in return, which are then used to purchase US assets, including US equities.

If the trade deficit is eliminated, there will be fewer dollars for foreigners to recycle into the S&P 500.

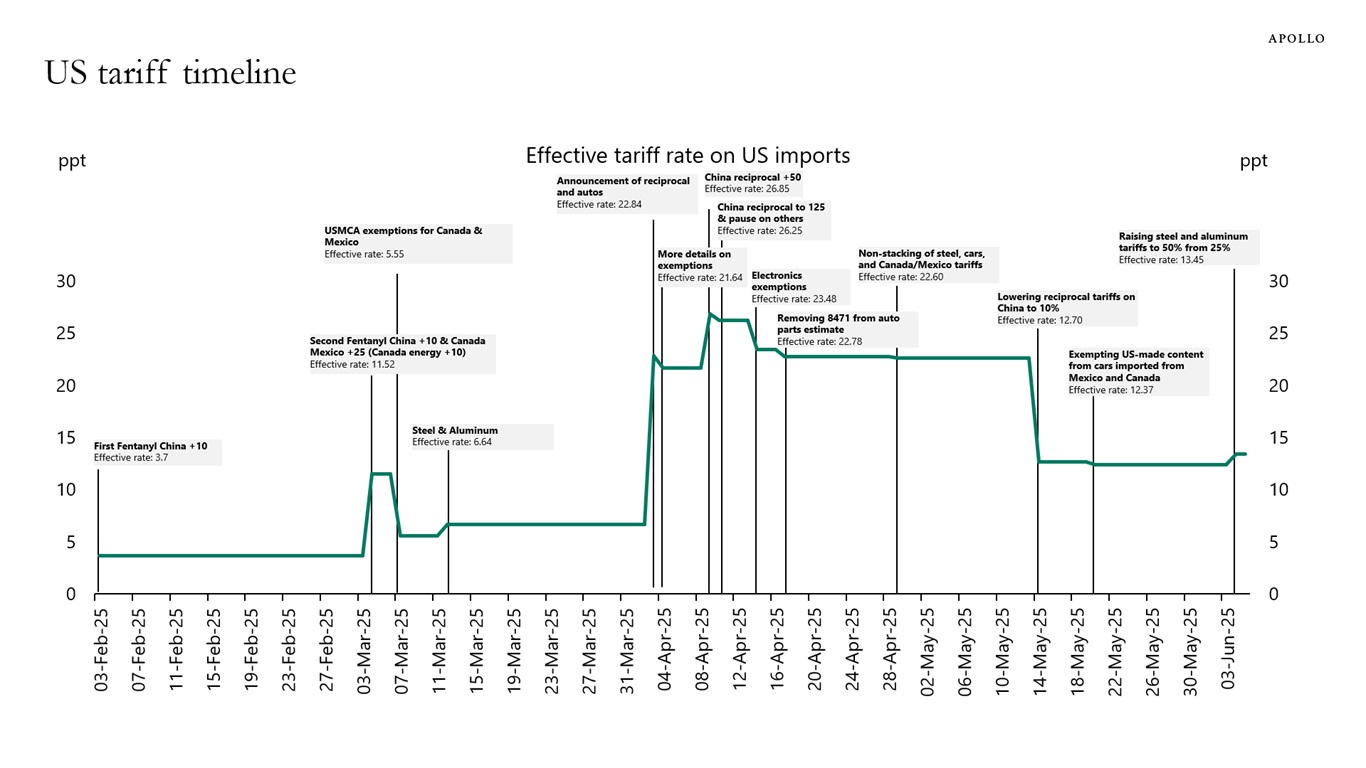

The chart below shows a timeline of US tariffs since early February.

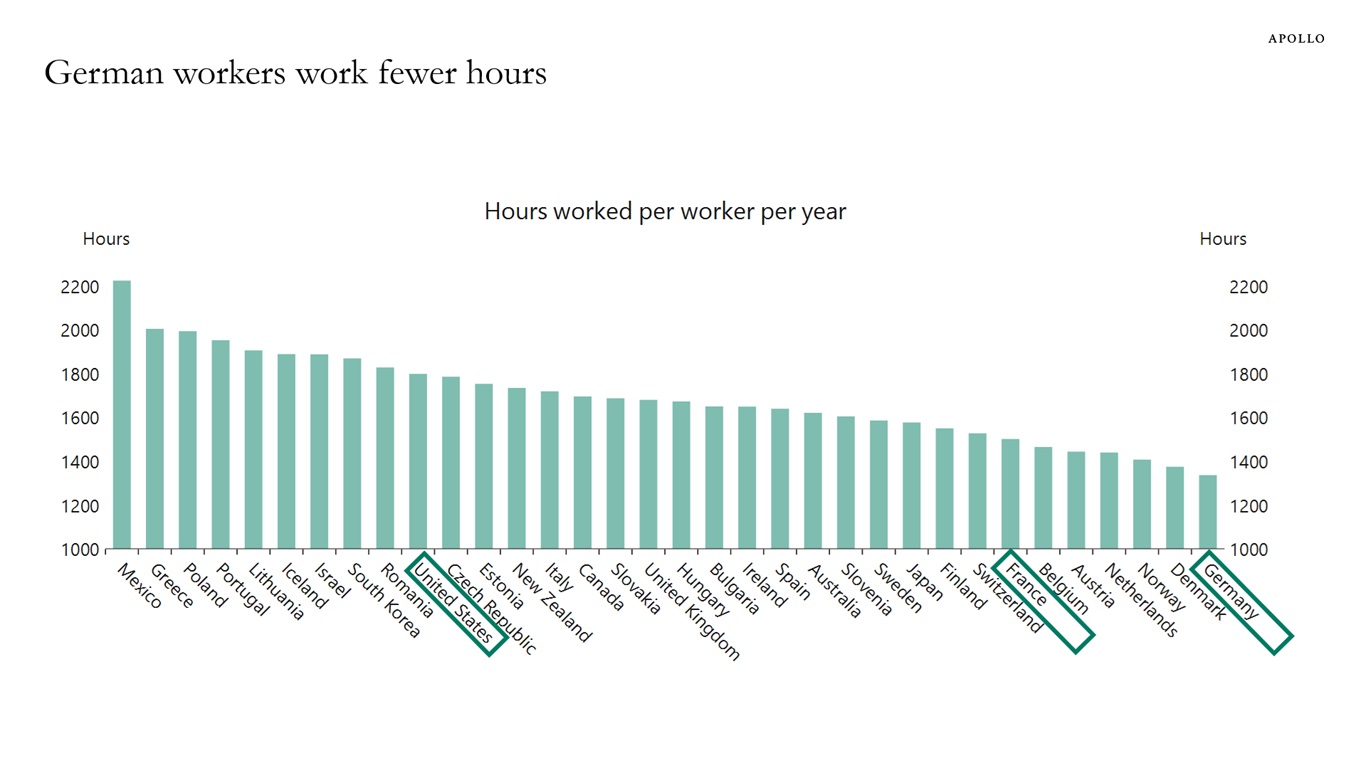

Europeans work far fewer hours per week than Americans, see chart below.

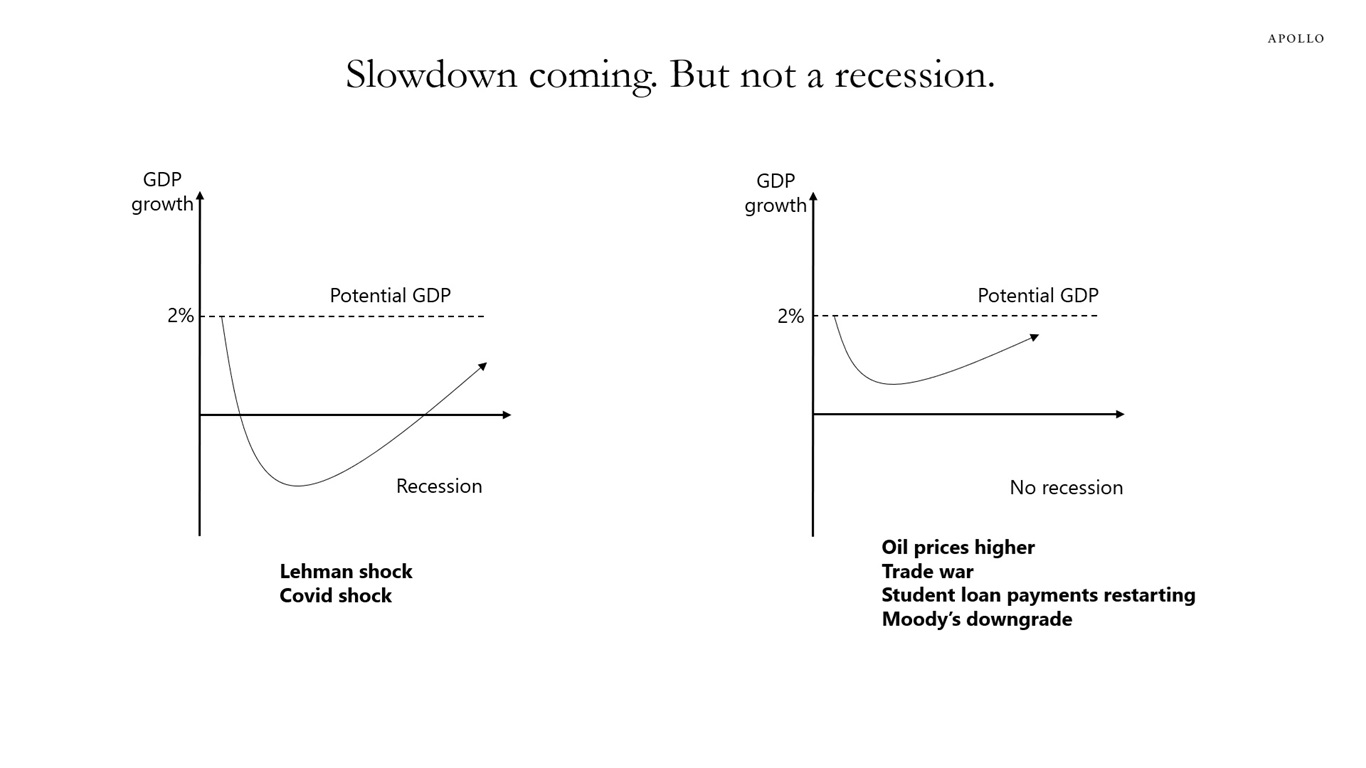

US economic growth is currently facing headwinds from higher oil prices, increased tariffs, the resumption of student loan payments, and higher long-term interest rates associated with the fiscal situation.

When we quantify these four drags on growth, we conclude that they are insufficient to push the economy into a recession.

In other words, these shocks are milder than those of Covid-19 and the Lehman crisis, see chart below.

However, we are closely monitoring these four risks to assess whether they become significant enough to put GDP growth into negative territory later this year—for example, if oil prices, tariffs, or long rates increase further.

According to the Fed’s model of the US economy, a sustained $10 increase in oil prices is expected to increase inflation by 0.4% and lower GDP by 0.4%, see table below.

Tariffs also increase inflation and lower GDP growth.

Restrictions on immigration also increase wage inflation and lower employment growth.

In short, higher oil prices exacerbate the ongoing stagflation shock stemming from tariffs and immigration restrictions.

Stagflation is a problem for the FOMC when they meet next week. Higher inflation says the Fed should be hiking. Lower GDP growth says the Fed should cutting. So will the FOMC next week put more weight on the upward pressure on inflation or more weight on the coming slowdown in growth?